|

市場調査レポート

商品コード

1686225

小型衛星:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Small Satellite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小型衛星:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 214 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

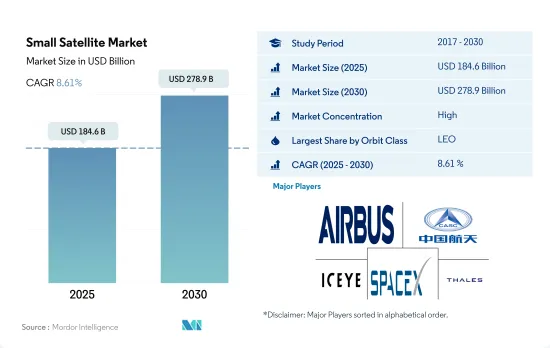

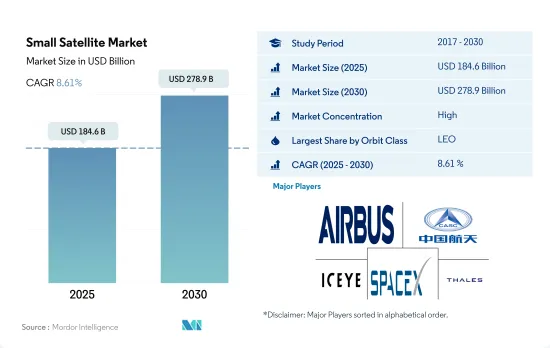

小型衛星の市場規模は2025年に1,846億米ドルと推定され、2030年には2,789億米ドルに達すると予測され、予測期間中(2025-2030年)のCAGRは8.61%で成長します。

LEO衛星が市場シェアの大半を占め、市場の成長を独占

- 衛星や宇宙船は通常、地球を周回する数多くの特別な軌道の1つに配置されるか、惑星間の旅に打ち上げられます。小型衛星は、科学研究から商業・軍事利用まで幅広い用途で宇宙への低コストアクセスを可能にし、近年の宇宙産業に革命をもたらしました。小型衛星の可能性を十分に発揮するためには、小型衛星が打ち上げることのできる軌道の種類を理解することが不可欠です。NASAの地球観測システムをはじめ、科学衛星のほとんどは地球低軌道にあります。

- 小型衛星市場は、通信、航法、地球観測、軍事偵察、科学ミッションに使用されるLEO衛星の需要増加に牽引され、力強い成長を続けています。2017年から2022年にかけて、約2900機のLEO小型衛星が製造・打ち上げられ、主に通信目的で使用されました。このため、SpaceX、OneWeb、Amazonなどの主要企業は、LEOへの数千の衛星打ち上げを計画しています。地球観測、ナビゲーション、気象学、軍事通信など様々な分野からの低軌道に対する需要の高まりに伴い、LEO衛星の打ち上げ数が増加しています。

- 近年、GEOやMEOへの小型衛星の打ち上げは非常に少ないが、この事実にもかかわらず、MEOやGEO衛星の軍事利用は拡大しています。また、信号強度の向上、通信・データ転送能力の向上、カバーエリアの拡大などの利点があるため、今後も増加すると予想されています。例えば、レイセオン・テクノロジーズとボーイングのミレニアム・スペース・システムズは、米国宇宙軍向けに最初のプロトタイプとなるミサイル・トラック・カストディ(MTC)MEO OPIRペイロードを開発しています。

北米は予測期間中に大きく成長する可能性があります。

- 世界の小型衛星市場は、高速インターネット、通信サービス、様々な産業におけるデータ転送の需要増に牽引され、今後数年間で大きく成長すると予想されます。市場は北米、欧州、アジア太平洋に関して分析されており、市場シェアと収益創出という点で主要な地域です。

- 北米は、Swarm Technologies、Planet Labs、SpaceXなど複数の大手企業が存在するため、予測期間中に世界の小型衛星市場を独占すると予想されます。米国政府も先進的な衛星技術の開発に多額の投資を行っており、これが北米の小型衛星市場を牽引すると期待されています。2017-2022年*の間、この地域は製造された小型衛星全体の75%を占めています。

- 欧州の小型衛星市場は、高速インターネットや通信サービスの需要増により、予測期間中に大きく成長すると予想されています。欧州宇宙機関(ESA)は先進的な衛星技術の開発に多額の投資を行っており、これが欧州の小型衛星市場の成長を牽引すると期待されています。2017-2022年*の間、この地域は製造された小型衛星全体の13%を占めています。

- アジア太平洋は、中国、インド、日本などの国々で衛星ベースの通信サービスやナビゲーションシステムの需要が増加しているため、予測期間中に小型衛星市場で大きな成長が見込まれます。2017-2022年*の間、この地域は製造された小型衛星全体の6%を占めました。

世界の小型衛星市場動向

燃料効率と運用効率の向上という動向が市場にプラスの影響を与える見込み

- 現在、衛星は小型化し続けています。小型衛星は、従来の人工衛星の数分の一のコストで、従来の人工衛星が行うほぼすべてのタスクをこなすことができるため、小型衛星コンステレーションの構築、打ち上げ、運用がますます実行可能になっています。それに応じて、小型衛星への依存度も飛躍的に高まり続けています。小型衛星は通常、開発サイクルが短く、開発チームも小規模で、打ち上げコストもはるかに低いです。革命的な技術の進歩により、エレクトロニクスの小型化が促進され、スマート素材の発明が推進され、衛星バスのサイズと質量がメーカーにとって長期的に削減されることになりました。

- 衛星は質量によって分類されます。質量が500kg未満のものは小型衛星とみなされます。世界全体では、約3800機以上の小型衛星が打ち上げられています。小型衛星は開発期間が短く、ミッション全体のコストを削減できるため、世界的に小型衛星の動向が高まっています。小型衛星は、科学的・技術的成果を得るために必要な時間を大幅に短縮します。小型衛星のミッションは柔軟である傾向があるため、新たな技術的機会やニーズに対応しやすいです。米国の小型衛星産業は、特定の用途に特化した小型衛星の設計・製造のための強固な枠組みの存在に支えられています。商業・軍事宇宙分野での需要の高まりにより、2023~2030年の間に小型衛星の数の増加が予想されます。

各宇宙機関の宇宙開発費の増加は、小型衛星産業にプラスの影響を与えると予想されます。

- カナダ政府によると、宇宙部門はカナダのGDPに23億米ドルを上乗せしています。政府の報告によると、カナダの宇宙企業の90%は中小企業です。カナダ宇宙庁の予算は控えめで、2022年から2023年の予算支出見込み額は3億2,900万米ドルです。2022年11月、ESAが行った発表によると、今後3年間の宇宙予算を25%増額することが提案されました。これは、地球観測における欧州のリードを維持し、航法サービスを拡大し、米国との探査パートナーであり続けるためのものでした。

- 例えば、2020年12月、IABGとBMWiは、高解像度カメラ、画像センサー、画像コンバーターを搭載した衛星を製造するために、2億3,000万ユーロの契約を締結しました。この新技術は2022年末までにミュンヘンで量産が開始され、世界中の地図作成やナビゲーションに必要な衛星の設置に使用されます。ドイツは衛星観測能力も徐々に開発しています。新たな観測衛星技術が軌道に打ち上げられ、国全体の環境負荷を軽減するための重要な取り組みとなりました。

- 研究助成金や投資助成金の面では、世界各国の政府や民間企業が宇宙分野の研究や技術革新に専用の資金を提供しています。例えば、2023年2月まで、米航空宇宙局(NASA)は研究助成金として3億3,300万米ドルを分配しました。小型衛星は、商業用途に比べ、科学研究、軍事、防衛分野でますます好まれるようになっています。地球や天体の観測、宇宙研究、通信といったデータ量の多いアプリケーションの要求が高まっているため、小型衛星の需要は過去最高を記録した、

小型衛星産業の概要

小型衛星市場はかなり統合されており、上位5社で98.09%を占めています。この市場の主要企業は以下の通りです。Airbus SE, China Aerospace Science and Technology Corporation(CASC), ICEYE Ltd., Space Exploration Technologies Corp. and Thales(アルファベット順).

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 レポートのオファー

第3章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第4章 主要産業動向

- 衛星の質量

- 宇宙開発への支出

- 規制の枠組み

- 世界

- オーストラリア

- ブラジル

- カナダ

- 中国

- フランス

- ドイツ

- インド

- イラン

- 日本

- ニュージーランド

- ロシア

- シンガポール

- 韓国

- アラブ首長国連邦

- 英国

- 米国

- バリューチェーンと流通チャネル分析

第5章 市場セグメンテーション

- 用途

- 通信

- 地球観測

- ナビゲーション

- 宇宙観測

- その他

- 軌道クラス

- GEO

- LEO

- MEO

- エンドユーザー

- 商業

- 軍事・政府

- その他

- 推進技術

- 電気式

- ガス

- 液体燃料

- 地域

- アジア太平洋

- 欧州

- 北米

- 世界のその他の地域

第6章 競合情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル.

- Airbus SE

- Astrocast

- Axelspace Corporation

- Chang Guang Satellite Technology Co. Ltd

- China Aerospace Science and Technology Corporation(CASC)

- German Orbital Systems

- GomSpaceApS

- ICEYE Ltd.

- Planet Labs Inc.

- Satellogic

- Space Exploration Technologies Corp.

- SpaceQuest Ltd

- Spire Global, Inc.

- Swarm Technologies, Inc.

- Thales

第7章 CEOへの主な戦略的質問

第8章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(DROs)

- 情報源と参考文献

- 図表一覧

- 主要洞察

- データパック

- 用語集

The Small Satellite Market size is estimated at 184.6 billion USD in 2025, and is expected to reach 278.9 billion USD by 2030, growing at a CAGR of 8.61% during the forecast period (2025-2030).

LEO satellites dominate the market's growth by occupying majority of the market share

- A satellite or spacecraft is usually placed into one of many special orbits around the Earth or launched into an interplanetary journey. Small satellites revolutionized the space industry in recent years as they have enabled low-cost access to space for a wide range of applications, from scientific research to commercial and military applications. To fully realize the potential of small satellites, it is essential to understand the different types of orbits they can be launched into. Most science satellites, including NASA's Earth Observation System, are in low Earth orbit.

- The small satellite market continues to experience strong growth, driven by the increasing demand for LEO satellites used for communication, navigation, Earth observation, military reconnaissance, and scientific missions. Between 2017 and 2022, around 2900 small LEO satellites were manufactured and launched, primarily used for communication purposes. This led companies such as SpaceX, OneWeb, and Amazon to plan the launch of thousands of satellites into LEO. With the rising demand for low earth orbit from various sectors like Earth observation, navigation, meteorology, and military communications, the market has witnessed a rise in the number of launches of LEO satellites.

- Though the launch of small satellites into GEO and MEO is very few in recent years, despite this fact, the military's use of MEO and GEO satellites has grown. It is also expected to increase, owing to the advantages, such as increased signal strength, improved communications and data transfer capabilities, and greater coverage area. For instance, Raytheon Technologies' and Boeing's Millennium Space Systems are developing the first prototype Missile Track Custody (MTC) MEO OPIR payloads for the US Space Force.

North America may witness significant growth during the forecast period

- The global small satellite market is expected to grow significantly in the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. The market is analyzed with respect to North America, Europe, and Asia-Pacific, which are the major regions in terms of market share and revenue generation.

- North America is expected to dominate the global small satellite market during the forecast period due to the presence of several leading players, such as Swarm Technologies, Planet Labs, and SpaceX. The US government has also been investing heavily in developing advanced satellite technology, which is expected to drive the North American small satellite market. During 2017-2022*, the region accounted for 75% of the total small satellites manufactured.

- The small satellite market in Europe is expected to grow significantly during the forecast period due to the rising demand for high-speed internet and communication services. The European Space Agency (ESA) has been investing heavily in developing advanced satellite technology, which is expected to drive the growth of the European small satellite market. During 2017-2022*, the region accounted for 13% of the total small satellites manufactured.

- Asia-Pacific is expected to witness significant growth in the small satellite market during the forecast period due to the increasing demand for satellite-based communication services and navigation systems in countries such as China, India, and Japan. During 2017-2022*, the region accounted for 6% of the total small satellites manufactured.

Global Small Satellite Market Trends

The trend of for better fuel and operational efficiency is expected to positively impact the market

- Satellites continue to be small-sized nowadays. They are capable of almost every task a conventional satellite does at a fraction of the cost of the conventional satellite, thereby making the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, our reliance on them continues to grow exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch. Revolutionary technological advancements facilitated the miniaturization of electronics, leading to a push for the invention of smart materials and reducing satellite bus size and mass over time for manufacturers.

- Satellites are classified according to mass. Those with a mass of less than 500 kg are considered small satellites. Globally, around 3800+ small satellites were launched. There has been a growing trend for small satellites worldwide owing to their shorter development time, which could reduce overall mission costs. They significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by the presence of a robust framework for the design and manufacture of small satellites tailored to serve specific application profiles. Owing to the growing demand in the commercial and military space sector, a rise in the number of small satellites is expected during 2023-2030.

Increasing space expenditures of different space agencies are expected to positively impact the small satellites industry

- According to the Canadian government, the space sector adds USD 2.3 billion to the Canadian GDP. The government reports that 90% of Canadian space firms are small- and medium-sized businesses. The Canadian Space Agency budget is modest, and the estimated budgetary spending for 2022-2023 is USD 329 million. In November 2022, as per the announcement that was made by ESA, a 25% boost was proposed in space funding over the next three years, which was designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States

- For instance, in December 2020, IABG and BMWi signed a EUR 230 million contract to create satellites with high-resolution cameras, image sensors, and image converters. The new technology began mass production in Munich by the end of 2022 and will be used to install satellites needed for mapping and navigation around the world. Germany is also gradually developing its satellite observation capabilities. New observation satellite technologies were launched into orbit in a significant effort to reduce the environmental impact across the nation.

- In terms of research and investment grants, governments globally governments and the private sector have dedicated funds for research and innovation in the space sector. For instance, till February 2023, the National Aeronautics and Space Administration (NASA) distributed USD 333 million as research grants. Small satellites are increasingly being preferred for scientific research, military, and defense sectors, compared to commercial applications. The demand for small satellites reached a new high owing to the increasing requirements of data-intense applications like Earth and celestial observation, space research, and communication,

Small Satellite Industry Overview

The Small Satellite Market is fairly consolidated, with the top five companies occupying 98.09%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), ICEYE Ltd., Space Exploration Technologies Corp. and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Spending On Space Programs

- 4.3 Regulatory Framework

- 4.3.1 Global

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 France

- 4.3.7 Germany

- 4.3.8 India

- 4.3.9 Iran

- 4.3.10 Japan

- 4.3.11 New Zealand

- 4.3.12 Russia

- 4.3.13 Singapore

- 4.3.14 South Korea

- 4.3.15 United Arab Emirates

- 4.3.16 United Kingdom

- 4.3.17 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Propulsion Tech

- 5.4.1 Electric

- 5.4.2 Gas based

- 5.4.3 Liquid Fuel

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Astrocast

- 6.4.3 Axelspace Corporation

- 6.4.4 Chang Guang Satellite Technology Co. Ltd

- 6.4.5 China Aerospace Science and Technology Corporation (CASC)

- 6.4.6 German Orbital Systems

- 6.4.7 GomSpaceApS

- 6.4.8 ICEYE Ltd.

- 6.4.9 Planet Labs Inc.

- 6.4.10 Satellogic

- 6.4.11 Space Exploration Technologies Corp.

- 6.4.12 SpaceQuest Ltd

- 6.4.13 Spire Global, Inc.

- 6.4.14 Swarm Technologies, Inc.

- 6.4.15 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms