|

|

市場調査レポート

商品コード

1688927

投資家向けESGソフトウェアの世界市場、市場規模と予測(2021年~2031年)、世界と地域のシェア、動向、成長機会の分析:コンポーネント別、企業規模別、地域別Investor ESG Software Market Size and Forecast 2021 - 2031, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component, Enterprise Size (Large Enterprises and SMEs), and Geography |

||||||

|

|||||||

| 投資家向けESGソフトウェアの世界市場、市場規模と予測(2021年~2031年)、世界と地域のシェア、動向、成長機会の分析:コンポーネント別、企業規模別、地域別 |

|

出版日: 2025年02月28日

発行: The Insight Partners

ページ情報: 英文 161 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の投資家向けESGソフトウェアの市場規模は、2024年に10億8,000万米ドルであり、2031年までに33億6,000万米ドルに達すると予測され、2024年~2031年にCAGRで17.6%の成長を記録すると推定されます。

投資家向けESGソフトウェアへの生成AIの統合は、今後数年間で市場に新たな動向をもたらすと予測されます。生成AIにより、投資家はESGデータにアクセスし、分析し、解釈します。ESGにおいて、この技術はESGデータの分析、レポート、意思決定プロセスを強化する上で極めて重要な役割を果たすことができます。生成AIをESGソフトウェアに統合するもっとも大きな利点の1つは、複雑なESGレポートの作成を自動化できることです。生成AIは、さまざまなソースからの膨大なESGデータを迅速に分析し、投資家向けにカスタマイズされた知見あるレポートを作成することができます。これらのレポートには、標準的な指標や予測分析が含まれ、ESGパフォーマンスにおける新たなリスクや機会、動向を特定することができます。こうしたプロセスを自動化することで、投資家は貴重な時間を節約しつつ、レポートの正確性と包括性を確保することができます。

投資家向けESGソフトウェアに生成AIが統合されることで、データの正確性、レポートの効率性、予測分析が大幅に進歩します。例えば、パリを拠点とするサステナビリティプラットフォームのCO2 AIは2024年7月、Product Footprintingを発表しました。これは、企業が製品の二酸化炭素排出を計算し、環境への影響の削減を支援することを目的とした、新しい生成AIによるソリューションです。このプラットフォームは、大規模で複雑な組織が影響を評価し、AIを活用して影響を削減するための手段を広く検出することを手助けすることを目的としたソリューションを提供します。同社によると、CO2 AIとBCGが発表した調査によると、サプライヤーから適切な製品レベルのデータを受け取っている企業は38%に過ぎません。同様に、2024年4月、産業クラウドのリーダーであるInforは、生産性の向上と環境に対する影響の追跡で顧客を支援するために設計されたInfor GenAIとESG Reportingの提供開始を発表しました。業界をリードするERPやサプライチェーンツールを含む、Inforの包括的な最新ソリューション一式は、製造、流通、医療、公共部門の重要な業務をサポートしています。生成AIのパワーと業界特有のユニークな機能や知見を組み合わせることで、これらのソリューションは、顧客が適切なデータとワークフローを効率的に活用し、価値実現を加速することを可能にします。さらに、これらのソリューションは、InforのOSプラットフォームによって強化された厳格なセキュリティとデータプライバシー標準に準拠しています。さらに、ESGデータの分析を自動化しパーソナライズすることで、生成AIは、投資家がより多くの情報に基づき、持続可能で、将来を見据えた投資判断を下せるよう支援し、投資分野におけるESGソフトウェアの成長と普及をさらに促進します。

エンドユーザー別では、投資家向けESGソフトウェア市場はソフトウェアとサービスに区分されます。2024年の投資家向けESGソフトウェアの市場シェアは、ソフトウェアセグメントが最大でした。投資家向けESGソフトウェアプラットフォームは、ESGプログラムの最適化とビジネスパフォーマンスエクスポージャーの把握により、企業の価値向上を支援します。例えば、EnHelix ESGソフトウェアは、金融カテゴリで受賞歴のあるサブスクリプションベースのSaaSアプリケーションです。EnHelixは、ESGレポーティングを行い、企業がビッグデータを容易にESGレピュテーションリスクレポーティングに変換できるよう支援します。さらに、このソフトウェアは、投資家や資本市場参入企業が企業行動を評価し、市場参入企業の将来の財務成績を判断するために使用されます。

当レポートでは、世界の投資家向けESGソフトウェア市場について調査分析し、市場規模と予測、促進要因と抑制要因、競合情勢などの情報を提供しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 重要考察

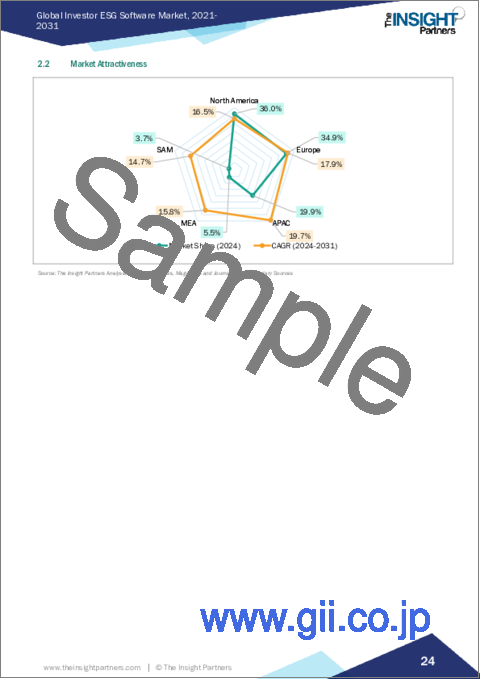

- 市場の魅力

第3章 調査手法

第4章 投資家向けESGソフトウェア市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダーリスト

第5章 投資家向けESGソフトウェア市場 - 主な市場力学

- 投資家向けESGソフトウェア市場 - 主な市場力学

- 市場促進要因

- 企業の社会的責任への注目

- 投資家の間での、正確なESGデータとアナリティクスに対する需要の急増

- 市場抑制要因

- ESGにおける標準化の欠如

- 市場機会

- ESGソフトウェアのイノベーションへの注目

- 今後の動向

- 生成AIとの統合

- 促進要因と抑制要因の影響

第6章 投資家向けESGソフトウェア市場 - 世界市場の分析

- 投資家向けESGソフトウェア市場の収益(2021年~2031年)

- 投資家向けESGソフトウェア市場の予測分析

第7章 投資家向けESGソフトウェア市場の分析 - コンポーネント別

- ソフトウェア

- サービス

第8章 投資家向けESGソフトウェア市場の分析 - 企業規模別

- 大企業

- 中小企業

第9章 投資家向けESGソフトウェア市場 - 地域の分析

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 中南米

第10章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第11章 産業情勢

- 市場戦略

- 製品開発

- 合併と買収

第12章 企業プロファイル

- MSCI Inc

- Workiva, Inc.

- London Stock Exchange Group Plc

- Cority Software Inc

- SAP SE

- Sphera Solutions, Inc.

- FactSet Research Systems Inc

- Morningstar Inc

- Bloomberg LP

- Prophix Software Inc.

第13章 付録

List Of Tables

- Table 1. Investor ESG Software Market Segmentation

- Table 2. Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 4. Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million) - by Enterprise Size

- Table 5. North America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 6. North America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 7. North America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 8. North America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 9. United States: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 10. United States: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 11. United States: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 12. Canada: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 13. Canada: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 14. Canada: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 15. Mexico: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 16. Mexico: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 17. Mexico: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 18. Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 19. Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 20. Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 21. Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 22. Germany: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 23. Germany: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 24. Germany: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 25. France: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 26. France: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 27. France: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 28. United Kingdom: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 29. United Kingdom: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 30. United Kingdom: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 31. Italy: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 32. Italy: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 33. Italy: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 34. Russia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 35. Russia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 36. Russia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 37. Rest of Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 38. Rest of Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 39. Rest of Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 40. Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 41. Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 42. Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 43. Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 44. China: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 45. China: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 46. China: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 47. Japan: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 48. Japan: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 49. Japan: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 50. Australia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 51. Australia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 52. Australia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 53. India: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 54. India: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 55. India: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 56. South Korea: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 57. South Korea: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 58. South Korea: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 59. Rest of APAC: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 60. Rest of APAC: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 61. Rest of APAC: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 62. Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 63. Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 64. Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 65. Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 66. United Arab Emirates: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 67. United Arab Emirates: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 68. United Arab Emirates: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 69. Saudi Arabia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 70. Saudi Arabia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 71. Saudi Arabia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 72. South Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 73. South Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 74. South Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 75. Rest of Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 76. Rest of Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 77. Rest of Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 78. South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 79. South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 80. South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 81. South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 82. Brazil: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 83. Brazil: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 84. Brazil: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 85. Argentina: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 86. Argentina: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 87. Argentina: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 88. Rest of South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 89. Rest of South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 90. Rest of South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million) - by Enterprise Size

- Table 91. Company Positioning & Concentration

- Table 92. List of Abbreviation

List Of Figures

- Figure 1. Investor ESG Software Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Investor ESG Software Market Revenue (US$ Million), 2021-2031

- Figure 5. Investor ESG Software Market Share (%) - by Component (2024 and 2031)

- Figure 6. Software: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Services: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Investor ESG Software Market Share (%) - by Enterprise Size (2024 and 2031)

- Figure 9. Large Enterprises: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. SMEs: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Investor ESG Software Market Breakdown by Region, 2024 and 2031 (%)

- Figure 12. North America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

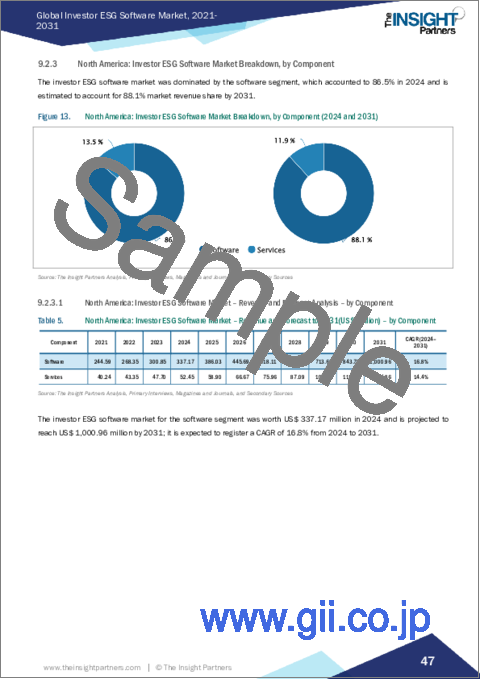

- Figure 13. North America: Investor ESG Software Market Breakdown, by Component (2024 and 2031)

- Figure 14. North America: Investor ESG Software Market Breakdown, by Services (2024 and 2031)

- Figure 15. North America: Investor ESG Software Market Breakdown, by Enterprise Size (2024 and 2031)

- Figure 16. North America: Investor ESG Software Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 17. United States: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 18. Canada: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 19. Mexico: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 20. Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 21. Europe: Investor ESG Software Market Breakdown, by Component (2024 and 2031)

- Figure 22. Europe: Investor ESG Software Market Breakdown, by Services (2024 and 2031)

- Figure 23. Europe: Investor ESG Software Market Breakdown, by Enterprise Size (2024 and 2031)

- Figure 24. Europe: Investor ESG Software Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 25. Germany: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. France: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. United Kingdom: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. Italy: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 29. Russia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 30. Rest of Europe: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 31. Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. Asia Pacific: Investor ESG Software Market Breakdown, by Component (2024 and 2031)

- Figure 33. Asia Pacific: Investor ESG Software Market Breakdown, by Services (2024 and 2031)

- Figure 34. Asia Pacific: Investor ESG Software Market Breakdown, by Enterprise Size (2024 and 2031)

- Figure 35. Asia Pacific: Investor ESG Software Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 36. China: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 37. Japan: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 38. Australia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 39. India: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 40. South Korea: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 41. Rest of APAC: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 42. Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 43. Middle East and Africa: Investor ESG Software Market Breakdown, by Component (2024 and 2031)

- Figure 44. Middle East and Africa: Investor ESG Software Market Breakdown, by Services (2024 and 2031)

- Figure 45. Middle East and Africa: Investor ESG Software Market Breakdown, by Enterprise Size (2024 and 2031)

- Figure 46. Middle East and Africa: Investor ESG Software Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 47. United Arab Emirates: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 48. Saudi Arabia: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 49. South Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 50. Rest of Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 51. South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 52. South and Central America: Investor ESG Software Market Breakdown, by Component (2024 and 2031)

- Figure 53. South and Central America: Investor ESG Software Market Breakdown, by Services (2024 and 2031)

- Figure 54. South and Central America: Investor ESG Software Market Breakdown, by Enterprise Size (2024 and 2031)

- Figure 55. South and Central America: Investor ESG Software Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 56. Brazil: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 57. Argentina: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 58. Rest of South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031(US$ Million)

- Figure 59. Heat Map Analysis by Key Players

The investor ESG software market size was valued at US$ 1.08 billion in 2024 and is anticipated to reach US$ 3.36 billion by 2031. The investor ESG software market is estimated to record a CAGR of 17.6% from 2024 to 2031.

The investor ESG software market in North America is further segmented into the US, The integration of generative AI into investor ESG software is expected to bring new trends into the market in the coming years. With generative AI, investors access, analyze, and interpret environmental, social, and governance (ESG) data. In ESG, this technology can play a pivotal role in enhancing ESG data analysis, reporting, and decision-making processes. One of the most significant benefits of integrating generative AI into ESG software is its ability to automate the creation of complex ESG reports. Generative AI can quickly analyze vast amounts of ESG data from various sources and generate tailored, insightful reports for investors. These reports can include standard metrics and predictive analyses, identifying emerging risks, opportunities, or trends in ESG performance. By automating these processes, investors can save valuable time while ensuring the reports are both accurate and comprehensive.

The integration of generative AI into the investor ESG software will drive significant advancements in data accuracy, reporting efficiency, and predictive analytics. For instance, in July 2024, a Paris-based sustainability platform, CO2 AI, launched Product Footprinting, a new generative AI-powered solution aimed at supporting companies to compute carbon emissions for products and reduce environmental impact. The platform offers solutions aimed at helping large and complex organizations evaluate impact and detect levers to reduce impact at scale, leveraging artificial intelligence. According to the company, the new solution comes to address a need for more precise and rapid product carbon foot printing, citing a study released by CO2 AI and BCG indicating that only 38% of companies receive adequate product-level data from suppliers. Similarly, in April 2024, Infor, the industry cloud leader, unveiled the launch of Infor GenAI and ESG Reporting, designed to assist customers in enhancing productivity and tracking their environmental impact. Infor's comprehensive suite of modern solutions, including industry-leading ERPs and supply chain tools, supports critical operations across manufacturing, distribution, healthcare, and public sectors. By combining the power of GenAI with unique industry-specific capabilities and insights, these solutions enable customers to efficiently harness the right data and workflows, accelerating value realization. Furthermore, these solutions comply with strict security and data privacy standards reinforced by Infor's OS platform. Additionally, by automating and personalizing ESG data analysis, generative AI will help investors make more informed, sustainable, and future-proof investment decisions, further enhancing the growth and adoption of ESG software in the investment space.

Based on end user, the investor ESG software market is segmented into software and services. The software segment held the largest investor ESG software market share in 2024. Investor ESG software platforms help enterprises achieve better value by optimizing ESG programs and understanding business performance exposure. For instance, EnHelix ESG software is an award-winning subscription-based SaaS application in the financial category. EnHelix can execute ESG reporting and help companies easily translate big data into curated and actionable ESG reputation risk reporting. Further, the software is used by investors and capital market players to evaluate corporate behavior to determine the future financial performance of market players.

MSCI, Workiva Inc.; Morningstar Sustainalytics; London Stock Exchange Group plc; Cority; Prophix Software Inc.; SAP SE; Sphera; FactSet; and Bloomberg Finance L.P. are among the prominent players profiled in the investor ESG software market report. Several other major players were also studied and analyzed in the investor ESG software market report to get a holistic view of the market and its ecosystem.

The overall investor ESG software market share has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the investor ESG software market. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the investor ESG software market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Investor ESG Software Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in Value Chain:

5. Investor ESG Software Market - Key Market Dynamics

- 5.1 Investor ESG Software Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Focus on Corporate Social Responsibility

- 5.2.2 Surge in Demand for Accurate ESG Data and Analytics Among Investors

- 5.3 Market Restraints

- 5.3.1 Lack of Standardization in ESG

- 5.4 Market Opportunities

- 5.4.1 Focus on Innovation in ESG Software

- 5.5 Future Trends

- 5.5.1 Integration with Generative AI

- 5.6 Impact of Drivers and Restraints:

6. Investor ESG Software Market - Global Market Analysis

- 6.1 Investor ESG Software Market Revenue (US$ Million), 2021-2031

- 6.2 Investor ESG Software Market Forecast Analysis

7. Investor ESG Software Market Analysis - by Component

- 7.1 Software

- 7.1.1 Overview

- 7.1.2 Software: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

8. Investor ESG Software Market Analysis - by Enterprise Size

- 8.1 Large Enterprises

- 8.1.1 Overview

- 8.1.2 Large Enterprises: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 SMEs

- 8.2.1 Overview

- 8.2.2 SMEs: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

9. Investor ESG Software Market - Geographical Analysis

- 9.1 Overview

- 9.2 North America

- 9.2.1 North America Investor ESG Software Market Overview

- 9.2.2 North America: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.3 North America: Investor ESG Software Market Breakdown, by Component

- 9.2.3.1 North America: Investor ESG Software Market - Revenue and Forecast Analysis - by Component

- 9.2.4 North America: Investor ESG Software Market Breakdown, by Services

- 9.2.4.1 North America: Investor ESG Software Market - Revenue and Forecast Analysis - by Services

- 9.2.5 North America: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.2.5.1 North America: Investor ESG Software Market - Revenue and Forecast Analysis - by Enterprise Size

- 9.2.6 North America: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.2.6.1 North America: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.2.6.2 United States: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.6.2.1 United States: Investor ESG Software Market Breakdown, by Component

- 9.2.6.2.2 United States: Investor ESG Software Market Breakdown, by Services

- 9.2.6.2.3 United States: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.2.6.3 Canada: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.6.3.1 Canada: Investor ESG Software Market Breakdown, by Component

- 9.2.6.3.2 Canada: Investor ESG Software Market Breakdown, by Services

- 9.2.6.3.3 Canada: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.2.6.4 Mexico: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.6.4.1 Mexico: Investor ESG Software Market Breakdown, by Component

- 9.2.6.4.2 Mexico: Investor ESG Software Market Breakdown, by Services

- 9.2.6.4.3 Mexico: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3 Europe

- 9.3.1 Europe Investor ESG Software Market Overview

- 9.3.2 Europe: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.3 Europe: Investor ESG Software Market Breakdown, by Component

- 9.3.3.1 Europe: Investor ESG Software Market - Revenue and Forecast Analysis - by Component

- 9.3.4 Europe: Investor ESG Software Market Breakdown, by Services

- 9.3.4.1 Europe: Investor ESG Software Market - Revenue and Forecast Analysis - by Services

- 9.3.5 Europe: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.5.1 Europe: Investor ESG Software Market - Revenue and Forecast Analysis - by Enterprise Size

- 9.3.6 Europe: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.3.6.1 Europe: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.3.6.2 Germany: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.2.1 Germany: Investor ESG Software Market Breakdown, by Component

- 9.3.6.2.2 Germany: Investor ESG Software Market Breakdown, by Services

- 9.3.6.2.3 Germany: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.6.3 France: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.3.1 France: Investor ESG Software Market Breakdown, by Component

- 9.3.6.3.2 France: Investor ESG Software Market Breakdown, by Services

- 9.3.6.3.3 France: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.6.4 United Kingdom: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.4.1 United Kingdom: Investor ESG Software Market Breakdown, by Component

- 9.3.6.4.2 United Kingdom: Investor ESG Software Market Breakdown, by Services

- 9.3.6.4.3 United Kingdom: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.6.5 Italy: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.5.1 Italy: Investor ESG Software Market Breakdown, by Component

- 9.3.6.5.2 Italy: Investor ESG Software Market Breakdown, by Services

- 9.3.6.5.3 Italy: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.6.6 Russia: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.6.1 Russia: Investor ESG Software Market Breakdown, by Component

- 9.3.6.6.2 Russia: Investor ESG Software Market Breakdown, by Services

- 9.3.6.6.3 Russia: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.3.6.7 Rest of Europe: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.6.7.1 Rest of Europe: Investor ESG Software Market Breakdown, by Component

- 9.3.6.7.2 Rest of Europe: Investor ESG Software Market Breakdown, by Services

- 9.3.6.7.3 Rest of Europe: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4 Asia Pacific

- 9.4.1 Asia Pacific Investor ESG Software Market Overview

- 9.4.2 Asia Pacific: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.3 Asia Pacific: Investor ESG Software Market Breakdown, by Component

- 9.4.3.1 Asia Pacific: Investor ESG Software Market - Revenue and Forecast Analysis - by Component

- 9.4.4 Asia Pacific: Investor ESG Software Market Breakdown, by Services

- 9.4.4.1 Asia Pacific: Investor ESG Software Market - Revenue and Forecast Analysis - by Services

- 9.4.5 Asia Pacific: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.5.1 Asia Pacific: Investor ESG Software Market - Revenue and Forecast Analysis - by Enterprise Size

- 9.4.6 Asia Pacific: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.4.6.1 Asia Pacific: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.4.6.2 China: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.2.1 China: Investor ESG Software Market Breakdown, by Component

- 9.4.6.2.2 China: Investor ESG Software Market Breakdown, by Services

- 9.4.6.2.3 China: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.6.3 Japan: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.3.1 Japan: Investor ESG Software Market Breakdown, by Component

- 9.4.6.3.2 Japan: Investor ESG Software Market Breakdown, by Services

- 9.4.6.3.3 Japan: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.6.4 Australia: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.4.1 Australia: Investor ESG Software Market Breakdown, by Component

- 9.4.6.4.2 Australia: Investor ESG Software Market Breakdown, by Services

- 9.4.6.4.3 Australia: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.6.5 India: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.5.1 India: Investor ESG Software Market Breakdown, by Component

- 9.4.6.5.2 India: Investor ESG Software Market Breakdown, by Services

- 9.4.6.5.3 India: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.6.6 South Korea: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.6.1 South Korea: Investor ESG Software Market Breakdown, by Component

- 9.4.6.6.2 South Korea: Investor ESG Software Market Breakdown, by Services

- 9.4.6.6.3 South Korea: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.4.6.7 Rest of APAC: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.6.7.1 Rest of APAC: Investor ESG Software Market Breakdown, by Component

- 9.4.6.7.2 Rest of APAC: Investor ESG Software Market Breakdown, by Services

- 9.4.6.7.3 Rest of APAC: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.5 Middle East and Africa

- 9.5.1 Middle East and Africa Investor ESG Software Market Overview

- 9.5.2 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.3 Middle East and Africa: Investor ESG Software Market Breakdown, by Component

- 9.5.3.1 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast Analysis - by Component

- 9.5.4 Middle East and Africa: Investor ESG Software Market Breakdown, by Services

- 9.5.4.1 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast Analysis - by Services

- 9.5.5 Middle East and Africa: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.5.5.1 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast Analysis - by Enterprise Size

- 9.5.6 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.5.6.1 Middle East and Africa: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.5.6.2 United Arab Emirates: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.6.2.1 United Arab Emirates: Investor ESG Software Market Breakdown, by Component

- 9.5.6.2.2 United Arab Emirates: Investor ESG Software Market Breakdown, by Services

- 9.5.6.2.3 United Arab Emirates: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.5.6.3 Saudi Arabia: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.6.3.1 Saudi Arabia: Investor ESG Software Market Breakdown, by Component

- 9.5.6.3.2 Saudi Arabia: Investor ESG Software Market Breakdown, by Services

- 9.5.6.3.3 Saudi Arabia: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.5.6.4 South Africa: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.6.4.1 South Africa: Investor ESG Software Market Breakdown, by Component

- 9.5.6.4.2 South Africa: Investor ESG Software Market Breakdown, by Services

- 9.5.6.4.3 South Africa: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.5.6.5 Rest of Middle East and Africa: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.6.5.1 Rest of Middle East and Africa: Investor ESG Software Market Breakdown, by Component

- 9.5.6.5.2 Rest of Middle East and Africa: Investor ESG Software Market Breakdown, by Services

- 9.5.6.5.3 Rest of Middle East and Africa: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.6 South and Central America

- 9.6.1 South and Central America Investor ESG Software Market Overview

- 9.6.2 South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6.3 South and Central America: Investor ESG Software Market Breakdown, by Component

- 9.6.3.1 South and Central America: Investor ESG Software Market - Revenue and Forecast Analysis - by Component

- 9.6.4 South and Central America: Investor ESG Software Market Breakdown, by Services

- 9.6.4.1 South and Central America: Investor ESG Software Market - Revenue and Forecast Analysis - by Services

- 9.6.5 South and Central America: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.6.5.1 South and Central America: Investor ESG Software Market - Revenue and Forecast Analysis - by Enterprise Size

- 9.6.6 South and Central America: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.6.6.1 South and Central America: Investor ESG Software Market - Revenue and Forecast Analysis - by Country

- 9.6.6.2 Brazil: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6.6.2.1 Brazil: Investor ESG Software Market Breakdown, by Component

- 9.6.6.2.2 Brazil: Investor ESG Software Market Breakdown, by Services

- 9.6.6.2.3 Brazil: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.6.6.3 Argentina: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6.6.3.1 Argentina: Investor ESG Software Market Breakdown, by Component

- 9.6.6.3.2 Argentina: Investor ESG Software Market Breakdown, by Services

- 9.6.6.3.3 Argentina: Investor ESG Software Market Breakdown, by Enterprise Size

- 9.6.6.4 Rest of South and Central America: Investor ESG Software Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6.6.4.1 Rest of South and Central America: Investor ESG Software Market Breakdown, by Component

- 9.6.6.4.2 Rest of South and Central America: Investor ESG Software Market Breakdown, by Services

- 9.6.6.4.3 Rest of South and Central America: Investor ESG Software Market Breakdown, by Enterprise Size

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

- 11.4 Mergers & Acquisitions

12. Company Profiles

- 12.1 MSCI Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Workiva, Inc.

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 London Stock Exchange Group Plc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Cority Software Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 SAP SE

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Sphera Solutions, Inc.

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 FactSet Research Systems Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Morningstar Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Bloomberg LP

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Prophix Software Inc.

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 Word Index

- 13.2 About The Insight Partners