|

市場調査レポート

商品コード

1850987

3PL:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 3PL:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月04日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

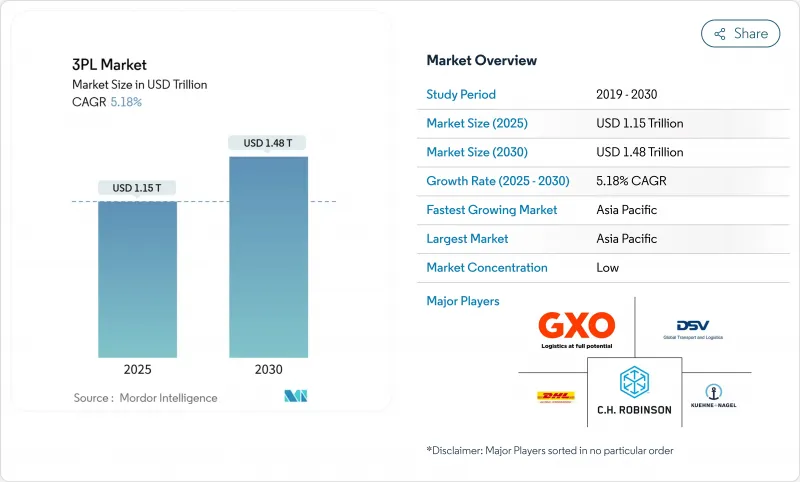

3PLの市場規模は、2025年に1兆1,500億米ドルと評価され、2030年には1兆4,800億米ドルに達すると予測されています。

現在の収益の55%近くは、車両や倉庫を所有するのではなく、パートナーを通じてネットワークを編成するアセット・ライト・プロバイダーが占めています。このモデルは、資本リスクを軽減し、貿易の流れが揺れ動くときにオペレーターがキャパシティを柔軟に調整できるようにします。アジア太平洋地域は、eコマースの拡大やインド、ベトナム、インドネシアへの生産シフトに後押しされ、世界の3PL市場の41.3%を占めています。リアルタイム可視化、デジタル運賃マッチング、倉庫自動化を統合したプロバイダーは、スピードとコスト面で優位に立ち、スピードの遅いライバルは太刀打ちできないです。メキシコへのニアショアリング、欧州におけるグリーン・ロジスティクスの義務化、北米におけるライフサイエンスに特化した流れが、サービス要件を厳格化し、このセクターを契約期間の短縮とデータ豊富なプラットフォームへの投資の強化へと押し上げています。

世界の3PL市場の動向と洞察

eコマースの規模拡大で即日フルフィルメントが加速

新興国のオンライン小売は急成長しており、買い物客は数日ではなく数時間での配達を望むようになっています。プロバイダーは、密集した近隣地域にハイパーローカルハブを設置し、ラインホールの距離を短縮し、配送密度を高めることで対応しています。このようなシフトにより、3PL市場の事業者は、ルート計画エンジンを微調整し、混雑する道路用に二輪車を増やし、リアルタイムのスロットスケジューリングが可能なクラウド受注管理を採用せざるを得なくなります。特殊な不動産信託は、街の小さな区画を、シャトルシステムや協働ロボットを備えた複数階建てのマイクロ・フルフィルメント・サイトに変えています。

国境を越えたシャトル貨物を生み出すOEMのニアショアリング戦略

2022年から2023年にかけて、メキシコは中国を抜いて米国にとって最大の貿易相手国となり、4,756億米ドルの貨物を扱い、毎月およそ2万900台の積載トラックを走らせています。モンテレイ近郊やバヒオ回廊沿いには新しい工業団地が建設中で、2025年以降も貨物輸送の窓口は開かれ続けると思われます。シャトル・レーン(サプライヤーの工場と米国の配送センターを結ぶ短くて高頻度のループ)は、現在、国境両側の専用トラクター、トレーラー、ドレー・サービスの年間契約を支えています。3PL市場のリーダーは、バイリンガルの管制塔、リアルタイムの国境待機トラッキング、デュアルコンプライアンスの通関仲介を追加し、滞留時間を短縮しています。鉄道とトラックの複合一貫輸送の組み合わせも増加しており、1回あたりのCO2排出量を削減し、予測可能な輸送スケジュールを固定化しています。

港湾の混雑によるコスト変動

主要ゲートウェイの滞貨は、海上スポット・レートとシャーシ留置料に大きな変動をもたらします。荷主は現在、複数年の契約ではなく、四半期ごとの契約を好んでおり、港の輻輳が解消した際にも対応できる余地を残しています。3PLマーケット・プロバイダーは、内陸のオーバーフロー・ヤード・スペースを確保し、貨物を同日中に鉄道に積み替えるためのポップアップ・トランスロード・サイトを配備することでヘッジしています。ターミナル・オペレーティング・システムからのリアルタイムのデータ・フィードは、ダイナミックなスロット・ブッキングを導き、コンテナがホイール・レディになったときだけトラックが到着するようにします。

セグメント分析

国内輸送管理は、2024年の3PL市場規模の45%(約5,220億米ドル)を占め、2030年まで毎年5.9%の成長が予測されています。アプリベースの貨物プラットフォームは、リアルタイム価格を入札エンジンにフィードし、一次検収率を引き上げ、エンプティマイルの割合を削減します。eコマースの即日配送ルートや地域化されたマイクロ・フルフィルメント・フットプリントの開始により、ポイント・ツー・ポイントのラインホールや国境内のミルクラン集荷の需要が高まっています。

3PL市場では、地政学的リスクや不安定な海上スケジュールが計画を複雑にするため、国際輸送管理も伸び悩んでいます。付加価値型倉庫・流通は、在庫の分散化から利益を得る。小売業者は在庫を顧客群の近くに置くため、事業者は高密度のシャトルラックや現場での返品処理ラインを備えた建物を改修する必要に迫られます。道路は依然として支配的な輸送手段であるが、インターモーダル鉄道は、信頼性がトラック輸送に匹敵するようになった900キロメートル以上のレーンでシェアを獲得しています。

地域分析

アジア太平洋地域は3PL市場売上の41.3%を占め、CAGRは地域最高の6.0%を記録しています。製造拠点は中国以外にも多様化し続けており、ホーチミン市からバンコク、そして深海港へと続く複合一貫輸送の回廊が形成されつつあります。シンガポールのデジタル通関プラットフォームは通関時間を2時間未満に短縮し、インドネシアのeコマース小包量は2022年以降3倍に増加しており、新たな自動仕分けセンターを必要としています。日本のグリーンポート計画に基づく資本プロジェクトは、コールドチェーンバーススペースを追加し、ワクチンペイロードの直接輸入を可能にします。

北米は3PLの市場規模では第2位であり、ニアショアリングによって再形成されつつあります。テキサス州ラレドは、現在、サバンナ港よりも多くの倉庫在庫を抱えます。短距離輸送のインターモーダル・チェーンは、空シャシの輸送を削減し、CPKCネットワーク経由の統一鉄道サービスは、単一区間のトランジットを丸1日短縮しています。ドライバー不足により、フリートはスリップシート・スケジューリングと遠隔操作可能なヤード・トラクターに移行し、労働時間を節約しながら資産回転率を高めています。

欧州の3PL市場は、拡大されたEU排出量取引制度の下、排出コストと格闘しています。海運会社は、2025年に船舶出荷量の70%をカバーする排出枠を購入しなければならず、電気機関車がゼロ・エミッションを謳っている近海航路では、貨物を海上から鉄道に移行させることになります。FuelEU Maritime規制とReFuelEU Aviation規制はさらに規律を強化し、低炭素燃料の混合を輸送会社に強制します。認証された削減量を文書化したプロバイダーは、気候変動に関する情報開示の遵守を迫られているブランドとの契約を確保することができます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- eコマースの拡大により、新興諸国における即日配送の需要が加速

- OEMニアショアリング戦略が北米における越境シャトル貨物輸送の機会を創出

- 先進国における医薬品コールドチェーンのアウトソーシングの急増

- 政府のグリーン物流規制(例:EU Fit-for-55)がカーボンニュートラルソリューションの需要を押し上げる

- ハイテクセクターのマルチテナントDCを必要とするD2C(Direct-to-Consumer)モデルへの移行

- オムニチャネル食料品店の台頭が都市部におけるマイクロフルフィルメント契約を推進

- 市場抑制要因

- 港湾混雑によるコスト変動が契約期間を短縮

- OECD諸国における運転手と倉庫労働者の不足が営業利益率を押し上げている

- ティア1物流拠点における産業用不動産コストの高騰が利益率を圧迫

- 国境を越えたデータ保管規則がクラウドWMSの展開を制限する

- バリュー/サプライチェーン分析

- テクノロジースナップショット(IoT、AIなど)

- 主要な政府規制と取り組み

- Eコマースビジネスへの洞察

- 倉庫市場の動向

- 需要動向分析(CEP、ラストマイル、コールドチェーンなど)

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 地政学的イベントが市場に与える影響

第5章 市場規模と成長予測

- サービス別

- 国内輸送管理(DTM)

- 道路

- 鉄道

- 航空

- 水路

- 国際輸送管理(ITM)

- 道路

- 鉄道

- 航空

- 水路

- 付加価値倉庫・配送(VAWD)

- 国内輸送管理(DTM)

- エンドユーザー別

- 自動車

- エネルギーと公益事業

- 製造業

- ライフサイエンスとヘルスケア

- テクノロジーとエレクトロニクス

- 小売業とeコマース

- 消費財およびFMCG

- 飲食品

- その他

- 物流モデル別

- アセットライト(管理ベース)

- 資産重視(自社の艦隊と倉庫を所有)

- ハイブリッド

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- オランダ

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- シンガポール

- ベトナム

- インドネシア

- オーストラリア

- その他アジア太平洋地域

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- イスラエル

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- ケニア

- その他アフリカ

- 北米

第6章 競合情勢

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- DHL Supply Chain and Global Forwarding

- Kuehne+Nagel International AG

- GXO Logistics

- C.H. Robinson Worldwide Inc.

- DSV A/S

- Nippon Express Holdings

- Sinotrans Ltd.

- CEVA Logistics(CMA CGM)

- XPO Logistics Inc.

- FedEx Logistics

- UPS Supply Chain Solutions

- GEODIS

- Kerry Logistics Network

- Yusen Logistics(NYK)

- Hitachi Transport System(LOGISTEED)

- J.B. Hunt Transport Services Inc.

- CJ Logistics

- Samsung SDS

- Americold Logistics LLC

- Penske Logistics

- Expeditors