|

|

市場調査レポート

商品コード

1226896

中東・アフリカの栄養バーの2028年市場予測- 地域別分析- タイプ別、カテゴリー別、流通チャネル別Middle East & Africa Nutritional Bars Market Forecast to 2028 - COVID-19 Impact and Regional Analysis - by Type, Category, Distribution Channel |

||||||

| 中東・アフリカの栄養バーの2028年市場予測- 地域別分析- タイプ別、カテゴリー別、流通チャネル別 |

|

出版日: 2023年02月14日

発行: The Insight Partners

ページ情報: 英文 100 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

中東・アフリカの栄養バー市場は、2022年の5億3,738万米ドルから2028年には7億6,715万米ドルに成長すると予測されています。2022年から2028年までのCAGRは6.1%と推定されます。

ラベルへの機能的主張の記載は、今後数年間、中東・アフリカの栄養バー市場のメーカーに大きな成長機会をもたらすと思われます。

機能性表示の確立は、食品に関連する健康コンセプトを機能性表示に変換する規制プロセスです。人はそれぞれ異なる体型を持っており、それぞれの体には特有の要求があります。消費者は、自分の特定のニーズを満たす製品を選びます。そのため、機能性を訴求した栄養バーが人気を博しています。栄養バーメーカーは、機能性を訴求した製品を発売することが増えており、バーの摂取に伴う健康効果を伝えています。これにより、顧客ベースを拡大し、利益を増やすことができるのです。機能性表示食品をうまく伝えることは、メーカーにとって最大の関心事です。最近の科学的な報告では、消費者が健康関連の訴求に純粋に関心を持っていることが確認されていますが、その関心は食品の種類によって異なるようです。栄養バーを購入する際に消費者に悪影響を与える要因として、情報が多すぎることや、さまざまなヘルスクレームの解釈が難しいことが指摘されています。そのため、機能性表示を説明する際に、言葉のシンプルさを維持することは、製品のリーチを向上させるのに役立つと考えられます。したがって、機能性食品のフロントラベルにヘルスクレームを短く表示することは、消費者の間でポジティブなブランドイメージを生み出す上でより効果的であると考えられます。多くの栄養バーには、"減量"、"免疫力アップ"、"ストレス解消"などの一言で済む機能性表示文句が含まれています。例えば、JiMMY!プロテインバー- シトラスブラスト」は、1日分のビタミンCの300%を摂取できるため、免疫力を高める効果があると主張しています。機能性表示の動向には、アレルゲンフリー(グルテンフリー、大豆フリー、ナッツフリーなど)や糖質制限(砂糖少なめ、砂糖なし、砂糖不使用など)の主張があります。したがって、ラベルに機能性表示を含めることは、今後数年間、栄養バーのメーカーに大きな成長機会をもたらすと思われます。

中東・アフリカの栄養バー市場の概要

中東・アフリカの栄養バー市場は、南アフリカ、サウジアラビア、UAE、その他中東・アフリカに区分されます。同地域では、身体活動への参加の増加に伴い、栄養バーの消費量が広く増加しています。中東諸国では、スポーツジムの会員数も増加しており、健康維持への関心が高まっていることがうかがえます。さらに、フィットネスクラブでは、通常の食事の代わりとしてプロテインバーを推奨しており、この地域で栄養バーの売上を大幅に伸ばしています。フィットネスクラブの増加やプロテインバーに対する意識の高まりにより、予測期間中に栄養バーの需要が増加することが予想されます。プロテインバーやエナジーバーは、筋肉増強に役立つため、アスリートや運動をしている人々の間で人気が高まっています。健康的なライフスタイルへの注目の高まりからフィットネスプログラムの人気が高まっており、栄養バーの消費量は大幅に増加すると予想されます。また、ミレニアル世代はフィットネスへの傾倒、高い購買力、健康的な製品への支払い意欲があることから、中東・アフリカの栄養バー市場に貢献しています。中東・アフリカの栄養バー市場で活動する複数の主なプレーヤーは、中東・アフリカの栄養バー市場の成長をさらに後押しする新製品を開発しています。

中東・アフリカの栄養バー市場の収益と2028年までの予測

中東・アフリカの栄養バー市場のセグメンテーション

中東・アフリカの栄養バー市場は、タイプ、カテゴリー、流通チャネル、国に区分されます。

タイプに基づき、中東・アフリカの栄養バー市場は、プロテインバー、ハイファイバーバー、その他に区分されます。2022年、中東・アフリカの栄養バー市場では、プロテインバー分野が最大のシェアを占めました。

カテゴリーに基づいて、中東・アフリカの栄養バー市場は、従来型とグルテンフリーに二分されます。2022年、中東・アフリカの栄養バー市場では、従来型セグメントがより大きなシェアを占めました。

流通チャネルに基づいて、中東・アフリカの栄養バー市場はスーパーマーケット&ハイパーマーケット、コンビニエンスストア、オンライン小売、およびその他に区分されます。2022年、スーパーマーケット&ハイパーマーケット部門は、中東・アフリカの栄養バー市場で最大のシェアを登録しました。

国に基づいて、中東・アフリカの栄養バー市場は、南アフリカ、サウジアラビア、UAE、その他中東・アフリカに分割されます。2022年、その他中東とアフリカのセグメントは、中東・アフリカの栄養バー市場で最大のシェアを登録しました。

Clif Bar &Co;General Mills Inc;Mars Inc;The Kellogg Co;The Quaker Oats Co;and The Simply Good Foods Coは、中東・アフリカの栄養バー市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- 調査対象範囲

- 調査手法

- データ収集

- 一次インタビュー

- 仮説の策定

- マクロ経済要因分析

- ベースナンバーの作成

- データの三角測量

- 国別レベルデータ

第4章 中東・アフリカの栄養バーの市場概要

- 市場概要

- 中東・アフリカのPEST分析

- 専門家別オピニオン

第5章 中東・アフリカの栄養バー市場- 主要な市場力学

- 市場促進要因

- ミレニアル世代におけるヘルシースナッキングへの嗜好の高まり

- 栄養バーメーカー別製品開発および発売

- 市場抑制要因

- 代替品の入手可能性

- 市場機会

- ラベルへの機能性表示の搭載

- 今後の動向

- フィットネス動向の高まり

- 促進要因と抑制要因の影響分析

第6章 中東・アフリカの栄養バー市場分析

第7章 中東・アフリカの栄養バーの分析- タイプ別

- 中東・アフリカの栄養バー市場、タイプ別(2021年、2028年)

- プロテインバー

- 高繊維バー

- その他

第8章 中東・アフリカの栄養バーの市場分析- カテゴリー別

- 中東・アフリカの栄養バー市場:カテゴリー別(2021年、2028年)

- コンベンショナル

- グルテンフリー

第9章 中東・アフリカの栄養バーの分析- 流通チャネル別

- 中東・アフリカの栄養バーの市場:流通チャネル別(2021年、2028年)

- スーパーマーケット、ハイパーマーケット

- コンビニエンスストア

- オンラインショップ

- その他

第10章 中東・アフリカの栄養バーの市場- 国別分析

- 中東・アフリカ地域

- サウジアラビア

- UAE

- 南アフリカ共和国

- その他中東・アフリカ地域

第11章 業界情勢

- 製品の発売

第12章 企業プロファイル

- The Simply Good Foods Co

- Clif Bar & Co

- General Mills Inc

- The Kellogg Co

- The Quaker Oats Co

- Mars Inc

第13章 付録

List Of Tables

- Table 1. MEA Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- Table 2. Saudi Arabia Nutritional Bars Market, By Type - Revenue and Forecast to 2028 (US$ Million)

- Table 3. Saudi Arabia Nutritional Bars Market, by Category - Revenue and Forecast to 2028 (US$ Million)

- Table 4. Saudi Arabia Nutritional Bars Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 5. UAE Nutritional Bars Market, By Type - Revenue and Forecast to 2028 (US$ Million)

- Table 6. UAE Nutritional Bars Market, by Category - Revenue and Forecast to 2028 (US$ Million)

- Table 7. UAE Nutritional Bars Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 8. South Africa Nutritional Bars Market, By Type - Revenue and Forecast to 2028 (US$ Million)

- Table 9. South Africa Nutritional Bars Market, by Category - Revenue and Forecast to 2028 (US$ Million)

- Table 10. South Africa Nutritional Bars Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 11. Rest of Middle East and Africa Nutritional Bars Market, by Type - Revenue and Forecast to 2028 (US$ Million)

- Table 12. Rest of Middle East and Africa Nutritional Bars Market, by Category - Revenue and Forecast to 2028 (US$ Million)

- Table 13. Rest of Middle East and Africa Nutritional Bars Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 14. List of Abbreviation

List Of Figures

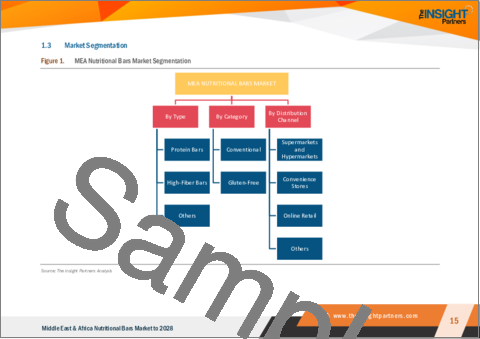

- Figure 1. MEA Nutritional Bars Market Segmentation

- Figure 2. MEA Nutritional Bars Market Segmentation - By Country

- Figure 3. MEA Nutritional Bars Market Overview

- Figure 4. MEA Nutritional Bars Market: By Category

- Figure 5. MEA Nutritional Bars Market: By Country

- Figure 6. MEA: PEST Analysis

- Figure 7. Expert Opinion

- Figure 8. MEA Nutritional Bars Market Impact Analysis of Drivers and Restraints

- Figure 9. MEA: Nutritional Bars Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 10. MEA Nutritional bars Market Revenue Share, By Type (2021 and 2028)

- Figure 11. Protein Bars: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 12. High-Fiber Bars: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 13. Others: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 14. MEA Nutritional bars Market Revenue Share, By Category (2021 and 2028)

- Figure 15. Conventional: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 16. Gluten-Free: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 17. MEA Nutritional bars Market Revenue Share, By Distribution Channel (2021 and 2028)

- Figure 18. Supermarkets and Hypermarkets: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 19. Convenience Stores: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 20. Online Retail: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 21. Others: MEA Nutritional bars Market - Revenue and Forecast To 2028 (US$ Million)

- Figure 22. Middle East and Africa: Nutritional Bars Market Revenue Share, by Key Country- Revenue (2021) (US$ Million)

- Figure 23. Middle East and Africa: Nutritional Bars Market Revenue Share, by Key Country (2021 and 2028)

- Figure 24. Saudi Arabia: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- Figure 25. UAE: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- Figure 26. South Africa: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- Figure 27. Rest of Middle East and Africa: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

The Middle East & Africa nutritional bars market is expected to grow from US$ 537.38 million in 2022 to US$ 767.15 million by 2028. It is estimated to grow at a CAGR of 6.1% from 2022 to 2028.

Inclusion of Functional Claims on Labels is likely to provide significant growth opportunities to the manufacturers of the Middle East & Africa nutritional bars market in the coming years

The establishment of functional claims is a regulatory process in which a health concept associated with a food product is converted into a functional claim. Each person has a different body type, and each body has specific requirements. Consumers choose products that fulfill their specific needs. Therefore, nutritional bars with functional claims are gaining traction. Nutritional bars manufacturers are increasingly launching products with functional claims and are communicating the health benefits associated with the consumption of the bars. This allows them to expand their customer base and increase their profits. The successful communication of functional claims is the main concern for manufacturers. Recent reports from scientific literature confirm that consumers are genuinely interested in health-related claims, but interest seems to vary depending on the type of food products. Too much information and difficulty interpreting different health claims have been noted as factors that can negatively influence consumers while purchasing nutritional bars. Therefore, maintaining the simplicity of language while explaining functional claims may help improve the reach of products. Thus, displaying health claims in short on the front label of functional foods can be more effective in generating a positive brand image among consumers. Many nutritional bars contain one-word functional claims such as "weight loss," "immunity booster," and "stress relief." For instance, JiMMY! Protein Bar - Citrus Blast claims to act as an immunity booster by providing 300% of daily Vitamin C. Trending examples of functional claims include allergen-free (e.g., gluten-free, soy-free, or nut-free) and sugar reduction claims (e.g., less sugar, no sugar, or no added sugars). Therefore, including functional claims on labels is likely to provide significant growth opportunities to the manufacturers of nutritional bars in the coming years.

Middle East & Africa Nutritional Bars Market Overview

The Middle East & Africa nutritional bars market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. The consumption of nutritional bars is widely increasing across the region owing to the growing participation in physical activities. The number of gym memberships is also increasing in Middle Eastern countries, indicating that people are becoming more interested in staying fit. Moreover, fitness clubs are recommending protein bars as a substitute for regular meals and significantly increasing the sales of these nutritional bars in the region. With an increasing number of health clubs and surging awareness about protein bars, the market is expected to witness a rise in demand for nutritional bars during the forecast period. Protein bars and energy bars are becoming increasingly popular among athletes and people who participate in physical activities as they help in muscle building. With the growing popularity of fitness programs due to increased focus on a healthy lifestyle, the consumption of nutritional bars is expected to grow significantly. Additionally, the millennial generation is contributing to the Middle East & Africa nutritional bars market due to their inclination toward fitness, high buying capacity, and willingness to pay for healthy products. Several key players operating in the Middle East & Africa nutritional bars market are developing new products that will further boost the Middle East & Africa nutritional bars market growth.

Middle East & Africa Nutritional Bars Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Nutritional Bars Market Segmentation

The Middle East & Africa nutritional bars market is segmented into type, category, distribution channel, and country.

Based on type, the Middle East & Africa nutritional bars market is segmented into protein bars, high-fiber bars, and others. In 2022, the protein bars segment registered a largest share in the Middle East & Africa nutritional bars market.

Based on category, the Middle East & Africa nutritional bars market is bifurcated into conventional and gluten-free. In 2022, the conventional segment registered a larger share in the Middle East & Africa nutritional bars market.

Based on distribution channel, the Middle East & Africa nutritional bars market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. In 2022, the supermarkets & hypermarkets segment registered a largest share in the Middle East & Africa nutritional bars market.

Based on country, the Middle East & Africa nutritional bars market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. In 2022, the Rest of the Middle East & Africa segment registered a largest share in the Middle East & Africa nutritional bars market.

Clif Bar & Co; General Mills Inc; Mars Inc; The Kellogg Co; The Quaker Oats Co; and The Simply Good Foods Co are the leading companies operating in the Middle East & Africa nutritional bars market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa nutritional bars market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa nutritional bars market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the nutritional bars market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Scope of the Study

- 3.2 Research Methodology

- 3.2.1 Data Collection:

- 3.2.2 Primary Interviews:

- 3.2.3 Hypothesis Formulation:

- 3.2.4 Macro-economic Factor Analysis:

- 3.2.5 Developing Base Number:

- 3.2.6 Data Triangulation:

- 3.2.7 Country Level Data:

4. MEA Nutritional Bars Market Overview

- 4.1 Market Overview

- 4.2 MEA PEST Analysis

- 4.3 Expert Opinion

5. MEA Nutritional Bars Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Preference for Healthy Snacking Among Millennials

- 5.1.2 Product Developments and Launches by Nutritional Bars Manufacturers

- 5.2 Market Restraints

- 5.2.1 Availability of Substitutes

- 5.3 Market Opportunities

- 5.3.1 Inclusion of Functional Claims on Labels

- 5.4 Future Trends

- 5.4.1 Rising Fitness Trends

- 5.5 Impact Analysis of Drivers and Restraints

6. Nutritional Bars - MEA Market Analysis

- 6.1 MEA Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

7. MEA Nutritional Bars Analysis - By Type

- 7.1 Overview

- 7.2 MEA Nutritional bars Market, By Type (2021 and 2028)

- 7.3 Protein Bars

- 7.3.1 Overview

- 7.3.2 Protein Bars: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 7.4 High-Fiber Bars

- 7.4.1 Overview

- 7.4.2 High-Fiber Bars: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

8. MEA Nutritional bars Market Analysis - By Category

- 8.1 Overview

- 8.2 MEA Nutritional bars Market, By Category (2021 and 2028)

- 8.3 Conventional

- 8.3.1 Overview

- 8.3.2 Conventional: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 8.4 Gluten-Free

- 8.4.1 Overview

- 8.4.2 Gluten-Free: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

9. MEA Nutritional Bars Analysis - By Distribution Channel

- 9.1 Overview

- 9.2 MEA Nutritional bars Market, By Distribution Channel (2021 and 2028)

- 9.3 Supermarkets and Hypermarkets

- 9.3.1 Overview

- 9.3.2 Supermarkets and Hypermarkets: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 9.4 Convenience Stores

- 9.4.1 Overview

- 9.4.2 Convenience Stores: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 9.5 Online Retail

- 9.5.1 Overview

- 9.5.2 Online Retail: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: MEA Nutritional bars Market - Revenue and Forecast to 2028 (US$ Million)

10. MEA Nutritional Bars Market - Country Analysis

- 10.1 Overview

- 10.1.1 Middle East and Africa: Nutritional Bars Market, by Key Country

- 10.1.1.1 Saudi Arabia: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.1.1 Saudi Arabia: Nutritional Bars Market, By Type

- 10.1.1.1.2 Saudi Arabia: Nutritional Bars Market, by Category

- 10.1.1.1.3 Saudi Arabia: Nutritional Bars Market, by Distribution Channel

- 10.1.1.2 UAE: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.2.1 UAE: Nutritional Bars Market, By Type

- 10.1.1.2.2 UAE: Nutritional Bars Market, by Category

- 10.1.1.2.3 UAE: Nutritional Bars Market, by Distribution Channel

- 10.1.1.3 South Africa: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.3.1 South Africa: Nutritional Bars Market, By Type

- 10.1.1.3.2 South Africa: Nutritional Bars Market, by Category

- 10.1.1.3.3 South Africa: Nutritional Bars Market, by Distribution Channel

- 10.1.1.4 Rest of Middle East and Africa: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.4.1 Rest of Middle East and Africa: Nutritional Bars Market, by Type

- 10.1.1.4.2 Rest of Middle East and Africa: Nutritional Bars Market, by Category

- 10.1.1.4.3 Rest of Middle East and Africa: Nutritional Bars Market, by Distribution Channel

- 10.1.1.1 Saudi Arabia: Nutritional Bars Market -Revenue and Forecast to 2028 (US$ Million)

- 10.1.1 Middle East and Africa: Nutritional Bars Market, by Key Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Product launch

12. Company Profiles

- 12.1 The Simply Good Foods Co

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Clif Bar & Co

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 General Mills Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 The Kellogg Co

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 The Quaker Oats Co

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Mars Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index