|

市場調査レポート

商品コード

1850008

スマート製造:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマート製造:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月26日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

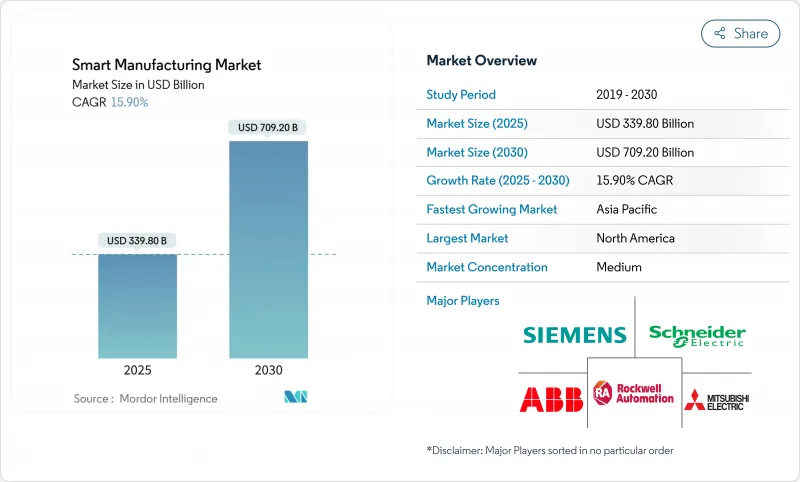

スマート製造の市場規模は、2025年に3,398億米ドルと評価され、2030年には7,092億米ドルに上昇し、15.90%のCAGRで推移すると予測されています。

リアルタイム分析、マシン・コネクティビティ、AIを活用したプロセス制御が収束して大幅な効率向上を実現する一方、各国政府は弾力的な国内生産能力に向けて奨励策を打ち出しています。エネルギーコストの上昇とカーボンプライス制度が工場レベルの透明性ソリューションへの関心を高め、労働力不足が協働ロボットと自律型マテリアルハンドリングシステムへの需要を強めています。ベンダーは新しい製品にプライベート5Gとエッジ分析を組み込み、セーフティ・クリティカルなプロセスのためのマイクロ秒の応答時間を可能にしています。競合の焦点は、ハードウェアのリフレッシュ・サイクルから、予測的考察とエネルギー最適化を収益化するソフトウェアのサブスクリプション・モデルへと移行しています。

世界のスマート製造市場の動向と洞察

効率化を目的としたインダストリー4.0/IIoTの採用が増加

工場がセンサー、分析、クラウドダッシュボードを統合することで、IIoTの導入は現在、52%の生産性向上と25%のコスト削減を実現しています。米国製造業拡張パートナーシップは、2024年に36,000社を支援し、スマート製造プログラムを通じて162億米ドルの売上を増加させました。接続された資産が統合データレイクに供給されることで、オペレータはライン停止を排除し、動的に生産能力をリバランスできます。航空宇宙のような精密さが要求されるセクターは、スクラップや保証クレームを減らすためにデジタルトレーサビリティを採用し、接続アーキテクチャの持続的なアップグレードに拍車をかけています。

デジタル工場に対する政府のインセンティブと政策的義務

連邦政府および州レベルの資金提供イニシアティブは、的を絞った財政支援と規制の枠組みを通じて、スマート製造の採用を加速させています。州政府の製造業リーダーシッププログラムは、中小製造業者向けに高性能コンピューティングリソースと技術支援を提供することで製造能力を強化するため、5,000万米ドルを拠出しています。一方、ドイツのインダストリー4.0イニシアチブは、中小企業に技術導入に関するガイダンスを提供する「ミッテルシュタント4.0エクセレンスセンター」の支援を受け、2020年までに年間400億ユーロの投資を見込んでいます。

高いCAPEXと不確実な中小企業のROI

中小企業は、先行投資と投資回収のタイムラインが不透明なため、スマート製造の導入に大きな障壁があります。包括的なスマート製造システムの導入コストは、数十万米ドルから数百万米ドルにも及び、リソースが限られた企業にとっては財務的な負担となります。相互接続されたシステムのROI計算が複雑であるため、中小企業の意思決定者は、特に2~3年間はメリットが顕在化しない可能性がある場合、投資を正当化することが難しくなります。

セグメント分析

製造実行システムは2024年にスマート製造市場の22.4%を占め、工場運営のデジタルバックボーンとしての役割を明確にしました。MESのスマート製造市場規模は、メーカーがグローバル工場全体のリアルタイムの可視化を義務付けていることから、2032年には417億8,000万米ドルに達すると予測されています。CAGR18.7%で拡大するデジタルツインプラットフォームにより、エンジニアはさまざまな負荷の下で機器の動作をシミュレートできるようになり、試運転時間を30%短縮できます。PLCとSCADAは依然として基本だが、ベンダーはパラメーターを自律的に調整するAIモジュールを組み込んでいます。エッジ分析ソフトウェアは、高速包装ラインの意思決定ループを短縮し、集中型サーバーから現場のマイクロデータセンターへのシフトを示しています。

ソフトウェア定義のアップグレードは、粘着性のある年間経常収益を生み出し、既存企業はライセンス更新にアナリティクスをバンドルするよう促されます。人間ー機械インターフェイスツールは拡張現実へと移行し、ライン技術者にガイド付きワークフローを提供します。製品ライフサイクル管理ソリューションはサプライチェーンのポータルと統合され、設計者は製造可能性を早期に検証できるようになります。これらの技術革新は、継続的改善投資の主要な導管としてスマート製造市場を強化します。

ソフトウェアは2024年の売上高の49.6%を占め、データ主導のワークフローへの軸足を反映しています。CAGRが17.5%になると予測される産業用ロボットは、慢性的な労働力不足と柔軟なバッチサイズのニーズに対応します。制御装置は現在、オンデバイスの推論エンジンを組み込んでおり、クラウドの待ち時間なしで自律的な調整を可能にしています。工場が統合、トレーニング、管理されたサイバーセキュリティをアウトソーシングすることで、サービス収入が拡大します。

プライベート5Gネットワークは、決定論的なレイテンシで1フロア上の数万のエンドポイントをサポートすることで、通信セグメントを再形成します。ベンダーは通信事業者と周波数戦略を共同開発し、接続性を戦略的堀に変えます。その結果、スマート製造市場はOTハードウェアとITソフトウェアの境界線を曖昧にし続け、デジタル価値創造のための統合プラットフォームを作り上げます。

地域分析

北米は2024年の売上高の42.3%を占め、米国エネルギー省の3,300万米ドルの助成金プログラムとManufacturing Extension Partnershipの全国的なアウトリーチに支えられています。ベンチャーキャピタルがテクノロジーの普及を加速させ、プライベートエクイティファンドがMES、ロボット統合、サイバーセキュリティサービスをバンドルしたプラットフォームのロールアップを追求。地域のサプライヤーは、リモート溶接のような遅延の影響を受けやすい使用事例を検証するために、民間の5Gテストベッドを採用しています。

アジア太平洋はCAGR 15.9%で最も急成長している地域であり、「メイド・イン・チャイナ2025」の旗印の下、中国が33のイノベーションセンターを設置し、韓国が従業員1万人当たり1,012台という世界をリードするロボット密度を推進しています。インドのデジタルインフラ成長イニシアティブは、3極のパートナーに支えられ、新興企業の参入障壁を下げ、同国をMES開発の新興国として位置づけています。

欧州では、400億ユーロ(440億米ドル)の年間投資予測とMittelstand 4.0コンピテンスセンターを背景に、ドイツのIndustrie 4.0に根ざした着実な導入が進んでいます。カーボンボーダー調整メカニズムは、エネルギー集約度ダッシュボードの需要を増幅し、欧州ベンダーに炭素会計モジュールにおける先行者利益をもたらします。これらの力学を総合すると、スマート製造市場において地域の専門性が強化され、ベンダーの市場参入のためのプレイブックが形成されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 効率化のためのインダストリー4.0/IIoTの導入増加

- デジタル工場に対する政府のインセンティブと政策義務

- 熟練労働者の不足が自動化の導入を加速

- 炭素国境調整メカニズム(CBAM)が工場レベルのエネルギー透明性を促進

- デジタルツインベースの予知保全サービスの収益

- 超低遅延制御を可能にするプライベート5Gネットワークの展開

- 市場抑制要因

- 高額な設備投資と中小企業のROIの不確実性

- サイバーセキュリティ/データ主権に関する懸念

- 相互運用性を制限する旧式のアナログ機器

- 半導体サプライチェーンの不安定さが制御ハードウェアの遅延を招いている

- バリュー/サプライチェーン分析

- 規制情勢

- ファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場規模と成長予測

- 技術別

- プログラマブルロジックコントローラ(PLC)

- 監視制御およびデータ収集(SCADA)

- エンタープライズリソースプランニング(ERP)

- 分散制御システム(DCS)

- ヒューマンマシンインターフェース(HMI)

- 製品ライフサイクル管理(PLM)

- 製造実行システム(MES)

- デジタルツインプラットフォーム

- エッジ分析ソフトウェア

- その他のテクノロジー

- コンポーネント別

- ハードウェア

- ロボット工学

- センサー

- マシンビジョンシステム

- 制御デバイス

- ソフトウェア

- MES

- PLM

- SCADA/ERPスイート

- デジタルツイン/AIと分析

- サービス

- 統合と実装

- コンサルティングとトレーニング

- マネージドサービス

- 通信セグメント

- ハードウェア

- 展開モード別

- オンプレミス

- クラウド

- ハイブリッド

- エンドユーザー業界別

- 自動車

- 半導体およびエレクトロニクス

- 石油・ガス

- 化学および石油化学

- 医薬品およびライフサイエンス

- 航空宇宙および防衛

- 食品・飲料

- 金属および鉱業

- エネルギーと公益事業

- 物流と倉庫

- その他の業界

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- ロシア

- その他欧州地域

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリアとニュージーランド

- ASEAN-5

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ABB Ltd.

- Emerson Electric Co.

- FANUC Corporation

- General Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Inc.

- Yokogawa Electric Corp.

- Cisco Systems Inc.

- IBM Corp.

- Oracle Corp.

- SAP SE

- Johnson Controls Intl. plc

- PTC Inc.

- Dassault Systems SE

- 3D Systems Corp.

- Stratasys Ltd.

- Delta Electronics Inc.

- Capgemini SE