|

|

市場調査レポート

商品コード

1858551

北米の冷凍野菜の市場規模と予測(2021年~2031年)、地域シェア、動向、成長機会分析:タイプ別、カテゴリー別、エンドユーザー別、国別North America Frozen Vegetables Market Size and Forecast 2021-2031, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type, Category, End User, and Country |

||||||

|

|||||||

| 北米の冷凍野菜の市場規模と予測(2021年~2031年)、地域シェア、動向、成長機会分析:タイプ別、カテゴリー別、エンドユーザー別、国別 |

|

出版日: 2025年08月26日

発行: The Insight Partners

ページ情報: 英文 195 Pages

納期: 即納可能

|

概要

北米の冷凍野菜の市場規模は2024年に90億2,000万米ドルと評価され、2031年には125億7,000万米ドルに達し、2025年から2031年までのCAGRは4.9%と予測されています。

北米の冷凍野菜市場は、消費者の嗜好の変化、健康志向、ライフスタイルの需要の収束によって加速度的な成長を遂げています。多忙な家庭では、栄養価を犠牲にすることなく食事の準備時間を短縮できる、迅速で信頼性の高い食品ソリューションが求められており、利便性が依然として市場を牽引しています。冷凍野菜は一年中入手可能で、保存期間が長く、廃棄物が少ないため、現代の消費者にとって理想的です。冷凍技術の進歩により、冷凍野菜の品質、食感、栄養保持力が大幅に改善され、生鮮野菜に比べて品質が劣るという汚名が払拭されつつあります。これと並行して、健康的な食事や植物由来の食事に対する意識が高まり、よりクリーンで自然な代替食品に対する需要が高まっています。消費者は、食物繊維が豊富で、低カロリー、非遺伝子組み換えの製品を優先する傾向が強まっており、これらはすべて、冷凍食品の通路で容易に入手できます。小売業者は、冷凍食品の品揃えを拡大し、健康、多様性、持続可能性を強調することで対応しています。さらに、この地域の成熟したコールドチェーンインフラと強固な小売流通網は、都市部から農村部まで一貫した製品の供給と幅広い市場への浸透を保証しています。

今後を展望すると、北米の冷凍野菜部門は、製品の革新、チャネルの多様化、持続可能性への取り組みを通じて大きな成長機会をもたらします。植物をベースとしたライフスタイルや、すぐに食べられる食事ソリューションの人気が高まっていることから、スーパーフードや高タンパク質、国際的な風味を強化した冷凍野菜ブレンドなど、新たな製品ラインに門戸が開かれています。こうした製品は、機能的な栄養と利便性を求める、特に健康志向の若い消費者にアピールします。eコマースも重要な役割を果たしており、オンライン食料品プラットフォームが主流になりつつあります。冷凍野菜は耐久性に優れ、腐敗リスクも低いため、デジタル小売や消費者直販モデルに適しており、ブランドはパーソナライズされたバンドルや定期購入サービスを提供できます。さらに、環境に対する意識の高まりが、環境にやさしいパッケージングや透明性の高い調達方法の採用を企業に促し、プレミアムポジショニングとブランド差別化の機会を生み出しています。学校、病院、職場のカフェテリアなど、施設やフードサービス分野への進出は、スケーラブルな量的成長のためのもう一つのチャネルとなります。これらの分野では、冷凍野菜が提供する一貫性、ポーションコントロール、保存効率を高く評価しています。最後に、消費者の洞察力と購買行動によってもたらされるデータ主導型のマーケティングとイノベーションによって、ブランドは進化する食生活のニーズやライフスタイルの動向に合わせた商品を提供することができます。付加価値の高い製品、持続可能な取り組み、オムニチャネル展開に注力することで、北米の冷凍野菜メーカーは、競合が激しく進化する市場情勢の中で長期的な市場シェアを獲得する好位置につけています。

北米の冷凍野菜市場で事業を展開している主要企業には、General Mills Inc.、Goya Foods Inc.、Alaska Food Inc.、Seneca Foods Corp、Hanover Foods、B&G Foods Inc.、Mantab Food Group Inc,、Nortera、Twin City Foods(TCF)、Rubicon Food Products Limited(Shana Foods)などがあります。

北米全体の冷凍野菜の市場規模は、一次情報と二次情報の両方を用いて算出しました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関する分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参加者には、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、北米冷凍野菜市場を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- アナリスト市場の展望

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

- 前提と範囲

第4章 北米の冷凍野菜市場情勢

- 市場概要

- ポーターのファイブフォース分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- 米国の貿易関税の北米冷凍野菜市場への影響

- 米国と中国の貿易

- 米国の輸出入動向への影響

- 輸入動向

- 輸出動向

- 米国消費者への影響

- 株式市場への影響

- 他国への影響

- 北米の冷凍野菜市場への影響

- 米国メーカーへの影響

- 海外メーカーへの影響

- 結論

- エコシステム分析

- 生鮮野菜のサプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

- 種類別平均価格(米国/KG)、2024年

- 輸出入分析 - HSコード0710(野菜、未調理または蒸すか水でゆでる調理済み、冷凍)

- 米国輸入(金額:千米ドル)

- 米国輸入(数量:トン)

- 米国輸出(金額:千米ドル)

- 米国輸出(数量:トン)

- カナダ輸入(金額:千米ドル)

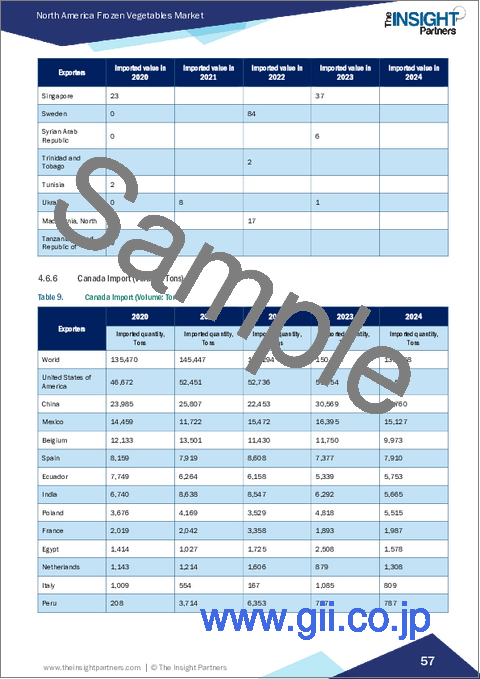

- カナダ輸入(数量:トン)

- カナダ輸出(金額:千米ドル)

- カナダ輸出(数量:トン)

- メキシコ輸入(金額:千米ドル)

- メキシコ輸入(数量:トン)

- メキシコ輸出(金額:千米ドル)

- メキシコ輸出(数量:トン)

第5章 北米の冷凍野菜市場:主要市場力学

- 北米の冷凍野菜市場 - 主要市場力学

- 市場促進要因

- 植物性食生活への嗜好の高まり

- 外食産業からの需要拡大

- 市場抑制要因

- 消費者の認識とサプライチェーンの課題

- 市場機会

- 有機・持続可能な冷凍野菜への需要の高まり

- 今後の動向

- 健康的で便利な食生活への志向の高まり

- 促進要因と抑制要因の影響

第6章 北米の冷凍野菜市場分析

- 北米の冷凍野菜の市場数量、2021年~2031年

- 北米の冷凍野菜の市場数量予測・分析

- 北米の冷凍野菜の市場収益と予測、2021年~2031年

- 北米の冷凍野菜の市場予測・分析

第7章 北米の冷凍野菜市場の数量・収益分析:タイプ別

- トウモロコシ穂軸

- スイートコーンカーネル

- グリーンピース

- ベビーコーン

- ニンジン

- カリフラワー

- インゲン豆

- ほうれん草

- ブロッコリー

- 玉ねぎ

- 芽キャベツ

- ミックスベジタブル

- オクラ

- その他

第8章 北米の冷凍野菜市場の数量・収益分析:カテゴリー別

- 有機野菜

- 慣行野菜

第9章 北米の冷凍野菜の市場規模・収益分析:エンドユーザー別

- 食品加工

- 食品小売

- 外食産業

第10章 北米の冷凍野菜市場分析:国別

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業シェア分析、2024年

第12章 業界情勢

- 企業ニュース

- 合併と買収

第13章 企業プロファイル

- General Mills Inc

- Goya Foods Inc

- Alasko Food Inc.

- Seneca Foods Corp

- Hanover Foods

- B&G Foods, Inc.

- Mantab Food Group Inc.

- Nortera

- Twin City Foods(TCF)

- Rubicon Food Products Limited(Shana Foods)