|

市場調査レポート

商品コード

1435999

希少疾患遺伝子検査:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Rare Disease Genetic Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 希少疾患遺伝子検査:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

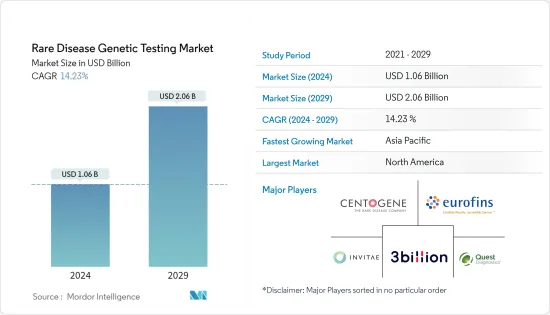

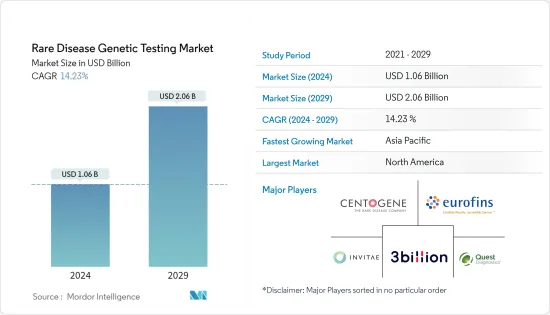

希少疾患遺伝子検査市場規模は、2024年に10億6,000万米ドルと推定され、2029年までに20億6,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に14.23%のCAGRで成長します。

新型コロナウイルス感染症(COVID-19)のパンデミックは、希少疾患遺伝子検査市場に影響を与えました。COVID-19感染症の症例数の増加により、世界のヘルスケアサービスはそのリソースをCOVID-19の治療にシフトし、希少疾患の患者に影響を与えました。たとえば、2022年 3月にジャーナルオブパブリックヘルスに掲載された記事では、5,000~8,000の希少疾患が存在し、そのほとんどが遺伝的根拠があると報告しています。記事はまた、これらの希少疾患が世界中で約4億人に影響を与えていると報告しました。希少疾患や遺伝性疾患に関する進行中の調査プロジェクトや臨床試験の多くは、患者や調査スタッフの間でのCOVID-19症の感染を避けるために中止されました。このように、パンデミックによりヘルスケアサービスの不足や予約のキャンセルが生じ、その結果、希少疾患患者の診断が不十分となった。しかし、COVID-19感染症の感染者数の減少に伴い、市場はパンデミック前のレベルに回復し始めており、予測期間中は同じ状態が続くと予想されています。

市場の成長を牽引する要因は、希少疾患の患者登録の拡大、遺伝子検査技術の開発、希少疾患に対する政府の取り組みの強化です。

利用可能な希少疾患レジストリの数の増加が市場の成長を推進しています。希少疾患患者登録の目的は、患者中心の希少疾患調査をより適切に推進および支援することであり、これにより、治療法の開発と希少疾患の科学的理解の基盤が向上します。たとえば、Journal Frontiers in Endocrinologyに2022年 3月に掲載された記事では、患者登録は、自然史と変異型疾患の経過に関する知識を向上させ、安全性、有効性、長期保存性を評価することにより、希少疾患調査の複数の目的を果たすことができると報告しています。予防ケアプログラム、診断戦略、およびオーファンドラッグなどの治療による健康上の利点。したがって、患者登録は、希少疾患内で使用する調査パートナーとして患者を中心として、疾患の自然史の文書化をサポートする効果的、便利、かつコスト効率の高いツールです。患者登録数の増加も、調査対象市場の成長を促進しています。

2022年 2月、Bionano Genomicsは、希少疾患を抱えて暮らす世界中の3億5,000万人を対象に、希少未診断遺伝病(RUGD)と呼ばれる戦略的取り組みを開始しました。 BionanoのRUGDイニシアチブには、一連の製品提供、教育意識のサポート、この分野での調査助成金の開発に向けた取り組み、RUGD患者のケアと管理を改善するという共通の使命を持つ専門家協会のサポートが含まれています。 BionanoのRUGDイニシアチブの一環として、同社はACMG Foundation for Genetic and Genomic Medicine(ACMGF)とその遺伝学とゲノミクスにおける次世代フェローシップおよびレジデンシートレーニングアワードプログラムに3年間の財政的支援を提供することを約束しました。したがって、このような取り組みは調査対象市場の成長を促進しています。

新しい遺伝子検査技術と希少疾患検査に対する政府の取り組みの増加により、研究市場の成長がさらに推進されています。たとえば、2022年 6月に米国FDAは、希少神経変性疾患に対するプログラムを発表しました。これは、効果的で安全な医療製品の進歩を進化させ、患者のアクセスを可能にすることで、希少疾患に苦しむ人々の寿命を延ばし、改善するための5か年戦略です。革新的な治療法へ。

同様に、2021年 1月には、5年間で350万人の希少疾患患者の迅速な診断、認識、ケア、治療へのアクセスに重点を置いた英国希少疾患フレームワークが開始されました。したがって、NGSベースの遺伝子検査などの新技術の導入、診断および政府の取り組みに対する需要の増加が、希少疾患遺伝子検査市場の成長に貢献しています。

したがって、希少疾患の患者登録の拡大とそれに対する政府の取り組みの増加、および新しい遺伝子検査技術の開発により、調査対象の市場は予測期間中に大幅な成長を遂げると予想されます。しかし、希少疾患や遺伝子検査やデータ管理に関連する技術的課題に対する認識の欠如により、市場の成長が鈍化する可能性があります。

希少疾患遺伝子検査市場動向

全エクソームシーケンス(WES)は、予測期間中に大幅な成長を遂げると予想されます

全エクソームシークエンシングセグメントは、ゲノミクス分野および次の分野における研究開発の増加に加え、臨床診断におけるWESの応用の増加と希少疾患の診断に対する需要の高まりにより、予測期間中に大幅な成長を遂げると予想されています。世代順序の変化と個別化医療への需要の増大。

全エクソームシーケンス遺伝子検査ツールの普及がこの分野の成長を促進しています。この技術は、全ゲノムの1~2%を構成し、病気の原因となるすべての変異の80%を含むエクソンのみをターゲットとします。このような継続的な技術開発により、正確かつ迅速な結果が得られることが期待されています。たとえば、2021年11月にBMJジャーナルに掲載された記事では、WESが稀な小児遺伝性疾患の定期診断のために選ばれた患者に利用可能であると報告しました。この記事はまた、次世代シーケンスにより、はるかに低コストで短期間に数百または数千の遺伝子のシーケンスが可能になると報告しました。

主要企業の戦略的活動は、予測期間中にこのセグメントをさらに推進すると推定されます。たとえば、2022年 10月に、BGI Australiaの研究所は、オーストラリアで臨床WESを実施するためのNATAの認定を取得しました。この認定により、BGIオーストラリアは、希少な遺伝性疾患や小児疾患の原因となるエクソームの変化を検出するためのサービスを臨床検査室、病院、その他のパートナーに提供することが容易になります。

北米は予測期間中に大幅な成長が見込まれる

北米では、希少疾患の高い有病率、多数の疾患登録、超希少疾患の相当数の研究開発施設の存在、および診断への大規模な投資により、予測期間中に大幅な成長が見込まれると予想されています。病気。たとえば、2021年に遺伝的希少疾患情報センター(GARD)は、既知の希少疾患症例が約7,000件あり、これは約10人に1人に相当し、2020年には米国で3,000万人が希少疾患に罹患したと報告しました。 2021年。したがって、希少疾患の罹患率の高さにより、高度な希少疾患検査装置の需要が増加しており、それによってこの地域の市場の成長が推進されています。

米国におけるこれらの病気の高い有病率を克服するために進行中の薬物検査の臨床試験に財政的支援と資金を提供する政府の取り組みも、市場の成長を支えています。たとえば、2020年10月に米国FDAは希少疾病用医薬品法を施行し、今後4年間で6件の臨床試験調査に産業界と学界に1,600万米ドル以上の資金を与えました。したがって、増加する政府資金が新薬治験の調査を支援し、この地域の市場の成長を促進しています。

主要な市場企業間の戦略的パートナーシップ、新製品の発売、合併と買収も、この地域の市場の成長を推進しています。たとえば、2021年 11月に、Genomenonは、希少疾患の治療と診断をより簡単に利用できるようにするために、AlexionおよびAstraZeneca Rare Disasterと協力しました。提携の目標は、希少疾患の診断に必要なデータを遺伝子検査機関に提供できるようにすることです。

北米における有病率の上昇と承認の増加に加えて、ヘルスケアインフラの支援、政府の取り組み、技術の進歩が市場を牽引すると予想されます。たとえば、Centogeneは2021年 4月に武田薬品工業株式会社と提携し、Centogeneの遺伝病検査機能へのアクセスを通じて患者を診断しました。したがって、このような技術開発は、この地域の市場の成長を促進しています。

希少疾患の高い有病率、多数の疾患登録、超希少疾患のための相当数の研究開発施設の存在、疾患の診断への大規模な投資により、この地域は世界的に見ても大幅な成長を遂げると予想されています。予測期間。

希少疾患遺伝子検査業界の概要

希少疾患遺伝子検査市場は、多くの企業が存在するため競争が激しく、細分化されています。これらの企業は、Quest Diagnostics Incorporated、Eurofins Scientific Inc.、SAmbry Genetics Corporations、PerkinElmer Genetics Inc.、Baylor Miraca Genetics Laboratories LLC、Beijing Genomics Institute Ltdなど、世界中および地域に存在しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 希少疾患の患者登録を拡大

- 遺伝子検査技術の開発

- 希少疾患に対する政府の取り組みの強化

- 市場抑制要因

- 希少疾患に対する認識の欠如

- 遺伝子検査とデータ管理に関連する技術的課題

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- テクノロジー別

- 次世代シーケンス

- 全エクソームシーケンシング(WES)

- 全ゲノム配列決定(WGS)

- アレイテクノロジー

- PCRベースの検査

- 魚

- その他の技術

- 次世代シーケンス

- 病気別

- 神経学的障害

- 免疫疾患

- 血液疾患

- 内分泌代謝疾患

- がん

- 筋骨格系疾患

- その他の病気

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Quest Diagnostics Incorporated

- Centogene NV

- Invitae Corporation

- 3billion Inc.

- ARUP Laboratories

- Eurofins Scientific Inc.

- Strand Life Sciences Private Limited

- Ambry Genetics Corporations

- PerkinElmer Genetics Inc.

- Macrogen Inc.

- Baylor Miraca Genetics Laboratories, LLC

- Color Health Inc.

- Beijing Genomics Institute Ltd

第7章 市場機会と将来の動向

The Rare Disease Genetic Testing Market size is estimated at USD 1.06 billion in 2024, and is expected to reach USD 2.06 billion by 2029, growing at a CAGR of 14.23% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the rare disease genetic testing market. The rising number of COVID-19 cases resulted in global healthcare services shifting their resources toward COVID-19 care, which impacted patients with rare diseases. For instance, an article published in the Journal of Public Health, in March 2022, reported that there are between 5,000 and 8,000 rare diseases, most of them with a genetic basis. The article also reported that these rare diseases affect approximately 400 million people worldwide. Many ongoing research projects and clinical trials for rare and genetic diseases were stalled to avoid the transmission of COVID-19 among the patients and research staff. Thus, the pandemic led to a lack of healthcare services and cancellation of appointments, resulting in the underdiagnosis of rare disease patients. However, with the declining cases of COVID-19, the market started to recover at the pre-pandemic levels and is expected to continue the same over the forecast period.

The factors driving the growth of the market are expansion of the patient registry for rare diseases, developing genetic testing technologies, and increasing government initiatives for rare diseases.

The increasing number of available registries for rare diseases is driving the growth of the market. The purpose of rare disease patient registries is to better promote and support patient-focused rare disease research, which improves the foundation for therapy development and scientific understanding of a rare disease. For instance, an article published in March 2022 in the Journal Frontiers in Endocrinology reported that patient registries can fulfil multiple purposes for rare disease research, by improving the knowledge about natural history and variant disease courses and evaluating the safety, effectiveness, and long-term health benefits of preventive care programs, diagnostic strategies, and therapies, such as orphan drugs. Thus, patient registries are effective, convenient, and cost-efficient tools to support documentation of the natural history of a disease, centering patients as research partners for use within rare diseases. The rising number of patient registries is also driving the growth of the studied market.

In February 2022, Bionano Genomics launched a strategic initiative called Rare Undiagnosed Genetic Disease (RUGD) for the 350 million people globally living with rare diseases. Bionano's RUGD initiative includes its suite of product offerings, supporting educational awareness, working toward the development of research grants in this area, and supporting professional societies with a shared mission of improving RUGD patient care and management. As part of Bionano's RUGD initiative, the company has committed to providing three years of financial support for the ACMG Foundation for Genetic and Genomic Medicine (ACMGF) and its Next Generation Fellowship & Residency Training Awards Program in genetics and genomics. Thus, such initiatives are driving the growth of the studied market.

The new genetic testing technologies and the increasing government initiatives for rare disease testing are further propelling the growth of the studied market. For instance, in June 2022, the US FDA revealed its program for rare neurodegenerative diseases, a five-year strategy for extending and refining the lives of people suffering from rare diseases, by evolving the progress of effective and safe medical products and enabling patient access to innovative treatments.

Similarly, in January 2021, the UK Rare Disease Framework was launched, which focused on faster diagnosis, awareness, care, and access to treatment for 3.5 million rare disease patients over five years. Hence, the launch of new technologies, such as NGS-based genetic testing, and the increased demand for diagnosis and government initiatives are contributing to the growth of the rare disease genetic testing market.

Thus, due to the expanding patient registry for rare diseases and increasing government initiatives for the same, as well as the development of new genetic testing technologies, the studied market is expected to witness significant growth over the forecast period. However, a lack of awareness regarding rare diseases and technical challenges associated with genetic tests and data management may slow down the growth of the market.

Rare Disease Genetic Testing Market Trends

Whole Exome Sequencing (WES) is Expected to Witness a Significant Growth During the Forecast Period

The whole-exome sequencing segment is expected to witness significant growth over the forecast period due to the increasing applications of WES in clinical diagnosis and the growing demand for the diagnosis of rare diseases, along with the increasing R&D in the field of genomics and next-generation sequencing and increasing demand for personalized medicine.

The high adoption of the whole-exome sequencing genetic testing tool is driving the growth of the segment. This technique targets only exons, which make 1-2% of the whole genome and contains 80% of all disease-causing mutations. Such continuous technological developments are expected to provide accurate and rapid results. For instance, an article published by the BMJ Journal, in November 2021, reported that WES is available for selected patients for the routine diagnosis of rare childhood genetic diseases. The article also reported that next-generation sequencing allows hundreds or thousands of genes to be sequenced in a short period at a much lower cost.

The strategic activities of key players are estimated to further drive the segment over the forecast period. For instance, in October 2022, BGI Australia's lab achieved accreditation from the NATA to perform clinical WES in Australia. This accreditation will facilitate BGI Australia to provide services to clinical laboratories, hospitals, and other partners to detect changes in the exome that contributes to rare genetic and pediatric diseases.

North America Expected to Witness a Significant Growth During the Forecast Period

North America is expected to witness significant growth over the forecast period due to the high prevalence of rare diseases, a large number of disease registries, the presence of a substantial number of R&D facilities for ultra-rare diseases, and extensive investments in the diagnosis of disease. For instance, in 2021, the Genetic Rare Diseases Information Center (GARD) reported that there were about 7,000 known rare disease cases, which accounted for about 1 in 10 people, and 30 million people in the United States had a rare disease during 2020-2021. Thus, the high prevalence of rare diseases is increasing the demand for advanced rare disease testing devices, thereby propelling the growth of the market in the region.

The government initiatives to provide financial support and funding for the ongoing clinical trials for drug testing to overcome the high prevalence of these diseases in the United States are also supporting the market's growth. For instance, in October 2020, the US FDA carried out the Orphan Drug Act and awarded over USD 16 million for six clinical trial research studies to industry and academia for the next four years. Thus, the increasing government funding is supporting research for new drug trials and driving the growth of the market in the region.

The strategic partnerships among key market players, new product launches, and mergers and acquisitions have also propelled the market's growth in the region. For instance, in November 2021, Genomenon collaborated with Alexion and AstraZeneca Rare Disease to make the treatment and diagnosis of rare diseases more readily available. The goal of the collaboration is to empower the genetic testing laboratories with the data they need for the diagnosis of rare diseases.

Along with rising prevalence and increased approvals, the supportive healthcare infrastructure, government initiatives, and technological advancements in North America are expected to drive the market. For instance, in April 2021, Centogene entered a partnership with Takeda Pharmaceutical Company Limited to diagnose patients through access to Centogene's genetic disease testing capabilities. Thus, such technological developments are fueling the growth of the market in the region.

Due to the high prevalence of rare diseases, a large number of disease registries, the presence of a substantial number of R&D facilities for ultra-rare diseases, and extensive investments in the diagnosis of diseases, the region is expected to witness significant growth over the forecast period.

Rare Disease Genetic Testing Industry Overview

The rare disease genetic testing market is highly competitive and fragmented due to the presence of many players. These players are present globally and regionally, which include Quest Diagnostics Incorporated, Eurofins Scientific Inc., SAmbry Genetics Corporations, PerkinElmer Genetics Inc., Baylor Miraca Genetics Laboratories LLC, and Beijing Genomics Institute Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Patient Registry for Rare Disease

- 4.2.2 Development in Genetic Testing Technologies

- 4.2.3 Increased Government Initiatives for Rare Diseases

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness Regarding Rare Diseases

- 4.3.2 Technical Challenges Associated with Genetic Tests and Data Management

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Technology

- 5.1.1 Next-generation Sequencing

- 5.1.1.1 Whole Exome Sequencing (WES)

- 5.1.1.2 Whole Genome Sequencing (WGS)

- 5.1.2 Array Technology

- 5.1.3 PCR-based Testing

- 5.1.4 FISH

- 5.1.5 Other Technologies

- 5.1.1 Next-generation Sequencing

- 5.2 By Disease

- 5.2.1 Neurological Disorders

- 5.2.2 Immunological Disorders

- 5.2.3 Hematology Diseases

- 5.2.4 Endocrine and Metabolism Diseases

- 5.2.5 Cancer

- 5.2.6 Musculoskeletal Disorders

- 5.2.7 Other Diseases

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Quest Diagnostics Incorporated

- 6.1.2 Centogene NV

- 6.1.3 Invitae Corporation

- 6.1.4 3billion Inc.

- 6.1.5 ARUP Laboratories

- 6.1.6 Eurofins Scientific Inc.

- 6.1.7 Strand Life Sciences Private Limited

- 6.1.8 Ambry Genetics Corporations

- 6.1.9 PerkinElmer Genetics Inc.

- 6.1.10 Macrogen Inc.

- 6.1.11 Baylor Miraca Genetics Laboratories, LLC

- 6.1.12 Color Health Inc.

- 6.1.13 Beijing Genomics Institute Ltd