|

|

市場調査レポート

商品コード

1666266

欧州の取引信用保険市場:2031年までの予測 - 地域別分析 - 企業規模別、用途別、エンドユーザー別Europe Trade Credit Insurance Market Forecast to 2031 - Regional Analysis - by Enterprise Size, Application, and End User |

||||||

|

|||||||

| 欧州の取引信用保険市場:2031年までの予測 - 地域別分析 - 企業規模別、用途別、エンドユーザー別 |

|

出版日: 2025年01月13日

発行: The Insight Partners

ページ情報: 英文 105 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の取引信用保険市場は、2023年に52億9,659万米ドルとなり、2031年までには111億801万米ドルに達すると予測され、2023年から2031年までのCAGRは9.7%と推定されます。

事業破産の急増が欧州の取引信用保険市場を牽引

事業倒産は、企業が財務上の義務を果たせなかったり、支払期日を過ぎた手形を支払えなかったりした場合に発生し、倒産や法的手続きに発展する可能性があります。事業倒産が増加するにつれ、倒産から企業を守り、キャッシュフローを維持するために、企業の間で取引信用保険の導入が急増しています。例えば、2024年2月に発表されたAllianz Tradeのレポートによると、倒産件数は2023年に7%増加し、2024年末までに9%増加すると予想されています。同社はまた、2025年末まで世界の倒産件数は高止まりすると予測しています。これは、建設・不動産プロジェクトの遅延が原因です。同様に、2024年4月に発表されたGroup Cofaceのデータによると、中東欧(CEE)諸国における2023年の倒産件数は非常に顕著でした。これらの国々では、ロシアのウクライナ侵攻の影響により、2022年から2023年にかけて倒産件数が約38.6%増加しました。CEE諸国における倒産件数の増加は、サプライチェーンの寸断、地理的近接性、労働力不足、エネルギー価格の高騰、投入コストの高騰などに起因する経済パフォーマンスの低下に関連しています。このため、建設、不動産、ホスピタリティ、運輸、小売業などの企業では、集中リスクを減らし、貸倒引当金を減らし、キャッシュフローを維持するために、取引信用保険の需要が高まっています。取引信用保険はまた、混乱したキャッシュフローを保護することで、企業を支援します。このように、事業破たんの事例が増加していることが、欧州の取引信用保険市場を牽引しています。

欧州の取引信用保険市場概要

欧州の取引信用保険市場は、ドイツ、フランス、英国、イタリア、ロシア、その他欧州に区分されます。欧州の企業は、金融不安に伴う倒産件数の多さに直面しており、また、サプライチェーンの複雑さを生み出す景気後退のリスクを経験しています。顧客との関係を改善することでタイムリーな支払いを行うため、企業は取引信用保険を強く求め、採用しているため、こうした要因が欧州市場を牽引しています。例えば、Allianz Tradeが2023年4月に発表した報告書によると、西欧の支払不能率は2023年に3年連続で20%上昇しました(2020年5%、2021年22%、2022年3%)。これにより、西欧は欧州の取引信用保険市場の主要な貢献者となっています。同様に、2024年4月のCOFACE SAのデータによると、中東欧でも2022年から2023年にかけて倒産手続きが38%増加しています。さらに、企業倒産の多発は、与信管理、不良債権の削減、運転資金の増強のための取引信用保険への需要を高め、市場を牽引しています。例えば、2023年4月に発表された欧州連合(EU)のデータによると、EU企業の破産宣告件数は、2023年第2四半期に前期比で6四半期ぶりに増加しました。欧州の倒産件数は2015年から2023年第2四半期にかけて8.4%増加しました。

欧州の取引信用保険市場の収益と2031年までの予測(金額)

欧州の取引信用保険市場のセグメンテーション

欧州の取引信用保険市場は、企業規模、用途、エンドユーザー、国に分類されます。

企業規模に基づき、欧州の取引信用保険市場は大企業と中小企業に二分されます。2023年には、大企業セグメントがより大きな市場シェアを占めました。

用途別では、欧州の取引信用保険市場は海外と国内に二分されます。2023年の市場シェアは国際セグメントが大きくなりました。

用途別では、欧州の取引信用保険市場はエネルギー、自動車、航空宇宙、化学、金属、農業、食品・飲料、金融サービス、技術・通信、運輸、その他に区分されます。2023年にはエネルギー分野が最大の市場シェアを占めました。

国別では、欧州の取引信用保険市場はドイツ、フランス、英国、イタリア、ロシア、その他欧州に区分されます。2023年の欧州の取引信用保険市場シェアはドイツが独占しました。

Allianz Trade、American International Group Inc、Aon Plc、Atradius NV、Chubb Ltd、COFACE SA、Credendo、Great American Insurance Company、QBE Insurance Group Ltd、Zurich Insurance Group AGは、欧州の取引信用保険市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 欧州の取引信用保険市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 欧州の取引信用保険市場:主要市場力学

- 市場促進要因

- 企業破産の急増

- インフ・高金利の上昇

- MSME・中小企業の取引信用保険導入を支援する政府のイニシアティブ

- 市場抑制要因

- 中小企業の認識不足

- 市場機会

- サプライチェーンの複雑さ

- 取引信用保険ソリューションにおけるAI利用促進のための重要なイニシアティブ

- 今後の動向

- クラウドベースの取引信用保険ソリューションの開発

- 促進要因と抑制要因の影響

第6章 取引信用保険市場:欧州市場分析

- 欧州の取引信用保険市場収益、2021年~2031年

- 欧州の取引信用保険市場の予測分析

第7章 欧州の取引信用保険市場分析:企業規模別

- 大企業

- 中小企業

第8章 欧州の取引信用保険市場分析:用途別

- 海外

- 国内

第9章 欧州の取引信用保険市場分析:エンドユーザー別

- エネルギー

- 自動車

- 航空宇宙

- 化学

- 金属

- 農業

- 食品・飲料

- 金融サービス

- テクノロジー・通信

- 運輸

- その他

第10章 欧州の取引信用保険市場:国別分析

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Allianz Trade

- COFACE SA

- American International Group, Inc

- Chubb Ltd

- QBE Insurance Group Ltd

- Aon plc

- Credendo

- Atradius NV

- Zurich Insurance Group AG

- Great American Insurance Company

第14章 付録

List Of Tables

- Table 1. Europe Trade Credit Insurance Market Segmentation

- Table 2. List of Vendors

- Table 3. Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 5. Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 6. Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 7. Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. Germany: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 9. Germany: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 10. Germany: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 11. France: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 12. France: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 13. France: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. United Kingdom: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 15. United Kingdom: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 16. United Kingdom: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. Italy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 18. Italy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 19. Italy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 20. Russia: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 21. Russia: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 22. Russia: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 23. Rest of Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 24. Rest of Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 25. Rest of Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 26. List of Abbreviation

List Of Figures

- Figure 1. Europe Trade Credit Insurance Market Segmentation, by Country

- Figure 2. Ecosystem: Europe Trade Credit Insurance Market

- Figure 3. Europe Trade Credit Insurance Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Europe Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- Figure 6. Europe Trade Credit Insurance Market Share (%) - by Enterprise Size (2023 and 2031)

- Figure 7. Large Enterprises: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. SMEs: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Europe Trade Credit Insurance Market Share (%) - by Application (2023 and 2031)

- Figure 10. International: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Domestic: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Europe Trade Credit Insurance Market Share (%) - by End User (2023 and 2031)

- Figure 13. Energy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Automotive: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Aerospace: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Chemicals: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Metals: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Agriculture: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Food and Beverages: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Financial Services: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Technology and Telecommunication: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Transportation: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Europe Trade Credit Insurance Market Breakdown, by Key Countries - Revenue (2023) (US$ Million)

- Figure 25. Europe Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 26. Germany: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. France: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. United Kingdom: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Italy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Russia: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Rest of Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Heat Map Analysis by Key Players

- Figure 33. Company Positioning & Concentration

The Europe trade credit insurance market was valued at US$ 5,296.59 million in 2023 and is expected to reach US$ 11,108.01 million by 2031; it is estimated to register a CAGR of 9.7% from 2023 to 2031.

Surge in Business Insolvencies Drives Europe Trade Credit Insurance Market

Business insolvency occurs when a company fails to meet its financial obligations or pay its due bills, which can lead to bankruptcy or legal proceedings. The increasing cases of business insolvencies surge the adoption of trade credit insurance among businesses to safeguard them against insolvency and maintain cash flow. For instance, according to the Allianz Trade report published in February 2024, the number of bankruptcies grew by 7% in 2023, and it is expected to increase by 9% by the end of 2024. The company also predicts that the number of bankruptcies worldwide is projected to remain high by the end of 2025; this is due to delays in construction and real estate projects. Similarly, according to The Group Coface data published on April 2024, the insolvencies rate in Central & Eastern Europe (CEE) countries was highly significant in 2023. These countries witnessed approximately 38.6% rise in insolvency records from 2022 to 2023 owing to the consequences of Russia's invasion of Ukraine across the region. The growing cases of insolvencies in CEE countries are associated with low economic performance, which is caused by disrupting supply chains, geographical proximity, labor shortages, surges in energy prices, and high input costs. This increases the demand for trade credit insurance among businesses across construction, real estate, hospitality, transport, and retail industries to decrease concentration risk, reduce bad debt reserves, and maintain cash flow. Trade credit insurance also helps businesses by protecting their disrupted cash flows. Thus, the increasing cases of business insolvencies drive the Europe trade credit insurance market .

Europe Trade Credit Insurance Market Overview

The Europe trade credit insurance market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Businesses in Europe are facing a high number of insolvencies associated with financial instability; also, they are experiencing a risk of recession that created supply chain complexities. These factors are driving the market in Europe as businesses are highly demanding and adopting trade credit insurance to make timely payments by improving customer relationships. For instance, according to a report published by Allianz Trade in April 2023, the insolvency rate in Western Europe has increased by 20% in 2023 for the third consecutive year (5% in 2020, 22% in 2021, and 3% in 2022). This makes Western Europe a major contributor to the Europe trade credit insurance market. Similarly, according to COFACE SA data of April 2024, Central & Eastern Europe has also observed a 38% increase in insolvency proceedings from 2022 to 2023. Moreover, the high cases of business bankruptcies increase the demand for trade credit insurance for credit controlling, reducing bad debt, and enhancing working capital, which drives the market. For instance, according to European Union (EU) data published on April 2023, the number of bankruptcy declarations of EU businesses increased for the sixth quarter in the second quarter of 2023, as compared to the previous quarter. The number of bankruptcies increased by 8.4% in Europe from 2015 to the second quarter of 2023.

Europe Trade Credit Insurance Market Revenue and Forecast to 2031 (US$ Million)

Europe Trade Credit Insurance Market Segmentation

The Europe trade credit insurance market is categorized into enterprise size, application, end user, and country.

Based on enterprise size, the Europe trade credit insurance market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

In terms of application, the Europe trade credit insurance market is bifurcated into international and domestic. The international segment held a larger market share in 2023.

By application, the Europe trade credit insurance market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunication, transportation, and others. The energy segment held the largest market share in 2023.

By country, the Europe trade credit insurance market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Germany dominated the Europe trade credit insurance market share in 2023.

Allianz Trade, American International Group Inc, Aon Plc, Atradius NV, Chubb Ltd, COFACE SA, Credendo, Great American Insurance Company, QBE Insurance Group Ltd, and Zurich Insurance Group AG are some of the leading companies operating in the Europe trade credit insurance market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Trade Credit Insurance Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in the Value Chain

5. Europe Trade Credit Insurance Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Surge in Business Insolvencies

- 5.1.2 Rise in Inflation and High Interest Rates

- 5.1.3 Government Initiatives Supporting MSMEs and SMEs to Adopt Trade Credit Insurance

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness Among SMEs

- 5.3 Market Opportunities

- 5.3.1 Supply Chain Complexities

- 5.3.2 Significant Initiatives to Promote AI use in Trade Credit Insurance Solutions

- 5.4 Future Trends

- 5.4.1 Development of Cloud-Based Trade Credit Insurance Solutions

- 5.5 Impact of Drivers and Restraints:

6. Trade Credit Insurance Market - Europe Market Analysis

- 6.1 Europe Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- 6.2 Europe Trade Credit Insurance Market Forecast Analysis

7. Europe Trade Credit Insurance Market Analysis - by Enterprise Size

- 7.1 Large Enterprises

- 7.1.1 Overview

- 7.1.2 Large Enterprises: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

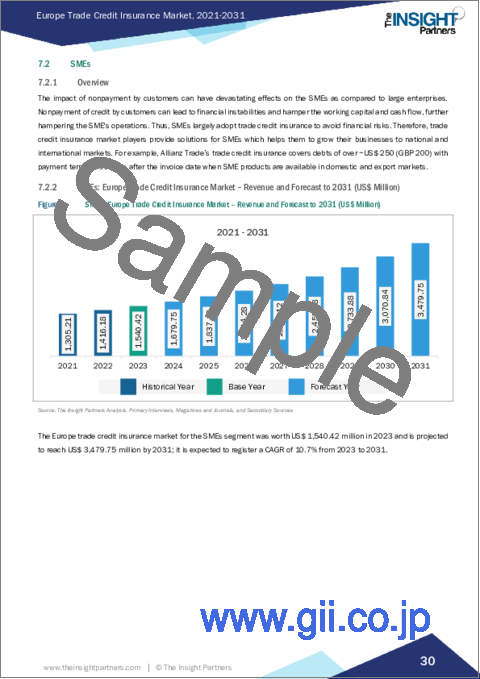

- 7.2 SMEs

- 7.2.1 Overview

- 7.2.2 SMEs: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

8. Europe Trade Credit Insurance Market Analysis - by Application

- 8.1 International

- 8.1.1 Overview

- 8.1.2 International: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Domestic

- 8.2.1 Overview

- 8.2.2 Domestic: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

9. Europe Trade Credit Insurance Market Analysis - by End User

- 9.1 Energy

- 9.1.1 Overview

- 9.1.2 Energy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Aerospace

- 9.3.1 Overview

- 9.3.2 Aerospace: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Chemicals

- 9.4.1 Overview

- 9.4.2 Chemicals: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Metals

- 9.5.1 Overview

- 9.5.2 Metals: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Agriculture

- 9.6.1 Overview

- 9.6.2 Agriculture: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Food and Beverages

- 9.7.1 Overview

- 9.7.2 Food and Beverages: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Financial Services

- 9.8.1 Overview

- 9.8.2 Financial Services: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.9 Technology and Telecommunication

- 9.9.1 Overview

- 9.9.2 Technology and Telecommunication: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.10 Transportation

- 9.10.1 Overview

- 9.10.2 Transportation: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.11 Others

- 9.11.1 Overview

- 9.11.2 Others: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

10. Europe Trade Credit Insurance Market - Country Analysis

- 10.1 Europe Trade Credit Insurance Market Overview

- 10.1.1 Europe Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Europe Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Germany: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 Germany: Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.2.2 Germany: Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.2.3 Germany: Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.3 France: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 France: Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.3.2 France: Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.3.3 France: Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.4 United Kingdom: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 United Kingdom: Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.4.2 United Kingdom: Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.4.3 United Kingdom: Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.5 Italy: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.5.1 Italy: Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.5.2 Italy: Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.5.3 Italy: Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.6 Russia: Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.6.1 Russia: Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.6.2 Russia: Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.6.3 Russia: Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.7 Rest of Europe Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.7.1 Rest of Europe Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.7.2 Rest of Europe Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.7.3 Rest of Europe Trade Credit Insurance Market Breakdown, by End User

- 10.1.1 Europe Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Allianz Trade

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 COFACE SA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 American International Group, Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Chubb Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 QBE Insurance Group Ltd

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Aon plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Credendo

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Atradius NV

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Zurich Insurance Group AG

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Great American Insurance Company

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index