|

|

市場調査レポート

商品コード

1733574

マーチャントバンキングサービスの世界市場の機会と戦略(~2034年)Merchant Banking Services Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| マーチャントバンキングサービスの世界市場の機会と戦略(~2034年) |

|

出版日: 2025年05月26日

発行: The Business Research Company

ページ情報: 英文 364 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のマーチャントバンキングサービスの市場規模は、2019年に311億588万米ドルであり、2024年まで11.00%を超えるCAGRで成長しました。

プライベートエクイティとベンチャーキャピタル投資の増加

過去の期間において、プライベートエクイティとベンチャーキャピタルへの投資が増加し、マーチャントバンキングサービス市場の成長に寄与しました。マーチャントバンキングサービスは、プライベートエクイティ(PE)やベンチャーキャピタル(VC)投資にとって極めて重要であり、ディールストラクチャリング、財務デューデリジェンス、資本調達に関する専門知識を提供し、投資の成功を保証します。さらに、戦略的アドバイザリー、リスク評価、イグジットプランニングを提供し、プライベートエクイティ(PE)やベンチャーキャピタル(VC)企業がリターンを最大化し、ポートフォリオ管理を最適化できるよう支援します。例えば、英国の業界団体であるBritish Private Equity and Venture Capital Association(BVCA)が2024年5月に発表した調査レポートによると、英国企業へのプライベートキャピタル投資総額は201億英ポンド(217億8,000万米ドル)に達し、2023年に投資された企業の58%がロンドン以外に所在しており、全国的な投資分布を示しています。さらに、英国による国外投資は総額390億米ドル(310億英ポンド)に達し、英国の世界的な投資フットプリントを浮き彫りにしています。このデータは、約200のBVCA会員から収集され、公的情報源からの情報で補足されました。さらに、2024年7月、英国を拠点とする金融企業、British Business Bankによると、英国はインドを抜いて世界第3位のベンチャーキャピタル(VC)市場となり、世界の投資額の6%を占め、英国企業は2021年~2023年に910億米ドル(720億英ポンド)を集めています。したがって、プライベートエクイティとベンチャーキャピタル投資の増加が、過去の期間におけるマーチャントバンキングサービス市場を牽引しました。

当レポートでは、世界のマーチャントバンキングサービス市場について調査分析し、市場の特徴、各地域の市場規模と予測、競合情勢、市場機会と戦略などの情報を提供しています。

目次

第1章 エグゼクティブサマリー

- マーチャントバンキングサービス - 市場の魅力とマクロ経済情勢

第2章 目次

第3章 表のリスト

第4章 図のリスト

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場の定義

- サマリー

- マーチャントバンキングサービス市場の定義とセグメンテーション

- 市場のセグメンテーション:サービスタイプ別

- 貿易金融

- 事業再編

- ポートフォリオ管理

- クレジットシンジケーション

- 新規株式公開(IPO)管理

- プロジェクト管理

- 市場のセグメンテーション:サービスプロバイダー別

- 銀行

- 非銀行金融機関

- 市場のセグメンテーション:エンドユーザー別

- 企業

- 個人

第7章 主な市場動向

- アジア太平洋市場における越境取引を変革する革新的なマーチャント決済

- 中小企業にシームレスなクレジットアクセスを提供する革新的なデジタル融資

- サービスが行き届いていない企業や投資家への民間融資を拡大するオルタナティブクレジットファンド

- マーチャントバンキングサービスの成長と革新を推進する戦略的パートナーシップ

第8章 世界のマーチャントバンキングサービスの成長分析、戦略的分析フレームワーク

- PESTEL分析

- エンドユーザー(B2B)の分析

- 企業

- 個人

- その他のエンドユーザー

- 世界のマーチャントバンキングサービス市場の成長率分析

- 市場成長の実績(2019年~2024年)

- 市場促進要因(2019年~2024年)

- 市場抑制要因(2019年~2024年)

- 市場成長の予測(2024年~2029年・2034年)

- 市場促進要因(2024年~2029年)

- 市場抑制要因(2024年~2029年)

- 成長要因の予測

- 量的成長要因

- 促進要因

- 抑制要因

- 世界のマーチャントバンキングサービスの総市場規模(TAM)

第9章 世界のマーチャントバンキングサービス市場のセグメンテーション

- 世界のマーチャントバンキングサービス市場:サービスタイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場:サービスプロバイダー別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場:エンドユーザー別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、貿易金融のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、事業再編のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、ポートフォリオ管理のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、クレジットシンジケーションのサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、新規株式公開(IPO)管理のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場、プロジェクト管理のサブセグメンテーション:タイプ別、実績と予測(2019年~2024年・2029年・2034年)

第10章 マーチャントバンキングサービス市場、地域と国の分析

- 世界のマーチャントバンキングサービス市場:地域別、実績と予測(2019年~2024年・2029年・2034年)

- 世界のマーチャントバンキングサービス市場:国別、実績と予測(2019年~2024年・2029年・2034年)

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- JPMorgan Chase & Co.

- China Merchants Bank

- Industrial and Commercial Bank of China

- Bank of America Corporation

- The Goldman Sachs Group Inc.

第19章 その他の主要企業と革新的企業

- BNP Paribas

- Wells Fargo and Co.

- HSBC Holdings Plc.

- Deutsche Bank AG

- Standard Charted plc

- UBS Group AG

- Citigroup Inc.

- Royal Bank of Canada

- DBS Bank Ltd.

- Axis Bank Limited

- Morgan Stanley

- LAZARD Inc.

- Arihant Capital Markets Ltd.

- Avendus Capital

- USA Capital Advisors, LLC

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主な合併と買収

- FG Merger Corp Completed Merger With iCoreConnect

- Elavon Inc Partnered With BMO Financial Group

- PeoplesBank Partnered With Cornerstone Bank

第23章 マーチャントバンキングサービス市場の近年の発展

第24章 機会と戦略

- 世界のマーチャントバンキングサービス市場 - もっとも新たな機会を提供する国(2029年)

- 世界のマーチャントバンキングサービス市場 - もっとも新たな機会を提供するセグメント(2029年)

- 世界のマーチャントバンキングサービス市場 - 成長戦略(2029年)

- 市場動向に基づく戦略

- 競合の戦略

第25章 マーチャントバンキングサービス市場:結論と提言

- 結論

- 提言

- 製品

- 流通

- 価格

- 販促

- 人々

第26章 付録

Merchant banking services refer to a range of financial services provided by specialized financial institutions to businesses and high-net-worth individuals. These services primarily focus on investment banking, corporate finance and advisory solutions that assist clients in managing financial transactions, raising capital and making strategic business decisions.

The merchant banking services market consists of sales, by entities (organizations, sole traders, or partnerships), of merchant banking services refer to a range of financial services provided by merchant banks to businesses and corporations. These services are designed to assist companies in their financial operations, investment decisions and strategic planning.

The global merchant banking services market was valued at $31,105.88 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 11.00%.

Rising Private Equity And Venture Capital Investments

During the historic period, the rise in private equity and venture capital investments contributed to the growth of the merchant banking services market. Merchant banking services are crucial for private equity (PE) and venture capital (VC) investments as they provide expertise in deal structuring, financial due diligence, and capital raising, ensuring successful investment execution. Additionally, they offer strategic advisory, risk assessment, and exit planning, helping PE and VC firms maximize returns and optimize portfolio management. For instance, in May 2024, according to a survey report published by the British Private Equity and Venture Capital Association (BVCA), a UK-based trade organization, total private capital investment in UK businesses reached £20.1 billion ($21.78 billion), with 58% of invested businesses in 2023 located outside London, demonstrating nationwide investment distribution. Additionally, UK-led investments abroad totaled $39 billion (£31 billion), highlighting the country's strong global investment footprint. The data was collected from nearly 200 BVCA members and supplemented with information from public sources. Moreover, in July 2024, according to the British Business Bank, a UK-based financing company, the UK has surpassed India to become the world's third-largest venture capital (VC) market, accounting for 6% of global investment, with UK companies raising $91billion (£72 billion) between 2021 and 2023. Therefore, the rise in private equity and venture capital investments drove the merchant banking services market in the historic period.

Innovative Merchant Payments Transforming Cross-Border Transactions In Asia-Pacific Market

Leading companies in the merchant banking services market are prioritizing the development of innovative solutions, such as merchant payment services, to improve global payment acceptance and streamline cross-border transactions for businesses in the Asia-Pacific region. Merchant payment services encompass financial solutions that allow businesses to securely accept and process electronic payments from customers through various channels, including credit cards, debit cards, mobile payments, and online transactions. These services are typically facilitated by payment processors or merchant service providers. For instance, in December 2024, Deutsche Bank AG, a Germany-based financial services company, launched Merchant Solutions in Australia, India, Indonesia, and South Korea to expand its payment acceptance capabilities in the Asia-Pacific region. The solution leverages DataMesh Group's payment orchestration technology, enabling businesses to seamlessly accept online payments across different regulated currency zones while integrating multiple local payment methods. This launch strengthens Deutsche Bank's position in the fast-growing eCommerce sector by offering centralized payment management across multiple jurisdictions, simplifying cross-border transactions for merchants.

The global merchant banking services markets are fairly concentrated, with large players operating in the market. The top 10 competitors in the market made up 22.87% of the total market in 2023.

Merchant Banking Services Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global merchant banking services market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for merchant banking services? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The merchant banking services market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider merchant banking services market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by services type, by service provider and by end user.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework- Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysi-s Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by service type, by service provider and by end user in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions- Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for merchant banking services providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Service Type: Trade Financing; Business Restructuring; Portfolio Management; Credit Syndication; Initial Public Offering (IPO) Management; Project Management

- 2) By Service Providers: Banks; Non-Banking Financial Institutions

- 3) By End User: Business; Individuals

- Companies Mentioned: JPMorgan Chase & Co; China Merchants Bank Industrial; Commercial Bank of China; Bank of America Corporation; The Goldman Sachs Group Inc.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; merchant banking services indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Merchant Banking Services - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Merchant Banking Services Market Definition And Segmentations

- 6.4 Market Segmentation By Service Type

- 6.4.1 Trade Financing

- 6.4.2 Business Restructuring

- 6.4.3 Portfolio Management

- 6.4.4 Credit Syndication

- 6.4.5 Initial Public Offering (IPO) Management

- 6.4.6 Project Management

- 6.5 Market Segmentation By Service Provider

- 6.5.1 Banks

- 6.5.2 Non-Banking Financial Institutions

- 6.6 Market Segmentation By End User

- 6.6.1 Business

- 6.6.2 Individuals

7 Major Market Trends

- 7.1 Innovative Merchant Payments Transforming Cross-Border Transactions In Asia-Pacific Market

- 7.2 Innovative Digital Lending Empowering Small and Medium-sized Enterprise with Seamless Credit Access

- 7.3 Alternative Credit Fund Expanding Private Lending For Underserved Businesses And Investors

- 7.4 Strategic Partnerships Driving Growth And Innovation In Merchant Banking Services

8 Global Merchant Banking Services Growth Analysis And Strategic Analysis Framework

- 8.1 PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User (B2B)

- 8.2.1 Business

- 8.2.2 Individuals

- 8.2.3 Other End Users

- 8.3 Global Merchant Banking Services Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019 - 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

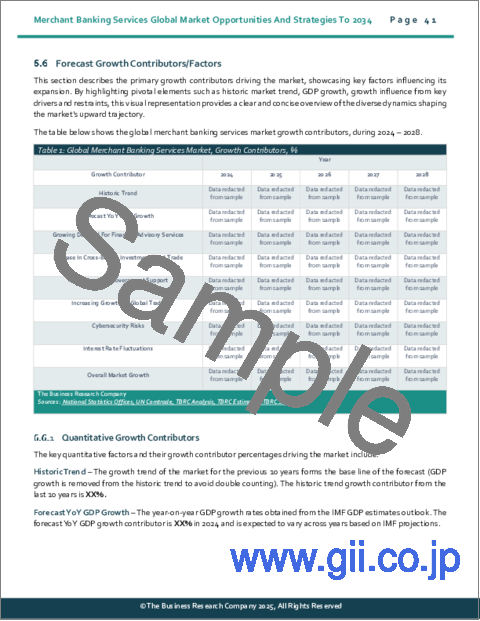

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Merchant Banking Services Total Addressable Market (TAM)

9 Global Merchant Banking Services Market Segmentation

- 9.1 Global Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Merchant Banking Services Market, Sub-Segmentation Of Trade Financing, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Merchant Banking Services Market, Sub-Segmentation Of Business Restructuring, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Merchant Banking Services Market, Sub-Segmentation Of Portfolio Management, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Merchant Banking Services Market, Sub-Segmentation By Credit Syndication, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Global Merchant Banking Services Market, Sub-Segmentation By Initial Public Offering (IPO) Management, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.9 Global Merchant Banking Services Market, Sub-Segmentation By Project Management, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Merchant Banking Services Market, Regional and Country Analysis

- 10.1 Global Merchant Banking Services Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Merchant Banking Services Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

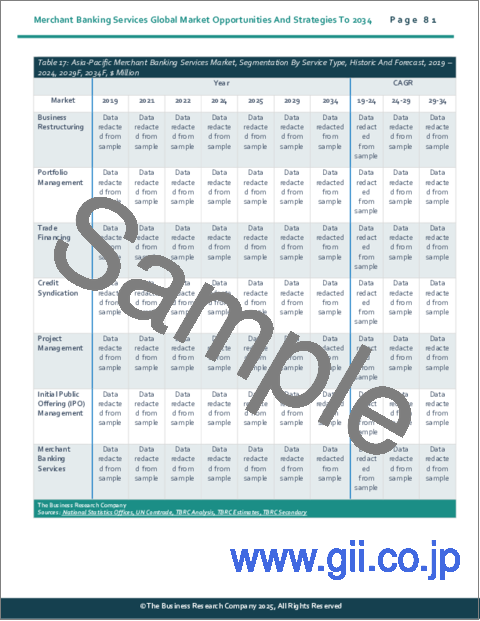

- 11.3 Asia-Pacific Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Merchant Banking Services Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 South Korea Market

- 11.28 Summary

- 11.29 Market Overview

- 11.29.1 Country Information

- 11.29.2 Market Information

- 11.29.3 Background Information

- 11.29.4 Government Initiatives

- 11.29.5 Regulations

- 11.29.6 Regulatory Bodies

- 11.29.7 Major Associations

- 11.29.8 Taxes Levied

- 11.29.9 Corporate Tax Structure

- 11.29.10 Investments

- 11.29.11 Major Companies

- 11.30 South Korea Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.32 South Korea Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.33 Indonesia Market

- 11.34 Indonesia Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 Indonesia Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 Indonesia Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 UK Market

- 12.7 UK Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.8 UK Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 Germany Market

- 12.11 Germany Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.12 Germany Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 France Market

- 12.15 France Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.16 France Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 Italy Market

- 12.19 Italy Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.20 Italy Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Spain Market

- 12.23 Spain Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.24 Spain Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Eastern Europe Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Russia Market

- 13.7 Russia Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.8 Russia Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 USA Market

- 14.7 Summary

- 14.8 Market Overview

- 14.8.1 Country Information

- 14.8.2 Market Information

- 14.8.3 Background Information

- 14.8.4 Government Initiatives

- 14.8.5 Regulations

- 14.8.6 Regulatory Bodies

- 14.8.7 Major Associations

- 14.8.8 Taxes Levied

- 14.8.9 Corporate Tax Structure

- 14.8.10 Investments

- 14.8.11 Major Companies

- 14.9 USA Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.10 USA Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 Canada Market

- 14.13 Summary

- 14.14 Market Overview

- 14.14.1 Region Information

- 14.14.2 Market Information

- 14.14.3 Background Information

- 14.14.4 Government Initiatives

- 14.14.5 Regulations

- 14.14.6 Regulatory Bodies

- 14.14.7 Major Associations

- 14.14.8 Taxes Levied

- 14.14.9 Corporate Tax Structure

- 14.14.10 Investments

- 14.14.11 Major Companies

- 14.15 Canada Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.16 Canada Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 Brazil Market

- 15.7 Brazil Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.8 Brazil Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Merchant Banking Services Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Merchant Banking Services Market, Segmentation By Service Provider, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Merchant Banking Services Market, Segmentation By End-User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 JPMorgan Chase & Co.

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 China Merchants Bank

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Financial Overview

- 18.4 Industrial and Commercial Bank of China

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Financial Overview

- 18.5 Bank of America Corporation

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Financial Overview

- 18.6 The Goldman Sachs Group Inc.

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 BNP Paribas

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 Wells Fargo and Co.

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 HSBC Holdings Plc.

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Deutsche Bank AG

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Standard Charted plc

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 UBS Group AG

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Citigroup Inc.

- 19.7.1 Company Overview

- 19.7.2 Products And Services

- 19.8 Royal Bank of Canada

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 DBS Bank Ltd.

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Axis Bank Limited

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Morgan Stanley

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 LAZARD Inc.

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Arihant Capital Markets Ltd.

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Avendus Capital

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 USA Capital Advisors, LLC

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 FG Merger Corp Completed Merger With iCoreConnect

- 22.2 Elavon Inc Partnered With BMO Financial Group

- 22.3 PeoplesBank Partnered With Cornerstone Bank

23 Recent Developments In The Merchant Banking Services Market

- 23.1 Innovative Business Banking Solution Transforming Financial Services For Enterprises

- 23.2 Global Banking Expansion Empowering Tech And Life Sciences Startups Worldwide

- 23.3 Revolutionizing Digital Payments With China's Central Bank Digital Currency (CBDC) For Seamless Business Transactions

24 Opportunities And Strategies

- 24.1 Global Merchant Banking Services Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Merchant Banking Services Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Merchant Banking Services Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Merchant Banking Services Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer