|

|

市場調査レポート

商品コード

1716261

欧州のコネクテッドカー市場:用途別、車両タイプ別、ネットワークタイプ別、販売チャネル別、形態別、トランスポンダ別、ハードウェア別、国別 - 分析と予測(2024年~2034年)Europe Connected Car Market: Focus on Application, Vehicle Type, Network Type, Sales Channel, Form, Transponder, Hardware, and Country-Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のコネクテッドカー市場:用途別、車両タイプ別、ネットワークタイプ別、販売チャネル別、形態別、トランスポンダ別、ハードウェア別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年05月01日

発行: BIS Research

ページ情報: 英文 89 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州コネクテッドカーの市場規模は、2024年の265億2,000万米ドルから2034年には1,302億9,000万米ドルに達し、予測期間の2024年~2034年のCAGRは17.26%になると予測されています。

C-V2X通信の急速な統合、AIを活用したモビリティサービス、欧州における5Gの広範な導入は、より優れた安全性、インフォテインメント、テレマティクス・ソリューションに対する消費者の需要の高まりに後押しされています。EUの厳しいユーロNCAP安全性評価、間近に迫ったユーロ7排ガス規制、積極的な電動化と自律走行目標により、OEMとフリートはこれらをより迅速に採用しています。Continental AG、Bosch、Valeo、Daimler、Volkswagenといった欧州の大手企業や、新進気鋭のソフトウェア・デファインド・ビークル専門企業によって、コネクテッド・モビリティ・プラットフォーム、スマート・テレマティクス、無線ソフトウェア・アップデートに多額の投資が行われています。欧州は、EUのイノベーション・プロジェクト(Horizon Europe、Digital Europe)や協調的なC-ITSパイロット・コリドーの支援を受けて、次世代自動車接続とモビリティ・アズ・ア・サービス・ソリューションの世界的リーダーとしての地位を確立しつつあります。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 265億2,000万米ドル |

| 2034年の予測 | 1,302億9,000万米ドル |

| CAGR | 17.26% |

デジタル技術、通信技術、自動車技術の統合により、欧州のコネクテッドカー・セクターは急速な変貌を遂げています。先進的なテレマティクス、エンターテインメント・システム、リアルタイム・ナビゲーション、予知保全アラート、V2X(Vehicle-to-Everything)通信機能は、今やすべて欧州のコネクテッド・カーに統合されています。デジタルモビリティ、排出削減、交通安全強化というEUの大きな目標に沿って、これらの技術は運転をより安全、スマート、効率的にします。

シームレスなデジタル体験に対する消費者の期待の高まりと、安全機能の向上、排出ガス監視、相互運用性基準を求める法律の厳格化により、コネクテッドカーに対する需要が飛躍的に高まっています。ユーロNCAPの安全基準や間近に迫ったユーロ7/VII規則などのイニシアチブのおかげで、OEMはインテリジェントな接続ソリューションをより迅速に採用しています。さらに、5Gネットワークの開発、協調型インテリジェント交通システム(C-ITS)の成長、スマートシティインフラへの投資によって、コネクテッドモビリティを支援する環境が整いつつあります。

無線でアップデートを受信し、自律走行機能をサポートするソフトウェア定義型車両は、大手自動車メーカーやTier1サプライヤーが通信会社やIT大手と提携して開発しています。このような心強い傾向にもかかわらず、サイバーセキュリティの動向、データ・プライバシーの問題、高額な導入コスト、欧州全域での法制の分断といった問題は依然として存在しています。しかし、モビリティの将来にとってコネクティビティがますます重要になるにつれ、市場は着実に拡大すると予想されます。

C-V2X通信、5Gコネクティビティ、AIを活用したモビリティソリューションは、いずれも欧州のコネクテッドカー市場の急成長に貢献しています。予知保全、リアルタイムのOTA(Over-the-Air)アップデート、車載パーソナライゼーションの改善を提供する能力を備えたソフトウェア定義の自動車は、ますます普及しています。データ駆動サービスや自律走行機能の革新は、通信事業者、デジタルビジネス、OEM間のパートナーシップの拡大によって促進されています。協調型インテリジェント交通システム(C-ITS)回廊とモビリティ・アズ・ア・サービス(MaaS)プラットフォームは、欧州の主要都市の都市交通を変えつつあります。

促進要因

差し迫ったユーロ7/VII排ガス基準やユーロNCAP安全要件の義務化など、EUの厳格な法律が、連携技術利用の重要な促進要因となっています。ナビゲーション、エンターテインメント、安全機能の向上に対する消費者の需要が高まっているため、普及が加速しています。強力なネットワーク・インフラの導入は、自律走行や自動車の電動化に向けた動きと密接な関係があります。市場の拡大は、各国のスマートモビリティ・プロジェクトやHorizon Europeのようなプログラムを通じたEUの多額の資金援助によってさらに支えられています。

課題

小規模なOEMやフリートオペレーターは、特に完全な5G V2Xエコシステムに対する高い実装コストのために障害に直面しています。国境を越えた相互運用性は、加盟国の政策が断片的であるために難しくなっています。OEMは、サイバーセキュリティリスクとGDPRデータプライバシーに関する懸念の高まりにより、コネクテッドプラットフォームを保護することが課題となっています。さらに、旧式の自動車は、相互接続されたエコシステムへの完全な移行を妨げており、ハイブリッドアプローチが必要となっています。

当レポートは、欧州コネクテッドカー市場に関する詳細な洞察を提供し、情報に基づいた意思決定と戦略的計画を可能にすることで、組織に付加価値を与えます。新興技術、市場動向、競争力学を明らかにし、企業が成長機会を特定し、提供する製品を業界の需要に適合させるのに役立ちます。当レポートの詳細なセグメンテーションと地域分析は、的を絞った市場参入戦略をサポートし、規制フレームワークとサイバーセキュリティ対策を網羅することで、進化する業界標準への準拠を保証します。当レポートを活用することで、企業はイノベーションを推進し、業務効率を向上させ、急速に進化するコネクテッドモビリティのエコシステムにおいて競争力を獲得し、持続可能な成長と技術的リーダーシップを確保することができます。

主要市場参入企業と競合の要約

欧州のコネクテッドカー市場でプロファイルされている企業は、企業のカバレッジ、製品ポートフォリオ、市場浸透度を分析した主要専門家から収集した情報に基づいて選定されています。

当レポートでは、欧州のコネクテッドカー市場について調査し、市場の概要とともに、用途別、車両タイプ別、ネットワークタイプ別、販売チャネル別、形態別、トランスポンダ別、ハードウェア別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 主要イベントの影響分析

- 市場力学:概要

第2章 地域

- 地域のサマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- 欧州(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Continental AG

- Robert Bosch GmbH

- TomTom International BV

- HERE

- Valeo

- Intellias

- AUDI AG

- Aptiv

第4章 調査手法

List of Figures

- Figure 1: Europe Connected Car Market (by Scenario), $Billion, 2024, 2027, and 2034

- Figure 2: Europe Connected Car Market (by Application), $Billion, 2023, 2027, and 2034

- Figure 3: Europe Connected Car Market (by Vehicle Type), $Billion, 2023, 2027, and 2034

- Figure 4: Europe Connected Car Market (by Network Type), $Billion, 2023, 2027, and 2034

- Figure 5: Europe Connected Car Market (by Sales Channel), $Billion, 2023, 2027, and 2034

- Figure 6: Europe Connected Car Market (by Form), $Billion, 2023, 2027, and 2034

- Figure 7: Europe Connected Car Market (by Transponder), $Billion, 2023, 2027, and 2034

- Figure 8: Europe Connected Car Market (by Hardware), $Billion, 2023, 2027, and 2034

- Figure 9: Key Events

- Figure 10: Vehicle Theft Incidents for 2019 and 2023 (Per 10,000 People)

- Figure 11: Breakdown of Motor Vehicle Theft (by Vehicle Type), 2019-2023

- Figure 12: Supply Chain and Risks within the Supply Chain

- Figure 13: Value Chain Analysis

- Figure 14: Connected Car Market Pricing Forecast, $/Car Technology, 2023-2034

- Figure 15: Patent Analysis (by Country), January 2021-November 2024

- Figure 16: Patent Analysis (by Company), January 2021-November 2024

- Figure 17: Impact Analysis of Market Navigating Factors, 2023-2034

- Figure 18: Estimated Percent of Registered Vehicles by ADAS Feature, 2020 and 2026

- Figure 19: Imported Luxury Car Sales in South Korea, Units, 2018-2023

- Figure 20: Germany Connected Car Market, $Billion, 2023-2034

- Figure 21: France Connected Car Market, $Billion, 2023-2034

- Figure 22: U.K. Connected Car Market, $Billion, 2023-2034

- Figure 23: Italy Connected Car Market, $Billion, 2023-2034

- Figure 24: Rest-of-Europe Connected Car Market, $Billion, 2023-2034

- Figure 25: Strategic Initiatives, January 2021-November 2024

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Top-Ranking UBI Insurers (by Region) and Customer Satisfaction Scores

- Table 6: Regulatory Landscape for the Connected Car Market

- Table 7: Connected Car Market (by Region), $Billion, 2023-2034

- Table 8: Europe Connected Car Market (by Application), $Billion, 2023-2034

- Table 9: Europe Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 10: Europe Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 11: Europe Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 12: Europe Connected Car Market (by Form), $Billion, 2023-2034

- Table 13: Europe Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 14: Europe Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 15: Germany Connected Car Market (by Application), $Billion, 2023-2034

- Table 16: Germany Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 17: Germany Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 18: Germany Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 19: Germany Connected Car Market (by Form), $Billion, 2023-2034

- Table 20: Germany Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 21: Germany Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 22: France Connected Car Market (by Application), $Billion, 2023-2034

- Table 23: France Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 24: France Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 25: France Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 26: France Connected Car Market (by Form), $Billion, 2023-2034

- Table 27: France Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 28: France Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 29: U.K. Connected Car Market (by Application), $Billion, 2023-2034

- Table 30: U.K. Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 31: U.K. Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 32: U.K. Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 33: U.K. Connected Car Market (by Form), $Billion, 2023-2034

- Table 34: U.K. Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 35: U.K. Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 36: Italy Connected Car Market (by Application), $Billion, 2023-2034

- Table 37: Italy Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 38: Italy Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 39: Italy Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 40: Italy Connected Car Market (by Form), $Billion, 2023-2034

- Table 41: Italy Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 42: Italy Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 43: Rest-of-Europe Connected Car Market (by Application), $Billion, 2023-2034

- Table 44: Rest-of-Europe Connected Car Market (by Vehicle Type), $Billion, 2023-2034

- Table 45: Rest-of-Europe Connected Car Market (by Network Type), $Billion, 2023-2034

- Table 46: Rest-of-Europe Connected Car Market (by Sales Channel), $Billion, 2023-2034

- Table 47: Rest-of-Europe Connected Car Market (by Form), $Billion, 2023-2034

- Table 48: Rest-of-Europe Connected Car Market (by Transponder), $Billion, 2023-2034

- Table 49: Rest-of-Europe Connected Car Market (by Hardware), $Billion, 2023-2034

- Table 50: Market Share,2023

Introduction to Europe Connected Car Market

The Europe connected car market is projected to reach $130.29 billion by 2034 from $26.52 billion in 2024, growing at a CAGR of 17.26% during the forecast period 2024-2034. The rapid integration of C-V2X communication, AI-powered mobility services, and widespread 5G deployment in Europe are being driven by growing consumer demand for better safety, infotainment, and telematics solutions. OEMs and fleets are adopting them more quickly due to the EU's strict Euro NCAP safety ratings, impending Euro 7 emissions regulations, and aggressive electrification and autonomous goals. Connected mobility platforms, smart telematics, and over-the-air software updates are being heavily invested in by major European players like Continental AG, Bosch, Valeo, Daimler, Volkswagen, and up-and-coming software-defined vehicle specialists. Europe is establishing itself as a global leader in next-generation automotive connection and mobility-as-a-service solutions with the help of EU innovation projects (Horizon Europe, Digital Europe) and coordinated C-ITS pilot corridors.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $26.52 Billion |

| 2034 Forecast | $130.29 Billion |

| CAGR | 17.26% |

The integration of digital, telecommunications, and automotive technologies is causing a rapid transformation of the connected car sector in Europe. Advanced telematics, entertainment systems, real-time navigation, predictive maintenance alerts, and vehicle-to-everything (V2X) communication capabilities are now all integrated into European connected cars. In line with the EU's larger objectives for digital mobility, emissions reduction, and road safety enhancements, these technologies make driving safer, smarter, and more efficient.

Growing consumer expectations for seamless digital experiences and stricter laws requiring improved safety features, emissions monitoring, and interoperability standards are driving a dramatic increase in demand for connected cars. OEMs are embracing intelligent connection solutions more quickly thanks to initiatives like the Euro NCAP's safety criteria and the impending Euro 7/VII rules. Additionally, a supportive environment for connected mobility is being created by the development of 5G networks, the growth of cooperative intelligent transport systems (C-ITS), and investments in smart city infrastructure.

Software-defined vehicles that can receive updates over the air and support autonomous capabilities are being developed by major automakers and Tier-1 suppliers in partnership with telecom companies and IT heavyweights. Notwithstanding the encouraging trend, issues including cybersecurity threats, data privacy issues, high implementation costs, and legislative fragmentation throughout Europe continue to exist. However, as connectivity becomes increasingly important to the future of mobility, the market is expected to increase steadily.

Market Segmentation

Segmentation 1: by Application

- Mobility Management

- Telematics

- Infotainment

- Driver Assistance

- Navigation

- Others (eCall, Autopilot, Remote Diagnostics, Home Integration)

Segmentation 2: by Vehicle Type

- Internal Combustion Engine (ICE) Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Segmentation 3: by Network Type

- Operational Data

- Dedicated Short-Range Communication (DSRC)

- Cellular

- Satellite

Segmentation 4: by Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Segmentation 5: by Form

- Embedded

- Integrated

Segmentation 6: by Transponder

- Onboard Unit

- Roadside Unit

Segmentation 7: by Hardware

- Head Unit

- Central Gateway

- Intelligent Antennas

- Electronic Control Unit (ECU)

- Telematics Control Unit

- Keyless Entry System

- Sensors

Segmentation 8: by Region

- Europe (Germany, France, U.K., Italy, and Rest-of-Europe)

Europe Connected Car Market Trends, Drivers and Challenges-

Trends

C-V2X communication, 5G connectivity, and AI-powered mobility solutions are all contributing to the fast growth of the connected automobile market in Europe. With the ability to provide predictive maintenance, real-time over-the-air (OTA) updates, and improved in-vehicle personalisation, software-defined vehicles are becoming more and more popular. Innovation in data-driven services and autonomous driving features is being fuelled by expanding partnerships among telecom providers, digital businesses, and OEMs. Cooperative intelligent transport systems (C-ITS) corridors and mobility-as-a-service (MaaS) platforms are changing urban transportation in key European cities.

Drivers

Strict EU laws, such the impending Euro 7/VII emissions standards and the mandated Euro NCAP safety requirements, are important drivers of the use of linked technologies. Deployment is accelerating due to rising consumer demand for improved navigation, entertainment, and safety features. The deployment of strong network infrastructures is closely related to the drive towards autonomous driving and vehicle electrification. Market expansion is further supported by significant EU financing through national smart mobility projects and programs like Horizon Europe.

Challenges

Smaller OEMs and fleet operators face obstacles because to high implementation costs, particularly for full 5G V2X ecosystems. Cross-border interoperability is made more difficult by member state policies that are fragmented. OEMs are challenged to safeguard connected platforms due to growing cybersecurity risks and GDPR data privacy concerns. Furthermore, fleets of outdated cars impede the complete shift to interconnected ecosystems, necessitating hybrid approaches.

How can this report add value to an organization?

This report adds value to an organization by providing in-depth insights into the Europe connected car market, enabling informed decision-making and strategic planning. It highlights emerging technologies, market trends, and competitive dynamics, helping organizations identify growth opportunities and align their offerings with industry demands. The report's detailed segmentation and regional analysis support targeted market entry strategies, while its coverage of regulatory frameworks and cybersecurity measures ensures compliance with evolving industry standards. By leveraging this report, organizations can drive innovation, enhance operational efficiency, and gain a competitive edge in the rapidly evolving connected mobility ecosystem, ensuring sustainable growth and technological leadership.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe connected car market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Continental AG

- Robert Bosch GmbH

- TomTom International BV

- Valeo

- AUDI AG

- Aptiv

- HERE Technologies

- Intellias

Companies not part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increasing Consumer Focus on Enhanced Anti-Theft Solutions

- 1.1.2 Growing Popularity of Usage-Based Insurance (UBI)

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

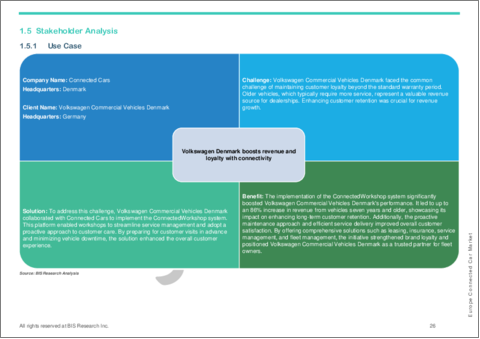

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Events

- 1.6.1 COVID-19

- 1.6.2 Russia/Ukraine War

- 1.7 Market Dynamics: Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Integration of Advanced Mobility Solutions

- 1.7.1.2 Growing Demand for Premium Vehicles Owing to Inclination of Consumers toward Comfort and Luxury

- 1.7.2 Market Restraints

- 1.7.2.1 Lack of Connectivity Infrastructure to Restrain Growth

- 1.7.2.2 Challenges in Ensuring Data Privacy and Security

- 1.7.3 Market Opportunities

- 1.7.3.1 Integration with Home Automation Systems

- 1.7.3.2 Leveraging Data for Monetization Opportunities

- 1.7.1 Market Drivers

2 Region

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe (by Country)

- 2.2.6.1 Germany

- 2.2.6.1.1 Application

- 2.2.6.1.2 Product

- 2.2.6.2 France

- 2.2.6.2.1 Application

- 2.2.6.2.2 Product

- 2.2.6.3 U.K.

- 2.2.6.3.1 Application

- 2.2.6.3.2 Product

- 2.2.6.4 Italy

- 2.2.6.4.1 Application

- 2.2.6.4.2 Product

- 2.2.6.5 Rest-of-Europe

- 2.2.6.5.1 Application

- 2.2.6.5.2 Product

- 2.2.6.1 Germany

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.3 Company Profiles

- 3.3.1 Continental AG

- 3.3.1.1 Overview

- 3.3.1.2 Top Products/Product Portfolio

- 3.3.1.3 Top Competitors

- 3.3.1.4 Target Customers/End Users

- 3.3.1.5 Key Personnel

- 3.3.1.6 Analyst View

- 3.3.1.7 Market Share, 2023

- 3.3.2 Robert Bosch GmbH

- 3.3.2.1 Overview

- 3.3.2.2 Top Products/Product Portfolio

- 3.3.2.3 Top Competitors

- 3.3.2.4 Target Customers/End Users

- 3.3.2.5 Key Personnel

- 3.3.2.6 Analyst View

- 3.3.2.7 Market Share, 2023

- 3.3.3 TomTom International BV

- 3.3.3.1 Overview

- 3.3.3.2 Top Products/Product Portfolio

- 3.3.3.3 Top Competitors

- 3.3.3.4 Target Customers/End Users

- 3.3.3.5 Key Personnel

- 3.3.3.6 Analyst View

- 3.3.3.7 Market Share, 2023

- 3.3.4 HERE

- 3.3.4.1 Overview

- 3.3.4.2 Top Products/Product Portfolio

- 3.3.4.3 Top Competitors

- 3.3.4.4 Target Customers/End Users

- 3.3.4.5 Key Personnel

- 3.3.4.6 Analyst View

- 3.3.4.7 Market Share, 2023

- 3.3.5 Valeo

- 3.3.5.1 Overview

- 3.3.5.2 Top Products/Product Portfolio

- 3.3.5.3 Top Competitors

- 3.3.5.4 Target Customers/End Users

- 3.3.5.5 Key Personnel

- 3.3.5.6 Analyst View

- 3.3.5.7 Market Share, 2023

- 3.3.6 Intellias

- 3.3.6.1 Overview

- 3.3.6.2 Top Products/Product Portfolio

- 3.3.6.3 Top Competitors

- 3.3.6.4 Target Customers/End Users

- 3.3.6.5 Key Personnel

- 3.3.6.6 Analyst View

- 3.3.6.7 Market Share, 2023

- 3.3.7 AUDI AG

- 3.3.7.1 Overview

- 3.3.7.2 Top Products/Product Portfolio

- 3.3.7.3 Top Competitors

- 3.3.7.4 Target Customers/End Users

- 3.3.7.5 Key Personnel

- 3.3.7.6 Analyst View

- 3.3.7.7 Market Share, 2023

- 3.3.8 Aptiv

- 3.3.8.1 Overview

- 3.3.8.2 Top Products/Product Portfolio

- 3.3.8.3 Top Competitors

- 3.3.8.4 Target Customers/End Users

- 3.3.8.5 Key Personnel

- 3.3.8.6 Analyst View

- 3.3.8.7 Market Share, 2023

- 3.3.1 Continental AG

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast