|

|

市場調査レポート

商品コード

1670182

自動マテリアルハンドリング装置市場規模、シェア、成長分析、製品タイプ別、ソフトウェアとサービス別、機能別、産業別、地域別 - 産業予測、2025-2032年Automated Material Handling Equipment Market Size, Share, and Growth Analysis, By Product (Robot, Automated Storage and Retrieval Systems ), By System Type, By Software and Services, By Function, By Industry, By Region - Industry Forecast 2025-2032 |

||||||

|

|||||||

| 自動マテリアルハンドリング装置市場規模、シェア、成長分析、製品タイプ別、ソフトウェアとサービス別、機能別、産業別、地域別 - 産業予測、2025-2032年 |

|

出版日: 2025年02月27日

発行: SkyQuest

ページ情報: 英文 190 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

自動マテリアルハンドリング装置(AMH)の世界市場規模は2023年に623億米ドルとなり、予測期間(2025-2032年)のCAGRは10.4%で、2024年の687億8,000万米ドルから2032年には1,517億8,000万米ドルに成長する見通しです。

世界の自動マテリアルハンドリング装置市場は、スマート工場へのシフトが原動力となり、大きな成長が見込まれています。製造企業が業務効率を高め、人件費を削減するために高度な自動保管・検索システムに投資する中、倉庫や生産施設における効果的なマテリアルハンドリングソリューションの需要が急増しています。モーション・コントロール技術の革新により、ロボットはより高い敏捷性と精度を実現し、ピッキングから仕分けまで、さまざまな作業にわたってその能力を拡大しています。その結果、無駄を最小限に抑え、生産性を向上させるためには、工程のリアルタイムモニタリングが不可欠となっています。さらに、オートメーションにおける人工知能の台頭は、自動マテリアルハンドリング装置業界に新たなサブセグメントを生み出し、こうした急速な変化に対応する従来の相手先ブランド製造(OEM)に課題を突きつけています。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次と一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2024年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

自動マテリアルハンドリング装置市場規模:製品別

- 市場概要

- ロボット

- 固定ロボット

- 多関節ロボット

- 円筒形ロボット

- スカラロボット

- パラレルロボット

- 直交ロボット

- 移動ロボット

- 自動倉庫システム(ASRS)

- ユニットロード

- ミニロード

- 垂直リフトモジュール

- カルーセル

- ミッド ロード

- オートストア

- コンベアおよび仕分けシステム

- ベルト

- ローラー

- オーバーヘッド

- スクリュー

- クレーン

- ジブ

- ブリッジ

- ガントリー

- スタッカー

- 自律移動ロボット(AMR)

- 自動棚搬送ロボット

- 自動運転フォークリフト

- 自律在庫ロボット

- 無人航空機

- 牽引車

- ユニットロードキャリア

- パレットトラック

- フォークリフト

- ハイブリッド車

- 無人搬送車(AGV)

- その他

自動マテリアルハンドリング装置市場規模:システムタイプ別

- 市場概要

- ユニットロードマテリアルハンドリングシステム

- バルクロードマテリアルハンドリングシステム

自動マテリアルハンドリング装置市場規模:ソフトウェアとサービス別

- 市場概要

- ソフトウェア

- 倉庫マネージメントシステム

- 倉庫コントロールシステム

- 倉庫実行システム

- サービス

- メンテナンスと修理

- トレーニング

- ソフトウェアのアップグレード

自動マテリアルハンドリング装置市場規模:機能別

- 市場概要

- 組み立て

- パッケージング

- 搬送

- 配付

- ストレージ

- 廃棄物処理

自動マテリアルハンドリング装置市場規模:業界別

- 市場概要

- 自動車

- 金属および重機

- 食品および飲料

- 化学薬品

- 半導体およびエレクトロニクス

- ヘルスケア

- 医薬品

- 医療機器

- 航空

- eコマース

- その他

自動マテリアルハンドリング装置市場規模

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2024年)

- 主な市場企業が採用した戦略

- 最近の市場動向

- 企業の市場シェア分析(2024年)

- 主要企業の企業プロファイル

- 企業の詳細

- 製品ポートフォリオ分析

- 企業のセグメント別シェア分析

- 収益の前年比比較(2022-2024)

主要企業プロファイル

- Daifuku(Japan)

- Murata Machinery(Japan)

- Dematic(Germany)

- Honeywell Intelligrated(USA)

- SSI Schaefer(Germany)

- Swisslog(Switzerland)

- Knapp AG(Austria)

- TGW Logistics Group(Austria)

- Vanderlande(Netherlands)

- Mecalux(Spain)

- Bastian Solutions(USA)

- Witron Logistik+Informatik GmbH(Germany)

- Beumer Group(Germany)

- Hyster-Yale Materials Handling(USA)

- Crown Equipment Corporation(USA)

- Kardex Group(Switzerland)

結論と提言

Global Automated Material Handling Equipment Market size was valued at USD 62.3 billion in 2023 and is poised to grow from USD 68.78 billion in 2024 to USD 151.78 billion by 2032, growing at a CAGR of 10.4% during the forecast period (2025-2032).

The global automated material handling equipment (AMH) market is poised for significant growth, driven by the shift towards smart factories. As manufacturing companies invest in advanced automated storage and retrieval systems to enhance operational efficiency and reduce labor costs, the demand for effective material handling solutions in warehouses and production facilities is surging. Innovations in motion control technology have enabled robots to achieve greater agility and precision, expanding their capabilities across various tasks, from picking to sorting. Consequently, real-time monitoring of processes has become essential for minimizing waste and boosting productivity. Additionally, the rise of artificial intelligence in automation is generating new subsegments within the AMH industry, challenging traditional OEMs as they adapt to these rapid changes.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Automated Material Handling Equipment market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

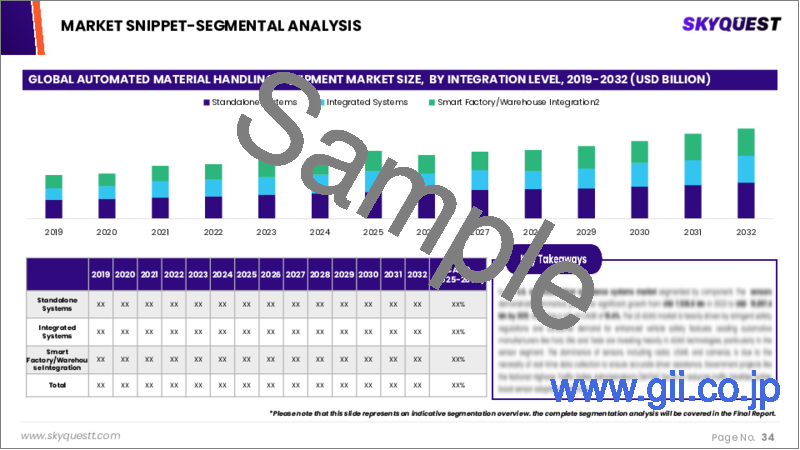

Global Automated Material Handling Equipment Market Segments Analysis

Global Automated Material Handling Equipment Market is segmented by Product, System Type, Software and Services, Function, Industry and region. Based on Product, the market is segmented into Robot, Automated Storage and Retrieval Systems (ASRS), Conveyor and Sortation Systems, Autonomous Mobile Robots (AMR), Tow Vehicle, Unit Load Carrier, Pallet Truck, Forklift Truck, Hybrid Vehicles, Automated Guided Vehicles (AGV) and Others. Based on System Type, the market is segmented into Unit Load Material Handling Systems and Bulk Load Material Handling Systems. Based on Software and Services, the market is segmented into Software, Warehouse Management System, Warehouse Control System, Warehouse Execution System, Services, Maintenance and Repair, Training and Software Upgrades. Based on Function, the market is segmented into Assembly, Packaging, Transportation, Distribution, Storage and Waste Handling. Based on Industry, the market is segmented into Automotive, Metals and Heavy Machinery, Food and Beverages, Chemicals, Semiconductor and Electronics, Healthcare, Pharmaceuticals, Medical Devices, Aviation, E-Commerce and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Global Automated Material Handling Equipment Market

The rapid expansion of e-commerce worldwide is driving significant demand for process automation, particularly in the Global Automated Material Handling Equipment market. Major players like Amazon and Walmart are increasingly adopting automated solutions to optimize their operations, ensuring efficiency, accuracy, cost-effectiveness, and safety. A notable example of this trend occurred in January 2020, when Amazon entered into a partnership with Baylo, a French robotics software startup. This collaboration aims to innovate and enhance robotic technologies for material handling trucks, ultimately improving Amazon's warehouse operations and streamlining its e-commerce activities, positioning the company for continued growth in a competitive landscape.

Restraints in the Global Automated Material Handling Equipment Market

One of the significant challenges facing the Global Automated Material Handling Equipment market is the substantial initial investment needed for implementation. This includes expenses related to installation, the integration of advanced sensors and software systems, after-sales support, and ongoing maintenance, all of which contribute to high overall ownership costs. Consequently, these factors deter companies from investing in automated material handling (AMH) solutions. Additionally, small and medium-sized enterprises encounter obstacles in transitioning from traditional material handling methods to automated alternatives, primarily due to concerns about low production output, insufficient returns on investment, and the necessity to restructure existing warehouses and facility layouts.

Market Trends of the Global Automated Material Handling Equipment Market

The Global Automated Material Handling Equipment market is experiencing significant growth driven by the evolution of Industry 4.0 and the proliferation of smart factories. As manufacturers increasingly adopt intelligent systems for picking, sorting, and conveying, the demand for automated solutions is on the rise to enhance operational efficiency and minimize waste. These modern facilities leverage advanced technologies like cloud connectivity and data analytics, empowering real-time monitoring and actionable insights. This integration not only optimizes asset performance but also supports seamless workflow management, positioning automated material handling equipment as an essential component in the transformation toward smarter manufacturing ecosystems.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Drivers & Opportunities

- Restraints & Challenges

- Porters Analysis

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2024

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

Global Automated Material Handling Equipment Market Size by Product & CAGR (2025-2032)

- Market Overview

- Robot

- Fixed Robots

- Articulated Robots

- Cylindrical Robots

- Scara Robots

- Parallel Robots

- Cartesian Robots

- Mobile Robots

- Automated Storage and Retrieval Systems (ASRS)

- Unit Load

- Mini Load

- Vertical Lift Module

- Carousel

- Mid Load

- Autostore

- Conveyor and Sortation Systems

- Belt

- Roller

- Overhead

- Screw

- Cranes

- JIB

- Bridge

- Gantry

- Stacker

- Autonomous Mobile Robots (AMR)

- Goods-to-person picking robots

- Self-driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Automated Guided Vehicles (AGV)

- Others

Global Automated Material Handling Equipment Market Size by System Type & CAGR (2025-2032)

- Market Overview

- Unit Load Material Handling Systems

- Bulk Load Material Handling Systems

Global Automated Material Handling Equipment Market Size by Software and Services & CAGR (2025-2032)

- Market Overview

- Software

- Warehouse Management System

- Warehouse Control System

- Warehouse Execution System

- Services

- Maintenance and Repair

- Training

- Software Upgrades

Global Automated Material Handling Equipment Market Size by Function & CAGR (2025-2032)

- Market Overview

- Assembly

- Packaging

- Transportation

- Distribution

- Storage

- Waste Handling

Global Automated Material Handling Equipment Market Size by Industry & CAGR (2025-2032)

- Market Overview

- Automotive

- Metals and Heavy Machinery

- Food and Beverages

- Chemicals

- Semiconductor and Electronics

- Healthcare

- Pharmaceuticals

- Medical Devices

- Aviation

- E-Commerce

- Others

Global Automated Material Handling Equipment Market Size & CAGR (2025-2032)

- North America (Product, System Type, Software and Services, Function, Industry)

- US

- Canada

- Europe (Product, System Type, Software and Services, Function, Industry)

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (Product, System Type, Software and Services, Function, Industry)

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America (Product, System Type, Software and Services, Function, Industry)

- Brazil

- Rest of Latin America

- Middle East & Africa (Product, System Type, Software and Services, Function, Industry)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2024

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2024

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2022-2024)

Key Company Profiles

- Daifuku (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Murata Machinery (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Dematic (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Honeywell Intelligrated (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- SSI Schaefer (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Swisslog (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Knapp AG (Austria)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- TGW Logistics Group (Austria)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Vanderlande (Netherlands)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Mecalux (Spain)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Bastian Solutions (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Witron Logistik + Informatik GmbH (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Beumer Group (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hyster-Yale Materials Handling (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Crown Equipment Corporation (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Kardex Group (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments