|

|

市場調査レポート

商品コード

1812624

デジタルトランスフォーメーションの世界市場 (~2031年):ソリューション (カスタマーエクスペリエンス・プロセスオートメーションプラットフォーム)・サービス (アプリケーション&インフラ近代化)・変革重点分野 (財務・オペレーション・ワークフォース) 別Digital Transformation Market by Solution (Customer Experience, Process Automation Platform), Services (Application and Infrastructure Modernization), Transformation Focus Area (Financial, Operational, Workforce Transformation) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| デジタルトランスフォーメーションの世界市場 (~2031年):ソリューション (カスタマーエクスペリエンス・プロセスオートメーションプラットフォーム)・サービス (アプリケーション&インフラ近代化)・変革重点分野 (財務・オペレーション・ワークフォース) 別 |

|

出版日: 2025年09月09日

発行: MarketsandMarkets

ページ情報: 英文 492 Pages

納期: 即納可能

|

概要

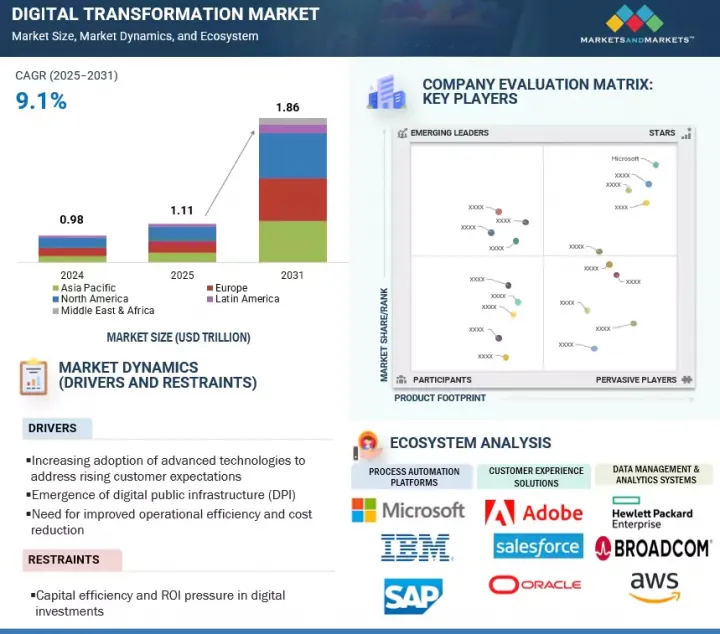

デジタルトランスフォーメーションの市場は急速に成長しており、市場規模は2025年の約1兆1,100億米ドルから、予測期間中は9.1%のCAGRで推移し、2031年には1兆8,600億米ドルに拡大すると予測されています。

運用効率の向上とコスト削減へのニーズが、企業が旧式のシステムを刷新し、全社的なプロセスを合理化する中で、デジタルトランスフォーメーションを推進する要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2031年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2031年 |

| 単位 | 米ドル |

| セグメント | 提供区分、技術、変革の重点分野、組織規模、産業別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

クラウドプラットフォーム、AI主導のアナリティクス、統合ワークフローソリューションを採用することで、企業はITインフラを統合し、保守コストを削減し、部門間の協働を改善することができます。デジタルトランスフォーメーションは、プロセスの標準化、リソースの最適化、反復的な作業の自動化を支援し、業務のスピードと正確性の両方を高めます。さらに、データに基づく洞察は、組織がボトルネックを発見し、戦略的に投資を配分するのに役立ちます。効率性とコスト管理への注力により、デジタルトランスフォーメーションは、長期的な業務のレジリエンスを確保し、競争力を維持するための重要な要素となっています。

"ソリューションタイプ別では、プロセスオートメーションプラットフォームが予測期間中に最も速い成長を遂げる見通し"

プロセスオートメーションプラットフォームは、運用効率の向上、コスト削減、ワークフロー最適化への企業の注力によって、最も速い成長を遂げています。これらのプラットフォームは、ロボティックプロセスオートメーション (RPA) 、AI、インテリジェントワークフロー管理を活用し、反復作業を自動化し、ビジネスプロセスを合理化し、人為的ミスを減少させます。さまざまな業界の組織が、生産性の向上、意思決定の迅速化、コンプライアンスや報告の強化のためにプロセスオートメーションを導入しています。AIや機械学習機能の急速な統合により、リアルタイムでのプロセス最適化や予測分析が可能となり、これらのソリューションは、拡張性があり、アジャイルで、データ駆動型のデジタルトランスフォーメーションを目指す企業にとって不可欠な存在となっています。

"産業別では、BFSI (銀行・金融サービス・保険) 部門が予測期間中に最大のシェアを占める見通し"

BFSI部門は、運用効率の改善、規制遵守、より良い顧客体験へのニーズによって、最大の市場シェアを占めています。BFSI組織は、クラウドコンピューティング、AI、アナリティクス、プロセスオートメーションを積極的に導入し、基幹業務、リスク管理、顧客エンゲージメント活動を簡素化しています。デジタルトランスフォーメーションは、リアルタイムの取引監視、パーソナライズされた金融サービス、シームレスなオムニチャネル対応を可能にしつつ、セキュリティを強化し、運用コストを削減します。この分野のイノベーション、データ駆動型の意思決定、拡張可能な技術導入への注力は、BFSIを世界のデジタルトランスフォーメーション業界の成長を牽引する主要な原動力としています。

"北米は運用効率でデジタルトランスフォーメーションを推進、アジア太平洋はデジタル公共インフラで進展"

北米は成熟したデジタルインフラ、先進的なITエコシステム、業務、顧客エンゲージメント、企業ワークフロー全体におけるAIの広範な統合に支えられ、デジタルトランスフォーメーション導入で引き続きリードしています。先進的な企業は、AI対応ソリューションを活用してプロセスオートメーションを最適化し、予測的意思決定を改善し、部門横断的な業務を合理化しています。この地域の高度な分析能力、強力なベンダーエコシステム、イノベーション重視の姿勢が、リアルタイムの洞察、スマートなリソース配分、自動化された業務効率を可能にしています。

一方、アジア太平洋地域は、急速な技術導入、企業のデジタル化の進展、デジタル公共インフラに対する政府支援の拡大により、最も急成長している市場です。中国、インド、韓国といった主要市場では、業務の統合、データ駆動型戦略の実現、顧客・従業員体験の向上を目的にソリューションが導入されています。クラウド導入の拡大、都市化、政策イニシアティブがさらなる普及を加速させています。効率性、イノベーション、価値を高める拡張可能なAI搭載ソリューションを求める企業が増える中、アジア太平洋は世界のデジタルトランスフォーメーションにおける主要な成長拠点となりつつあります。

当レポートでは、世界のデジタルトランスフォーメーションの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 2025年の米国関税の影響:デジタルトランスフォーメーション市場

- 市場の進化

- 技術ロードマップ

- サプライチェーン分析

- エコシステム分析

- ビジネスモデル

- 成熟モデル

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 2025-2026年の主な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客の事業に影響を与える動向/混乱

- 生成AIがデジタルトランスフォーメーションに与える影響

- 変革の旅:プロセスのデジタル化からビジネスモデルの革新へ

第6章 デジタルトランスフォーメーション市場:提供区分別

- ソリューション

- プロセスオートメーションプラットフォーム

- カスタマーエクスペリエンスソリューション

- データ管理・分析システム

- ワークフォース有効化ツール

- サービス

- マネージドサービス

第7章 デジタルトランスフォーメーション市場:変革重点分野別

- オペレーション

- ワークフォース

- 顧客中心

- 財務

- R&D

第8章 デジタルトランスフォーメーション市場:技術別

- クラウドコンピューティング

- AI・アナリティクス

- ブロックチェーン

- サイバーセキュリティ

- IoT

- その他

第9章 デジタルトランスフォーメーション市場:組織規模別

- 中小企業

- 大企業

第10章 デジタルトランスフォーメーション市場:産業別

- BFSI

- 小売・Eコマース

- ITとITES

- メディア&エンターテインメント

- 製造

- ヘルスケア、ライフサイエンス、医薬品

- エネルギー&ユーティリティ

- 政府・防衛

- 電気通信

- 教育

- 輸送・物流

- 建設・不動産

- その他

第11章 デジタルトランスフォーメーション市場:地域別

- 北米

- 市場促進要因

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 英国

- ドイツ

- フィンランド

- スウェーデン

- その他

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 中国

- インド

- 韓国

- シンガポール

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 製品比較分析

- 企業評価と財務指標

- 企業評価マトリックス:主要企業 (ソリューションプロバイダー)

- 企業評価マトリックス:主要企業 (サービスプロバイダー)

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業 (ソフトウェア中心)

- MICROSOFT

- SAP

- IBM

- ORACLE

- ADOBE

- SALESFORCE

- HPE

- HCLTECH

- AWS

- BROADCOM

- EQUINIX

- ALIBABA CLOUD

- BAIDU

- CISCO

- EMUDHRA

- HAPPIEST MINDS

- CENTIFIC

- TIBCO SOFTWARE

- BRILLIO

- 主要企業 (サービス中心)

- ALMAVIVA

- COGNIZANT

- ERNST & YOUNG

- ACCENTURE

- GENPACT

- KYNDRYL

- SCIENCESOFT

- DELOITTE

- その他の企業 (ソフトウェア中心)

- BUDIBASE

- ELECTRONEEK

- AIXORA.AI

- MATTERWAY

- LAIYE

- ORBY AI

- KISSFLOW

- PROCESSMAKER

- PROCESS STREET

- INFINITUS SYSTEMS

- SCORO

- ALCOR SOLUTIONS

- SMARTSTREAM

- CLOUDANGLES

- SCITARA

- INTRINSIC

- AEXONIC TECHNOLOGIES

- スタートアップ/SME (サービス中心)

- VERITIS

- DEMPTON CONSULTING GROUP

- MAGNETAR IT

- AGICENT