|

|

市場調査レポート

商品コード

1646514

欧州の飼料用種子の市場規模・予測、2021年~2031年、地域別シェア、動向、成長機会分析レポート:品種別、国別Europe Forage Seeds Market Size and Forecast 2021-2031, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Species and Country |

||||||

|

|||||||

| 欧州の飼料用種子の市場規模・予測、2021年~2031年、地域別シェア、動向、成長機会分析レポート:品種別、国別 |

|

出版日: 2025年01月06日

発行: The Insight Partners

ページ情報: 英文 97 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

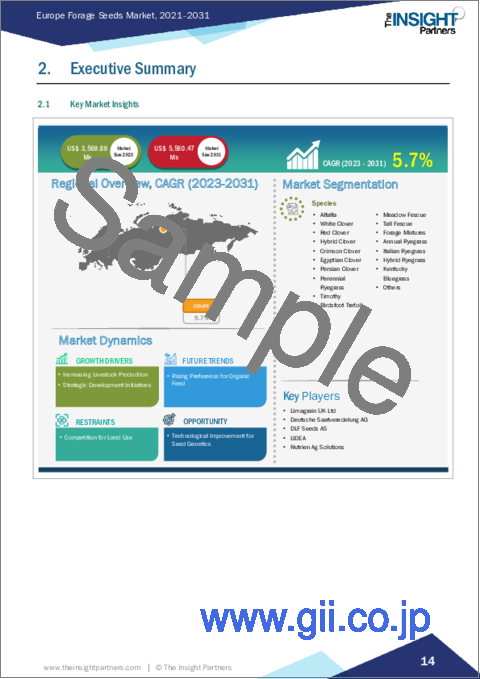

欧州の飼料用種子の市場規模は、2023年の35億7,000万米ドルから、2031年までには55億8,000万米ドルに成長すると予測されており、2023年から2031年にかけてのCAGRは5.7%と予測されています。

人々は健康に対する意識が高まっており、農薬を使用しない有機食品の消費を好むようになっています。有機牛乳や有機肉には、酵素、バイオフラボノイド、抗酸化物質などの栄養素が豊富に含まれています。そのため、人々は無機物よりも有機食品や有機肉を好みます。そのため、消費者に有機肉を供給するための有機飼料の需要が高まっています。酪農場、養鶏セクター、畜産業は、有機食肉・乳製品への需要の高まりから、高品質の有機飼料購入に注力しています。

従来の飼料には、動物が摂取すると肉の品質を損なう化学物質が多量に含まれていることが多いです。そのような肉を長期的に摂取すると、さまざまな健康障害を引き起こします。この問題を克服するため、メーカーは化学添加物を含まない有機飼料を開発しています。そのような飼料を食べた動物は、栄養価の高い肉を提供します。そのため消費者は、オーガニック製品やナチュラル製品を、従来の製品に代わるより健康的な選択肢として見出すことが多いです。このため、有機飼料に対する需要の高まりが、欧州の飼料用種子市場を牽引しています。

しかし、耕作可能な土地が限られていることが市場の成長を妨げています。農地がますます不足し、農家は生産性と収益性を最大化する必要に迫られているため、飼料用地の配分は難しい決断となっています。農家は、主に家畜の飼料として使用される飼料用作物よりも、すぐに高い収益が得られるトウモロコシ、大豆、小麦などの換金作物を優先することが多いです。

ロシアは欧州における飼料用種子の重要な市場のひとつですが、これは農業産業が確立しており、家畜飼料の需要が高まっているためです。ロシアは欧州地域の主要経済国のひとつであり、畜産業を含む幅広い産業が存在します。国民一人当たりの所得が高く、栄養価の高い畜産物への需要が高まっていることが、ロシア市場を繁栄させています。さらに、ロシアは欧州地域で2番目の動物飼料生産国であり、Alltech Globalのデータによると、2020年には3,130万トンの動物飼料を生産しています。食肉生産の工業化が進み、家畜が増加していることが、動物飼料としての飼料需要にプラスに働いています。従って、飼料需要の急増がロシアの飼料用種子市場を牽引すると予想されます。

Nutrien Ag Solutions、KWS SAAT SE &Co.KGaA、DLF Seeds AS、LIDEA、Deutsche Saatveredelung AG、Lantmannen ek、Limagrain Uk Ltd、Feldsaaten Freudenberger GmbH &Co KG、Nordic Seed ASなどが、欧州の飼料用種子市場で事業を展開する主要企業です。

欧州の飼料用種子市場全体の規模は、一次情報および二次情報を用いて算出されています。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関するより分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家、および欧州の飼料用種子市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 欧州の飼料用種子市場情勢

- 市場概要

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 植え付け前の活動

- 植え付け後の活動

- 流通業者または供給業者

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 欧州の飼料用種子市場:主要市場力学

- 欧州の飼料用種子市場:主要市場力学

- 市場促進要因

- 家畜生産の増加

- 戦略的開発イニシアティブ

- 市場抑制要因

- 土地利用の競合

- 市場機会

- 種子遺伝学の技術改良

- 今後の動向

- 有機飼料への選好の高まり

- 促進要因と抑制要因の影響

第6章 欧州の飼料用種子市場分析

- 欧州の飼料用種子市場の収益、2021年~2031年

- 欧州の飼料用種子市場の予測と分析

第7章 欧州の飼料用種子市場分析:品種別

- アルファルファ

- ホワイトクローバー

- レッドクローバー

- ハイブリッドクローバー

- クリムゾンクローバー

- エジプシャンクローバー

- ペルシアンクローバー

- ペレニアルライグラス

- チモシー

- バーズフット・トレフォイル

- メドウ・フェスク

- トールフェスク

- フォレージ・ミックス

- アニュアルライグラス

- イタリアンライグラス

- ハイブリッド・ライグラス

- ケンタッキーブルーグラス

- その他

第8章 欧州の飼料用種子市場:国別分析

- 欧州

- ドイツ

- フランス

- イタリア

- ロシア

- スペイン

- 英国

- その他欧州

第9章 競合情勢

- 企業のポジショニングと集中度

- ヒートマップ分析:主要企業別

第10章 企業プロファイル

- Nutrien Ag Solutions

- KWS SAAT SE & Co. KGaA

- DLF Seeds AS

- LIDEA

- Deutsche Saatveredelung AG

- Cerience

- Lantmannen ek

- Limagrain UK Ltd

- Feldsaaten Freudenberger GmbH & Co KG

- Nordic Seed AS

第11章 付録

List Of Tables

- Table 1. Europe Forage Seeds Market Segmentation

- Table 2. List of Vendors

- Table 3. Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 5. Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 6. Germany: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 7. France: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 8. Italy: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 9. Russian Federation: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 10. Spain: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 11. United Kingdom: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

- Table 12. Rest of Europe: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million) - by Species

List Of Figures

- Figure 1. Europe Forage Seeds Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis: Europe Forage Seeds Market

- Figure 3. Ecosystem: Europe Forage Seeds Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Europe Forage Seeds Market Revenue (US$ Million), 2021-2031

- Figure 6. Europe Forage Seeds Market Share (%) - by Species, 2023 and 2031

- Figure 7. Alfalfa: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. White Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Red Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Hybrid Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Crimson Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Egyptian Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Persian Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Perennial Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Timothy: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Birdsfoot Trefoil: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Meadow Fescue: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Tall Fescue: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Forage Mixtures: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Annual Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Italian Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Hybrid Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Kentucky Bluegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Others: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Europe Forage Seeds Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 26. Germany: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. France: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Italy: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Russian Federation: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Spain: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. United Kingdom: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Rest of Europe: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Company Positioning and Concentration

- Figure 34. Heat Map Analysis by Key Players

The Europe forage seeds market size is projected to grow from US$ 3.57 billion in 2023 to US$ 5.58 billion by 2031; the market is expected to register a CAGR of 5.7% during 2023-2031.

People are becoming more conscious about their health; thus, they prefer consuming organic food as it does not contain pesticides. Organic milk and meat are richer in nutrients such as enzymes, bioflavonoids, and antioxidants. Hence, people prefer organic food and organic meat over inorganic. This has led to the demand for organic feed to supply organic meat to consumers. Dairy farms, the poultry sector, and animal husbandry have focused on purchasing high-quality organic forage feed due to the growing demand for organic meat and dairy products.

Conventional feed often contains high amounts of chemicals that hamper meat quality when consumed by animals. Long-term consumption of such meat results in various health disorders. To overcome this issue, manufacturers are developing organic feed that contains no chemical additives. Animals feeding on such feed offer meat that has high nutritional value. Thus, consumers often find organic and natural products as healthier alternatives to conventional products. This, the rising demand for organic animal feed is driving the Europe forage seeds market.

However, the limited availability of arable land hampers the market growth. As agricultural land becomes increasingly scarce and farmers face pressure to maximize productivity and profitability, the allocation of land for forage becomes a difficult decision. Farmers often prioritize cash crops, such as corn, soybeans, or wheat, which offer higher immediate returns, over forage crops that are primarily used for livestock feed.

Russia is one of the significant markets for forage seeds in Europe due to the presence of well-established agriculture industry and rising demand for cattle feed. Russia is one the major economies of the European region and houses a wide array of industries including livestock industry. The country's high per capita income and growing demand for nutritional animal products are prospering the market in Russia. Furthermore, Russia is the second leading animal feed producing country in the European region and as per the Alltech Global data, in 2020, the country has produced 31.3 million tons of animal feed. The rising Industrialization of meat production and increasing livestock in the country is positively favoring the demand for forages as animal feed. Thus, surging demand for forages expected to drive the forage seeds market in Russia.

Nutrien Ag Solutions, KWS SAAT SE & Co. KGaA, DLF Seeds AS, LIDEA, Deutsche Saatveredelung AG, Lantmannen ek, Limagrain Uk Ltd, Feldsaaten Freudenberger GmbH & Co KG, and Nordic Seed AS are among the key players operating in the Europe forage seeds market.

The overall Europe forage seeds market size has been derived using primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs; business development managers; market intelligence managers; national sales managers; and external consultants, including valuation experts, research analysts, and key opinion leaders, specializing in the Europe forage seeds market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Forage Seeds Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.2.1 Pre-Planting Activities

- 4.3.2.2 Post-planting activities

- 4.3.3 Distributors or Suppliers

- 4.3.4 End User

- 4.3.5 List of Vendors in the Value Chain

5. Europe Forage Seeds Market - Key Market Dynamics

- 5.1 Europe Forage Seeds Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Livestock Production

- 5.2.2 Strategic Development Initiatives

- 5.3 Market Restraints

- 5.3.1 Competition for Land Use

- 5.4 Market Opportunities

- 5.4.1 Technological Improvement for Seed Genetics

- 5.5 Future Trends

- 5.5.1 Rising Preference for Organic Feed

- 5.6 Impact of Drivers and Restraints:

6. Europe Forage Seeds Market Analysis

- 6.1 Europe Forage Seeds Market Revenue (US$ Million), 2021-2031

- 6.2 Europe Forage Seeds Market Forecast and Analysis

7. Europe Forage Seeds Market Analysis - by Species

- 7.1 Alfalfa

- 7.1.1 Overview

- 7.1.2 Alfalfa: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 White Clover

- 7.2.1 Overview

- 7.2.2 White Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Red Clover

- 7.3.1 Overview

- 7.3.2 Red Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Hybrid Clover

- 7.4.1 Overview

- 7.4.2 Hybrid Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Crimson Clover

- 7.5.1 Overview

- 7.5.2 Crimson Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Egyptian Clover

- 7.6.1 Overview

- 7.6.2 Egyptian Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.7 Persian Clover

- 7.7.1 Overview

- 7.7.2 Persian Clover: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.8 Perennial Ryegrass

- 7.8.1 Overview

- 7.8.2 Perennial Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.9 Timothy

- 7.9.1 Overview

- 7.9.2 Timothy: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.10 Birdsfoot Trefoil

- 7.10.1 Overview

- 7.10.2 Birdsfoot Trefoil: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.11 Meadow Fescue

- 7.11.1 Overview

- 7.11.2 Meadow Fescue: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.12 Tall Fescue

- 7.12.1 Overview

- 7.12.2 Tall Fescue: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.13 Forage Mixtures

- 7.13.1 Overview

- 7.13.2 Forage Mixtures: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.14 Annual Ryegrass

- 7.14.1 Overview

- 7.14.2 Annual Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.15 Italian Ryegrass

- 7.15.1 Overview

- 7.15.2 Italian Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.16 Hybrid Ryegrass

- 7.16.1 Overview

- 7.16.2 Hybrid Ryegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.17 Kentucky Bluegrass

- 7.17.1 Overview

- 7.17.2 Kentucky Bluegrass: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 7.18 Others

- 7.18.1 Overview

- 7.18.2 Others: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

8. Europe Forage Seeds Market - Country Analysis

- 8.1 Europe

- 8.1.1 Europe Forage Seeds Market Breakdown by Countries

- 8.1.2 Europe Forage Seeds Market Revenue and Forecast and Analysis - by Country

- 8.1.2.1 Europe Forage Seeds Market Revenue and Forecast and Analysis - by Country

- 8.1.2.2 Germany: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.2.1 Germany: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.3 France: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.3.1 France: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.4 Italy: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.4.1 Italy: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.5 Russian Federation: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.5.1 Russian Federation: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.6 Spain: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.6.1 Spain: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.7 United Kingdom: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.7.1 United Kingdom: Europe Forage Seeds Market Breakdown by Species

- 8.1.2.8 Rest of Europe: Europe Forage Seeds Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.2.8.1 Rest of Europe: Europe Forage Seeds Market Breakdown by Species

9. Competitive Landscape

- 9.1 Company Positioning and Concentration

- 9.2 Heat Map Analysis by Key Players

10. Company Profiles

- 10.1 Nutrien Ag Solutions

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 KWS SAAT SE & Co. KGaA

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 DLF Seeds AS

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 LIDEA

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Deutsche Saatveredelung AG

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 Cerience

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Lantmannen ek

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Limagrain UK Ltd

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 Feldsaaten Freudenberger GmbH & Co KG

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Nordic Seed AS

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About The Insight Partners