|

|

市場調査レポート

商品コード

1702240

小型衛星の市場規模、シェア、動向、予測:コンポーネント、タイプ、周波数、用途、エンドユーザー、地域別、2025年~2033年Small Satellite Market Size, Share, Trends and Forecast by Component, Type, Frequency, Application, End User, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 小型衛星の市場規模、シェア、動向、予測:コンポーネント、タイプ、周波数、用途、エンドユーザー、地域別、2025年~2033年 |

|

出版日: 2025年04月01日

発行: IMARC

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

小型衛星の世界市場規模は2024年に49億米ドルとなりました。今後、IMARC Groupは、市場は2033年までに84億米ドルに達し、2025年から2033年にかけて5.91%のCAGRを示すと予測しています。現在、北米が市場を独占しており、2024年には43.3%を超える大きな市場シェアを占めています。市場を牽引しているのは、コスト効率、技術の進歩、通信、地球観測、科学研究の需要拡大、民間投資の増加、政府の支援などです。

小型衛星はスモールサットとも呼ばれ、通常1,200kg未満の低質量・低サイズの衛星を指します。重量によって、小型衛星、超小型衛星、超小型衛星、ピコ衛星、フェムト衛星に分類されます。小型衛星は、営利企業、非営利団体、教育機関が地球低軌道でミッションを実施することを可能にする手頃な代替手段です。小型衛星は、低コストで、比較的容易に、かつ決められた時間内に、軌道上でいくつかの科学調査や技術実証を行うことを可能にします。その結果、小型衛星は、民間、商業、軍事、政府機関によって、通信や航法などの特定の用途に広く利用されています。

小型衛星の市場傾向:

エネルギー、石油・ガス、防衛、農業など様々な分野におけるリモートセンシングや地球観測サービスのニーズの高まりが、主に世界の小型衛星の市場を牽引しています。これに加えて、オーバー・ザ・トップ(OTT)サービスやインターネット・プロトコル・テレビ(IPTV)などの先端技術の普及により、通信やナビゲーションのために小型衛星が広く利用されるようになったことも、世界市場を刺激しています。さらに、新興国で低コストのブロードバンドを提供するためにLEOベースの小型衛星に対する需要が高まっていることも、市場の成長をさらに後押ししています。これとは別に、通信業界における小型衛星の導入は、衛星通信(Satcom)企業に新たな市場機会をもたらすだけでなく、世界の5G展開の加速につながっています。このことは、世界市場に明るい展望をもたらしています。加えて、学術目的や宇宙での技術実験のための研究機関による小型衛星の利用が拡大していることも、もう一つの重要な成長促進要因として作用しています。例えば、NASAのキューブサット構想は、教育機関やNGOに今後の小型衛星打ち上げで協力する機会を提供しています。さらに、効率的な通信の確保、宇宙船の信頼性の向上、調整の強化のために、ロボット工学、人工知能、機械学習などの数多くの革新的な技術の統合が進んでおり、予測期間中、世界の小型衛星の市場を増強すると予想されます。

本レポートで扱う主な質問

- 小型衛星とは何ですか?

- 小型衛星の市場の規模は?

- 2025-2033年における世界の小型衛星の市場の予想成長率は?

- 世界の小型衛星の市場を牽引する主要因は何か?

- 小型衛星の市場の構成要素に基づく世界の主要セグメントは?

- 小型衛星の市場の世界の主要セグメントをタイプ別に見ると?

- 小型衛星の市場の世界の主要セグメントを周波数別に見ると?

- 小型衛星の市場の世界の主要セグメントを用途別に見ると?

- 小型衛星の市場の世界の主要セグメントをエンドユーザー別に見ると?

- 小型衛星の市場の世界における主要地域は?

- 世界の小型衛星の市場における主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の小型衛星市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:コンポーネント別

- ペイロードと構造

- 電力システム

- ソーラーパネルとアンテナシステム

- 推進システム

- その他

第7章 市場内訳:タイプ別

- ミニ衛星

- マイクロ衛星

- ナノ衛星

- その他

第8章 市場内訳:周波数別

- Lバンド

- Sバンド

- Cバンド

- Xバンド

- Kuバンド

- Kaバンド

- Q/Vバンド

- HF/VHF/UHFバンド

- その他

第9章 市場内訳:用途別

- 通信

- 地球観測とリモートセンシング

- 科学と探検

- マッピングとナビゲーション

- 宇宙観測

- その他

第10章 市場内訳:エンドユーザー別

- 商業

- 学術

- 政府と軍隊

- その他

第11章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第12章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第13章 バリューチェーン分析

第14章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第15章 価格分析

第16章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- AAC Clyde Space

- Airbus SE

- Ball Corporation

- Blue Canyon Technologies(Raytheon Technologies Corporation)

- Exolaunch Gmbh

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Millennium Space Systems Inc.(The Boeing Company)

- Northrop Grumman Corporation

- Spire Global Inc.

- The Aerospace Corporation

List of Figures

- Figure 1: Global: Small Satellite Market: Major Drivers and Challenges

- Figure 2: Global: Small Satellite Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Small Satellite Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Small Satellite Market: Breakup by Component (in %), 2024

- Figure 5: Global: Small Satellite Market: Breakup by Type (in %), 2024

- Figure 6: Global: Small Satellite Market: Breakup by Frequency (in %), 2024

- Figure 7: Global: Small Satellite Market: Breakup by Application (in %), 2024

- Figure 8: Global: Small Satellite Market: Breakup by End User (in %), 2024

- Figure 9: Global: Small Satellite Market: Breakup by Region (in %), 2024

- Figure 10: Global: Small Satellite (Payloads and Structures) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Small Satellite (Payloads and Structures) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Small Satellite (Electric Power System) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Small Satellite (Electric Power System) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Small Satellite (Solar Panels and Antenna System) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Small Satellite (Solar Panels and Antenna System) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Small Satellite (Propulsion System) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Small Satellite (Propulsion System) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Small Satellite (Other Components) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Small Satellite (Other Components) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Small Satellite (Mini Satellite) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Small Satellite (Mini Satellite) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Small Satellite (Micro Satellite) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Small Satellite (Micro Satellite) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Small Satellite (Nano Satellite) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Small Satellite (Nano Satellite) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Small Satellite (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Small Satellite (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Small Satellite (L-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Small Satellite (L-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Small Satellite (S-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Small Satellite (S-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Small Satellite (C-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Small Satellite (C-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Small Satellite (X-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Small Satellite (X-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Small Satellite (Ku-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Small Satellite (Ku-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Global: Small Satellite (Ka-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Global: Small Satellite (Ka-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Global: Small Satellite (Q/V-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Global: Small Satellite (Q/V-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Global: Small Satellite (HF/VHF/UHF-Band) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Global: Small Satellite (HF/VHF/UHF-Band) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Global: Small Satellite (Other Frequencies) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Global: Small Satellite (Other Frequenciesl) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Global: Small Satellite (Communication) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Global: Small Satellite (Communication) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Global: Small Satellite (Earth Observation and Remote Sensing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Global: Small Satellite (Earth Observation and Remote Sensing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Global: Small Satellite (Science and Exploration) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Global: Small Satellite (Science and Exploration) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Global: Small Satellite (Mapping and Navigation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Global: Small Satellite (Mapping and Navigation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Global: Small Satellite (Space Observation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Global: Small Satellite (Space Observation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Global: Small Satellite (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Global: Small Satellite (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Global: Small Satellite (Commercial) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Global: Small Satellite (Commercial) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Global: Small Satellite (Academic) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Global: Small Satellite (Academic) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Global: Small Satellite (Government and Military) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Global: Small Satellite (Government and Military) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Global: Small Satellite (Other End Users) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Global: Small Satellite (Other End Users) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: North America: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: North America: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: United States: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: United States: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Canada: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Canada: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Asia-Pacific: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Asia-Pacific: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: China: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: China: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Japan: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Japan: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: India: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: India: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: South Korea: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: South Korea: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Australia: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Australia: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 84: Indonesia: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 85: Indonesia: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 86: Others: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 87: Others: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 88: Europe: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 89: Europe: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 90: Germany: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 91: Germany: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 92: France: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 93: France: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 94: United Kingdom: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 95: United Kingdom: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 96: Italy: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 97: Italy: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 98: Spain: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 99: Spain: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 100: Russia: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 101: Russia: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 102: Others: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 103: Others: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 104: Latin America: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 105: Latin America: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 106: Brazil: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 107: Brazil: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 108: Mexico: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 109: Mexico: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 110: Others: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 111: Others: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 112: Middle East and Africa: Small Satellite Market: Sales Value (in Million USD), 2019 & 2024

- Figure 113: Middle East and Africa: Small Satellite Market: Breakup by Country (in %), 2024

- Figure 114: Middle East and Africa: Small Satellite Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 115: Global: Small Satellite Industry: SWOT Analysis

- Figure 116: Global: Small Satellite Industry: Value Chain Analysis

- Figure 117: Global: Small Satellite Industry: Porter's Five Forces Analysis

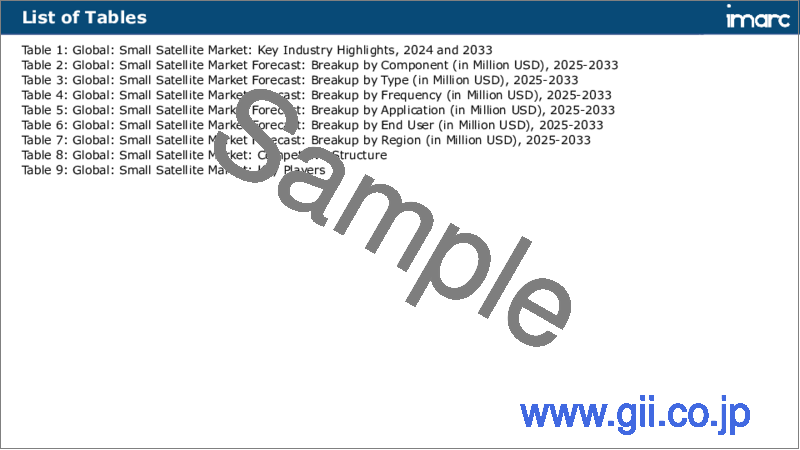

List of Tables

- Table 1: Global: Small Satellite Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Small Satellite Market Forecast: Breakup by Component (in Million USD), 2025-2033

- Table 3: Global: Small Satellite Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 4: Global: Small Satellite Market Forecast: Breakup by Frequency (in Million USD), 2025-2033

- Table 5: Global: Small Satellite Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 6: Global: Small Satellite Market Forecast: Breakup by End User (in Million USD), 2025-2033

- Table 7: Global: Small Satellite Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 8: Global: Small Satellite Market: Competitive Structure

- Table 9: Global: Small Satellite Market: Key Players

The global small satellite market size was valued at USD 4.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.4 Billion by 2033, exhibiting a CAGR of 5.91% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.3% in 2024. The market is driven by cost efficiency, technological advancements, growing demand for communications, earth observation, scientific research, increased private sector investment and government support.

A small satellite, also known as smallsat, refers to a type of low mass and size satellite, usually under 1,200 kg. Based on weight, it is categorized into minisatellite, microsatellite, nanosatellite, picosatellite, and femtosatellite. Small satellites are affordable alternatives that enable commercial enterprises, non-profit groups, and educational institutions to conduct missions in the lower Earth orbit. They make it possible to perform several scientific investigations and technology demonstrations in orbit at a low cost, with relative ease, and within a stipulated time. As a result, small satellites are extensively utilized for specific applications such as communication and navigation by civil, commercial, military, and government bodies.

Small Satellite Market Trends:

The rising need for remote sensing and Earth observation services across various sectors, including energy, oil & gas, defense, agriculture, etc., is primarily driving the global small satellite market. In addition to this, the widespread utilization of small satellites for communication and navigation owing to the increasing popularity of advanced technologies, such as over-the-top (OTT) services and Internet Protocol Television (IPTV), is also stimulating the global market. Moreover, the elevating demand for LEO-based small satellites to provide low-cost broadband in developing countries is further propelling the market growth. Apart from this, the introduction of small satellites in the telecom industry has led to the acceleration of 5G deployment globally, besides generating new market opportunities for satellite communication (Satcom) companies. This, in turn, is creating a positive outlook for the global market. Additionally, the escalating usage of small satellites by research organizations for academic purposes and technological experimentation in space is acting as another significant growth-inducing factor. For instance, NASA's CubeSat initiative offers educational institutions and NGOs a chance to collaborate on upcoming small satellite launches. Furthermore, the rising integration of numerous innovative technologies, such as robotics, artificial intelligence, machine learning, etc., to ensure efficient communications, improve spacecraft reliability, and enhance coordination is expected to augment the global small satellite market over the forecast period.

Key Market Segmentation:

Breakup by Component:

- Payloads and Structures

- Electric Power System

- Solar Panels and Antenna System

- Propulsion System

- Others

Breakup by Type:

- Mini Satellite

- Micro Satellite

- Nano Satellite

- Others

Breakup by Frequency:

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- Ka-Band

- Q/V-Band

- HF/VHF/UHF-Band

- Others

Breakup by Application:

- Communication

- Earth Observation and Remote Sensing

- Science and Exploration

- Mapping and Navigation

- Space Observation

- Others

Breakup by End User:

- Commercial

- Academic

- Government and Military

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being AAC Clyde Space, Airbus SE, Ball Corporation, Blue Canyon Technologies (Raytheon Technologies Corporation), Exolaunch Gmbh, GomSpace, L3Harris Technologies Inc., Lockheed Martin Corporation, Millennium Space Systems Inc. (The Boeing Company), Northrop Grumman Corporation, Spire Global Inc. and The Aerospace Corporation.

Key Questions Answered in This Report

- 1.What is small satellite?

- 2.How big is the small satellite market?

- 3.What is the expected growth rate of the global small satellite market during 2025-2033?

- 4.What are the key factors driving the global small satellite market?

- 5.What is the leading segment of the global small satellite market based on the component?

- 6.What is the leading segment of the global small satellite market based on type?

- 7.What is the leading segment of the global small satellite market based on frequency?

- 8.What is the leading segment of the global small satellite market based on application?

- 9.What is the leading segment of the global small satellite market based on end user?

- 10.What are the key regions in the global small satellite market?

- 11.Who are the key players/companies in the global small satellite market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Small Satellite Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Component

- 6.1 Payloads and Structures

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Electric Power System

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Solar Panels and Antenna System

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Propulsion System

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Type

- 7.1 Mini Satellite

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Micro Satellite

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Nano Satellite

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Frequency

- 8.1 L-Band

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 S-Band

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 C-Band

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 X-Band

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Ku-Band

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Ka-Band

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

- 8.7 Q/V-Band

- 8.7.1 Market Trends

- 8.7.2 Market Forecast

- 8.8 HF/VHF/UHF-Band

- 8.8.1 Market Trends

- 8.8.2 Market Forecast

- 8.9 Others

- 8.9.1 Market Trends

- 8.9.2 Market Forecast

9 Market Breakup by Application

- 9.1 Communication

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Earth Observation and Remote Sensing

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Science and Exploration

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Mapping and Navigation

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Space Observation

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

- 9.6 Others

- 9.6.1 Market Trends

- 9.6.2 Market Forecast

10 Market Breakup by End User

- 10.1 Commercial

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 Academic

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

- 10.3 Government and Military

- 10.3.1 Market Trends

- 10.3.2 Market Forecast

- 10.4 Others

- 10.4.1 Market Trends

- 10.4.2 Market Forecast

11 Market Breakup by Region

- 11.1 North America

- 11.1.1 United States

- 11.1.1.1 Market Trends

- 11.1.1.2 Market Forecast

- 11.1.2 Canada

- 11.1.2.1 Market Trends

- 11.1.2.2 Market Forecast

- 11.1.1 United States

- 11.2 Asia-Pacific

- 11.2.1 China

- 11.2.1.1 Market Trends

- 11.2.1.2 Market Forecast

- 11.2.2 Japan

- 11.2.2.1 Market Trends

- 11.2.2.2 Market Forecast

- 11.2.3 India

- 11.2.3.1 Market Trends

- 11.2.3.2 Market Forecast

- 11.2.4 South Korea

- 11.2.4.1 Market Trends

- 11.2.4.2 Market Forecast

- 11.2.5 Australia

- 11.2.5.1 Market Trends

- 11.2.5.2 Market Forecast

- 11.2.6 Indonesia

- 11.2.6.1 Market Trends

- 11.2.6.2 Market Forecast

- 11.2.7 Others

- 11.2.7.1 Market Trends

- 11.2.7.2 Market Forecast

- 11.2.1 China

- 11.3 Europe

- 11.3.1 Germany

- 11.3.1.1 Market Trends

- 11.3.1.2 Market Forecast

- 11.3.2 France

- 11.3.2.1 Market Trends

- 11.3.2.2 Market Forecast

- 11.3.3 United Kingdom

- 11.3.3.1 Market Trends

- 11.3.3.2 Market Forecast

- 11.3.4 Italy

- 11.3.4.1 Market Trends

- 11.3.4.2 Market Forecast

- 11.3.5 Spain

- 11.3.5.1 Market Trends

- 11.3.5.2 Market Forecast

- 11.3.6 Russia

- 11.3.6.1 Market Trends

- 11.3.6.2 Market Forecast

- 11.3.7 Others

- 11.3.7.1 Market Trends

- 11.3.7.2 Market Forecast

- 11.3.1 Germany

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.1.1 Market Trends

- 11.4.1.2 Market Forecast

- 11.4.2 Mexico

- 11.4.2.1 Market Trends

- 11.4.2.2 Market Forecast

- 11.4.3 Others

- 11.4.3.1 Market Trends

- 11.4.3.2 Market Forecast

- 11.4.1 Brazil

- 11.5 Middle East and Africa

- 11.5.1 Market Trends

- 11.5.2 Market Breakup by Country

- 11.5.3 Market Forecast

12 SWOT Analysis

- 12.1 Overview

- 12.2 Strengths

- 12.3 Weaknesses

- 12.4 Opportunities

- 12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

- 14.1 Overview

- 14.2 Bargaining Power of Buyers

- 14.3 Bargaining Power of Suppliers

- 14.4 Degree of Competition

- 14.5 Threat of New Entrants

- 14.6 Threat of Substitutes

15 Price Analysis

16 Competitive Landscape

- 16.1 Market Structure

- 16.2 Key Players

- 16.3 Profiles of Key Players

- 16.3.1 AAC Clyde Space

- 16.3.1.1 Company Overview

- 16.3.1.2 Product Portfolio

- 16.3.1.3 Financials

- 16.3.2 Airbus SE

- 16.3.2.1 Company Overview

- 16.3.2.2 Product Portfolio

- 16.3.2.3 Financials

- 16.3.2.4 SWOT Analysis

- 16.3.3 Ball Corporation

- 16.3.3.1 Company Overview

- 16.3.3.2 Product Portfolio

- 16.3.3.3 Financials

- 16.3.3.4 SWOT Analysis

- 16.3.4 Blue Canyon Technologies (Raytheon Technologies Corporation)

- 16.3.4.1 Company Overview

- 16.3.4.2 Product Portfolio

- 16.3.5 Exolaunch Gmbh

- 16.3.5.1 Company Overview

- 16.3.5.2 Product Portfolio

- 16.3.6 GomSpace

- 16.3.6.1 Company Overview

- 16.3.6.2 Product Portfolio

- 16.3.7 L3Harris Technologies Inc.

- 16.3.7.1 Company Overview

- 16.3.7.2 Product Portfolio

- 16.3.7.3 Financials

- 16.3.8 Lockheed Martin Corporation

- 16.3.8.1 Company Overview

- 16.3.8.2 Product Portfolio

- 16.3.8.3 Financials

- 16.3.8.4 SWOT Analysis

- 16.3.9 Millennium Space Systems Inc. (The Boeing Company)

- 16.3.9.1 Company Overview

- 16.3.9.2 Product Portfolio

- 16.3.10 Northrop Grumman Corporation

- 16.3.10.1 Company Overview

- 16.3.10.2 Product Portfolio

- 16.3.10.3 Financials

- 16.3.10.4 SWOT Analysis

- 16.3.11 Spire Global Inc.

- 16.3.11.1 Company Overview

- 16.3.11.2 Product Portfolio

- 16.3.11.3 Financials

- 16.3.12 The Aerospace Corporation

- 16.3.12.1 Company Overview

- 16.3.12.2 Product Portfolio

- 16.3.12.3 SWOT Analysis

- 16.3.1 AAC Clyde Space