|

市場調査レポート

商品コード

1851353

デジタルサイネージ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタルサイネージ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月07日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

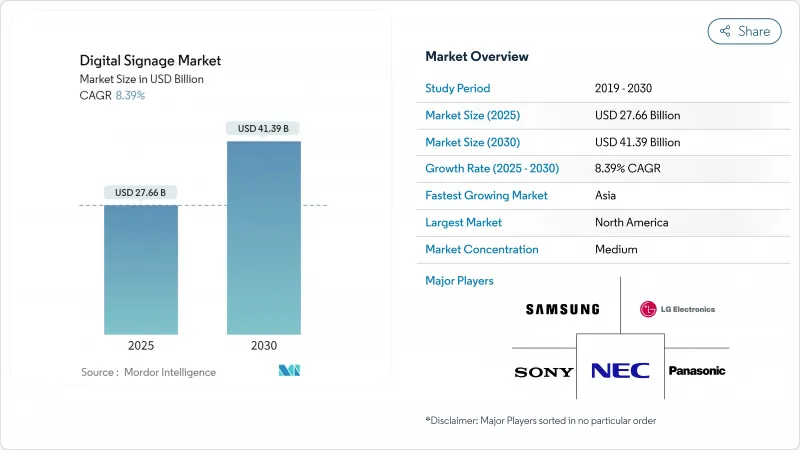

デジタルサイネージ市場規模は2025年に276億6,000万米ドル、2030年には413億9,000万米ドルに達すると予測され、CAGRは8.39%です。

AI主導のコンテンツエンジン、5G対応のエッジネットワーク、エネルギー消費の少ないMicroLEDスクリーンの一貫した普及がこの拡大を支えています。大企業はコネクテッド・ディスプレイを使ってハイブリッドな職場全体のコミュニケーションを統一し、市当局はインタラクティブ・ボードをスマートシティ・インフラに組み込んでモビリティと公共安全イニシアチブを合理化しています。小売企業は、視聴者分析プラットフォームが店内スクリーンを収益を生む小売メディア資産に変えるため、投資を強化しています。同時に、交通事業者はリアルタイム旅客情報システムを導入し、サービスの質を高める。

世界のデジタルサイネージ市場動向と洞察

AIを活用した視聴者分析がダイナミックなコンテンツ・パーソナライゼーションを後押し

小売企業は現在、買い物客が近づくとリアルタイムでメッセージングを調整するAIエンジンで、画一的なループを置き換えています。コンピュータビジョンモジュールは、年齢層、性別、エンゲージメントの長さを測定し、コンバージョンを最大30%向上させるクリエイティブのバリエーションを引き起こします。米国、英国、ドイツ、フランスのチェーンは、オムニチャネル・キャンペーンを充実させるために、これらの洞察をロイヤルティアプリのデータとリンクさせています。代理店は、このような正確な露出のためにプレミアムCPMを支払い、店舗ネットワークを利益率の高いメディアチャンネルに変えています。GDPRへの対応が欧州での展開ペースを形成しているが、ベンダーは分析前にローカルでビデオフレームを匿名化するプライバシー・バイ・デザインのワークフローを組み込んでいます。これらの要因により、デジタルサイネージ市場は中期的に堅調な成長軌道を維持しています。

リアルタイム屋外ストリーミングを可能にする5G+エッジコンピューティング

東京、ソウル、シンガポール、シドニーの交通当局は、ミリ波5Gバックボーンを使用して、超低遅延ビデオと緊急警報を屋外のLEDボードにプッシュしています。デバイス上のエッジサーバーが高解像度のクリップを事前にキャッシュすることで、データ転送コストを削減し、人通りが急増したときにキャンペーンを即座に切り替えることができます。アジアの交通ハブを対象とした調査では、5Gがレガシーファイバーを置き換えた場合、生産性が52%から245%向上し、コストが最大90%削減されることが示されています。より多くのメトロがスタンドアロン5Gコアを稼動させれば、デジタルサイネージ市場は即座に活性化します。

細分化されたCMS標準がマルチベンダーの相互運用性を複雑化

世界的な小売業者は、複数のブランドのスクリーンを使い分けているが、スケジューリングやアナリティクスのための共通プロトコルは見つかっていないです。国際通信連合は、相互運用性の欠如が導入を遅らせ、総所有コストを引き上げると警告しています。そのため、多くの企業は単一ベンダーのエコシステムに閉じこもり、競合入札を制限しています。業界アライアンスはAPIを起草しているが、ベンダー間でロードマップが異なっているため、進捗は遅々として進まないです。この現実が、デジタルサイネージ市場の短期的な拡張性を抑制しています。

セグメント分析

2024年の売上はビデオウォールが28.1%のシェアを占めました。デジタルサイネージ市場は、ブランドシアターや企業のタウンホールイベントで引き続き好まれています。また、クイックサービスレストランのデジタルポスターの需要も安定しています。

しかし、キオスク端末は、セルフレジ、ウェイファインディング、ロイヤリティ登録がレスポンシブ・タッチスクリーンで利用されるようになり、2030年までのCAGRは最速の9.2%となっています。デジタルサイネージ市場の小売企業は、チェックアウト時にアドオンを推奨し、チケットのサイズを調整するAIモジュールを導入しています。透明液晶ディスプレイは、高級店や自動車ショールームで、商品の視認性とデータオーバーレイを融合させるというニッチな分野を開拓しています。メーカーは現在、交通機関のコンコース向けに、マルチパネルのビデオウォールとキオスク端末のインタラクションを融合させたハイブリッド機器を試みています。

ハードウェア部品は2024年の売上高の60.7%を占め、LEDタイル、メディアプレーヤー、取付キットをカバーするデジタルサイネージ市場の基盤であり続ける。ピクセルのコストが低下しているため、4~5年ごとの更新サイクルで設備投資を管理しやすくなっています。

コンテンツオーケストレーションとアナリティクスがROIを促進することを企業が発見したため、ソフトウェア収益は2桁のCAGR 10.5%で成長しています。クラウド・ダッシュボードは遠隔診断によって車両の稼働時間を確保し、AIスケジューラーはキャンペーンの関連性を向上させる。ベンダーは、広告主がエクスポージャーを監査できるようにプルーフ・オブ・プレイ台帳を統合し、デジタルサイネージ市場の信頼性を高めています。

地域分析

北米は2024年の収入の33.4%を占め、米国企業のロビー改装によるデジタルファーストのショーケースがその中心でした。カナダの小売業者はチェックアウトの近代化を加速させ、地域の需要を安定させる。この地域のデジタルサイネージ市場は、成熟したクラウドインフラストラクチャが展開の摩擦を減らしています。

アジア太平洋は、中国の都市クラスター・プロジェクト、日本の技術輸出促進、インドのモール・ブーム、東南アジアの観光業回復に後押しされ、CAGR 8.5%の軌道に乗っています。パネルとICの統合サプライチェーンは単価を下げ、地域のバイヤーに価格の幅を与えてデジタルサイネージ市場の浸透を後押ししています。

欧州はエコデザインの義務化と高い購買力に支えられ、安定した伸びを記録。歴史地区看板の上限規制はコンプライアンスに手間をかけるが、ドイツと北欧の企業はエネルギークラスAのディスプレイを採用し、観光ゾーンの休止を相殺します。東欧の空港は、没入型案内表示でハブ空港の地位を競い、デジタルサイネージ市場を東に拡大。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- AIを活用した視聴者分析が、北米および欧州の小売店や交通機関の通路におけるダイナミックコンテンツのパーソナライゼーションを促進

- 5G+エッジコンピューティングがアジアとオセアニアの主要交通ハブでリアルタイムの屋外ストリーミングを実現

- EU企業の持続可能性義務化により、エネルギー効率の高いMicroLEDと電子ペーパーサイネージの採用が加速

- クラウドベースの企業コミュニケーション・ダッシュボードを推進する米国におけるポスト・パンデミック・ハイブリッド・ワークモデル

- 中東全域で大型デジタル看板を統合したスマートシティ・メガプロジェクト(NEOM、ドバイ2040)が進行中

- ラテンアメリカの大型チェーンによるビデオウォール展開を後押しする小売メディア収益化戦略

- 市場抑制要因

- グローバル小売業者のマルチベンダー相互運用性を複雑化する断片的なCMS標準

- 欧州の歴史的中心市街地における屋外LEDファサードの高いCAPEXと許認可のハードル

- 米国トランジットディスプレイのランサムウェアで浮かび上がったサイバーセキュリティの脆弱性

- 大型パネル用特殊ドライバーICのサプライチェーン価格高騰

- エコシステム分析

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- ビデオウォール

- ビデオスクリーン

- キオスク

- 透明LCDスクリーン

- デジタルポスター

- ビルボード

- その他のタイプ

- コンポーネント別

- ハードウェア

- LCD/LEDディスプレイ

- OLEDディスプレイ

- マイクロLEDディスプレイ

- メディアプレーヤー

- コントローラー

- プロジェクター/プロジェクションスクリーン

- その他のハードウェア

- ソフトウェア

- サービス

- 設置と統合

- マネージド・サービス

- サポートとメンテナンス

- ハードウェア

- 展開別

- オンプレミス

- クラウドベース

- ハイブリッド

- スクリーンサイズ別

- 32インチ以下

- 32インチ~52インチ

- 52インチ以上

- 超大型100インチ以上

- ロケーション別

- インストア/インドア

- アウトドア

- 最終用途産業別

- 小売り

- 輸送機関

- ホスピタリティ

- コーポレート

- 教育

- ヘルスケア

- 政府機関

- スポーツとエンターテインメント

- 銀行・金融サービス

- 製造施設

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- 北欧諸国

- その他欧州地域

- 南米

- ブラジル

- その他南米

- アジア太平洋地域

- 中国

- 日本

- インド

- 東南アジア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- GCC

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- NEC Display Solutions Ltd.

- LG Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Group Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview

- Cisco Systems Inc.

- Scala Inc.

- Broadsign International LLC

- Appspace Inc.

- BrightSign LLC

- Mvix Inc.

- Christie Digital Systems USA Inc.

- Daktronics Inc.

- Leyard Optoelectronic Co. Ltd.

- Unilumin Group Co. Ltd.

- JCDecaux SA

- E Ink Holdings Inc.

- Clear Channel Outdoor Holdings Inc.

- Sharp Corporation