|

|

市場調査レポート

商品コード

1753867

サードパーティロジスティクス(3PL)の世界市場機会と2034年までの戦略Third-Party Logistics (3PL) Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| サードパーティロジスティクス(3PL)の世界市場機会と2034年までの戦略 |

|

出版日: 2025年06月20日

発行: The Business Research Company

ページ情報: 英文 352 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のサードパーティロジスティクス(3PL)市場は2019年に9,021億9,425万米ドルとなり、2024年までCAGR6.00%以上で成長しました。

燃料価格と輸送コストの上昇

燃料価格と輸送コストの上昇は、歴史的な期間にサードパーティロジスティクス(3PL)市場の成長を牽引しました。燃料価格は、輸送に使用されるガソリン、ディーゼル、その他の燃料のコストを指し、輸送コストは、燃料、労働力、メンテナンス、ロジスティクスを含む、商品の移動に関連するすべての経費を含みます。燃料価格と輸送コストの上昇は、企業の財務的圧力を高め、費用対効果の高いロジスティクスを困難にします。これに対処するため、多くの企業は、サプライチェーンの効率を高め、経費を削減するために、サードパーティー・ロジスティクス(3PL)プロバイダーを利用します。3PLプロバイダーは、スケールメリット、高度なルート最適化、戦略的パートナーシップを活用し、タイムリーな配送を確保しながら燃料費をコントロールします。ロジスティクスをアウトソーシングすることで、企業はコスト削減、柔軟性の向上、サプライチェーン管理の改善の恩恵を受けながら、中核業務に集中することができます。例えば、米国の政府機関である運輸統計局によると、2022年8月、レギュラーガソリンの価格は2022年1月から6月にかけて49%上昇し、ディーゼル燃料の価格は55%とわずかに上昇しました。さらに、カナダに本拠を置く政府機関であるカナダ統計局によると、2022年8月、鉄道による複合一貫輸送コンテナの輸送コストは、2022年7月に前年比28.4%上昇し、平均17.7%上昇したカナダの全貨物鉄道サービスの中で最も高い値上がりを記録しました。したがって、燃料価格と輸送コストの上昇がサードパーティー・ロジスティクス(3PL)市場を牽引しました。

目次

第1章 エグゼクティブサマリー

- サードパーティロジスティクス(3PL)-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- サードパーティロジスティクス(3PL)市場定義とセグメンテーション

- サービスタイプ別の市場セグメンテーション

- 専用契約運送

- 国内輸送管理

- 国際輸送管理

- 倉庫保管および配送

- その他のサービスタイプ

- 輸送手段別の市場セグメンテーション

- 鉄道

- 道路

- 水路

- 航空

- 最終用途産業別の市場セグメンテーション

- 製造業

- 小売り

- ヘルスケア

- 自動車

- その他の産業

第7章 主要な市場動向

- AIを活用した注文配分と最適化でサプライチェーンの効率を向上

- 物流と在庫管理を革新するAI搭載プラットフォーム

- 拡大戦略サードパーティロジスティクス(3PL)市場

- 輸送管理システム(TMS)の進歩が3PLの成長を促進

- 最適化された在庫管理のための3PL保管サービスの進化

第8章 世界のサードパーティロジスティクス(3PL)の成長分析と戦略分析フレームワーク

- 世界: PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- エンドユーザー分析(B2B)

- 製造業

- 小売り

- ヘルスケア

- 自動車

- その他の最終用途産業

- 世界の市場規模と成長

- 市場促進要因、2019年~2024年

- 市場抑制要因、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

- 市場促進要因、2024年~2029年

- 市場抑制要因、2024年~2029年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界サードパーティロジスティクス(3PL)の潜在市場規模(TAM)

第9章 世界のサードパーティロジスティクス(3PL)市場:セグメンテーション

- 世界のサードパーティロジスティクス(3PL)市場:サービスタイプ別、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場:輸送手段別、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場:最終用途産業別、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場、専用契約運送(DCC)のサービスタイプ別サブセグメンテーション、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場、国内輸送管理(DTM)のサービスタイプ別サブセグメンテーション、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場、国際輸送管理(ITM)のサービスタイプ別サブセグメンテーション、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場、倉庫・配送のサービスタイプ別サブセグメンテーション、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場、その他のサービスタイプのサブセグメンテーション、サービスタイプ別、実績と予測、2019年~2024年、2029年、2034年

第10章 サードパーティロジスティクス(3PL)市場:地域・国別分析

- 世界のサードパーティロジスティクス(3PL)市場:地域別、実績と予測、2019年~2024年、2029年、2034年

- 世界のサードパーティロジスティクス(3PL)市場:国別、実績と予測、2019年~2024年、2029年、2034年

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Amazon.com Inc.

- C.H. Robinson Worldwide Inc.

- Maersk AS

- DHL Supply Chain & Global Forwarding

- Kuehne+Nagel International AG

第19章 その他の大手企業と革新的企業

- CEVA Logistics SA

- Nippon Express Co. Ltd.

- United Parcel Service of America Inc.

- Sinotrans Ltd.

- Uber Technologies Inc.

- DSV AS

- DP World Logistics FZE

- Expeditors International of Washington Inc.

- Ryder Supply Chain Solutions LLP

- Kerry Logistics Network Limited

- Bollore Logistics

- BDP International Inc.

- Total Quality Logistics LLC

- The Deutsche Bahn AG

- J.B. Hunt Transport Inc.

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Bertelsmann Acquired Carbel LLC

- WWEX Group Acquired JEAR Logistics

- eShipping Acquired Integrated Logistics

- Shadowfax Acquired CriticaLog

- BlueGrace Logistics Acquired FreightCenter

- Scan Global Logistics(SGL)Acquired Blu Logistics

- Metro Supply Chain Inc, Acquired SCI Group Inc

- BlueYonder Acquired Doddle Parcel Services Ltd.

- Red Arts Capital Acquired FLEX Logistics

- CEVA Logistics Acquired Ingram Micro Commerce & Lifecycle Services

- Weber Logistics Acquired Pacific Coast Warehouse Company

第23章 サードパーティロジスティクス(3PL)の最近の動向

- クラウドベースのSaaSツールが3PLの収益性を変革

- 革新的なプラットフォームにより複数の物流業者の必要性がなくなる

- 透明性が物流パフォーマンスに与える影響

- 電気自動車による持続可能な物流の推進

第24章 機会と戦略

- 世界のサードパーティロジスティクス(3PL)市場2029年:新たな機会を提供する国

- 世界のサードパーティロジスティクス(3PL)市場2029年:新たな機会を提供するセグメント

- 世界のサードパーティロジスティクス(3PL)市場2029年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 サードパーティロジスティクス(3PL)市場、結論・提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々

第26章 付録

Third-party logistics (3PL) refers to the outsourcing of logistics and supply chain management functions to a specialized external service provider. These providers offer a range of services, including transportation, warehousing, inventory management, order fulfillment and distribution. 3PL providers act as intermediaries, bridging the gap between manufacturers, suppliers and end customers, facilitating the smooth flow of goods throughout the supply chain.

The third-party logistics (3PL) market consists of sales, by entities (organizations, sole traders and partnerships), of third-party logistics services that are used in logistics and supply-chain management to contract a company's shipping and fulfillment needs, which may involve warehousing, purchasing supplies, inventory control, customs brokerage, freight audit, payments and shipment monitoring.

The global third-party logistics (3PL) market was valued at $902,194.25 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 6.00%.

Rising Fuel Prices And Transportation Costs

The rising fuel prices and transportation costs drove the growth of the third-party logistics (3PL) market during the historic period. Fuel prices refer to the cost of gasoline, diesel, or other fuels used for transportation, while transportation costs encompass all expenses related to the movement of goods, including fuel, labor, maintenance and logistics. Rising fuel prices and transportation costs increase the financial pressure on businesses, challenging cost-effective logistics. To address this, many companies turn to third-party logistics (3PL) providers to enhance supply chain efficiency and reduce expenses. 3PL providers use economies of scale, advanced route optimization and strategic partnerships to control fuel costs while ensuring timely deliveries. By outsourcing logistics, businesses can focus on their core operations while benefiting from cost savings, greater flexibility and improved supply chain management. For instance, in August 2022, according to the Bureau of Transportation Statistics, a US-based government agency, the price of regular motor gasoline increased by 49% from January to June 2022, while the price of diesel fuel rose by a slightly higher 55%. Additionally, in August 2022, according to Statistics Canada, a Canada-based government agency, the cost of transporting intermodal shipping containers by rail increased by 28.4% in July 2022 compared to the previous year, marking the highest price rise among all Canadian freight rail services, which saw an average increase of 17.7%.Therefore, rising fuel prices and transportation costs drove the third-party logistics (3PL) market.

AI-Driven Order Allocation And Optimization For Enhanced Supply Chain Efficiency

Companies operating in the third-party logistics (3PL) market are focusing on developing advanced products, such as AI-driven order allocation and optimization, to enhance operational efficiency. Automated order allocation and optimization software is a system that uses algorithms and real-time data to efficiently assign and prioritize orders across warehouses, fulfillment centers and delivery networks to minimize costs and improve delivery speed. For instance, in December 2024, Logility, a US-based software company, launched Intelligent Order Response, an AI-native features that will revolutionize supply chain management. Intelligent Order Response is an AI-driven order allocation and optimization software that actively scans for and resolves demand-supply imbalances, enhancing the order fulfillment process. As part of Logility's Decision Intelligence Platform, this solution eliminates rigid allocation rules and manual processes, automatically and intelligently allocating available inventory to meet demand within specified business goals and timeframes. This AI-first approach optimizes business outcomes by reducing costly expedited logistics fees, minimizing supply chain fines and improving customer satisfaction while offering AI-powered recommendations for supply chain network adjustments through Logility's Continuous Network Optimization.

The global third-party logistics (3PL) market is fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 6.11% of the total market in 2023.

Third-Party Logistics (3PL) Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global third-party logistics (3PL) market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for third-party logistics (3PL)? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The third-party logistics (3PL) market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider third-party logistics (3PL) market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by service type, by mode of transport and by end-user industries.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework- Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by service type, by mode of transport and by end-user industries in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments- Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to third-party logistics (3PL) be followed in those markets.

- Conclusions And Recommendations - This section includes recommendations for third-party logistics (3PL) market providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Service Type: Dedicated Contract Carriage; Domestic Transportation Management; International Transportation Management; Warehousing And Distribution; Other Service Types

- 2) By Mode Of Transport: Railways; Roadways; Waterways; Airways

- 3) By End-Use Industry: Manufacturing; Retail; Healthcare; Automotive; Other Industries

- Companies Mentioned: Amazon.com Inc.; C.H. Robinson Worldwide Inc.; Maersk AS; DHL Supply Chain & Global Forwarding; Kuehne+Nagel International AG

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; third-party logistics (3PL) indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Third-Party Logistics (3PL) - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Third-Party Logistics (3PL) Market Definition And Segmentations

- 6.4 Market Segmentation By Service Type

- 6.4.1 Dedicated Contract Carriage

- 6.4.2 Domestic Transportation Management

- 6.4.3 International Transportation Management

- 6.4.4 Warehousing And Distribution

- 6.4.5 Other Service Types

- 6.5 Market Segmentation By Mode Of Transport

- 6.5.1 Railways

- 6.5.2 Roadways

- 6.5.3 Waterways

- 6.5.4 Airways

- 6.6 Market Segmentation By End-Use Industry

- 6.6.1 Manufacturing

- 6.6.2 Retail

- 6.6.3 Healthcare

- 6.6.4 Automotive

- 6.6.5 Other Industries

7 Major Market Trends

- 7.1 AI-Driven Order Allocation And Optimization For Enhanced Supply Chain Efficiency

- 7.2 AI-Powered Platform Revolutionizing Logistics And Inventory Management

- 7.3 Expansion Strategies In The Third-Party Logistics (3PL) Market

- 7.4 Advancements In Transportation Management Systems (TMS) Driving 3PL Growth

- 7.5 Advancing 3PL Storage Services For Optimized Inventory Management

8 Global Third-Party Logistics (3PL) Growth Analysis And Strategic Analysis Framework

- 8.1 Global: PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User Analysis (B2B)

- 8.2.1 Manufacturing

- 8.2.2 Retail

- 8.2.3 Healthcare

- 8.2.4 Automotive

- 8.2.5 Other End-Use Industries

- 8.3 Global Market Size and Growth

- 8.3.1 Market Drivers 2019 - 2024

- 8.3.1 Market Restraints 2019 - 2024

- 8.4 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.4.1 Market Drivers 2024 - 2029

- 8.4.1 Market Restraints 2024 - 2029

- 8.5 Forecast Growth Contributors/Factors

- 8.5.1 Quantitative Growth Contributors

- 8.5.2 Drivers

- 8.5.3 Restraints

- 8.6 Global Third-Party Logistics (3PL) Total Addressable Market (TAM)

9 Global Third-Party Logistics (3PL) Market Segmentation

- 9.1 Global Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Third-Party Logistics (3PL) Market, Sub-Segmentation Of Dedicated Contract Carriage (DCC), By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Third-Party Logistics (3PL) Market, Sub-Segmentation Of Domestic Transportation Management (DTM), By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Third-Party Logistics (3PL) Market, Sub-Segmentation Of International Transportation Management (ITM), By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Third-Party Logistics (3PL) Market, Sub-Segmentation Of Warehousing And Distribution, By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Global Third-Party Logistics (3PL) Market, Sub-Segmentation Of Other Service Types, By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Third-Party Logistics (3PL) Market, Regional and Country Analysis

- 10.1 Global Third-Party Logistics (3PL) Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Third-Party Logistics (3PL) Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

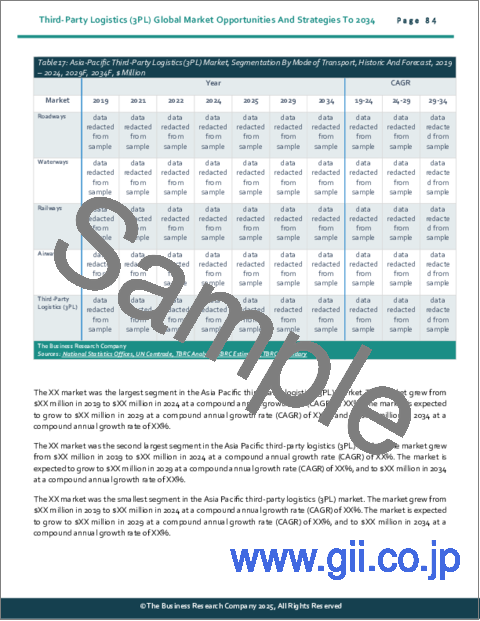

- 11.4 Asia-Pacific Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Third-Party Logistics (3PL) Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 Indonesia Market

- 11.28 Indonesia Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 Indonesia Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Market

- 11.32 Summary

- 11.33 Market Overview

- 11.33.1 Country Information

- 11.33.2 Market Information

- 11.33.3 Background Information

- 11.33.4 Government Initiatives

- 11.33.5 Regulations

- 11.33.6 Regulatory Bodies

- 11.33.7 Major Associations

- 11.33.8 Taxes Levied

- 11.33.9 Corporate Tax Structure

- 11.33.10 Investments

- 11.33.11 Major Companies

- 11.34 South Korea Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 South Korea Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate Tax Structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Third-Party Logistics (3PL) Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Eastern Europe Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Russia Market

- 13.7 Russia Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.8 Russia Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Third-Party Logistics (3PL) Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 South America Third-Party Logistics (3PL) Market: Country Analysis

- 15.7 Brazil Market

- 15.8 Brazil Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.10 Brazil Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Major Companies

- 16.3 Middle East Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Major Companies

- 17.3 Africa Third-Party Logistics (3PL) Market, Segmentation By Service Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Third-Party Logistics (3PL) Market, Segmentation By Mode Of Transport, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Third-Party Logistics (3PL) Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 Amazon.com Inc.

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Financial Overview

- 18.3 C.H. Robinson Worldwide Inc.

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Maersk AS

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Financial Overview

- 18.5 DHL Supply Chain & Global Forwarding

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Financial Overview

- 18.6 Kuehne+Nagel International AG

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 CEVA Logistics SA

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 Nippon Express Co. Ltd.

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 United Parcel Service of America Inc.

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Sinotrans Ltd.

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Uber Technologies Inc.

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 DSV AS

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 DP World Logistics FZE

- 19.7.1 Company Overview

- 19.7.2 products And Services

- 19.8 Expeditors International of Washington Inc.

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Ryder Supply Chain Solutions LLP

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Kerry Logistics Network Limited

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Bollore Logistics

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 BDP International Inc.

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Total Quality Logistics LLC

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 The Deutsche Bahn AG

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 J.B. Hunt Transport Inc.

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Bertelsmann Acquired Carbel LLC

- 22.2 WWEX Group Acquired JEAR Logistics

- 22.3 eShipping Acquired Integrated Logistics

- 22.4 Shadowfax Acquired CriticaLog

- 22.5 BlueGrace Logistics Acquired FreightCenter

- 22.6 Scan Global Logistics (SGL) Acquired Blu Logistics

- 22.7 Metro Supply Chain Inc, Acquired SCI Group Inc

- 22.8 BlueYonder Acquired Doddle Parcel Services Ltd.

- 22.9 Red Arts Capital Acquired FLEX Logistics

- 22.10 CEVA Logistics Acquired Ingram Micro Commerce & Lifecycle Services

- 22.11 Weber Logistics Acquired Pacific Coast Warehouse Company

23 Recent Developments In Third-Party Logistics (3PL)

- 23.1 Cloud-Based SaaS Tool Transforms 3PL Profitability

- 23.2 Innovative Platform Eliminates The Need For Multiple Logistics Providers

- 23.3 Impact Of Transparency On Logistics Performance

- 23.4 Advancing Sustainable Logistics Through Electric Vehicles

24 Opportunities And Strategies

- 24.1 Global Third-Party Logistics (3PL) Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Third-Party Logistics (3PL) Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Third-Party Logistics (3PL) Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Third Party Logistics (3PL) Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer