|

市場調査レポート

商品コード

1851557

クラフトビール:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Craft Beer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クラフトビール:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月13日

発行: Mordor Intelligence

ページ情報: 英文 156 Pages

納期: 2~3営業日

|

概要

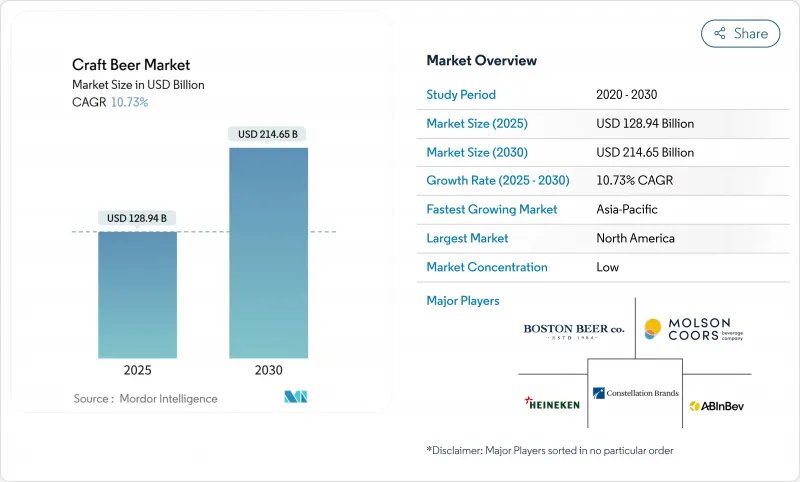

世界のクラフトビール市場は、2025年の1,289億4,000万米ドルから2030年には2,146億5,000万米ドルに拡大し、CAGR 10.73%で推移すると予測されています。

この成長は、特徴的な原料や地域の味を紹介する職人的なビールに対する消費者の嗜好の高まりに起因しています。市場力学は、低アルコール品種と多様な風味プロファイルへのシフトを反映しており、地ビールメーカーや既存のビールメーカーは製品ポートフォリオの拡大を余儀なくされています。パッケージ動向では、携帯性に優れ、持続可能で鮮度保持に優れた缶が好まれるようになっています。オン・トレード・チャネル、特にパブやクラフト・タップルームが販売の優位性を維持する一方で、オフ・トレード・セグメントは小売店やデジタル・プラットフォームを通じて着実に成長しています。地域別では、北米が最大市場の座を維持する一方、アジア太平洋地域は、都市化の進展、可処分所得の増加、進化する地ビールエコシステムに支えられ、急成長を示しています。

世界のクラフトビール市場の動向と洞察

旺盛な需要による地ビール醸造所の増加

クラフトビール市場は、地ビール醸造所の増加によって大きく成長しています。Brewers Associationによると、米国のクラフトビール醸造所の数は2020年の9,092から2023年には9,906に増加し、地元で生産された少量生産の個性的な風味のビールへの消費者のシフトを反映しています。この拡大は、本物の製品、伝統的な醸造方法、地域コミュニティとのつながりに対する消費者の関心を反映しています。現在では、多くの施設がタップルームを併設し、地元のフードベンダー、アーティスト、ミュージシャンを招いたイベントを開催しています。マイクロブルワリーは、職人的な製造方法を維持しながら、オペレーションを改善するためにテクノロジーを取り入れています。自動発酵制御、IoT機能付き醸造センサー、予知保全システムを使って、安定した品質を確保し、無駄を省いています。このような技術統合により、マイクロブルワリーは伝統的な醸造方法を維持しながら、効率的に事業を拡大し、収益性を向上させ、市場の変化に適応することができます。

原料、フレーバー、アルコール度数による製品の差別化

クラフトビールメーカーは、伝統的なビールの種類を超えた革新的な製品を開発することで、競争上の優位性を獲得するため、戦略的に製品の差別化を採用してきました。特に、独特の味覚体験を求める若い消費者の共感を呼ぶフルーツ風味や菓子類風味のビールの導入を通じて、市場は実験的な方向に大きくシフトしています。プレミアム・セグメントでは、機能性原料の統合が進んでおり、ビールメーカーは適応原性化合物や健康に焦点を当てた添加物を取り入れ、独自の市場ポジションを確立しています。多様な消費者の嗜好に対応するため、醸造所は、高アルコール度数のスペシャルティ・ビールと低アルコール度数のセッション・ビールの両方を含むポートフォリオを体系的に拡大してきました。ペンシルベニア州エクステンションの調査によると、ペンシルベニア州のクラフトビール製造業者の51%以上が、地元産のホップを購入する可能性がやや高いか、非常に高いことが分かっており、65%がビール製造に使用する果物や野菜の地元購入を検討しています。このような包括的な差別化アプローチにより、クラフトビールメーカーは戦略的な製品の反復や限定リリースの実施を通じて市場競争力を維持し、消費者の関心を効果的に喚起しながら、高騰する製造コストを補うプレミアム価格体系を支えることができます。

厳しい政府規制

市場力学業界は、その市場軌道と経営力学に大きな影響を与える、ますます複雑化する規制環境に直面しています。米国では、2025年1月にアルコール飲料にがん警告を表示することが提案されているが、これはタバコ型の健康表示への根本的な転換を意味し、消費者の意識を一変させる可能性があります。同時に、アルコール・タバコ税貿易局(TTB)は包括的なラベリング要件を導入し、主要な食品アレルゲンの開示とアルコール情報表示を義務付けた。こうした規制の動向は、アルコール監督における国際的な動向を反映したものであり、保健当局はアルコール関連の健康への影響をますます重視するようになっています。健康警告の強化は、低アルコール代替品や別の飲料カテゴリーへの消費者の移行を加速させる可能性があるため、規制の影響は当面のコンプライアンス費用を超え、市場力学に影響を与える可能性があります。業界は今、革新性と真正性という独自の特徴を維持しながら、こうした規制要件を統合するという重大な課題に直面しています。このことは、厳しいコンプライアンス対策と消費者との持続的な関わりや市場での存在感とのバランスを取らなければならない製造業者にとって、複雑な経営状況を生み出しています。

セグメント分析

2024年の市場シェアはエールが32.58%を占め、その際立った風味とクラフトビール生産における優位性によってビール市場をリードしています。この市場地位は、エールの多様性によってビールメーカーが多様な風味のバリエーションを生み出すことができる一方で、より充実した味わいプロファイルを求める消費者の嗜好を反映しています。伝統的にラガー中心の市場において、クラフトビールメーカーがユニークなエールを提供することで市場での存在感を確立しているため、クラフトビールムーブメントとエール醸造との結びつきは、このカテゴリーの優位性を強めています。

その他のビール・タイプ・セグメントは、2025~2030年にCAGR 10.95%で成長すると予想されます。この成長は、サワービール、ハイブリッドスタイル、実験的なビールなどの特殊品種に対する消費者の関心から生じています。米国農務省のデータによると、クラフトビール醸造所は2022年から2024年にかけて、実験的なビアスタイルのために特殊な穀物や添加物の使用を増やしました。コールドIPAは、ラガー酵母と強力なホップの特徴を組み合わせたこの醸造イノベーションの代表です。このセグメントの成長を支えているのは、クラフトビール醸造所、ワイナリー、蒸留所のコラボレーションであり、多様な風味体験を求める消費者の需要に応える新しい飲料カテゴリーを生み出しています。

クラフトビール市場は明確な性別分布を示し、2024年の市場シェアは男性が72.43%を占める。この優位性は、確立された消費パターンと、歴史的に男性消費者に焦点を当てたマーケティング戦略によるものです。クラフトビール分野はこの傾向を例証しており、男性愛好家は当初、従来のビールの代替品を求めて市場成長を牽引していました。彼らの市場リーダーシップは、クラフトビールの知識を文化的洗練と結びつける確立された社会慣行を通じて続いています。

女性向けセグメントはダイナミックな促進要因であり、2025~2030年のCAGRは11.27%と市場全体の拡大率を上回ると予測されています。この進化は、社会規範の変化、ターゲットを絞ったマーケティング・アプローチ、女性消費者に特化した製品イノベーションを反映しています。ビール会社は、フルーツ風味のサワーやマイルドなIPAなど、女性の嗜好に沿った製品を開発することで対応しています。女性消費者層の重要性は個人消費にとどまらず、家計支出に対する大きな影響力が個人と家族のビール購入に影響を及ぼしています。

クラフトビール市場レポートは、製品タイプ別(エール、ラガー、その他のタイプ)、エンドユーザー別(男性、女性)、パッケージ別(ボトル、缶、その他)、流通チャネル別(オン・トレード、オフ・トレード)、地域別(北米、欧州、アジア太平洋、南米、中東アフリカ)に業界をセグメンテーションしています。市場セグメンテーションは、上記のすべてのセグメントについて米ドル建てで表示されています。

地域別分析

北米は2024年のクラフトビール世界市場において49.65%のシェアを占めており、その背景には確立されたクラフトビールエコシステムと消費者のプレミアム製品志向の高まりがあります。この地域の強固なインフラは、約10,000の醸造所を擁し、大量生産よりも品質と革新が優先される市場を反映しています。包括的な規制の枠組みは、ある種の課題を提示しながらも、企業にとって明確な運営上のパラメーターを確立し、新しい醸造所の設立を常に刺激する活発な起業環境によって補完されています。

アジア太平洋は、2025~2030年のCAGRが12.05%と予測される、市場で最もダイナミックな地域です。この成長軌道は、急速な都市化、可処分所得の増加、クラフト・アルコール飲料に対する消費者の態度の変化に起因しています。同地域の都市部では、欧米の影響と中流階級の人口増加が交錯し、プレミアム・ビールに対する旺盛な需要が創出されるなど、市場開拓が著しいです。中国はこの動向を象徴しており、クラフトビールの醸造所登録数は2020年の1,182から2024年には2,010へと急増します。日本と韓国は、その豊かな醸造の伝統を活用してクラフトビールの採用を促進し、着実な市場拡大を維持しています。ベトナムやタイなどの新興国は、クラフトビールが社会的に広く受け入れられ、市場に浸透するにつれて、有望な成長の可能性を示しています。デジタルプラットフォームと高度な醸造技術の統合は、特にインターネット接続が急速に普及している地域において、市場開拓を加速させる。

南米では、プレミアムでユニークなアルコール飲料を求める都市部のミレニアル世代に牽引され、特にブラジルやアルゼンチンなど、地元の地ビールメーカーが人気を集めている国々で勢いが増しています。欧州では、市場は成熟しているが、英国、ドイツ、ベルギーで独立系醸造所が存在感を示しており、活気に満ちています。消費者はますます職人的な製品を好むようになっており、風味プロファイルの革新や持続可能な醸造方法に拍車をかけています。一方、中東・アフリカ地域は、宗教的・規制的な制約から始まったばかりではあるが、特にアラブ首長国連邦(UAE)と南アフリカでは、外国人人口の増加と飲料消費に関する社会規範の変化に支えられ、ノンアルコール・セグメントとプレミアム輸入品が徐々に成長しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 旺盛な需要による地ビール醸造所の増加

- 原料、フレーバー、アルコール度数による製品の差別化

- 低アルコール飲料の需要急増

- パブ&バーチェーンによる戦略的拡大

- 成長する観光・ホスピタリティ部門

- 生産面での技術進歩

- 市場抑制要因

- 厳しい政府規制

- 過剰消費をめぐる健康問題

- 消費者の機能性飲料への傾斜

- 醸造事業における熟練労働者の不足

- 消費者行動分析

- 規制の見通し

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長

- 製品タイプ別

- エール

- ラガー

- その他のビールタイプ

- エンドユーザー別

- 男性

- 女性

- パッケージング別

- ボトル

- 缶

- その他

- 流通チャネル別

- オントレード

- オフトレード

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- オランダ

- イタリア

- スウェーデン

- ノルウェー

- ベルギー

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ベトナム

- インドネシア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- チリ

- コロンビア

- ペルー

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- ナイジェリア

- サウジアラビア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Anheuser-Busch InBev SA/NV

- Heineken N.V.

- Molson Coors Beverage Company

- Boston Beer Company Inc.

- Constellation Brands Inc.

- D.G. Yuengling and Son Inc.

- Kirin Holdings Co.Ltd

- Sierra Nevada Brewing Co.

- BrewDog plc

- Sapporo Holdings Ltd.

- Monster Beverage Corporation(Oskar Blues Brewery)

- Deschutes Brewery

- Artisanal Brewing Ventures

- Tsingtao Brewery Co.,Ltd.

- Thai Beverage Public Limited Company

- Diageo Plc

- Asahi Group Holdings Ltd

- Brooklyn Brewery Corp.

- Victory Brewing Company

- San Miguel Corporation