|

|

市場調査レポート

商品コード

1586561

臨床試験市場- 世界の産業規模、シェア、動向、機会、予測、タイプ別、フェーズ別、試験デザイン別、適応症別、エンドユーザー別、地域別、競合、2019年~2029年Clinical Trials Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type, By Phase, By Study Design, By Indication, By End User, By Region and Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| 臨床試験市場- 世界の産業規模、シェア、動向、機会、予測、タイプ別、フェーズ別、試験デザイン別、適応症別、エンドユーザー別、地域別、競合、2019年~2029年 |

|

出版日: 2024年11月08日

発行: TechSci Research

ページ情報: 英文 186 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

臨床試験の世界市場規模は2023年に848億5,000万米ドルで、予測期間中のCAGRは6.49%で2029年には1,254億8,000万米ドルに達すると予測されています。

世界の臨床試験市場は、医薬品研究開発への投資の増加、革新的な治療法に対する需要の高まり、慢性疾患の有病率の上昇など、いくつかの重要な要因によって牽引されています。バイオテクノロジーと個別化医療の拡大は、より複雑な試験デザインと標的療法への注力をもたらし、市場の成長をさらに後押ししています。デジタルヘルスソリューションやデータ分析などのテクノロジーの進歩は、臨床試験プロセスを合理化し、患者募集を改善しています。規制当局も、新規治療の承認を迅速に行うための枠組みを強化しています。世界化は多様な患者集団へのアクセスを容易にし、臨床試験をより効率的かつ効果的なものにしており、市場全体の拡大に寄与しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 848億5,000万米ドル |

| 市場規模:2029年 | 1,254億8,000万米ドル |

| CAGR:2024年~2029年 | 6.49% |

| 急成長セグメント | 医薬品トライアル |

| 最大市場 | アジア太平洋 |

市場促進要因

研究開発投資の増加

慢性疾患の増加

バイオテクノロジーの進歩

デジタルヘルス技術

主な市場課題

規制の複雑さ

患者の確保と維持

主要市場動向

臨床試験の世界化

患者中心の治験への注目の高まり

目次

第1章 概要

- 市場の定義

- 市場の範囲

- 対象市場

- 調査対象年

- 主要市場セグメンテーション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(医薬品試験、医療機器試験)

- フェーズ別(フェーズ I、フェーズ II、フェーズ III、フェーズ IV)

- 試験デザイン別(介入、観察、拡大アクセス)

- 適応症別(自己免疫/炎症、腫瘍学、中枢神経系、糖尿病、心血管、その他)

- エンドユーザー別(臨床調査機関、製薬・バイオテクノロジー企業、臨床検査機関、その他)

- 地域別

- 企業別(2023)

- 市場マップ

第6章 北米の臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- フェーズ別

- 試験デザイン別

- 適応症別

- エンドユーザー別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州の臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- フェーズ別

- 試験デザイン別

- 適応症別

- エンドユーザー別

- 国別

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋地域の臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- フェーズ別

- 試験デザイン別

- 適応症別

- エンドユーザー別

- 国別

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米の臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- フェーズ別

- 試験デザイン別

- 適応症別

- エンドユーザー別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカの臨床試験市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- フェーズ別

- 試験デザイン別

- 適応症別

- エンドユーザー別

- 国別

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

- 合併および買収(該当する場合)

- 製品の発売(該当する場合)

- 最近の動向

第13章 ポーターのファイブフォース分析

- 業界内の競合

- 新規参入の可能性

- サプライヤーの力

- 顧客の力

- 代替品の脅威

第14章 競合情勢

- IQVIA Holdings Inc.

- ICON plc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Medpace, Inc.

- Parexel International(MA)Corporation

- SGS SA

- ACM Medical Laboratory, Inc.

- Charles River Laboratories International, Inc.

- Syneos Health, Inc.

第15章 戦略的提言

第16章 調査会社について・免責事項

Global Clinical Trials Market was valued at USD 84.85 Billion in 2023 and is expected to reach USD 125.48 Billion by 2029 with a CAGR of 6.49% during the forecast period. The global clinical trials market is driven by several key factors, including increasing investment in pharmaceutical research and development, a growing demand for innovative therapies, and a rising prevalence of chronic diseases. The expansion of biotechnology and personalized medicine has led to more complex trial designs and a focus on targeted therapies, further boosting market growth. Advancements in technology, such as digital health solutions and data analytics, are streamlining trial processes and improving patient recruitment. Regulatory agencies are also enhancing their frameworks to expedite the approval of new treatments. Globalization is facilitating access to diverse patient populations, making clinical trials more efficient and effective, thereby contributing to the overall expansion of the market.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 84.85 Billion |

| Market Size 2029 | USD 125.48 Billion |

| CAGR 2024-2029 | 6.49% |

| Fastest Growing Segment | Pharmaceutical Trials |

| Largest Market | Asia-Pacific |

Key Market Drivers

Increasing Investment in R&D

The growing investment in research and development (R&D) within the pharmaceutical and biotechnology sectors is a significant driver of the Global Clinical Trials Market. As healthcare demands escalate globally due to an aging population and the rising prevalence of chronic diseases, companies are increasingly allocating resources to discover new drugs and therapies. This strategic focus on innovation is critical, especially for addressing complex health challenges such as cancer, diabetes, cardiovascular diseases, and neurodegenerative disorders. In March 2024, the CDC's Tuberculosis Trials Consortium (TBTC) has initiated an international clinical trial named Combination Regimens for Shortening Tuberculosis Treatment, or CRUSH-TB. This promising trial seeks to identify new drug combinations that could offer additional options for shortening the treatment duration for tuberculosis (TB) disease. These new regimens aim to enhance drug tolerability and reduce the risk of drug interactions, providing healthcare providers with more effective strategies for treating TB and ensuring treatment completion. The trial will evaluate the effectiveness and safety of new four-month regimens based on bedaquiline, moxifloxacin, and pyrazinamide, comparing them to the standard six-month regimen in patients with drug-susceptible pulmonary TB.

In recent years, the healthcare landscape has become highly competitive, prompting pharmaceutical and biotech companies to prioritize R&D as a means of gaining a competitive edge. Organizations are investing heavily in cutting-edge technologies and methodologies to streamline the drug development process. This investment is not only aimed at developing new drugs but also at improving existing therapies, enhancing efficacy, and minimizing side effects. As a result, there is a notable push toward personalized medicine, where treatments are tailored to the genetic and biochemical profiles of individual patients. Increased funding for R&D allows for more comprehensive and robust clinical studies. These studies are essential for evaluating the safety and efficacy of new therapies before they reach the market. With more resources, companies can conduct larger trials, recruit diverse patient populations, and gather extensive data, all of which contribute to higher success rates in drug approvals. The ability to conduct multi-phase trials more efficiently accelerates the time to market, which is crucial in a fast-evolving healthcare environment.

Rise in Chronic Diseases

The escalating prevalence of chronic diseases, including cardiovascular diseases, diabetes, and cancer, is a significant global health concern that necessitates the urgent development of new treatments. These conditions are increasingly affecting populations worldwide, leading to substantial morbidity and mortality. The World Health Organization (WHO) projects that chronic diseases will be responsible for nearly three-quarters of all deaths globally, highlighting the critical need for effective interventions. This rising burden of chronic illnesses drives demand for clinical trials as pharmaceutical companies and healthcare providers strive to address these unmet medical needs.

As populations age, the incidence of chronic diseases continues to rise. Older adults are particularly susceptible to conditions such as heart disease, diabetes, and cancer, which often require long-term management and innovative treatment approaches. Lifestyle-related factors-such as poor diet, physical inactivity, and tobacco use-are contributing to the growing prevalence of these diseases. The interaction between aging populations and lifestyle factors creates a pressing need for effective therapies that can alleviate the burden of chronic conditions. In response to this urgent need, pharmaceutical companies are increasingly focused on developing new drugs, biologics, and medical devices that target these chronic diseases. The Global Clinical Trials Market is consequently experiencing robust growth, as organizations invest in research to evaluate the safety and efficacy of these innovative therapies. Clinical trials serve as the backbone of this process, providing a structured framework for testing new treatments and gathering vital data on their effectiveness in diverse patient populations.

Advancements in Biotechnology

Technological advancements in biotechnology are significantly revolutionizing the Global Clinical Trials Market, transforming how researchers develop, test, and approve new therapies. Innovations in areas such as genomics, proteomics, and bioinformatics are at the forefront of this transformation, facilitating the creation of targeted therapies and personalized medicine approaches that hold the promise of more effective treatments tailored to individual patients. In October 2024, Ireland's first dedicated Phase 1 clinical trials unit has been launched at Mater Misericordiae University Hospital in Dublin. Named START Dublin, this initiative is a collaboration among the Mater Hospital, University College Dublin, and the START Centre for Cancer Research based in San Antonio, US.

Genomics, the study of an organism's complete set of DNA, has paved the way for significant breakthroughs in understanding the genetic underpinnings of diseases. By analyzing genomic data, researchers can identify specific genetic mutations and variations associated with various conditions, allowing for the development of targeted therapies that directly address these underlying causes. For example, targeted treatments for cancers that harbor specific genetic alterations can be more effective and result in fewer side effects compared to traditional chemotherapy. This precision in targeting not only enhances treatment efficacy but also streamlines the clinical trial process by focusing on populations more likely to respond positively to specific interventions.

Proteomics, the large-scale study of proteins, also plays a crucial role in the development of new therapies. By understanding protein expressions and functions, researchers can identify biomarkers that indicate how a patient might respond to a given treatment. These biomarkers can be instrumental in designing clinical trials that are more efficient and cost-effective, as they allow for the selection of participants who are more likely to benefit from the experimental therapy. This targeted recruitment reduces the time and resources required to conduct trials, ultimately accelerating the development process. Bioinformatics, the application of computational tools to manage and analyze biological data, further enhances these capabilities. The integration of bioinformatics allows researchers to handle vast amounts of data generated from genomic and proteomic studies, enabling them to draw meaningful insights that inform trial designs. Sophisticated algorithms and machine learning techniques can identify patterns in patient responses, optimize dosing regimens, and predict potential adverse effects, leading to more informed decision-making throughout the trial process.

Digital Health Technologies

The integration of digital health technologies is fundamentally transforming the clinical trials landscape, creating a more efficient, patient-centered approach to research. Tools such as electronic health records (EHRs), wearable devices, and mobile health applications are revolutionizing how clinical trials are conducted, significantly enhancing patient monitoring, data collection, and overall trial management.

Electronic Health Records (EHRs) serve as a foundational technology in modern clinical research. EHRs provide a comprehensive and centralized database of patient health information, which can be invaluable for clinical trials. They streamline data collection by allowing researchers to access a wealth of real-time patient data, including medical history, lab results, and medication adherence. This centralized access reduces the burden on both patients and trial coordinators, as it minimizes the need for redundant data entry and helps ensure data accuracy. EHRs can facilitate patient recruitment by identifying eligible participants based on specific health criteria, expediting the process of assembling study cohorts.

Wearable devices are another significant advancement in the Global Clinical Trials Market. These technologies, which include fitness trackers, smartwatches, and other biometric monitoring devices, allow for continuous and remote patient monitoring. Wearables can track vital signs such as heart rate, blood pressure, and activity levels, providing researchers with a wealth of data that can be used to assess patient responses to treatment in real-time. This capability enhances the granularity of data collection, allowing for more nuanced insights into how participants are responding to therapies. By collecting data outside of the clinical setting, wearables reduce the need for frequent in-person visits, making participation in trials more convenient and appealing for patients.

Key Market Challenges

Regulatory Complexity

The global clinical trials market faces significant challenges due to the complexity of regulatory requirements. Different countries and regions have varying regulations that govern the conduct of clinical trials, leading to a fragmented landscape. Navigating these diverse regulatory frameworks can be daunting for sponsors and researchers, often resulting in delays and increased costs. The stringent approval processes can slow down the initiation of trials, while variations in requirements for data submission, ethical approvals, and patient consent complicate planning. Regulatory bodies are continuously updating their guidelines to address emerging safety and efficacy concerns, which can further complicate compliance. Ensuring adherence to these complex regulations while maintaining the integrity of the trial process requires significant resources and expertise, posing a challenge for many organizations in the Global Clinical Trials Market.

Patient Recruitment and Retention

Patient recruitment and retention are critical challenges in clinical trials, often determining the success or failure of a study. Identifying suitable candidates who meet specific inclusion and exclusion criteria can be time-consuming and resource-intensive. The increasing number of clinical trials has created a competitive environment, making it challenging for sponsors to attract participants. Patients may have concerns about the safety and efficacy of trial interventions, leading to hesitance in participation. Once enrolled, retaining participants throughout the trial duration is equally challenging. Factors such as travel burdens, time commitments, and adverse effects can lead to dropouts, affecting the trial's validity and results. Innovative strategies, such as decentralized trials and enhanced patient engagement efforts, are essential to address these recruitment and retention challenges, but they require careful planning and investment.

Key Market Trends

Globalization of Clinical Trials

The globalization of clinical trials is reshaping the research landscape by enabling the conduct of studies across diverse patient populations. This shift is driven by the growing recognition that understanding how treatments perform in various demographic and geographic contexts is essential for developing safe and effective therapies. As pharmaceutical companies increasingly seek to expand their reach beyond domestic markets, they are tapping into emerging economies that offer larger patient pools, thereby enhancing the overall efficiency and robustness of clinical trials.

One of the primary advantages of conducting clinical trials in emerging economies is the ability to achieve faster patient recruitment. Many countries with developing healthcare systems have a higher prevalence of certain diseases, providing a readily available and diverse population for clinical studies. This access allows researchers to enroll participants more quickly than in regions where competition for patients is fierce or where stringent eligibility criteria limit enrollment. Faster recruitment translates into shorter timelines for trials, ultimately accelerating the drug development process. As sponsors can reach their recruitment targets more swiftly, they can gather essential data more rapidly, reducing the time it takes for new treatments to reach the market.

Globalization facilitates more robust data collection. Conducting trials in varied geographical locations and patient demographics enables researchers to gather comprehensive data on how treatments perform across different populations. This diversity enhances the generalizability of trial results, allowing for more accurate assessments of a drug's safety and efficacy. Understanding how factors such as genetics, lifestyle, and environmental influences affect treatment responses can provide critical insights that improve clinical practice. For instance, a drug that proves effective in a diverse cohort may exhibit varying levels of efficacy or safety in specific subgroups, highlighting the importance of tailored treatment strategies.

Increased Focus on Patient-Centric Trials

The Global Clinical Trials Market is increasingly shifting towards patient-centric approaches, emphasizing the importance of patient experience and involvement. This trend is driven by a recognition of the need to enhance recruitment, retention, and adherence to study protocols. Patient-centric trials prioritize participant feedback, preferences, and needs, leading to more meaningful engagement. By adopting strategies such as flexible trial designs, decentralized trials, and improved communication, sponsors can create a more supportive environment for participants. This focus on patient-centricity not only improves trial outcomes but also drives greater participation, ultimately expanding the Global Clinical Trials Market.

Segmental Insights

Type Insights

Based on the Type, pharmaceutical trials currently dominated over medical device trials, driven by several key factors that highlight the increasing complexity and necessity of drug development. Pharmaceutical trials encompass a broad range of studies focused on the evaluation of new drugs, biologics, and therapies, all aimed at addressing various medical conditions. The demand for innovative medications to tackle the rising prevalence of chronic diseases, coupled with the urgent need for new treatments due to emerging health challenges, propels the pharmaceutical sector forward.

One primary factor contributing to the dominance of pharmaceutical trials is the escalating prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases. As these conditions continue to affect a significant portion of the global population, there is a growing imperative for pharmaceutical companies to invest in research and development. This urgency leads to an increased number of clinical trials focused on developing new drugs and therapies, resulting in a more robust pipeline of potential treatments. Advancements in technology and science are fostering innovation within the pharmaceutical industry, enabling the development of more targeted therapies. The rise of personalized medicine-where treatments are tailored to the individual characteristics of patients, including their genetic makeup-has resulted in a surge of clinical trials aimed at testing these innovative approaches. This trend not only enhances the efficacy of treatments but also increases the complexity and scope of pharmaceutical trials, driving more investments and resources into this sector.

End User Insights

Based on the end user segment, Clinical Research Organizations (CROs) are currently the dominant players, significantly shaping the landscape of clinical research. The rise of CROs can be attributed to various factors, including the increasing complexity of clinical trials, the need for specialized expertise, and the growing demand for outsourcing clinical research activities by pharmaceutical and biotechnological companies.

One of the primary reasons for the dominance of CROs is their ability to provide a wide range of services that streamline the clinical trial process. As the drug development process has become more intricate, pharmaceutical and biotech companies often lack the internal resources and expertise to manage every aspect of clinical trials effectively. CROs fill this gap by offering specialized services, including trial design, patient recruitment, data management, regulatory compliance, and biostatistics. By outsourcing these functions to CROs, sponsors can focus on their core competencies, such as drug discovery and development, while ensuring that the clinical trial process is managed efficiently and effectively. The complexity of modern clinical trials necessitates a level of expertise that many pharmaceutical and biotechnological companies may not possess in-house. This complexity arises from various factors, including the need for innovative trial designs, the requirement to analyze large datasets, and the increasing emphasis on personalized medicine. CROs, with their extensive experience and specialized knowledge, are better equipped to navigate these challenges. They leverage advanced technologies and methodologies to optimize trial designs, enhance patient engagement, and ensure compliance with regulatory standards.

Regional Insights

The Asia Pacific region is rapidly emerging as a dominant force in the global clinical trials market, driven by a combination of factors that enhance its appeal for pharmaceutical and biotechnology companies. This growth can be attributed to a large and diverse patient population, increasing investment in healthcare infrastructure, regulatory advancements, and the region's competitive cost structures.

One of the most compelling reasons for the dominance of Asia Pacific in clinical trials is its vast and diverse patient population. Countries like China and India, with populations exceeding a billion, provide a substantial pool of potential participants for clinical studies. This demographic diversity allows sponsors to recruit a wide range of patients with various genetic backgrounds, disease profiles, and health conditions. Access to such a diverse population enables researchers to gather data that is more representative and generalizable, which is particularly crucial for trials focused on diseases prevalent in these regions. This large patient base can lead to faster recruitment timelines, a significant advantage in a market where speed is often critical.

Investment in healthcare infrastructure is another key driver of Asia Pacific's dominance in clinical trials. Many countries in the region, including China, India, and Singapore, are significantly enhancing their healthcare facilities and capabilities. This investment includes the establishment of advanced clinical research centers, hospitals, and laboratories that meet international standards. Such improvements not only facilitate the execution of high-quality clinical trials but also attract multinational pharmaceutical companies seeking to conduct research in a well-equipped environment. The development of infrastructure supports robust data collection and patient monitoring, which are essential components of successful clinical trials.

Key Market Players

- IQVIA Holdings Inc.

- ICON plc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Medpace, Inc.

- Parexel International (MA) Corporation

- SGS SA

- ACM Medical Laboratory, Inc.

- Charles River Laboratories International, Inc.

- Syneos Health, Inc.

Report Scope:

In this report, the Global Clinical Trials Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Clinical Trials Market, By Type:

- Pharmaceutical Trials

- Medical Device Trials

Clinical Trials Market, By Phase:

- Phase I

- Phase II

- Phase III

- Phase IV

Clinical Trials Market, By Study Design:

- Interventional

- Observational

- Expanded Access

Clinical Trials Market, By Indication:

- Autoimmune/Inflammation

- Oncology

- CNS

- Diabetes

- Cardiovascular

- Others

Clinical Trials Market, By End User:

- Clinical Research Organizations

- Pharmaceutical and Biotechnological Companies

- Clinical Testing Laboratories

- Others

Clinical Trials Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Clinical Trials Market.

Available Customizations:

Global Clinical Trials market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Service Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validations

- 2.7. Assumptions and Limitations

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions/Countries

- 3.5. Overview of Market Drivers, Challenges, Trends

4. Voice of Customer

5. Global Clinical Trials Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Type (Pharmaceutical Trials, Medical Device Trials)

- 5.2.2. By Phase (Phase I, Phase II, Phase III, Phase IV)

- 5.2.3. By Study Design (Interventional, Observational, Expanded Access)

- 5.2.4. By Indication (Autoimmune/Inflammation, Oncology, CNS, Diabetes, Cardiovascular, Others)

- 5.2.5. By End User (Clinical Research Organizations, Pharmaceutical and Biotechnological Companies, Clinical Testing Laboratories, Others)

- 5.2.6. By Region

- 5.2.7. By Company (2023)

- 5.3. Market Map

6. North America Clinical Trials Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Phase

- 6.2.3. By Study Design

- 6.2.4. By Indication

- 6.2.5. By End User

- 6.2.6. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Clinical Trials Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Type

- 6.3.1.2.2. By Phase

- 6.3.1.2.3. By Study Design

- 6.3.1.2.4. By Indication

- 6.3.1.2.5. By End User

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Clinical Trials Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Type

- 6.3.2.2.2. By Phase

- 6.3.2.2.3. By Study Design

- 6.3.2.2.4. By Indication

- 6.3.2.2.5. By End User

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Clinical Trials Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Type

- 6.3.3.2.2. By Phase

- 6.3.3.2.3. By Study Design

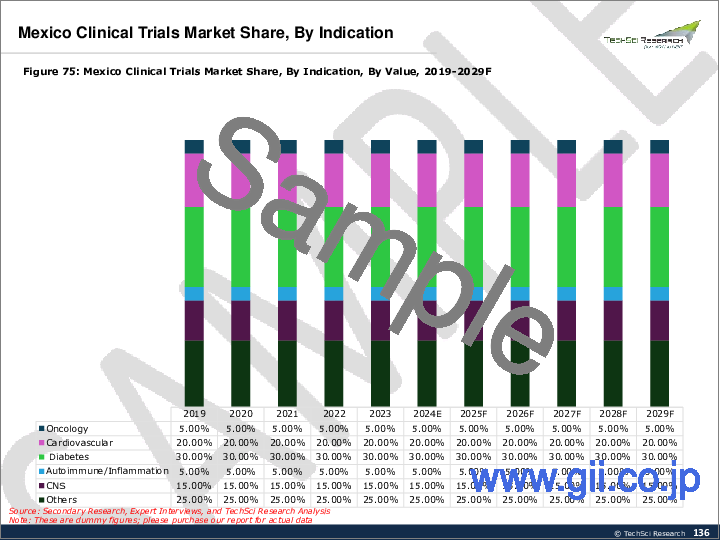

- 6.3.3.2.4. By Indication

- 6.3.3.2.5. By End User

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Clinical Trials Market Outlook

7. Europe Clinical Trials Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Phase

- 7.2.3. By Study Design

- 7.2.4. By Indication

- 7.2.5. By End User

- 7.2.6. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Clinical Trials Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Type

- 7.3.1.2.2. By Phase

- 7.3.1.2.3. By Study Design

- 7.3.1.2.4. By Indication

- 7.3.1.2.5. By End User

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Clinical Trials Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Type

- 7.3.2.2.2. By Phase

- 7.3.2.2.3. By Study Design

- 7.3.2.2.4. By Indication

- 7.3.2.2.5. By End User

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Clinical Trials Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Type

- 7.3.3.2.2. By Phase

- 7.3.3.2.3. By Study Design

- 7.3.3.2.4. By Indication

- 7.3.3.2.5. By End User

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Clinical Trials Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Type

- 7.3.4.2.2. By Phase

- 7.3.4.2.3. By Study Design

- 7.3.4.2.4. By Indication

- 7.3.4.2.5. By End User

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Clinical Trials Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Type

- 7.3.5.2.2. By Phase

- 7.3.5.2.3. By Study Design

- 7.3.5.2.4. By Indication

- 7.3.5.2.5. By End User

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Clinical Trials Market Outlook

8. Asia-Pacific Clinical Trials Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Phase

- 8.2.3. By Study Design

- 8.2.4. By Indication

- 8.2.5. By End User

- 8.2.6. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Clinical Trials Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Type

- 8.3.1.2.2. By Phase

- 8.3.1.2.3. By Study Design

- 8.3.1.2.4. By Indication

- 8.3.1.2.5. By End User

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Clinical Trials Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Type

- 8.3.2.2.2. By Phase

- 8.3.2.2.3. By Study Design

- 8.3.2.2.4. By Indication

- 8.3.2.2.5. By End User

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Clinical Trials Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Type

- 8.3.3.2.2. By Phase

- 8.3.3.2.3. By Study Design

- 8.3.3.2.4. By Indication

- 8.3.3.2.5. By End User

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Clinical Trials Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Type

- 8.3.4.2.2. By Phase

- 8.3.4.2.3. By Study Design

- 8.3.4.2.4. By Indication

- 8.3.4.2.5. By End User

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Clinical Trials Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Type

- 8.3.5.2.2. By Phase

- 8.3.5.2.3. By Study Design

- 8.3.5.2.4. By Indication

- 8.3.5.2.5. By End User

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Clinical Trials Market Outlook

9. South America Clinical Trials Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Phase

- 9.2.3. By Study Design

- 9.2.4. By Indication

- 9.2.5. By End User

- 9.2.6. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Clinical Trials Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Type

- 9.3.1.2.2. By Phase

- 9.3.1.2.3. By Study Design

- 9.3.1.2.4. By Indication

- 9.3.1.2.5. By End User

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Clinical Trials Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Type

- 9.3.2.2.2. By Phase

- 9.3.2.2.3. By Study Design

- 9.3.2.2.4. By Indication

- 9.3.2.2.5. By End User

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Clinical Trials Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Type

- 9.3.3.2.2. By Phase

- 9.3.3.2.3. By Study Design

- 9.3.3.2.4. By Indication

- 9.3.3.2.5. By End User

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Clinical Trials Market Outlook

10. Middle East and Africa Clinical Trials Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type

- 10.2.2. By Phase

- 10.2.3. By Study Design

- 10.2.4. By Indication

- 10.2.5. By End User

- 10.2.6. By Country

- 10.3. MEA: Country Analysis

- 10.3.1. South Africa Clinical Trials Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Type

- 10.3.1.2.2. By Phase

- 10.3.1.2.3. By Study Design

- 10.3.1.2.4. By Indication

- 10.3.1.2.5. By End User

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Clinical Trials Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Type

- 10.3.2.2.2. By Phase

- 10.3.2.2.3. By Study Design

- 10.3.2.2.4. By Indication

- 10.3.2.2.5. By End User

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Clinical Trials Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Type

- 10.3.3.2.2. By Phase

- 10.3.3.2.3. By Study Design

- 10.3.3.2.4. By Indication

- 10.3.3.2.5. By End User

- 10.3.3.1. Market Size & Forecast

- 10.3.1. South Africa Clinical Trials Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

- 12.1. Merger & Acquisition (If Any)

- 12.2. Product Launches (If Any)

- 12.3. Recent Developments

13. Porter's Five Forces Analysis

- 13.1. Competition in the Industry

- 13.2. Potential of New Entrants

- 13.3. Power of Suppliers

- 13.4. Power of Customers

- 13.5. Threat of Substitute Products

14. Competitive Landscape

- 14.1. IQVIA Holdings Inc.

- 14.1.1. Business Overview

- 14.1.2. Company Snapshot

- 14.1.3. Products & Services

- 14.1.4. Financials (As Reported)

- 14.1.5. Recent Developments

- 14.1.6. Key Personnel Details

- 14.1.7. SWOT Analysis

- 14.2. ICON plc.

- 14.3. Thermo Fisher Scientific Inc.

- 14.4. F. Hoffmann-La Roche Ltd.

- 14.5. Medpace, Inc.

- 14.6. Parexel International (MA) Corporation

- 14.7. SGS SA

- 14.8. ACM Medical Laboratory, Inc.

- 14.9. Charles River Laboratories International, Inc.

- 14.10. Syneos Health, Inc.