|

|

市場調査レポート

商品コード

1666260

北米の取引信用保険市場:2031年までの予測 - 地域別分析 - 企業規模別、用途別、エンドユーザー別North America Trade Credit Insurance Market Forecast to 2031 - Regional Analysis - by Enterprise Size, Application, and End User |

||||||

|

|||||||

| 北米の取引信用保険市場:2031年までの予測 - 地域別分析 - 企業規模別、用途別、エンドユーザー別 |

|

出版日: 2025年01月13日

発行: The Insight Partners

ページ情報: 英文 98 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の取引信用保険市場は、2023年に36億8,052万米ドルとなり、2031年までには72億6,403万米ドルに達すると予測され、2023年から2031年までのCAGRは8.9%と推定されます。

インフレと高金利が北米の取引信用保険市場を活性化

インフレと高金利は、事業量が増加していなくても財務的な脆弱性につながります。事業コストの上昇は、不良債権や取引先の債務不履行リスクの増大を招き、円滑な事業運営をサポートする取引信用保険の需要を高めています。コスト増、経費増、高金利による支払不履行から保険会社を守ります。取引信用保険は、企業が取引量を増やし、継続的な変動に直面しても回復力を維持し、新しい分野や市場に進出できるようサポートします。例えば、潜在的なビジネスパートナーからの支払いが期日通りに行われたかどうかなどです。さらに、取引信用保険は、ブローカーが保険会社の既存の与信管理方法を改善し、インフレや高金利の影響からマージンを守るための情報を保険会社に提供します。さらに、取引信用保険は、企業が資金提供者や投資家からより良い条件を受け取るのを助ける売上債権を提供し、企業が高金利やインフレ上昇の状況に効果的に対処することを可能にします。これは、インフレに対応する能力が低い企業にとっても有用です。このように、インフレの拡大と高金利が北米の取引信用保険市場の成長を後押ししています。

北米の取引信用保険市場の概要

米国、カナダ、メキシコは北米の主要経済国のひとつです。この地域は、シングルリスクやボンディングなどの保険活動の拡大により、北米の取引信用保険市場で大きなシェアを占めています。企業の間で取引信用保険に対する要求が高まっているため、市場各社は顧客の要求を満たすために新世代のサービスを開発するようになっています。例えば、2023年にCOFACE SAはURBA360を立ち上げました。これは新しいオンライン・リスク管理ツールで、事業報告書、財務報告書、経済報告書、および公共データや独自データセットからの情報を使用して、リスクの包括的な視点をグラフィック形式で提供するものです。このツールを使えば、企業は自社の財務リスクを容易に理解し、適切な保険を選択することができます。さらに、2024年2月に発表されたAllianz Tradeのデータによると、北米の支払不能率は41%上昇しており、小規模なサプライヤーにとってはさらなる不払いリスクが発生すると予想されています。このため、小規模サプライヤーがタイムリーな支払いを行うために、取引信用保険の需要が高まっています。

貿易や輸出活動の増加により、支払いを行い、懸案となっている債務を清算するために、企業の間で取引信用保険への需要が高まっています。例えば、Coface North Americaの社長は、同地域における輸出活動の増加により、同社の取引信用保険は2024年に25%の成長が見込まれると予測しています。これにより、同地域の企業は債務を削減し、キャッシュフローを改善し、販売を促進する機会が生まれます。

北米の取引信用保険市場の収益と2031年までの予測(金額)

北米の取引信用保険市場のセグメンテーション

北米の取引信用保険市場は、企業規模、用途、エンドユーザー、国別に分類されます。

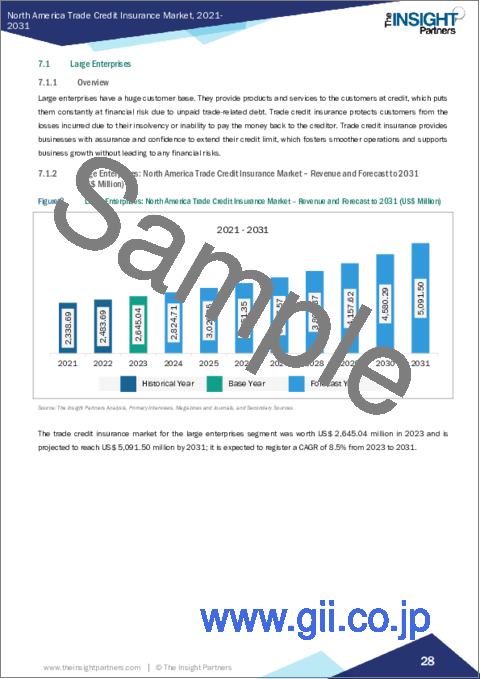

企業規模に基づき、北米の取引信用保険市場は大企業と中小企業に二分されます。2023年には大企業セグメントがより大きな市場シェアを占めています。

用途別では、北米の取引信用保険市場は海外と国内に二分されます。2023年の市場シェアは国際セグメントが大きいです。

用途別では、北米の取引信用保険市場はエネルギー、自動車、航空宇宙、化学、金属、農業、食品・飲料、金融サービス、技術・通信、運輸、その他に区分されます。2023年にはエネルギー分野が最大の市場シェアを占めています。

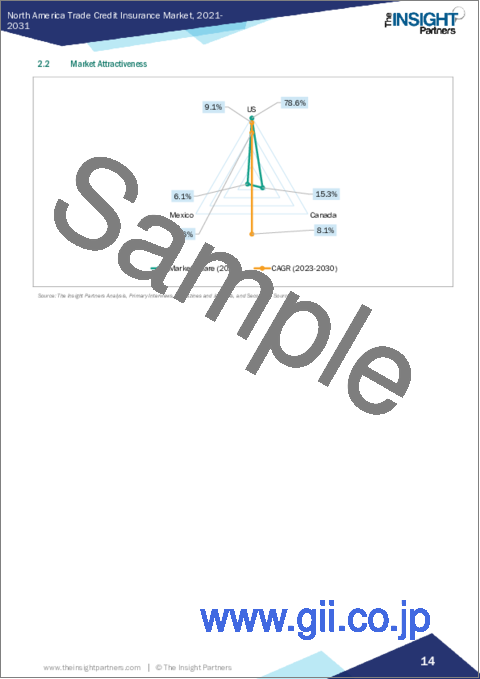

国別では、北米の取引信用保険市場は米国、カナダ、メキシコに区分されます。2023年の北米の取引信用保険市場シェアは米国が独占しました。

Allianz Trade、American International Group Inc、Aon Plc、Atradius NV、Chubb Ltd、COFACE SA、Great American Insurance Company、QBE Insurance Group Ltd、Zurich Insurance Group AG、Credendoは北米の取引信用保険市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の取引信用保険市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の取引信用保険市場:主要市場力学

- 市場促進要因

- 企業倒産の急増

- インフレと高金利の上昇

- MSMEや中小企業の取引信用保険導入を支援する政府のイニシアティブ

- 市場抑制要因

- 中小企業の認識不足

- 市場機会

- サプライチェーンの複雑さ

- 取引信用保険ソリューションにおけるAI利用促進のための重要なイニシアティブ

- 今後の動向

- クラウドベースの取引信用保険ソリューションの開発

- 促進要因と抑制要因の影響

第6章 取引信用保険市場:北米分析

- 北米の取引信用保険市場収益、2021年~2031年

- 北米の取引信用保険市場予測分析

第7章 北米の取引信用保険の市場分析:企業規模別

- 大企業

- 中小企業

第8章 北米の取引信用保険の市場分析:用途別

- 海外

- 国内

第9章 北米の取引信用保険の市場分析:エンドユーザー別

- エネルギー

- 自動車

- 航空宇宙

- 化学

- 金属

- 農業

- 食品・飲料

- 金融サービス

- テクノロジー・通信

- 運輸

- その他

第10章 北米の取引信用保険市場:国別分析

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Allianz Trade

- COFACE SA

- American International Group, Inc

- Chubb Ltd

- QBE Insurance Group Ltd

- Aon plc

- Credendo

- Atradius N.V.

- Zurich Insurance Group AG

- Great American Insurance Company

第14章 付録

List Of Tables

- Table 1. North America Trade Credit Insurance Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 5. North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 6. North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 7. North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. United States: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 9. United States: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 10. United States: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 11. Canada: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 12. Canada: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 13. Canada: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Mexico: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 15. Mexico: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 16. Mexico: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. List of Abbreviation

List Of Figures

- Figure 1. North America Trade Credit Insurance Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: North America Trade Credit Insurance Market

- Figure 4. North America Trade Credit Insurance Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. North America Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- Figure 7. North America Trade Credit Insurance Market Share (%) - by Enterprise Size (2023 and 2031)

- Figure 8. Large Enterprises: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. SMEs: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. North America Trade Credit Insurance Market Share (%) - by Application (2023 and 2031)

- Figure 11. International: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Domestic: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. North America Trade Credit Insurance Market Share (%) - by End User (2023 and 2031)

- Figure 14. Energy: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Automotive: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Aerospace: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Chemicals: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Metals: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Agriculture: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Food and Beverages: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Financial Services: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Technology and Telecommunication: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Transportation: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Others: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. North America Trade Credit Insurance Market Breakdown, by Key Countries - Revenue (2023) (US$ million)

- Figure 26. North America Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 27. United States: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Canada: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Mexico: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Heat Map Analysis by Key Players

- Figure 31. Company Positioning & Concentration

The North America trade credit insurance market was valued at US$ 3,680.52 million in 2023 and is expected to reach US$ 7,264.03 million by 2031; it is estimated to register a CAGR of 8.9% from 2023 to 2031.

Rise in Inflation and High Interest Rates Fuels North America Trade Credit Insurance Market

Inflation and high interest rates lead to financial vulnerabilities even when the business volume is not increasing. Rising business costs result in a higher risk of bad debts and counterparty default, which boosts the demand for trade credit insurance among businesses to support smooth operations. It protects insurers from default on payments due to increased costs, rising expenses, and high interest rates. Trade credit insurance supports businesses to increase their volume, support resilience in the face of continued volatility, and expand into new sectors and markets. Trade credit insurance provides businesses with an up-to-date insight into payment performance; for example, if the payment was made by their potential business partner on time or not. Furthermore, trade credit insurance gives insurers information that supports brokers to improve insurers' existing credit management methods and protect margins from being influenced by inflation and high interest rates. Additionally, trade credit insurance gives trade receivables that help businesses receive better terms from funders or investors, allowing businesses to deal effectively with high interest rates and rising inflation situations. This is also helpful for businesses that are less capable of dealing with inflation. Thus, the growing inflation and high interest rates fuel the North America trade credit insurance market growth.

North America Trade Credit Insurance Market Overview

The US, Canada, and Mexico are among the major economies in North America. This region accounts for a significant share of the North America trade credit insurance market owing to the growing insurance activities such as single risk and bonding. Increasing requirements for trade credit insurance among businesses encourages market players to develop new-generation services to meet their customers' requirements. For instance, in 2023, COFACE SA launched URBA360. It is a new online risk management tool that uses information from business reports, financials, economic briefings, and public and unique data sets to provide a comprehensive perspective of risk in graphic format. With this tool, businesses can easily understand their financial risks and select appropriate insurance coverage. Moreover, according to Allianz Trade data published in February 2024, the insolvency rate in North America has risen by 41%, which is expected to generate an additional risk of nonpayment for small suppliers. This created the demand for trade credit insurance among small suppliers to make timely payments.

A rise in trade and export activities has led to an increased demand for trade credit insurance among businesses to make payments and clear their pending debt. For instance, the president of Coface North America predicted that their trade credit insurance is expected to grow by 25% in 2024 due to growing export activities in the region. This creates opportunities for businesses in the region to reduce their debts, improve cash flows, and facilitate sales.

North America Trade Credit Insurance Market Revenue and Forecast to 2031 (US$ Million)

North America Trade Credit Insurance Market Segmentation

The North America trade credit insurance market is categorized into enterprise size, application, end user, and country.

Based on enterprise size, the North America trade credit insurance market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

In terms of application, the North America trade credit insurance market is bifurcated into international and domestic. The international segment held a larger market share in 2023.

By application, the North America trade credit insurance market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunication, transportation, and others. The energy segment held the largest market share in 2023.

By country, the North America trade credit insurance market is segmented into the US, Canada, and Mexico. The US dominated the North America trade credit insurance market share in 2023.

Allianz Trade, American International Group Inc, Aon Plc, Atradius NV, Chubb Ltd, COFACE SA, Great American Insurance Company, QBE Insurance Group Ltd, Zurich Insurance Group AG, and Credendo are some of the leading companies operating in the North America Trade Credit Insurance market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Trade Credit Insurance Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Trade Credit Insurance Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Surge in Business Insolvencies

- 5.1.2 Rise in Inflation and High Interest Rates

- 5.1.3 Government Initiatives Supporting MSMEs and SMEs to Adopt Trade Credit Insurance

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness Among SMEs

- 5.3 Market Opportunities

- 5.3.1 Supply Chain Complexities

- 5.3.2 Significant Initiatives to Promote AI use in Trade Credit Insurance Solutions

- 5.4 Future Trends

- 5.4.1 Development of Cloud-Based Trade Credit Insurance Solutions

- 5.5 Impact of Drivers and Restraints:

6. Trade Credit Insurance Market - North America Analysis

- 6.1 North America Trade Credit Insurance Market Revenue (US$ Million), 2021-2031

- 6.2 North America Trade Credit Insurance Market Forecast Analysis

7. North America Trade Credit Insurance Market Analysis - by Enterprise Size

- 7.1 Large Enterprises

- 7.1.1 Overview

- 7.1.2 Large Enterprises: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 SMEs

- 7.2.1 Overview

- 7.2.2 SMEs: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Trade Credit Insurance Market Analysis - by Application

- 8.1 International

- 8.1.1 Overview

- 8.1.2 International: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Domestic

- 8.2.1 Overview

- 8.2.2 Domestic: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Trade Credit Insurance Market Analysis - by End User

- 9.1 Energy

- 9.1.1 Overview

- 9.1.2 Energy: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Aerospace

- 9.3.1 Overview

- 9.3.2 Aerospace: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Chemicals

- 9.4.1 Overview

- 9.4.2 Chemicals: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Metals

- 9.5.1 Overview

- 9.5.2 Metals: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Agriculture

- 9.6.1 Overview

- 9.6.2 Agriculture: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Food and Beverages

- 9.7.1 Overview

- 9.7.2 Food and Beverages: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Financial Services

- 9.8.1 Overview

- 9.8.2 Financial Services: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.9 Technology and Telecommunication

- 9.9.1 Overview

- 9.9.2 Technology and Telecommunication: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.10 Transportation

- 9.10.1 Overview

- 9.10.2 Transportation: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 9.11 Others

- 9.11.1 Overview

- 9.11.2 Others: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Trade Credit Insurance Market - Country Analysis

- 10.1 Overview

- 10.1.1 North America Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 10.1.1.1 North America Trade Credit Insurance Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 United States: North America Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.2.2 United States: North America Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.2.3 United States: North America Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.3 Canada: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Canada: North America Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.3.2 Canada: North America Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.3.3 Canada: North America Trade Credit Insurance Market Breakdown, by End User

- 10.1.1.4 Mexico: North America Trade Credit Insurance Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 Mexico: North America Trade Credit Insurance Market Breakdown, by Enterprise Size

- 10.1.1.4.2 Mexico: North America Trade Credit Insurance Market Breakdown, by Application

- 10.1.1.4.3 Mexico: North America Trade Credit Insurance Market Breakdown, by End User

- 10.1.1 North America Trade Credit Insurance Market Breakdown, by Key Countries, 2023 and 2031 (%)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Allianz Trade

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 COFACE SA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 American International Group, Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Chubb Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 QBE Insurance Group Ltd

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Aon plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Credendo

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Atradius N.V.

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Zurich Insurance Group AG

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Great American Insurance Company

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index