|

市場調査レポート

商品コード

1432663

トウモロコシ種子処理:市場シェア分析、産業動向、成長予測(2024~2029年)Maize Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| トウモロコシ種子処理:市場シェア分析、産業動向、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

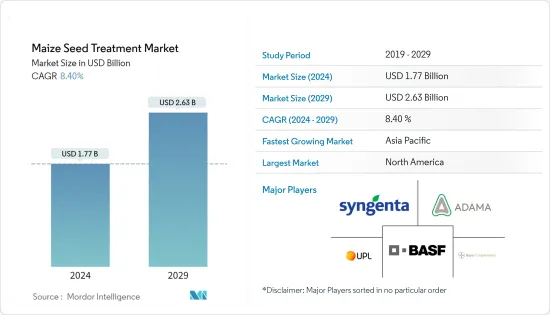

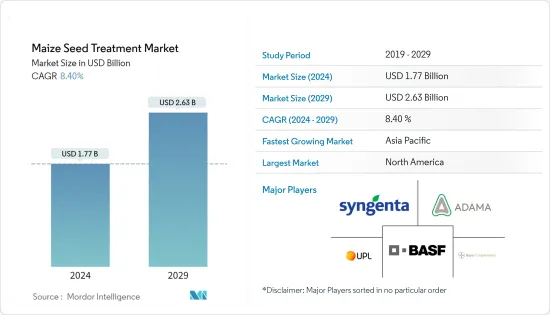

トウモロコシ種子処理市場規模は2024年に17億7,000万米ドルと推定され、2029年には26億3,000万米ドルに達すると予測され、予測期間中(2024-2029年)にCAGR 8.40%で成長する見込みです。

主なハイライト

- トウモロコシは世界で1億9,700万ヘクタールで栽培されており、コメ、小麦に次いで3番目に重要な穀物です。この作物は、遺伝子組み換え種子を含む市販のハイブリッド種子の普及率が高く、先進国市場でも新興国市場でも、農家はトウモロコシ栽培に先進的な農法を採用しています。

- 過去3年間、トウモロコシ栽培において害虫である秋蚕が広く発生しました。この致命的な害虫から若い苗を守るには、適切な種子処理が有効です。企業はまた、秋蚕を対象とした製品を開発するための研究開発に取り組んでいます。

トウモロコシ種子処理市場の動向

種子交換率の上昇が商業用セグメントの活況をもたらす

商業用トウモロコシのハイブリッドは、世界中でますます人気が高まっています。従来、北米、欧州、南米では、過去20年来、商業用トウモロコシ・ハイブリッドが栽培されてきました。しかし、種子の代替率の増加とハイブリッドの採用率の上昇により、アジア太平洋やアフリカなどの新興国市場が著しい成長を遂げています。2018年、アジア太平洋の種子交換率は80%近くに達しました。ハイブリッド品種の採用が増加し、遺伝子組み換え品種を含む高度なハイブリッド品種が浸透した結果、トウモロコシ種子処理製品の商業用途市場が活況を呈しています。これらの製品は、B2Bレベルで種子会社に販売されています。トウモロコシのハイブリッドを販売する種子会社の増加も、トウモロコシ種子処理製品の商業用途市場を支えています。ハイブリッド化と種子交換率の増加の次のフロンティアはアフリカであり、予測期間中、これらに関連する指標は堅調なペースで増加すると予想されます。

北米が世界市場をリード

トウモロコシは北米で約3,500万ヘクタールで栽培されています。この地域では最も重要な穀物作物であり、穀物、家畜飼料、飼料として幅広く利用されています。同地域では遺伝子組み換え種子やハイブリッド種子の採用が増加しており、地理的セグメントは世界の全地域の中で最大となっています。この市場を牽引しているのは商業用途であり、企業は土壌と環境の持続可能性を念頭に置きながら、農家の作物保護ニーズを満たす製品を発売しています。この地域は、予測期間中、トウモロコシ種子処理市場において最大の地域セグメントであり続けると予想されます。

トウモロコシ種子処理産業の概要

トウモロコシ種子処理市場は高度に統合されており、世界の主要企業が市場シェアの70%以上を占めています。これらのプレーヤーの市場シェアが高いのは、製品ポートフォリオが高度に多様化し、多数の買収や契約が行われているためです。さらに、これらのプレーヤーは、研究開発、製品ポートフォリオの拡大、幅広い地理的プレゼンス、積極的な買収戦略に注力しています。同市場の主要企業には、BASF SE、Syngenta AG、Adama Agricultural Solutions、UPL Limited、Bayer Crop Scienceなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 化学由来

- 合成

- 生物由来

- 製品タイプ

- 殺虫剤

- 殺菌剤

- その他の製品タイプ

- 用途

- 農場レベル

- 商業

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- ロシア

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- その他のアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- BASF SE

- Bayer Crop Science AG

- Syngenta AG

- Adama Agricultural Solutions

- UPL Limited

- Advanced Biological Marketing Inc.

- Corteva Agriscience

- Incotec Group BV

- Valent USA Corporation

第7章 市場機会と今後の動向

The Maize Seed Treatment Market size is estimated at USD 1.77 billion in 2024, and is expected to reach USD 2.63 billion by 2029, growing at a CAGR of 8.40% during the forecast period (2024-2029).

Key Highlights

- Maize is grown over 197 million hectares worldwide and is the third important cereal crop, after rice and wheat. The crop has high degree of penetration in commercial hybrid seeds, including genetically modified seed, and farmers adopt advanced farming practices for maize cultivation in both developed and developing markets.

- In last three years, there was a widespread incidence of the pest fall amyworm in maize cultivation. Proper seed treatment can go a long way in protecting young plants against this deadly pest. Companies have also been engaging in R&D to develop products that target fall amyworm.

Maize Seed Treatment Market Trends

Increasing Seed Replacement Rate Leading to Boom in the Commercial Segment

Commercial maize hybrids are increasingly becoming popular across the world. Traditionally, North America, Europe, and South America have been cultivating commercial maize hybrids, since last two decades. However, increasing seed replacement rates and rising adoption of hybrids led to a remarkable growth of developing markets, such as Asia-Pacific and Africa. In 2018, seed replacement rates in Asia-Pacific stood at close to 80%. Increased adoption of hybrid varieties and penetration of advanced hybrids, including genetically modified varieties, have resulted in a booming market for commercial applications of maize seed treatment products. These products are being sold at a B2B level to seed companies. An increase in the number of seed companies selling maize hybrids has also supported the market for commercial applications of maize seed treatment products. The next frontier of hybridization and increased seed replacement rates is Africa, where the metrics related to these are expected to increase at a robust pace over the forecast period.

North America Leads the Global Market

Maize is grown over approximately 35 million hectares in North America. It is the most important grain crop in the region, with extensive application as grain, animal feed, and forage. Increased adoption of genetically modified and hybrid seeds in the region makes the geographical segment the largest among all the regions across the world. The market is driven by commercial applications, where companies are launching products that satisfy the crop protection needs of the farmer, while keeping sustainability of the soil and environment in mind. The region is expected to remain the largest geographical segment in the maize seed treatment market over the forecast period.

Maize Seed Treatment Industry Overview

The maize seed treatment market is highly consolidated, with the top global players occupying more than 70% of the market share. The greater market shares of these players can be attributed to highly diversified product portfolio and numerous acquisitions and agreements. Moreover, these players are focusing on R&D, expansion of product portfolio, wide geographical presence, and aggressive acquisition strategies. Some of the key players in the market include BASF SE, Syngenta AG, Adama Agricultural Solutions, UPL Limited, and Bayer Crop Science, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Origin

- 5.1.1 Synthetic

- 5.1.2 Biological

- 5.2 Product Type

- 5.2.1 Insecticides

- 5.2.2 Fungicides

- 5.2.3 Other Product Types

- 5.3 Application

- 5.3.1 Farm-level

- 5.3.2 Commercial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Crop Science AG

- 6.3.3 Syngenta AG

- 6.3.4 Adama Agricultural Solutions

- 6.3.5 UPL Limited

- 6.3.6 Advanced Biological Marketing Inc.

- 6.3.7 Corteva Agriscience

- 6.3.8 Incotec Group BV

- 6.3.9 Valent USA Corporation