|

|

市場調査レポート

商品コード

1367741

バッタープレミックス・ブレッダープレミックスの世界市場:バッタータイプ別、ブレッダータイプ別、用途別、エンドユーザー別、地域別-2028年までの予測Batter & Breader Premixes Market by Batter Type (Adhesion Batter, Beer Batter, Thick Batter, Customized Batter), Breader Type (Crumbs & Flakes, Flour & Starch), Application (Meat, Seafood, Vegetables), End Users and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| バッタープレミックス・ブレッダープレミックスの世界市場:バッタータイプ別、ブレッダータイプ別、用途別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年10月04日

発行: MarketsandMarkets

ページ情報: 英文 378 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバッタープレミックス・ブレッダープレミックスの市場規模は、2023年に27億米ドルになるとみられており、予測期間中に6.7%のCAGRで拡大すると予測され、2028年には38億米ドルに達すると見込まれています。

| 調査範囲 | |

|---|---|

| 対象範囲 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル, 数量 |

| セグメント | バッタータイプ, ブレッダータイプ, 用途, エンドユーザー, 地域 |

| 対象地域 | 北米, 南米, 欧州, アジア太平洋, その他の地域 |

都市化はバッタープレミックス・ブレッダープレミックス市場にとって重要かつ有望な機会です。より良い経済的展望と生活水準の向上を求めて都市部に移住する人々が世界中で増えるにつれて、バッタープレミックス・ブレッダープレミックスのような便利で保存性の高い食品に対する需要が増大します。都市化の進展は、しばしば勤労専門職や単身世帯の増加を伴います。こうした人口動態の変化が、1食分ずつ簡単に調理できる食事の需要を押し上げています。バッタープレミックス・ブレッダープレミックスは、豊富な調理技術や手の込んだ調理を必要とせず、風味豊かで満足度の高い料理を作るための重要な材料として役立つため、時間や調理資源に限りのある都市生活者にとって理想的な選択肢となります。進化する都市型ライフスタイル、食生活の嗜好の変化、利便性へのニーズは、バッタープレミックス・ブレッダープレミックスの特性とよく合致しています。こうした動向を効果的に利用し、都市部の消費者に合わせたマーケティング戦略を立てることで、バッタープレミックス・ブレッダープレミックスメーカーは、成長し受容性の高い市場セグメントを開拓し、消費拡大と市場拡大を促進することができます。

アジア太平洋の人口の大幅な増加は、消費者基盤の拡大につながるだけでなく、すぐに食べられて調理が簡単な食品に対する需要の高まりをもたらしています。消費者が味や品質に妥協しない便利な食事ソリューションを求める中、特殊なバッターやブレッダーはこうした嗜好に応える上で極めて重要な役割を果たしています。これらは、一貫した風味と食感の食品を作ることを可能にし、この地域で一般的なペースの速いライフスタイルに完璧に合致します。

さらに、アジア太平洋ではファストフード産業が盛んであるため、高品質のバッターやブレッダーに対するニーズが高まっています。これらの店舗では、特徴的なサクサク感と風味豊かなプロファイルを提供するために、コーティング剤に大きく依存しています。こうした特殊な原材料の需要は、多国籍ファストフードチェーンだけでなく、この地域の人口の多様な嗜好や嗜好に対応する地元のフードサービスセクターの繁栄によっても牽引されています。

当レポートでは、世界のバッタープレミックス・ブレッダープレミックス市場について調査し、バッタータイプ別、ブレッダータイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- エコシステム分析

- 消費者のビジネスに影響を与える動向/混乱

- 特許分析

- 貿易分析

- 関税と規制状況

- 規制の枠組み

- 技術分析

- ポーターのファイブフォース分析

- 主要な会議とイベント

- 主要な利害関係者と購入基準

- ケーススタディ分析

第7章 バッタープレミックス・ブレッダープレミックス市場、バッタータイプ別

- イントロダクション

- 接着用

- 天ぷら用

- ビール入り

- 厚衣

- カスタマイズ用

第8章 バッタープレミックス・ブレッダープレミックス市場、ブレッダータイプ別

- イントロダクション

- パン粉・フレーク

- 小麦粉・でんぷん

- 豆類

- ブレンド

- その他

第9章 バッタープレミックス・ブレッダープレミックス市場、用途別

- イントロダクション

- 肉

- シーフード

- 野菜

- その他

第10章 バッタープレミックス・ブレッダープレミックス市場、エンドユーザー別

- イントロダクション

- フードサービスレストラン

- オフラインプラットフォーム

- オンラインプラットフォーム

第11章 バッタープレミックス・ブレッダープレミックス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要企業の市場シェア分析

- 主要参入企業が採用した戦略

- 主要企業のセグメント別収益分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- ADM

- KERRY GROUP PLC

- ASSOCIATED BRITISH FOODS PLC

- CARGILL, INCORPORATED

- INGREDION

- MCCORMICK & COMPANY, INC.

- SHOWA SANGYO CO., LTD.

- TATE & LYLE

- BUNGE LIMITED

- HOUSE-AUTRY MILLS

- NEWLY WEDS FOODS

- SHIMAKYU

- THAI NISSHIN TECHNOMIC CO., LTD.

- ARCADIA FOODS

- KYOEIFOOD

- BLENDEX COMPANY

- スタートアップ/中小企業

- BON FOOD INDUSTRIES SDN BHD

- HELIOFOOD

- BRF GLOBAL

- PT SRIBOGA FLOUR MILL

- BRATA PRODUKTIONS

- XIAMEN UPRISING STAR FOODSTUFFS CO., LTD.

- ZHUHAI YITONG INDUSTRIAL CO., LTD.

- PT. PRIMERA PANCA DWIMA

- DONGGUAN HONGXING FOODS CO., LTD.

- BOWMAN INGREDIENTS

第14章 隣接市場および関連市場

第15章 付録

The global market for batter & breader premixes is estimated at USD 2.7 billion in 2023 and is projected to reach USD 3.8 billion by 2028, at a CAGR of 6.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD, Kilotons |

| Segments | Batter type, Breader type, Application, End User, Region |

| Regions covered | North America, South America, Europe, APAC, RoW |

Capitalizing on Urbanization: Expanding batter & breader premixes market opportunities in the modern culinary landscape.

Urbanization presents a significant and promising opportunity for the batter & breader premixes market. As more individuals around the world migrate to urban areas in search of better economic prospects and improved living standards, the demand for convenient and shelf-stable food products like batter & breader premixes is poised to rise. The rise of urbanization is often accompanied by an increase in the number of working professionals and single-person households. These demographic shifts drive the demand for single-serving and easy-to-prepare meals. Batter & breader premixes can serve as a key ingredient in creating flavorful and satisfying dishes without the need for extensive cooking skills or elaborate meal preparation, making it an ideal choice for urban dwellers with limited time and culinary resources. The evolving urban lifestyle, changing dietary preferences, and the need for convenience align well with the attributes of batter & breader premixes. By effectively capitalizing on these trends and tailoring marketing strategies to urban consumers, batter & breader premixes manufacturers can tap into a growing and receptive market segment, fostering increased consumption and market expansion.

Asia Pacific is projected to witness the highest growth rate during the forecast period.

The substantial population growth in Asia Pacific not only translates to a larger consumer base but also drives a heightened demand for ready-to-eat and easy-to-prepare food products. As consumers seek convenient meal solutions that do not compromise on taste or quality, specialized batters, and breaders play a pivotal role in meeting these preferences. They enable the creation of consistently flavorful and textured food items, aligning perfectly with the fast-paced lifestyles prevalent in this region.

Furthermore, the flourishing fast-food industry in the Asia Pacific has propelled the need for high-quality batters and breaders. These establishments heavily rely on coatings to deliver the signature crispy and flavorful profiles that define their offerings. The demand for these specialized ingredients is not only driven by multinational fast-food chains but also by a thriving local food service sector that caters to the diverse tastes and preferences of the region's population.

In addition to fast food, the region's rich and diverse culinary landscape further contributes to the significance of specialized batters and breaders. With a wide range of traditional dishes and regional specialties, there is a growing need for customized coatings that can enhance and elevate the flavors of local cuisines. This presents an exciting opportunity for manufacturers and suppliers of batters and breaders to tailor their products. With a wide range of traditional dishes and regional specialties, there is a growing need for customized coatings that can enhance and elevate the flavors of local cuisines. This presents an exciting opportunity for manufacturers and suppliers of batters and breaders to tailor their products to suit the unique requirements of each market within the Asia Pacific region.

Customized batters are gaining rapid popularity in the batter & breader premixes market across the globe

Customized batter formulations are a transformative force in the batter and breader market, revolutionizing culinary creations for chefs and food processors. These specialized batters cater to specific preferences, dietary needs, and culinary applications, providing a distinct and signature quality to food products. Their adaptability to fine-tune ingredients, textures, and flavors meets diverse consumer demands, allowing for standout products in a competitive market. Moreover, customized batters align with the industry's emphasis on health and wellness, offering options like gluten-free, low-sodium, and plant-based alternatives. This versatility positions them as crucial players in catering to evolving dietary trends. Additionally, in a landscape driven by culinary innovation, customized batters serve as a creative canvas, enabling the incorporation of unique ingredients and flavor infusions. This adaptability extends across a range of applications, showcasing the versatility and ingenuity of customized batter formulations. As the market continues to evolve, the central role of customized batters in shaping the future of culinary excellence is assured.

By breader type, crumbs & flakes dominated the market for batter & breader premixes in value terms

Unlike traditional batters, crumbs & flakes introduce a distinctive textural element, enhancing the overall sensory experience for consumers. Their irregular, granular structure delivers a consistently crunchy and crispy texture, significantly augmenting the perceived quality of products. This sought-after textural enhancement is particularly valued in the food industry, making products coated with crumbs and flakes more enticing to consumers. Furthermore, their remarkable adaptability across a wide range of food items, from proteins to vegetables and desserts, provides a convenient and efficient means to achieve a desirable crunch. This versatility empowers chefs and food manufacturers to explore a broad spectrum of culinary creations, solidifying crumbs, and flakes as an indispensable tool in culinary innovation. Additionally, the rustic and artisanal appearance bestowed by the irregular surface of crumbs and flakes enhances the overall perception of quality, contributing to the marketability and branding of food products. In conclusion, crumbs and flakes are a fundamental demand driver, revolutionizing the coating and preparation of food products. Their unique textural enhancement, adaptability, and visual appeal position them as critical components in creating appealing and marketable food offerings. As consumer preferences continue to evolve, the enduring influence of crumbs and flakes in shaping the future of the food industry is assured.

By end user, the food service restaurant channel is projected to grow at a higher rate in the global batter & breader premixes market

One of the key factors contributing to the significance of food service restaurants is their role as trendsetters in the culinary industry. These establishments are at the forefront of consumer preferences, often leading the way in introducing innovative and unique menu items. They demand batters and breaders that can not only provide a reliable and appealing coating but also offer a canvas for creativity and differentiation. This drives manufacturers to continually develop and refine specialized formulations that meet the exact standards of the food service sector.

Moreover, food service restaurants operate in a highly competitive landscape, where differentiation is paramount. The ability to offer distinct and memorable dining experiences is a key strategy for success. Batters and breaders play a critical role in achieving this differentiation. Whether it's a signature crispy chicken sandwich, a perfectly coated fish fillet, or a uniquely battered vegetable side, the quality of the coating directly impacts the overall impression of the dish. This drives a continuous demand for specialized batters and breaders that can help restaurants stand out in a crowded market.

The break-up of the profile of primary participants in the batter & breader premixes market:

- By Company: Tier 1: 45%, Tier 2: 33%, and Tier 3: 22%

- By Designation: D-level - 45%, C-Level Executives - 33%, and Others- 22%

- By Region: North America - 15, Europe - 29%, Asia Pacific - 44 %, and RoW - 12%

Research Coverage:

This research report categorizes the batter & breader premixes market by batter type (Adhesion batter, Tempura batter, Beer batter, Thick batter and Customized batter), by breader type (Crumbs & flakes, Flour & starch), by Application (meat, seafood, vegetable), by end user (Food Service Restaurants, Offline Platforms, and Online Platforms), and region (North America, Europe, Asia Pacific, South America and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the batter & breader premixes market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the batter & breader premixes market. Competitive analysis of upcoming startups in the batter & breader premixes market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall batter & breader premixes market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for processed, prepared, and convenience food), restraints (Prevalence of allergies to batter & breader premix sources, such as soy and wheat), opportunities (Increase in investments in research & development for new batter & breader technologies), and challenges (Shift toward fresh food products) influencing the growth of the batter & breader premixes market.

- Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the batter & breader premixes market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the batter & breader premixes market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the batter & breader premixes market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Archer Daniels Midland (US), Kerry Group Plc (Ireland), Associated British Foods Plc (UK), Cargill, Incorporated (US) and Ingredion (US), among others in the batter & breader premixes market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key insights from industry experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION ON BATTER & BREADER PREMIXES MARKET

- 2.6.1 RECESSION MACROINDICATORS

- FIGURE 6 RECESSION MACROINDICATORS

- FIGURE 7 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 8 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 9 RECESSION INDICATORS AND THEIR IMPACT ON BATTER & BREADER PREMIXES MARKET

- FIGURE 10 GLOBAL BATTER & BREADER PREMIXES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 11 ADHESION BATTER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 FLOUR & STARCH SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 MEAT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 FOOD SERVICE RESTAURANTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN BATTER & BREADER PREMIXES MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF BATTER & BREADER PREMIXES MARKET

- FIGURE 16 POTENTIAL RISE IN DEMAND FOR CONVENIENCE MEAT AND SEAFOOD PRODUCTS TO DRIVE MARKET

- 4.2 ASIA PACIFIC BATTER & BREADER PREMIXES MARKET: KEY APPLICATION AND TOP THREE COUNTRIES

- FIGURE 17 ASIA PACIFIC: CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 18 MEAT APPLICATION TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 19 BATTER & BREADER PREMIXES MARKET SHARE, BY TYPE, 2023 VS. 2028

- FIGURE 20 BATTER & BREADER PREMIXES MARKET SIZE, BY FLOUR AND STARCH TYPE, 2023 VS. 2028

- 4.3 BATTER & BREADER PREMIXES MARKET, BY COUNTRY

- FIGURE 21 US TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISING GLOBAL POPULATION AND DIVERSE FOOD CONSUMPTION

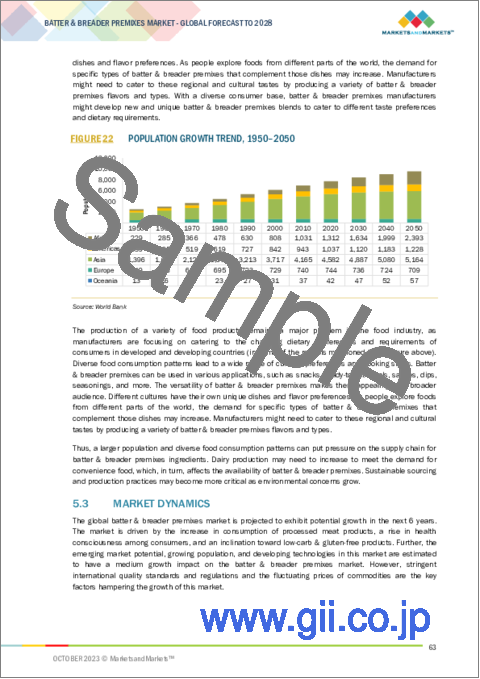

- FIGURE 22 POPULATION GROWTH TREND, 1950-2050

- 5.3 MARKET DYNAMICS

- FIGURE 23 BATTER & BREADER PREMIXES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Rise in consumption of premium meat products

- FIGURE 24 GLOBAL MEAT DEMAND, 2005 VS. 2050 (USD BILLION)

- FIGURE 25 CHICKEN CONSUMPTION IN US: SUPERMARKETS VS. FOODSERVICE ESTABLISHMENTS, 2014-2018

- 5.3.1.2 Inclination toward low-carb and gluten-free products

- 5.3.1.3 Rising demand for processed, prepared, and convenience food products

- 5.3.1.4 Expanding fast food industry

- 5.3.2 RESTRAINTS

- 5.3.2.1 Volatility in raw material prices

- 5.3.2.2 Prevalence of allergies to batter & breader premix sources, such as soy and wheat

- 5.3.2.3 Stringent regulatory standards

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emerging markets to illustrate great potential for batter and breader premixes

- 5.3.3.2 Increase in investments in research & development for new batter and breader technologies

- 5.3.4 CHALLENGES

- 5.3.4.1 Infrastructural and regulatory challenges in developing countries

- 5.3.4.2 Shift toward fresh food products

- 5.3.4.3 Health and nutritional concerns

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 27 SUPPLY CHAIN MAP

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE OF BATTER AND BREADER PREMIXES TYPES, BY KEY COMPANY

- FIGURE 28 AVERAGE SELLING PRICE OF BATTER AND BREADER PREMIXES TYPES, BY KEY COMPANY

- TABLE 2 AVERAGE SELLING PRICE OF BATTER AND BREADER TYPES, BY KEY COMPANY, 2022 (USD/KG)

- 6.4.2 AVERAGE SELLING PRICE OF BATTER AND BREADER PREMIXES, BY TYPE

- FIGURE 29 AVERAGE SELLING PRICE OF BATTER TYPES, 2019-2022 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE OF KEY BREADER TYPES, 2019-2022 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE OF BATTER AND BREADER PREMIXES, BY REGION, 2019-2022 (USD/KG)

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 ECOSYSTEM VIEW

- 6.5.2 ECOSYSTEM MAP

- 6.5.2.1 Upstream

- 6.5.2.1.1 Batter and breader premix manufacturers

- 6.5.2.1.2 Raw material providers

- 6.5.2.1.3 Academia and research institutes

- 6.5.2.2 Downstream

- 6.5.2.1 Upstream

- 6.6 TRENDS/DISRUPTIONS IMPACTING CONSUMERS' BUSINESSES

- FIGURE 31 REVENUE SHIFT FOR BATTER & BREADER PREMIXES MARKET

- 6.7 PATENT ANALYSIS

- FIGURE 32 PATENTS GRANTED, BY REGION

- FIGURE 33 PATENTS GRANTED ANNUALLY, 2012-2022

- TABLE 4 KEY PATENTS PERTAINING TO BATTER AND BREADER PREMIXES, 2022-2023

- 6.8 TRADE ANALYSIS

- FIGURE 34 EXPORT VALUE OF FLOUR AND STARCH, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 35 IMPORT VALUE OF FLOUR AND STARCH, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 REGULATORY FRAMEWORK

- 6.10.1 INTRODUCTION

- 6.10.2 NORTH AMERICA

- 6.10.2.1 US Food and Drug Administration (FDA)

- 6.10.2.2 Food and Agriculture Organization (FAO)

- 6.10.2.3 Canadian Food and Drug Act and Regulations

- 6.10.2.4 Mexico

- 6.10.3 EUROPE

- 6.10.4 ASIA PACIFIC

- 6.10.4.1 China

- 6.10.4.2 Japan

- TABLE 10 FOOD COATING WITH STANDARDS OF USE

- 6.10.4.3 Australia & New Zealand

- 6.10.4.3.1 Australia New Zealand Food Standards Code - Standard 1.3.1 - Food Additives

- 6.10.4.3 Australia & New Zealand

- 6.10.5 SOUTH AMERICA

- 6.10.5.1 Brazil

- 6.10.5.2 Argentina

- 6.10.5.2.1 Argentina Food Safety Act

- 6.10.5.3 Rest of South America

- 6.10.6 MIDDLE EAST

- 6.10.6.1 UAE

- 6.11 TECHNOLOGY ANALYSIS

- 6.11.1 CLEAN-LABEL INGREDIENTS

- 6.11.2 HEALTH-CONSCIOUS OPTIONS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY CONFERENCES & EVENTS

- TABLE 11 KEY CONFERENCES & EVENTS, 2023-2024

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BATTER AND BREADER PREMIXES

- 6.14.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR BATTER AND BREADER PREMIXES

- TABLE 13 KEY BUYING CRITERIA FOR TOP BATTER AND BREADER PREMIXES

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 INGREDION ADOPTED SUSTAINABLE, CLEAN-LABEL PULSE FLOURS TO IMPROVE PRODUCT QUALITY

- 6.15.2 KERRY DEVELOPED PRETZEL BREADCRUMB COATING SYSTEM INSPIRED BY GERMAN TRADITIONAL BAKING TECHNIQUES TO ADD CRUNCHY TEXTURE TO ITS FOOD PRODUCTS

7 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE

- 7.1 INTRODUCTION

- FIGURE 38 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 14 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 15 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 16 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 17 BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- 7.2 ADHESION BATTER

- 7.2.1 GROWING DEMAND FOR BATTERED AND BREADED MEAT AND SEAFOOD ITEMS AND RISING FAST-FOOD CHAINS TO DRIVE MARKET

- TABLE 18 ADHESION BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 19 ADHESION BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 20 ADHESION BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 21 ADHESION BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 7.3 TEMPURA BATTER

- 7.3.1 UNIQUE BATTER COMPOSITION, LESS OIL USAGE, AND ESCHEWING BREADCRUMBS TO DRIVE DEMAND FOR TEMPURA BATTER

- TABLE 22 TEMPURA BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 TEMPURA BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 TEMPURA BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 25 TEMPURA BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 7.4 BEER BATTER

- 7.4.1 NEED TO MAINTAIN LIGHTNESS OF FOOD PRODUCTS WHILE ENHANCING VOLUME TO FUEL DEMAND FOR BEER BATTER

- TABLE 26 BEER BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 BEER BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 BEER BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 29 BEER BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 7.5 THICK BATTER

- 7.5.1 RISING DEMAND FOR THICK BATTER IN NORTH AMERICAN SNACK FOOD INDUSTRY TO DRIVE MARKET

- TABLE 30 THICK BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 THICK BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 THICK BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 33 THICK BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 7.6 CUSTOMIZED BATTER

- 7.6.1 HIGH COMPETITION AMONG QUICK SERVICE RESTAURANTS TO DRIVE CONSUMPTION OF CUSTOMIZED BATTER

- TABLE 34 CUSTOMIZED BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 CUSTOMIZED BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 CUSTOMIZED BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 37 CUSTOMIZED BATTER: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

8 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE

- 8.1 INTRODUCTION

- FIGURE 39 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 38 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 39 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 40 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 41 BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

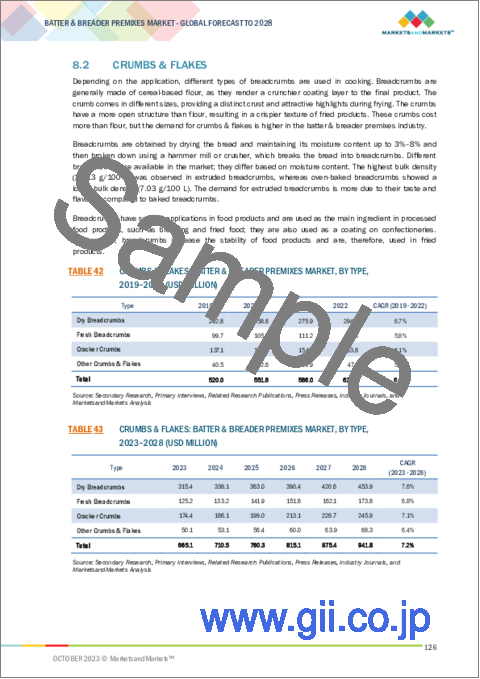

- 8.2 CRUMBS & FLAKES

- TABLE 42 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 43 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 44 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 45 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 46 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 49 CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.2.1 DRY BREADCRUMBS

- 8.2.1.1 Rising trend of product differentiation to fuel demand for dry breadcrumbs

- TABLE 50 DRY BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 DRY BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 DRY BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 53 DRY BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.2.2 FRESH BREADCRUMBS

- 8.2.2.1 Use of fresh breadcrumbs for soft coating on fried foods or for stuffing to drive demand

- TABLE 54 FRESH BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 FRESH BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 FRESH BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 57 FRESH BREADCRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.2.3 CRACKER CRUMBS

- 8.2.3.1 Cracker crumbs to be used in pre-dust applications

- TABLE 58 CRACKER CRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 CRACKER CRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 CRACKER CRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 61 CRACKER CRUMBS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.2.4 OTHER CRUMBS & FLAKES

- TABLE 62 OTHER CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 OTHER CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 OTHER CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 65 OTHER CRUMBS & FLAKES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.3 FLOUR & STARCH

- TABLE 66 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 67 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 68 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 69 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 70 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 72 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 73 FLOUR & STARCH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.3.1 CEREALS

- TABLE 74 CEREALS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 75 CEREALS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 76 CEREALS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 77 CEREALS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 78 CEREALS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 CEREALS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 80 CEREALS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 81 CEREALS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.3.1.1 Wheat

- 8.3.1.1.1 Increased demand for wheat in meat industry due to crispiness, fried appearance, and reduced coating blow-off

- 8.3.1.2 Rice

- 8.3.1.2.1 Rice flour to serve as alternative to wheat flour in battered and breaded foods

- 8.3.1.1 Wheat

- FIGURE 40 VOLUME OF RICE EXPORTED, BY COUNTRY, 2019 (MILLION TONS)

- 8.3.1.3 Corn

- 8.3.1.3.1 Corn breaders harder in texture and larger in size

- 8.3.1.3 Corn

- FIGURE 41 ANNUAL GLOBAL PRODUCTION OF CORN, 2017-2019 (MMT)

- 8.3.1.4 Other cereals

- 8.4 PULSES

- 8.4.1 HIGH PROTEIN AND FIBER CONTENT OF PULSES TO ADD DISTINCT FLAVOR TO COATED FOODS

- TABLE 82 PULSES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 PULSES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 84 PULSES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 85 PULSES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.5 BLENDS

- 8.5.1 BLENDED BREADERS MADE FROM BREADCRUMBS, CEREAL BREADERS, OR FRUIT & NUT BREADERS TO DRIVE MARKET

- TABLE 86 BLENDS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 BLENDS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 BLENDS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 89 BLENDS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 8.6 OTHER FLOUR & STARCH TYPES

- TABLE 90 OTHER FLOUR & STARCH TYPES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 91 OTHER FLOUR & STARCH TYPES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 92 OTHER FLOUR & STARCH TYPES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 93 OTHER FLOUR & STARCH TYPES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

9 BATTER & BREADER PREMIXES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 42 BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 94 BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 97 BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 9.2 MEAT

- 9.2.1 INCREASING MEAT CONSUMPTION TO DRIVE DEMAND FOR BATTER & BREADER PREMIXES

- FIGURE 43 MEAT PRODUCTION IN EUROPE, 2006-2021

- TABLE 98 MEAT: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 99 MEAT: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 100 MEAT: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 101 MEAT: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 102 MEAT: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 MEAT: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 MEAT: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 105 MEAT: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.2.2 PORK

- 9.2.2.1 Rising consumption of pork in fast-food chains in North American and European countries to drive market

- FIGURE 44 PORK CONSUMPTION, BY COUNTRY, 2012-2022 (KILOGRAMS/CAPITA)

- TABLE 106 PORK: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 PORK: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 108 PORK: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 109 PORK: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.2.3 CHICKEN

- 9.2.3.1 Rising health concerns and preference for low-calorie foods to fuel consumption of chicken

- TABLE 110 CHICKEN: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 111 CHICKEN: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 CHICKEN: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 113 CHICKEN: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.3 SEAFOOD

- 9.3.1 INCREASING USAGE OF TEMPURA BATTER & BREADER IN SEAFOOD APPLICATIONS TO DRIVE MARKET

- FIGURE 45 ESTIMATED PER CAPITA CONSUMPTION OF FISH AND SEAFOOD BY COUNTRY, 2019 (KG)

- TABLE 114 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 115 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 116 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 117 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 118 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 119 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 120 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 121 SEAFOOD: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.3.2 CRAB

- TABLE 122 CRAB: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 123 CRAB: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 124 CRAB: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 125 CARB: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.3.3 FISH

- TABLE 126 FISH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 127 FISH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 128 FISH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 129 FISH: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.3.4 OTHER SEAFOOD APPLICATIONS

- TABLE 130 OTHER SEAFOOD APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 131 OTHER SEAFOOD APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 132 OTHER SEAFOOD APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 133 OTHER SEAFOOD APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.4 VEGETABLES

- 9.4.1 RISING DEMAND FOR GOURMET FRIED VEGETABLE SNACKS TO BOOST DEMAND FOR BATTER AND BREADER PREMIXES

- TABLE 134 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 135 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 137 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 138 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 139 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 140 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 141 VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.4.2 ONION RINGS

- 9.4.2.1 Popularity in US as restaurant snack and side dish to drive its demand

- TABLE 142 ONION RINGS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 143 ONION RINGS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 144 ONION RINGS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 145 ONION RINGS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.4.3 OTHER VEGETABLES

- TABLE 146 OTHER VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 147 OTHER VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 148 OTHER VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 149 OTHER VEGETABLES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 9.5 OTHER APPLICATIONS

- TABLE 150 OTHER APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 151 OTHER APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 152 OTHER APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 153 OTHER APPLICATIONS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

10 BATTER & BREADER PREMIXES MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 46 BATTER & BREADER PREMIXES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- TABLE 154 BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 155 BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.2 FOOD SERVICE RESTAURANTS

- TABLE 156 FOOD SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 157 FOOD SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 158 FOOD SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 159 FOOD SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.1 QUICK SERVICE RESTAURANTS

- 10.2.1.1 Need for crunchy textures and consumers seeking convenient and delectable meals to drive market

- TABLE 160 QUICK-SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 161 QUICK-SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 FULL-SERVICE RESTAURANTS

- 10.2.2.1 Need for high standards during peak hours and enhanced customer to drive demand for full-service restaurants

- TABLE 162 FULL-SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 163 FULL-SERVICE RESTAURANTS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 OFFLINE PLATFORMS

- TABLE 164 OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 165 OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 166 OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 167 OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.1 SUPERMARKETS & HYPERMARKETS

- 10.3.1.1 Supermarkets and hypermarkets to drive market with wide-ranging consumer-centric approach

- TABLE 168 SUPERMARKETS & HYPERMARKETS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 169 SUPERMARKETS & HYPERMARKETS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 CONVENIENCE STORES

- 10.3.2.1 Convenience stores to benefit from premixes due to their simplicity of application and reduced cooking times

- TABLE 170 CONVENIENCE STORES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 171 CONVENIENCE STORES: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 OTHER OFFLINE PLATFORMS

- TABLE 172 OTHER OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 173 OTHER OFFLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 ONLINE PLATFORMS

- 10.4.1 ONLINE PLATFORMS TO PROPEL SALE OF BATTER & BREADER PREMIXES TO GLOBAL AUDIENCE BY REVOLUTIONIZING CUSTOMER BASE

- TABLE 174 ONLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 175 ONLINE PLATFORMS: BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

11 BATTER & BREADER PREMIXES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 47 BATTER & BREADER PREMIXES MARKET: GEOGRAPHIC SNAPSHOT, 2023-2028

- TABLE 176 BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 177 BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 178 BATTER & BREADER PREMIXES MARKET, BY REGION, 2019-2022 (KT)

- TABLE 179 BATTER & BREADER PREMIXES MARKET, BY REGION, 2023-2028 (KT)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 48 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2019-2021

- FIGURE 49 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 50 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET SNAPSHOT

- TABLE 180 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 181 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 183 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 184 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 185 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 187 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- TABLE 188 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 189 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 190 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 191 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

- TABLE 192 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 193 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 194 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 195 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 196 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 197 NORTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Need for gluten-free, low-carb, and low-fat batter premixes to drive market

- TABLE 198 US: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 199 US: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 200 US: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 201 US: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.2.3 CANADA

- 11.2.3.1 Rising immigration, increasing interest in global cuisines, and growing restaurant business to drive market

- TABLE 202 CANADA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 203 CANADA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 204 CANADA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 205 CANADA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.2.4 MEXICO

- 11.2.4.1 Increasing need for processed foods at reasonable price to drive market

- TABLE 206 MEXICO: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 207 MEXICO: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 208 MEXICO: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 209 MEXICO: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3 EUROPE

- FIGURE 51 EUROPE: ESTIMATED PER CAPITA CONSUMPTION OF FISH AND SEAFOOD BY COUNTRY, 2019-2020

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 52 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 53 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- TABLE 210 EUROPE: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 211 EUROPE: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 212 EUROPE: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 213 EUROPE: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 214 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 215 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 216 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 217 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- TABLE 218 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 219 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 220 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 221 EUROPE: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

- TABLE 222 EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 223 EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 224 EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 225 EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 226 EUROPE: BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 227 EUROPE: BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Large consumer base, high purchasing power, hectic lifestyles, and rising demand for frozen processed foods to drive market

- TABLE 228 GERMANY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 229 GERMANY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 230 GERMANY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 231 GERMANY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3.3 UK

- 11.3.3.1 Growing consumption of meat and seafood products and rising demand for beer batter to drive market

- TABLE 232 UK: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 233 UK: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 234 UK: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 235 UK: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3.4 FRANCE

- 11.3.4.1 Rising trend of eating out and increasing tourism to drive demand for batter & breader premixes

- TABLE 236 FRANCE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 237 FRANCE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 238 FRANCE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 239 FRANCE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3.5 SPAIN

- 11.3.5.1 Increasing demand for innovation in food products and willingness to spend to fuel demand for customized batter & breader premixes

- TABLE 240 SPAIN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 241 SPAIN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 242 SPAIN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 243 SPAIN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3.6 ITALY

- 11.3.6.1 Increasing number of food service chains and growing need for convenient and ready-to-cook food products to drive market

- TABLE 244 ITALY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 245 ITALY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 246 ITALY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 247 ITALY: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.3.7 REST OF EUROPE

- TABLE 248 REST OF EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 249 REST OF EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 250 REST OF EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 251 REST OF EUROPE: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 54 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 55 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 56 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET SNAPSHOT

- TABLE 252 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 253 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 254 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 255 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 256 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 257 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 258 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 259 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- TABLE 260 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 261 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 262 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 263 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

- TABLE 264 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 265 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 266 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 267 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 268 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 269 ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing purchasing power of middle-class families, rapid urbanization, increased adoption of convenience meat and seafood products to drive market

- TABLE 270 CHINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 271 CHINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 272 CHINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 273 CHINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.3 INDIA

- 11.4.3.1 Increasing adoption of Western cuisines and rising standards of living to propel market

- TABLE 274 INDIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 275 INDIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 276 INDIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 277 INDIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.4 JAPAN

- 11.4.4.1 Increasing consumption of batter premixes in homemade dishes to drive market

- TABLE 278 JAPAN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 279 JAPAN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 280 JAPAN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 281 JAPAN: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Increasing shift toward ready-to-prepare meat and seafood products to propel market

- TABLE 282 AUSTRALIA AND NEW ZEALAND: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 283 AUSTRALIA AND NEW ZEALAND: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 284 AUSTRALIA AND NEW ZEALAND: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 285 AUSTRALIA AND NEW ZEALAND: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing number of Western tourists and rising demand for Western flavors to propel market

- TABLE 286 SOUTH KOREA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 287 SOUTH KOREA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 288 SOUTH KOREA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 289 SOUTH KOREA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.7 INDONESIA

- 11.4.7.1 Rising online food delivery services and increasing tourism to fuel demand for batter & breader premixes

- TABLE 290 INDONESIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 291 INDONESIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 292 INDONESIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 293 INDONESIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.8 MALAYSIA

- 11.4.8.1 Strong poultry trade support to drive batter & breader premixes market

- TABLE 294 MALAYSIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 295 MALAYSIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 296 MALAYSIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 297 MALAYSIA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.4.9 REST OF ASIA PACIFIC

- TABLE 298 REST OF ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 300 REST OF ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 301 REST OF ASIA PACIFIC: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 57 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 58 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 302 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 303 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 304 SOUTH AMERICA: BREADER PREMIXES MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 305 SOUTH AMERICA: BREADER PREMIXES MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 306 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 307 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 308 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 309 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- TABLE 310 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 311 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 312 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 313 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

- TABLE 314 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 315 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 316 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 317 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 318 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 319 SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Increasing consumption of processed meat products and rising investment in meat sector to drive market

- TABLE 320 BRAZIL: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 321 BRAZIL: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 322 BRAZIL: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 323 BRAZIL: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.5.3 ARGENTINA

- 11.5.3.1 Culinary shifts and growing appetite for convenience foods to fuel demand for batter & breader premixes

- TABLE 324 ARGENTINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 325 ARGENTINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 326 ARGENTINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 327 ARGENTINA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 328 REST OF SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 329 REST OF SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 330 REST OF SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 331 REST OF SOUTH AMERICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.6 ROW

- 11.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 59 ROW: INFLATION RATES, BY KEY SUBREGION, 2017-2021

- FIGURE 60 ROW: RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 332 ROW: BATTER & BREADER PREMIXES MARKET, BY SUBREGION, 2019-2022 (USD MILLION)

- TABLE 333 ROW: BATTER & BREADER PREMIXES MARKET, BY SUBREGION, 2023-2028 (USD MILLION)

- TABLE 334 ROW: BATTER & BREADER PREMIXES MARKET, BY SUBREGION, 2019-2022 (KT)

- TABLE 335 ROW: BATTER & BREADER PREMIXES MARKET, BY SUBREGION, 2023-2028 (KT)

- TABLE 336 ROW: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (USD MILLION)

- TABLE 337 ROW: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (USD MILLION)

- TABLE 338 ROW: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2019-2022 (KT)

- TABLE 339 ROW: BATTER & BREADER PREMIXES MARKET, BY BATTER TYPE, 2023-2028 (KT)

- TABLE 340 ROW: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (USD MILLION)

- TABLE 341 ROW: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (USD MILLION)

- TABLE 342 ROW: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2019-2022 (KT)

- TABLE 343 ROW: BATTER & BREADER PREMIXES MARKET, BY BREADER TYPE, 2023-2028 (KT)

- TABLE 344 ROW: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 345 ROW: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 346 ROW: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 347 ROW: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 348 ROW: BATTER & BREADER PREMIXES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 349 ROW: BATTER & BREADER PREMIXES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Rising tourism and businesses and high consumption of chicken and beef products to drive market

- TABLE 350 MIDDLE EAST: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 351 MIDDLE EAST: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 352 MIDDLE EAST: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 353 MIDDLE EAST: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

- 11.6.3 AFRICA

- 11.6.3.1 Diverse culinary culture and rising expansion of food service industry to propel market

- TABLE 354 AFRICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 355 AFRICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 356 AFRICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 357 AFRICA: BATTER & BREADER PREMIXES MARKET, BY APPLICATION, 2023-2028 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 358 BATTER & BREADER PREMIXES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 12.3 STRATEGIES ADOPTED BY KET PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 61 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018-2022 (USD BILLION)

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 62 COMPANY EVALUATION MATRIX, 2022

- 12.5.5 COMPANY FOOTPRINT

- TABLE 359 COMPANY FOOTPRINT, BY TYPE

- TABLE 360 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 361 COMPANY FOOTPRINT, BY REGION

- TABLE 362 OVERALL COMPANY FOOTPRINT

- 12.6 START-UP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 63 START-UP/SME EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 363 DETAILED LIST OF START-UPS/SMES

- TABLE 364 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

- TABLE 365 BATTER & BREADER PREMIXES: DEALS, 2019-2023

- 12.7.3 OTHERS

- TABLE 366 BATTER & BREADER PREMIXES: OTHERS, 2019-2023

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 ADM

- TABLE 367 ADM: BUSINESS OVERVIEW

- FIGURE 64 ADM: COMPANY SNAPSHOT

- TABLE 368 ADM: PRODUCTS OFFERED

- TABLE 369 ADM: DEALS

- TABLE 370 ADM: OTHERS

- 13.2.2 KERRY GROUP PLC

- TABLE 371 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 65 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 372 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 373 KERRY GROUP PLC: OTHERS

- 13.2.3 ASSOCIATED BRITISH FOODS PLC

- TABLE 374 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- FIGURE 66 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 375 ASSOCIATED BRITISH FOODS PLC: PRODUCTS OFFERED

- TABLE 376 ASSOCIATED BRITISH FOODS PLC: DEALS

- TABLE 377 ASSOCIATED BRITISH FOODS PLC: OTHERS

- 13.2.4 CARGILL, INCORPORATED

- TABLE 378 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 67 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 379 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 380 CARGILL, INCORPORATED: OTHERS

- 13.2.5 INGREDION

- TABLE 381 INGREDION: BUSINESS OVERVIEW

- FIGURE 68 INGREDION: COMPANY SNAPSHOT

- TABLE 382 INGREDION: PRODUCTS OFFERED

- TABLE 383 INGREDION: OTHERS

- 13.2.6 MCCORMICK & COMPANY, INC.

- TABLE 384 MCCORMICK & COMPANY, INC.: BUSINESS OVERVIEW

- FIGURE 69 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT

- TABLE 385 MCCORMICK & COMPANY, INC.: PRODUCTS OFFERED

- TABLE 386 MCCORMICK & COMPANY, INC.: OTHERS

- 13.2.7 SHOWA SANGYO CO., LTD.

- TABLE 387 SHOWA SANGYO CO., LTD.: BUSINESS OVERVIEW

- FIGURE 70 SHOWA SANGYO CO., LTD.: COMPANY SNAPSHOT

- TABLE 388 SHOWA SANGYO CO., LTD.: PRODUCTS OFFERED

- 13.2.8 TATE & LYLE

- TABLE 389 TATE & LYLE: BUSINESS OVERVIEW

- FIGURE 71 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 390 TATE & LYLE: PRODUCTS OFFERED

- TABLE 391 TATE & LYLE: DEALS

- TABLE 392 TATE & LYLE: OTHERS

- 13.2.9 BUNGE LIMITED

- TABLE 393 BUNGE LIMITED: BUSINESS OVERVIEW

- FIGURE 72 BUNGE LIMITED: COMPANY SNAPSHOT

- TABLE 394 BUNGE LIMITED: PRODUCTS OFFERED

- 13.2.10 HOUSE-AUTRY MILLS

- TABLE 395 HOUSE-AUTRY MILLS: BUSINESS OVERVIEW

- TABLE 396 HOUSE-AUTRY MILLS: PRODUCTS OFFERED

- 13.2.11 NEWLY WEDS FOODS

- TABLE 397 NEWLY WEDS FOODS: BUSINESS OVERVIEW

- TABLE 398 NEWLY WEDS FOODS: PRODUCTS OFFERED

- TABLE 399 NEWLY WEDS FOODS: DEALS

- 13.2.12 SHIMAKYU

- TABLE 400 SHIMAKYU: BUSINESS OVERVIEW

- TABLE 401 SHIMAKYU: PRODUCTS OFFERED

- 13.2.13 THAI NISSHIN TECHNOMIC CO., LTD.

- TABLE 402 THAI NISSHIN TECHNOMIC CO., LTD.: BUSINESS OVERVIEW

- TABLE 403 THAI NISSHIN TECHNOMIC CO., LTD.: PRODUCTS OFFERED

- 13.2.14 ARCADIA FOODS

- TABLE 404 ARCADIA FOODS: BUSINESS OVERVIEW

- TABLE 405 ARCADIA FOODS: PRODUCTS OFFERED

- 13.2.15 KYOEIFOOD

- TABLE 406 KYOEIFOOD: BUSINESS OVERVIEW

- TABLE 407 KYOEIFOOD: PRODUCTS OFFERED

- 13.2.16 BLENDEX COMPANY

- TABLE 408 BLENDEX COMPANY: BUSINESS OVERVIEW

- TABLE 409 BLENDEX COMPANY: PRODUCTS OFFERED

- 13.3 START-UPS/SMES

- 13.3.1 BON FOOD INDUSTRIES SDN BHD

- TABLE 410 BON FOOD INDUSTRIES SDN BHD: BUSINESS OVERVIEW

- TABLE 411 BON FOOD INDUSTRIES SDN BHD: PRODUCTS OFFERED

- 13.3.2 HELIOFOOD

- TABLE 412 HELIOFOOD: BUSINESS OVERVIEW

- TABLE 413 HELIOFOOD: PRODUCTS OFFERED

- 13.3.3 BRF GLOBAL

- TABLE 414 BRF GLOBAL: BUSINESS OVERVIEW

- TABLE 415 BRF GLOBAL: PRODUCTS OFFERED

- 13.3.4 PT SRIBOGA FLOUR MILL

- TABLE 416 PT SRIBOGA FLOUR MILL: BUSINESS OVERVIEW

- TABLE 417 PT SRIBOGA FLOUR MILL: PRODUCTS OFFERED

- 13.3.5 BRATA PRODUKTIONS

- TABLE 418 BRATA PRODUKTIONS: BUSINESS OVERVIEW

- TABLE 419 BRATA PRODUKTIONS: PRODUCTS OFFERED

- 13.3.6 XIAMEN UPRISING STAR FOODSTUFFS CO., LTD.

- 13.3.7 ZHUHAI YITONG INDUSTRIAL CO., LTD.

- 13.3.8 PT. PRIMERA PANCA DWIMA

- 13.3.9 DONGGUAN HONGXING FOODS CO., LTD.

- 13.3.10 BOWMAN INGREDIENTS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 420 ADJACENT MARKETS TO BATTER & BREADER PREMIXES

- 14.2 LIMITATIONS

- 14.3 FOOD COATING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 421 FOOD COATING MARKET, BY INGREDIENT TYPE, 2019-2022 (USD MILLION)

- TABLE 422 FOOD COATING MARKET, BY INGREDIENT TYPE, 2023-2028 (USD MILLION)

- TABLE 423 FOOD COATING MARKET, BY INGREDIENT TYPE, 2019-2022 (KT)

- TABLE 424 FOOD COATING MARKET, BY INGREDIENT TYPE, 2023-2028 (KT)

- 14.4 PULSE FLOUR MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 425 PULSE FLOURS MARKET, BY TYPE, 2015-2022 (MMT)

- TABLE 426 PULSE FLOURS MARKET, BY TYPE, 2015-2022 (USD BILLION)

- 14.5 FUNCTIONAL FLOUR MARKET

- 14.5.1 MARKET DEFINITION

- 14.5.2 MARKET OVERVIEW

- TABLE 427 FUNCTIONAL FLOURS MARKET, BY TYPE, 2014-2022 (USD BILLION)

- TABLE 428 FUNCTIONAL FLOURS MARKET, BY TYPE, 2014-2022 (MT)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS