|

|

市場調査レポート

商品コード

1733578

リテールバンキングの世界市場の機会と戦略(~2034年)Retail Banking Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| リテールバンキングの世界市場の機会と戦略(~2034年) |

|

出版日: 2025年05月26日

発行: The Business Research Company

ページ情報: 英文 305 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のリテールバンキングの市場規模は、2019年に2兆3,988億8,745万米ドルであり、2024年まで7.00%を超えるCAGRで成長しました。

モバイルバンキングの利用の拡大

モバイルバンキングの利用の拡大が、過去の期間におけるリテールバンキング市場の成長を支えました。モバイルバンキングは銀行のリーチを広げ、実店舗が少ない遠隔地の顧客にもアクセスを可能にします。このデジタルアプローチは、より多くの個人がオンラインで口座を開設し管理できるようにすることで、顧客獲得を促進します。さらに、実店舗やスタッフへの依存を減らすことで経営コストを削減し、銀行はより戦略的にリソースを配分できるようになります。例えば2022年4月、米国のフィンテック企業、MX Technologiesが米国の成人1,002人を対象に実施した調査によると、利用者の68%が口座へのアクセスや管理にモバイルアプリを利用しており、若い世代ほど利用率が高いです。さらに、回答者の72%がオンラインまたはモバイルアプリで口座を管理することを選好します。年代別では、ミレニアル世代のオンラインとモバイルを好む割合が89%で、次いでZ世代の84%となっています。したがって、モバイルバンキングの利用の拡大がリテールバンキング市場の成長を促進しました。

当レポートでは、世界のリテールバンキング市場について調査分析し、市場の特徴、各地域の市場規模と予測、競合情勢、市場機会と戦略などの情報を提供しています。

目次

第1章 エグゼクティブサマリー

- リテールバンキング - 市場の魅力とマクロ経済情勢

第2章 目次

第3章 表のリスト

第4章 図のリスト

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場の定義

- サマリー

- リテールバンキング市場の定義とセグメンテーション

- 市場のセグメンテーション:タイプ別

- 公的銀行

- 民間銀行

- 外国銀行

- コミュニティ開発銀行

- 非銀行金融企業(NBFC)

- 市場のセグメンテーション:サービス別

- 普通預金口座、当座預金口座

- 取引口座

- 個人ローン

- 住宅ローン

- モーゲージ

- デビットカード、クレジットカード

- ATMカード

- 譲渡性預金

第7章 主な市場動向

- リテールバンキングにおけるイノベーションを推進する戦略的パートナーシップ

- トリプルレイヤーAIによるリテールバンキングの革新

- 顧客の期待に応える革新的なオンラインリテール貯蓄銀行

- リテール/ホールセールバンキングを変革する革新的なデジタルソリューション

- 業務効率化に生成AIを利用することによるコアバンキングの進歩

- 貯蓄口座を再形成するパーソナライズされた金融ツール

第8章 世界のリテールバンキングの成長分析、戦略的分析フレームワーク

- 世界:PESTEL分析

- 最終用途産業(B2C)の分析

- 個人消費者

- 富裕層(HNWI)

- 学生、ヤングプロフェッショナル

- 退職者、年金受給者

- 世界のリテールバンキング市場の成長率分析

- 市場成長の実績(2019年~2024年)

- 市場促進要因(2019年~2024年)

- 市場抑制要因(2019年~2024年)

- 市場成長の予測(2024年~2029年・2034年)

- 市場促進要因(2024年~2029年)

- 市場抑制要因(2024年~2029年)

- 成長要因の予測

- 量的成長要因

- 促進要因

- 抑制要因

- 世界のリテールバンキングの総市場規模(TAM)

第9章 世界のリテールバンキング市場のセグメンテーション

- 世界のリテールバンキング市場:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場:サービス別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場、公的部門のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場、民間銀行のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場、外国銀行のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場、コミュニティ開発銀行のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場、非銀行系金融企業(NBFC)のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

第10章 リテールバンキング市場、地域と国の分析

- 世界のリテールバンキング市場:地域別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のリテールバンキング市場:国別、実績と予測(2019年~2024年・2029年・2034年)

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- JPMorgan Chase & Co

- Bank of China Ltd

- Banco Santander SA

- BNP Paribas

- Ping An Bank Co., Ltd

第19章 その他の主要企業と革新的企業

- TD Bank Group

- China Merchants Bank

- Citigroup

- Wells Fargo

- China Construction Bank

- HSBC Holdings plc

- Lloyds Banking Plc

- Barclays Plc

- Bank of Montreal (BMO)

- Bank of America Corp

- Industrial and Commercial Bank of China Ltd. (ICBC)

- Westpac Banking Corporation

- Banco Bilbao Vizcaya Argentaria, S.A.

- Societe Generale S.A.

- Standard Chartered

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主な合併と買収

- Bank of Bahrain & Kuwait Acquired HSBC Holdings

- HSBC Bank(China)Company Limited Acquired Citigroup

- Al Salam Bank Acquired KFH Bahrain

- Barclays Bank Acquired Tesco Personal Finance

- HSBC Holdings acquired Silicon Valley Bank

- DBS Bank Ltd Acquired Citigroup

第23章 リテールバンキング市場の近年の発展

第24章 機会と戦略

- 世界のリテールバンキング市場 - もっとも新たな機会を提供する国(2029年)

- 世界のリテールバンキング市場 - もっとも新たな機会を提供するセグメント(2029年)

- 世界のリテールバンキング市場 - 成長戦略(2029年)

- 市場動向に基づく戦略

- 競合の戦略

第25章 リテールバンキング市場:結論と提言

- 結論

- 提言

- 製品

- 流通

- 価格

- 販促

- 人々

第26章 付録

Retail banking refers to the provision of financial services by banks and financial institutions to individual consumers rather than businesses or institutions. It is a critical component of the banking industry, catering to the financial needs of individuals through various deposit, lending and transactional services.

The retail banking market consists of sales by entities (organizations, sole traders and partnerships) of retail banking services that encompasses a wide range of financial products, including savings and checking accounts, personal loans, home loans, mortgages, debit and credit cards and certificates of deposit. These services are designed to facilitate the day-to-day financial activities of individuals, helping them manage their money, build savings, access credit and make transactions efficiently.

The global retail banking market was valued at $2,398,887.45 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 7.00%.

Growth In Mobile Banking Usage

The growth in mobile banking usage supported the growth of the retail banking market during the historic period. Mobile banking expands a bank's reach, allowing access to customers in remote areas where physical branches are scarce. This digital approach enhances customer acquisition by enabling more individuals to open and manage accounts online. Additionally, it lowers operational costs by reducing reliance on physical branches and staff, allowing banks to allocate resources more strategically. For instance, in April 2022, according to a survey of 1,002 American adults conducted by MX Technologies, a US-based fintech company, 68% of users use mobile apps to access or manage their accounts, with younger generations showing higher usage rates. Additionally, 72% of respondents prefer to handle their accounts online or via mobile apps. Among different age groups, millennials prefer online and mobile, at 89%, followed by Gen Z, at 84%. Therefore, the growth in mobile banking usage drove the growth of the retail banking market.

Revolutionizing Retail Banking With Triple-Layer AI

Companies operating in the retail banking market are advancing triple-layer AI-banking platforms to enhance customer experience, automation and decision-making. These platforms integrate Predictive AI for behavior analysis, Generative AI for personalized recommendations and Autonomous AI for real-time assistance, enabling banks to offer seamless, data-driven and efficient banking services. For instance, in February 2025, BUSINESSNEXT is an India-based digital-first enterprise solutions provider launched retail banking customer 360 platform. This innovative platform integrates Predictive AI (Artificial Intelligence), Generative AI and Autonomous AI agents to deliver a seamless and enhanced retail banking experience. Predictive AI forecasts customer behavior and preferences, while Generative AI creates personalized content and recommendations. Autonomous AI agents automate tasks and offer real-time assistance, improving efficiency. The platform provides a unified, real-time view of customer interactions, product holdings and transaction history, enabling banks to analyze behavior and deliver tailored services. Additionally, AI-powered insights, alerts and next-best actions help boost customer engagement and sales opportunities.

The global retail banking market is fragmented, with large number of players operating in the market. The top ten competitors in the market made up to 7.84% of the total market in 2023.

Retail Banking Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global retail banking market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for retail banking? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The retail banking market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider retail banking market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type and by service.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework - Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Regional And Country Analysis - Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by type and by service in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth - Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies - Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions - Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments - Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for retail banking providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Type: Public Sector Banks; Private Sector Banks, Foreign Banks; Community Development Banks; Non-Banking Financial Companies (NBFCS)

- 2) By Service: Saving And Checking Account; Transactional Account; Personal Loan; Home Loan; Mortgages; Debit And Credit Cards; Automated Teller Machine (ATM)Cards; Certificates Of Deposits

- Companies Mentioned: JPMorgan Chase; Bank of China Ltd.; Banco Santander, S.A.; BNP Paribas; Ping An Bank Co., Ltd.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; Retail banking indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Retail Banking - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Retail Banking Market Definition And Segmentations

- 6.4 Market Segmentation By Type

- 6.4.1 Public Sector Banks

- 6.4.2 Private Sector Banks

- 6.4.3 Foreign Banks

- 6.4.4 Community Development Banks

- 6.4.5 Non-Banking Financial Companies (NBFCS)

- 6.5 Market Segmentation By Service

- 6.5.1 Saving And Checking Account

- 6.5.2 Transactional Account

- 6.5.3 Personal Loan

- 6.5.4 Home Loan

- 6.5.5 Mortgages

- 6.5.6 Debit And Credit Cards

- 6.5.7 Automated Teller Machine (ATM) Cards

- 6.5.8 Certificates Of Deposits

7 Major Market Trends

- 7.1 Strategic Partnerships Driving Innovation In Retail Banking

- 7.2 Revolutionizing Retail Banking With Triple-Layer AI

- 7.3 Innovative Online Retail Savings Banks To Meet Customer Expectations

- 7.4 Innovative Digital Solutions Transforming Retail And Wholesale Banking

- 7.5 Advancing Core Banking With Generative AI For Operational Efficiency

- 7.6 Personalized Financial Tools Reshaping Savings Accounts

8 Global Retail Banking Growth Analysis And Strategic Analysis Framework

- 8.1 Global: PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End Use Industries (B2C)

- 8.2.1 Individual Consumers

- 8.2.2 High-Net-Worth Individuals (HNWIs)

- 8.2.3 Students And Young Professionals

- 8.2.4 Retirees And Pensioners

- 8.3 Global Retail Banking Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019 - 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Retail Banking Total Addressable Market (TAM)

9 Global Retail Banking Market Segmentation

- 9.1 Global Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Retail Banking Market, Sub-Segmentation Of Public Sector Banks, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Retail Banking Market, Sub-Segmentation By Private Sector Banks, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Retail Banking Market, Sub-Segmentation By Foreign Banks, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Retail Banking Market, Sub-Segmentation By Community Development Banks, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Retail Banking Market, Sub-Segmentation By Non-Banking Financial Companies (NBFCS), By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Retail Banking Market, Regional and Country Analysis

- 10.1 Global Retail Banking Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Retail Banking Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

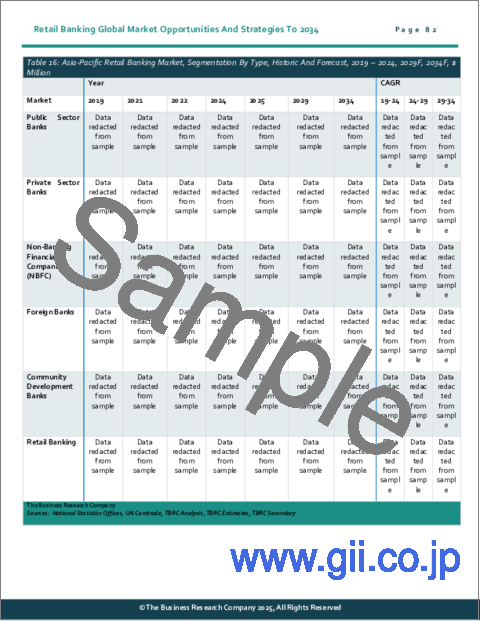

- 11.3 Asia-Pacific Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Retail Banking Market: Country Analysis

- 11.6 China Market

- 11.7 Summary

- 11.8 Market Overview

- 11.8.1 Country Information

- 11.8.2 Market Information

- 11.8.3 Background Information

- 11.8.4 Government Initiatives

- 11.8.5 Regulations

- 11.8.6 Regulatory Bodies

- 11.8.7 Major Associations

- 11.8.8 Taxes Levied

- 11.8.9 Corporate Tax Structure

- 11.8.10 Investments

- 11.8.11 Major Companies

- 11.9 China Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.10 China Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 India Market

- 11.12 India Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.14 Japan Market

- 11.15 Summary

- 11.16 Market Overview

- 11.16.1 Country Information

- 11.16.2 Market Information

- 11.16.3 Background Information

- 11.16.4 Government Initiatives

- 11.16.5 Regulations

- 11.16.6 Regulatory Bodies

- 11.16.7 Major Associations

- 11.16.8 Taxes Levied

- 11.16.9 Corporate Tax Structure

- 11.16.10 Investments

- 11.16.11 Major Companies

- 11.17 Japan Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.18 Japan Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.19 Australia Market

- 11.20 Australia Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Australia Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Indonesia Market

- 11.23 Indonesia Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.24 Indonesia Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 South Korea Market

- 11.26 Summary

- 11.27 Market Overview

- 11.27.1 Country Information

- 11.27.2 Market Information

- 11.27.3 Background Information

- 11.27.4 Government Initiatives

- 11.27.5 Regulations

- 11.27.6 Regulatory Bodies

- 11.27.7 Major Associations

- 11.27.8 Taxes Levied

- 11.27.9 Corporate Tax Structure

- 11.27.10 Investments

- 11.27.11 Major Companies

- 11.28 South Korea Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 South Korea Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Retail Banking Market: Country Analysis

- 12.6 UK Market

- 12.7 UK Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.8 UK Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 Germany Market

- 12.10 Germany Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.12 France Market

- 12.13 France Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 France Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 Italy Market

- 12.16 Italy Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 Italy Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 Spain Market

- 12.19 Spain Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.20 Spain Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major companies

- 13.3 Eastern Europe Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Retail Banking Market: Country Analysis

- 13.6 Russia Market

- 13.7 Russia Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.8 Russia Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Retail Banking Market: Country Analysis

- 14.6 USA Market

- 14.7 Summary

- 14.8 Market Overview

- 14.8.1 Country Information

- 14.8.2 Market Information

- 14.8.3 Background Information

- 14.8.4 Government Initiatives

- 14.8.5 Regulations

- 14.8.6 Regulatory Bodies

- 14.8.7 Major Associations

- 14.8.8 Taxes Levied

- 14.8.9 Corporate Tax Structure

- 14.8.10 Investments

- 14.8.11 Major Companies

- 14.9 USA Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.10 USA Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 Canada Market

- 14.12 Summary

- 14.13 Market Overview

- 14.13.1 Region Information

- 14.13.2 Market Information

- 14.13.3 Background Information

- 14.13.4 Government Initiatives

- 14.13.5 Regulations

- 14.13.6 Regulatory Bodies

- 14.13.7 Major Associations

- 14.13.8 Taxes Levied

- 14.13.9 Corporate Tax Structure

- 14.13.10 Investment

- 14.13.11 Major Companies

- 14.14 Canada Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.15 Canada Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.1 Market Overview

- 15.1.4 Region Information

- 15.1.5 Market Information

- 15.1.6 Background Information

- 15.1.7 Government Initiatives

- 15.1.8 Regulations

- 15.1.9 Regulatory Bodies

- 15.1.10 Major Associations

- 15.1.11 Taxes Levied

- 15.1.12 Corporate Tax Structure

- 15.1.13 Investments

- 15.1.14 Major Companies

- 15.2 South America Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.3 South America Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Retail Banking Market: Country Analysis

- 15.5 Brazil Market

- 15.6 Brazil Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.7 Brazil Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Retail Banking Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Retail Banking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape and Company Profiles

- 18.1 Company Profiles

- 18.2 JPMorgan Chase & Co

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 Bank of China Ltd

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Banco Santander S.A.

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Business Strategy

- 18.4.4 Financial Overview

- 18.5 BNP Paribas

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Business Strategy

- 18.5.4 Financial Overview

- 18.6 Ping An Bank Co., Ltd

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Financial Overview

19 Other Major And Innovative Companies

- 19.1 TD Bank Group

- 19.1.1 Company Overview

- 19.1.2 Products and Services

- 19.2 China Merchants Bank

- 19.2.1 Company Overview

- 19.2.2 Products and Services

- 19.3 Citigroup

- 19.3.1 Company Overview

- 19.3.2 Products and Services

- 19.4 Wells Fargo

- 19.4.1 Company Overview

- 19.4.2 Products and Services

- 19.5 China Construction Bank

- 19.5.1 Company Overview

- 19.5.2 Products and Services

- 19.6 HSBC Holdings plc

- 19.6.1 Company Overview

- 19.6.2 Products and Services

- 19.7 Lloyds Banking Plc

- 19.7.1 Company Overview

- 19.7.2 Products and Services

- 19.8 Barclays Plc

- 19.8.1 Company Overview

- 19.8.2 Products and Services

- 19.9 Bank of Montreal (BMO)

- 19.9.1 Company Overview

- 19.9.2 Products and Services

- 19.10 Bank of America Corp

- 19.10.1 Company Overview

- 19.10.2 Products and Services

- 19.11 Industrial and Commercial Bank of China Ltd. (ICBC)

- 19.11.1 Company Overview

- 19.11.2 Products and Services

- 19.12 Westpac Banking Corporation

- 19.12.1 Company Overview

- 19.12.2 Products and Services

- 19.13 Banco Bilbao Vizcaya Argentaria, S.A.

- 19.13.1 Company Overview

- 19.13.2 Products and Services

- 19.14 Societe Generale S.A.

- 19.14.1 Company Overview

- 19.14.2 Products and Services

- 19.15 Standard Chartered

- 19.15.1 Company Overview

- 19.15.2 Products and Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Bank of Bahrain & Kuwait Acquired HSBC Holdings

- 22.2 HSBC Bank (China) Company Limited Acquired Citigroup

- 22.3 Al Salam Bank Acquired KFH Bahrain

- 22.4 Barclays Bank Acquired Tesco Personal Finance

- 22.5 HSBC Holdings acquired Silicon Valley Bank

- 22.6 DBS Bank Ltd Acquired Citigroup

23 Recent Developments In The Retail Banking Market

- 23.1 Enhancing Customer Experience Through Mobile-First Banking Solution

- 23.2 Innovative Mobile Banking App For Retail Customers

24 Opportunities And Strategies

- 24.1 Global Retail Banking Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Retail Banking Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Retail Banking Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Retail Banking Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer