|

市場調査レポート

商品コード

1851258

アセプティック包装:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アセプティック包装:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月10日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

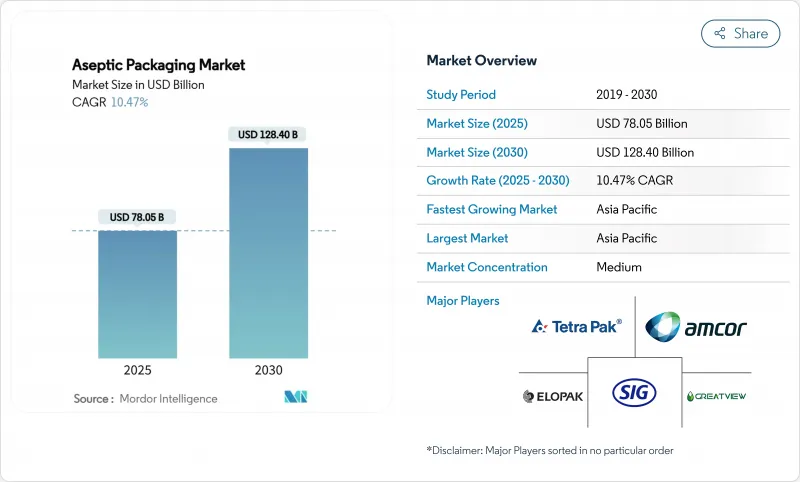

アセプティック包装市場規模は2025年に780億5,000万米ドル、2030年には1,284億米ドルに達し、CAGR 10.47%で拡大すると予測されています。

保存可能な食品および飲料に対する需要の高まり、食品安全規則の厳格化、コールドチェーン・コストの削減の必要性が、無菌常温流通形態の魅力を強化しています。ブランド所有者は、冷蔵インフラストラクチャーがまだ不完全な地域で、すぐに飲める(RTD)機能性飲料や保存可能な乳製品の需要増に対応するため、無菌ラインを拡大しつつあります。同時に、生物製剤の製造と個別化治療が、アセプティック包装市場の医薬品収益基盤を拡大しています。アルミニウムフリーのハイバリアカートンやPFASフリーのコーティング剤など、材料科学のブレークスルーは、メーカーが無菌性を犠牲にすることなく新たな持続可能性の義務に準拠するのに役立っています。コンバーターと樹脂メーカーの統合は、不安定なポリマー市場における購買力を強化し、デジタル印刷は、急増する在庫管理ユニットに適したコスト効率の高い小ロット生産を可能にしています。

世界のアセプティック包装市場の動向と洞察

RTD機能性飲料の急成長

機能性RTD飲料は現在、敏感な微量栄養素、プロバイオティクス、植物成分を常温で最長12カ月間閉じ込めるアセプティックソリューションが求められています。各ブランドは、コンビニエンスストアでのラストワンマイルの流通を容易にしながら、酸素、光、紫外線の保護を提供するハイバリアカートンや多層ボトルを選択しています。米国、中国、タイの飲料充填業者は、スポーツニュートリション、エネルギー茶、植物性プロテインの発売に対応するため、1時間当たり48,000本以上の定格を持つ新しい高速アセプティックラインを導入しました。飲食品グレードの無菌性と医薬品グレードのバリデーションの重複は狭まりつつあり、バイアル&アンプルのサプライヤーはプレミアムなポジショニングを求める飲料メーカーへの参入を促しています。成分サプライヤーは、アセプティック処理によって得られる長い保存期間によって、より少ない防腐剤とより多くの活性化合物の配合が可能になり、よりクリーンなラベルとより高い小売価格が可能になると指摘しています。

新興アジアにおける乳製品流通の拡大

インド、ベトナム、インドネシアでは、緩やかに管理されたチルドサプライチェーンから無菌の保存可能な牛乳やヨーグルトへのアップグレードが急速に進んでいます。都市部の乳製品加工業者は、送電網が不安定で冷蔵コストが高騰する農村部へ供給するため、UHT殺菌機やブリックパック充填機に投資しています。中国では、2024年に保存可能な飲料への調製粉乳の使用が禁止されることが決定したため、純乳アセプティックラインへの設備投資が相次ぎ、135℃の殺菌に耐える低酸性カートンラミネートへの需要が高まっています。多国籍ブランドは、地元の協同組合と合弁会社を設立して生乳を確保し、農場の近くにモジュール式の無菌マイクロプラントを配備することで、輸送コストを削減し、腐敗を軽減しています。その結果、アセプティック包装市場は、アジア新興国政府の長期的な食糧安全保障課題に不可欠なものとなりつつあります。

多層ポリマー価格の乱高下

ポリエチレンとポリプロピレンの価格は2024年にポンド当たり5セント上昇し、コンバーターのマージンを引き締め、四半期ごとのサーチャージを促しました。ナフサとエタン原料市場の変動は、カートンの注ぎ口、キャップ、バリアフィルムの予算編成を複雑にします。大手の購入者は複数年の樹脂契約によってヘッジしているが、小規模の充填業者はスポット価格の痛みに見舞われ、ホットフィルラインをアセプティック設備に置き換えることを目的とした設備プロジェクトが遅れています。クラッカーコンプレックスでの計画外操業停止や出荷のボトルネックなど、世界的な樹脂供給の構造的制約は、価格の不安定性が当面続くことを示唆しています。

セグメント分析

乳製品、ジュース、RTDコーヒーへの浸透により、カートン市場は2024年の収益の64%を確保しました。長方形のフットプリントはパレット効率と棚の見栄えを最大化し、新しいストローレス・クロージャーはプラスチック削減目標にアピールします。一方、バイアルとアンプルは、注射用生物製剤、ワクチン、細胞療法の普及に伴い、2030年までCAGR 13.2%で拡大します。バイアル&アンプルのアセプティック包装市場規模は、ヒト医療と動物医療の両方での採用を反映して、2030年までに97億米ドルに達すると予測されます。ボトルは、スムージーのような粘度の高い飲料や、より大きなリシーラブルフォーマットが消費の利便性を高めるフレーバーミルクにとって引き続き重要です。缶はUHTココナッツウォーターと高酸性フルーツピューレにおいて、その強固な耐パンク性によりニッチなポジションを維持しているが、アルミニウム価格の変動と若い消費者の紙ベースのパックへの嗜好により成長は抑えられています。パウチベースのバッグ・イン・ボックス・システムは、コンパクトな輸送と開封後の賞味期限延長を求める飲食品事業者を惹きつけています。1回分のスパウト付きパウチは、幼児用飲料やスポーツ用栄養ジェルに携帯性を提供します。

カーボンフットプリント削減の追求は、製品レベルのイノベーションを刺激しています。SIG社が2025年に発売した、12ヶ月の常温保存が可能な完全にリサイクル可能なアルミニウムフリーの1Lカートンは、欧州の大手乳製品ブランドからいち早く採用されました。これとは別に、ガラス瓶メーカーは、不活性な接触面を維持しながら重量を30%削減するポリマーとガラスのハイブリッド容器を開発し、世界的なワクチンキャンペーンにおける運賃の排出を緩和しています。新素材の出現に伴い、バリア性能、リサイクル性、充填速度における製品レベルの差別化が、市場競争における優位性を形成し続けるであろう。

地域分析

アジア太平洋地域は、中国、インド、インドネシアが牽引し、2024年の売上高の38.4%を占めました。インドの国家栄養プログラムは、2027年までにパック牛乳の普及率を15%以上に引き上げることを目標としており、無菌処理能力への官民投資を促進しています。グジャラート州にあるSIGの9,000万ユーロの新工場は、地元の乳製品と飲むヨーグルト用に年間40億パックの生産量を追加します。UHTカートン入り粉ミルクを禁止する中国の政策により、加工業者はより完全性の高いメーカーに押され、価格規律が強化され、利幅が拡大しています。東南アジアの新興企業は、ビタミン強化茶を250mLのスリムなカートン入りで発売し、外出先での消費を取り込もうとしています。

南米は最も急成長している地域で、2030年までのCAGRは14.21%と予測されています。ブラジルの包装食品市場は2024年に1,136億米ドルに達し、インフレ圧力が消費者に大判で保存のきく商品の購入を促したためです。ディーゼル燃料と電気代が高いため、内陸部の流通センターへの投資は常温製品を選好しています。アルゼンチンの乳製品輸出業者は、フレキシブルパウチラインを活用して、冷蔵なしで乳糖を含まない牛乳をチリとペルーに出荷しています。

北米と欧州は一桁台半ばの成長を示しているが、これは数量拡大よりも持続可能性を重視した素材交換が後押ししています。EUのPFAS禁止令は、酸化ケイ素ベースのカートン障壁の商業化を刺激し、米国の充填業者は労働力不足を補うために介護度の高いゾーンでロボットを採用します。中東とアフリカは、金額的には小さいもの、人口動態の成長と政府の食糧安全保障戦略に結びついた長期的な上昇余地があります。エジプトの工業地帯には、地域供給を目的としたUFlexの2億米ドルのラミネートボード複合施設があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- RTD機能性飲料の急成長

- 新興アジアにおける常温乳製品流通の拡大

- 厳しい食品安全規制がアセプティック包装の採用を後押し

- コールドチェーンからシェルフステーブル・ロジスティクスへのインフレ連動シフト

- 持続可能な軽量包装へのシフトが義務化される

- D2Cブランドにおけるデジタル/印刷対応ショートSKUの台頭

- 市場抑制要因

- 多層ポリマー価格の変動

- アセプティック充填ラインの初期CAPEXが高め

- アルミ箔ラミネートのリサイクルインフラは限られている

- PFASバリアコーティングをめぐる規制の不確実性

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 価格分析

- 飲料のアセプティック包装- 需要洞察

第5章 市場規模と成長予測

- 製品別

- カートン

- ボトル

- 缶

- バッグとパウチ

- バイアルおよびアンプル

- 材料構成別

- 紙・板紙

- プラスチック(PP、PE、PET)

- ガラス

- 金属(アルミニウム、スチール)

- 複合ラミネート

- 用途別

- 飲料

- RTD飲料

- 乳飲料

- 食品

- 加工食品

- 果物および野菜

- 乳製品

- 医薬品

- パーソナルケアと化粧品

- 飲料

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Tetra Pak International SA

- SIG Combibloc Group

- Amcor PLC

- Elopak ASA

- IPI SRL(Coesia Group)

- DS Smith PLC

- Smurfit Kappa Group

- Mondi PLC

- Uflex Limited

- Schott AG

- Gerresheimer AG

- Toyo Seikan Group

- CDF Corporation

- BIBP Sp. z o.o.

- Nampak Ltd

- Greatview Aseptic Packaging

- Liqui-Box(Graphic Packaging)

- OPLATEK Group

- Sealed Air Corporation

- ProAmpac