|

|

市場調査レポート

商品コード

1526811

小型衛星の世界市場:質量別、サブシステム別、用途別、最終用途別、周波数別、軌道別、地域別 - 2029年までの予測Small Satellite Market by Mass (Small, Mini, Micro, Nano, Cube), Subsystem (Satellite bus, Payloads, Solar Pannels, Satellite Antennas), Orbit (LEO, MEO, GEO, Other Orbits), Application, End Use, Frequency and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 小型衛星の世界市場:質量別、サブシステム別、用途別、最終用途別、周波数別、軌道別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月31日

発行: MarketsandMarkets

ページ情報: 英文 304 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

小型衛星の市場規模は、2024年の52億米ドルから2029年には112億米ドルに成長すると予測され、2024年から2029年までのCAGRは16.6%になると見込まれています。

2024年からの小型衛星打ち上げ予定数は3220機から約1442機増加し、2029年には4662機に達すると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 質量別、サブシステム別、用途別、最終用途別、周波数別、軌道別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

小型衛星の打ち上げを後押しする商業衛星の需要増が、この急成長を後押ししています。小型衛星は手頃な価格で開発期間が短く、通信や地球観測など様々な目的に利用できるため、広く受け入れられています。小型衛星のニーズの高まりは、革新的な製造方法、より軽量な素材、人工知能の統合といった技術の進歩に後押しされています。このような改良により、従来は大型衛星に限られていた困難なタスクをこなす、高度な能力を持つ衛星の製造が容易になっています。さらに、小型化が進むと同時に、高性能の小型デバイスの建設が進み、より効果的な宇宙船の設計が容易になります。

最終用途別では、小型衛星市場は商業、政府・防衛、デュアルユースに分類されます。政府・防衛分野の市場シェアは9.1%で2番目に高くなります。小型衛星市場の政府・防衛分野は、通信・監視・偵察能力の強化という重要なニーズによって牽引されています。地政学的緊張の高まりと、国家安全機能を一歩前進させる必要性は、小型衛星の採用を推進する重要な要素です。

用途別では、市場はさらに通信、地球観測、科学研究、技術、その他に区分されます。地球観測&リモートセンシング分野は30.8%と2番目に高い市場シェアを持っています。業界の主なプレーヤーは、この市場の新たな機会を活用するために、先進的な高解像度地球観測衛星の開発に積極的に取り組んでいます。衛星画像技術とデータ解析能力の進歩により、小型衛星は気候調査、資源管理、政府の政策決定に貴重な洞察を提供できるようになっています。また、官民パートナーシップや企業からの投資もこの分野の成長を大きく後押しし、地球観測サービスの手頃な価格と利用しやすさを高めています。

当レポートでは、世界の小型衛星市場について調査し、質量別、サブシステム別、用途別、最終用途別、周波数別、軌道別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 規制状況

- 貿易分析

- 主な利害関係者と購入基準

- 2024年の主な会議とイベント

- 技術分析

- 使用事例分析

- 運用データ

- ビジネスモデル

- 総所有コスト

- 部品表

- 生成AIの影響

- 技術ロードマップ

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 小型衛星市場(質量別)

- イントロダクション

- 小型

- ミニ

- マイクロ

- ナノ

- キューブ

第8章 小型衛星市場(サブシステム別)

- イントロダクション

- 衛星バス

- ペイロード

- ソーラーパネル

- 衛星アンテナ

- その他

第9章 小型衛星市場(用途別)

- イントロダクション

- 通信

- 地球観測とリモートセンシング

- 科学研究

- テクノロジー

- その他

第10章 小型衛星市場(最終用途別)

- イントロダクション

- 商業

- 政府・防衛

- デュアルユース

第11章 小型衛星市場(周波数別)

- イントロダクション

- Lバンド

- Sバンド

- Cバンド

- Xバンド

- KUバンド

- KAバンド

- Q/V/Eバンド

- HF/VHF/UHFバンド

- レーザー/光バンド

第12章 小型衛星市場(軌道別)

- イントロダクション

- LEO

- MEO

- GEO

- その他

第13章 小型衛星市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020-2023

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- SPACEX

- LOCKHEED MARTIN CORPORATION

- AIRBUS DEFENCE AND SPACE

- NORTHROP GRUMMAN

- L3HARRIS TECHNOLOGIES, INC.

- THALES ALENIA SPACE

- MDA

- SURREY SATELLITE TECHNOLOGY LTD

- PLANET LABS PBC

- SNC

- MAXAR TECHNOLOGIES

- GOMSPACE

- MITSUBISHI ELECTRIC CORPORATION

- BAE SYSTEMS

- RTX

- OHB SE

- THE AEROSPACE CORPORATION

- MILLENNIUM SPACE SYSTEMS, INC.

- KUIPER SYSTEMS LLC

- TERRAN ORBITAL CORPORATION

- その他の企業

- AEROSPACELAB

- ENDUROSAT

- NANOAVIONICS

- ALEN SPACE

- NEARSPACE LAUNCH

- SWARM

- ARGOTEC S.R.L.

- ASTRANIS

第16章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

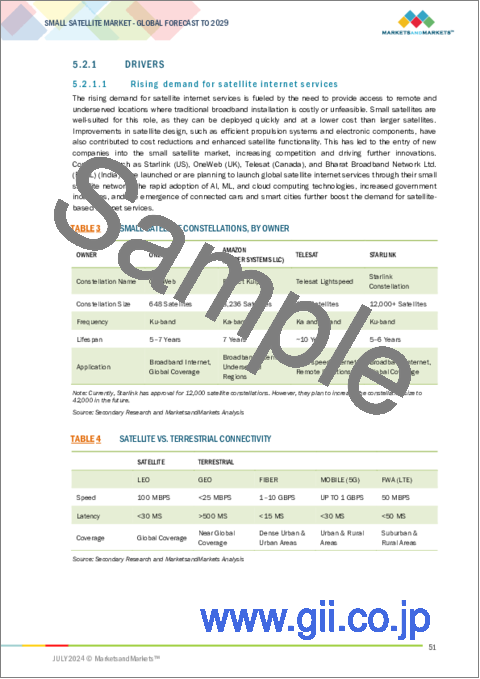

- TABLE 3 SMALL SATELLITE CONSTELLATIONS, BY OWNER

- TABLE 4 SATELLITE VS. TERRESTRIAL CONNECTIVITY

- TABLE 5 OPERATIONAL SMALL SATELLITE CONSTELLATIONS

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 INDICATIVE PRICING ANALYSIS OF SMALL SATELLITES, BY MASS (USD MILLION)

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPORT DATA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP FOUR APPLICATIONS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2024

- TABLE 18 SMALL SATELLITE ACTIVE FLEET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 19 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 20 COMPARISON OF TOTAL COST OF OWNERSHIP FOR SATELLITES

- TABLE 21 AVERAGE TOTAL COST OF OWNERSHIP FOR SMALL SATELLITES, BY MASS (USD MILLION)

- TABLE 22 BILL OF MATERIALS ANALYSIS FOR SMALL SATELLITES

- TABLE 23 COMPARISON OF BILL OF MATERIALS FOR SMALL SATELLITES

- TABLE 24 IMPACT OF AI ON SPACE APPLICATIONS

- TABLE 25 PATENT ANALYSIS

- TABLE 26 SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 27 SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

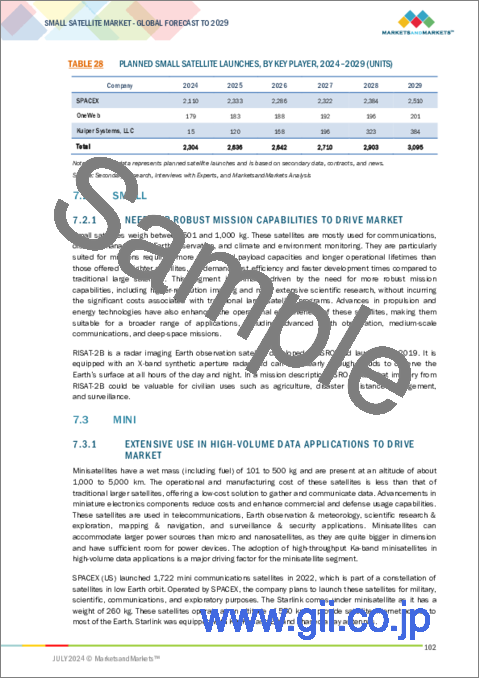

- TABLE 28 PLANNED SMALL SATELLITE LAUNCHES, BY KEY PLAYER, 2024-2029 (UNITS)

- TABLE 29 CUBE SATELLITE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 30 CUBE SATELLITE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2020-2023 (USD MILLION)

- TABLE 32 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2024-2029 (USD MILLION)

- TABLE 33 SATELLITE BUSES: SMALL SATELLITE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 34 SATELLITE BUSES: SMALL SATELLITE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 35 PROPULSION SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 36 PROPULSION SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 37 PAYLOADS: SMALL SATELLITE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 38 PAYLOADS: SMALL SATELLITE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 39 TRADITIONAL PAYLOAD MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 40 TRADITIONAL PAYLOAD MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 41 SMALL SATELLITE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 42 SMALL SATELLITE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 43 SMALL SATELLITE VOLUME, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 44 SMALL SATELLITE VOLUME, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 45 SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 46 SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 47 COMMERCIAL: SMALL SATELLITE MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 48 COMMERCIAL: SMALL SATELLITE MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 49 GOVERNMENT & DEFENSE: SMALL SATELLITE MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 50 GOVERNMENT & DEFENSE: SMALL SATELLITE MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 51 SMALL SATELLITE MARKET, BY FREQUENCY, 2020-2023 (USD MILLION)

- TABLE 52 SMALL SATELLITE MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- TABLE 53 SMALL SATELLITE MARKET, BY ORBIT, 2020-2023 (USD MILLION)

- TABLE 54 SMALL SATELLITE MARKET, BY ORBIT, 2024-2029 (USD MILLION)

- TABLE 55 SMALL SATELLITE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 SMALL SATELLITE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 59 NORTH AMERICA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: SMALL SATELLITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: SMALL SATELLITE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 63 US: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 64 US: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 65 US: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 66 US: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 67 CANADA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 68 CANADA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 69 CANADA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 70 CANADA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 71 EUROPE: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 73 EUROPE: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 74 EUROPE: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 75 EUROPE: SMALL SATELLITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 76 EUROPE: SMALL SATELLITE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 77 RUSSIA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 78 RUSSIA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 79 RUSSIA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 80 RUSSIA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 81 UK: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 82 UK: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 83 UK: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 84 UK: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 85 GERMANY: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 86 GERMANY: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 87 GERMANY: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 88 GERMANY: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 89 FRANCE: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 90 FRANCE: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 91 FRANCE: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 92 FRANCE: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 93 ITALY: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 94 ITALY: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 95 ITALY: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 96 ITALY: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 97 REST OF EUROPE: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 98 REST OF EUROPE: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 99 REST OF EUROPE: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 100 REST OF EUROPE: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMALL SATELLITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SMALL SATELLITE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 107 CHINA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 108 CHINA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 109 CHINA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 110 CHINA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 111 INDIA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 112 INDIA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 113 INDIA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 114 INDIA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 115 JAPAN: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 116 JAPAN: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 117 JAPAN: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 118 JAPAN: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 119 SOUTH KOREA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 120 SOUTH KOREA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 121 SOUTH KOREA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 122 SOUTH KOREA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 123 AUSTRALIA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 124 AUSTRALIA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 125 AUSTRALIA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 126 AUSTRALIA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 131 MIDDLE EAST: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 132 MIDDLE EAST: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 133 MIDDLE EAST: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 134 MIDDLE EAST: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 135 MIDDLE EAST: SMALL SATELLITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 136 MIDDLE EAST: SMALL SATELLITE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 137 UAE: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 138 UAE: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 139 UAE: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 140 UAE: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 141 SAUDI ARABIA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 142 SAUDI ARABIA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 143 SAUDI ARABIA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 144 SAUDI ARABIA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 149 REST OF THE WORLD: SMALL SATELLITE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 150 REST OF THE WORLD: SMALL SATELLITE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 151 REST OF THE WORLD: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 152 REST OF THE WORLD: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 153 REST OF THE WORLD: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 154 REST OF THE WORLD: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 155 LATIN AMERICA: SMALL SATELLITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 156 LATIN AMERICA: SMALL SATELLITE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 157 LATIN AMERICA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 158 LATIN AMERICA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 159 LATIN AMERICA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 160 LATIN AMERICA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 161 MEXICO: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 162 MEXICO: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 163 MEXICO: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 164 MEXICO: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 165 ARGENTINA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 166 ARGENTINA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 167 ARGENTINA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 168 ARGENTINA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 173 AFRICA: SMALL SATELLITE MARKET, BY MASS, 2020-2023 (USD MILLION)

- TABLE 174 AFRICA: SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- TABLE 175 AFRICA: SMALL SATELLITE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 176 AFRICA: SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 177 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 178 SMALL SATELLITE MARKET: DEGREE OF COMPETITION

- TABLE 179 END USE FOOTPRINT

- TABLE 180 APPLICATION FOOTPRINT

- TABLE 181 MASS FOOTPRINT

- TABLE 182 REGION FOOTPRINT

- TABLE 183 LIST OF START-UPS/SMES

- TABLE 184 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 185 SMALL SATELLITE MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 186 SMALL SATELLITE MARKET: DEALS, 2020-2024

- TABLE 187 SMALL SATELLITE MARKET: OTHERS, 2020-2024

- TABLE 188 SPACEX: COMPANY OVERVIEW

- TABLE 189 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 SPACEX: OTHERS

- TABLE 191 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 192 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 194 AIRBUS DEFENCE AND SPACE: COMPANY OVERVIEW

- TABLE 195 AIRBUS DEFENCE AND SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 AIRBUS DEFENCE AND SPACE: DEALS

- TABLE 197 AIRBUS DEFENCE AND SPACE: OTHERS

- TABLE 198 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 199 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 NORTHROP GRUMMAN: DEALS

- TABLE 201 NORTHROP GRUMMAN: OTHERS

- TABLE 202 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 203 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 205 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 206 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 207 THALES ALENIA SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 THALES ALENIA SPACE: DEALS

- TABLE 209 THALES ALENIA SPACE: OTHERS

- TABLE 210 MDA: COMPANY OVERVIEW

- TABLE 211 MDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 MDA: OTHERS

- TABLE 213 SURREY SATELLITE TECHNOLOGY LTD: COMPANY OVERVIEW

- TABLE 214 SURREY SATELLITE TECHNOLOGY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SURREY SATELLITE TECHNOLOGY LTD: DEALS

- TABLE 216 SURREY SATELLITE TECHNOLOGY LTD: OTHERS

- TABLE 217 PLANET LABS PBC: COMPANY OVERVIEW

- TABLE 218 PLANET LABS PBC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 PLANET LABS PBC: PRODUCT LAUNCHES

- TABLE 220 PLANET LABS PBC: DEALS

- TABLE 221 PLANET LABS PBC: OTHERS

- TABLE 222 SNC: COMPANY OVERVIEW

- TABLE 223 SNC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 SNC: OTHERS

- TABLE 225 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 226 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 MAXAR TECHNOLOGIES: OTHERS

- TABLE 228 GOMSPACE: COMPANY OVERVIEW

- TABLE 229 GOMSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 GOMSPACE: DEALS

- TABLE 231 GOMSPACE: OTHERS

- TABLE 232 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 233 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 235 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 236 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 BAE SYSTEMS: DEALS

- TABLE 238 RTX: COMPANY OVERVIEW

- TABLE 239 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 RTX: DEALS

- TABLE 241 RTX: OTHERS

- TABLE 242 OHB SE: COMPANY OVERVIEW

- TABLE 243 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 OHB SE: DEALS

- TABLE 245 OHB SE: OTHERS

- TABLE 246 THE AEROSPACE CORPORATION: COMPANY OVERVIEW

- TABLE 247 THE AEROSPACE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 THE AEROSPACE CORPORATION: OTHERS

- TABLE 249 MILLENNIUM SPACE SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 250 MILLENNIUM SPACE SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 MILLENNIUM SPACE SYSTEMS, INC.: OTHERS

- TABLE 252 KUIPER SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 253 KUIPER SYSTEMS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 TERRAN ORBITAL CORPORATION: COMPANY OVERVIEW

- TABLE 255 TERRAN ORBITAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 TERRAN ORBITAL CORPORATION: PRODUCT LAUNCHES

- TABLE 257 TERRAN ORBITAL CORPORATION: DEALS

- TABLE 258 TERRAN ORBITAL CORPORATION: OTHERS

- TABLE 259 AEROSPACELAB: COMPANY OVERVIEW

- TABLE 260 ENDUROSAT: COMPANY OVERVIEW

- TABLE 261 NANOAVIONICS: COMPANY OVERVIEW

- TABLE 262 ALEN SPACE: COMPANY OVERVIEW

- TABLE 263 NEARSPACE LAUNCH: COMPANY OVERVIEW

- TABLE 264 SWARM: COMPANY OVERVIEW

- TABLE 265 ARGOTEC S.R.L.: COMPANY OVERVIEW

- TABLE 266 ASTRANIS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SMALL SATELLITE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SMALL SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 8 COMMUNICATIONS SEGMENT TO ACQUIRE MAXIMUM SHARE IN 2029

- FIGURE 9 LEO SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR SMALL SATELLITES IN 2024

- FIGURE 11 INCREASING USE OF SMALL SATELLITES FOR TRACKING, MONITORING, AND SURVEILLANCE TO DRIVE MARKET

- FIGURE 12 SATELLITE BUSES TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 13 KU-BAND TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 COMMERCIAL SEGMENT TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 15 CANADA TO BE FASTEST-GROWING MARKET FOR SMALL SATELLITES DURING FORECAST PERIOD

- FIGURE 16 SMALL SATELLITE MARKET DYNAMICS

- FIGURE 17 SHARE OF SMALL SATELLITES, BY OPERATOR, 2023

- FIGURE 18 ORBITAL LAUNCHES, BY COUNTRY, 2023

- FIGURE 19 SPACE JUNK ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 24 EQUITY INVESTMENTS IN SATELLITES, BY INVESTOR TYPE, 2023

- FIGURE 25 AVERAGE SELLING PRICE OF SMALL SATELLITES, BY REGION, 2020-2023 (USD MILLION)

- FIGURE 26 INDICATIVE PRICING ANALYSIS OF SMALL SATELLITES, BY MASS (USD MILLION)

- FIGURE 27 IMPORT DATA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 28 EXPORT DATA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 30 KEY BUYING CRITERIA FOR TOP FOUR APPLICATIONS

- FIGURE 31 BUSINESS MODELS IN SMALL SATELLITE MARKET

- FIGURE 32 BUSINESS MODELS IN SATELLITE MANUFACTURING

- FIGURE 33 BREAKDOWN OF TOTAL COST OF OWNERSHIP

- FIGURE 34 TOTAL COST OF OWNERSHIP FOR SMALL SATELLITES, BY MASS (USD MILLION)

- FIGURE 35 BILL OF MATERIALS FOR CUBE SATELLITES

- FIGURE 36 BILL OF MATERIALS FOR SMALL SATELLITES

- FIGURE 37 AI IN SPACE

- FIGURE 38 ADOPTION OF AI IN SPACE BY TOP COUNTRIES

- FIGURE 39 IMPACT OF AI ON SATELLITE PLATFORMS

- FIGURE 40 IMPACT OF AI ON SMALL SATELLITE MARKET

- FIGURE 41 TECHNOLOGY ROADMAP

- FIGURE 42 EVOLUTION OF SMALL SATELLITE TECHNOLOGIES

- FIGURE 43 EMERGING TECHNOLOGY TRENDS

- FIGURE 44 TECHNOLOGY TRENDS

- FIGURE 45 SUPPLY CHAIN ANALYSIS

- FIGURE 46 PATENT ANALYSIS

- FIGURE 47 SMALL SATELLITE MARKET, BY MASS, 2024-2029 (USD MILLION)

- FIGURE 48 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2024-2029 (USD MILLION)

- FIGURE 49 SMALL SATELLITE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- FIGURE 50 SMALL SATELLITE MARKET, BY END USE, 2024-2029 (USD MILLION)

- FIGURE 51 SMALL SATELLITE MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- FIGURE 52 SMALL SATELLITE MARKET, BY ORBIT, 2024-2029 (USD MILLION)

- FIGURE 53 SMALL SATELLITE MARKET, BY REGION, 2024-2029

- FIGURE 54 NORTH AMERICA: SMALL SATELLITE MARKET SNAPSHOT

- FIGURE 55 EUROPE: SMALL SATELLITE MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: SMALL SATELLITE MARKET SNAPSHOT

- FIGURE 57 MIDDLE EAST: SMALL SATELLITE MARKET SNAPSHOT

- FIGURE 58 REST OF THE WORLD: SMALL SATELLITE MARKET SNAPSHOT

- FIGURE 59 REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2020-2023

- FIGURE 60 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 61 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 62 COMPANY FOOTPRINT

- FIGURE 63 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 64 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 65 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 66 BRAND/PRODUCT COMPARISON

- FIGURE 67 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 AIRBUS DEFENCE AND SPACE: COMPANY SNAPSHOT

- FIGURE 69 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 70 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 71 MDA: COMPANY SNAPSHOT

- FIGURE 72 PLANET LABS PBC: COMPANY SNAPSHOT

- FIGURE 73 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 74 GOMSPACE: COMPANY SNAPSHOT

- FIGURE 75 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 77 RTX: COMPANY SNAPSHOT

- FIGURE 78 OHB SE: COMPANY SNAPSHOT

- FIGURE 79 TERRAN ORBITAL CORPORATION: COMPANY SNAPSHOT

The small satellite market is estimated to grow to USD 11.2 billion by 2029, from USD 5.2 billion in 2024, at a CAGR of 16.6% from 2024 to 2029. The anticipated number of small satellite launches from 2024 is expected to increase by around 1442 from 3220 units to reach 4,662 units in 2029.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Mass, Subsystem, Orbit, Application, End Use, Frequency and Region |

| Regions covered | North America, Europe, APAC, RoW |

This surge has been stimulated by increasing demand for commercial satellites boosting the launching of small satellites. They are widely accepted since they are affordable, have short developing periods and can serve various purposes such as telecommunication, earth observation, etc. The growing need for small satellites is fueled by technology advancements like innovative production methods, lighter materials and artificial intelligence integration. Such improvements make it easier to build advanced capable satellites which can do difficult tasks that were limited to larger ones in the past. Furthermore, greater miniaturization focus as well as high performance small devices construction facilitate design of more effective spacecrafts.

"Government & Defence segment by end use is expected to hold the second highest market share in 2024."

Based on end use, the small satellite market is categorized into commercial, government & defence, and dual use. The government & defence segment having second highest market share of 9.1%. The government and defense segment of the small satellite market is driven by the critical need for enhanced communication, surveillance, and reconnaissance capabilities. Increasing geopolitical tensions and the necessity for stepped forward national safety features are key elements propelling the adoption of small satellites.

"Earth observation & remote sensing segment by application is estimated to hold the second highest market share in 2024."

Based on application, the market is further segmented into communication, earth observation, scientific research, technology and others. The Earth observation & remote sensing segment having second highest market share of 30.8%. Key players in the industry are actively working on developing advanced high resolution earth observation satellites to take advantage of new opportunities in this market. Advancements in satellite imaging technologies and data analysis capabilities have enabled small satellites to offer valuable insights for climate research, resource management and government policy making. Public-private partnerships and investments from businesses also significantly drive this segment's growth thereby enhancing affordability and accessibility of Earth observation services.

"Asia Pacific is expected to hold the second highest market share in 2024."

The small satellite industry in Asia Pacific is booming, with more money flowing in from both established and up-and-coming space countries. New companies focusing on small satellite tech are popping up all over the region. These new organizations bring new ideas making the whole market stronger and more exciting. This growth is prompted by the need for better communication infrastructure particularly in remote and rural areas, as well as growing government's focus on managing disasters and environmental monitoring through satellite technology. In addition to that, the region has a strong collaboration between the countries and private companies that have improved innovation leading to deployment capabilities thus making Asia Pacific one of the dynamic players in global small satellite industry.

The break-up of the profile of primary participants in the small satellite market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, Others - 40%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 35%, Middle East - 10%, and Rest of the World - 10%

SpaceX (US), Lockheed Martin Corporation (US), Airbus Defence and Space (Germany), Northrop Grumman (US), L3Harris Technologies, Inc. (US). These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, Africa, and Rest of the World.

Research Coverage:

In terms of Mass, the small satellite market is divided into small, micro, mini, nano, and cube. The end use segment of the small satellite market is commercial, government & defence and dual use.

The frequency-based segmentation includes L- Band, S-Band, C-Band, X-Band, Ku-Band, Ka-Band, Q/V/E- Band, HF/VHF/UHF-Band, and Laser/Optical.

Based on application, communication, earth observation, scientific research, technology, and others. The orbit segment is divided into LEO, MO, GEO, and other orbits.

This report segments the small satellite market across five key regions: North America, Europe, Asia Pacific, the Middle East, Africa and Rest of the World along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the small satellite market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the small satellite market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the small satellite market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies for Simulation. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Rising demand for satellite internet services, Expanding satellite networks for internet access in underserved areas) restraint (Absence of unified regulations and government policies across nations, Limited coverage and complexity of small satellites compared to large satellites) opportunities (Increased government investments in space agencies, Increased use of small satellites in various applications) and challenges (Concerns over increasing space debris, Supply chain management issues) there are several other factors that could contribute in the small satellite market.

- Market Penetration: Comprehensive information on small satellite solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the small satellite market

- Market Development: Comprehensive information about lucrative markets - the report analyses the small satellite market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the small satellite market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the small satellite market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.1.2 Market size illustration - US Earth observation nanosatellite market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMALL SATELLITE MARKET

- 4.2 SMALL SATELLITE MARKET, BY SUBSYSTEM

- 4.3 SMALL SATELLITE MARKET, BY FREQUENCY

- 4.4 SMALL SATELLITE MARKET, BY END USE

- 4.5 SMALL SATELLITE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for satellite internet services

- 5.2.1.2 Need for Earth observation imagery and analytics

- 5.2.1.3 Increasing launches of cube satellites

- 5.2.1.4 Cost-effectiveness of small satellites

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of unified regulations and government policies

- 5.2.2.2 Resource constraints on small satellites

- 5.2.2.3 Limited coverage and operational complexity of small satellites

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased government investments in space agencies

- 5.2.3.2 Widespread adoption of small satellites

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in space debris

- 5.2.4.2 Intricacies of propulsion systems

- 5.2.4.3 Supply chain management issues

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY REGION

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY MASS

- 5.8 REGULATORY LANDSCAPE

- 5.9 TRADE ANALYSIS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS, 2024

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGY

- 5.12.1.1 Advanced power systems

- 5.12.1.2 Miniaturization

- 5.12.2 COMPLEMENTARY TECHNOLOGY

- 5.12.2.1 Hyperspectral and multispectral imaging

- 5.12.1 KEY TECHNOLOGY

- 5.13 USE CASE ANALYSIS

- 5.13.1 HAWKEYE 360 LEVERAGES GOMSPACE'S SMALL-SATELLITE RADIO AND ANTENNA TECHNOLOGY FOR ITS PATHFINDER MISSION

- 5.13.2 SEAM PROJECT DEPLOYS NANOSATELLITE FOR MAGNETIC AND ELECTRIC FIELD MEASUREMENTS IN EARTH IONOSPHERE

- 5.13.3 EUROPEAN FIRERS PROJECT COMBATS FOREST FIRE USING LUME-1 CUBESAT

- 5.14 OPERATIONAL DATA

- 5.15 BUSINESS MODELS

- 5.16 TOTAL COST OF OWNERSHIP

- 5.17 BILL OF MATERIALS

- 5.18 IMPACT OF GENERATIVE AI

- 5.18.1 INTRODUCTION

- 5.18.2 ADOPTION OF AI IN SPACE BY TOP COUNTRIES

- 5.18.3 IMPACT OF AI ON SPACE USE CASES

- 5.18.4 IMPACT OF AI ON SMALL SATELLITE MARKET

- 5.19 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ADVANCED MATERIALS

- 6.2.2 ADDITIVE MANUFACTURING

- 6.2.3 DEDICATED LAUNCH VEHICLES

- 6.2.4 ELECTRIC PROPULSION SYSTEMS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 INDUSTRY 4.0

- 6.3.2 CLOUD COMPUTING

- 6.3.3 INTER-SATELLITE LINK COMMUNICATION

- 6.3.4 HYBRID BEAMFORMING

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

7 SMALL SATELLITE MARKET, BY MASS

- 7.1 INTRODUCTION

- 7.2 SMALL

- 7.2.1 NEED FOR ROBUST MISSION CAPABILITIES TO DRIVE MARKET

- 7.3 MINI

- 7.3.1 EXTENSIVE USE IN HIGH-VOLUME DATA APPLICATIONS TO DRIVE MARKET

- 7.4 MICRO

- 7.4.1 NEED FOR TACTICAL COMMUNICATIONS IN MILITARY APPLICATIONS TO DRIVE MARKET

- 7.5 NANO

- 7.5.1 ADVANCES IN MINIATURIZATION OF ELECTRONICS TO DRIVE MARKET

- 7.6 CUBE

- 7.6.1 RAPID DEPLOYMENT IN INTERPLANETARY MISSIONS TO DRIVE MARKET

- 7.6.2 0.25-1U

- 7.6.3 2U

- 7.6.4 3U

- 7.6.5 6U

- 7.6.6 >12U

8 SMALL SATELLITE MARKET, BY SUBSYSTEM

- 8.1 INTRODUCTION

- 8.2 SATELLITE BUSES

- 8.2.1 ATTITUDE & ORBITAL CONTROL SYSTEMS

- 8.2.1.1 Need for precision in satellite positioning to drive market

- 8.2.2 COMMAND & DATA HANDLING SYSTEMS

- 8.2.2.1 Increasing complexity of small satellite missions to drive market

- 8.2.3 ELECTRICAL POWER SYSTEMS

- 8.2.3.1 Focus on enhancing satellite performance to drive market

- 8.2.4 PROPULSION SYSTEMS

- 8.2.4.1 Chemical propulsion

- 8.2.4.1.1 Immediate thrust capabilities to drive market

- 8.2.4.2 Electric propulsion

- 8.2.4.2.1 Improved propulsive performance of thrusters to drive market

- 8.2.4.3 Hybrid propulsion

- 8.2.4.3.1 Multi-phase missions requiring rapid maneuvers and long-duration station-keeping to drive market

- 8.2.4.1 Chemical propulsion

- 8.2.5 TELEMETRY, TRACKING, & COMMAND SYSTEMS

- 8.2.5.1 Need for effective communications between satellites and ground stations to drive market

- 8.2.6 STRUCTURES

- 8.2.6.1 Expanding capabilities of structural subsystems to drive market

- 8.2.7 THERMAL SYSTEMS

- 8.2.7.1 Advances in materials science and thermal management solutions to drive market

- 8.2.1 ATTITUDE & ORBITAL CONTROL SYSTEMS

- 8.3 PAYLOADS

- 8.3.1 TRADITIONAL PAYLOADS

- 8.3.1.1 Optical & infrared payloads

- 8.3.1.1.1 Ongoing development of high-resolution optical imaging payloads to drive market

- 8.3.1.2 Hyperspectral & multispectral payloads

- 8.3.1.2.1 Growing demand for enhanced Earth observation capabilities to drive market

- 8.3.1.3 SAR payloads

- 8.3.1.3.1 Need for high-resolution remote sensing to drive market

- 8.3.1.4 Communications payloads/transponders

- 8.3.1.4.1 Extensive use in telecom satellites to drive market

- 8.3.1.5 Other traditional payloads

- 8.3.1.1 Optical & infrared payloads

- 8.3.2 SOFTWARE-DEFINED PAYLOADS

- 8.3.2.1 Flexibility to alter space missions to drive market

- 8.3.1 TRADITIONAL PAYLOADS

- 8.4 SOLAR PANELS

- 8.4.1 ENHANCED EFFICIENCY WITH PHOTOVOLTAIC CELL MATERIALS TO DRIVE MARKET

- 8.5 SATELLITE ANTENNAS

- 8.5.1 WIRE ANTENNAS

- 8.5.1.1 Monopole antennas

- 8.5.1.1.1 Ease of use in wireless personal area networks to drive market

- 8.5.1.2 Dipole antennas

- 8.5.1.2.1 Significance in radiofrequency antennas to drive market

- 8.5.1.1 Monopole antennas

- 8.5.2 HORN ANTENNAS

- 8.5.2.1 Ability to operate in multiple frequencies to drive market

- 8.5.3 ARRAY ANTENNAS

- 8.5.3.1 Cost-efficiency with advancements in solid-state technology to drive market

- 8.5.4 REFLECTOR ANTENNAS

- 8.5.4.1 Parabolic reflectors

- 8.5.4.1.1 Wide scope of applications to drive market

- 8.5.4.2 Double reflectors

- 8.5.4.2.1 Higher gain and mechanical strength than other antennas to drive market

- 8.5.4.1 Parabolic reflectors

- 8.5.1 WIRE ANTENNAS

- 8.6 OTHER SUBSYSTEMS

9 SMALL SATELLITE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 COMMUNICATIONS

- 9.2.1 ADVANCEMENTS IN MINIATURE HARDWARE SYSTEMS TO DRIVE MARKET

- 9.3 EARTH OBSERVATION & REMOTE SENSING

- 9.3.1 FOCUS ON ENVIRONMENTAL CONSERVATION TO DRIVE MARKET

- 9.4 SCIENTIFIC RESEARCH

- 9.4.1 REDUCED COST OF SPACE MISSIONS WITH SMALL SATELLITES TO DRIVE MARKET

- 9.5 TECHNOLOGY

- 9.5.1 EXTENSIVE USE OF SMALL SATELLITES IN MISSILE TRACKING AND THREAT DETECTION TO DRIVE MARKET

- 9.6 OTHER APPLICATIONS

10 SMALL SATELLITE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL

- 10.2.1 SATELLITE OPERATORS/OWNERS

- 10.2.1.1 Rapid deployment of small satellite constellations to drive market

- 10.2.2 MEDIA & ENTERTAINMENT COMPANIES

- 10.2.2.1 High demand for fast broadband connectivity from streaming platforms to drive market

- 10.2.3 ENERGY SERVICE PROVIDERS

- 10.2.3.1 Integration of satellite technology to enhance energy-related operations and services to drive market

- 10.2.4 SCIENTIFIC RESEARCH & DEVELOPMENT ORGANIZATIONS

- 10.2.4.1 Untapped potential in space research to drive market

- 10.2.5 OTHER COMMERCIAL END USERS

- 10.2.1 SATELLITE OPERATORS/OWNERS

- 10.3 GOVERNMENT & DEFENSE

- 10.3.1 DEPARTMENT OF DEFENSE & INTELLIGENCE AGENCIES

- 10.3.1.1 Surge in demand for real-time data and imaging to drive market

- 10.3.2 NATIONAL SPACE AGENCIES

- 10.3.2.1 Need for cost-effective space exploration solutions to drive market

- 10.3.3 SEARCH & RESCUE ENTITIES

- 10.3.3.1 Need for swift and accurate data in emergency situations to drive market

- 10.3.4 ACADEMIC & RESEARCH INSTITUTIONS

- 10.3.4.1 Active participation in small satellite development to drive market

- 10.3.5 NATIONAL MAPPING & TOPOGRAPHIC AGENCIES

- 10.3.5.1 Emphasis on improving navigation and tracking capabilities to drive market

- 10.3.1 DEPARTMENT OF DEFENSE & INTELLIGENCE AGENCIES

- 10.4 DUAL USE

- 10.4.1 NEED FOR RESOURCE OPTIMIZATION TO DRIVE MARKET

11 SMALL SATELLITE MARKET, BY FREQUENCY

- 11.1 INTRODUCTION

- 11.2 L-BAND

- 11.2.1 LESS SUSCEPTIBILITY TO ATMOSPHERIC INTERFERENCE TO DRIVE MARKET

- 11.3 S-BAND

- 11.3.1 INCREASING SCIENTIFIC MISSIONS TO DRIVE MARKET

- 11.4 C-BAND

- 11.4.1 ESCALATING DEMAND FOR STEADY COMMUNICATIONS SERVICES FROM DEVELOPING REGIONS TO DRIVE MARKET

- 11.5 X-BAND

- 11.5.1 RISING GEOPOLITICAL TENSIONS TO DRIVE MARKET

- 11.6 KU-BAND

- 11.6.1 GROWING INTERNET PENETRATION IN SMALL SATELLITES TO DRIVE MARKET

- 11.7 KA-BAND

- 11.7.1 NEED FOR BACKHAUL SOLUTIONS WITH EXPANSION OF 5G TO DRIVE MARKET

- 11.8 Q/V/E-BAND

- 11.8.1 ELEVATED DEMAND FOR ULTRA-HIGH-SPEED DATA SERVICES TO DRIVE MARKET

- 11.9 HF/VHF/UHF-BAND

- 11.9.1 NEED FOR WIDE-RANGE COVERAGE TO DRIVE MARKET

- 11.10 LASER/OPTICAL BAND

- 11.10.1 DEVELOPMENT OF LASER COMMUNICATIONS TECHNOLOGY BY PROMINENT COMPANIES TO DRIVE MARKET

12 SMALL SATELLITE MARKET, BY ORBIT

- 12.1 INTRODUCTION

- 12.2 LEO

- 12.3 MEO

- 12.4 GEO

- 12.5 OTHER ORBITS

13 SMALL SATELLITE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 PESTLE ANALYSIS

- 13.2.2 US

- 13.2.2.1 High demand for small satellites from defense sector to drive market

- 13.2.3 CANADA

- 13.2.3.1 Government initiatives for space technology development to drive market

- 13.3 EUROPE

- 13.3.1 PESTLE ANALYSIS

- 13.3.2 RUSSIA

- 13.3.2.1 Focus on enhancing defense capabilities to drive market

- 13.3.3 UK

- 13.3.3.1 Continuous innovations in satellite technologies to drive market

- 13.3.4 GERMANY

- 13.3.4.1 Active participation in European space programs to drive market

- 13.3.5 FRANCE

- 13.3.5.1 Rapid small satellite development to drive market

- 13.3.6 ITALY

- 13.3.6.1 Collaborations with global space agencies to drive market

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 PESTLE ANALYSIS

- 13.4.2 CHINA

- 13.4.2.1 Rise in commercial satellite launches to drive market

- 13.4.3 INDIA

- 13.4.3.1 Well-developed domestic space infrastructure to drive market

- 13.4.4 JAPAN

- 13.4.4.1 Significant investments from JAXA and other government organizations to drive market

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Increase in government funding for small satellite development to drive market

- 13.4.6 AUSTRALIA

- 13.4.6.1 Government measures for space industry development to drive market

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST

- 13.5.1 PESTLE ANALYSIS

- 13.5.2 GCC

- 13.5.2.1 UAE

- 13.5.2.1.1 Ongoing investments in space technology to drive market

- 13.5.2.2 Saudi Arabia

- 13.5.2.2.1 Strategic partnerships with leading private aerospace companies to drive market

- 13.5.2.1 UAE

- 13.5.3 REST OF MIDDLE EAST

- 13.6 REST OF THE WORLD

- 13.6.1 PESTLE ANALYSIS

- 13.6.2 LATIN AMERICA

- 13.6.2.1 Mexico

- 13.6.2.1.1 Growing integration of small satellite technology for economic development to drive market

- 13.6.2.2 Argentina

- 13.6.2.2.1 Emphasis on developing space infrastructure to drive market

- 13.6.2.3 Rest of Latin America

- 13.6.2.1 Mexico

- 13.6.3 AFRICA

- 13.6.3.1 Increasing budget allocations for space exploration to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 REVENUE ANALYSIS, 2020-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT

- 14.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SPACEX

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Others

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 LOCKHEED MARTIN CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Others

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 AIRBUS DEFENCE AND SPACE

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 NORTHROP GRUMMAN

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.3.2 Others

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 L3HARRIS TECHNOLOGIES, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.3.2 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 THALES ALENIA SPACE

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Others

- 15.1.7 MDA

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Others

- 15.1.8 SURREY SATELLITE TECHNOLOGY LTD

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Others

- 15.1.9 PLANET LABS PBC

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.9.3.3 Others

- 15.1.10 SNC

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Others

- 15.1.11 MAXAR TECHNOLOGIES

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Others

- 15.1.12 GOMSPACE

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.12.3.2 Others

- 15.1.13 MITSUBISHI ELECTRIC CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Others

- 15.1.14 BAE SYSTEMS

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.15 RTX

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.15.3.2 Others

- 15.1.16 OHB SE

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.16.3.2 Others

- 15.1.17 THE AEROSPACE CORPORATION

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Solutions/Services offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Others

- 15.1.18 MILLENNIUM SPACE SYSTEMS, INC.

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Solutions/Services offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Others

- 15.1.19 KUIPER SYSTEMS LLC

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Solutions/Services offered

- 15.1.20 TERRAN ORBITAL CORPORATION

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Solutions/Services offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Product launches

- 15.1.20.3.2 Deals

- 15.1.20.3.3 Others

- 15.1.1 SPACEX

- 15.2 OTHER PLAYERS

- 15.2.1 AEROSPACELAB

- 15.2.2 ENDUROSAT

- 15.2.3 NANOAVIONICS

- 15.2.4 ALEN SPACE

- 15.2.5 NEARSPACE LAUNCH

- 15.2.6 SWARM

- 15.2.7 ARGOTEC S.R.L.

- 15.2.8 ASTRANIS

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 ANNEXURE: OTHER MAPPED COMPANIES

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS