|

|

市場調査レポート

商品コード

1652643

スマートマニュファクチャリング市場:技術別、業界別、地域別 - 2029年までの予測Smart Manufacturing Market: Edge Computing, Industrial 3D Printing, Robots, Sensor, Machine Vision, Artificial intelligence, Cybersecurity, Digital Twin, Private 5G, AGV, AMR, AR & VR, CAD, CAM, PLM, HMI, IPC, MES, WMS, and ERP - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| スマートマニュファクチャリング市場:技術別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2025年02月14日

発行: MarketsandMarkets

ページ情報: 英文 391 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマートマニュファクチャリングの市場規模は、2024年に2,333億3,000万米ドルとなりました。

同市場は、2029年には4,791億7,000万米ドルに達すると予測され、予測期間中のCAGRは15.5%と見込まれています。3Dプリンティング技術に対する政府支出の増加が、スマートマニュファクチャリング市場の成長を促進しています。一方、初期設備投資の高さがスマートマニュファクチャリング市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

産業用ロボット分野は、予測期間中に2番目に高いCAGRを示すと予測されています。産業用ロボットの開発は、生産性、品質、コスト、安全性などの顕著な改善により、著しく飛躍しました。単純で反復的な機能を実行するロボットのイントロダクションより、ヒューマンエラーの可能性を最小限に抑えながら24時間サービスを提供することが可能になっています。人工知能(AI)や協働ロボットなどの技術開発も、製造、倉庫管理、物流などの分野でのロボット利用を刺激しています。

石油・ガスセグメントは、2024年にスマートマニュファクチャリング市場で第2位のシェアを占めると予想されています。石油・ガス産業がスマートマニュファクチャリング市場で主導権を握る主な理由は、この分野が特に必要とする課題や必要性による。この分野では、安全性、効率性、遠隔地、データ主導の意思決定、厳格な規制が特に重視されているため、市場シェアは第2位となっています。予知保全、自動化、ロボットは、この業界のコスト削減、安全性向上、効率化に役立つ重要なスマート技術の一部です。

北米市場は予測期間中、2番目に高いCAGRを示すと予想されます。米国では、税制改革への取り組み、製造業やインフラ企業向けの重要なパッケージの発表、大手テクノロジープロバイダーの利用可能性など、優れたビジネスエコシステムが、同地域でのスマートマニュファクチャリング技術の採用に好材料となっています。さらに、最適な資産活用への強い関心、職場と個人の安全に関する厳しい政府規制の施行、石油・ガス、化学、飲食品産業における生産品質の管理と保証の必要性に対する高い意識が、この地域における機械状態監視システムとプラント資産管理(PAM)ソリューションの需要を促進しています。

当レポートでは、世界のスマートマニュファクチャリング市場について調査し、技術別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- スマートマニュファクチャリング市場における生成AI/AIの影響

第6章 スマートマニュファクチャリング市場、技術別

- イントロダクション

- 自動化および制御システム

- 資産管理とメンテナンス管理

- 製造オペレーションシステム

- 産業用ネットワークと接続性

- 産業用ロボット

- センサーとビジョンシステム

- デジタル変革システム

- 設計・計画システム

第7章 スマートマニュファクチャリング市場、業界別

- イントロダクション

- 石油・ガス

- 食品・飲料

- 医薬品

- 化学薬品

- エネルギー・電力

- 金属・鉱業

- パルプ・紙

- 自動車

- 航空宇宙

- 半導体・エレクトロニクス

- 医療機器

- 重機

- その他

第8章 スマートマニュファクチャリング市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年~2025年

- 産業用ロボットの市場シェア分析、2023年

- 収益分析、2019年~2023年

- 産業用センサーの市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第10章 企業プロファイル

- 主要参入企業

- ABB

- EMERSON ELECTRIC CO.

- GENERAL ELECTRIC COMPANY

- HONEYWELL INTERNATIONAL INC.

- ROCKWELL AUTOMATION

- SCHNEIDER ELECTRIC

- SIEMENS

- YOKOGAWA ELECTRIC CORPORATION

- 3D SYSTEMS, INC.

- CISCO SYSTEMS, INC.

- IBM

- MITSUBISHI ELECTRIC CORPORATION

- ORACLE

- SAP

- STRATASYS

- その他の企業

- COGNEX CORPORATION

- INTEL CORPORATION

- KEYENCE CORPORATION

- NVIDIA CORPORATION

- PTC

- SAMSUNG

- SONY CORPORATION

- UNIVERSAL ROBOTS A/S

- OMRON CORPORATION

- ADDVERB TECHNOLOGIES LIMITED

- LOCUS ROBOTICS

- EIRATECH ROBOTICS LTD.

- GREYORANGE

第11章 付録

List of Tables

- TABLE 1 SMART MANUFACTURING MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN SMART MANUFACTURING ECOSYSTEM

- TABLE 3 INDICATIVE PRICING TREND OF INDUSTRIAL ROBOTS OFFERED BY KEY PLAYERS, BY ROBOT TYPE (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF DIGITAL TEMPERATURE SENSORS OFFERED BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF TRADITIONAL ROBOTS, BY PAYLOAD CAPACITY (USD)

- TABLE 6 LIST OF MAJOR PATENTS, 2022-2024

- TABLE 7 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (Q1-Q3) (USD BILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (Q1-Q3) (USD BILLION)

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INTERNATIONAL: SAFETY STANDARDS

- TABLE 15 NORTH AMERICA: SAFETY STANDARDS

- TABLE 16 EUROPE: SAFETY STANDARDS

- TABLE 17 ASIA PACIFIC: SAFETY STANDARDS

- TABLE 18 ROW: SAFETY STANDARDS

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 22 SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 23 SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 24 AUTOMATION & CONTROL SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 AUTOMATION & CONTROL SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 26 AUTOMATION & CONTROL SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 AUTOMATION & CONTROL SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 29 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 30 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY HARDWARE, 2020-2023 (USD MILLION)

- TABLE 31 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 32 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET FOR SOFTWARE, BY DEPLOYMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 33 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET FOR SOFTWARE, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 34 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 35 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 36 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 HUMAN-MACHINE INTERFACE: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 39 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 40 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 41 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 42 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 INDUSTRIAL PC: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 ASSET & MAINTENANCE MANAGEMENT: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 45 ASSET & MAINTENANCE MANAGEMENT: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 46 ASSET & MAINTENANCE MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 ASSET & MAINTENANCE MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 PLANT ASSET MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 49 PLANT ASSET MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 50 PLANT ASSET MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 PLANT ASSET MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 MACHINE CONDITION MONITORING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 53 MACHINE CONDITION MONITORING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 MACHINE CONDITION MONITORING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 MACHINE CONDITION MONITORING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 57 COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 58 COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 ASSET PERFORMANCE MAINTENANCE: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 61 ASSET PERFORMANCE MAINTENANCE: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 62 ASSET PERFORMANCE MAINTENANCE: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 ASSET PERFORMANCE MAINTENANCE: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 MANUFACTURING OPERATION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 MANUFACTURING OPERATION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 66 MANUFACTURING OPERATION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 MANUFACTURING OPERATION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 MANUFACTURING EXECUTION SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 MANUFACTURING EXECUTION SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 MANUFACTURING EXECUTION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 MANUFACTURING EXECUTION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 WAREHOUSE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 73 WAREHOUSE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 74 WAREHOUSE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 WAREHOUSE MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 MANUFACTURING OPERATION MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 77 MANUFACTURING OPERATION MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 MANUFACTURING OPERATION MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 MANUFACTURING OPERATION MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 ENTERPRISE RESOURCE PLANNING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 81 ENTERPRISE RESOURCE PLANNING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 ENTERPRISE RESOURCE PLANNING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 83 ENTERPRISE RESOURCE PLANNING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 QUALITY MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 QUALITY MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 QUALITY MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 87 QUALITY MANAGEMENT SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 INDUSTRIAL NETWORKING & CONNECTIVITY: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 INDUSTRIAL NETWORKING & CONNECTIVITY: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 INDUSTRIAL NETWORKING & CONNECTIVITY: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 INDUSTRIAL NETWORKING & CONNECTIVITY: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 PRIVATE 5G: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 93 PRIVATE 5G: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 PRIVATE 5G: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 95 PRIVATE 5G: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 EDGE COMPUTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 EDGE COMPUTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 EDGE COMPUTING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 EDGE COMPUTING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 CLOUD COMPUTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 101 CLOUD COMPUTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 CLOUD COMPUTING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 103 CLOUD COMPUTING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 104 INDUSTRIAL COMMUNICATION: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 105 INDUSTRIAL COMMUNICATION: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 INDUSTRIAL COMMUNICATION: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 107 INDUSTRIAL COMMUNICATION: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 108 INDUSTRIAL ROBOTICS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 109 INDUSTRIAL ROBOTICS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 110 INDUSTRIAL ROBOTICS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 111 INDUSTRIAL ROBOTICS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 112 INDUSTRIAL 3D PRINTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 113 INDUSTRIAL 3D PRINTING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 114 INDUSTRIAL 3D PRINTING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 115 INDUSTRIAL 3D PRINTING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 116 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 117 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 118 INDUSTRIAL ROBOTS, SMART MANUFACTURING MARKET, BY PRODUCT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 119 INDUSTRIAL ROBOTS, SMART MANUFACTURING MARKET, BY PRODUCT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 120 TRADITIONAL ROBOTS, SMART MANUFACTURING MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 121 TRADITIONAL ROBOTS, SMART MANUFACTURING MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 122 COLLABORATIVE ROBOTS, SMART MANUFACTURING MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 123 COLLABORATIVE ROBOTS, SMART MANUFACTURING MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 124 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 125 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 INDUSTRIAL ROBOTS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 AUTOMATED GUIDED VEHICLES: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 129 AUTOMATED GUIDED VEHICLES: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 130 AUTOMATED GUIDED VEHICLES: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 131 AUTOMATED GUIDED VEHICLES: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 132 AUTONOMOUS MOBILE ROBOTS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 133 AUTONOMOUS MOBILE ROBOTS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 134 AUTONOMOUS MOBILE ROBOTS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 AUTONOMOUS MOBILE ROBOTS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 SENSORS & VISION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 137 SENSORS & VISION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 138 SENSORS & VISION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 139 SENSORS & VISION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 140 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 141 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 142 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 143 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 144 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 145 INDUSTRIAL SENSORS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 146 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 147 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 148 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 149 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 150 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 151 INDUSTRIAL MACHINE VISION: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 152 DIGITAL TRANSFORMATION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 153 DIGITAL TRANSFORMATION SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 154 DIGITAL TRANSFORMATION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 155 DIGITAL TRANSFORMATION SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 156 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 157 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 158 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 159 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 160 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 161 AI IN MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 162 INDUSTRIAL CYBERSECURITY: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 163 INDUSTRIAL CYBERSECURITY: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 164 INDUSTRIAL CYBERSECURITY: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 165 INDUSTRIAL CYBERSECURITY: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 166 DIGITAL TWIN: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 167 DIGITAL TWIN: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 168 DIGITAL TWIN: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 DIGITAL TWIN: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 170 AR & VR IN MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 171 AR & VR IN MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 172 AR & VR IN MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 173 AR & VR IN MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 174 DESIGN & PLANNING SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 175 DESIGN & PLANNING SYSTEMS: SMART MANUFACTURING MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 176 DESIGN & PLANNING SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 177 DESIGN & PLANNING SYSTEMS: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 178 COMPUTER-AIDED DESIGN: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 179 COMPUTER-AIDED DESIGN: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 180 COMPUTER-AIDED DESIGN: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 181 COMPUTER-AIDED DESIGN: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 182 COMPUTER-AIDED MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 183 COMPUTER-AIDED MANUFACTURING: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 184 COMPUTER-AIDED MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 185 COMPUTER-AIDED MANUFACTURING: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 186 PRODUCT LIFECYCLE MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 187 PRODUCT LIFECYCLE MANAGEMENT: SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 188 PRODUCT LIFECYCLE MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 189 PRODUCT LIFECYCLE MANAGEMENT: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 190 SMART MANUFACTURING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 191 SMART MANUFACTURING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 192 SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 193 SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 194 NORTH AMERICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 195 NORTH AMERICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 196 NORTH AMERICA: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 197 NORTH AMERICA: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 198 EUROPE: SMART MANUFACTURING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 199 EUROPE: SMART MANUFACTURING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 200 EUROPE: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 201 EUROPE: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 202 ASIA PACIFIC: SMART MANUFACTURING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 203 ASIA PACIFIC: SMART MANUFACTURING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 204 ASIA PACIFIC: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 206 ROW: SMART MANUFACTURING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 207 ROW: SMART MANUFACTURING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 208 ROW: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 209 ROW: SMART MANUFACTURING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 210 SOUTH AMERICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 211 SOUTH AMERICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: SMART MANUFACTURING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 214 SMART MANUFACTURING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 215 INDUSTRIAL ROBOTICS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 216 INDUSTRIAL SENSORS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 217 INDUSTRIAL ROBOTICS MARKET: PAYLOAD FOOTPRINT

- TABLE 218 INDUSTRIAL ROBOTICS MARKET: ROBOT TYPE FOOTPRINT

- TABLE 219 INDUSTRIAL ROBOTICS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 220 INDUSTRIAL ROBOTICS MARKET: REGION FOOTPRINT

- TABLE 221 INDUSTRIAL ROBOTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 222 INDUSTRIAL ROBOTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 223 SMART MANUFACTURING MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, APRIL 2023-JANUARY 2025

- TABLE 224 SMART MANUFACTURING MARKET: DEALS, APRIL 2023-JANUARY 2025

- TABLE 225 SMART MANUFACTURING MARKET: EXPANSIONS, APRIL 2023-JANUARY 2025

- TABLE 226 SMART MANUFACTURING MARKET: OTHER, APRIL 2023-JANUARY 2025

- TABLE 227 ABB: COMPANY OVERVIEW

- TABLE 228 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 230 ABB: DEALS

- TABLE 231 ABB: EXPANSIONS

- TABLE 232 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 233 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 235 EMERSON ELECTRIC CO.: DEALS

- TABLE 236 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 237 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 GENERAL ELECTRIC COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 240 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 241 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 243 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 244 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 245 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 246 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ROCKWELL AUTOMATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 248 ROCKWELL AUTOMATION: DEALS

- TABLE 249 ROCKWELL AUTOMATION: OTHERS

- TABLE 250 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 251 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 253 SCHNEIDER ELECTRIC: DEALS

- TABLE 254 SCHNEIDER ELECTRIC: OTHERS

- TABLE 255 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 256 SIEMENS: COMPANY OVERVIEW

- TABLE 257 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 259 SIEMENS: DEALS

- TABLE 260 SIEMENS: OTHERS

- TABLE 261 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 262 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 263 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 264 3D SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 265 3D SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 3D SYSTEMS, INC.: DEALS

- TABLE 267 3D SYSTEMS, INC.: OTHERS

- TABLE 268 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 269 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 CISCO SYSTEMS, INC.: DEALS

- TABLE 271 CISCO SYSTEMS, INC.: OTHERS

- TABLE 272 IBM: COMPANY OVERVIEW

- TABLE 273 IBM: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 274 IBM: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 275 IBM: DEALS

- TABLE 276 IBM: OTHERS

- TABLE 277 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 278 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 279 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 280 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 281 ORACLE: COMPANY OVERVIEW

- TABLE 282 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ORACLE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 284 ORACLE: DEALS

- TABLE 285 ORACLE: ANNOUNCEMENT

- TABLE 286 ORACLE: EXPANSIONS

- TABLE 287 SAP: COMPANY OVERVIEW

- TABLE 288 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SAP: DEALS

- TABLE 290 STRATASYS: COMPANY OVERVIEW

- TABLE 291 STRATASYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 STRATASYS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 293 STRATASYS: DEALS

- TABLE 294 STRATASYS: OTHERS

- TABLE 295 EIRATECH ROBOTICS LTD.: COMPANY OVERVIEW

- TABLE 296 GREYORANGE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SMART MANUFACTURING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL ROBOTS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 INDUSTRIAL ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 6 INDUSTRIAL ROBOTS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 SMART MANUFACTURING MARKET: DATA TRIANGULATION

- FIGURE 8 SMART MANUFACTURING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 DIGITAL TRANSFORMATION SYSTEMS SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 10 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 EMPHASIS ON REAL-TIME DATA ANALYSIS AND PREDICTIVE MAINTENANCE TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 13 DIGITAL TRANSFORMATION SYSTEMS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 14 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SMART MANUFACTURING MARKET IN 2024

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL SMART MANUFACTURING MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO HOLD LARGEST SHARE OF GLOBAL SMART MANUFACTURING MARKET IN 2029

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 INDUSTRIES WITH MAJOR INVESTMENTS AND GOVERNMENT INITIATIVES IN INDIA

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

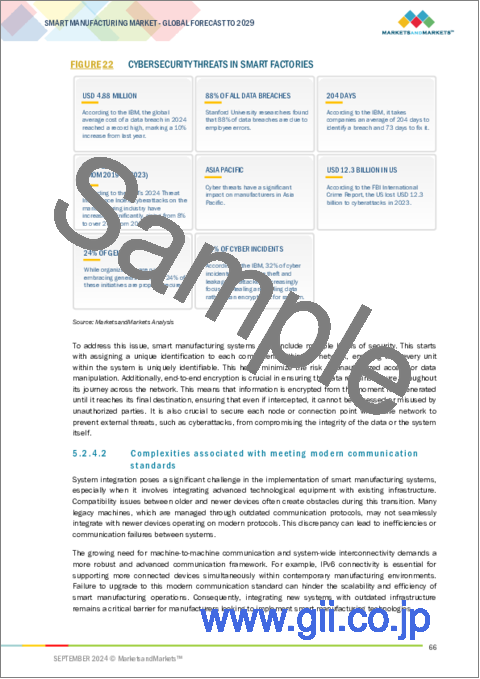

- FIGURE 22 CYBERSECURITY THREATS IN SMART FACTORIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 SMART MANUFACTURING ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE TREND OF INDUSTRIAL ROBOTS OFFERED BY KEY PLAYERS, BY ROBOT TYPE

- FIGURE 27 AVERAGE SELLING PRICE TREND OF DIGITAL TEMPERATURE SENSORS OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF INDUSTRIAL SENSORS, 2020-2023

- FIGURE 29 AVERAGE SELLING PRICE TREND OF TRADITIONAL ROBOTS, BY TYPE, 2020-2023

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ARTICULATED ROBOTS, BY REGION, 2020-2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF INDUSTRIAL TEMPERATURE SENSORS, BY REGION, 2020-2023

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2024 (Q1-Q3)

- FIGURE 36 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2024 (Q1-Q3)

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 40 GEN AI/AI USE CASES

- FIGURE 41 SMART MANUFACTURING MARKET, BY TECHNOLOGY

- FIGURE 42 DIGITAL TRANSFORMATION SYSTEMS SEGMENT TO HOLD LARGEST SHARE OF SMART MANUFACTURING MARKET IN 2029

- FIGURE 43 SMART MANUFACTURING MARKET, BY AUTOMATION & CONTROL SYSTEM

- FIGURE 44 SMART MANUFACTURING MARKET, BY ASSET & MAINTENANCE MANAGEMENT

- FIGURE 45 SMART MANUFACTURING MARKET, BY MANUFACTURING OPERATION SYSTEM

- FIGURE 46 SMART MANUFACTURING MARKET, BY INDUSTRIAL NETWORKING & CONNECTIVITY

- FIGURE 47 SMART MANUFACTURING MARKET, BY INDUSTRIAL ROBOTICS

- FIGURE 48 SMART MANUFACTURING MARKET, BY SENSOR & VISION SYSTEM

- FIGURE 49 SMART MANUFACTURING MARKET, BY DIGITAL TRANSFORMATION SYSTEM

- FIGURE 50 SMART MANUFACTURING MARKET, BY DESIGN & PLANNING SYSTEM

- FIGURE 51 SMART MANUFACTURING MARKET, BY INDUSTRY

- FIGURE 52 AUTOMOTIVE SEGMENT TO HOLD LARGEST SHARE OF SMART MANUFACTURING MARKET IN 2029

- FIGURE 53 SMART MANUFACTURING MARKET, BY REGION

- FIGURE 54 ASIA PACIFIC TO DOMINATE SMART MANUFACTURING MARKET DURING FORECAST PERIOD

- FIGURE 55 NORTH AMERICA: SMART MANUFACTURING MARKET SNAPSHOT

- FIGURE 56 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN SMART MANUFACTURING MARKET IN 2029

- FIGURE 57 EUROPE: SMART MANUFACTURING MARKET SNAPSHOT

- FIGURE 58 GERMANY TO DOMINATE EUROPEAN SMART MANUFACTURING MARKET FROM 2024 TO 2029

- FIGURE 59 ASIA PACIFIC: SMART MANUFACTURING MARKET SNAPSHOT

- FIGURE 60 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC SMART MANUFACTURING MARKET IN 2029

- FIGURE 61 SOUTH AMERICA TO EXHIBIT HIGHER CAGR IN ROW SMART MANUFACTURING MARKET FROM 2024 TO 2029

- FIGURE 62 MARKET SHARE ANALYSIS OF COMPANIES OFFERING INDUSTRIAL ROBOTS, 2023

- FIGURE 63 INDUSTRIAL ROBOTICS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 64 MARKET SHARE ANALYSIS OF COMPANIES OFFERING INDUSTRIAL SENSORS, 2023

- FIGURE 65 COMPANY VALUATION, 2024

- FIGURE 66 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 67 BRAND/PRODUCT COMPARISON

- FIGURE 68 INDUSTRIAL ROBOTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 69 INDUSTRIAL ROBOTICS MARKET: COMPANY FOOTPRINT

- FIGURE 70 INDUSTRIAL ROBOTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 71 ABB: COMPANY SNAPSHOT

- FIGURE 72 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 73 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 74 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 75 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 76 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 77 SIEMENS: COMPANY SNAPSHOT

- FIGURE 78 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 79 3D SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 80 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 81 IBM: COMPANY SNAPSHOT

- FIGURE 82 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 83 ORACLE: COMPANY SNAPSHOT

- FIGURE 84 SAP: COMPANY SNAPSHOT

- FIGURE 85 STRATASYS: COMPANY SNAPSHOT

The global smart manufacturing market was valued at USD 233.33 billion in 2024 and is projected to reach USD 479.17 billion by 2029; it is expected to register a CAGR of 15.5% during the forecast period. Increasing government expenditure on 3D printing technologies is driving the growth of the smart manufacturing market. Whereas high initial capital investment is restraining the growth of the smart manufacturing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By technology, industry, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Industrial Robotics segment is expected to grow at the second highest CAGR during the forecast period."

The industrial robotics segment is expected to exhibit the second highest CAGR during the forecast period. The development of industrial robotics has taken off remarkably due to the notable improvements in productivity, quality, cost, safety and others that have been observed. The introduction of robots to perform simple and repetitive functions allows for a 24 hour service with minimal chances of human errors. Development of technology such as artificial intelligence (AI) and collaborative robots has also stimulated the use of robotics in areas such as manufacturing, warehousing, logistics and so on.

"Oil & Gas segment is likely to hold the second largest market in 2024."

Oil & Gas segment to is expected to hold the second largest share in smart manufacturing market in 2024. The chief reason the oil and gas industry takes the lead in the smart manufacturing market is primarily due to challenges and necessities, this sector specifically needs. Due to the specific emphasis on safety, efficiency, remote locations, data-driven decisions, and strict regulations followed in this sector has lead it to hold the second largest market share. Predictive maintenance, automation, and robots are some of the critical smart technologies that help the industry lower costs, improve safety, and increase efficiency.

"The North America segment is likely to grow at the second highest CAGR during the forecast period."

The market in North America is expected to gow the second highest CAGR during the forecast period. The good business ecosystem in the US - with reformative initiatives in tax codes, significant package announcements for manufacturing and infrastructure companies, and availability of major technology providers - augur well for smart manufacturing technology adoption in the region.. In addition, the intense focus on optimum asset utilization, the enforcement of stringent government regulations for workplace and personal safety, and the high awareness of the need to control and assure output quality in oil & gas, chemicals, and food & beverages industries drive the demand for machine condition monitoring systems and plant asset management (PAM) solutions in the region.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation- C-level Executives - 45%, Directors - 35%, Others - 20%

- By Region-North America - 30%, Europe - 25%, Asia Pacific - 40%, RoW - 5%

The smart manufacturing market is dominated by a few globally established players such as 3D System, Inc. (US), ABB (Switzerland), Cisco System, Inc. (US), Emerson Electric Co. (US), General Electric (US), Honeywell International Inc. (US), IBM (US), Mitsubishi Electric Corporation (Japan), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), Oracle (US), SAP (Germany), Stratasys (US), Yokogawa Electric Corporation(Japan). The study includes an in-depth competitive analysis of these key players in the smart manufacturing market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the smart manufacturing market and forecasts its size by technology, industry, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the smart manufacturing ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (emphasis on boosting manufacturing efficiency through automated production, rising government expenditure on 3D printing technologies and rising demand for innovative technologies to minimize manufacturing downtime and production waste). Restraint (Requirement of high initial capital; investment and lack of standardization of industrial services), Opportunity (Accelerated developments in IIoT and cloud computing, growing investment in infrastructure development), Challenges (Security issues in smart manufacturing and complexities in integration of new technology equipment with existing ones).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the smart manufacturing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart manufacturing market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the smart manufacturing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players 3D System, Inc. (US), ABB (Switzerland), Cisco System, Inc. (US), Emerson Electric Co. (US), General Electric (US), Honeywell International Inc. (US), IBM (US), Mitsubishi Electric Corporation (Japan) among others in the smart manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key industry insights

- 2.1.3.4 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART MANUFACTURING MARKET

- 4.2 SMART MANUFACTURING MARKET, BY TECHNOLOGY

- 4.3 SMART MANUFACTURING MARKET, BY INDUSTRY

- 4.4 SMART MANUFACTURING MARKET, BY COUNTRY

- 4.5 SMART MANUFACTURING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing reliance on automation technologies to improve manufacturing efficiency

- 5.2.1.2 Rising government investment in 3D printing technologies

- 5.2.1.3 Increasing need to maintain regulatory compliance of industrial solutions

- 5.2.1.4 Growing emphasis on minimizing manufacturing downtime and production waste

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investments

- 5.2.2.2 Lack of standardization of industrial equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid advances in IIoT and cloud computing technologies

- 5.2.3.2 Increasing adoption of automation technologies in industrial sector

- 5.2.3.3 Growing investment in infrastructure development projects in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Security issues

- 5.2.4.2 Complexities associated with meeting modern communication standards

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY ROBOT TYPE

- 5.5.2 AVERAGE SELLING PRICE TREND, BY INDUSTRIAL SENSOR

- 5.5.3 AVERAGE SELLING PRICE TREND, BY ROBOT TYPE

- 5.5.4 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Digital twin

- 5.8.1.2 Blockchain

- 5.8.1.3 Augmented reality (AR) & virtual reality (VR)

- 5.8.1.4 Predictive maintenance

- 5.8.1.5 IoT

- 5.8.2 COMPLIMENTARY TECHNOLOGIES

- 5.8.2.1 Smart energy management

- 5.8.2.2 Cybersecurity

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Edge computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 847950)

- 5.10.2 EXPORT SCENARIO (HS CODE 847950)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 HTC CORPORATION SUPPORTS FLAIM TRAINER VR SIMULATION TO REDUCE COSTS OF TRAINING FIREFIGHTERS

- 5.12.2 CO2METER ENABLES LONG-RANGE DATA COLLECTION AND LEAK DETECTION OF CO2 WITH ISENSE ALARM (CM-0052)

- 5.12.3 SKF DEPLOYS ONLINE CONDITION MONITORING SYSTEM TO PREVENT CATASTROPHIC BEARING FAILURE

- 5.12.4 ELMWOOD RECLAIMED TIMBER USES SIEMENS' OPCENTER ADVANCED SCHEDULING SOLUTION TO SYNCHRONIZE MANUFACTURING AND ENHANCE DELIVERY

- 5.12.5 DHL LEVERAGES MANHATTAN ACTIVE WAREHOUSE MANAGEMENT SOLUTION TO ENABLE SCALABLE AND AGILE WAREHOUSE MANAGEMENT

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCE ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON SMART MANUFACTURING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 GEN AI/AI-SPECIFIC USE CASES

6 SMART MANUFACTURING MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AUTOMATION & CONTROL SYSTEMS

- 6.2.1 HUMAN-MACHINE INTERFACE

- 6.2.1.1 Hardware

- 6.2.1.1.1 Basic HMI

- 6.2.1.1.1.1 Increasing use in small-scale machinery and home automation systems to foster segmental growth

- 6.2.1.1.2 Advanced panel-based HMI

- 6.2.1.1.2.1 Shifting preference toward advanced user interface with mobile functionalities to drive market

- 6.2.1.1.3 Advanced PC-based HMI

- 6.2.1.1.3.1 Growing adoption of high-performance devices for data-intensive and complex visualization tasks to fuel segmental growth

- 6.2.1.1.4 Other hardware types

- 6.2.1.1.1 Basic HMI

- 6.2.1.2 Software

- 6.2.1.2.1 On-premises

- 6.2.1.2.1.1 Rising focus on enhancing data security and control to accelerate segmental growth

- 6.2.1.2.2 Cloud-based

- 6.2.1.2.2.1 Increasing reliance on software with multi-location access support to boost segmental growth

- 6.2.1.2.1 On-premises

- 6.2.1.1 Hardware

- 6.2.2 INDUSTRIAL PC

- 6.2.2.1 Panel IPC

- 6.2.2.1.1 Ability to withstand rugged industrial environments to foster segmental growth

- 6.2.2.2 Rack-mount IPC

- 6.2.2.2.1 Adoption in space-constrained applications to contribute to segmental growth

- 6.2.2.3 Embedded IPC

- 6.2.2.3.1 High emphasis on effective management of manufacturing plants to augment segmental growth

- 6.2.2.4 DIN rail IPC

- 6.2.2.4.1 Rise in demand for interconnected factories and enterprise networks to expedite segmental growth

- 6.2.2.1 Panel IPC

- 6.2.1 HUMAN-MACHINE INTERFACE

- 6.3 ASSET & MAINTENANCE MANAGEMENT

- 6.3.1 PLANT ASSET MANAGEMENT

- 6.3.1.1 Increasing need for periodic monitoring and predictive analytics of plants to boost segmental growth

- 6.3.1.2 Production assets

- 6.3.1.3 Automation assets

- 6.3.2 MACHINE CONDITION MONITORING

- 6.3.2.1 Rising emphasis on increasing operational life of machinery to fuel segmental growth

- 6.3.2.2 Vibration monitoring

- 6.3.2.3 Thermography

- 6.3.2.4 Oil analysis

- 6.3.2.5 Ultrasound emission monitoring

- 6.3.2.6 Corrosion monitoring

- 6.3.2.7 Motor current analysis

- 6.3.3 COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEMS

- 6.3.3.1 Growing automation of routine maintenance tasks to contribute to segmental growth

- 6.3.4 ASSET PERFORMANCE MANAGEMENT

- 6.3.4.1 Increasing need for proactive maintenance and plant condition monitoring to augment segmental growth

- 6.3.4.2 Solutions

- 6.3.4.2.1 Asset strategy management

- 6.3.4.2.2 Asset reliability management

- 6.3.4.2.3 Predictive asset management

- 6.3.4.2.4 Other solutions

- 6.3.4.3 Services

- 6.3.4.3.1 Professional

- 6.3.4.3.2 Managed

- 6.3.1 PLANT ASSET MANAGEMENT

- 6.4 MANUFACTURING OPERATION SYSTEMS

- 6.4.1 MANUFACTURING EXECUTION SYSTEMS

- 6.4.1.1 Increasing use to improve business processes and profitability to foster segmental growth

- 6.4.1.2 Software

- 6.4.1.3 Services

- 6.4.1.3.1 Implementation

- 6.4.1.3.2 Software upgrade

- 6.4.1.3.3 Training

- 6.4.1.3.4 Maintenance

- 6.4.2 WAREHOUSE MANAGEMENT SYSTEMS

- 6.4.2.1 Rising adoption to handle physical inventories and cycle counting to bolster segmental growth

- 6.4.2.2 Software

- 6.4.2.3 Services

- 6.4.3 MANUFACTURING OPERATION MANAGEMENT

- 6.4.3.1 Growing emphasis on achieving operational excellence through oversight to augment segmental growth

- 6.4.4 ENTERPRISE RESOURCE PLANNING

- 6.4.4.1 Increasing use to automate workflow and inventory management to expedite segmental growth

- 6.4.5 QUALITY MANAGEMENT SYSTEMS

- 6.4.5.1 Growing emphasis on meeting customer and regulatory standards to accelerate segmental growth

- 6.4.1 MANUFACTURING EXECUTION SYSTEMS

- 6.5 INDUSTRIAL NETWORKING & CONNECTIVITY

- 6.5.1 PRIVATE 5G

- 6.5.1.1 Growing demand for seamless wireless communication to contribute to segmental growth

- 6.5.1.2 Hardware

- 6.5.1.3 Software

- 6.5.1.4 Services

- 6.5.2 EDGE COMPUTING

- 6.5.2.1 Rising number of smartphone users to augment segmental growth

- 6.5.2.2 Hardware

- 6.5.2.3 Software

- 6.5.3 CLOUD COMPUTING

- 6.5.3.1 Increasing need to satisfy customer expectations of secure services to foster segmental growth

- 6.5.3.2 IaaS

- 6.5.3.3 PaaS

- 6.5.3.4 SaaS

- 6.5.4 INDUSTRIAL COMMUNICATION

- 6.5.4.1 Growing need for reliable and secure networks to improve operational efficiency to fuel segmental growth

- 6.5.4.2 Components

- 6.5.4.3 Software

- 6.5.4.4 Services

- 6.5.1 PRIVATE 5G

- 6.6 INDUSTRIAL ROBOTICS

- 6.6.1 INDUSTRIAL 3D PRINTING

- 6.6.1.1 Increasing focus on creating well-designed, lightweight, and less expensive components to expedite segmental growth

- 6.6.1.2 Printers

- 6.6.1.3 Materials

- 6.6.1.4 Software

- 6.6.1.5 Services

- 6.6.2 INDUSTRIAL ROBOTS

- 6.6.2.1 Traditional robots

- 6.6.2.1.1 Increasing adoption in high-volume production to fuel segmental growth

- 6.6.2.2 Collaborative robots

- 6.6.2.2.1 Ease of use and low-cost deployment to drive market

- 6.6.2.1 Traditional robots

- 6.6.3 AUTOMATED GUIDED VEHICLES

- 6.6.3.1 Ease of operation and low operational costs to augment segmental growth

- 6.6.3.2 Tow vehicles

- 6.6.3.3 Unit load carriers

- 6.6.3.4 Pallet trucks

- 6.6.3.5 Assembly line vehicles

- 6.6.3.6 Forklift trucks

- 6.6.3.7 Other automated guided vehicles

- 6.6.4 AUTOMATED MOBILE ROBOTS

- 6.6.4.1 Rapid advances in battery technology to contribute to segmental growth

- 6.6.4.2 Hardware

- 6.6.4.3 Software & services

- 6.6.1 INDUSTRIAL 3D PRINTING

- 6.7 SENSORS & VISION SYSTEMS

- 6.7.1 INDUSTRIAL SENSORS

- 6.7.1.1 Contact sensors

- 6.7.1.1.1 Low costs and high accuracy to bolster segmental growth

- 6.7.1.2 Non-contact sensors

- 6.7.1.2.1 Adoption to detect thermal radiation to contribute to segmental growth

- 6.7.1.1 Contact sensors

- 6.7.2 INDUSTRIAL MACHINE VISION

- 6.7.2.1 Hardware

- 6.7.2.1.1 Easy configuration and maintenance to accelerate segmental growth

- 6.7.2.1.2 Cameras

- 6.7.2.1.3 Frame grabbers

- 6.7.2.1.4 Optics

- 6.7.2.1.5 LED lighting

- 6.7.2.1.6 Processors

- 6.7.2.2 Software

- 6.7.2.2.1 Adoption of smart cameras to maximize productivity of vision systems to foster segmental growth

- 6.7.2.2.2 Traditional

- 6.7.2.2.3 Deep learning

- 6.7.2.1 Hardware

- 6.7.1 INDUSTRIAL SENSORS

- 6.8 DIGITAL TRANSFORMATION SYSTEMS

- 6.8.1 AI IN MANUFACTURING

- 6.8.1.1 Hardware

- 6.8.1.1.1 Increasing need for high-computing processors to run AI algorithms to fuel segmental growth

- 6.8.1.1.2 Processors

- 6.8.1.1.3 Memory devices

- 6.8.1.1.4 Network devices

- 6.8.1.2 Software

- 6.8.1.2.1 Rising emphasis on predictive maintenance and manufacturing quality control to boost segmental growth

- 6.8.1.2.2 AI platforms

- 6.8.1.2.3 AI solutions

- 6.8.1.3 Services

- 6.8.1.3.1 Increasing deployment of advanced technologies in industrial sectors to expedite segmental growth

- 6.8.1.3.2 Deployment & integration

- 6.8.1.3.3 Support & maintenance

- 6.8.1.1 Hardware

- 6.8.2 INDUSTRIAL CYBERSECURITY

- 6.8.2.1 Growing adoption of connected devices and IT systems to boost segmental growth

- 6.8.2.2 Gateways

- 6.8.2.3 Networking devices

- 6.8.2.3.1 Routers

- 6.8.2.3.2 Industrial ethernet switches

- 6.8.2.4 Solutions & services

- 6.8.3 DIGITAL TWIN

- 6.8.3.1 Increasing deployment to provide valuable insights and drive operational improvements to fuel segmental growth

- 6.8.4 AR & VR IN MANUFACTURING

- 6.8.4.1 Rising integration of digital information and virtual objects with real-world environments to foster segmental growth

- 6.8.4.2 Hardware

- 6.8.4.3 Software

- 6.8.1 AI IN MANUFACTURING

- 6.9 DESIGN & PLANNING SYSTEMS

- 6.9.1 COMPUTER-AIDED DESIGN

- 6.9.1.1 Growing focus on precise and efficient methods for creating detailed designs to expedite segmental growth

- 6.9.2 COMPUTER-AIDED MANUFACTURING

- 6.9.2.1 Rising emphasis on automating and streamlining manufacturing processes to accelerate segmental growth

- 6.9.3 PRODUCT LIFECYCLE MANAGEMENT

- 6.9.3.1 Increasing need to eliminate data silos and reduce inconsistencies in product development processes to drive market

- 6.9.1 COMPUTER-AIDED DESIGN

7 SMART MANUFACTURING MARKET, BY INDUSTRY

- 7.1 INTRODUCTION

- 7.1.1 OIL & GAS

- 7.1.1.1 Rising integration of advanced automation systems to enhance operational efficiency to boost segmental growth

- 7.1.2 FOOD & BEVERAGES

- 7.1.2.1 Increasing focus on complying with safety standards to contribute to segmental growth

- 7.1.3 PHARMACEUTICALS

- 7.1.3.1 Rapid digitalization of manufacturing plants to enhance operational efficiency to fuel segmental growth

- 7.1.4 CHEMICALS

- 7.1.4.1 Increasing reliance on automated solutions to maintain ideal inventory levels to contribute to segmental growth

- 7.1.5 ENERGY & POWER

- 7.1.5.1 Rapid industrialization and infrastructure development to augment segmental growth

- 7.1.6 METALS & MINING

- 7.1.6.1 Rising implementation of stringent rules to ensure safety using advanced technologies to fuel segmental growth

- 7.1.7 PULP & PAPER

- 7.1.7.1 Burgeoning demand for wood-based products to contribute to segmental growth

- 7.1.8 AUTOMOTIVE

- 7.1.8.1 Rising emphasis on increasing production speed and efficiency to accelerate segmental growth

- 7.1.9 AEROSPACE

- 7.1.9.1 Increasing adoption of critical machine condition monitoring techniques to fuel segmental growth

- 7.1.10 SEMICONDUCTOR & ELECTRONICS

- 7.1.10.1 Growing focus on reducing waste, inventory, and supply chain costs to boost segmental growth

- 7.1.11 MEDICAL DEVICES

- 7.1.11.1 Rising aging population and health risks to expedite segmental growth

- 7.1.12 HEAVY MACHINERY

- 7.1.12.1 Increasing reliance on AI technology to reduce downtime to accelerate segmental growth.

- 7.1.13 OTHER INDUSTRIES

- 7.1.1 OIL & GAS

8 SMART MANUFACTURING MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.2.2 US

- 8.2.2.1 Rising need to boost operational efficiency and optimize resource utilization to foster market growth

- 8.2.3 CANADA

- 8.2.3.1 Increasing investment to improve automotive manufacturing to accelerate market growth

- 8.2.4 MEXICO

- 8.2.4.1 Escalating adoption of IoT, AI, and other automation technologies to contribute to market growth

- 8.3 EUROPE

- 8.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.3.2 UK

- 8.3.2.1 Increasing adoption of digital technologies to transform business operations to accelerate market growth

- 8.3.3 GERMANY

- 8.3.3.1 Rising implementation of cloud-based solutions in manufacturing facilities to drive market

- 8.3.4 FRANCE

- 8.3.4.1 Increasing allocation of funds to promote digital revolution to contribute to market growth

- 8.3.5 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.4.2 CHINA

- 8.4.2.1 Rising government focus on R&D of IoT-based solutions to fuel market growth

- 8.4.3 JAPAN

- 8.4.3.1 Increasing trend of industrial automation to expedite market growth

- 8.4.4 INDIA

- 8.4.4.1 Rising deployment of industrial automation technologies to augment market growth

- 8.4.5 REST OF ASIA PACIFIC

- 8.5 ROW

- 8.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 8.5.2 SOUTH AMERICA

- 8.5.2.1 Brazil

- 8.5.2.1.1 Rising emphasis on modernizing industrial sector to boost market growth

- 8.5.2.2 Rest of South America

- 8.5.2.1 Brazil

- 8.5.3 MIDDLE EAST & AFRICA

- 8.5.3.1 Rapid digitalization and technology integration to foster market growth

- 8.5.3.2 GCC

- 8.5.3.3 Africa & Rest of Middle East

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 9.3 MARKET SHARE ANALYSIS OF INDUSTRIAL ROBOTS, 2023

- 9.4 REVENUE ANALYSIS, 2019-2023

- 9.5 MARKET SHARE ANALYSIS OF INDUSTRIAL SENSORS, 2023

- 9.6 COMPANY VALUATION AND FINANCIAL METRICS

- 9.7 BRAND/PRODUCT COMPARISON

- 9.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 9.8.1 STARS

- 9.8.2 EMERGING LEADERS

- 9.8.3 PERVASIVE PLAYERS

- 9.8.4 PARTICIPANTS

- 9.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 9.8.5.1 Company footprint

- 9.8.5.2 Payload footprint

- 9.8.5.3 Robot type footprint

- 9.8.5.4 End-use industry footprint

- 9.8.5.5 Region footprint

- 9.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 9.9.1 PROGRESSIVE COMPANIES

- 9.9.2 RESPONSIVE COMPANIES

- 9.9.3 DYNAMIC COMPANIES

- 9.9.4 STARTING BLOCKS

- 9.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 9.9.5.1 Detailed list of key startups/SMEs

- 9.9.5.2 Competitive benchmarking of key startups/SMEs

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 9.10.2 DEALS

- 9.10.3 EXPANSIONS

- 9.10.4 OTHER

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 ABB

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches/developments

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths/Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses/Competitive threats

- 10.1.2 EMERSON ELECTRIC CO.

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches/developments

- 10.1.2.3.2 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths/Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses/Competitive threats

- 10.1.3 GENERAL ELECTRIC COMPANY

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Product launches/developments

- 10.1.3.3.2 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths/Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses/Competitive threats

- 10.1.4 HONEYWELL INTERNATIONAL INC.

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches/developments

- 10.1.4.3.2 Deals

- 10.1.4.3.3 Others

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths/Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses/Competitive threats

- 10.1.5 ROCKWELL AUTOMATION

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product launches/developments

- 10.1.5.3.2 Deals

- 10.1.5.3.3 Others

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths/Right to win

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses/Competitive threats

- 10.1.6 SCHNEIDER ELECTRIC

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches/developments

- 10.1.6.3.2 Deals

- 10.1.6.3.3 Others

- 10.1.6.3.4 Expansions

- 10.1.6.4 MnM view

- 10.1.6.4.1 Key strengths/Right to win

- 10.1.6.4.2 Strategic choices

- 10.1.6.4.3 Weaknesses/Competitive threats

- 10.1.7 SIEMENS

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Product launches/developments

- 10.1.7.3.2 Deals

- 10.1.7.3.3 Others

- 10.1.7.4 MnM view

- 10.1.7.4.1 Key strengths/Right to win

- 10.1.7.4.2 Strategic choices

- 10.1.7.4.3 Weaknesses/Competitive threats

- 10.1.8 YOKOGAWA ELECTRIC CORPORATION

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.8.4 MnM view

- 10.1.8.4.1 Key strengths/Right to win

- 10.1.8.4.2 Strategic choices

- 10.1.8.4.3 Weaknesses/Competitive threats

- 10.1.9 3D SYSTEMS, INC.

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/Services offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.9.3.2 Others

- 10.1.10 CISCO SYSTEMS, INC.

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Solutions/Services offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Deals

- 10.1.10.3.2 Others

- 10.1.11 IBM

- 10.1.11.1 Business overview

- 10.1.11.2 Products/Solutions/Services offered

- 10.1.11.3 Recent developments

- 10.1.11.3.1 Product launches/developments

- 10.1.11.3.2 Deals

- 10.1.11.3.3 Others

- 10.1.12 MITSUBISHI ELECTRIC CORPORATION

- 10.1.12.1 Business overview

- 10.1.12.2 Products/Solutions/Services offered

- 10.1.12.3 Recent developments

- 10.1.12.3.1 Product launches/developments

- 10.1.12.3.2 Deals

- 10.1.13 ORACLE

- 10.1.13.1 Business overview

- 10.1.13.2 Products/Solutions/Services offered

- 10.1.13.3 Recent developments

- 10.1.13.3.1 Product launches/developments

- 10.1.13.3.2 Deals

- 10.1.13.3.3 Others

- 10.1.13.3.4 Expansions

- 10.1.14 SAP

- 10.1.14.1 Business overview

- 10.1.14.2 Products/Solutions/Services offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Deals

- 10.1.15 STRATASYS

- 10.1.15.1 Business overview

- 10.1.15.2 Products/Solutions/Services offered

- 10.1.15.3 Recent developments

- 10.1.15.3.1 Product launches/developments

- 10.1.15.3.2 Deals

- 10.1.15.3.3 Others

- 10.1.1 ABB

- 10.2 OTHER PLAYERS

- 10.2.1 COGNEX CORPORATION

- 10.2.2 GOOGLE

- 10.2.3 INTEL CORPORATION

- 10.2.4 KEYENCE CORPORATION

- 10.2.5 NVIDIA CORPORATION

- 10.2.6 PTC

- 10.2.7 SAMSUNG

- 10.2.8 SONY CORPORATION

- 10.2.9 UNIVERSAL ROBOTS A/S

- 10.2.10 OMRON CORPORATION

- 10.2.11 ADDVERB TECHNOLOGIES LIMITED

- 10.2.12 LOCUS ROBOTICS

- 10.2.13 EIRATECH ROBOTICS LTD.

- 10.2.14 GREYORANGE

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS