|

|

市場調査レポート

商品コード

1494514

北米の食品・飲料用マスキングフレーバー市場:2030年までの予測- 地域別分析- タイプ別、用途別North America Flavor Masking Agents for Food and Beverages Market Forecast to 2030 - Regional Analysis - by Type and Application |

||||||

|

|||||||

| 北米の食品・飲料用マスキングフレーバー市場:2030年までの予測- 地域別分析- タイプ別、用途別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 97 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の食品・飲料用マスキングフレーバー市場は、2022年に3,686万米ドルと評価され、2030年には5,980万米ドルに達すると予測され、2022年から2030年までのCAGRは6.2%を記録すると予測されます。

マスキングフレーバーの技術進歩が北米の食品・飲料用マスキングフレーバー市場を牽引

マスキングフレーバーは、マイクロカプセル化、ナノテクノロジー、ポリマーコーティング、有機食品法、ホットメルト押し出し、コンプレックス化、噴霧乾燥など、さまざまな技術や手法を通じて食品や飲食品に使用されています。ナノテクノロジーは、フレーバーの溶解性と安定性を高め、放出特性を制御するのに役立ちます。そのため、マスキングフレーバーの製造にナノテクノロジーを利用するメーカーが増えています。

さらに、マイクロカプセル化は比較的新しい技術で、フレーバー成分が固体マトリックスにカプセル化されています。フレーバーは、物質が加熱されたり水にさらされたりすると放出されます。マイクロカプセル化には、噴霧乾燥、コアセルベーション、重合などの技術が用いられます。マイクロカプセル化プロセスでは、油水混合物を壁材の存在下で均質化し、その後制御された噴霧乾燥を行う。壁材には、植物性ガム、デンプン、デキストリン、タンパク質、セルロースエステルなどが含まれます。マイクロカプセル化は、適切な場所と希望する時間に、コントロールされたフレーバー・リリースを提供します。有効成分(フレーバー)を湿気、酸、熱、酸化、成分の相互作用から保護します。また、乾燥し流動性があるため、成分の取り扱いが容易で、全体的な輸送および取り扱いコストを削減します。マイクロカプセル化されたフレーバー・マスキングは保存性が高く、他のフォーマットよりも望ましいです。この技術はフレーバーや臭いをマスキングするだけでなく、安定性を向上させ、成分の相互作用を防ぎ、成分の放出を修正することもできます。このように、マスキングフレーバーの製造における技術の進歩が、北米のマスキングフレーバー市場の成長を後押ししています。

北米の食品・飲料用マスキングフレーバー市場概要

北米は食品・飲料用マスキングフレーバーの世界市場で大きなシェアを占めています。同地域の市場は米国、カナダ、メキシコに区分されます。マスキングフレーバーは、不快で好ましくない味をマスキングしたり、様々な製品の特定のフレーバーを強化するために使用されます。例えば、塩味マスキング剤は、製品に実際に塩を加えることなく、バランスの取れた好ましい塩味を維持するために使用されます。また、過剰な塩味のマスキングにも使われます。消費者が健康志向になり、低糖、低脂肪、低ナトリウム、低塩の食品を積極的に求めるようになったため、マスキングフレーバーの需要が急増しています。このような減塩・減糖製品に対する需要の高まりにより、人工甘味料や砂糖代替品の使用量が増加しており、これらの甘味料には独特の後味があるため、マスキングが必要となっています。こうした要因から、北米地域ではフレーバー・マスキング剤の需要が急増しています。近年、北米では、ビーガン食品の健康上の利点に関する意識の高まりと、植物ベースの製品における技術革新の急増により、ビーガン動向が大きな盛り上がりを見せています。世界食糧機関によると、米国では人口の6%がビーガンであり、植物性食品の売上は2020年と比較して2021年には27%増加しています。このように、ビーガン、グルテンフリー、FODMAP食などの食事制限や嗜好の増加は、風味マスキング剤のニーズを生み出しています。これらの薬剤は、楽しい風味プロファイルを維持しながら、特定の食事要件を満たすように設計された製品の味を改善するのに役立ちます。さらに、北米の飲食品業界では、よりクリーンなラベルの製品へのシフトが進んでいます。消費者がナチュラルでクリーンな原材料を求める中、メーカーはマスキングフレーバーを使用して、天然原材料に由来する好ましくない味をカバーし、全体的な官能体験を向上させています。このように、上記の要因は北米の飲食品用風味マスキング剤市場の成長に寄与しています。

北米の食品・飲料用マスキングフレーバー市場の収益と2030年までの予測(金額)

北米の食品・飲料用マスキングフレーバー市場セグメンテーション

北米の食品・飲料用マスキングフレーバー市場は、タイプ、用途、国によって区分されます。

タイプ別では、北米の食品・飲料用マスキングフレーバー市場は、甘味、塩味、脂肪、苦味、その他に区分されます。苦味セグメントは2022年に最大のシェアを占めました。

用途別では、北米の食品・飲料用風味マスキング剤市場は、ベーカリー・菓子類、乳製品・冷菓類、飲食品、肉・鶏肉・魚介類、肉代替品、乳製品代替品、RTE・RTC食、その他に区分されます。飲料セグメントが2022年に最大のシェアを占めました。

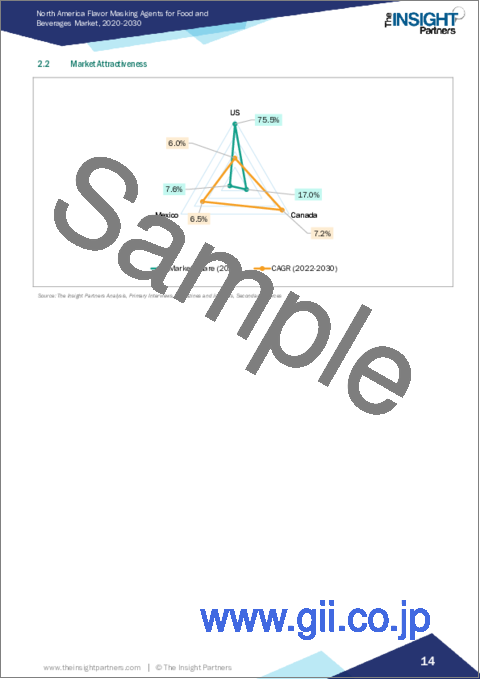

国別に見ると、北米の食品・飲料用マスキングフレーバー市場は米国、カナダ、メキシコに区分されます。米国は2022年に北米の食品・飲料用マスキングフレーバー市場を独占しました。

Sensient Technologies Corp、Firmenich International SA、Tate &Lyle Plc、Archer-Daniels-Midland Co、Kerry Group Plc、Carmi Flavor &Fragrance Co Inc、Synergy Flavors Inc、Virginia Dare Extract Co Inc、GEO Specialty Chemicals Inc、Koninklijke DSM NVは、北米の食品・飲料用マスキングフレーバー市場で事業を展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

- 限界と前提条件

第4章 北米の食品・飲料用マスキングフレーバー市場情勢

- 市場の定義

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- 最終用途産業

- ベンダー一覧

第5章 食品・飲料用マスキングフレーバーの北米市場:主要市場力学

- 市場促進要因

- 幅広い用途

- マスキングフレーバーにおける技術の進歩

- 市場抑制要因

- 製造コストの高騰による製品コストの上昇

- 市場機会

- 植物由来製品におけるマスキングフレーバーの使用増加

- 今後の動向

- 天然添加物に対する需要の増加

- 促進要因と抑制要因の影響分析

第6章 食品・飲料用マスキングフレーバー市場:北米市場分析

- 北米の食品・飲料用マスキングフレーバー市場収益

- 北米の食品・飲料用マスキングフレーバー市場数量

- 北米の食品・飲料用マスキングフレーバー市場収益と予測・分析

- 北米の食品・飲料用マスキングフレーバー市場数量と予測・分析

第7章 北米の食品・飲料用マスキングフレーバーの市場分析:タイプ

- 甘味

- 塩味

- 脂肪

- 苦味

- その他

第8章 北米の食品・飲料用マスキングフレーバー市場分析-用途

- ベーカリーおよび菓子類

- 乳製品と冷凍デザート

- 飲料

- 肉・鶏肉・魚介類

- 食肉代替品

- 乳製品代替品

- RTEおよびRTCミール

- その他

第9章 北米の食品・飲料用マスキングフレーバー市場:国別分析

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- ヒートマップ分析

- 企業のポジショニングと集中度

第11章 企業プロファイル

- Sensient Technologies Corp

- Firmenich International SA

- Tate & Lyle Plc

- Archer-Daniels-Midland Co

- Kerry Group Plc

- Carmi Flavor & Fragrance Co Inc

- Synergy Flavors Inc

- Virginia Dare Extract Co Inc

- GEO Specialty Chemicals Inc

- Koninklijke DSM NV

第12章 付録

List Of Tables

- Table 1. North America Flavor Masking Agents for Food and Beverages Market Segmentation

- Table 2. List of Vendors in the Value Chain

- Table 3. North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand)

- Table 4. North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons)

- Table 5. North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - Type

- Table 6. North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons) - Type

- Table 7. North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - Application

- Table 8. US: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Type

- Table 9. US: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons) - By Type

- Table 10. US: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Application

- Table 11. Canada: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Type

- Table 12. Canada: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons) - By Type

- Table 13. Canada: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Application

- Table 14. Mexico: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Type

- Table 15. Mexico: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons) - By Type

- Table 16. Mexico: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand) - By Application

- Table 17. Heat Map Analysis

List Of Figures

- Figure 1. North America Flavor Masking Agents for Food and Beverages Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis: North America Flavor Masking Agents for Food and Beverages Market

- Figure 3. Ecosystem: North America Flavor Masking Agents for Food & Beverages Market

- Figure 4. North America Flavor Masking Agents for Food and Beverages Market - Key Industry Dynamics

- Figure 5. North America Flavor Masking Agents for Food and Beverages Market Impact Analysis of Drivers and Restraints

- Figure 6. North America Flavor Masking Agents for Food and Beverages Market Revenue (US$ Thousand), 2020 - 2030

- Figure 7. North America Flavor Masking Agents for Food and Beverages Market Volume (Tons), 2020 - 2030

- Figure 8. North America Flavor Masking Agents for Food and Beverages Market Share (%) - Type, 2022 and 2030

- Figure 9. Sweet Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 10. Sweet Market Volume and Forecasts To 2030 (Tons)

- Figure 11. Salt Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 12. Salt Market Volume and Forecasts To 2030 (Tons)

- Figure 13. Fat Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 14. Fat Market Volume and Forecasts To 2030 (Tons)

- Figure 15. Bitter Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 16. Bitter Market Volume and Forecasts To 2030 (Tons)

- Figure 17. Others Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 18. Others Market Volume and Forecasts To 2030 (Tons)

- Figure 19. North America Flavor Masking Agents for Food and Beverages Market Share (%) -Application, 2022 and 2030

- Figure 20. Bakery and Confectionery Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 21. Dairy and Frozen Desserts Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 22. Beverages Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 23. Meat, Poultry, and Seafood Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 24. Meat Substitutes Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 25. Dairy Alternatives Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 26. RTE & RTC Meals Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 27. Others Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 28. North America Flavor Masking Agents for Food and Beverages Market Breakdown by Key Countries - Revenue (2022) (US$ thousand)

- Figure 29. North America Flavor Masking Agents for Food and Beverages Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 30. US: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 31. US: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons)

- Figure 32. Canada: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 33. Canada: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons)

- Figure 34. Mexico: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts To 2030 (US$ Thousand)

- Figure 35. Mexico: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts To 2030 (Tons)

- Figure 36. Company Positioning & Concentration

The North America flavor masking agents for food and beverages market was valued at US$ 36.86 million in 2022 and is expected to reach US$ 59.80 million by 2030; it is estimated to record a CAGR of 6.2% from 2022 to 2030.

Technological Advancements in Flavor Masking Drive North America Flavor Masking Agents for Food and Beverages Market

Flavor masking agents are used in food products and beverages through various techniques and technologies such as microencapsulation, nanotechnology, polymer coating, organoleptic methods, hot melt extrusion, complexation, and spray drying. Nanotechnology aids in enhancing the solubility and stability of flavors, as well as providing controlled release properties. Thus, manufacturers increasingly use nanotechnology to make flavor masking agents.

Moreover, microencapsulation is a relatively new technology in which the flavor content is encapsulated in a solid matrix. The flavor is released when the substance is heated or exposed to water. Spray drying, coacervation, polymerization, and other techniques are used in microencapsulation. In the microencapsulation process, the oilwater mixture is homogenized in the presence of wall material, followed by controlled spray drying. Wall materials include vegetable gums, starches, dextrin, proteins, cellulose esters, and others. Microencapsulation provides controlled flavor release at the right place and desired time. It protects the active ingredients (flavors) from moisture, acid, heat, oxidation, and ingredient interaction. It also provides the ease of handling ingredients as they are dry and free flowing, reducing overall transportation and handling costs. Microencapsulated flavor masking is highly shelf-stable, making it more desirable than other formats. The technology is not just for flavor and odor masking; it can also improve stability, prevent ingredient interaction, and modify the release of ingredients. Thus, technological advancements in the manufacturing of flavor masking agents bolster the North America flavor masking agents market growth.

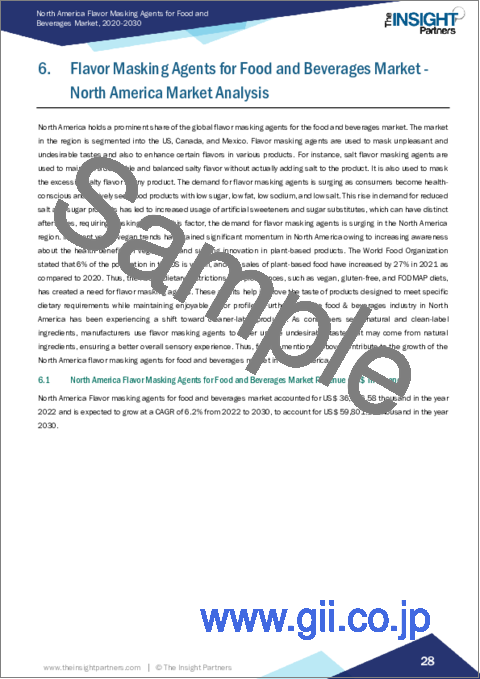

North America Flavor Masking Agents for Food and Beverages Market Overview

North America holds a prominent share of the global flavor masking agents for the food and beverages market. The market in the region is segmented into the US, Canada, and Mexico. Flavor masking agents are used to mask unpleasant and undesirable tastes and also to enhance certain flavors in various products. For instance, salt flavor masking agents are used to maintain a desirable and balanced salty flavor without actually adding salt to the product. It is also used to mask the excessive salty flavor in any product. The demand for flavor masking agents is surging as consumers become health-conscious and actively seek food products with low sugar, low fat, low sodium, and low salt. This rise in demand for reduced salt and sugar products has led to increased usage of artificial sweeteners and sugar substitutes, which can have distinct aftertastes, requiring masking. Due to this factor, the demand for flavor masking agents is surging in the North America region. In recent years, vegan trends have gained significant momentum in North America owing to increasing awareness about the health benefits of vegan food and surging innovation in plant-based products. The World Food Organization stated that 6% of the population in the US is vegan, and the sales of plant-based food have increased by 27% in 2021 as compared to 2020. Thus, the rise in dietary restrictions and preferences, such as vegan, gluten-free, and FODMAP diets, has created a need for flavor masking agents. These agents help improve the taste of products designed to meet specific dietary requirements while maintaining enjoyable flavor profiles. Furthermore, the food & beverages industry in North America has been experiencing a shift toward cleaner-label products. As consumers seek natural and clean-label ingredients, manufacturers use flavor masking agents to cover up the undesirable taste that may come from natural ingredients, ensuring a better overall sensory experience. Thus, factors mentioned above contribute to the growth of the North America flavor masking agents for food and beverages market.

North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecast to 2030 (US$ Million)

North America Flavor Masking Agents for Food and Beverages Market Segmentation

The North America flavor masking agents for food and beverages market is segmented based on type, application, and country.

Based on type, the North America flavor masking agents for food and beverages market is segmented into sweet, salt, fat, bitter, and others. The bitter segment held the largest share in 2022.

By application, the North America flavor masking agents for food and beverages market is segmented into bakery and confectionery, dairy and frozen desserts, beverages, meat, poultry, and seafood, meat substitutes, dairy alternatives, RTE and RTC meals, and others. The beverages segment held the largest share in 2022.

Based on country, the North America flavor masking agents for food and beverages market is segmented into the US, Canada, and Mexico. The US dominated the North America flavor masking agents for food and beverages market in 2022.

Sensient Technologies Corp, Firmenich International SA, Tate & Lyle Plc, Archer-Daniels-Midland Co, Kerry Group Plc, Carmi Flavor & Fragrance Co Inc, Synergy Flavors Inc, Virginia Dare Extract Co Inc, GEO Specialty Chemicals Inc, and Koninklijke DSM NV are some of the leading companies operating in the North America flavor masking agents for food and beverages market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

- 3.4 Limitations and Assumptions

4. North America Flavor Masking Agents for Food and Beverages Market Landscape

- 4.1 Overview

- 4.1.1 Market Definition:

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 End-Use Industries

- 4.4 List of Vendors

5. North America Flavor Masking Agents for Food and Beverages Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Wide Array of Applications

- 5.1.2 Technological Advancements in Flavor Masking

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Expenses Results in High Product Cost

- 5.3 Market Opportunities

- 5.3.1 Rising Use of Flavor Masking Agents in Plant-Based Products

- 5.4 Future Trends

- 5.4.1 Increasing Demand for Natural Additives

- 5.5 Impact Analysis of Drivers and Restraints

6. Flavor Masking Agents for Food and Beverages Market - North America Market Analysis

- 6.1 North America Flavor Masking Agents for Food and Beverages Market Revenue (US$ Thousand)

- 6.2 North America Flavor Masking Agents for Food and Beverages Market Volume (Tons)

- 6.3 North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecast and Analysis (US$ Thousand)

- 6.4 North America Flavor Masking Agents for Food and Beverages Market Volume and Forecast and Analysis (Tons)

7. North America Flavor Masking Agents for Food and Beverages Market Analysis - Type

- 7.1 Sweet

- 7.1.1 Overview

- 7.1.2 Sweet Market Revenue and Forecast to 2030 (US$ Thousand)

- 7.1.3 Sweet Market Volume and Forecast to 2030 (Tons)

- 7.2 Salt

- 7.2.1 Overview

- 7.2.2 Salt Market Revenue and Forecast to 2030 (US$ Thousand)

- 7.2.3 Salt Market Volume and Forecast to 2030 (Tons)

- 7.3 Fat

- 7.3.1 Overview

- 7.3.2 Fat Market Revenue and Forecast to 2030 (US$ Thousand)

- 7.3.3 Fat Market Volume and Forecast to 2030 (Tons)

- 7.4 Bitter

- 7.4.1 Overview

- 7.4.2 Bitter Market Revenue and Forecast to 2030 (US$ Thousand)

- 7.4.3 Bitter Market Volume and Forecast to 2030 (Tons)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market Revenue and Forecast to 2030 (US$ Thousand)

- 7.5.3 Others Market Volume and Forecast to 2030 (Tons)

8. North America Flavor Masking Agents for Food and Beverages Market Analysis - Application

- 8.1 Bakery and Confectionery

- 8.1.1 Overview

- 8.1.2 Bakery and Confectionery Market Revenue and Forecast to 2030 (US$ Thousand)

- 8.2 Dairy and Frozen Desserts

- 8.2.1 Overview

- 8.2.2 Dairy and Frozen Desserts Market Revenue and Forecast to 2030 (US$ Thousand)

- 8.3 Beverages

- 8.3.1 Overview

- 8.3.2 Beverages Market Revenue and Forecast to 2030 (US$ Thousand)

- 8.4 Meat, Poultry, and Seafood

- 8.4.1 Overview

- 8.4.2 Meat, Poultry, and Seafood Market Revenue, and Forecast to 2030 (US$ Thousand)

- 8.5 Meat Substitutes

- 8.5.1 Overview

- 8.5.2 Meat Substitutes Market Revenue, and Forecast to 2030 (US$ Thousand)

- 8.6 Dairy Alternatives

- 8.6.1 Overview

- 8.6.2 Dairy Alternatives Market Revenue and Forecast to 2030 (US$ Thousand)

- 8.7 RTE & RTC Meals

- 8.7.1 Overview

- 8.7.2 RTE & RTC Meals Market Revenue and Forecast to 2030 (US$ Thousand)

- 8.8 Others

- 8.8.1 Overview

- 8.8.2 Others Market Revenue and Forecast to 2030 (US$ Thousand)

9. North America Flavor Masking Agents for Food and Beverages Market - Country Analysis

- 9.1 North America Flavor Masking Agents for Food and Beverages Market - Country Analysis

- 9.1.1 North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts and Analysis - By Countries

- 9.1.1.1 North America Flavor Masking Agents for Food and Beverages Market Breakdown by Country

- 9.1.1.2 US: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts to 2030 (US$ Thousand)

- 9.1.1.3 US: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts to 2030 (Tons)

- 9.1.1.3.1 US: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.3.2 US: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.3.3 US: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Application

- 9.1.1.4 Canada: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts to 2030 (US$ Thousand)

- 9.1.1.5 Canada: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts to 2030 (Tons)

- 9.1.1.5.1 Canada: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.5.2 Canada: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.5.3 Canada: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Application

- 9.1.1.6 Mexico: North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts to 2030 (US$ Thousand)

- 9.1.1.7 Mexico: North America Flavor Masking Agents for Food and Beverages Market Volume and Forecasts to 2030 (Tons)

- 9.1.1.7.1 Mexico: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.7.2 Mexico: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Type

- 9.1.1.7.3 Mexico: North America Flavor Masking Agents for Food and Beverages Market Breakdown by Application

- 9.1.1 North America Flavor Masking Agents for Food and Beverages Market Revenue and Forecasts and Analysis - By Countries

10. Competitive Landscape

- 10.1 Heat Map Analysis

- 10.2 Company Positioning & Concentration

11. Company Profiles

- 11.1 Sensient Technologies Corp

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Firmenich International SA

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Tate & Lyle Plc

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Archer-Daniels-Midland Co

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Kerry Group Plc

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Carmi Flavor & Fragrance Co Inc

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Synergy Flavors Inc

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Virginia Dare Extract Co Inc

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 GEO Specialty Chemicals Inc

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 Koninklijke DSM NV

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments