|

市場調査レポート

商品コード

1693448

飼料用種子:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Forage Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 飼料用種子:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 491 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

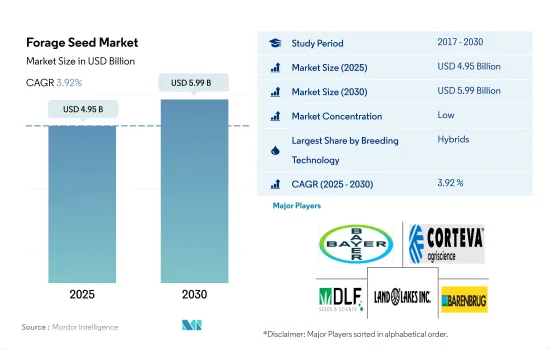

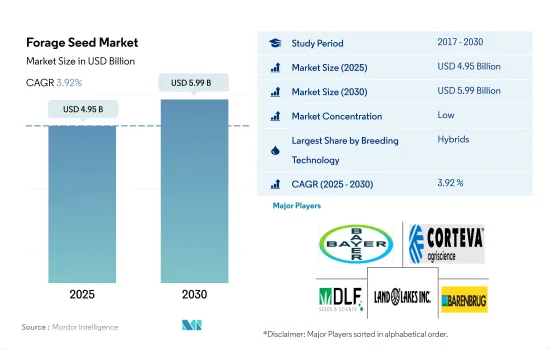

飼料用種子市場規模は2025年に49億5,000万米ドルと予測され、2030年には59億9,000万米ドルに達し、予測期間中(2025-2030年)のCAGRは3.92%で成長すると予測されます。

雑種は、開放受粉品種に関するより高い成長の可能性で、飼料用種子市場を独占しています。

- 家畜人口は地域全体で増加しています。家畜頭数の増加には飼料作付面積の拡大が必要であり、高収量が期待でき飼料価値の高い品種の使用が求められます。これが、ハイブリッド種子市場および顕受粉種子市場の成長につながる主な要因のひとつです。

- 大手企業は需要の増加を受けて、種子の品質向上に投資しています。例えば、2021年、世界有数の牧草種子育種会社であるDLF Seedsは、最先端の混合・流通施設の新設に460万米ドルを投資しました。この投資により、同社の現在のOPVおよび飼料用ハイブリッド種子の生産施設は一変し、飼料用種子市場におけるアメニティ、消費者、環境スチュワードシップにおける将来の市場需要に対応するために、大いに必要とされる追加能力と効率性がもたらされます。

- ハイブリッド種子部門は、その利点に関する普及と認知度の向上により市場を独占しています。ハイブリッド種子市場セグメントは、種子交換率の上昇と市場における改良品種の利用可能性により、予測期間中にCAGR 3.9%で増加すると予測されます。

- 雑草や病気による作物損失の増加により、さまざまな飼料生産地域で遺伝子組み換え品種に対する農家の嗜好が徐々に高まっています。そのため、遺伝子組み換え分野は予測期間中CAGR 5%で成長しています。

- OPV種子を使用するアジア太平洋の飼料用種子市場は最も急速に成長し、予測期間中のCAGRは4.3%と予測されます。これは、開放受粉品種は肥料や農薬などの投入が少なくて済み、小規模農家や低所得農家にとって安価で手が届きやすいためです。

北米と欧州は飼料用種子の需要が大きいため、世界の飼料用種子市場をリードしています。

- 世界的には、北米が飼料としての飼料需要の増加、食肉消費の増加、気象条件などから、2022年の金額ベースで世界の飼料用種子市場の42.3%を占め、大きなシェアを占めています。北米では、米国が最大の飼料用種子市場を有しており、2022年には北米の飼料用種子市場の37.0%を占める。これは、同国における飼料としての飼料需要の高さと畜牛人口の増加によるものです。

- 欧州は飼料の主要生産国です。2022年の世界の飼料用種子市場に26.7%寄与しています。家畜生産と消費の増加がこの地域の飼料市場を牽引しています。ドイツは欧州最大の飼料作物生産国で、2022年の同地域の飼料用種子市場における市場シェアは29.4%です。

- アジア太平洋は、2022年の世界の飼料用種子市場の約15.1%を占めています。インドはこの地域で最大の飼料用種子市場を有しており、2022年には金額ベースでアジア太平洋の飼料用種子市場の18%を占める。同地域の畜産部門の成長による飼料作物への需要の増加は、同地域の飼料用種子市場を牽引し、予測期間中のCAGRは2.7%を記録すると予測されています。

- 2022年には、南米は世界の飼料用種子市場の11.3%の市場シェアを占めていました。アルファルファは南米で栽培されている主要な飼料作物です。除草剤耐性があり水ストレスに強く、消化率を高めるためにリグニンを多く含むアルファルファの遺伝子組み換え雑種が入手可能であることが、南米における遺伝子組み換えアルファルファ種子市場を牽引しており、CAGRは4.2%を記録すると予想されます。

- 家畜人口の増加による需要の増加が、予測期間中の市場を牽引すると予想されます。

世界の飼料用種子市場動向

アルファルファは、異なる天候や土壌条件下でも高い飼料収量を生産できることから、優位を占めています。

- 世界的に、飼料作物の栽培面積は2022年に8,040万haに達し、2017年から2022年の間に4.3%増加しました。この背景には、食肉や乳製品の需要増を背景とした世界の畜産業の拡大があり、飼料としての飼料作物の需要が高まっています。飼料作物の中では、アルファルファが栽培面積で圧倒的なシェアを占めています。2022年には世界の飼料作物作付面積の39.2%を占めました。これは、アルファルファが様々な天候や土壌条件下で豊富なタンパク質と魅力的な飼料を生産する優れた能力を持つためです。

- 北米は世界の飼料作物栽培面積の大部分を占め、2022年のシェアは29.7%でした。2022年には米国だけでこの地域の飼料作付面積の59.8%を占めています。これは主に、同国の飼料産業からの需要増加によるものです。

- アジア太平洋地域では、飼料作物の総栽培面積は2017年から2022年の間に7.6%増加しました。飼料作物の栽培面積が最も大きいのはインドで、2022年には52.2%となります。同国で栽培が増加している主な要因は、畜産人口の多さと飼料需要の増加です。

- 欧州は世界最大の飼料生産国のひとつです。同地域の飼料総栽培面積は2022年に910万haに達し、家畜の飼料需要の増加により2017年から2022年の間に4.6%増加しました。飼料用トウモロコシとアルファルファの栽培面積が最も大きく、2022年の欧州全体の飼料栽培面積の63.5%と35.4%を占める。したがって、飼料産業からの需要の増加と家畜人口の増加が、飼料栽培の拡大を促進すると推定されます。

畜産における飼料需要の増加が、耐病性、幅広い適応性、早熟の特徴を持つ飼料用種子の使用を促進しています。

- アルファルファと飼料用トウモロコシは、消化率が高く高タンパク質であるなど、家畜の飼育に有益であることから、主要な飼料作物となっています。また、農家は良質で高い収量を得ることができます。アルファルファの適応性の広さは、天候の変化、早熟に対する需要の増加、さまざまな投入資材の使用を最小限に抑えるために単一製品でリグニンの含有量が低いことから、最も多く採用された形質でした。さらに、広い適応性は世界市場で最も採用された形質であり、特に南米では2022年の地域市場シェアが35.4%でした。この作物が最も採用されているのは、農業気候条件の変化、圃場ストレス、さまざまな地域での作物栽培の拡大が理由です。

- バイエル、DLF、バレンブルグなどの企業は、アルファルファ(DKC 3218、DKC 3204、Debalto、Marcamo)や飼料用トウモロコシ(Daisy、Fado、Power 4.2)など、多くの品種を導入しています。これらの品種は、多様な環境条件に耐え、さまざまな土壌タイプに適応し、圃場ストレスや暑熱条件にも耐えることができます。EU委員会のREFORMAプロジェクト(2016~2020年)は、高度な育種技術を開発し、アルファルファの新品種を導入することを目的としていました。

- 生育期間が短く、農家が早期に収穫できることから、早生でデンプン含量の高い形質を持つ種子の需要が増加しています。飼料コーンに含まれる高でんぷん含量は、家畜飼料としての栄養価を高める。そのため、予測期間中、企業はこのような品種を大量に生産すると予想されます。

- 病害による損失の増加を防ぎ、短期間で生産性を向上させるために、耐病性や早熟などの形質を持つ種子が市場を牽引しています。

飼料用種子産業の概要

飼料用種子市場は細分化されており、上位5社で33.65%を占めています。この市場の主要企業は以下の通りです。 Bayer AG, Corteva Agriscience, DLF, Land O'Lakes Inc. and Royal Barenbrug Group(アルファベット順)

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 レポートのオファー

第3章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第4章 主要産業動向

- 耕作面積

- 耕作作物

- 最も人気のある品種

- アルファルファと飼料用トウモロコシ

- 育種技術

- 畑作物

- 規制の枠組み

- バリューチェーンと流通チャネル分析

第5章 市場セグメンテーション

- 育種技術

- ハイブリッド

- 非トランスジェニック・ハイブリッド

- 遺伝子組み換え雑種

- 除草剤耐性雑種

- その他の形質

- 開放受粉品種とハイブリッド派生品種

- ハイブリッド

- 作物

- アルファルファ

- 飼料用トウモロコシ

- 飼料用ソルガム

- その他の飼料作物

- 地域

- アフリカ

- 育種技術別

- 作物別

- 国別

- エジプト

- エチオピア

- ガーナ

- ケニア

- ナイジェリア

- 南アフリカ

- タンザニア

- その他のアフリカ

- アジア太平洋

- 育種技術別

- 作物別

- 国別

- オーストラリア

- バングラデシュ

- 中国

- インド

- インドネシア

- 日本

- ミャンマー

- パキスタン

- フィリピン

- タイ

- ベトナム

- その他アジア太平洋地域

- 欧州

- 育種技術別

- 作物別

- 国別

- フランス

- ドイツ

- イタリア

- オランダ

- ポーランド

- ルーマニア

- ロシア

- スペイン

- トルコ

- ウクライナ

- 英国

- その他欧州

- 中東

- 育種技術別

- 作物別

- 国別

- イラン

- サウジアラビア

- その他中東

- 北米

- 育種技術別

- 作物別

- 国別

- カナダ

- メキシコ

- 米国

- 北米その他

- 南米

- 育種技術別

- 作物別

- 国別

- アルゼンチン

- ブラジル

- その他南米地域

- アフリカ

第6章 競合情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル

- Advanta Seeds-UPL

- Ampac Seed Company

- Bayer AG

- Corteva Agriscience

- DLF

- KWS SAAT SE & Co. KGaA

- Land O'Lakes Inc.

- RAGT Group

- Royal Barenbrug Group

- S&W Seed Co.

第7章 CEOへの主な戦略的質問

第8章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 世界市場規模とDRO

- 情報源と参考文献

- 図表リスト

- 主要洞察

- データパック

- 用語集

目次

Product Code: 92510

The Forage Seed Market size is estimated at 4.95 billion USD in 2025, and is expected to reach 5.99 billion USD by 2030, growing at a CAGR of 3.92% during the forecast period (2025-2030).

Hybrids dominate the forage seed market with the higher growth potential concerning the open-pollinated varieties.

- The livestock population is increasing across the regions. The increase in livestock population needs an expansion of the area under forages and demands the use of varieties with high yield potential and a high feed value. This is one of the major factors leading to the growth of the hybrid and open-pollinated seed market.

- Major companies are investing in improving seed quality due to increased demand. For instance, in 2021, DLF Seeds, the world's leading grass seed breeder, invested USD 4.6 million in new state-of-the-art mixing and distribution facilities. The investment will transform their current production facilities of OPVs and the hybrid seed of forage and bring much-needed additional capacity and efficiency to cope with the future market demands in the amenity, consumer, and environmental stewardship in the forage seed market.

- The hybrid seed segment dominates the market due to the increased adoption and awareness about its benefits. The hybrid seed market segment is estimated to increase by a CAGR of 3.9% during the forecast period due to the rise in the seed replacement rate and the availability of improved varieties in the market.

- The farmer's preference for transgenic varieties is slowly rising in various forage-growing regions due to increased crop losses due to weeds and diseases. Therefore, the transgenic segment is growing with a CAGR of 5% during the forecast period.

- The Asia-Pacific forage seed market using OPVs seeds is projected to be the fastest growing, at a CAGR of 4.3% during the forecast period because open-pollinated varieties require fewer inputs, such as fertilizer and pesticides, and are less expensive and more affordable for small holding and low-income farmers.

North America and Europe are leading forage seed markets in the world due to the large demand for forage seeds in these regions

- Globally, North America holds a major share, accounting for 42.3% of the global forage seeds market in terms of value in 2022 due to the increase in the demand for forage as feed, an increase in meat consumption, and weather conditions. In North America, the United States has the largest forage seed market, accounting for 37.0% of North America's forage seed market in 2022. This is due to the high demand for forage as feed and the increase in the cattle population in the country.

- Europe was the primary producer of forages. It contributed 26.7% to the global forage seed market in 2022. The increase in livestock production and consumption is driving the forage market in the region. Germany is the largest producer of forage crops in Europe, with a market share of 29.4% in the region's forage seed market in 2022.

- Asia-Pacific accounted for about 15.1% of the global forage seed market in 2022. India has the largest forage seed market in the region, and it accounted for 18% of the Asia-Pacific forage seed market in terms of value in 2022. The growing demand for forage crops due to the growing livestock sector in the region is anticipated to drive the region's forage seed market, registering a CAGR of 2.7% during the forecast period.

- In 2022, South America had a market share of 11.3% of the global forage seed market. Alfalfa is the major forage crop grown in South America. The availability of GM hybrids of alfalfa that are herbicide-resistant and tolerant to water stress and high lignin content for better digestibility is driving the transgenic alfalfa seed market in South America, and it is expected to register a CAGR of 4.2%.

- The increasing demand due to the increased livestock population is anticipated to drive the market during the forecast period.

Global Forage Seed Market Trends

Alfalfa dominates due to its ability to produce high forage yield under different weather and soil conditions.

- Globally, the area under forage crop cultivation reached 80.4 million ha in 2022, which increased by 4.3% between 2017 and 2022. This is due to the expansion of the global livestock industry, driven by increasing demand for meat and dairy products, which has led to a higher demand for forage crops as feed. Among the forage crops, alfalfa is a dominant crop in terms of cultivation area. It accounted for 39.2% of the global forage crop acreage in 2022. This is because of alfalfa's exceptional capacity to produce abundant protein and attractive forage under various weather and soil conditions.

- North America accounted for the major area under forage crop cultivation in the world, with a share of 29.7% in 2022. The United States alone held 59.8% of the region's forage acreage in 2022. This is mainly due to increased demand from the animal feed industry in the country.

- In the Asia-Pacific region, the total area under forage crop cultivation increased by 7.6% between 2017 and 2022. India has the largest area under forage crops, with 52.2% in 2022. The main factors increasing cultivation in the country are the high livestock population and rising demand for animal feed.

- Europe is one of the largest producers of Forages in the world. The total forage cultivation area in the region reached 9.1 million ha in 2022, which increased by 4.6% between 2017 and 2022 due to rising feed demand from livestock. Forage corn and alfalfa have the largest area under cultivation, accounting for 63.5% and 35.4% of the overall European forage cultivation area in 2022. Therefore, increased demand from the animal feed industry and the growing livestock population are estimated to drive the expansion of forage cultivation.

Increasing demand for fodder in livestock farming is driving the usage of forage seeds with disease resistance, wider adaptability, and early maturity traits

- Alfalfa and forage corn are the major forage crops because of their benefits to livestock rearing, such as more digestibility and high protein. They also allow farmers to attain higher yields with good quality. Wider adaptability for alfalfa was the largest adopted trait as there have been weather changes, increased demand for early maturity, and low lignin content in a single product to minimize the usage of different inputs. Additionally, wider adaptability was the most adopted trait in the global market, especially in South America, as it had a regional market share of 35.4% in 2022. It is the most adopted crop because of the changing agro-climatic conditions, field stress, and growing crop cultivation in different regions.

- Companies such as Bayer, DLF, and Barenbrug have introduced many varieties of alfalfa and forage corn, such as Alfalfa (DKC 3218, DKC 3204, Debalto, and Marcamo), as well as forage corn (Daisy, Fado, and Power 4.2). These varieties can withstand diverse environmental conditions, adapt to various soil types, and withstand field stress and heat conditions. The EU Commission's REFORMA project (2016-2020) aimed to develop advanced breeding techniques and introduce new alfalfa cultivars.

- There is an increase in the demand for seeds with early maturity and high starch content traits as they offer a shorter growing period, allowing farmers to harvest earlier. High starch content in forage corn enhances its nutritional value for animal feed. Therefore, the companies are expected to produce such varieties in larger quantities during the forecast period.

- To prevent the increasing losses from diseases and increase productivity in a shorter period, the seeds with traits such as disease resistance and early maturity drive the market.

Forage Seed Industry Overview

The Forage Seed Market is fragmented, with the top five companies occupying 33.65%. The major players in this market are Bayer AG, Corteva Agriscience, DLF, Land O'Lakes Inc. and Royal Barenbrug Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa & Forage Corn

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Alfalfa

- 5.2.2 Forage Corn

- 5.2.3 Forage Sorghum

- 5.2.4 Other Forage Crops

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Breeding Technology

- 5.3.1.2 By Crop

- 5.3.1.3 By Country

- 5.3.1.3.1 Egypt

- 5.3.1.3.2 Ethiopia

- 5.3.1.3.3 Ghana

- 5.3.1.3.4 Kenya

- 5.3.1.3.5 Nigeria

- 5.3.1.3.6 South Africa

- 5.3.1.3.7 Tanzania

- 5.3.1.3.8 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Breeding Technology

- 5.3.2.2 By Crop

- 5.3.2.3 By Country

- 5.3.2.3.1 Australia

- 5.3.2.3.2 Bangladesh

- 5.3.2.3.3 China

- 5.3.2.3.4 India

- 5.3.2.3.5 Indonesia

- 5.3.2.3.6 Japan

- 5.3.2.3.7 Myanmar

- 5.3.2.3.8 Pakistan

- 5.3.2.3.9 Philippines

- 5.3.2.3.10 Thailand

- 5.3.2.3.11 Vietnam

- 5.3.2.3.12 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Breeding Technology

- 5.3.3.2 By Crop

- 5.3.3.3 By Country

- 5.3.3.3.1 France

- 5.3.3.3.2 Germany

- 5.3.3.3.3 Italy

- 5.3.3.3.4 Netherlands

- 5.3.3.3.5 Poland

- 5.3.3.3.6 Romania

- 5.3.3.3.7 Russia

- 5.3.3.3.8 Spain

- 5.3.3.3.9 Turkey

- 5.3.3.3.10 Ukraine

- 5.3.3.3.11 United Kingdom

- 5.3.3.3.12 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Breeding Technology

- 5.3.4.2 By Crop

- 5.3.4.3 By Country

- 5.3.4.3.1 Iran

- 5.3.4.3.2 Saudi Arabia

- 5.3.4.3.3 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Breeding Technology

- 5.3.5.2 By Crop

- 5.3.5.3 By Country

- 5.3.5.3.1 Canada

- 5.3.5.3.2 Mexico

- 5.3.5.3.3 United States

- 5.3.5.3.4 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Breeding Technology

- 5.3.6.2 By Crop

- 5.3.6.3 By Country

- 5.3.6.3.1 Argentina

- 5.3.6.3.2 Brazil

- 5.3.6.3.3 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Ampac Seed Company

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 KWS SAAT SE & Co. KGaA

- 6.4.7 Land O'Lakes Inc.

- 6.4.8 RAGT Group

- 6.4.9 Royal Barenbrug Group

- 6.4.10 S&W Seed Co.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms