|

|

市場調査レポート

商品コード

1345512

ロケーションアナリティクス市場:オファリング別(ソリューション、サービス)、ロケーションタイプ別、用途別、業界別、地域別-2028年までの予測Location Analytics Market by Offering (Solutions, and Services), Location Type, Application, Vertical, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ロケーションアナリティクス市場:オファリング別(ソリューション、サービス)、ロケーションタイプ別、用途別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年08月31日

発行: MarketsandMarkets

ページ情報: 英文 352 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ロケーションアナリティクスの市場規模は、2023年の206億米ドルから2028年には385億米ドルに成長し、予測期間中のCAGRは13.4%になると予測されています。

ロケーションアナリティクスの最大の促進要因は、データ駆動型の意思決定です。ロケーションアナリティクスによって、企業は地理空間データに基づいて情報に基づいた選択を行うことができるようになり、業務の最適化、顧客体験の向上、競合優位性の獲得が可能になります。位置データを分析することで、企業は顧客の行動を理解し、物流を合理化し、資源配分を強化し、災害管理や都市計画などのさまざまな課題に効果的に対応することができます。より良い意思決定を行うためにロケーションデータの力を活用できることが、業界全体でロケーションアナリティクスの導入が進む根本的な原動力となっています。

BFSI分野では、ロケーションアナリティクスは競争優位性を促進する戦略的ツールです。リスク評価を強化し、銀行や保険会社が融資や保険に影響を与える地理的要因を評価できるようにします。位置情報から得られる正確な顧客インサイトにより、パーソナライズされたマーケティングが可能になり、エンゲージメントが向上します。足取りや人口統計分析を利用したスマートな支店やATMの配置最適化により、業務効率が向上します。位置情報に基づくトランザクションモニタリングにより、不正検知が可能になります。信用スコアリング・モデルは、位置情報履歴データによって改良されます。市場拡大、資産管理、災害復旧計画はすべて、ロケーションアナリティクスから恩恵を受けます。コンプライアンス、不動産投資、サプライチェーンファイナンス戦略も強化され、BFSIの意思決定において重要な資産となっています。

位置情報分析は、企業の緊急対応管理にとって貴重なツールです。様々なソースからのリアルタイムデータを統合することで状況認識を強化し、迅速な対応を可能にします。企業は、正確な位置データによってリソース配分を最適化し、人員や機材の迅速な派遣を実現できます。位置情報分析によって安全なルートと避難予想時間が特定されるため、避難計画がより効率的になります。予測分析は、緊急事態の予測と準備に役立ちます。交通管理とリソースの追跡により、危機発生時のシームレスなオペレーションが可能になります。事故後の分析は対応策の改善に役立ち、モバイル・アプリを通じたコミュニティ参加はコミュニケーションを強化します。省庁間の連携が合理化され、協調的かつ効果的な緊急対応が促進され、最終的には企業や地域社会の安全を守ります。

当レポートでは、世界のロケーションアナリティクス市場について調査し、オファリング別、ロケーションタイプ別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- 特許分析

- エコシステム分析

- サプライチェーン分析

- 価格モデルの分析

- 動向/混乱

- ポーターのファイブフォース分析

- 規制状況

- ロケーションアナリティクス技術

- 2023年から2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

- ロケーションアナリティクスのビジネスモデル

- ロケーションアナリティクス市場の将来の方向性

第6章 ロケーションアナリティクス市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 ロケーションアナリティクス市場、ロケーションタイプ別

- イントロダクション

- 屋内

- 屋外

第8章 ロケーションアナリティクス市場、用途別

- イントロダクション

- 危機管理

- 緊急対応管理

- 顧客体験管理

- サプライチェーンの計画と最適化

- 販売とマーケティングの最適化

- 場所の選択と最適化

- その他

第9章 ロケーションアナリティクス市場、業界別

- イントロダクション

- 小売と電子商取引

- 製造業

- 政府と防衛

- メディアとエンターテイメント

- 自動車、輸送、物流

- エネルギーと公共事業

- 通信

- BFSI

- IT/アイテス

- ヘルスケアとライフサイエンス

- 農業

- その他

第10章 ロケーションアナリティクス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 市場シェア分析

- 収益分析

- 企業評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- スタートアップ/中小企業の競合ベンチマーキング

- ロケーションアナリティクス製品の情勢

- 競合シナリオ

- 主要な位置情報分析ベンダーの評価と財務指標

- 主要な位置情報分析ベンダーの年初来(YTD)価格の総収益と株価ベータ

第12章 企業プロファイル

- INTRODUCTION

- 主要参入企業

- IBM

- ORACLE

- MICROSOFT

- ESRI

- SAS INSTITUTE

- PRECISELY

- SAP

- CISCO

- TOMTOM

- HEXAGON AB

- ZEBRA TECHNOLOGIES

- FOURSQUARE

- ALTERYX

- HERE TECHNOLOGIES

- PURPLE

- GALIGEO

- CARTO

- TIBCO SOFTWARE

- MAPLARGE

- SPARKGEO

- ASCENT CLOUD

- LEPTON SOFTWARE

- スタートアップ/中小企業

- GEOMOBY

- QUUPPA

- CLEVERMAPS

- INDOORATLAS

- SEDIMENTIQ

- ARIADNE MAP

- LOCALE.AI

- GEOBLINK

- NRBY

- MAPIDEA

- GAPMAPS

- LOCATIONSCLOUD

第13章 隣接市場

第14章 付録

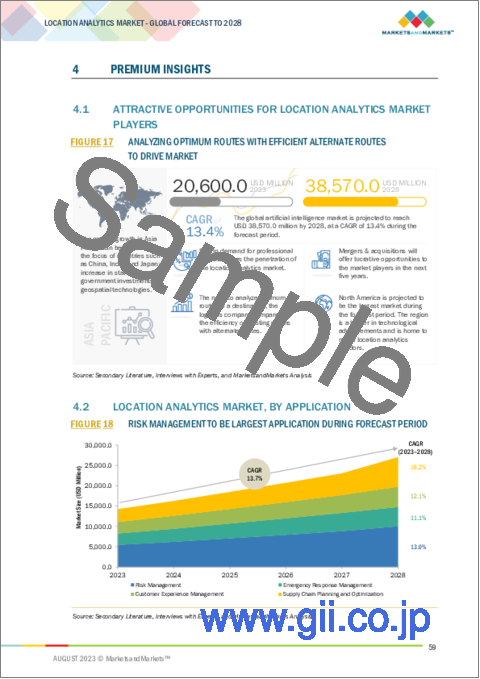

The market for location analytics is estimated to grow from USD 20.6 billion in 2023 to USD 38.5 billion by 2028, at a CAGR of 13.4% during the forecast period. The top driving factor of location analytics is data-driven decision-making. location analytics empowers organizations to make informed choices based on geospatial data, enabling them to optimize operations, improve customer experiences, and gain a competitive edge. By analyzing location data, businesses can understand customer behavior, streamline logistics, enhance resource allocation, and respond effectively to various challenges, such as disaster management or urban planning. The ability to harness the power of location data to make better decisions is a fundamental driver behind the growing adoption of location analytics across industries.

The BFSI vertical is projected to be the largest market during the forecast period.

In the BFSI sector, location analytics is a strategic tool driving competitive advantage. It enhances risk assessment, enabling banks and insurers to evaluate geographical factors impacting lending and insurance. Precise customer insights gleaned from location data allow for personalized marketing, improving engagement. Smart branch and ATM placement optimization, using foot traffic and demographic analysis, boost operational efficiency. Fraud detection benefits from location-based transaction monitoring. Credit scoring models are refined with location history data. Market expansion, asset management, and disaster recovery planning all benefit from location analytics. Compliance, real estate investment, and supply chain finance strategies are also enhanced, making it a crucial asset in BFSI decision-making.

Among application, the emergency response management segment is registered to grow at the highest CAGR during the forecast period.

Location analytics is a valuable tool for emergency response management for businesses. It enhances situational awareness by integrating real-time data from various sources, enabling faster response times. Businesses can optimize resource allocation with precise location data, ensuring quicker dispatch of personnel and equipment. Evacuation planning becomes more efficient as location analytics identifies safe routes and estimated evacuation times. Predictive analytics helps anticipate and prepare for emergencies. Traffic management and resource tracking ensure seamless operations during crises. Post-incident analysis aids in response improvement, and community engagement through mobile apps enhances communication. Cross-agency collaboration is streamlined, promoting coordinated and effective emergency response, ultimately safeguarding businesses and communities.

Among offering, the solutions segment is anticipated to account for the largest market size during the forecast period.

The market for location analytics software is experiencing significant growth driven by several key factors. Solution providers across industries are integrating location analytics to enhance their offerings. Geographic Information Systems (GIS) providers such as Esri and IoT companies incorporate location analysis into their solutions for urban planning, asset tracking, and more. Business Intelligence (BI) platforms such as Tableau leverage location data for market insights, and fleet management systems optimize routes with real-time location monitoring. Retail analytics companies use location analytics to enhance the in-store shopping experience, while emergency response and public safety solutions improve response times with location data. Supply chain and logistics providers optimize operations, real estate tech companies offer property insights, and healthcare systems use location analytics for patient tracking and resource allocation. These applications enhance decision-making, efficiency, and customer experiences in various industries.

North America to account for the largest market size during the forecast period.

North America is estimated to account for the largest share of the location analytics market. The global market for location analytics is dominated by North America. The location analytics market is experiencing significant growth globally, with North America expected to dominate the market share. The increasing demand for position intelligence and geospatial analytics solutions among industry verticals such as government, defense, and retail is driving this growth. Companies are using location-based services to gain valuable insights into customer behavior, market trends, and operational efficiency. The development of advanced location analytics solutions by key players in the industry is also contributing to market growth. With the adoption of wireless devices and location-based sensors, the demand for location analytics solutions is increasing globally. In North America, the U.S. government collaborated with technology players to deploy analytics tools in response to the COVID-19 pandemic. As businesses gain a competitive edge, sales and marketing optimization strategies with location intelligence solutions would play a significant role.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the location analytics market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 40%, Europe: 20%, APAC: 30%, MEA: 5%, Latin America: 5%

Major vendors offering location analytics solutions and services across the globe are IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US).

Research Coverage

The market study covers location analytics across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for location analytics and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growth in adoption of spatial data and analytical tools across several verticals, Rise in use of location-based applications among consumers, Greater need to gain competitive advantage across verticals), restraints (Legal concerns associated with geo privacy and confidential data, High initial cost of deployment), opportunities (Increase in adoption in small and medium-sized enterprises, Growing in penetration of advanced technologies), and challenges (Lack of uniform regulatory norms, Lack of skilled workforce) influencing the growth of the location analytics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the location analytics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the location analytics market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in location analytics market strategies; the report also helps stakeholders understand the pulse of the location analytics market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), among others in the location analytics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 LOCATION ANALYTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 PRIMARY SOURCES

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 LOCATION ANALYTICS MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF LOCATION ANALYTICS COMPANIES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE) - COLLECTIVE REVENUE OF LOCATION ANALYTICS SOLUTIONS/SERVICES PROVIDING COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM LOCATION ANALYTICS SOFTWARE/SERVICES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4 - BOTTOM-UP (DEMAND SIDE): SHARE OF LOCATION ANALYTICS THROUGH OVERALL LOCATION ANALYTICS SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RECESSION IMPACT ON LOCATION ANALYTICS MARKET

- TABLE 4 RECESSION IMPACT ON LOCATION ANALYTICS MARKET

3 EXECUTIVE SUMMARY

- TABLE 5 LOCATION ANALYTICS MARKET AND GROWTH RATE, 2017-2022 (USD MILLION AND Y-O-Y GROWTH)

- TABLE 6 LOCATION ANALYTICS MARKET AND GROWTH RATE, 2023-2028 (USD MILLION AND Y-O-Y GROWTH)

- FIGURE 8 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 9 GEOCODING & REVERSE GEOCODING SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 10 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 11 CONSULTING SERVICES TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 12 CLOUD TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 13 OUTDOOR LOCATION TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 14 RISK MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 15 HEALTHCARE & LIFE SCIENCES VERTICAL TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR LOCATION ANALYTICS MARKET PLAYERS

- FIGURE 17 ANALYZING OPTIMUM ROUTES WITH EFFICIENT ALTERNATE ROUTES TO DRIVE MARKET

- 4.2 LOCATION ANALYTICS MARKET, BY APPLICATION

- FIGURE 18 RISK MANAGEMENT TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- 4.3 LOCATION ANALYTICS MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST REGIONAL MARKET IN 2023

- 4.4 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING AND VERTICAL

- FIGURE 20 SOLUTION AND TELECOMMUNICATION TO ACCOUNT FOR LARGEST SHARES IN 2023

5 MARKET OVERVIEW AND TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 LOCATION ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in adoption of spatial data and analytical tools

- 5.2.1.2 Rise in use of location-based applications among consumers

- 5.2.1.3 Greater organizational need to gain competitive advantage across verticals

- 5.2.2 RESTRAINTS

- 5.2.2.1 Legal concerns associated with geoprivacy and confidential data

- 5.2.2.2 High initial cost of deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in adoption by small- and medium-sized enterprises

- 5.2.3.2 Growth in penetration of advanced technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of uniform regulatory norms

- 5.2.4.2 Lack of skilled workforce

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 BANKING & FINANCIAL SERVICES

- 5.3.1.1 Use case 1: CARTO helped Mastercard with data monetization

- 5.3.1.2 Use case 2: Esri helped retail bank improve business performance

- 5.3.1.3 Use case 3: Quadrant.io helped optimize ATM locations for retail bank

- 5.3.1.4 Use case 4: Quadrant.io improved targeted advertising

- 5.3.2 INSURANCE

- 5.3.2.1 Use case 1: CARTO modeled platforms to detect fraud

- 5.3.2.2 Use case 2: GravyAnalytics worked with insurance companies to predict risks

- 5.3.2.3 Use case 3: Esri helped risk managers build profitable portfolios

- 5.3.3 RETAIL

- 5.3.3.1 Use case 1: CARTO used location analytics to select sites for brick-and-mortar workspaces

- 5.3.3.2 Use case 2: Xtract.io assisted companies in expanding new markets

- 5.3.3.3 Use case 3: Cisco DNA Spaces' location-based services acquired new customers and increase loyalty

- 5.3.4 HEALTHCARE

- 5.3.4.1 Use case 1: Quuppa Intelligent Locating System solution reduced hospital infections

- 5.3.4.2 Use case 2: Spatial modeling and analysis identified root causes of health issues

- 5.3.5 REAL ESTATE

- 5.3.5.1 Use case 1: Jones Lang LaSalle used CARTO-designed platform for site planning

- 5.3.5.2 Use case 2: Tinsa Digital used CARTO's platform for to manage real estate portfolio

- 5.3.5.3 Use case 3: CARTO-powered platform enabled OneMap's customers to leverage location data

- 5.3.6 ENERGY & UTILITY

- 5.3.6.1 Use case 1: MapLarge Platform assisted oil & gas companies in fulfilling growing resource demand

- 5.3.6.2 Use case 2: MapLarge Platform helped manage outages

- 5.3.7 HOSPITALITY

- 5.3.7.1 Use case 1: Skyhook LI implemented loyalty management

- 5.3.7.2 Use case 2: Skyhook's solutions helped gain competitive insights

- 5.3.8 MEDIA & ENTERTAINMENT

- 5.3.8.1 Use case 1: CARTO Platform analyzed ad campaigns for geomarketing

- 5.3.9 TRANSPORTATION & LOGISTICS

- 5.3.9.1 Use case 1: CARTO's logistics analytics helped achieve supply chain optimization

- 5.3.10 GOVERNMENT

- 5.3.10.1 Use case 1: Quuppa Intelligent Locating System enhanced access control

- 5.3.10.2 Use case 2: Quuppa Intelligent Locating System helped in law enforcement and corrections

- 5.3.1 BANKING & FINANCIAL SERVICES

- 5.4 PATENT ANALYSIS

- 5.4.1 METHODOLOGY

- 5.4.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2013-2023

- 5.4.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.4.3.1 Top applicants

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- TABLE 8 TOP 20 PATENT OWNERS, 2013-2023

- TABLE 9 LIST OF PATENTS IN LOCATION ANALYTICS MARKET, 2021-2023

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 25 ECOSYSTEM ANALYSIS

- TABLE 10 LOCATION ANALYTICS MARKET: SOLUTION PROVIDERS

- TABLE 11 LOCATION ANALYTICS MARKET: SERVICE PROVIDERS

- TABLE 12 LOCATION ANALYTICS MARKET: TECHNOLOGY PROVIDERS

- TABLE 13 LOCATION ANALYTICS MARKET: REGULATORY BODIES

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING MODEL ANALYSIS

- TABLE 14 AVERAGE SELLING PRICING ANALYSIS, 2022

- 5.8 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 South Korea

- 5.10.1.3.2 China

- 5.10.1.3.3 India

- 5.10.1.4 Middle East & Africa

- 5.10.1.4.1 UAE

- 5.10.1.4.2 KSA

- 5.10.1.4.3 Bahrain

- 5.10.1.5 Latin America

- 5.10.1.5.1 Brazil

- 5.10.1.5.2 Mexico

- 5.10.1.1 North America

- 5.11 TECHNOLOGIES IN LOCATION ANALYTICS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 BLUETOOTH

- 5.11.1.2 GPS

- 5.11.1.3 RFID

- 5.11.1.4 WI-FI

- 5.11.1.5 NFC

- 5.11.1.6 BEACON

- 5.11.2 ADJACENT TECHNOLOGIES

- 5.11.2.1 Smart Sensors and IoT

- 5.11.2.2 Cloud Computing

- 5.11.2.3 Blockchain

- 5.11.1 KEY TECHNOLOGIES

- 5.12 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 20 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.14 BUSINESS MODELS OF LOCATION ANALYTICS

- 5.14.1 DATA AS A SERVICE (DAAS)

- 5.14.2 SOFTWARE AS A SERVICE (SAAS)

- 5.14.3 PLATFORM AS A SERVICE (PAAS)

- 5.15 FUTURE DIRECTION OF LOCATION ANALYTICS MARKET

- TABLE 23 SHORT-TERM ROADMAP, 2023-2025

- TABLE 24 MID-TERM ROADMAP, 2026-2028

- TABLE 25 LONG-TERM ROADMAP, 2029-2030

6 LOCATION ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: MARKET DRIVERS

- FIGURE 31 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 26 LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 27 LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 COMPANIES INVESTING IN GEOSPATIAL ANALYTICS SOLUTIONS TO UNDERSTAND BUSINESS TRENDS AND INCREASE PRODUCTIVITY

- 6.2.2 SOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE

- FIGURE 32 GEOCODING AND REVERSE GEOCODING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 28 SOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 29 SOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 30 TYPE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 TYPE: LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.1 Geocoding & reverse geocoding

- 6.2.2.1.1 Geocoding & reverse geocoding solution to have real-time impact on customer experience solutions

- 6.2.2.1 Geocoding & reverse geocoding

- TABLE 32 GEOCODING & REVERSE GEOCODING: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 GEOCODING & REVERSE GEOCODING: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.2 Data integration & ETL

- 6.2.2.2.1 Ability to extract geographic data from any source system to drive adoption of location analytics solutions

- 6.2.2.2 Data integration & ETL

- TABLE 34 DATA INTEGRATION & ETL: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 DATA INTEGRATION & ETL: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.3 Reporting & visualization

- 6.2.2.3.1 Reporting & visualization solution to offer detailed simplified analysis of complex data for customers

- 6.2.2.3 Reporting & visualization

- TABLE 36 REPORTING & VISUALIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 REPORTING & VISUALIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.4 Thematic mapping & spatial analysis

- 6.2.2.4.1 Thematic mapping & spatial analytics to provide rapid visual representations of geographical data

- 6.2.2.4 Thematic mapping & spatial analysis

- TABLE 38 THEMATIC MAPPING & SPATIAL ANALYSIS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 THEMATIC MAPPING & SPATIAL ANALYSIS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.5 Other solutions

- TABLE 40 OTHER SOLUTIONS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 OTHER SOLUTIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 SOLUTIONS: LOCATION ANALYTICS MARKET, BY DEPLOYMENT

- FIGURE 33 CLOUD SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 42 LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 43 LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 6.2.3.1 On-premises

- 6.2.3.1.1 Rising need for security and compliances to drive adoption of on-premises location analytics solutions

- 6.2.3.1 On-premises

- TABLE 44 ON-PREMISES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 ON-PREMISES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.2 Cloud

- 6.2.3.2.1 Adoption of cloud-based solutions to drive market

- 6.2.3.2 Cloud

- TABLE 46 CLOUD: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 CLOUD: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

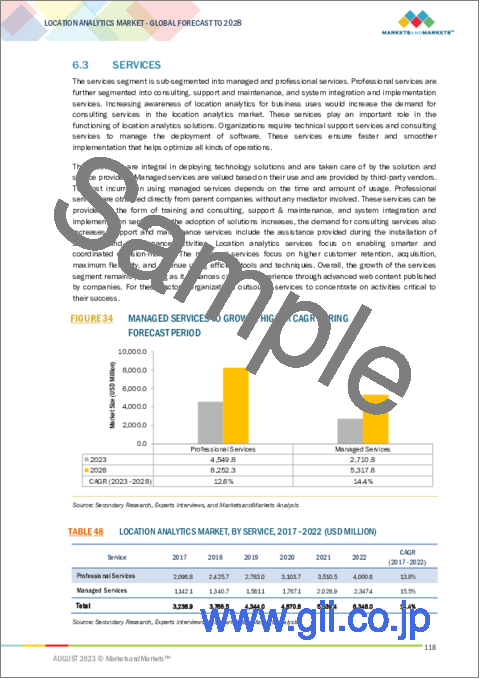

- 6.3 SERVICES

- FIGURE 34 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 48 LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 49 LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 50 SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Need to develop location analytics strategies and roadmaps to drive market growth

- FIGURE 35 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 52 LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 53 LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 54 PROFESSIONAL SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 PROFESSIONAL SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Consulting Services

- TABLE 56 CONSULTING SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 CONSULTING SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 Deployment & Integration

- TABLE 58 DEPLOYMENT & INTEGRATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 DEPLOYMENT & INTEGRATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.4 Training, Support, and Maintenance

- TABLE 60 TRAINING, SUPPORT, AND MAINTENANCE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 TRAINING, SUPPORT, AND MAINTENANCE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Optimizing location analytics with managed services for improved business performance

- TABLE 62 MANAGED SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 MANAGED SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 LOCATION ANALYTICS MARKET, BY LOCATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 LOCATION TYPE: MARKET DRIVERS

- FIGURE 36 OUTDOOR LOCATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 64 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 65 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- 7.2 INDOOR LOCATION

- 7.2.1 ADVANCED TECHNOLOGIES TO BE USED FOR INDOOR LOCATION TRACKING

- TABLE 66 INDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 INDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 OUTDOOR LOCATION

- 7.3.1 OUTDOOR LOCATION ANALYTICS TO MONITOR IMMOVABLE ASSETS TO REDUCE COSTS

- TABLE 68 OUTDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 OUTDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 LOCATION ANALYTICS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: MARKET DRIVERS

- FIGURE 37 SUPPLY CHAIN PLANNING AND OPTIMIZATION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 70 LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 71 LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 RISK MANAGEMENT

- 8.2.1 LOCATION ANALYTICS TO IMPROVE DATA QUALITY AND STREAMLINE BUSINESS PROCESSES

- TABLE 72 RISK MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 RISK MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 EMERGENCY RESPONSE MANAGEMENT

- 8.3.1 LOCATION ANALYTICS TO COORDINATE CRISIS RESPONSE BETWEEN SERVICES AND EMERGENCY DEPARTMENTS

- TABLE 74 EMERGENCY RESPONSE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 75 EMERGENCY RESPONSE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 CUSTOMER EXPERIENCE MANAGEMENT

- 8.4.1 LOCATION ANALYTICS TO PROVIDE USER INFORMATION AND USER EXPERIENCE DATA

- TABLE 76 CUSTOMER EXPERIENCE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 77 CUSTOMER EXPERIENCE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 SUPPLY CHAIN PLANNING AND OPTIMIZATION

- 8.5.1 LOCATION ANALYTICS TO IMPROVE PERFORMANCE OF ORDER-PICKING AND STOCK-TAKING PROCESSES

- TABLE 78 SUPPLY CHAIN PLANNING AND OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 79 SUPPLY CHAIN PLANNING AND OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 SALES & MARKETING OPTIMIZATION

- 8.6.1 LOCATION ANALYTICS TO ENABLE OPTIMIZATION OF SUPPLY CHAIN NETWORKS FOR ENHANCED EFFICIENCY AND COST SAVINGS

- TABLE 80 SALES & MARKETING OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 SALES & MARKETING OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 LOCATION SELECTION & OPTIMIZATION

- 8.7.1 LOCATION ANALYTICS TO AID IN UNDERSTANDING BUSINESS GROWTH WITH LOCATION INTELLIGENCE AND OTHER FEATURES

- TABLE 82 LOCATION SELECTION & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 LOCATION SELECTION & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 84 OTHER APPLICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 LOCATION ANALYTICS MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 38 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 86 LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 87 LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.1.1 VERTICAL: MARKET DRIVERS

- 9.2 RETAIL & ECOMMERCE

- 9.2.1 LOCATION ANALYTICS SOLUTIONS TO PROMOTE CUSTOMER EXPERIENCE

- TABLE 88 RETAIL & ECOMMERCE: USE CASES

- TABLE 89 RETAIL & ECOMMERCE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 90 RETAIL & ECOMMERCE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MANUFACTURING

- 9.3.1 LOCATION ANALYTICS SOLUTIONS TO SUPPORT INCREASING PRODUCTIVITY

- TABLE 91 MANUFACTURING: USE CASES

- TABLE 92 MANUFACTURING: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 93 MANUFACTURING: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 GOVERNMENT & DEFENSE

- 9.4.1 DATA SECURITY AND SAFETY TO BE KEY FACTOR FOR MARKET GROWTH

- TABLE 94 GOVERNMENT & DEFENSE: USE CASES

- TABLE 95 GOVERNMENT & DEFENSE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 96 GOVERNMENT & DEFENSE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 MEDIA & ENTERTAINMENT

- 9.5.1 ADOPTION OF TECHNOLOGIES IN MEDIA & ENTERTAINMENT TO HELP VENDORS INCREASE PROFITABILITY

- TABLE 97 MEDIA & ENTERTAINMENT: USE CASES

- TABLE 98 MEDIA & ENTERTAINMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 99 MEDIA & ENTERTAINMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 AUTOMOTIVE, TRANSPORTATION & LOGISTICS

- 9.6.1 DEMAND FOR REAL-TIME LOCATION SYSTEMS TO DRIVE GROWTH

- TABLE 100 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: USE CASES

- TABLE 101 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 102 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 ENERGY & UTILITY

- 9.7.1 GIS TO AID ELECTRIC UTILITY COMPANIES IN DATA MANAGEMENT, PLANNING AND ANALYSIS, AND SITUATIONAL AWARENESS

- TABLE 103 ENERGY & UTILITY: USE CASES

- TABLE 104 ENERGY & UTILITY: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 105 ENERGY & UTILITY: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 TELECOMMUNICATION

- 9.8.1 STRATEGIC ALIGNMENT OF LOCATION-BASED INSIGHTS WITH CUSTOMER SEGMENTATION TO DRIVE GROWTH

- TABLE 106 TELECOMMUNICATION: USE CASES

- TABLE 107 TELECOMMUNICATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 108 TELECOMMUNICATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 BFSI

- 9.9.1 LOCATION ANALYTICS TO FACILITATE DIGITAL PORTFOLIO MANAGEMENT FROM DATA REPOSITORY

- TABLE 109 BFSI: USE CASES

- TABLE 110 BFSI: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 111 BFSI: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 IT/ITES

- 9.10.1 LOCATION ANALYTICS TO PROVIDE ACCURATE INSIGHTS TO MINIMIZE DOWNTIME

- TABLE 112 IT/ITES: USE CASES

- TABLE 113 IT/ITES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 114 IT/ITES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11 HEALTHCARE & LIFE SCIENCES

- 9.11.1 LOCATION ANALYTICS TO AID HEALTHCARE PROFESSIONALS IN CLASSIFYING HEALTH TRENDS

- TABLE 115 HEALTHCARE & LIFE SCIENCES: USE CASES

- TABLE 116 HEALTHCARE & LIFE SCIENCES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 117 HEALTHCARE & LIFE SCIENCES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.12 AGRICULTURE

- 9.12.1 ABILITY TO PROVIDE UNPARALLELED INSIGHTS INTO CROP PHENOLOGY TO DRIVE DEMAND

- TABLE 118 AGRICULTURE: USE CASES

- TABLE 119 AGRICULTURE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 120 AGRICULTURE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.13 OTHER VERTICALS

- TABLE 121 OTHER VERTICALS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 122 OTHER VERTICALS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 LOCATION ANALYTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 123 LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 124 LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 125 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 126 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 127 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 136 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 140 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 141 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Increase in adoption of geospatial analytics technologies to drive growth

- TABLE 143 US: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 144 US: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 145 US: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 146 US: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 147 US: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 148 US: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 149 US: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 150 US: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 151 US: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 152 US: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 153 US: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 154 US: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Rising adoption of cloud to drive adoption of location analytics

- 10.3 EUROPE

- 10.3.1 EUROPE: MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 155 EUROPE: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 156 EUROPE: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 157 EUROPE: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 158 EUROPE: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 159 EUROPE: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 160 EUROPE: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 161 EUROPE: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 162 EUROPE: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 163 EUROPE: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 164 EUROPE: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 165 EUROPE: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 166 EUROPE: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 167 EUROPE: LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 168 EUROPE: LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 169 EUROPE: LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 170 EUROPE: LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 171 EUROPE: LOCATION ANALYTICS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 172 EUROPE: LOCATION ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Investments in innovation for smart infrastructure to boost tracking and navigation solutions

- TABLE 173 UK: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 174 UK: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 175 UK: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 176 UK: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 177 UK: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 178 UK: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 179 UK: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 180 UK: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 181 UK: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 182 UK: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 183 UJK: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 184 UK: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Adoption of location intelligence in smart grid development to contribute to market growth

- 10.3.5 FRANCE

- 10.3.5.1 Investment in intelligent location technologies to augment market growth

- 10.3.6 ITALY

- 10.3.6.1 Location analytics for enhanced decision-making and operational efficiency to drive growth

- 10.3.7 SPAIN

- 10.3.7.1 Technological advancements to drive growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 185 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 194 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 196 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 198 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Government initiatives for R&D and investments by global players to drive market

- TABLE 203 CHINA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 204 CHINA: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 205 CHINA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 206 CHINA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 207 CHINA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 208 CHINA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 209 CHINA: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 210 CHINA: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 211 CHINA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 212 CHINA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 213 CHINA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 214 CHINA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Growth of geospatial analytics in construction to create opportunities for location intelligence technologies

- 10.4.5 INDIA

- 10.4.5.1 Adoption of location intelligence to increase profitability and improve customer engagement

- 10.4.6 ANZ

- 10.4.6.1 Data-driven technologies to lower costs, manage risk, and drive growth

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Real-time location data to enhance route optimization and transportation efficiency

- 10.4.8 ASEAN

- 10.4.8.1 Increasing shift toward adoption of advanced technologies to fuel growth

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 215 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 KSA

- 10.5.3.1 Adoption of location analytics and other data-driven technologies to drive growth

- 10.5.4 UAE

- 10.5.4.1 Initiatives by government to promote adoption and development of AI and ML technologies

- 10.5.5 ISRAEL

- 10.5.5.1 Support for technological innovation in Israel to accelerate adoption of location analytics across industries and public services

- 10.5.6 TURKEY

- 10.5.6.1 Growing adoption of geospatial analytics through government initiatives and collaborations to drive growth

- 10.5.7 QATAR

- 10.5.7.1 Location analytics to improve route planning and supply chain effectiveness

- 10.5.8 SOUTH AFRICA

- 10.5.8.1 Increasing investments and initiatives from government and private sector companies to drive growth

- 10.5.9 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 233 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Investments to enable asset and people management to push demand for location intelligence solutions

- 10.6.4 MEXICO

- 10.6.4.1 Adoption of location analytics in construction and oil & gas to fuel growth

- 10.6.5 ARGENTINA

- 10.6.5.1 Skilled workforce and supportive government initiatives to fuel growth

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 251 OVERVIEW OF STRATEGIES ADOPTED BY KEY LOCATION ANALYTICS VENDORS

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 43 SHARE ANALYSIS OF KEY PLAYERS

- TABLE 252 LOCATION ANALYTICS MARKET: DEGREE OF COMPETITION

- 11.4 REVENUE ANALYSIS

- FIGURE 44 REVENUE ANALYSIS FOR LEADING PLAYERS, 2020-2022 (USD MILLION)

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 45 GLOBAL LOCATION ANALYTICS MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 253 LOCATION ANALYTICS MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- 11.7 STARTUP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 46 GLOBAL LOCATION ANALYTICS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 11.8 STARTUP/SME COMPETITIVE BENCHMARKING

- TABLE 254 LOCATION ANALYTICS MARKET: DETAILED LIST OF KEY STARTUP/SME

- TABLE 255 LOCATION ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME

- 11.9 LOCATION ANALYTICS PRODUCT LANDSCAPE

- 11.9.1 COMPARATIVE ANALYSIS OF LOCATION ANALYTICS PRODUCTS

- TABLE 256 COMPARATIVE ANALYSIS OF LOCATION ANALYTICS PRODUCTS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- TABLE 257 PRODUCT LAUNCHES, JUNE 2019-AUGUST 2023

- 11.10.2 DEALS

- TABLE 258 DEALS, AUGUST 2019-AUGUST 2023

- 11.11 VALUATION AND FINANCIAL METRICS OF KEY LOCATION ANALYTICS VENDORS

- FIGURE 47 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.12 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY LOCATION ANALYTICS VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.2.1 IBM

- TABLE 259 IBM: BUSINESS OVERVIEW

- FIGURE 49 IBM: COMPANY SNAPSHOT

- TABLE 260 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 IBM: DEALS

- 12.2.2 GOOGLE

- TABLE 263 GOOGLE: BUSINESS OVERVIEW

- FIGURE 50 GOOGLE: COMPANY SNAPSHOT

- TABLE 264 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 266 GOOGLE: DEALS

- 12.2.3 ORACLE

- TABLE 267 ORACLE: BUSINESS OVERVIEW

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- TABLE 268 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 ORACLE: DEALS

- 12.2.4 MICROSOFT

- TABLE 271 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- TABLE 272 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 274 MICROSOFT: DEALS

- 12.2.5 ESRI

- TABLE 275 ESRI: BUSINESS OVERVIEW

- TABLE 276 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ESRI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 ESRI: DEALS

- 12.2.6 SAS INSTITUTE

- TABLE 279 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 280 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 SAS INSTITUTE: DEALS

- 12.2.7 PRECISELY

- TABLE 283 PRECISELY: BUSINESS OVERVIEW

- TABLE 284 PRECISELY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 PRECISELY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 PRECISELY: DEALS

- 12.2.8 SAP

- TABLE 287 SAP: BUSINESS OVERVIEW

- FIGURE 53 SAP: COMPANY SNAPSHOT

- TABLE 288 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 SAP: DEALS

- 12.2.9 CISCO

- TABLE 291 CISCO: BUSINESS OVERVIEW

- FIGURE 54 CISCO: COMPANY SNAPSHOT

- TABLE 292 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 294 CISCO: DEALS

- 12.2.10 TOMTOM

- TABLE 295 TOMTOM: BUSINESS OVERVIEW

- FIGURE 55 TOMTOM: COMPANY SNAPSHOT

- TABLE 296 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 TOMTOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 298 TOMTOM: DEALS

- 12.2.11 HEXAGON AB

- TABLE 299 HEXAGON AB: BUSINESS OVERVIEW

- FIGURE 56 HEXAGON AB: COMPANY SNAPSHOT

- TABLE 300 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 HEXAGON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 302 HEXAGON: DEALS

- 12.2.12 ZEBRA TECHNOLOGIES

- TABLE 303 ZEBRA TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 57 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 304 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 ZEBRA TECHNOLOGIES: DEALS

- 12.2.13 FOURSQUARE

- TABLE 307 FOURSQUARE: BUSINESS OVERVIEW

- TABLE 308 FOURSQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 FOURSQUARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 310 FOURSQUARE: DEALS

- 12.2.14 ALTERYX

- TABLE 311 ALTERYX: BUSINESS OVERVIEW

- FIGURE 58 ALTERYX: COMPANY SNAPSHOT

- TABLE 312 ALTERYX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 314 ALTERYX: DEALS

- 12.2.15 HERE TECHNOLOGIES

- TABLE 315 HERE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 316 HERE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 HERE TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 318 HERE TECHNOLOGIES: DEALS

- 12.2.16 PURPLE

- TABLE 319 PURPLE: BUSINESS OVERVIEW

- TABLE 320 PURPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 PURPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 322 PURPLE: DEALS

- 12.2.17 GALIGEO

- TABLE 323 GALIGEO: BUSINESS OVERVIEW

- TABLE 324 GALIGEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 GALIGEO: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.18 CARTO

- 12.2.19 TIBCO SOFTWARE

- 12.2.20 MAPLARGE

- 12.2.21 SPARKGEO

- 12.2.22 ASCENT CLOUD

- 12.2.23 LEPTON SOFTWARE

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.3 STARTUPS/SMES

- 12.3.1 GEOMOBY

- 12.3.2 QUUPPA

- 12.3.3 CLEVERMAPS

- 12.3.4 INDOORATLAS

- 12.3.5 SEDIMENTIQ

- 12.3.6 ARIADNE MAP

- 12.3.7 LOCALE.AI

- 12.3.8 GEOBLINK

- 12.3.9 NRBY

- 12.3.10 MAPIDEA

- 12.3.11 GAPMAPS

- 12.3.12 LOCATIONSCLOUD

13 ADJACENT MARKET

- 13.1 ADJACENT/RELATED MARKETS

- 13.1.1 GEOSPATIAL IMAGERY ANALYTICS MARKET

- 13.1.1.1 Market definition

- 13.1.1.2 Market overview

- 13.1.1.3 Geospatial imagery analytics market, by type

- TABLE 326 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 327 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.1.1.4 Geospatial imagery analytics market, by collection medium

- TABLE 328 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2016-2020 (USD MILLION)

- TABLE 329 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2021-2026 (USD MILLION)

- 13.1.1.5 Geospatial imagery analytics market, by application

- TABLE 330 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2016-2020 (USD MILLION)

- TABLE 331 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 13.1.1.6 Geospatial imagery analytics market, by deployment mode

- TABLE 332 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2020 (USD MILLION)

- TABLE 333 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 13.1.1.7 Geospatial imagery analytics market, by organization size

- TABLE 334 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 335 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.1.1.8 Geospatial imagery analytics market, by vertical

- TABLE 336 HEALTHCARE AND LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 337 HEALTHCARE AND LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 13.1.1.9 Geospatial imagery analytics market, by region

- TABLE 338 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 339 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 13.1.2 INDOOR LOCATION MARKET

- 13.1.2.1 Market definition

- 13.1.2.2 Market overview

- 13.1.2.3 Indoor Location Market, by offering

- TABLE 340 INDOOR LOCATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 341 INDOOR LOCATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 13.1.2.4 Indoor Location Market, by solution

- TABLE 342 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 343 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.1.2.5 Indoor Location Market, by Service

- TABLE 344 INDOOR LOCATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 345 INDOOR LOCATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 13.1.2.6 Indoor Location Market, by technology

- TABLE 346 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 347 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 13.1.2.7 Indoor Location Market, by application

- TABLE 348 INDOOR LOCATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 349 INDOOR LOCATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 13.1.2.8 Indoor Location Market, by vertical

- TABLE 350 INDOOR LOCATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 351 INDOOR LOCATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 13.1.2.9 Indoor Location Market, by region

- TABLE 352 INDOOR LOCATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 353 INDOOR LOCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.1.1 GEOSPATIAL IMAGERY ANALYTICS MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS