|

市場調査レポート

商品コード

1567379

FE・先進パッケージング向け金属化学品市場:2024年~2025年(Critical Materials Report)Metal Chemicals for FE & Advanced Packaging Market Report 2024-2025 (Critical Materials Report) |

||||||

|

|||||||

| FE・先進パッケージング向け金属化学品市場:2024年~2025年(Critical Materials Report) |

|

出版日: 2024年10月10日

発行: TECHCET

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

概要

当レポートでは、FE・先進パッケージング向け金属化学品市場について調査し、先進パッケージング(ウエハーレベル)と半導体デバイス製造(ダマシンプロセス)に適用される金属化学品市場の動向とサプライチェーンを網羅しています。銅めっきと添加剤の動向、市場シェア、技術動向、サプライヤープロファイルをお届けします。また付録として、先進パッケージングに使用されるめっき製品について、一般に入手可能な情報をまとめたサプライヤー製品比較表も掲載しています。

インフォグラフィックス

目次

第1章 エグゼクティブサマリー

第2章 調査範囲、目的、手法

第3章 半導体産業の市場見通し

- 世界経済と産業全体の見通し

- 電子製品セグメント別チップ売上

- 半導体製造の成長と拡大

- 政策と貿易の動向と影響

- 半導体材料の概要

第4章 セグメント別金属化学品市場

- 定義

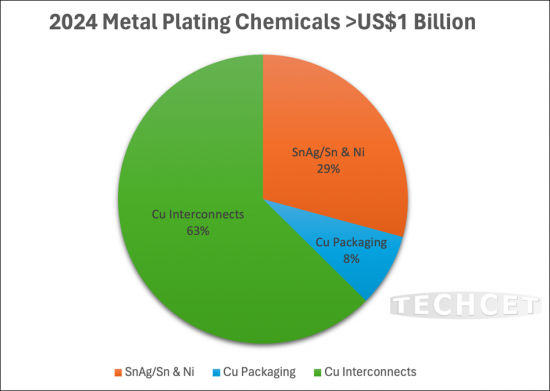

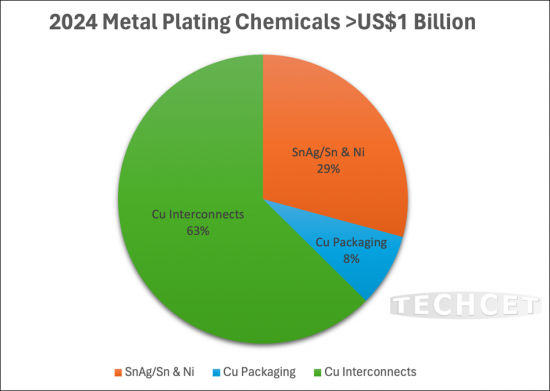

- 金属めっき薬品市場概要

- 先進パッケージングメタライゼーション-市場促進要因

- チップインターコネクトの成長動向

- めっき化学品用金属の鉱山所在地

- ICメッキに使用される金属の潜在的なチョークポイント

- 将来起こりうる需要価格圧力

第5章 技術動向

- 半導体金属めっきに使用される化学物質

- パッケージング技術の動向

- 技術動向

第6章 競合情勢

- 先進パッケージングおよびインターコネクト市場シェア合計

- OEM市場シェア- メッキ装置

- 用途別市場シェア-先進パッケージング向けCUめっき

- 地域別参入企業とその他

- M&A活動

第7章 アナリストの評価

- 先進的金属めっきの応用市場評価

第8章 サプライヤープロファイル

- BASF

- DUPONT

- CHANG CHUN GROUP

- INCHEON CHEMICAL COMPANY

- ISHIHARA CHEMICAL/UNICON

- その他9社

第9章 付録A:パッケージング技術の動向

- テクノロジーの課題

- 金属洗浄の課題

- 市場の動向

- ウエハーレベルめっき- 第一レベル相互接続

- 先進パッケージングアプリケーションの市場促進要因

- ウエハーレベルパッケージングアーキテクチャ

- 技術動向-RDL

- チップレットアーキテクチャの市場促進要因

- TSV充填2.5-3D

- 包装電気メッキ要件

図表

LIST OF FIGURES

- FIGURE 1.1: PLATING MATERIALS FOR ADVANCED PACKAGING AND INTERCONNECT REVENUES ($M'S)

- FIGURE 1.2. WAFERS/YR & % OF PACKAGING THAT IS ADVANCED PACKAGING (AP)

- FIGURE 1.3: ADV LOGIC DEVICE GROWTH FORECAST

- FIGURE 1.4: COPPER PLATING CHEMICALS REVENUES ($M'S) FOR ADVANCED PACKAGING & FE CU INTERCONNECTS

- FIGURE 1.5: 2023 SUPPLIER MARKET SHARES CU PLATING FOR INTERCONNECT ADDITIVES

- FIGURE 1.6: 2023 SUPPLIER MARKET SHARES CU PLATING FOR ADV. PACKAGING

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000'S OF NTD

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: PACKAGING METALLIZATION APPLICATIONS

- FIGURE 4.2: USE OF SILICON INTERPOSER IN 2.5D PACKAGING

- FIGURE 4.3: VERSIONS OF TSV & PROCESS FLOW EXAMPLE

- FIGURE 4.4: PLATING MATERIALS FOR ADVANCED PACKAGING AND DEVICE INTERCONNECT REVENUES (M'S)

- FIGURE 4.5: CU PLATING CHEMICALS 5-YEAR FORECAST

- FIGURE 4.6: WAFERS/YR & % OF PACKAGING THAT IS ADVANCED PACKAGING

- FIGURE 4.7: REVENUE FORECAST CU PLATING ADVANCED PACKAGING

- FIGURE 4.8: CU PILLAR & CU RDL SEGMENTED FORECAST

- FIGURE 4.9: ADV. PACKAGING CU CUSO4 AMOUNT DEMAND FORECAST

- FIGURE 4.10: ADV. PACKAGING CU/VMS VOLUME DEMAND FORECAST ADV.PACKAGING CU PLATING ADDITIVES

- FIGURE 4.11: BUMPING MATERIALS FOR FIRST LEVEL INTERCONNECT

- FIGURE 4.12: HYBRID BONDING PROCESS

- FIGURE 4.13: SN AND SNAG PLATING REVENUE

- FIGURE 4.14: NICKEL PLATING REVENUE

- FIGURE 4.15: ADV LOGIC DEVICE GROWTH FORECAST

- FIGURE 4.16: METAL PLATING WAFER PASSES

- FIGURE 4.17: WW DAMASCENE REVENUE FORECAST ESTIMATES

- FIGURE 4.18: DAMASCENE CUSO4 VOLUME DEMAND FORECAST

- FIGURE 4.19: DAMASCENE CU PLATING CHEMICAL AMOUNT DEMAND FORECAST

- FIGURE 5.1: KEY TRENDS IN ADVANCED PACKAGING

- FIGURE 5.2: CHALLENGES OF ELECTROPLATING VIA FILL

- FIGURE 5.3: METAL INTERCONNECTS BY LOGIC NODE

- FIGURE 5.4: INTERCONNECT METAL COMPARISON BY RESISTIVITY

- FIGURE 5.5: CU CHIP INTERCONNECTS QUALIFICATION

- FIGURE 5.6: LEADING EDGE LOGIC POWER RAIL SCHEMES

- FIGURE 5.7: DRAM STRUCTURE

- FIGURE 5.8: 3D NAND STRUCTURE

- FIGURE 6.1: TOTAL PLATING FOR ADV. PACKAGING AND CU INTERCONNECT ADDITIVES 2023

- FIGURE 6.2: PLATING EQUIPMENT OEM MARKET SHARES % 2023

- FIGURE 6.3: PLATING CHEMICAL SUPPLIER FOR INTERCONNECTS AND ADVANCED PACKAGING APPLICATIONS

- FIGURE 9.1: CLEANING COMPLEXITY

- FIGURE 9.2: OSATS PACKAGING BUSINESS CANNIBALIZATION TREND

- FIGURE 9.3: WAFER LEVEL PLATING

- FIGURE 9.4: ADVANCED PACKAGING MARKET DRIVERS AND APPLICATIONS

- FIGURE 9.4: ADVANCED PACKAGING MARKET DRIVERS AND APPLICATIONS

- FIGURE 9.5: FAN-IN (WLCSP) & FAN-OUT (WLFO) COMPARISON

- FIGURE 9.6: RDL CIRCUITRY EXAMPLE

- FIGURE 9.7: COMPARISON WITH DAMASCENE- TYPE RDL

- FIGURE 9.8: COST/PERFORMANCE IMPROVEMENTS THROUGH CHIPLETS INTEGRATION

- FIGURE 9.9: 2.5 AND 3D PACKAGING EXAMPLES

- FIGURE 9.10: USE OF SILICON INTERPOSER

- FIGURE 9.11: TSV PROCESS FLOW EXAMPLE

- FIGURE 9.12: PROCESS COMPARISON OF TRADITIONAL VS. WLP FLOWS

LIST OF TABLES

- TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 5.1: IRDS 2023 MORE MOORE INTERCONNECT ROADMAP

- TABLE 5.2: BARRIER METAL ROADMAP

- TABLE 5.3: METALS REQUIRED FOR DEVICE FEATURES

- TABLE 5.4: DRAM USE OF MO OR RU PRESENT & FUTURE

- TABLE 5.5: GENERAL PROCESS FLOW ADVANCED DRAM

- TABLE 5.5: 3D NAND MATERIAL CHANGES PRESENT & FUTURE

- TABLE 5.6: NUMBER OF STACKS (S) & LAYERS (L) PER GENERATION OF 3DNAND - SOME ARE ESTIMATES FOR THE FUTURE

- TABLE 5.7: EXAMPLE OF LOGIC PROCESS FLOW 20 NM TO 32 NM LOGIC PVD

- TABLE 5.8: TECHNICAL REQUIREMENTS SUMMARY

- TABLE 5.9: TECHNICAL REQUIREMENTS SUMMARY, CONTINUED

- TABLE 6.1: REGIONAL PLAYERS - MARKET LEADER AND "OTHERS"

- TABLE 9.1: CU PACKAGING APPLICATIONS AND REQUIREMENTS

目次

This report covers the Metal Chemicals market trends and supply-chain as it applied to Advanced Packaging (wafer level) and Semiconductor Device Manufacturing (damascene process). Included are forecasts for copper plating and additives, market shares, technical trends, and supplier profiles. Also included in the appendix is a supplier product comparison table of publicly available information on plating products used for advanced packaging.

INFOGRAPHICS

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 EXECUTIVE SUMMARY

- 1.2 ADVANCED PACKAGING PER WAFER STARTS

- 1.3 DEVICE DEMAND DRIVERS - LOGIC

- 1.4 CU PLATING FORECAST FOR CU INTERCONNECTS AND ADVANCED PACKAGING

- 1.5 MARKET SHARES

- 1.6 SUPPLIER ACTIVITIES - VARIOUS ANNOUNCEMENTS

- 1.7 RISK FACTORS

- 1.8 ANALYST ASSESSMENT

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 PURPOSE & METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR REPORTS

3 SEMICONDUCTOR INDUSTRY MARKET OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OVERALL INDUSTRY OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 METAL CHEMICALS MARKET BY SEGMENT

- 4.1 DEFINITIONS

- 4.2 METAL PLATING CHEMICALS MARKET OVERVIEW

- 4.2.1 OVERVIEW - CU ADVANCED PACKAGING AND CHIP INTERCONNECTS METALLIZATION

- 4.2.2 OVERVIEW - PLATING MARKET TRANSITIONAL TRENDS

- 4.3 ADVANCED PACKAGING METALLIZATION - MARKET DRIVERS

- 4.3.1 ADVANCED PACKAGING - ADDITIVES FOR CU PLATING REVENUE

- 4.3.2 ADVANCED PACKAGING - COPPER CHEMICALS REVENUE

- 4.3.3 ADVANCED PACKAGING ADDITIVE VOLUMES

- 4.3.4 OTHER PLATING MATERIALS FOR ADVANCED PACKAGING

- 4.3.5 SN / SNAG PLATING

- 4.4 CHIP INTERCONNECTS GROWTH TRENDS

- 4.4.1 CHIP INTERCONNECTS GROWTH DRIVERS

- 4.4.2 CHIP INTERCONNECTS CU PLATING REVENUES

- 4.4.3 CHIP INTERCONNECTS ADDITIVE VOLUMES

- 4.5 MINE LOCATIONS FOR METALS IN PLATING CHEMICALS

- 4.6 POSSIBLE CHOKE POINTS FOR METALS USED IN IC PLATING

- 4.7 FUTURE POSSIBLE DEMAND PRICE PRESSURES

5 TECHNICAL TRENDS

- 5.1 CHEMISTRIES USE FOR SEMICONDUCTOR METAL PLATING

- 5.2 PACKAGING TECH TRENDS

- 5.2.1 PACKAGING TECHNICAL CHALLENGES

- 5.3 TECH TRENDS

- 5.3.1 MARKET DRIVES TECHNOLOGY TRENDS

- 5.3.2 ADV LOGIC INTERCONNECT WIRING TECHNOLOGY EVOLUTION

- 5.3.3 CU INTERCONNECTS QUALIFICATION REQUIREMENTS

- 5.3.4 LOGIC METALLIZATION ROADMAP

- 5.3.5 ADV LOGIC BURIED POWER RAIL

- 5.3.6 TECHNOLOGY ROADMAP: DRAM WITH MO OR RU

- 5.3.7 PRECURSOR TECHNOLOGY ROADMAP: 3D NAND USING MO OR RU

- 5.3.8 EXAMPLE OF LOGIC PRO CESS FLOW 20 NM TO 32 NM LOGIC PVD

- 5.3.9 TECHNICAL REQUIREMENTS SUMMARY 1/2

6 COMPETITIVE LANDSCAPE

- 6.1 TOTAL ADVANCED PACKAGING AND INTERCONNECTS MARKET SHARES

- 6.2 OEM MARKET SHARE - PLATING EQUIPMENT

- 6.3 MARKET SHARE BY APPLICATION - CU PLATING FOR ADVANCED PACKAGING

- 6.4 REGIONAL PLAYERS AND OTHERS

- 6.5 M&A ACTIVITY

7 ANALYST ASSESSMENT

- 7.1 ADVANCED METAL PLATING APPLICATIONS MARKET ASSESSMENT

8 SUPPLIER PROFILES

- BASF

- DUPONT

- CHANG CHUN GROUP

- INCHEON CHEMICAL COMPANY

- ISHIHARA CHEMICAL/UNICON

- ...AND 9 MORE

9 APPENDIX A: PACKAGING TECH TRENDS

- 9.1 TECHNOLOGY CHALLENGE

- 9.1.1 METAL CLEANINGS CHALLENGE

- 9.1.2 MARKET DYNAMIC

- 9.1.3 WAFER LEVEL PLATING-FIRST LEVEL INTERCONNECT

- 9.1.4 MARKET DRIVERS OF ADVANCED PACKAGING APPLICATIONS

- 9.1.5 WAFER LEVEL PACKAGING ARCHITECTURES

- 9.1.6 TECH TRENDS- RDL

- 9.1.7 MARKET DRIVERS OF CHIPLET ARCHITECTURE

- 9.1.8 TSV FILLING 2.5-3D

- 9.1.9 PACKAGING ELECTROPLATING REQUIREMENTS