|

|

市場調査レポート

商品コード

1633741

オンライン食品デリバリーサービスの世界市場:市場規模・シェア・動向分析 (種類別・チャネル別・決済手段別・地域別)、セグメント別予測 (2025年~2030年)Online Food Delivery Services Market Size, Share & Trends Analysis Report By Type (Restaurant-to-Consumer, Platform-to-Consumer), By Channel (Website/Desktop, Mobile Applications), By Payment Method, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| オンライン食品デリバリーサービスの世界市場:市場規模・シェア・動向分析 (種類別・チャネル別・決済手段別・地域別)、セグメント別予測 (2025年~2030年) |

|

出版日: 2024年12月10日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

オンライン食品デリバリーサービス市場の成長と動向:

Grand View Research Inc.の最新調査によると、世界のオンライン食品デリバリーサービス市場規模は2030年に6,183億6,000万米ドルに達すると予測され、2025年から2030年にかけてCAGR 9.0%で成長すると予測されています。

スマートフォンの普及とインターネットの浸透が業界の成長に寄与しています。さらに、顧客が様々なレストランに料理を注文できる食品デリバリー業界全体の成長が、成長を促進する上で極めて重要な役割を果たしています。ZomatoやSwiggyといったデリバリー・アグリゲーターがここ数年インド市場で拡大していることも、業界の成長にさらに貢献しています。共働き家庭の増加、ライフスタイルや食事パターンの変化は、予測期間中の業界の成長に有利に働くと予想されます。

さらに、手頃な価格で食品を素早く入手したいという需要の高まりが成長を後押ししています。オンラインデリバリーサービスが提供するメリットには、大幅な割引、特典&キャッシュバック・オファー、置き配、複数の決済オプションなどがあります。さらに、フードサービス・プロバイダーは、高品質の食品を提供するために生鮮食品を保管する大型倉庫を設置し、オンライン・デリバリーサービスの採用を促進しています。さらに、新興国におけるインフラの進歩は、この業界で事業を展開するベンダーに成長機会を提供しています。これらのインフラによって、企業はさまざまな都市でレストラン・パートナーネットワークやデリバリーネットワークを拡大することができます。IoTの統合により、ユーザーは音声コマンドを通じてオンライン食品デリバリーサービスを選択できるようになり、デリバリープロセスがさらに容易になります。

このような技術的進歩は業界の成長を促進すると予想されます。COVID-19の大流行により、Domino's Pizza Inc.、McDonald's Corp.、Zomatoのような一部の大手企業は非接触型デリバリーサービスを導入しており、これは今後数年間継続すると予想されます。クラウドキッチンは、COVID-19パンデミックの間、いくつかのダイニングレストランの閉鎖により人気が急上昇しました。パンデミック後も、人々はオンライン注文に慣れているため、この動向は堅調に推移すると予想されます。このようにクラウドキッチンの数が急速に増加していることが、オンライン食品注文の動向を後押しすると予想され、これは業界の成長にとって良い兆しです。

オンライン食品デリバリーサービス市場:分析概要

- プラットフォーム対消費者のセグメントは2024年に73%超の市場シェアを占め、予測期間中もこの傾向が続くと予想されます。食品デリバリーのロジスティクスとリソースの側面を扱うと同時に、社内にデリバリーリソースを持たないレストランに出荷サービスを提供します。このモデルへの投資件数の増加が、首都圏におけるセグメント成長の原動力となっています。

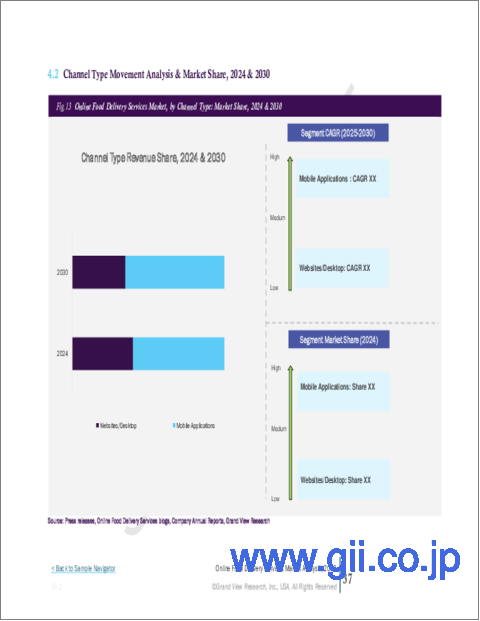

- モバイルアプリ・チャネルのセグメントは、3Gや4Gネットワークなどの技術的進歩と相まって、スマートフォンの普及が拡大しているため、2024年に最大の市場シェアを占めました。さらに、多くのレストランがモバイルアプリ経由で食事を注文するエンドユーザーに対して様々な割引を提供しています。

- アジア太平洋は、予測期間中に最も速い成長率で成長すると予測されています。この成長は、一人当たりの所得水準の上昇とミレニアル世代の嗜好の変化に起因しています。

- パンデミック以来、主要企業は製品の品質を向上させる製品の導入に注力しています。食品デリバリー企業はますますテクノロジーに投資し、それらを食品デリバリーのサプライチェーンの一部とすることで、迅速かつ非接触の宅配を実現しています。

- 例えば、米国カリフォルニア州を拠点とする食品デリバリー会社Postmates, Inc.は、COVID-19の大流行が始まって以来、ロサンゼルスでの食品デリバリーに配達ロボットを活用しています。

目次

第1章 分析方法・範囲

第2章 エグゼクティブサマリー

第3章 オンライン食品デリバリーサービス市場:変動要因・傾向・範囲

- 市場連関の見通し

- 市場力学

- 市場促進要因の分析

- 市場抑制要因の分析

- 業界の課題

- オンライン食品デリバリーサービス市場:分析ツール

- 業界分析:ポーターのファイブフォース分析

- PESTEL分析

- 問題点の分析

第4章 オンライン食品デリバリーサービス市場:種類別の推定・動向分析

- セグメントダッシュボード

- オンライン食品デリバリーサービス市場:変動分析、種類別 (2024年・2030年)

- レストラン対消費者

- プラットフォーム対消費者

第5章 オンライン食品デリバリーサービス市場:チャネル別の推定・動向分析

- セグメントダッシュボード

- オンライン食品デリバリーサービス市場:変動分析、チャネル別 (2024年・2030年)

- Webサイト/デスクトップ

- モバイルアプリ

第6章 オンライン食品デリバリーサービス市場:決済手段別の推定・動向分析

- セグメントダッシュボード

- オンライン食品デリバリーサービス市場:変動分析、決済手段別 (2024年・2030年)

- 代金引換

- オンライン

第7章 オンライン食品デリバリーサービス市場:地域別の推定・動向分析

- オンライン食品デリバリーサービス市場:市場シェア、地域別 (2024年・2030年)

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第8章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc

List of Tables

- Table 1 Global Online Food Delivery Services market size estimates & forecasts 2018 - 2030 (USD Billion)

- Table 2 Global Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 3 Global Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 4 Global Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 5 Global Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 6 Restaurant-to-Consumer Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 7 Platform-to-Consumer Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 8 Mobile Applications Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 9 Websites/Desktop Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 10 Cash on Delivery Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 11 Online Food Delivery Services market, by region 2018 - 2030 (USD Billion)

- Table 12 North America Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 13 North America Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 14 North America Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 15 U.S. Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 16 U.S. Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 17 U.S. Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 18 Canada Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 19 Canada Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 20 Canada Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 21 Mexico Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 22 Mexico Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 23 Mexico Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 24 Europe Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 25 Europe Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 26 Europe Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 27 UK Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 28 UK Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 29 UK Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 30 Germany Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 31 Germany Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 32 Germany Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 33 France Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 34 France Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 35 France Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 36 Asia Pacific Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 37 Asia Pacific Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 38 Asia Pacific Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 39 China Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 40 China Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 41 China Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 42 India Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 43 India Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 44 India Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 45 Japan Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 46 Japan Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 47 Japan Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 48 Australia Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 49 Australia Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 50 Australia Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 51 South Korea Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 52 South Korea Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 53 South Korea Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 54 Latin America Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 55 Latin America Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 56 Latin America Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 57 Brazil Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 58 Brazil Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 59 Brazil Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 60 MEA Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 61 MEA Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 62 MEA Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 63 UAE Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 64 UAE Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 65 UAE Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 66 KSA Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 67 KSA Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 68 KSA Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

- Table 69 South Africa Online Food Delivery Services market, by Type 2018 - 2030 (USD Billion)

- Table 70 South Africa Online Food Delivery Services market, by Channel 2018 - 2030 (USD Billion)

- Table 71 South Africa Online Food Delivery Services market, by Payment Method 2018 - 2030 (USD Billion)

List of Figures

- Fig. 1 Online Food Delivery Services market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing & forecasting

- Fig. 7 Parent market analysis

- Fig. 8 Market formulation & validation

- Fig. 9 Online Food Delivery Services market snapshot

- Fig. 10 Online Food Delivery Services market segment snapshot

- Fig. 11 Online Food Delivery Services market competitive landscape snapshot

- Fig. 12 Market research process

- Fig. 13 Market driver relevance analysis (Current & future impact)

- Fig. 14 Market restraint relevance analysis (Current & future impact)

- Fig. 15 Online Food Delivery Services market: Type outlook key takeaways (USD Billion)

- Fig. 16 Online Food Delivery Services market: Type movement analysis 2024 & 2030 (USD Billion)

- Fig. 17 Restaurant-to-Consumer Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 18 Platform-to-Consumer Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 19 Online Food Delivery Services market: Channel outlook key takeaways (USD Billion)

- Fig. 20 Online Food Delivery Services market: Channel movement analysis 2024 & 2030 (USD Billion)

- Fig. 21 Websites/Desktop Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 22 Mobile Applications Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 23 Online Food Delivery Services market: Payment Method outlook key takeaways (USD Billion)

- Fig. 24 Online Food Delivery Services market: Payment Method movement analysis 2024 & 2030 (USD Billion)

- Fig. 25 Cash on Delivery Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 26 Online Market, Market Size estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 27 Regional marketplace: Key takeaways

- Fig. 28 Online Food Delivery Services market: Regional outlook, 2024 & 2030 (USD Billion)

- Fig. 29 North America Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 30 U.S. Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 31 Canada Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 32 Mexico Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 33 Europe Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 34 UK Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 35 Germany Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 36 France Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 37 Asia Pacific Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 38 Japan Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 39 China Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 40 India Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 41 Australia Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 42 South Korea Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 43 Latin America Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 44 Brazil Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 45 MEA Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 46 KSA Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 47 UAE Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 48 South Africa Online Food Delivery Services market estimates and forecasts, 2018 - 2030 (USD Billion)

- Fig. 49 Strategy framework

- Fig. 50 Company Categorization

Online Food Delivery Services Market Growth & Trends:

The global online food delivery services market size is anticipated to reach USD 618.36 billion in 2030 and is projected to grow at a CAGR of 9.0% from 2025 to 2030, according to a new study by Grand View Research Inc. The increasing use of smartphones and internet penetration contributes to the industry's growth. Moreover, the growth of the overall food delivery industry that allows customers to order food from a variety of restaurants is playing a pivotal role in driving the growth. The expansion of delivery aggregators, such as Zomato and Swiggy, in the Indian market over the last couple of years has further contributed to the industry's growth. The growing number of dual-income families and changing lifestyles & eating patterns are anticipated to favor the industry growth over the forecast period.

Furthermore, the growing demand for quick access to food at affordable prices is driving the growth. Benefits offered by online delivery services include heavy discounts, rewards & cashback offers, doorstep delivery, and multiple payment options. Furthermore, providers of food services are setting up large warehouses to store fresh produce for offering high-quality food, encouraging the adoption of online delivery services. In addition, infrastructural advancements in emerging economies offer growth opportunities to vendors operating in the industry. They enable companies to expand their restaurant partner network and delivery network in different cities. IoT integration enables users to opt for online food delivery services through voice commands, further easing the delivery process.

Such technological advancements are anticipated to drive industry growth. Due to the COVID-19 pandemic, some leading players like Domino's Pizza Inc., McDonald's Corp., and Zomato have introduced contactless delivery services, which are expected to continue over the coming years. Cloud kitchens witnessed a surge in popularity during the COVID-19 pandemic due to the closure of several dine-in restaurants. The trend is expected to remain strong post-pandemic, owing to people getting accustomed to online ordering. This rapidly rising number of cloud kitchens is expected to boost the online food ordering trend, which bodes well for the industry's growth.

Online Food Delivery Services Market Report Highlights:

- The platform-to-consumer segment held a market share of over 73% in 2024 and is expected to continue the trend over the forecast period. It deals with the logistics and resource aspects of food delivery while simultaneously offering shipment services to restaurants that do not have in-house delivery resources. A rise in the number of investments in this model drives segment growth in capital cities

- The mobile channel segment held the largest market share in 2024 due to the growing smartphone penetration, coupled with technological advancements, such as 3G and 4G networks. Moreover, many restaurants offer various discounts to end-users ordering food via mobile applications

- Asia Pacific is anticipated to grow at the fastest growth rate during the forecast period. This growth is attributable to the increasing per capita income levels and millennials' changing preferences

- Since the pandemic, key players have been focusing on introducing products that can improve product quality. Food delivery companies are increasingly investing in technologies and making them a part of food delivery supply chains, ensuring quick and contactless deliveries

- For instance, Postmates, Inc., a food delivery company based in California, U.S., has used delivery robots to help deliver food in Los Angeles since the beginning of the COVID-19 pandemic

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Research Methodology

- 1.2.1. Information Procurement

- 1.3. Information or Data Analysis

- 1.4. Methodology

- 1.5. Research Scope and Assumptions

- 1.6. Market Formulation & Validation

- 1.7. Country Based Segment Share Calculation

- 1.8. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Online Food Delivery Services Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Industry Challenge

- 3.3. Online Food Delivery Services Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. Industry Analysis - Porter's

- 3.4. Pain Point Analysis

Chapter 4. Online Food Delivery Services Market: Type Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Online Food Delivery Services Market: Type Movement Analysis, 2024 & 2030 (USD Billion)

- 4.3. Restaurant-to-Consumer

- 4.3.1. Restaurant-to-Consumer Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.4. Platform-to-Consumer

- 4.4.1. Platform-to-Consumer Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Online Food Delivery Services Market: Channel Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Online Food Delivery Services Market: Channel Movement Analysis, 2024 & 2030 (USD Billion)

- 5.3. Websites/Desktop

- 5.3.1. Websites/Desktop Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.4. Mobile Applications

- 5.4.1. Mobile Applications Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Online Food Delivery Services Market: Payment Method Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Online Food Delivery Services Market: Payment Method Movement Analysis, 2024 & 2030 (USD Billion)

- 6.3. Cash on Delivery

- 6.3.1. Cash on Delivery Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.4. Online

- 6.4.1. Online Market, Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Online Food Delivery Services Market: Regional Estimates & Trend Analysis

- 7.1. Online Food Delivery Services Market Share, By Region, 2024 & 2030 (USD Billion)

- 7.2. North America

- 7.2.1. North America Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.2.2. U.S.

- 7.2.2.1. U.S. Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.2.3. Canada

- 7.2.3.1. Canada Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.2.4. Mexico

- 7.2.4.1. Mexico Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3. Europe

- 7.3.1. Europe Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.2. UK

- 7.3.2.1. UK Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.3. Germany

- 7.3.3.1. Germany Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.4. France

- 7.3.4.1. France Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.2. China

- 7.4.2.1. China Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.3. Japan

- 7.4.3.1. Japan Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.4. India

- 7.4.4.1. India Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.5. South Korea

- 7.4.5.1. South Korea Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.6. Australia

- 7.4.6.1. Australia Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.5. Latin America

- 7.5.1. Latin America Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.5.2. Brazil

- 7.5.2.1. Brazil Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.2. UAE

- 7.6.2.1. UAE Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.3. KSA

- 7.6.3.1. KSA Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.4. South Africa

- 7.6.4.1. South Africa Online Food Delivery Services Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Company Market Positioning

- 8.3. Company Heat Map Analysis

- 8.4. Company Profiles/Listing

- 8.4.1. Deliveroo PLC

- 8.4.1.1. Participant's Overview

- 8.4.1.2. Financial Performance

- 8.4.1.3. Product Benchmarking

- 8.4.1.4. Strategic Initiatives

- 8.4.2. DoorDash Inc.

- 8.4.2.1. Participant's Overview

- 8.4.2.2. Financial Performance

- 8.4.2.3. Product Benchmarking

- 8.4.2.4. Strategic Initiatives

- 8.4.3. Delivery Hero Group

- 8.4.3.1. Participant's Overview

- 8.4.3.2. Financial Performance

- 8.4.3.3. Product Benchmarking

- 8.4.3.4. Strategic Initiatives

- 8.4.4. Just Eat Limited

- 8.4.4.1. Participant's Overview

- 8.4.4.2. Financial Performance

- 8.4.4.3. Product Benchmarking

- 8.4.4.4. Strategic Initiatives

- 8.4.5. Uber Technologies Inc.

- 8.4.5.1. Participant's Overview

- 8.4.5.2. Financial Performance

- 8.4.5.3. Product Benchmarking

- 8.4.5.4. Strategic Initiatives

- 8.4.6. Swiggy

- 8.4.6.1. Participant's Overview

- 8.4.6.2. Financial Performance

- 8.4.6.3. Product Benchmarking

- 8.4.6.4. Strategic Initiatives

- 8.4.7. Zomato

- 8.4.7.1. Participant's Overview

- 8.4.7.2. Financial Performance

- 8.4.7.3. Product Benchmarking

- 8.4.7.4. Strategic Initiatives

- 8.4.8. Delivery.com LLC

- 8.4.8.1. Participant's Overview

- 8.4.8.2. Financial Performance

- 8.4.8.3. Product Benchmarking

- 8.4.8.4. Strategic Initiatives

- 8.4.9. Yelp Inc.

- 8.4.9.1. Participant's Overview

- 8.4.9.2. Financial Performance

- 8.4.9.3. Product Benchmarking

- 8.4.9.4. Strategic Initiatives

- 8.4.10. Amazon.com Inc.

- 8.4.10.1. Participant's Overview

- 8.4.10.2. Financial Performance

- 8.4.10.3. Product Benchmarking

- 8.4.10.4. Strategic Initiatives

- 8.4.11. Rappi Inc

- 8.4.11.1. Participant's Overview

- 8.4.11.2. Financial Performance

- 8.4.11.3. Product Benchmarking

- 8.4.11.4. Strategic Initiatives

- 8.4.1. Deliveroo PLC