|

|

市場調査レポート

商品コード

1509790

貿易信用保険の市場:規模・予測、世界・地域別シェア、動向、成長機会分析:企業規模別、用途別、エンドユーザー別、地域別Trade Credit Insurance Market Size and Forecast, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Enterprise Size, Application, End User, and Geography |

||||||

|

|||||||

| 貿易信用保険の市場:規模・予測、世界・地域別シェア、動向、成長機会分析:企業規模別、用途別、エンドユーザー別、地域別 |

|

出版日: 2024年05月31日

発行: The Insight Partners

ページ情報: 英文 176 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

貿易信用保険の市場規模は、2023年の141億9,000万米ドルから2031年には275億6,000万米ドルに達すると予測され、2023年から2031年までの推定CAGRは8.7%です。

地域別に見ると、世界の貿易信用保険市場は北米、欧州、アジア太平洋、中東・アフリカ、中南米に区分されます。2023年には、アジア太平洋地域が大きな成長率で伸びています。アジア太平洋貿易信用保険市場は、中国、インド、日本、オーストラリア、韓国、その他アジア太平洋地域に区分されます。同市場は、2023年から2031年にかけて著しい成長が見込まれています。与信管理に戦略的アプローチを採用する企業数の増加や貿易レートの低迷は、企業間での取引信用保険の利用を後押しするいくつかの要因であり、アジア太平洋における取引信用保険市場の成長を支えています。例えば、2024年4月に発表された国際通貨基金(IMF)の報告書によると、アジア太平洋では2023年以降、企業間のインフレ圧力の継続が原因で貿易の低迷が続いています。世界の商品・製品価格の下落、金融引き締め、サプライチェーンの混乱、高金利は、財務リスクから身を守るために企業の間で取引信用保険への需要を高めている他のいくつかの要因です。

アジア太平洋における事業倒産事例の増加は、予測期間中、取引信用保険市場の成長に大きな機会をもたらすと予想されます。例えば、2023年9月に発表されたAtradius N.V.のレポートによると、企業が直面する倒産事例の増加、政府からの支援の減少、企業にとって財政的に厳しい環境の存在により、アジア太平洋の倒産率は2024年も増加し続けるといいます。同出典によると、香港(68%)や韓国(45%)を含む国々で事業失敗の事例が増加し、シンガポール(49%)、インド(50%)、オーストラリア(45%)では事業破産の事例が増加していることから、今後数年間で貿易信用保険市場の成長に新たな機会が生まれると予想されます。

貿易信用保険市場の分析は、企業規模、用途、エンドユーザーの各セグメントを考慮して実施されました。

企業規模に基づき、貿易信用保険市場シェアは中小企業と大企業に区分されます。大企業は巨大な顧客基盤を持っています。大企業は信用取引で製品やサービスを顧客に提供しているため、未払い貿易関連債務による財務リスクに常にさらされています。取引信用保険は、取引先の倒産や債権者への返済不能による損失から取引先を保護します。取引信用保険は、企業に対して与信枠を拡大するための保証と自信を提供し、金融リスクにつながることなく、円滑な業務運営を促進し、事業の成長をサポートします。

さらに、事業倒産件数の急増といった要因も、取引信用保険市場の成長を後押ししています。また、クラウドベースの貿易信用保険ソリューションの開拓は、今後数年間に新たな貿易信用保険市場動向をもたらすと予想されます。

市場はエンドユーザー別に、エネルギー、自動車、航空宇宙、化学、金属、農業、飲食品、金融サービス、技術・通信、運輸、その他に区分されます。売上高では、エネルギー分野が貿易信用保険市場のシェアを独占しています。エネルギー部門は石油・ガス取引とエネルギープロジェクトで構成されています。燃料・石油・ガス業界では、タイトマージンが常態化しており、貸倒れの危険性が高まっています。エネルギーセクターでは、プロジェクトが大規模で、多額の資金負担を伴うことがあります。例えば、太陽光発電所や風力発電所、嫌気性消化プラントなどの再生可能エネルギープロジェクトでは、複数のサプライヤーによる複雑なサプライチェーンが大きく関わっています。これらのプロジェクトでは、風力タービン、ソーラーパネル、エネルギー貯蔵システムなどの設備に関連する高額な初期費用が必要となります。取引信用保険の採用は、サプライチェーンにおけるサプライヤーの混乱や債務不履行に関連するリスクを軽減し、円滑なプロジェクト運営を確保するのに役立ちます。また、エネルギー企業が新規および既存の顧客に対して、より競争力のある与信を安全に提供できるようになるため、事業の拡大が可能になります。

貿易信用保険市場レポートでは、Allianz Trade、COFACE SA、American International Group Inc、Chubb Ltd、QBE Insurance Group Ltd、Aon Plc、Credendo、Atradius NV、Zurich Insurance Group AG、Great American Insurance Companyなどが主要企業プロファイルとして紹介されています。

貿易信用保険の市場推計・予測は、主要企業の出版物、協会データ、データベースなど、様々な2次調査と1次調査に基づいています。貿易信用保険市場の成長に関連する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのに役立ちます。また、データを検証し分析的洞察を得るために、業界関係者との複数の一次インタビューを実施しました。このプロセスには、副社長、市場開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、貿易信用保険市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

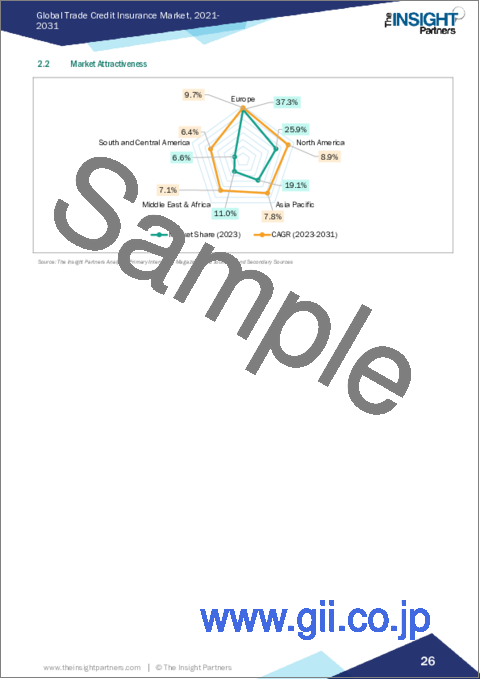

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 貿易信用保険の市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 貿易信用保険市場:主要市場力学

- 貿易信用保険市場- 主要市場力学

- 市場促進要因

- 企業倒産の急増

- インフレと高金利の上昇

- MSMEや中小企業の取引信用保険導入を支援する政府のイニシアティブ

- 市場抑制要因

- 新興国における認識不足

- 市場機会

- サプライチェーンの複雑さ

- 貿易信用保険ソリューションにおけるAI利用促進のための重要なイニシアティブ

- 今後の動向

- クラウドベースの貿易信用保険ソリューションの開発

- 促進要因と抑制要因の影響

第6章 貿易信用保険市場:世界市場分析

- 貿易信用保険市場の売上高、2021-2031年

- 貿易信用保険市場の予測分析

第7章 貿易信用保険市場分析-企業規模別

- 大企業

- 中小企業

第8章 貿易信用保険市場分析-用途別

- 海外

- 国内

第9章 貿易信用保険市場分析-エンドユーザー別

- エネルギー

- 自動車

- 航空宇宙

- 化学

- 金属

- 農業

- 飲食品

- 金融サービス

- テクノロジーと通信

- 運輸

- その他

第10章 貿易信用保険市場:地域別分析

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他欧州

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- アジア太平洋のその他諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他中東とアフリカ

- 中南米

- ブラジル

- アルゼンチン

- その他中南米

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Allianz Trade

- COFACE SA

- American International Group Inc

- Chubb Ltd

- QBE Insurance Group Ltd

- Aon Plc

- Credendo

- Atradius NV

- Zurich Insurance Group AG

- Great American Insurance Company

第14章 付録

List Of Tables

- Table 1. Trade Credit Insurance Market Segmentation

- Table 2. List of Vendors

- Table 3. Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 5. Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 6. Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 7. Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 8. Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 9. Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 10. Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 11. Germany: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 12. Germany: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 13. Germany: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 14. France: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 15. France: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 16. France: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 17. United Kingdom: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 18. United Kingdom: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 19. United Kingdom: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 20. Italy: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 21. Italy: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 22. Italy: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 23. Russia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 24. Russia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 25. Russia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 26. Rest of Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 27. Rest of Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 28. Rest of Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 29. North America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 30. North America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 31. North America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 32. North America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 33. United States: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 34. United States: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 35. United States: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 36. Canada: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 37. Canada: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 38. Canada: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 39. Mexico: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 40. Mexico: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 41. Mexico: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 42. Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 43. Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 44. Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 45. Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 46. China: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 47. China: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 48. China: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 49. Japan: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 50. Japan: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 51. Japan: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 52. South Korea: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 53. South Korea: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 54. South Korea: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 55. India: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 56. India: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 57. India: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 58. Australia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 59. Australia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 60. Australia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 61. Rest of APAC: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 62. Rest of APAC: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 63. Rest of APAC: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 64. Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 65. Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 66. Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 67. Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 68. Saudi Arabia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 69. Saudi Arabia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 70. Saudi Arabia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 71. UAE: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 72. UAE: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 73. UAE: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 74. South Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 75. South Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 76. South Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 77. Rest of Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 78. Rest of Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 79. Rest of Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 80. South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 81. South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 82. South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 83. South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 84. Brazil: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 85. Brazil: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 86. Brazil: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 87. Argentina: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 88. Argentina: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 89. Argentina: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 90. Rest of South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 91. Rest of South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 92. Rest of South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 93. List of Abbreviation

List Of Figures

- Figure 1. Trade Credit Insurance Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Trade Credit Insurance Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Trade Credit Insurance Market Breakdown by Geography, 2023 and 2031 (%)

- Figure 6. Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- Figure 7. Trade Credit Insurance Market Share (%) - by Enterprise Size (2023 and 2031)

- Figure 8. Large Enterprises: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. SMEs: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Trade Credit Insurance Market Share (%) - by Application (2023 and 2031)

- Figure 11. International: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Domestic: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Trade Credit Insurance Market Share (%) - by End User (2023 and 2031)

- Figure 14. Energy: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

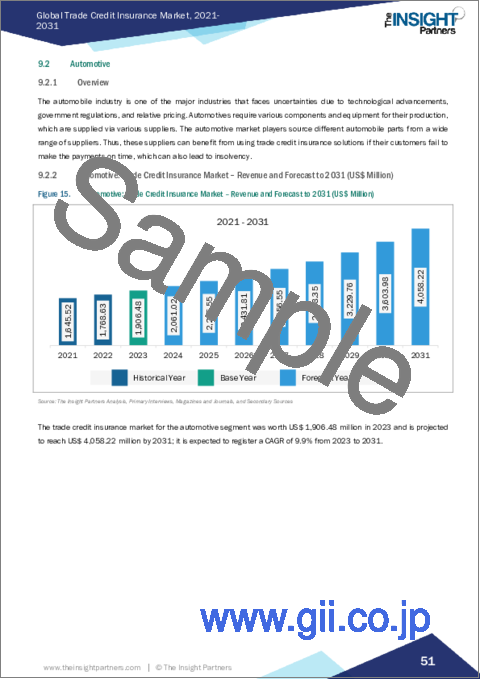

- Figure 15. Automotive: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Aerospace: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Chemicals: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Metals: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Agriculture: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Food and Beverages: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Financial Services: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Technology and Telecommunication: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Transportation: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Others: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Trade Credit Insurance Market Breakdown by Region, 2023 and 2031 (%)

- Figure 26. Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Europe: Trade Credit Insurance Market Breakdown, by Enterprise Size (2023 and 2031)

- Figure 28. Europe: Trade Credit Insurance Market Breakdown, by Application (2023 and 2031)

- Figure 29. Europe: Trade Credit Insurance Market Breakdown, by End User (2023 and 2031)

- Figure 30. Europe: Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 31. Germany: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. France: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. United Kingdom: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. Italy: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 35. Russia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 36. Rest of Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 37. North America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 38. North America: Trade Credit Insurance Market Breakdown, by Enterprise Size (2023 and 2031)

- Figure 39. North America: Trade Credit Insurance Market Breakdown, by Application (2023 and 2031)

- Figure 40. North America: Trade Credit Insurance Market Breakdown, by End User (2023 and 2031)

- Figure 41. North America: Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 42. United States: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 43. Canada: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 44. Mexico: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 45. Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 46. Asia Pacific: Trade Credit Insurance Market Breakdown, by Enterprise Size (2023 and 2031)

- Figure 47. Asia Pacific: Trade Credit Insurance Market Breakdown, by Application (2023 and 2031)

- Figure 48. Asia Pacific: Trade Credit Insurance Market Breakdown, by End User (2023 and 2031)

- Figure 49. Asia Pacific: Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 50. China: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 51. Japan: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 52. South Korea: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 53. India: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 54. Australia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 55. Rest of APAC: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 56. Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 57. Middle East and Africa: Trade Credit Insurance Market Breakdown, by Enterprise Size (2023 and 2031)

- Figure 58. Middle East and Africa: Trade Credit Insurance Market Breakdown, by Application (2023 and 2031)

- Figure 59. Middle East and Africa: Trade Credit Insurance Market Breakdown, by End User (2023 and 2031)

- Figure 60. Middle East and Africa: Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 61. Saudi Arabia: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 62. UAE: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 63. South Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 64. Rest of Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 65. South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 66. South and Central America: Trade Credit Insurance Market Breakdown, by Enterprise Size (2023 and 2031)

- Figure 67. South and Central America: Trade Credit Insurance Market Breakdown, by Application (2023 and 2031)

- Figure 68. South and Central America: Trade Credit Insurance Market Breakdown, by End User (2023 and 2031)

- Figure 69. South and Central America: Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 70. Brazil: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 71. Argentina: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 72. Rest of South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031(US$ Million)

- Figure 73. Heat Map Analysis by Key Players

- Figure 74. Company Positioning & Concentration

The trade credit insurance market size is expected to reach US$ 27.56 billion by 2031 from 14.19 billion in 2023, at an estimated CAGR of 8.7% from 2023 to 2031.

By Geography the global trade credit insurance market is segmented into North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. In 2023, the Asia Pacific regions is growing with a significant growth rate. The Asia Pacific trade credit insurance market is segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. The market is expected to grow at a significant rate from 2023 to 2031. The rise in the number of businesses adopting strategic approaches for credit management and slow trade rates are a few factors boosting the usage of trade credit insurance among businesses, supporting the trade credit insurance market growth in APAC. For instance, according to an International Monetary Fund report published on April 2024, APAC has been observing slow trade since 2023 due to continuity in the inflation pressures among businesses. The global decrease in commodity and goods prices, monetary tightening, supply-chain disruptions, and high interest rates are a few other factors increasing the demand for trade credit insurance among businesses to protect themselves against financial risks.

The growing cases of business insolvencies in APAC are expected to create significant opportunities for the trade credit insurance market growth during the forecast period. For instance, according to Atradius N.V. report published on September 2023, the insolvency rate in APAC will continue to increase in 2024 due to the rising cases of bankruptcy faced by firms, less support from the government, and the presence of a financially challenging environment for companies. According to the same source, increasing incidents of business failures in countries, including Hong Kong (68%) and South Korea (45%), and growing cases of business insolvencies in Singapore (49%), India (50%), and Australia (45%) are expected to create new opportunities for the trade credit insurance market growth in the coming years.

The Trade Credit Insurance market analysis has been carried out by considering the following segments: enterprise size, application, and end user.

Based on enterprise size, the Trade Credit Insurance market share is segmented into SMEs and large enterprises. Large enterprises have a huge customer base. They provide products and services to the customers at credit, which puts them constantly at financial risk due to unpaid trade-related debt. Trade credit insurance protects customers from the losses incurred due to their insolvency or inability to pay the money back to the creditor. Trade credit insurance provides businesses with assurance and confidence to extend their credit limit, which fosters smoother operations and supports business growth without leading to any financial risks.

Moreover, factor such as surge in business insolvencies propel the trade credit insurance market growth. Also, development of cloud-based trade credit insurance solutions is expected to bring new trade credit insurance market trends in the coming years.

Based on end-user, the market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunications, transportation, and others. In terms of revenue the energy segment dominates the Trade Credit Insurance market share. The energy sector comprises of trades in oil and gas, and energy projects. Tight margins are the norm in the fuel, oil, and gas industry, increasing the danger of bad debt. In the energy sector, the projects can be significant and involve substantial financial commitments. For example, renewable energy projects, such as solar and wind farms and anaerobic digestion plants, majorly involve complex supply chains with multiple suppliers. These projects require high initial costs associated with equipment such as wind turbines, solar panels, and energy storage systems. The adoption of trade credit insurance helps to mitigate the risks linked with supplier disruptions or defaults in the supply chain to ensure smooth project operations. It enables business expansion by facilitating energy companies to safely offer more competitive credit to new and existing customers.

Allianz Trade, COFACE SA, American International Group Inc, Chubb Ltd, QBE Insurance Group Ltd, Aon Plc, Credendo, Atradius NV, Zurich Insurance Group AG, and Great American Insurance Company are among the key players profiled in the trade credit insurance market report.

The Trade Credit Insurance market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Trade Credit Insurance market growth. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Trade Credit Insurance market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Trade Credit Insurance Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. Trade Credit Insurance Market - Key Market Dynamics

- 5.1 Trade Credit Insurance Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Surge in Business Insolvencies

- 5.2.2 Rise in Inflation and High Interest Rates

- 5.2.3 Government Initiatives Supporting MSMEs and SMEs to Adopt Trade Credit Insurance

- 5.3 Market Restraints

- 5.3.1 Lack of Awareness Among Emerging Economies

- 5.4 Market Opportunities

- 5.4.1 Supply Chain Complexities

- 5.4.2 Significant Initiatives to Promote AI use in Trade Credit Insurance Solutions

- 5.5 Future Trends

- 5.5.1 Development of Cloud-Based Trade Credit Insurance Solutions

- 5.6 Impact of Drivers and Restraints:

6. Trade Credit Insurance Market - Global Market Analysis

- 6.1 Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- 6.2 Trade Credit Insurance Market Forecast Analysis

7. Trade Credit Insurance Market Analysis - by Enterprise Size

- 7.1 Large Enterprises

- 7.1.1 Overview

- 7.1.2 Large Enterprises: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 SMEs

- 7.2.1 Overview

- 7.2.2 SMEs: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

8. Trade Credit Insurance Market Analysis - by Application

- 8.1 International

- 8.1.1 Overview

- 8.1.2 International: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Domestic

- 8.2.1 Overview

- 8.2.2 Domestic: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

9. Trade Credit Insurance Market Analysis - by End User

- 9.1 Energy

- 9.1.1 Overview

- 9.1.2 Energy: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Aerospace

- 9.3.1 Overview

- 9.3.2 Aerospace: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Chemicals

- 9.4.1 Overview

- 9.4.2 Chemicals: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Metals

- 9.5.1 Overview

- 9.5.2 Metals: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Agriculture

- 9.6.1 Overview

- 9.6.2 Agriculture: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Food and Beverages

- 9.7.1 Overview

- 9.7.2 Food and Beverages: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Financial Services

- 9.8.1 Overview

- 9.8.2 Financial Services: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.9 Technology and Telecommunication

- 9.9.1 Overview

- 9.9.2 Technology and Telecommunication: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.10 Transportation

- 9.10.1 Overview

- 9.10.2 Transportation: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.11 Others

- 9.11.1 Overview

- 9.11.2 Others: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

10. Trade Credit Insurance Market - Geographical Analysis

- 10.1 Overview

- 10.2 Europe

- 10.2.1 Europe Trade Credit Insurance Market Overview

- 10.2.2 Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.3 Europe: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.3.1 Europe: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Enterprise Size

- 10.2.4 Europe: Trade Credit Insurance Market Breakdown, by Application

- 10.2.4.1 Europe: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Application

- 10.2.5 Europe: Trade Credit Insurance Market Breakdown, by End User

- 10.2.5.1 Europe: Trade Credit Insurance Market - Revenue and Forecast Analysis - by End User

- 10.2.6 Europe: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.2.6.1 Europe: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.2.6.2 Germany: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.2.1 Germany: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.2.2 Germany: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.2.3 Germany: Trade Credit Insurance Market Breakdown, by End User

- 10.2.6.3 France: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.3.1 France: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.3.2 France: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.3.3 France: Trade Credit Insurance Market Breakdown, by End User

- 10.2.6.4 United Kingdom: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.4.1 United Kingdom: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.4.2 United Kingdom: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.4.3 United Kingdom: Trade Credit Insurance Market Breakdown, by End User

- 10.2.6.5 Italy: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.5.1 Italy: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.5.2 Italy: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.5.3 Italy: Trade Credit Insurance Market Breakdown, by End User

- 10.2.6.6 Russia: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.6.1 Russia: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.6.2 Russia: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.6.3 Russia: Trade Credit Insurance Market Breakdown, by End User

- 10.2.6.7 Rest of Europe: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.6.7.1 Rest of Europe: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.2.6.7.2 Rest of Europe: Trade Credit Insurance Market Breakdown, by Application

- 10.2.6.7.3 Rest of Europe: Trade Credit Insurance Market Breakdown, by End User

- 10.3 North America

- 10.3.1 North America Trade Credit Insurance Market Overview

- 10.3.2 North America: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.3 North America: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.3.3.1 North America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Enterprise Size

- 10.3.4 North America: Trade Credit Insurance Market Breakdown, by Application

- 10.3.4.1 North America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Application

- 10.3.5 North America: Trade Credit Insurance Market Breakdown, by End User

- 10.3.5.1 North America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by End User

- 10.3.6 North America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.3.6.1 North America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.3.6.2 United States: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.6.2.1 United States: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.3.6.2.2 United States: Trade Credit Insurance Market Breakdown, by Application

- 10.3.6.2.3 United States: Trade Credit Insurance Market Breakdown, by End User

- 10.3.6.3 Canada: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.6.3.1 Canada: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.3.6.3.2 Canada: Trade Credit Insurance Market Breakdown, by Application

- 10.3.6.3.3 Canada: Trade Credit Insurance Market Breakdown, by End User

- 10.3.6.4 Mexico: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.6.4.1 Mexico: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.3.6.4.2 Mexico: Trade Credit Insurance Market Breakdown, by Application

- 10.3.6.4.3 Mexico: Trade Credit Insurance Market Breakdown, by End User

- 10.4 Asia Pacific

- 10.4.1 Asia Pacific Trade Credit Insurance Market Overview

- 10.4.2 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.3 Asia Pacific: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.3.1 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Enterprise Size

- 10.4.4 Asia Pacific: Trade Credit Insurance Market Breakdown, by Application

- 10.4.4.1 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Application

- 10.4.5 Asia Pacific: Trade Credit Insurance Market Breakdown, by End User

- 10.4.5.1 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast Analysis - by End User

- 10.4.6 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.4.6.1 Asia Pacific: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.4.6.2 China: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.2.1 China: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.2.2 China: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.2.3 China: Trade Credit Insurance Market Breakdown, by End User

- 10.4.6.3 Japan: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.3.1 Japan: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.3.2 Japan: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.3.3 Japan: Trade Credit Insurance Market Breakdown, by End User

- 10.4.6.4 South Korea: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.4.1 South Korea: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.4.2 South Korea: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.4.3 South Korea: Trade Credit Insurance Market Breakdown, by End User

- 10.4.6.5 India: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.5.1 India: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.5.2 India: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.5.3 India: Trade Credit Insurance Market Breakdown, by End User

- 10.4.6.6 Australia: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.6.1 Australia: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.6.2 Australia: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.6.3 Australia: Trade Credit Insurance Market Breakdown, by End User

- 10.4.6.7 Rest of APAC: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4.6.7.1 Rest of APAC: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.4.6.7.2 Rest of APAC: Trade Credit Insurance Market Breakdown, by Application

- 10.4.6.7.3 Rest of APAC: Trade Credit Insurance Market Breakdown, by End User

- 10.5 Middle East and Africa

- 10.5.1 Middle East and Africa Trade Credit Insurance Market Overview

- 10.5.2 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5.3 Middle East and Africa: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.5.3.1 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Enterprise Size

- 10.5.4 Middle East and Africa: Trade Credit Insurance Market Breakdown, by Application

- 10.5.4.1 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Application

- 10.5.5 Middle East and Africa: Trade Credit Insurance Market Breakdown, by End User

- 10.5.5.1 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast Analysis - by End User

- 10.5.6 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.5.6.1 Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.5.6.2 Saudi Arabia: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5.6.2.1 Saudi Arabia: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.5.6.2.2 Saudi Arabia: Trade Credit Insurance Market Breakdown, by Application

- 10.5.6.2.3 Saudi Arabia: Trade Credit Insurance Market Breakdown, by End User

- 10.5.6.3 UAE: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5.6.3.1 UAE: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.5.6.3.2 UAE: Trade Credit Insurance Market Breakdown, by Application

- 10.5.6.3.3 UAE: Trade Credit Insurance Market Breakdown, by End User

- 10.5.6.4 South Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5.6.4.1 South Africa: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.5.6.4.2 South Africa: Trade Credit Insurance Market Breakdown, by Application

- 10.5.6.4.3 South Africa: Trade Credit Insurance Market Breakdown, by End User

- 10.5.6.5 Rest of Middle East and Africa: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5.6.5.1 Rest of Middle East and Africa: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.5.6.5.2 Rest of Middle East and Africa: Trade Credit Insurance Market Breakdown, by Application

- 10.5.6.5.3 Rest of Middle East and Africa: Trade Credit Insurance Market Breakdown, by End User

- 10.6 South and Central America

- 10.6.1 South and Central America Trade Credit Insurance Market Overview

- 10.6.2 South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.6.3 South and Central America: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.6.3.1 South and Central America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Enterprise Size

- 10.6.4 South and Central America: Trade Credit Insurance Market Breakdown, by Application

- 10.6.4.1 South and Central America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Application

- 10.6.5 South and Central America: Trade Credit Insurance Market Breakdown, by End User

- 10.6.5.1 South and Central America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by End User

- 10.6.6 South and Central America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.6.6.1 South and Central America: Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.6.6.2 Brazil: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.6.6.2.1 Brazil: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.6.6.2.2 Brazil: Trade Credit Insurance Market Breakdown, by Application

- 10.6.6.2.3 Brazil: Trade Credit Insurance Market Breakdown, by End User

- 10.6.6.3 Argentina: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.6.6.3.1 Argentina: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.6.6.3.2 Argentina: Trade Credit Insurance Market Breakdown, by Application

- 10.6.6.3.3 Argentina: Trade Credit Insurance Market Breakdown, by End User

- 10.6.6.4 Rest of South and Central America: Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.6.6.4.1 Rest of South and Central America: Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.6.6.4.2 Rest of South and Central America: Trade Credit Insurance Market Breakdown, by Application

- 10.6.6.4.3 Rest of South and Central America: Trade Credit Insurance Market Breakdown, by End User

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Allianz Trade

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 COFACE SA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 American International Group Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Chubb Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 QBE Insurance Group Ltd

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Aon Plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Credendo

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Atradius NV

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Zurich Insurance Group AG

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Great American Insurance Company

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index