|

市場調査レポート

商品コード

1693627

電気トラック:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電気トラック:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 333 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

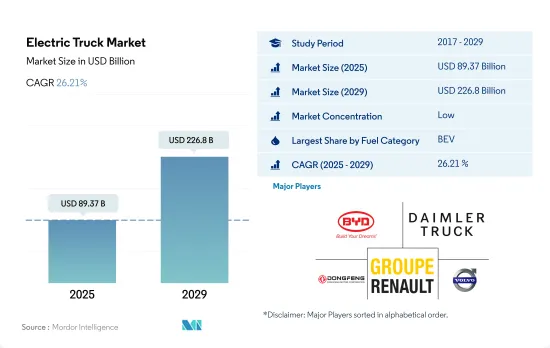

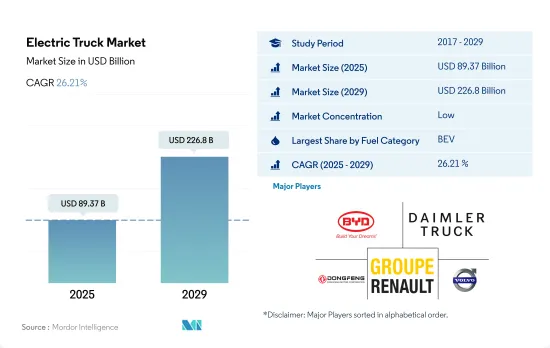

電気トラックの市場規模は2025年に893億7,000万米ドルと推定され、2029年には2,268億米ドルに達すると予測され、予測期間中(2025-2029年)のCAGRは26.21%で成長すると予測されます。

電動中型・大型トラックの世界市場は、よりクリーンな輸送ソリューションの必要性に後押しされ、大きな成長が見込まれる

- 中型・大型セグメントをカバーする世界の電気トラック市場は、持続可能な貨物・物流ソリューションに対する需要の高まりを反映して、2023年に大きな成長を遂げました。この拡大は、輸送排出を抑制する緊急の必要性と車両電動化の世界の推進への直接的な反応です。2024年には、電気自動車(EV)技術の進歩、バッテリーコストの低下、よりクリーンな商業輸送を重視する環境規制の強化に後押しされ、市場は成長の勢いを維持する見通しです。

- EV購入奨励金、充電インフラへの投資、物流・輸送における二酸化炭素排出量削減の義務化といった世界各国の政府政策が、電気トラック採用の増加を後押ししています。これらの措置は、企業の持続可能性への関心の高まりと相まって、電気トラックへのシフトを早めています。企業は、そのオペレーションを環境目標と一致させ、より環境に優しいサプライチェーンに対する消費者の期待に応えようとしています。

- 今後数年間、世界の電気トラック市場は、より効率的で航続距離の長い電気トラックの開発における自動車メーカーの投資増加によって、力強い成長が見込まれます。EV技術における継続的な進歩により、電気トラックはより幅広い輸送用途でますます実行可能になっています。より多くの都市や国が低排出ガス地帯やゼロエミッション物流目標を設定するにつれて、電気トラックの需要は急増するものと思われます。

世界的に、電気トラック市場は、技術の進歩、規制政策、および持続可能性に向けた市場力学の変化により、全地域で大きな成長を経験しています。

- 中国の市場における圧倒的な存在感、野心的な環境政策、EV技術とインフラへの多額の投資が、アジア太平洋地域を世界の電気トラック市場の最前線へと押し上げています。日本と韓国も主要なプレーヤーであり、技術革新と電気自動車導入のための支援政策を重視しています。アジア太平洋地域市場は、強力な政府補助金、急速な技術進歩、持続可能な輸送の重要性の認識の高まりから恩恵を受けています。

- 欧州の電気トラック市場は、その厳しい排出規制、環境持続可能性への強い関心、輸送部門におけるカーボンフットプリント削減の野心的な目標で際立っています。欧州連合のグリーンディールとそのゼロエミッション車推進政策は、欧州大陸全体における電気トラックの採用をさらに促進しています。欧州の製造業者と物流企業は、これらの規制に合わせて電気トラックを迅速に採用しています。

- 北米の電気トラック市場は、規制イニシアチブ、技術的進歩、および進化する消費者嗜好のミックスによって、徐々に成長しています。米国とカナダは、輸送からの温室効果ガス排出を抑制するための取り組みを強化しており、電気自動車の採用を促進するために、連邦政府や州レベルでインセンティブを提供しています。

- 南米の電気トラック市場はまだ始まったばかりで、ブラジルやチリのような国々が、経済変動やインフラ格差といった課題にもかかわらず、電動化の先陣を切っています。これらの国々における電気バスのイントロダクションは、トラックを含む電気商用車の幅広い導入の基礎を築いた。

電気トラック市場の動向

世界の需要の高まりと政府の支援が電気自動車市場の成長を後押し

- 電気自動車(EV)は、エネルギー効率を高め、温室効果ガスや公害の排出を削減する可能性に後押しされ、自動車産業において不可欠なものとなっています。この急成長の主な要因は、環境に対する関心の高まりと政府の支援策にあります。特に、EVの世界販売台数は、2021年と比較して2022年には10.82%増と堅調な伸びを示しました。予測によると、電気乗用車の年間販売台数は2025年末までに500万台を突破し、自動車販売台数全体の約15%を占めるようになります。

- ロンドン警視庁消防局のような大手メーカーや組織は、電動モビリティ戦略を積極的に推進しています。例えば、2025年までに車両をゼロエミッション化し、2030年までにバンの40%を電動化、2040年までに完全電動化を達成するという目標を掲げています。世界的にも同様の動向が予想され、2024年から2030年にかけて電気自動車の需要と販売が急増します。

- アジア太平洋地域と欧州は、バッテリー技術と車両電化の進歩に牽引され、電気自動車生産を支配する態勢を整えています。2020年5月、起亜自動車欧州は「プランS」を発表し、電動化への戦略的シフトを表明しました。この決定は、起亜のEVが欧州で記録的な販売台数を達成したことを受けてのものです。起亜は2025年までに、乗用車、SUV、MPVなどさまざまなセグメントにまたがる11のEVモデルを世界に投入するという野心的な計画を掲げています。同社は2026年までにEVの世界年間販売台数50万台の達成を目指しています。

電気トラック産業の概要

電気トラック市場は断片化されており、上位5社で21.50%を占めています。この市場の主要企業は以下の通り。 BYD Auto, Daimler Truck Holding AG, Dongfeng Motor Corporation, Groupe Renault and Volvo Group(アルファベット順)

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 レポートのオファー

第3章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第4章 主要産業動向

- 人口

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- 一人当たりGDP

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- 自動車購入のための消費支出(cvp)

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- インフレ率

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- 自動車ローンの金利

- 電化の影響

- EV充電ステーション

- バッテリーパック価格

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- Xev新モデル発表

- ロジスティクス・パフォーマンス・インデックス

- アフリカ

- アジア太平洋地域

- 欧州

- 中東

- 北米

- 南米

- 燃料価格

- メーカー別生産統計

- 規制の枠組み

- バリューチェーンと流通チャネル分析

第5章 市場セグメンテーション

- 車両構成

- トラック

- 大型商用トラック

- 中型商用トラック

- トラック

- 燃料カテゴリー

- BEV

- FCEV

- HEV

- PHEV

- 地域

- アフリカ

- 南アフリカ

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- 欧州

- フランス

- ドイツ

- イタリア

- スペイン

- その他欧州

- 中東

- その他中東

- 北米

- カナダ

- メキシコ

- 米国

- 南米

- ブラジル

- その他南米

- アフリカ

第6章 競合情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル

- BYD Auto Co. Ltd.

- Daimler Truck Holding AG

- Dongfeng Motor Corporation

- Groupe Renault

- Hino Motors Ltd.

- Isuzu Motors Limited

- Navistar International Transportation Corporation

- PACCAR Inc.

- Scania AB

- Volvo Group

第7章 CEOへの主な戦略的質問

第8章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(DROs)

- 情報源と参考文献

- 図表一覧

- 主要洞察

- データパック

- 用語集

目次

Product Code: 93015

The Electric Truck Market size is estimated at 89.37 billion USD in 2025, and is expected to reach 226.8 billion USD by 2029, growing at a CAGR of 26.21% during the forecast period (2025-2029).

The global market for electric medium and heavy-duty trucks is poised for significant growth, driven by the imperative for cleaner transportation solutions

- The global electric truck market, covering medium and heavy-duty segments, witnessed significant growth in 2023, reflecting a rising demand for sustainable freight and logistics solutions. This expansion is a direct response to the urgent need to curb transportation emissions and the global push for vehicle electrification. In 2024, the market is poised to sustain its growth momentum, propelled by advancements in electric vehicle (EV) technology, falling battery costs, and stricter environmental regulations emphasizing cleaner commercial transportation.

- Government policies worldwide, such as EV purchase incentives, investments in charging infrastructure, and mandates to reduce carbon footprints in logistics and transportation, are bolstering the upswing in electric truck adoption. These measures, coupled with a growing corporate focus on sustainability, are hastening the shift to electric trucks. Businesses are aligning their operations with environmental goals and meeting consumer expectations for greener supply chains.

- In the coming years, the global electric truck market is set for robust growth, fueled by increased investments from vehicle manufacturers in developing more efficient and longer-range electric trucks. Ongoing advancements in EV technology are making electric trucks increasingly viable across a broader range of transport applications. As more cities and countries establish low-emission zones and zero-emission logistics targets, the demand for electric trucks is poised to surge.

Globally, the electric truck market is experiencing significant growth across all regions, driven by technological advancements, regulatory policies, and shifting market dynamics toward sustainability

- China's dominant market presence, ambitious environmental policies, and significant investments in EV technology and infrastructure are propelling the APAC region to the forefront of the global electric truck market. Japan and South Korea are also key players, emphasizing innovation and supportive policies for electric vehicle adoption. The APAC market benefits from robust government subsidies, rapid technological advancements, and a heightened recognition of the importance of sustainable transportation.

- The European electric truck market stands out for its stringent emissions regulations, strong focus on environmental sustainability, and ambitious targets for reducing carbon footprints in the transport sector. The European Union's Green Deal and its pro-zero-emission vehicle policies have further expedited the adoption of electric trucks across the continent. European manufacturers and logistics firms are swiftly embracing electric trucks to align with these regulations.

- The North American electric truck market is growing gradually, driven by a mix of regulatory initiatives, technological advancements, and evolving consumer preferences. The United States and Canada are intensifying their efforts to curb greenhouse gas emissions from transportation, offering incentives at federal and state levels to promote electric vehicle adoption.

- The South American electric truck market is nascent, with countries like Brazil and Chile spearheading electrification despite challenges such as economic volatility and infrastructure gaps. The introduction of electric buses in these countries has laid the groundwork for the broader adoption of electric commercial vehicles, including trucks.

Electric Truck Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Truck Industry Overview

The Electric Truck Market is fragmented, with the top five companies occupying 21.50%. The major players in this market are BYD Auto Co. Ltd., Daimler Truck Holding AG, Dongfeng Motor Corporation, Groupe Renault and Volvo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Trucks

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Medium-duty Commercial Trucks

- 5.1.1 Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 South Korea

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.5.2 Mexico

- 5.3.5.3 US

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.6.2 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler Truck Holding AG

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Groupe Renault

- 6.4.5 Hino Motors Ltd.

- 6.4.6 Isuzu Motors Limited

- 6.4.7 Navistar International Transportation Corporation

- 6.4.8 PACCAR Inc.

- 6.4.9 Scania AB

- 6.4.10 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms