|

|

市場調査レポート

商品コード

1806432

eスポーツの世界市場レポート2025年E-Sports Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| eスポーツの世界市場レポート2025年 |

|

出版日: 2025年09月05日

発行: The Business Research Company

ページ情報: 英文 250 Pages

納期: 2~10営業日

|

概要

eスポーツ市場規模は、今後数年で飛躍的な成長が見込まれます。2029年には年間平均成長率(CAGR)20.5%で63億6,000万米ドルに成長します。予測期間における成長の要因としては、ゲームジャンルの多様化、視聴者の増加、eスポーツカフェの出現、インターネットにアクセスできるデバイスの増加、スポンサーシップの高まり、モバイルゲームの増加、認知度の向上などが挙げられます。予測期間の主要動向としては、COVID-19によるeスポーツへのシフトの増加、拡張現実(AR)と仮想現実(VR)技術によるeスポーツの進化、M&A活動の増加、投資の急増、新しいeスポーツプラットフォームなどが挙げられます。

今後5年間の成長率20.5%という予測は、前回の予測から0.1%の微減を反映しています。この減少は主に米国と他国との間の関税の影響によるものです。ゲーム機、ハイエンドPC、ストリーミング技術に対する関税は、eスポーツアリーナやゲーム大会に関連した観光の成長を制限する可能性があります。また、相互関税や、貿易緊張の高まりと制限による世界経済と貿易への悪影響により、その影響はより広範囲に及ぶと考えられます。

ビデオゲームへの需要の高まりとeスポーツの認知度の向上が、eスポーツ市場の拡大を後押ししています。技術の進歩に伴い、ビデオコンテンツ、仮想現実製品、ビデオゲーム競合の利用が増加しています。ビデオゲームはポップカルチャーの重要な側面へと進化し、若者のエンターテインメントへの関わり方を再構築しています。例えば、2024年4月、英国の産業団体であるUK Interactive Entertainmentは、2023年の英国のビデオゲーム消費者市場の評価額が101億5,000万米ドル(78億2,000万英ポンド)となり、2022年の修正総額97億2,000万米ドル(74億9,000万英ポンド)から4.4%増加したと報告しました。したがって、ビデオゲームに対する需要の高まりとeスポーツの認知度の向上が、予測期間中の市場の成長を後押ししています。

目次

第1章 エグゼクティブサマリー

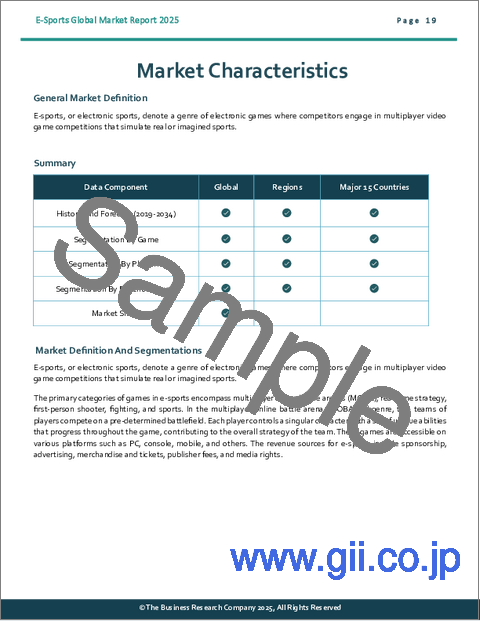

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場:金利、インフレ、地政学、貿易戦争と関税、コロナ禍と回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界のeスポーツ:PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界のeスポーツ市場:成長率分析

- 世界のeスポーツ市場の実績:規模と成長、2019~2024年

- 世界のeスポーツ市場の予測:規模と成長、2024~2029年、2034年

- 世界のeスポーツ:総潜在市場規模(TAM)

第6章 市場セグメンテーション

- 世界のeスポーツ市場ゲーム別、実績と予測、2019~2024年、2024~2029年、2034年

- マルチプレーヤーオンラインバトルアリーナ(MOBA)

- リアルタイムストラテジー

- ファーストパーソンシューティングゲーム(FPS)

- 格闘技とスポーツ

- 世界のeスポーツ市場:プラットフォーム別、実績と予測、2019~2024年、2024~2029年、2034年

- PC

- コンソール

- モバイル

- その他

- 世界のeスポーツ市場:収入源別、実績と予測、2019~2024年、2024~2029年、2034年

- スポンサーシップ

- 広告

- グッズとチケット

- 出版社手数料

- メディア権利

- 世界のeスポーツ市場、マルチプレーヤーオンラインバトルアリーナ(MOBA)のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- リーグ・オブ・レジェンド

- Dota 2

- Smite

- Heroes of the Storm

- 世界のeスポーツ市場、リアルタイムストラテジー(RTS)のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- スタークラフトII

- エイジ・オブ・エンパイア

- ウォークラフトIII

- コマンド・アンドコンカー

- 世界のeスポーツ市場、ファーストパーソンシューティングゲーム(FPS)のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- カウンターストライク:Global Offensive(CS:GO)

- コール・オブ・デューティ

- オーバーウォッチ

- Rainbow Six Siege

- 世界のeスポーツ市場、格闘技とスポーツのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- ストリートファイターシリーズ

- 鉄拳シリーズ

- モータルコンバットシリーズ

- 大乱闘スマッシュブラザーズ

- FIFAシリーズ

- NBA 2Kシリーズ

- マッデンNFLシリーズ

- グランツーリスモ

第7章 地域別・国別分析

- 世界のeスポーツ市場:地域別、実績と予測、2019~2024年、2024~2029年、2034年

- 世界のeスポーツ市場:国別、実績と予測、2019~2024年、2024~2029年、2034年

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- eスポーツ市場:競合情勢

- eスポーツ市場:企業プロファイル

- Activision Blizzard Inc.

- Modern Times Group MTG AB

- Tencent

- Valve Corporation

- Nintendo

第31章 その他の大手企業と革新的企業

- Team SoloMid(TSM)

- Cloud9

- Take-Two Interactive

- RIoT Games Inc.

- Nazara Technology

- Jetsynthesys

- Nodwin Group

- Gaming Monk

- Neon Gaming Studio

- Viacom 18

- Sony

- Xbox

- BenQ

- Electronic Arts

- Red Entertainment

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、戦略

- eスポーツ市場、2029年:新たな機会を提供する国

- eスポーツ市場、2029年:新たな機会を提供するセグメント

- eスポーツ市場、2029年:成長戦略

- 市場動向による戦略

- 競合の戦略