|

|

市場調査レポート

商品コード

1867081

ゲームコントローラー市場:種類別、プラットフォーム別、価格帯別、用途別、流通チャネル別- 世界予測2025-2032年Gaming Controller Market by Type, Platform, Price Tier, Application, Distribution Channel - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ゲームコントローラー市場:種類別、プラットフォーム別、価格帯別、用途別、流通チャネル別- 世界予測2025-2032年 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

概要

ゲームコントローラー市場は、2032年までにCAGR7.97%で613億8,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 332億3,000万米ドル |

| 推定年2025 | 359億4,000万米ドル |

| 予測年2032 | 613億8,000万米ドル |

| CAGR(%) | 7.97% |

技術革新、変化する消費者の期待、流通のダイナミクスによって推進される、進化するグローバルなゲームコントローラーエコシステムに関する簡潔な概要

本稿では、技術革新、プレイヤー行動の変化、複雑なグローバル貿易動向によって形作られる、急速に進化するゲームコントローラーの情勢について、その背景を説明いたします。

コントローラーは、単純な入力デバイスから、触覚フィードバック、無線プロトコル、モジュール設計、プラットフォーム固有の統合を融合した高度なインターフェースへと進化しました。低遅延無線規格、アダプティブトリガー、クロスプラットフォーム互換性の進歩が、ユーザーの期待を再定義しています。同時に、カジュアルプレイヤー、eスポーツ選手、プロユーザー間で消費者の嗜好が異なるため、人間工学、遅延、耐久性、価格のアクセシビリティをバランスさせる差別化された製品戦略が必要となっています。

開発・流通チャネルも変化しており、従来型小売モデルと、消費者向けブランド直販サイト、大規模eコマースプラットフォームが共存しています。この摩擦は、新SKUの市場投入期間や、コンソール発売、主要ゲームリリース、トーナメントシーズンに伴う需要急増に対応した生産拡大能力に影響を及ぼします。これらの要因は、規制や関税の動向と相まって、複数のセグメントや地域で価値を獲得しようとするハードウェアメーカー、部品サプライヤー、小売業者にとってリスクと機会の両方をもたらします。

コントローラーの革新、流通、競争上の差別化をバリューチェーン全体で再構築する、技術面・消費者動向・商業面における重要な変化を検証します

変革的な変化は、コントローラーカテゴリーが漸進的な刷新サイクルを超え、業界横断的なコンポーネントや新たなユーザー行動の影響を受けた、プラットフォームを定義する革新へと移行していることを浮き彫りにしています。

高度なBluetoothプロファイル、低エネルギーの独自リンク、電波共存性の向上といった無線技術により、特定の実装では10ミリ秒未満の遅延が実現され、有線と無線の性能差が縮まりつつあります。同時に、有線・無線モードの切替や複数コネクタタイプのサポートを可能とするモジュラー設計やハイブリッド設計の採用が増加しており、消費者の多様性への需要を反映しています。MEMSセンサー、プログラマブルハプティクス、統合型電源管理などのコンポーネントレベルの動向は、機能の可能性を拡大する一方で、サプライチェーンの複雑化をもたらしています。

商業面では、流通と収益化のモデルが変化しています。ブランドは、生涯価値の向上とフィードバックループの加速を図るため、ダイレクトチャネルやコミュニティ主導の製品開発に投資しています。eスポーツやコンテンツクリエイターは製品の魅力に大きな影響力を及ぼしており、プロ選手の推奨やトーナメント要件が機能ロードマップを形作っています。これらの変化は規制環境や貿易政策と相互作用するため、競争力を維持するには機敏な製品計画と多様なサプライヤー関係が求められます。

2025年における米国新たな関税措置がもたらす広範な影響、およびサプライチェーン全体で促される戦略的調達・価格設定・流通調整の分析

2025年に米国で導入された新たな関税措置は、ハードウェアカテゴリー全体でコスト圧力を増幅させ、コントローラーエコシステムにおける調達と価格設定の決定に影響を与えました。

輸入部品や完成品に対する関税は、グローバルサプライチェーンに依存するメーカーの着陸コストを増加させ、いくつかの戦略的対応を促しています。一部企業は、単一国への関税リスクを軽減するため、ニアショアリングや地域分散による組立の検討を進めています。他方、長期的な価格安定を確保すべく、一次サプライヤーとの契約再交渉を行う企業も見られます。製品チームは、同等の性能を持ちながら原産地が異なる代替部品を特定するため、部品表(BOM)構成の再評価を進めています。企業は関税影響評価を実施し、新たな関税スケジュールに合わせた税関分類を確保するため、調達サイクルが長期化しています。

流通チャネルの観点では、輸入コストの上昇が流通業者や小売業者の利益率を圧迫し、最終消費者の価格感応度を高めています。利益率を維持するため、ブランド側はプレミアム化、サービスのバンドル化、またはサブスクリプション型アクセサリーエコシステムの提供へとシフトする可能性があります。同時に、規制の不確実性は、重要サブシステムにおける垂直統合や、関税還付の最適化、保税在庫戦略、コンプライアンス遵守下での関税設計を実現するための物流パートナーとの緊密な連携を促進します。結局のところ、関税環境は柔軟な製造拠点配置とシナリオベースの商業計画の必要性を強めています。

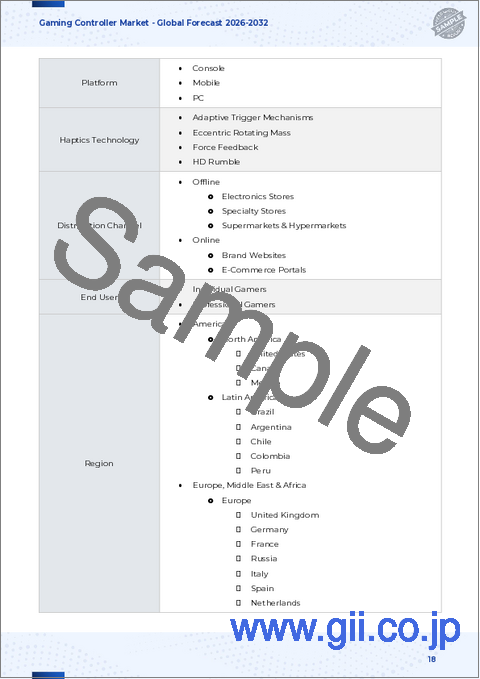

製品ポジショニングと市場投入戦略の決定に資する、タイプ・プラットフォーム・価格帯・用途・流通動向を統合した包括的なセグメンテーション分析

セグメンテーション分析により、差別化された需要パターンと製品要件が明らかになり、製品ロードマップやチャネル戦略の指針となります。

タイプ別では、デバイスはUSBと無線接続を融合したハイブリッド形式、レガシーUSB Type-Aや新型USB Type-Cインターフェースを含む有線オプション、Bluetooth、赤外線、独自無線プロトコルを活用した純粋な無線モデルに分類されます。この多様性が、遅延、電力、相互運用性における開発上のトレードオフを形作ります。プラットフォーム別では、コントローラーはNintendo Switch、PlayStation、Xboxなどのコンソール、携帯型システムからスマートフォン・タブレットに至るモバイルカテゴリー、デスクトップ・ノートPCを含むPC環境を対象とします。プラットフォーム固有の認証、人間工学、ボタン配置はユーザー受容において極めて重要です。

価格帯により、エントリーレベル、ミドルレンジ、プレミアム製品へと提案が分化され、各層は耐久性、機能セット、保証サポートに関する購入者の期待値にそれぞれ対応しています。アプリケーションの使用事例は、カジュアルゲーミング、競技向けeスポーツ、プロゲーミングに及び、それぞれ異なるレベルの性能検証と周辺機器エコシステムが求められます。流通チャネルは、オフラインルート(電気店、専門店、スーパーマーケット・ハイパーマーケット)と、ブランドウェブサイトやeコマースポータルを経由するオンライン経路に分岐し、製品の発見可能性、購入後のサービス、プロモーション戦略に影響を与えます。これらのセグメント次元を統合することで、微妙なターゲティングとポートフォリオの最適化が可能となります。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域における普及状況、流通構造、競争パターンの詳細な地域別分析により、地理的戦略立案を支援します

地域ごとの動向は、アメリカ大陸、欧州・中東・アフリカ、アジア太平洋地域における技術導入率、流通構造、競争の激しさに影響を与えます。

南北アメリカでは、コンソールエコシステムへの消費者親和性と成熟したeスポーツインフラが、プレミアムおよびミドルクラスのコントローラー双方への需要を牽引しています。小売パートナーシップとDTC投資が共存し、迅速な市場対応を求めるブランドにとって、保税在庫と迅速なフルフィルメントを支える物流ネットワークは共通の優先事項です。欧州・中東・アフリカ地域では、認証や地域特化型コンテンツ提携が重要となる多様な規制状況と小売環境が存在します。需要パターンは西欧の高性能競技向けセグメントから、中東・北アフリカ地域の一部における新興eスポーツシーンまで多岐にわたります。アジア太平洋では、大規模製造能力、高いモバイルゲーム普及率、高度なeコマース環境が相まって、製品の迅速な改良とコスト競争力のある設計選択を促進しています。

地域を問わず、現地の嗜好やプラットフォーム選好には、言語サポート、人間工学に基づいたサイズ設計、地域別バンドル戦略など、カスタマイズされたマーケティングと製品適応が求められます。貿易政策の差異や物流リードタイムは、最終組立拠点の立地や戦略的在庫の保管場所の決定にさらに影響を与え、地域ハブは関税負担の最小化と季節ごとの展開加速のために頻繁に活用されます。

主要競合情報:プラットフォーム主導の制約、周辺機器専門企業、部品パートナーの活用、コントローラー業界プレイヤー間のサービス主導型差別化を浮き彫りにする

競争環境は、プラットフォーム提携、知的財産(IP)におけるリーダーシップ、強力なチャネル実行力を組み合わせ、プレミアムセグメントを守る企業と、価値とニッチな差別化を追求する課題者によって形成されています。

主要プラットフォーム保有企業は、コントローラーの規格や認証要件に影響力を及ぼすため、サードパーティの参入を制限する一方で、専門周辺機器メーカーにはライセンシングの機会も生み出しています。周辺機器専門メーカーは、センサーの精度、人間工学、ソフトウェアエコシステム、コミュニティエンゲージメントで競争し、一方、ブティックメーカーは、強化されたハードウェアとカスタムファームウェアでeスポーツチームやプロプレイヤーをターゲットにしています。部品サプライヤーやODMパートナーも同様に、市場投入までの時間とコスト構造に影響を与えます。これらのサプライヤーとの戦略的関係は、先進的なハプティクス、カスタムIC、差別化されたワイヤレスモジュールへのアクセスを決定づける可能性があります。

製品機能を超え、企業は設定可能なファームウェア、ソフトウェアプロファイリングスイート、延長保証、コミュニティ主導のカスタマイズといったサービスでも競争しています。戦略的なM&Aやパートナーシップは、ニッチ技術の獲得や新規チャネルへの進出手段としてますます活用されています。その結果、製品革新を厳格なサプライチェーン管理と魅力的なチャネル体験と結びつける企業が、プレミアムマージンの獲得と複数プラットフォームセグメントにおける収益性の高い成長の拡大において、最も有利な立場に立つことになります。

貿易リスクの低減、製品差別化の加速、チャネル強化に向けた具体的な戦略的・運営的施策として、モジュラー設計、供給先の多様化、ソフトウェアエコシステムなどが挙げられます

実行可能な提言は、製品・サプライチェーン・商業機能全体でリスクを低減し差別化された顧客価値を創出する戦術的施策に焦点を当てます。

第一に、単一SKUで有線・無線両方の使用事例に対応し、複数のコネクタ規格をサポートするモジュラー設計戦略を優先してください。これによりSKUの過剰増加を抑えつつ、コンソール、モバイル、PCセグメント全体での訴求力を最大化できます。第二に、製造・組立拠点を多様化し、ニアショアリングや地域パートナーを組み込むことで、関税リスクを軽減し補充サイクルを短縮してください。第三に、低遅延ワイヤレス技術とプログラマブルハプティクスに選択的に投資し、性能特性に対して高い支払い意欲が求められるプレミアム層およびeスポーツ市場を獲得します。第四に、ファームウェア更新、ボタン再マッピング、クラウドベースのプロファイルを含むソフトウェアエコシステムを強化し、継続的な顧客エンゲージメントを創出するとともに、コモディティ製品との差別化を図ります。

商業面では、消費者向け直接販売への投資と、商品発見性やアフターサービスを強化する戦略的小売パートナーシップとのバランスを図ります。供給確保とコスト予測可能性を高めるため、性能条項を盛り込んだ長期部品調達契約を交渉します。最後に、製品発売時にシナリオプランニングを組み込み、関税影響・部品調達リードタイム・プラットフォームサイクルに伴う需要変動をモデル化します。これにより、複数の不測の事態下でも迅速な価格設定と流通チャネル対応が可能となります。

戦略的提言を支えるため、一次インタビュー、技術検証、シナリオプランニング、データ三角測量を組み合わせた堅牢な混合手法調査フレームワークを採用します

本調査手法は、1次調査、技術分析、業界情報及び公開情報の統合を組み合わせ、意思決定者向けの実践的知見を創出します。

主な入力情報として、製品マネージャー、調達責任者、eスポーツコーチ、小売バイヤー、物流プロバイダーへのインタビューを実施し、機能優先度、供給制約、流通上の優先事項を評価します。技術的検証では、デバイスの分解調査、レイテンシーベンチマーク、部品サプライヤー評価に基づき、有線/無線実装のトレードオフ、コネクタ選択、触覚サブシステムを評価します。2次調査では、特許出願、公開文書、規制関税表、業界ニュースを網羅し、サプライチェーンの変化や政策影響を文脈化します。データ三角測量により、複数の角度から得られた知見を裏付け、異なる仮定下でも堅牢性を確保します。

分析手法としては、関税・供給混乱へのシナリオプランニング、部品表(BOM)耐性のためのリファレンスアーキテクチャマッピング、直接販売ルートとパートナー主導ルートの利益率比較のためのチャネル経済モデル構築が含まれます。必要に応じてユーザーテストと人間工学的フィードバックを組み込み、製品推奨事項を実際のユーザー成果に整合させました。機密保持条項と匿名化された情報源により、参加者のプライバシーを保護しつつ分析の厳密性を維持しています。

戦略的課題と実行優先事項の統合により、混乱を乗り切り、製品価値を高め、進化するコントローラーカテゴリーにおいて持続的な優位性を確保します

結論として、ゲームコントローラー業界は転換点に立っており、技術革新、消費行動の変化、貿易政策の変遷が相まって競争優位性を再構築しつつあります。

モジュラー設計とクロスプラットフォーム対応を採用し、低遅延ワイヤレスソリューションに投資するメーカーは、プレミアム層と競合層の市場を獲得する態勢を整えています。一方、関税圧力下で利益率を維持するには、販売チャネルの慎重な調整が不可欠です。製造の多様化、長期的なサプライヤー契約、関税を意識した物流戦略によって構築されるサプライチェーンのレジリエンスは、タイムリーな製品投入と価格安定化の重要な基盤となります。同様に重要なのは、顧客エンゲージメントを深化させ、販売時点を超えて継続的な価値を創出するソフトウェアおよびサービス層の開発です。

意思決定者は、現在の環境をポートフォリオの再構築、サプライヤーパートナーシップの強化、eスポーツやプロユーザーの高性能要求を満たしつつ一般消費者層を疎外しない製品機能の加速化を図る機会と捉えるべきです。製品、サプライチェーン、商業機能における規律ある実行により、利害関係者は短期的な混乱を乗り切り、急速に進化するカテゴリーにおいて持続的な優位性を獲得することが可能となります。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 複数のプラットフォームで没入感のあるゲーム体験を実現する、アダプティブトリガーとハプティックフィードバックの統合

- ワイヤレス充電と低遅延Bluetooth接続がプレミアムコントローラーの標準装備となる

- モジュラー式ボタンマッピングと交換可能なコンポーネントによるカスタマイズ可能なeスポーツレベルのコントローラー性能

- PC、コンソール、モバイルゲーム間でシームレスなコントローラー使用を可能にするクロスプラットフォーム互換性

- プレイヤーのグリップ圧力センサーに基づくAI駆動の人間工学設計調整により、パーソナライズされた快適性を実現します

- 持続可能な素材と環境に配慮した製造プロセスが、コントローラーのデザインとパッケージングに影響を与えています。

- クラウドベースのファームウェア更新とコントローラー性能分析により、ユーザー体験と耐久性が向上します

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 ゲームコントローラー市場:タイプ別

- ハイブリッド

- USBおよびワイヤレス

- 有線

- USB Type-A

- USB Type-C

- ワイヤレス

- Bluetooth

- 赤外線

- 独自規格

第9章 ゲームコントローラー市場:プラットフォーム別

- コンソール

- Nintendo Switch

- プレイステーション

- Xbox

- モバイル

- 携帯型

- スマートフォン

- タブレット

- PC

- デスクトップ

- ノートパソコン

第10章 ゲームコントローラー市場価格帯別

- エントリーレベル

- ミドルレンジ

- プレミアム

第11章 ゲームコントローラー市場:用途別

- カジュアルゲーミング

- eスポーツ

- プロゲーミング

第12章 ゲームコントローラー市場:流通チャネル別

- オフライン

- 電気店

- 専門店

- スーパーマーケット及びハイパーマーケット

- オンライン

- ブランド公式サイト

- eコマースポータルサイト

第13章 ゲームコントローラー市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州、中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第14章 ゲームコントローラー市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 ゲームコントローラー市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Sony Interactive Entertainment LLC

- Microsoft Corporation

- Nintendo Co., Ltd

- Logitech International S.A.

- Razer Inc.

- Performance Designed Products LLC

- 8BitDo Co., Ltd

- Nacon

- Guillemot Corporation

- HORI Co., Ltd