|

|

市場調査レポート

商品コード

1686666

自動マテリアルハンドリング(AMH)-市場シェア分析、産業動向&統計、成長予測(2025年~2030年)Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動マテリアルハンドリング(AMH)-市場シェア分析、産業動向&統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 249 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

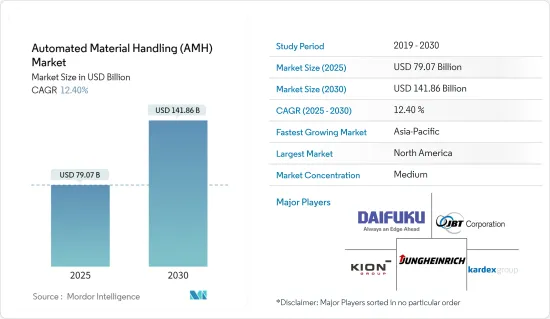

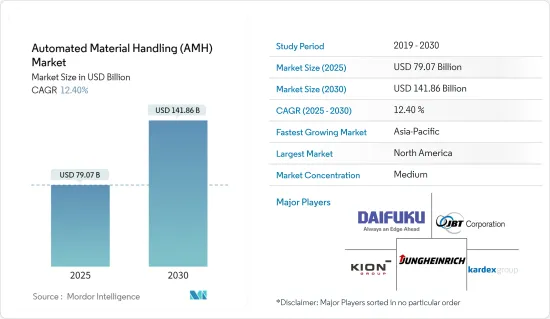

自動マテリアルハンドリング市場規模は2025年に790億7,000万米ドルと推定され、予測期間中(2025年~2030年)のCAGRは12.4%で、2030年には1,418億6,000万米ドルに達すると予測されます。

主なハイライト

- 技術の進歩、人件費と安全性への懸念の高まり、製造・倉庫業務の効率化、世界の製造業の大幅な回復、産業界における自動化への需要の高まり、製造装置や倉庫施設におけるロボットのニーズの高まり、新興市場の成長が、自動マテリアルハンドリング市場を牽引する主な要因です。その他の特典として、予測期間中、サプライチェーン業務のデジタル化が拡大し、注文のカスタマイズやパーソナライゼーションの増加がさらに市場を後押しします。

- 自動マテリアルハンドリング(AMH)システムは、製造施設、倉庫、小売店、空港、物流センターなど、さまざまな環境における資材の移動を合理化します。これらのシステムは、同じエリア内、部門間、あるいは異なる建物間であっても、資材のシームレスな移動を容易にします。AMHシステムは、製造実行システム(MES)によって指定されたルートに依存しています。これらのシステムは、光学式文字認識(OCR)、バーコード、RFID、超広帯域屋内追跡、近距離通信など、さまざまな技術を採用しています。

- 過去70年間、マテリアルハンドリングは大きな変貌を遂げ、業界の情勢を再構築してきました。機械やロボットが手作業に取って代わり、各分野の成長に拍車をかけています。特に自動車産業は際立っており、10倍という目覚ましい拡大を誇っています。インダストリー4.0と最先端の製造業におけるカナダの進歩は、多様な気候の下でも、製品の設計、納品、メンテナンスに革命をもたらしています。ロボット工学や自動化から積層造形(3Dプリンティング)に至るまで、これらの技術はeコマース、自動車、農業、製薬など幅広い分野で有用性を見出しています。カナダのイノベーターたちは、国内市場だけでなく、競争の激しい世界な舞台でも、洗練された高価値の製品を率先して生み出しています。彼らの取り組みは、現地での実践を向上させるだけでなく、先進自動化技術の軌跡を定義する共同事業の舞台も整えています。

- 最初のAGVは1953年にデビューしたが、生産および倉庫管理企業全体への普及は、様々な要因によって妨げられてきました。典型的な無人搬送車の価格は6万~10万米ドルだが、ナビゲーション補助装置やセンサーなどの高度な機能を備えたシステムは、かなり高価になります。こうした高額な初期費用は、メンテナンスの課題と相まって、市場の成長に水を差しています。大手企業は、技術革新や研究開発投資に妥協することなく、コストの抑制に努めています。

- COVID-19の流行は、部門を問わず自動化の導入に大きな影響を与え、業務規範を再構築し、社会的距離や非接触操作などの課題を導入しました。組織は需要の急増と労働力の減少に直面し、強化された安全プロトコルの導入を促しました。2020年以降、米国の労働者に感染が拡大し、企業は新たな安全対策を迅速に導入する必要に迫られました。食品製造のように、ウイルスの深刻さのために操業停止を経験した産業もあったが、他の多くの産業は、操業を維持するために厳格な健康対策を取り入れることによって適応しました。

自動マテリアルハンドリング(AMH)市場動向

インダストリー4.0への投資が市場成長を大きく牽引

- 市場は、各国がインダストリー4.0とIoT技術を採用することによって起こる開発によって牽引されています。ロボット工学の利用を通じて、インダストリー4.0はマテリアルハンドリングの方法に革命をもたらしつつあります。倉庫や流通施設では、ロボット工学がますます普及しています。例えば、国際ロボット連盟は、米国メーカーがオートメーションに多額の投資を行い、産業用ロボットの設置台数が12%増加し、2023年には合計4万4,303台になると報告しています。注文品のピッキングや梱包、トラックへの積み下ろし、さらには倉庫フロアの清掃に加え、これらの作業にもロボットを採用することができます。職場の正確さと生産性はロボットによって向上します。ロボットはまた、必要な手作業の量を減らすことで、企業のコスト削減を可能にします。

- 例えば、倉庫は巨大であるため、従業員はSKUを探し出し、注文を梱包・出荷エリアに届けるためにかなりの距離を歩かなければならないです。毎年、平均的な倉庫では、不必要な歩行やその他の動作で6.9週間を浪費しており、これは2億6,500万時間の労働に相当し、43億米ドルのコストがかかっています。協働ロボットは、選別プロセスの各段階で、機能エリア間を長時間歩く必要性も最小限に抑えます。マテリアルハンドリング機器の注文の増加は、調査された市場を大きく牽引すると思われます。

- さらに、ロボット工学、自動化、積層造形(3Dプリンティング)のような技術は、eコマース、自動車、農業、製薬などのカナダの産業で幅広い用途があります。カナダのイノベーターは、国内市場や競合市場競争の激しい世界市場向けに、技術的に複雑で価値の高い製品を総合的に生産しており、強化された手法を共有し、高度自動化技術の未来を形作る協力関係の基礎を築いています。

- ドイツはまた、自律性、相互運用性、持続可能性という3つの戦略的行動分野におけるインダストリー4.0の2030年ビジョンに焦点を当てています。この2030年ビジョンにおいて、インダストリー4.0プラットフォームの利害関係者は、デジタル・エコシステムを形成するための全体的アプローチを提示しています。その目標は、社会的市場経済の要求による将来のデータ経済の枠組みを構築することであり、オープンなエコシステム、多様性を重視し、自動化市場に関するドイツの産業基盤の特定の状況と確立された強みに基づき、すべての市場関係者間の競争を支援することです。

- さらに、買収プログラムにおける政府の強力な支援は、中国がインダストリー4.0に向かうことを可能にしています。例えば、中国を拠点とする産業用ロボットメーカーのSiasunは、中国科学院に所属しており、さらに政府と連携しています。様々な企業による産業用制御システムの採用は、この国の注目すべき動向です。先進的なシステムは工場での生産を容易にします。これはまた、手作業に頼っていた企業が、設備の自動化を可能にする先進技術ベースのシステムへと徐々にシフトしていることを指し示しています。

- 調査した市場に影響を与えている重要な動向は、スマートな製造手法への注目です。IBEFのデータによると、インド政府は2025年までに国内総生産(GDP)に占める製造業の生産高寄与度を16%から25%に引き上げるという野心的な目標を設定しました。Smart Advanced Manufacturing and Rapid Transformation Hub(SAMARTH)Udyog Bharat 4.0イニシアチブは、インドの製造業におけるインダストリー4.0に関する認識を高め、利害関係者がオートメーション・マテリアルハンドリングに関する課題に対処できるようにすることを目的としています。

アジア太平洋が最も急成長する市場になる見込み

- 中国は、アジア太平洋AMH市場の成長に大きく貢献しています。製造業、自動車、eコマースなどの業界全体でAMH製品に対する需要が増加していることが、市場の成長を後押ししています。中国は人口が多く、産業政策を推進しています。PPP(購買力平価)ベースで見ると、この10年間で世界最大の経済大国となり、世界最大の輸出国・貿易国になりました。中国は現在、製造業と建設業主導の経済から消費者主導の経済へと移行しつつあります。

- 中国国家統計局によると、2023年の中国消費財市場の小売総売上高は約41兆8,605億人民元(5兆7,863億1,000万米ドル)でした。中国のオンライン・バイヤーの数は、2006年の3,400万人以下から2023年には9億1,500万人を超えるまでに急増しており、中国のeコマース・ビジネスの普及を可能にしています。したがって、eコマースの成長とともに、マテリアルハンドリング機器の需要は予測される数年間に増加すると思われます。

- 日本は主に製造業国家です。その製造業の名目GDPへの寄与度は、他の先進諸国が10%に近いのに対し、日本は20%に近いです。IMFによると、日本の製造業は、ICTの導入拡大により、サービス業よりも大幅な産業生産性の向上を達成しています。自動車部門とエレクトロニクス部門は、国内で最も生産性の高い製造部門です。

- 産業界の貢献と「メイク・イン・インディア」キャンペーンに後押しされた政府のインフラ投資強化は、自動マテリアルハンドリング(AMH)システムの需要を押し上げると思われます。製造業がインドのGDPの17%を占め、2,730万人以上を雇用していることを考えると、国の経済状況におけるその重要性は否定できないです。2025年までに経済生産の25%を製造業から得るというビジョンを掲げ、インド政府はさまざまな取り組みや政策を展開しています。その結果、製造業はこの野心的な目標を達成するため、インダストリー4.0やその他のデジタル革新を取り入れる準備を進めています。

- 韓国は第4次産業革命を採用しました。韓国では、スマート工場が最も重要な分野のひとつとなります。韓国では、民間と公的セクターの両方が、国内のスマート工場の数を増やすことにコミットしています。その目標は野心的で、2023年までに最新のデジタル技術と分析技術を備えた最先端工場を全国で3万カ所稼働させることを目指しています。さらに、韓国の生産年齢人口の減少に対抗するため、2030年までに20のスマート工業団地を設立する計画もあります。この構想の一環として、第4次産業革命の特徴であるデジタル化と自動化の急速なペースに合わせ、2030年までに新たに2,000のAI搭載スマート工場を設立することを目標としています。

自動マテリアルハンドリング(AMH)業界の概要

自動マテリアルハンドリング(AMH)市場は、半固定化と高い競合が特徴です。同市場の主要企業は、激しい競争を勝ち抜くために、主に製品の発売、研究開発への多額の投資、パートナーシップの形成や買収などの戦略に依存しています。

- 2024年5月、リンデ・マテリアルハンドリング機器の著名なメーカーであるKION北米(KION NA)とFox Roboticsは、戦略的非独占的パートナーシップを締結しました。この提携の一環として、KION NAはサウスカロライナ州サマービルにある最新鋭の施設でFoxBotの自律型トレーラーローダー/アンローダー(ATL)の製造と組み立てを行う予定。

- 2023年11月、マテリアルハンドリングのパイオニアであるトヨタ・マテリアルハンドリング(TMH)は、最先端の電動フォークリフト3モデルを発表しました。これらの新機種は、TMHのすでに幅広いマテリアルハンドリング・ソリューションのラインアップを強化するものです。この3機種は、サイド・エントリー・エンド・ライダー、センター・ライダー・スタッカー、および産業用牽引トラクターを含みます。これらのモデルは、運転者の快適さを重視しながら、効率性、多用途性、およびトップクラスの性能の向上を約束します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- COVID-19パンデミックの市場への影響

第5章 市場力学

- 市場促進要因

- 技術的進歩の増加が市場の成長を促進

- 自動化とマテリアルハンドリングの需要を促進するインダストリー4.0投資

- eコマース分野の急成長

- 市場の課題

- 高い初期設備コスト

- 熟練労働者の不足

第6章 市場セグメンテーション

- 製品タイプ別

- ハードウェア

- ソフトウェア

- サービス

- 機器タイプ別

- 移動ロボット

- 無人搬送車(AGV)

- 自律移動ロボット(AMR)

- 自動保管・検索システム

- 固定通路

- カルーセル

- 垂直リフトモジュール

- 自動コンベア

- ベルト

- ローラー

- パレット

- オーバーヘッド

- パレタイザー

- 従来型

- ロボット

- 仕分けシステム

- 移動ロボット

- エンドユーザー別

- 空港

- 自動車

- 食品・飲料

- 小売/倉庫/配送センター/物流センター

- 一般製造業

- 医薬品

- 郵便・小包

- その他エンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- イタリア

- スペイン

- アジア

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Daifuku Co. Ltd

- Kardex Group

- KION Group AG

- JBT Corporation

- Jungheinrich AG

- TGW Logistics Group GmbH

- SSI Schaefer AG

- KNAPP AG

- Mecalux SA

- System Logistics SpA

- Viastore Systems GmbH

- BEUMER Group GmbH & Co. KG

- Interroll Holding AG

- WITRON Logistik

- Siemens AG

- KUKA AG

- Honeywell Intelligrated Inc.(Honeywell International Inc.)

- Murata Machinery Ltd

- Toyota Industries Corporation

- Visionnav Robotics

- Dearborn Mid-West Company

第8章 投資分析

第9章 市場の将来

目次

Product Code: 53959

The Automated Material Handling Market size is estimated at USD 79.07 billion in 2025, and is expected to reach USD 141.86 billion by 2030, at a CAGR of 12.4% during the forecast period (2025-2030).

Key Highlights

- Technological advancements, rising labor costs and safety concerns, improved efficiency in manufacturing and warehouse operations, a significant recovery in global manufacturing, increasing demand for automation in industries, growing need for robots in manufacturing units and warehousing facilities, and the growth of emerging markets are key factors driving the automated material handling market. Additionally, the market will benefit from the expanding digitization of supply chain operations, further supported by increasing order customization and personalization during the forecast period.

- Automated Material Handling (AMH) systems streamline the movement of materials across various settings, including manufacturing facilities, warehouses, retail outlets, airports, and logistics centers. These systems facilitate the seamless transfer of materials, whether within the same area, across departments, or even between distinct buildings. AMH systems rely on routes designated by the manufacturing execution system (MES). These systems employ various technologies, including optical character recognition (OCR), barcodes, RFID, ultra-wideband indoor tracking, and near-field communication.

- Over the past seven decades, material handling has undergone significant transformations, reshaping the industry's landscape. Machines and robots have largely supplanted manual labor, catalyzing growth across sectors. Notably, the automotive industry stands out, boasting a remarkable tenfold expansion. Canada's advancements in Industry 4.0 and cutting-edge manufacturing are revolutionizing product design, delivery, and maintenance, even in diverse climates. From robotics and automation to additive manufacturing (3D printing), these technologies find broad utility in sectors spanning e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are spearheading the creation of sophisticated, high-value products, not only for domestic markets but also for a fiercely competitive global arena. Their initiatives not only elevate local practices but also set the stage for collaborative ventures that will define the trajectory of advanced automation technologies.

- While the first AGV debuted in 1953, widespread adoption across production and warehousing firms has been hindered by various factors, with cost being a primary concern. A typical guided vehicle is priced between USD 60,000 and 100,000, but systems with advanced features like navigation aids and sensors can be considerably pricier. These high upfront costs, coupled with maintenance challenges, are dampening the market's growth. Leading firms are striving to control costs without compromising on innovation or R&D investments.

- The COVID-19 pandemic has significantly impacted the adoption of automation across sectors, reshaping operational norms and introducing challenges such as social distancing and contactless operations. Organizations faced surging demands and reduced workforces, prompting the implementation of enhanced safety protocols. Since 2020, the outbreak affected the US workers, compelling companies to adopt new safety measures swiftly. While some industries, like food production, experienced shutdowns due to the virus's severity, many others adapted by incorporating stringent health measures to sustain operations.

Automated Material Handling (AMH) Market Trends

Industry 4.0 Investments Significantly Drive the Market's Growth

- The market is driven by the developments occurring due to countries adopting Industry 4.0 and IOT technologies. Through the use of robotics, industry 4.0 is revolutionizing how material handling is done. In warehouses and distribution facilities, robotics is becoming more and more prevalent. For instance, the International Federation of Robotics reported that US manufacturers heavily invested in automation, leading to a 12% increase in industrial robot installations, totaling 44,303 units in 2023. In addition to picking and packaging orders, loading and unloading trucks, and even cleaning the warehouse floor, they can also be employed for these activities. Workplace accuracy and productivity can both be enhanced by robotics. Robots can also enable company save money by lowering the quantity of necessary manual work.

- For instance, as warehouses are huge, associates must walk considerable distances to locate SKUs and deliver orders to the packing and shipping regions. Every year, an average warehouse wastes 6.9 weeks on unnecessary walking and other movements, equating to 265 million hours of work at the cost of USD 4.3 billion. During each stage of the selection process, collaborative robots also minimize the need for extended walks between functional areas. The rise in material handling equipment orders will significantly drive the studied market.

- Moreover, robotics, automation, and technologies like additive manufacturing (3D printing) have a wide range of applications in Canadian industries such as e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are producing a comprehensive range of technologically complex, increased-value products for domestic and competitive global markets, sharing enhanced practices and laying the groundwork for collaborations that shape the future of advanced automation technologies.

- Germany is also focused on the 2030 vision for Industry 4.0 in three strategic fields of action: autonomy, interoperability, and sustainability. In this 2030 vision, the stakeholders of the platform Industry 4.0 present a holistic approach to shaping the digital ecosystem. The goal is to create a framework for a future data economy that is by the demands of a social market economy, emphasizing open ecosystems, diversity, and supporting competition between all market stakeholders based on the specific situation and established strengths of the German industry base for the automation market.

- Furthermore, the government's strong support in the acquisition program has enabled China to move toward Industry 4.0. For instance, Siasun, a China-based industrial robot maker, is affiliated with the Chinese Academy of Sciences, which is further linked to the government. The country's adoption of industrial control systems by various companies is a notable trend. The advanced systems allow ease of production in factories. This also points to the gradual shift of companies from depending on manual labor to advanced technology-based systems that will enable the facility's automation.

- A significant trend impacting the market studied is the focus on smart manufacturing practices. According to the data from IBEF, the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of the gross domestic product (GDP) by 2025 from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about Industry 4.0 within the Indian manufacturing industry and enable stakeholders to address challenges related to automation material handling.

Asia-Pacific is Expected to be the Fastest Growing Market

- China has been a prominent contributor to the growth of the Asia-Pacific AMH market. The increasing demand for AMH products across industries, such as manufacturing, automotive, and e-commerce, boosts the market's growth. China has a vast population and pursues an industrial policy. Measured on the PPP basis, the country became the largest global economy and the largest global exporter and trader during the current decade. The country is currently transitioning from a manufacturing and construction-led economy to a consumer-led economy.

- According to China's National Bureau of Statistics, total retail sales in China's consumer products market were around CNY 41,860.5 billion (USD 5786.31 billion) in 2023. The number of Chinese online buyers has risen rapidly from under 34 million in 2006 to over 915 million in 2023, enabling China's e-commerce business to proliferate. Hence, with growing e-commerce, the demand for material-handling equipment will likely rise in the forecasted years.

- Japan is predominantly a manufacturing nation. Its manufacturing industry contributes close to 20% to the nominal GDP, whereas it is close to 10% for other developed countries. According to the IMF, the country's manufacturing sector has achieved significant industrial productivity gains over the services sector, owing to the increased adoption of ICT. The automotive and electronics sectors are the most productive manufacturing sectors in the country.

- The government's heightened infrastructure investments, bolstered by industry contributions and the 'Make in India' campaign, are set to propel the demand for automated material handling (AMH) systems. Given that the manufacturing sector accounts for 17% of India's GDP and employs over 27.3 million individuals, its significance in the nation's economic landscape is undeniable. With a vision to derive 25% of the economy's output from manufacturing by 2025, the Indian government is rolling out various initiatives and policies. Consequently, manufacturers are gearing up to embrace Industry 4.0 and other digital innovations to meet this ambitious goal.

- South Korea adopted the 4th Industrial Revolution. In Korea, smart factories will be one of the most important fields. Both the private and public sectors in Korea have committed to ramping up the number of domestic smart factories. Their target is ambitious: they aim to have 30,000 such cutting-edge factories equipped with the latest digital and analytical technologies up and running across the nation by 2023. Furthermore, in a bid to counteract Korea's shrinking working-age population, there are plans to establish 20 smart industrial zones by 2030. As part of this initiative, the goal is to set up 2,000 new AI-powered smart factories by 2030, aligning with the rapid pace of digitalization and automation characteristic of the fourth industrial revolution.

Automated Material Handling (AMH) Industry Overview

The automated material handling (AMH) market is characterized by semi-consolidation and high competitiveness. Key players in the market primarily rely on strategies like product launches, significant investments in R&D, and forming partnerships or making acquisitions to navigate the fierce competition.

- In May 2024, KION North America (KION NA), a prominent manufacturer of Linde Material Handling equipment, and Fox Robotics entered into a strategic non-exclusive partnership. As part of this collaboration, KION NA is expected to manufacture and assemble FoxBot autonomous trailer loader/unloaders (ATLs) at its state-of-the-art facilities in Summerville, South Carolina.

- In November 2023, Toyota Material Handling (TMH), a pioneer in material handling, unveiled three cutting-edge electric forklift models. These additions bolster TMH's already extensive range of material handling solutions. The trio includes a Side-Entry End Rider, a Center Rider Stacker, and an Industrial Tow Tractor. These models promise heightened efficiency, versatility, and top-tier performance, all while emphasizing operator comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements aiding the Market's Growth

- 5.1.2 Industry 4.0 Investments driving the Demand for Automation and Material Handling

- 5.1.3 Rapid Growth of the E-commerce Sector

- 5.2 Market Challenges

- 5.2.1 High Initial Equipment Costs

- 5.2.2 Unavailability for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.2 Autonomous Mobile Robot (AMR)

- 6.2.2 Automated Storage and Retrieval System

- 6.2.2.1 Fixed Aisle

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food And Beverages

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 Italy

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Kardex Group

- 7.1.3 KION Group AG

- 7.1.4 JBT Corporation

- 7.1.5 Jungheinrich AG

- 7.1.6 TGW Logistics Group GmbH

- 7.1.7 SSI Schaefer AG

- 7.1.8 KNAPP AG

- 7.1.9 Mecalux SA

- 7.1.10 System Logistics SpA

- 7.1.11 Viastore Systems GmbH

- 7.1.12 BEUMER Group GmbH & Co. KG

- 7.1.13 Interroll Holding AG

- 7.1.14 WITRON Logistik

- 7.1.15 Siemens AG

- 7.1.16 KUKA AG

- 7.1.17 Honeywell Intelligrated Inc. (Honeywell International Inc.)

- 7.1.18 Murata Machinery Ltd

- 7.1.19 Toyota Industries Corporation

- 7.1.20 Visionnav Robotics

- 7.1.21 Dearborn Mid-West Company