|

|

市場調査レポート

商品コード

1773178

物理セキュリティの世界市場 (~2030年):システム (物理アクセス制御・ビデオ監視・物理IAM・火災&生命安全)・サービス・産業 (BFSI・住宅・小売・政府機関・輸送&物流)・地域別Physical Security Market by System (Physical Access Control, Video Surveillance, Physical IAM, and Fire & Life Safety), Service, Vertical (BFSI, Residential, Retail, Government, and Transportation & Logistics), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 物理セキュリティの世界市場 (~2030年):システム (物理アクセス制御・ビデオ監視・物理IAM・火災&生命安全)・サービス・産業 (BFSI・住宅・小売・政府機関・輸送&物流)・地域別 |

|

出版日: 2025年07月16日

発行: MarketsandMarkets

ページ情報: 英文 420 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の物理セキュリティの市場規模は、2025年の1,207億9,000万米ドルから、予測期間中は4.6%のCAGRで推移し、2030年には1,515億米ドルに成長すると予測されています。

物理的なシステムに対する悪意ある行為やセキュリティ侵害の件数が増加していることから、多くの組織が物理セキュリティの強化に取り組んでいます。これには、不正侵入の防止や資産の保護を目的とした、高度な監視システム、アクセス制御、警報システムの導入が含まれます。こうした脅威が拡大する中で、物理セキュリティはますます予防的かつ即応的な姿勢へと進化しており、事件が発生する前に未然に防ぐことが重視されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 提供区分・システム・サービス・組織規模・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

"システム別では、物理的アイデンティティおよびアクセス管理 (PIAM) が予測期間中に最も高いCAGRで成長する見込み"

この成長の背景には、複雑かつ分散化された環境において、物理アクセスを集中管理し、ポリシーベースで制御するニーズの高まりがあります。企業は、アイデンティティライフサイクルの管理を効率化し、入退社手続きの自動化、規制遵守の確保、セキュリティ態勢の強化を目的にPIAMソリューションを導入しています。さらに、ITと物理セキュリティの融合、ゼロトラストセキュリティフレームワークの推進といった動向も、重要インフラ、医療、交通、スマートビルディングなどの分野におけるPIAMシステムへの需要を加速させています。

"地域別では、北米が予測期間中に市場を支配する見込み"

北米の物理セキュリティ分野は急速に進化しており、先進技術の導入と重要インフラ保護の強化が進んでいます。米国とカナダを中心とする北米は、最も技術的に発展した地域として、世界の物理セキュリティ市場をリードしています。通信システムや機密データに対する脅威の増加により、政府の関与が強まり、PCI-DSS、HIPAA、GLBA、SOX、NIST (米国国立標準技術研究所) のフレームワークといった厳格な規制基準によって支えられています。

特に、北米は世界でも最も高いレベルのサイバー攻撃、特にアイデンティティ関連犯罪に直面しており、強固な物理セキュリティシステムへの需要が高まっています。また、この地域にはサイバーセキュリティベンダーが多数存在しており、セキュリティ技術の進展をさらに後押ししています。COVID-19以降の勤務形態の変化、BYODやIoTの普及、フィッシング、BEC、マルウェアといった脅威への認識の高まりなども、物理セキュリティ強化の重要性を高めています。企業はこうした動向に対応するため、明確な予算の配分や物理セキュリティに関する義務的な対策を講じています。これらの傾向により、北米はベンダーの集中と積極的な技術導入を背景に、世界の物理セキュリティ市場において最も収益性の高い地域として位置づけられています。

当レポートでは、世界の物理セキュリティの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム分析

- 生成AIが物理セキュリティ市場に与える影響

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 2025年の米国トランプ関税が物理セキュリティ市場に与える影響

- 主要なステークホルダーと購入基準

- 顧客の事業に影響を与える動向/混乱

- 物理セキュリティ市場:ビジネスモデル

- 投資と資金調達のシナリオ

- 2025-26年の主な会議とイベント

第6章 物理セキュリティ:市場

- システム

- サービス

第7章 物理セキュリティ市場:システム別

- 物理アクセス制御システム

- ロック

- 生体認証

- スマートカードとリーダー

- アクセス制御ソフトウェア

- ビデオ監視システム

- カメラ

- レコーダー

- ビデオ分析ソフトウェア

- 境界侵入検知および防止

- 物理的セキュリティ情報管理

- 物理IDアクセス管理

- セキュリティスキャン、イメージング、金属検出

- 火災と生命の安全

第8章 物理セキュリティ市場:サービス別

- 専門サービス

- 設計、コンサルティング、実装サービス

- リスクアセスメント

- トレーニングと教育

- サポートとメンテナンス

- マネージドサービス

- ACaaS (Access Control as a Service)

- VSaaS (Video Surveillance as a Service)

- リモートモニタリング

第9章 物理セキュリティ市場:組織規模別

- 中小企業

- 大企業

第10章 物理セキュリティ市場:産業別

- BFSI

- ヘルスケア

- 政府

- 小売・Eコマース

- 運輸・物流

- 住宅

- 教育

- 航空宇宙および防衛

- IT・ITES

- その他

第11章 物理セキュリティ市場:地域別

- 北米

- 市場促進要因

- マクロ経済見通し

- 規制状況

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 規制状況

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 規制状況

- 中国

- 日本

- インド

- シンガポール

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- 規制状況

- 中東

- アフリカ

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド比較

- 企業評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- JOHNSON CONTROLS

- BOSCH BUILDING TECHNOLOGIES

- HONEYWELL

- ADT

- CISCO

- TELUS

- WESCO

- GENETEC

- HID GLOBAL

- PELCO

- HIKVISION

- その他の企業

- GALLAGHER

- SECOM

- ALLIED UNIVERSAL

- ZHEJIANG DAHUA TECHNOLOGY

- AXIS COMMUNICATIONS

- HANWHA VISION AMERICA

- TELEDYNE FLIR

- HEXAGON AB

- GENERAL DYNAMICS

- BAE SYSTEMS

- HUAWEI

- NEC

- SMARTCONE TECHNOLOGIES

- VERKADA

- CLOUDASTRUCTURE

第14章 隣接市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 PHYSICAL SECURITY MARKET: ECOSYSTEM

- TABLE 4 PORTER'S FIVE FORCES' IMPACT ON PHYSICAL SECURITY MARKET

- TABLE 5 AVERAGE SELLING PRICE TREND OF OFFERINGS, BY KEY PLAYER (2024)

- TABLE 6 INDICATIVE PRICING LEVELS OF PHYSICAL SECURITY SOLUTIONS

- TABLE 7 LIST OF FEW PATENTS IN PHYSICAL SECURITY MARKET, 2022-2024

- TABLE 8 IMPORT DATA FOR HS CODE 852589-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 852589-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 10 TARIFF RELATED TO PHYSICAL SECURITY TOOL AND EQUIPMENT (852580)

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR PHYSICAL SECURITY HARDWARE

- TABLE 18 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 21 PHYSICAL SECURITY MARKET: BUSINESS MODELS

- TABLE 22 PHYSICAL SECURITY MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025-26

- TABLE 23 PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 24 PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 25 SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 26 SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 30 PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 31 PHYSICAL ACCESS CONTROL SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 32 PHYSICAL ACCESS CONTROL SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 VIDEO SURVEILLANCE SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 34 VIDEO SURVEILLANCE SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 IP CAMERA VS. ANALOG CAMERA

- TABLE 36 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 PHYSICAL SECURITY INFORMATION MANAGEMENT: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 PHYSICAL SECURITY INFORMATION MANAGEMENT: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SECURITY SCANNING, IMAGING, AND METAL DETECTION: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 SECURITY SCANNING, IMAGING, AND METAL DETECTION: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 FIRE AND LIFE SAFETY: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 FIRE AND LIFE SAFETY: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

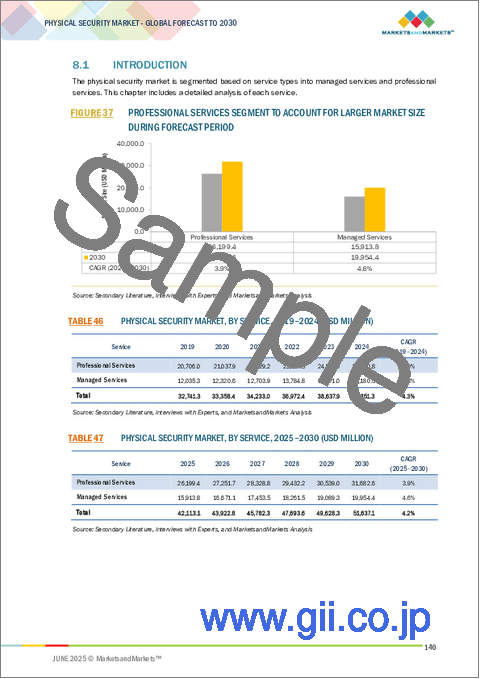

- TABLE 46 PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 47 PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 PROFESSIONAL SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 DESIGN, CONSULTING, AND IMPLEMENTATION SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 DESIGN, CONSULTING, AND IMPLEMENTATION SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 RISK ASSESSMENT: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 RISK ASSESSMENT: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 TRAINING & EDUCATION: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 TRAINING & EDUCATION: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SUPPORT & MAINTENANCE: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 SUPPORT & MAINTENANCE: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 MANAGED SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 MANAGED SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 61 PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 62 SMALL AND MEDIUM-SIZED ENTERPRISES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 63 SMALL AND MEDIUM-SIZED ENTERPRISES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 LARGE ENTERPRISES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 65 LARGE ENTERPRISES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 67 PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 BFSI: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 69 BFSI: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 HEALTHCARE: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 71 HEALTHCARE: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 GOVERNMENT: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 73 GOVERNMENT: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 RETAIL & ECOMMERCE: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 75 RETAIL & ECOMMERCE: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 TRANSPORTATION & LOGISTICS: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 77 TRANSPORTATION & LOGISTICS: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 RESIDENTIAL: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 79 RESIDENTIAL: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 EDUCATION: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 81 EDUCATION: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 AEROSPACE & DEFENSE: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 83 AEROSPACE & DEFENSE: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 IT & ITES: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 85 IT & ITES: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 OTHER VERTICALS: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 87 OTHER VERTICALS: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 89 PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 US: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 105 US: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 US: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 107 US: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 108 US: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 109 US: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 110 US: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 111 US: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 112 US: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 113 US: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 114 US: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 115 US: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 116 CANADA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 117 CANADA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 118 CANADA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 119 CANADA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 120 CANADA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 121 CANADA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 122 CANADA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 123 CANADA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 125 CANADA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 127 CANADA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 129 EUROPE: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 131 EUROPE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 133 EUROPE: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 135 EUROPE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 137 EUROPE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 139 EUROPE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 141 EUROPE: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 UK: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 143 UK: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 144 UK: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 145 UK: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 146 UK: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 147 UK: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 148 UK: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 149 UK: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 150 UK: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 151 UK: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 152 UK: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 153 UK: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 154 GERMANY: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 155 GERMANY: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 156 GERMANY: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 157 GERMANY: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 158 GERMANY: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 159 GERMANY: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 160 GERMANY: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 161 GERMANY: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 162 GERMANY: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 163 GERMANY: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 164 GERMANY: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 165 GERMANY: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 166 FRANCE: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 167 FRANCE: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 168 FRANCE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 169 FRANCE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 170 FRANCE: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 171 FRANCE: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 172 FRANCE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 173 FRANCE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 174 FRANCE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 175 FRANCE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 176 FRANCE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 177 FRANCE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 178 ITALY: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 179 ITALY: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 180 ITALY: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 181 ITALY: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 182 ITALY: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 183 ITALY: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 184 ITALY: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 185 ITALY: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 186 ITALY: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 187 ITALY: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 188 ITALY: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 189 ITALY: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 190 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 191 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 192 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 193 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 194 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 195 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 196 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 197 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 198 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 199 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 200 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 201 REST OF EUROPE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 203 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 206 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 207 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 208 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 209 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 211 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 212 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 213 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 215 ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 216 CHINA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 217 CHINA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 218 CHINA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 219 CHINA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 220 CHINA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 221 CHINA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 222 CHINA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 223 CHINA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 224 CHINA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 225 CHINA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 226 CHINA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 227 CHINA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 228 JAPAN: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 229 JAPAN: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 230 JAPAN: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 231 JAPAN: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 232 JAPAN: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 233 JAPAN: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 234 JAPAN: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 235 JAPAN: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 236 JAPAN: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 237 JAPAN: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 238 JAPAN: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 239 JAPAN: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 240 INDIA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 241 INDIA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 242 INDIA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 243 INDIA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 244 INDIA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 245 INDIA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 246 INDIA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 247 INDIA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 248 INDIA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 249 INDIA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 250 INDIA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 251 INDIA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 252 SINGAPORE: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 253 SINGAPORE: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 254 SINGAPORE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 255 SINGAPORE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 256 SINGAPORE: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 257 SINGAPORE: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 258 SINGAPORE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 259 SINGAPORE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 260 SINGAPORE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 261 SINGAPORE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 262 SINGAPORE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 263 SINGAPORE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 264 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 265 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 266 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 267 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 268 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 269 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 270 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 271 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 272 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 273 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 274 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 275 AUSTRALIA & NEW ZEALAND: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: PHYSICAL SECURITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 302 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 303 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 304 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 305 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 306 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 307 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 308 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 309 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 310 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 311 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 312 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 313 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 315 MIDDLE EAST: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 316 GCC: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 317 GCC: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 318 GCC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 319 GCC: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 320 GCC: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 321 GCC: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 322 GCC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 323 GCC: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 324 GCC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 325 GCC: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 326 GCC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 327 GCC: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 328 GCC: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 329 GCC: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 330 UAE: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 331 UAE: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 332 UAE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 333 UAE: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 334 UAE: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 335 UAE: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 336 UAE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 337 UAE: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 338 UAE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 339 UAE: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 340 UAE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 341 UAE: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 342 KSA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 343 KSA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 344 KSA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 345 KSA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 346 KSA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 347 KSA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 348 KSA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 349 KSA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 350 KSA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 351 KSA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 352 KSA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 353 KSA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 354 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 355 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 356 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 357 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 358 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 359 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 360 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 361 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 362 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 363 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 364 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 365 REST OF GCC COUNTRIES: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 366 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 367 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 368 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 378 AFRICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 379 AFRICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 380 AFRICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 381 AFRICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 382 AFRICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 383 AFRICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 384 AFRICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 385 AFRICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 386 AFRICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 387 AFRICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 388 AFRICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 389 AFRICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 390 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 391 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 392 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 393 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 394 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 395 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 396 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 397 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 398 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 399 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 400 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 401 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 402 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 403 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 404 LATIN AMERICA: PHYSICAL SECURITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 405 BRAZIL: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 406 BRAZIL: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 407 BRAZIL: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 408 BRAZIL: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 409 BRAZIL: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 410 BRAZIL: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 411 BRAZIL: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 412 BRAZIL: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 413 BRAZIL: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 414 BRAZIL: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 415 BRAZIL: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 416 BRAZIL: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 417 MEXICO: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 418 MEXICO: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 419 MEXICO: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 420 MEXICO: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 421 MEXICO: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 422 MEXICO: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 423 MEXICO: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 424 MEXICO: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 425 MEXICO: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 426 MEXICO: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 427 MEXICO: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 428 MEXICO: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 429 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 430 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 431 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 432 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 433 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 434 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 435 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 436 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 437 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 438 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 439 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 440 REST OF LATIN AMERICA: PHYSICAL SECURITY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 441 OVERVIEW OF STRATEGIES ADOPTED BY KEY PHYSICAL SECURITY VENDORS, 2022-2024

- TABLE 442 PHYSICAL SECURITY MARKET: DEGREE OF COMPETITION

- TABLE 443 PHYSICAL SECURITY MARKET: REGION FOOTPRINT

- TABLE 444 PHYSICAL SECURITY MARKET: SYSTEM FOOTPRINT

- TABLE 445 PHYSICAL SECURITY MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 446 PHYSICAL SECURITY MARKET: VERTICAL FOOTPRINT

- TABLE 447 PHYSICAL SECURITY MARKET: KEY STARTUPS/SMES

- TABLE 448 PHYSICAL SECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 449 PHYSICAL SECURITY MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, MAY 2023-APRIL 2025

- TABLE 450 PHYSICAL SECURITY MARKET: DEALS, OCTOBER 2023-MARCH 2025

- TABLE 451 EXPERIAN: COMPANY OVERVIEW

- TABLE 452 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 453 JOHNSON CONTROLS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 454 JOHNSON CONTROLS: DEALS

- TABLE 455 BOSCH BUILDING TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 456 BOSCH BUILDING TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 457 BOSCH BUILDING TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 458 BOSCH BUILDING TECHNOLOGIES: DEALS

- TABLE 459 HONEYWELL: COMPANY OVERVIEW

- TABLE 460 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 461 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 462 HONEYWELL: DEALS

- TABLE 463 ADT: COMPANY OVERVIEW

- TABLE 464 ADT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 465 ADT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 466 ADT: DEALS

- TABLE 467 CISCO: COMPANY OVERVIEW

- TABLE 468 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 469 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 470 CISCO: DEALS

- TABLE 471 TELUS: COMPANY OVERVIEW

- TABLE 472 TELUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 473 TELUS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 474 TELUS: DEALS

- TABLE 475 WESCO: COMPANY OVERVIEW

- TABLE 476 WESCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 WESCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 478 WESCO: DEALS

- TABLE 479 GENETEC: COMPANY OVERVIEW

- TABLE 480 GENETEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 481 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 482 GENETEC: DEALS

- TABLE 483 GENETEC: EXPANSIONS

- TABLE 484 HID GLOBAL: COMPANY OVERVIEW

- TABLE 485 HID GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 486 HID GLOBAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 487 HID GLOBAL: DEALS

- TABLE 488 PELCO: COMPANY OVERVIEW

- TABLE 489 PELCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 490 PELCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 491 HIKVISION: COMPANY OVERVIEW

- TABLE 492 HIKVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 493 HIKVISION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 494 HIKVISION: DEALS

- TABLE 495 ADJACENT MARKETS AND FORECASTS

- TABLE 496 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 497 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 498 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 499 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 500 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 501 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 502 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2018-2023 (USD BILLION)

- TABLE 503 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 504 PUBLIC SAFETY AND SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 505 PUBLIC SAFETY AND SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 506 PUBLIC SAFETY AND SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 507 PUBLIC SAFETY AND SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 508 PUBLIC SAFETY AND SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 509 PUBLIC SAFETY AND SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 510 PUBLIC SAFETY AND SECURITY MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 511 PUBLIC SAFETY AND SECURITY MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 512 PUBLIC SAFETY AND SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 513 PUBLIC SAFETY AND SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 514 PUBLIC SAFETY AND SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 515 PUBLIC SAFETY AND SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 516 PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 517 PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 518 PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 519 PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 520 PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 521 PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 522 PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 523 PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 524 PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 525 PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 PHYSICAL SECURITY MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 PHYSICAL SECURITY MARKET: DATA TRIANGULATION

- FIGURE 4 PHYSICAL SECURITY MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 5 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SYSTEM/SERVICES OF PHYSICAL SECURITY VENDORS

- FIGURE 6 APPROACH 2 (SUPPLY-SIDE ANALYSIS)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): BOTTOM-UP (DEMAND SIDE) - SOLUTIONS/SERVICES

- FIGURE 8 GLOBAL PHYSICAL MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 10 FASTEST-GROWING SEGMENTS OF PHYSICAL SECURITY MARKET

- FIGURE 11 INCREASING USE OF IP-BASED CAMERAS FOR VIDEO SURVEILLANCE, AND PROLIFERATION OF SMART BUILDINGS AND CONNECTED INFRASTRUCTURE DRIVING PHYSICAL SECURITY MARKET

- FIGURE 12 SYSTEMS SEGMENT TO DOMINATE MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 VIDEO SURVEILLANCE SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 DESIGN, CONSULTING, AND IMPLEMENTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 RESIDENTIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 19 PHYSICAL SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL NUMBER OF TERRORIST ATTACKS, 2011-2021

- FIGURE 21 PHYSICAL SECURITY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN PHYSICAL SECURITY MARKET ECOSYSTEM

- FIGURE 23 POTENTIAL OF GENERATIVE AI IN PHYSICAL SECURITY MARKET ACROSS INDUSTRIES

- FIGURE 24 IMPACT OF GENERATIVE AI/AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF OFFERINGS, BY KEY PLAYER (2024)

- FIGURE 27 NUMBER OF PATENTS GRANTED FOR PHYSICAL SECURITY MARKET, 2015-2025

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PHYSICAL SECURITY MARKET

- FIGURE 29 IMPORT DATA FOR HS CODE 852589-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 852589-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD MILLION)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 33 PHYSICAL SECURITY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 LEADING GLOBAL PHYSICAL SECURITY INVESTMENT ROUNDS AND FUNDING ROUNDS, BY KEY VENDOR

- FIGURE 35 SYSTEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 VIDEO SURVEILLANCE SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 37 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 38 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 39 RETAIL AND ECOMMERCE VERTICAL TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 44 SHARE OF LEADING COMPANIES IN THE PHYSICAL SECURITY MARKET, 2024

- FIGURE 45 PHYSICAL SECURITY MARKET: COMPARISON OF VENDOR BRANDS

- FIGURE 46 COMPANY VALUATION OF KEY VENDORS, 2024 (USD BILLION)

- FIGURE 47 EV/EBIDTA, 2025

- FIGURE 48 GLOBAL PHYSICAL SECURITY MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2024

- FIGURE 49 PHYSICAL SECURITY MARKET: COMPANY FOOTPRINT

- FIGURE 50 GLOBAL PHYSICAL SECURITY MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 51 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 52 HONEYWELL: COMPANY SNAPSHOT

- FIGURE 53 ADT: COMPANY SNAPSHOT

- FIGURE 54 CISCO: COMPANY SNAPSHOT

- FIGURE 55 TELUS: COMPANY SNAPSHOT

- FIGURE 56 WESCO: COMPANY SNAPSHOT

- FIGURE 57 HIKVISION: COMPANY SNAPSHOT

The global physical security market size is projected to grow from USD 120.79 billion in 2025 to USD 151.50 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 4.6% during the forecast period. Rising cases of malicious activities and security breaches on physical systems are making organizations improve their physical security. This includes using advanced surveillance, access controls, and alert systems to stop unauthorized entry and protect property. As these threats grow, physical security is becoming more proactive and responsive to stopping incidents before they happen.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Offering, System, Service, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By system, the physical identity and access management is expected to grow at the highest CAGR during the forecast period."

Within the systems segment of the physical security market, Physical Identity and Access Management (PIAM) is expected to grow at the highest CAGR during the forecast period. This growth is fueled by the rising need for centralized, policy-based control of physical access across complex and distributed environments. Organizations are increasingly adopting PIAM solutions to streamline identity lifecycle management, automate onboarding and offboarding, ensure regulatory compliance, and enhance security posture. The convergence of IT and physical security, along with the push for zero-trust frameworks, is further accelerating demand for PIAM systems across sectors such as critical infrastructure, healthcare, transportation, and smart buildings.

"By region, North America is expected to dominate the physical security market during the forecast period."

The physical security landscape in North America is evolving rapidly as the region continues to adopt advanced technologies and reinforce critical infrastructure protection. As the most technologically developed region, North America, driven by the US and Canada, leads the global market in physical security solutions. Rising threats to communication systems and sensitive data have spurred strong government involvement, backed by strict regulatory standards such as PCI-DSS, HIPAA, GLBA, SOX, and frameworks from the National Institute of Standards and Technology (NIST).

North America faces some of the highest rates of cyberattacks globally, especially identity-related crimes, fueling demand for robust physical security systems. The region is also home to a high concentration of cybersecurity vendors, further supporting security advancements. Market momentum is reinforced by shifting work environments post-COVID-19, increasing BYOD and IoT usage, and a growing awareness of threats like phishing, BEC, and malware. Organizations are responding with specific budget allocations and mandatory physical security protocols. These trends position North America as the most lucrative region in the global physical security market, led by widespread vendor presence and aggressive technology adoption.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 43%, Tier 2 - 36%, and Tier 3 - 21%

- By Designation: C-level - 58%, Directors - 32%, and Managers - 10%

- By Region: North America - 55%, Europe - 19%, Asia Pacific - 12%, RoW - 14%

The key players in the Physical Security market include Johnson Controls (Ireland), Bosch Building Technologies (Germany), Honeywell (US), ADT (US), Cisco (US), Telus (Canada), Wesco (US), Genetec (Canada), HID Global (US), Pelco (US), Hikvision (China), Gallagher (New Zealand), Secom (Japan), Allied Universal (US), Zhejiang Dahua Technology (China), Axis Communications (Sweden), Hanwha Vision America (US), Teledyne Flir (US), Hexagon AB (Sweden), General Dynamics (US), BAE Systems (UK), Huawei (China), NEC (Japan), SmartCone Technologies (Canada), Verkada (US), and Cloudastructure (US)

The study includes an in-depth competitive analysis of the key players in the physical security market, their profiles, recent developments, and key market strategies.

Research Coverage

The report segments the physical security market and forecasts its size by Offering (Systems, Services), by System (Physical Access Control System, Video Surveillance System, Perimeter Intrusion Detection and Prevention, Physical Security Information Management, Physical Identity Access Management, Security Scanning, Imaging and Metal Detection, and Fire and Life Safety), Service (Professional Services and Managed Services), Organization Size (Small and Medium Sized Enterprises (SMEs) and Large Enterprises), Vertical (Banking, Financial Services, and Insurance (BFSI), Healthcare, Government, Retail & Ecommerce, Transportation & Logistics, Residential, Education, Aerospace & Defense, IT & ITES, and Other Verticals (Manufacturing, Energy & Utilities, and Telecom), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall physical security market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for public safety and asset protection, Expansion of smart cities and critical infrastructure, Rising instances of malicious activities and security breaches to physical systems, Growing use of IP-based cameras for video surveillance, Increasing cyber threats to physical security systems), restraints (Privacy concerns related to surveillance and biometric data, Limited budget allocation, especially in public sector and SMEs, Considerable false alarm rates), opportunities (Rising deployment of AI and machine learning in surveillance and threat detection, Adoption of unified security platforms for centralized command and control, Digital transformation enabled by video security systems, Adoption of IoT-based security systems with cloud computing platforms) and challenges (Balancing security needs with privacy and compliance regulations, Resistance to change from traditional to digital or AI-enhanced systems, High installation and maintenance costs for SMEs, Integration of logical and physical components of security systems.)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the physical security market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Physical Security market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Physical Security market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Johnson Controls (Ireland), Bosch Building Technologies (Germany), Honeywell (US), ADT (US), Cisco (US), Telus (Canada), Wesco (US), Genetec (Canada), HID Global (US), Pelco (US), Hikvision (China), Gallagher (New Zealand), Secom (Japan), Allied Universal (US), Zhejiang Dahua Technology (China), Axis Communications (Sweden), Hanwha Vision America (US), Teledyne Flir (US), Hexagon AB (Sweden), General Dynamics (US), BAE Systems (UK), Huawei (China), NEC (Japan), SmartCone Technologies (Canada), Verkada (US), and Cloudastructure (US) among others, in the physical security market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHYSICAL SECURITY MARKET

- 4.2 PHYSICAL SECURITY MARKET, BY OFFERING

- 4.3 PHYSICAL SECURITY MARKET, BY SYSTEM

- 4.4 PHYSICAL SECURITY MARKET, BY SERVICE

- 4.5 PHYSICAL SECURITY MARKET, BY PROFESSIONAL SERVICE

- 4.6 PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE

- 4.7 PHYSICAL SECURITY MARKET, BY VERTICAL

- 4.8 PHYSICAL SECURITY MARKET INVESTMENT SCENARIO: REGIONAL ANALYSIS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for public safety and asset protection

- 5.2.1.2 Expansion of smart cities and critical infrastructure

- 5.2.1.3 Rising instances of malicious activities and security breaches to physical systems

- 5.2.1.4 Growing use of IP-based cameras for video surveillance

- 5.2.1.5 Increasing cyber threats to physical security systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Privacy concerns related to surveillance and biometric data

- 5.2.2.2 Limited budget allocation, especially in public sector and SMEs

- 5.2.2.3 Considerable false alarm rates

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising deployment of AI and machine learning in surveillance and threat detection

- 5.2.3.2 Adoption of unified security platforms for centralized command and control

- 5.2.3.3 Digital transformation enabled by video security systems

- 5.2.3.4 Adoption of IoT-based security systems with cloud computing platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing security needs with privacy and compliance regulations

- 5.2.4.2 Resistance to change from traditional to digital or AI-enhanced systems

- 5.2.4.3 High installation and maintenance costs for SMEs

- 5.2.4.4 Integration of logical and physical components of security systems

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 STRENGTHENING PHYSICAL SECURITY AND CAMPUS OPERATIONS AT MANIPAL UNIVERSITY WITH HONEYWELL'S SMART CARD SOLUTION

- 5.3.2 ENHANCING PHYSICAL SECURITY AND OPERATIONAL EFFICIENCY AT DUBLIN AIRPORT TERMINAL 2 WITH ADT'S INTEGRATED SURVEILLANCE SOLUTION

- 5.3.3 STRENGTHENING PHYSICAL AND CYBERSECURITY IN MUNICIPAL WASTEWATER INFRASTRUCTURE WITH WESCO'S INTEGRATED NETWORK UPGRADE

- 5.3.4 SECURING A VITAL TRANSPORTATION LINK: PELCO'S PHYSICAL SECURITY TRANSFORMATION AT CHESAPEAKE BAY BRIDGE-TUNNEL

- 5.3.5 HEATHROW UNIFIES AIRPORT OPERATIONS AND SECURITY WITH GENETEC'S SCALABLE PLATFORM

- 5.3.6 CISCO ENHANCED VIDEO SURVEILLANCE SYSTEMS OF CITY OF SAN LUIS POTOSI

- 5.3.7 SPEEDY HIRE USED SECOM'S CCTV SYSTEMS TO COMBAT BANDWIDTH BURDEN

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 COMPONENT SUPPLIERS/R&D

- 5.4.2 PLANNING AND DESIGN

- 5.4.3 IMPLEMENTATION & INSTALLATION

- 5.4.4 SYSTEM INTEGRATORS

- 5.4.5 DISTRIBUTION

- 5.4.6 END USERS

- 5.4.7 POST-SALES SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 IMPACT OF GENERATIVE AI ON PHYSICAL SECURITY MARKET

- 5.6.1 GENERATIVE AI

- 5.6.2 TOP USE CASES AND MARKET POTENTIAL IN PHYSICAL SECURITY MARKET

- 5.6.3 IMPACT OF GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.6.3.1 Video Surveillance Systems

- 5.6.3.2 Intelligent Perimeter and Facility Control

- 5.6.3.3 IoT & Sensor Networks

- 5.6.3.4 Cloud-based Security Platforms

- 5.6.3.5 Artificial intelligence (AI) & Machine Learning (ML)

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF OFFERINGS, BY KEY PLAYER (2024)

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY SYSTEM (2024)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 AI/ML

- 5.9.1.2 Smart devices

- 5.9.1.3 Wireless security systems

- 5.9.1.4 Contactless biometrics

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Thermal imaging and infrared sensors

- 5.9.2.2 Drones and autonomous patrol robots

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Blockchain

- 5.9.3.2 IoT

- 5.9.3.3 Robotic Process Automation (RPA)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA

- 5.11.2 EXPORT DATA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF RELATED TO PHYSICAL SECURITY PRODUCTS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 KEY REGULATIONS

- 5.12.3.1 General Data Protection Regulation (GDPR)

- 5.12.3.2 Sarbanes-Oxley (SOX) Act

- 5.12.3.3 Health Insurance Portability and Accountability Act

- 5.12.3.4 Health Information Technology for Economic and Clinical Health

- 5.12.3.5 Payment Card Industry Data Security Standard

- 5.12.3.6 Federal Information Processing Standards

- 5.13 IMPACT OF 2025 US TRUMP TARIFF ON PHYSICAL SECURITY MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 KEY IMPACT ON VARIOUS REGIONS/COUNTRIES

- 5.13.4.1 NORTH AMERICA

- 5.13.4.2 Europe

- 5.13.4.3 Asia Pacific

- 5.13.5 IMPACT ON END-USE INDUSTRIES

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 PHYSICAL SECURITY MARKET: BUSINESS MODELS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 KEY CONFERENCES & EVENTS IN 2025-26

6 PHYSICAL SECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SYSTEMS

- 6.2.1 INCREASING CONCERN FOR SAFETY AND RISING INCIDENTS OF TERRORISM TO DRIVE DEMAND FOR PHYSICAL SECURITY SYSTEMS

- 6.2.2 SYSTEMS: PHYSICAL SECURITY MARKET DRIVERS

- 6.3 SERVICES

- 6.3.1 NEED FOR AUTOMATION IN SURVEILLANCE SYSTEMS AND REMOTE MONITORING INFRASTRUCTURE TO DRIVE MARKET

- 6.3.2 SERVICES: PHYSICAL SECURITY MARKET DRIVERS

7 PHYSICAL SECURITY MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 PHYSICAL ACCESS CONTROL SYSTEM

- 7.2.1 NEED TO PREVENT LOSS OR DAMAGE TO ASSETS AND REDUCE RISK OF UNWANTED ACCESS TO DRIVE MARKET

- 7.2.2 PHYSICAL ACCESS CONTROL SYSTEMS: PHYSICAL SECURITY MARKET DRIVERS

- 7.2.3 LOCKS

- 7.2.3.1 Mechanical locks

- 7.2.3.2 Electronic locks

- 7.2.4 BIOMETRICS

- 7.2.4.1 Fingerprint recognition

- 7.2.4.2 Facial recognition

- 7.2.4.3 Other biometric systems

- 7.2.5 SMART CARDS AND READERS

- 7.2.6 ACCESS CONTROL SOFTWARE

- 7.3 VIDEO SURVEILLANCE SYSTEMS

- 7.3.1 NEED TO REDUCE SECURITY THREATS AND CONTROL AND MONITOR CRIMINAL ACTIVITIES TO DRIVE MARKET

- 7.3.2 VIDEO SURVEILLANCE SYSTEMS: PHYSICAL SECURITY MARKET DRIVERS

- 7.3.3 CAMERAS

- 7.3.3.1 Analog cameras

- 7.3.3.2 IP cameras

- 7.3.4 RECORDERS

- 7.3.4.1 Digital Video Recorders (DVR)

- 7.3.4.2 Network Video Recorders (NVR)

- 7.3.5 VIDEO ANALYTICS SOFTWARE

- 7.3.5.1 Video management software

- 7.4 PERIMETER INTRUSION DETECTION AND PREVENTION

- 7.4.1 TECHNOLOGICAL ADVANCEMENTS AND RISING CONCERNS FOR SECURITY TO DRIVE DEMAND FOR PERIMETER INTRUSION DETECTION AND PREVENTION SYSTEMS

- 7.4.2 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET DRIVERS

- 7.5 PHYSICAL SECURITY INFORMATION MANAGEMENT

- 7.5.1 NEED TO INTEGRATE DISPARATE SECURITY COMPONENTS FOR STREAMLINING SECURITY MANAGEMENT TO PROPEL DEMAND FOR PSIM

- 7.5.2 PHYSICAL SECURITY INFORMATION MANAGEMENT: PHYSICAL SECURITY MARKET DRIVERS

- 7.6 PHYSICAL IDENTITY ACCESS MANAGEMENT

- 7.6.1 ADOPTION OF MODERNIZED SYSTEMS AND STRINGENT SECURITY COMPLIANCE TO BOOST DEMAND FOR PIAM SOLUTIONS

- 7.6.2 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET DRIVERS

- 7.7 SECURITY SCANNING, IMAGING, AND METAL DETECTION

- 7.7.1 INCREASING FOCUS ON PUBLIC SAFETY AND GOVERNMENT REGULATION AND SUBSEQUENT PENALTIES TO DRIVE MARKET

- 7.7.2 SECURITY SCANNING, IMAGING, AND METAL DETECTION: PHYSICAL SECURITY MARKET DRIVERS

- 7.8 FIRE AND LIFE SAFETY

- 7.8.1 RISING FIRE-RELATED INCIDENTS AND TECHNOLOGICAL PROLIFERATION TO FUEL DEMAND FOR FIRE AND LIFE SAFETY SOLUTIONS

- 7.8.2 FIRE AND LIFE SAFETY: PHYSICAL SECURITY MARKET DRIVERS

8 PHYSICAL SECURITY MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 PROFESSIONAL SERVICES

- 8.2.1 PROFESSIONAL SECURITY SERVICES TO HELP BUSINESSES ASSESS, SUPPORT, AND DEVELOP CONTROL SYSTEM SECURITY INFRASTRUCTURE

- 8.2.2 PROFESSIONAL SERVICES: PHYSICAL SECURITY MARKET DRIVERS

- 8.2.3 DESIGN, CONSULTING, AND IMPLEMENTATION SERVICES

- 8.2.4 RISK ASSESSMENT

- 8.2.5 TRAINING & EDUCATION

- 8.2.6 SUPPORT & MAINTENANCE

- 8.3 MANAGED SERVICES

- 8.3.1 RISING INSTANCES OF PHYSICAL ATTACKS AND NEED TO REDUCE PHYSICAL INFRASTRUCTURE RISKS TO DRIVE DEMAND FOR MANAGED SERVICES

- 8.3.2 MANAGED SERVICES: PHYSICAL SECURITY MARKET DRIVERS

- 8.3.3 ACCESS CONTROL AS A SERVICE

- 8.3.4 VIDEO SURVEILLANCE AS A SERVICE

- 8.3.5 REMOTE MONITORING

9 PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.1 RISING INSTANCES OF DATA BREACHES AND NEED TO MAINTAIN COMPLIANCE TO FUEL DEMAND FOR PHYSICAL SECURITY IN SMES

- 9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: PHYSICAL SECURITY MARKET DRIVERS

- 9.3 LARGE ENTERPRISES

- 9.3.1 RISING SMART CITY INITIATIVES ACCELERATING DEMAND FOR VIDEO SURVEILLANCE TECHNOLOGY TO DRIVE MARKET

- 9.3.2 LARGE ENTERPRISES: PHYSICAL SECURITY MARKET DRIVERS

10 PHYSICAL SECURITY MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 BFSI

- 10.2.1 INCREASING CYBERATTACKS AND GROWING SUPPORTIVE GOVERNMENT REGULATIONS TO PROTECT DATA TO DRIVE MARKET

- 10.2.2 BFSI: PHYSICAL SECURITY MARKET DRIVERS

- 10.3 HEALTHCARE

- 10.3.1 INCREASING CYBERATTACKS DUE TO ADOPTION OF IOT IN HEALTHCARE TO FUEL DEMAND FOR PHYSICAL SECURITY

- 10.3.2 HEALTHCARE: PHYSICAL SECURITY MARKET DRIVERS

- 10.4 GOVERNMENT

- 10.4.1 RISING INCIDENTS OF TERROR ATTACKS AND NEED TO PROTECT CRUCIAL DATA TO DRIVE DEMAND FOR PHYSICAL SECURITY IN GOVERNMENT SECTOR

- 10.4.2 GOVERNMENT: PHYSICAL SECURITY MARKET DRIVERS

- 10.5 RETAIL & ECOMMERCE

- 10.5.1 INCREASING CYBER THEFT DUE TO RISING TREND OF ONLINE SHOPPING TO FUEL DEMAND FOR PHYSICAL SECURITY IN RETAIL SECTOR

- 10.5.2 RETAIL & ECOMMERCE: PHYSICAL SECURITY MARKET DRIVERS

- 10.6 TRANSPORTATION & LOGISTICS

- 10.6.1 RISING CASES OF ILLEGAL IMMIGRATION TO FUEL DEMAND FOR PHYSICAL SECURITY IN TRANSPORTATION AND LOGISTICS

- 10.6.2 TRANSPORTATION & LOGISTICS: PHYSICAL SECURITY MARKET DRIVERS

- 10.7 RESIDENTIAL

- 10.7.1 NEED TO PREVENT INVASION AND BURGLARY TO FUEL DEMAND FOR PHYSICAL SECURITY IN RESIDENTIAL SECTOR

- 10.7.2 RESIDENTIAL: PHYSICAL SECURITY MARKET DRIVERS

- 10.8 EDUCATION

- 10.8.1 NEED TO FORTIFY EDUCATIONAL INSTITUTIONS WITH APPROPRIATE SECURITY TO DRIVE MARKET

- 10.8.2 EDUCATION: PHYSICAL SECURITY MARKET DRIVERS

- 10.9 AEROSPACE & DEFENSE

- 10.9.1 NEED TO SHIELD CRITICAL ASSETS WITH REQUIRED SECURITY TO BOOST DEMAND FOR PHYSICAL SECURITY IN AEROSPACE AND DEFENSE

- 10.9.2 AEROSPACE & DEFENSE: PHYSICAL SECURITY MARKET DRIVERS

- 10.10 IT & ITES

- 10.10.1 ADVENT OF PROGRESSIVE CYBERATTACKS TO FUEL DEMAND FOR PHYSICAL SECURITY IN IT AND ITES

- 10.10.2 IT & ITES: PHYSICAL SECURITY MARKET DRIVERS

- 10.11 OTHER VERTICALS

11 PHYSICAL SECURITY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: PHYSICAL SECURITY MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- 11.2.4 US

- 11.2.4.1 Adoption of video surveillance to combat rising cases of identity theft

- 11.2.5 CANADA

- 11.2.5.1 Adoption of advanced technologies to strengthen physical security measures

- 11.3 EUROPE

- 11.3.1 EUROPE: PHYSICAL SECURITY MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 EUROPE: REGULATORY LANDSCAPE

- 11.3.4 UK

- 11.3.4.1 Need for safe and secure working environment to drive growth of physical security in UK

- 11.3.5 GERMANY

- 11.3.5.1 Widespread usage of access control systems to drive growth

- 11.3.6 FRANCE

- 11.3.6.1 France to balance physical security and AI surveillance dilemma

- 11.3.7 ITALY

- 11.3.7.1 Italy to reinforce physical security infrastructure amid rising AI surveillance discourse

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: PHYSICAL SECURITY MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 11.4.4 CHINA

- 11.4.4.1 Maximizing commercial revenue via advanced surveillance to drive growth

- 11.4.5 JAPAN