|

|

市場調査レポート

商品コード

1752094

衛星NTNの世界市場:軌道別、周波数別、最終用途部門別、技術別、ハードウェア別、用途別、地域別 - 2030年までの予測Satellite NTN Market by Technology (NR NTN, IoT NTN), Hardware (RF Front End, Antenna, Onboard Processors), Application (eMBB, mMTC, uRLLC), Frequency (L, S, C, Ku and Ka, HF/VHF/UHF-band), Orbit, End Use and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 衛星NTNの世界市場:軌道別、周波数別、最終用途部門別、技術別、ハードウェア別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月11日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

衛星NTNの市場規模は、38.0%のCAGRで拡大し、2025年の5億6,000万米ドルから2030年には27億9,000万米ドルに成長すると予測されています。

市場成長の原動力は、モバイルグローバルブロードバンドサービスを実現するために、地上と衛星の相互運用性をエンド・ツー・エンドで実現する5G NRプロトコルの標準化です。また、軽量化、ステアラブルアンテナ、衛星搭載処理の進歩により、衛星運用がより柔軟かつ効率的になることも、市場成長の原動力となっています。市場の成長は、自律走行車、AIを中心としたIoTネットワーク、重要インフラ監視のためのNTNの開発にも起因しています。さらに、マルチ軌道で弾力性のある通信ネットワークに対する政府や軍の戦略的関心も成長を後押ししており、従来の通信要件を上回る継続的な投資と技術革新が後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 軌道別、周波数別、最終用途部門別、技術別、ハードウェア別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

アンテナセグメントは、信頼性の高い効率的な信号転送を可能にし、ネットワーク構成における高さと受信を分離するアンテナの中心的な役割により、予測期間中、衛星NTN市場をリードすると予測されています。NTNは5Gと統合され、ダイナミックケースをサポートするため、多くのダイナミック衛星をトレースし、接続を維持できる先進的な、主に電子ステレオアンテナの需要が高まっています。米国は、アンテナの研究開発への多額の投資と、L3harris、Kymmeta、Ball Aerospaceなどの重要なメーカーの存在に触発され、アンテナの開発に不可欠な貢献者です。スペースXやAmazonがそうであるように、米国を拠点とする衛星通信事業者は、衛星や地上端末のためのスケーラブルで軽量、低電力アップのソリューションを必要とする著名なLEOコンステレーションを配布しています。さらに、米国国防総省は、柔軟で遠い環境での柔軟な通信を確保するために、擦るような複数軌道のアンテナシステムに投資しています。

LEOセグメントが予測期間中に最も高い成長を記録すると予測されているのは、LEO衛星通信システムが少ない和解、世界アクセス-5 gバックホール、リアルタイムIoT、自律輸送で高い移動接続を提供できるためです。従来の静止衛星とは異なり、LEO衛星は高度500~2,000kmで動作するため、信号遅延が大幅に削減され、迅速なデータ転送が可能になり、時間に制約のあるユースケースに最適です。米国はこの開発に先行しており、SpaceXのStarlinkやAmazonのProject Kuiperといった大規模な取り組みを通じて、大規模処理に注力しています。このメガコンステレーションは、何千もの衛星を配備し、特に外部や低地でのブロードバンドカバレッジで地球を覆い尽くすことを目指しています。

民間用途の多くで高速で広範な接続に対する需要が急増しているため、予測期間中、商業セグメントが衛星地上ネットワーク(NTN)市場で最大のシェアを占めると予測されています。海事、航空、ロジスティクス、農業、鉱業、メディアの各分野では、衛星NTNサービスを活用し、特に遠隔地やサービスが行き届いていない地域で、地上インフラが及ばないネットワーク拡張を提供するケースが増えています。モバイルブロードバンド、インテリジェント輸送、産業用IoTは、耐障害性と不変の通信を提供する衛星NTNの展開に魅力的な商業的根拠を煽っています。特に、NTNと5Gの統合は、広帯域でリアルタイムの接続が必要とされる消費者や企業にとって大きな機会となります。SpaceXのStarlinkやAmazonのProject Kuiperのような野心的な商用イニシアチブは、スケーラブルで低遅延のインターネットサービスを消費者、企業、政府ユーザーに直接提供することで動向に拍車をかけています。これらのイニシアチブは、信頼性の高い衛星ブロードバンド・ソリューションを求める様々な業界からの多額の民間投資と打ち上げ前のサービス契約に支えられています。幅広い用途の関連性、費用対効果の高いLEOコンステレーション、商業的パートナーシップの拡大が、商業セグメントを衛星NTN市場成長の主要な原動力にしています。

欧州は、柔軟な接続と野心的な地域的取り組みへの需要を増加させる強力な制度的支援により、最も急成長する市場になると予測されています。EUとESA(欧州宇宙機関)は、欧州とアフリカで当局と商業通信を可能にするため、次世代の衛星インフラ(衛星の柔軟性、相互作用とセキュリティインフラ、セキュリティインフラ)に多額の投資を行っています。欧州諸国はデジタル・インクルージョンに重点を置き、村落や遠隔地を結ぶ衛星NTNを推進しています。欧州は衛星の現地生産、打上げサービス、NTN技術の研究開発にも投資しています。Airbus、Thales Alenia Space、SESなどの市場リーダーはNTNポートフォリオを拡大しており、衛星通信事業者と通信事業者の連携強化により、地上と衛星のハイブリッド5Gネットワークが現実のものとなりつつあります。欧州の規制環境も、周波数帯域の割り当てとNTNの迅速な展開を可能にするよう変化しています。これら全ての促進要因が組み合わさることで、強力で競争力のあるエコシステムが構築され、欧州は衛星NTNにとって最も急成長している市場となっています。

当レポートでは、世界の衛星NTN市場について調査し、軌道別、周波数別、最終用途部門別、技術別、ハードウェア別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 衛星NTNの打ち上げ:ボリュームデータ

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- バリューチェーン分析

- 価格分析

- ケーススタディ分析

- HSコード

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- 主要な利害関係者と購入基準

- 技術分析

- 投資と資金調達のシナリオ

- マクロ経済見通し

- 部品表(BOM)分析

- 技術ロードマップ

- 総所有コスト(TCO)

- 2025年の米国関税の影響

- 業界動向

- メガトレンドの影響

- 生成AIの影響

- 特許分析

第6章 衛星NTN市場、軌道別

- イントロダクション

- LEO

- GEO

第7章 衛星NTN市場、周波数別

- イントロダクション

- Lバンド

- Sバンド

- Cバンド

- KUバンドとKAバンド

- HF/VHF/UHFバンド

第8章 衛星NTN市場、最終用途部門別

- イントロダクション

- 商業

- 防衛

- 政府

第9章 衛星NTN市場、技術別

- イントロダクション

- NR NTN

- IoT NTN

第10章 衛星NTN市場、ハードウェア別

- イントロダクション

- 使用事例1:マルチバンド衛星通信用高性能RFフロントエンドコンポーネントの採用

- 使用事例2:低遅延衛星NTNサービス向けオンボード処理ユニットの採用

- RFフロントエンド

- アンテナ

- オンボードプロセッサユニット

- その他

第11章 衛星NTN市場、用途別

- イントロダクション

- 使用事例1:リモートブロードバンドアクセスのための拡張モバイルブロードバンド(EMBB)

- 使用事例2:ミッションクリティカルなネットワーク向けの超信頼性低遅延通信(URLLC)

- 拡張モバイルブロードバンド(EMBB)

- 超信頼性低遅延通信(URLLC)

- 大規模マシン型通信(MMTC)

第12章 衛星NTN市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- 中国

- 日本

- オーストラリア

- 韓国

- 欧州

- PESTLE分析

- ルクセンブルク

- フランス

- ドイツ

- イタリア

- スペイン

- スイス

- その他の地域

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- AIRBUS

- THALES ALENIA SPACE

- NEC CORPORATION

- KONGSBERG

- ANALOG DEVICES, INC.

- LOCKHEED MARTIN CORPORATION

- SAFRAN

- HONEYWELL INTERNATIONAL INC.

- L3HARRIS TECHNOLOGIES

- TELEDYNE TECHNOLOGIES

- SMITHS INTERCONNECT

- QORVO, INC

- MERCURY SYSTEMS, INC.

- MINI-CIRCUITS

- BAE SYSTEMS

- FILTRONIC PLC

- SWISSTO12

- その他の企業

- ALEN SPACE

- RADIALL

- ETL SYSTEMS LTD

- AETHERCOMM

- SPECTRUM CONTROL

- ADVANTECH WIRELESS

- TEMWELL CORPORATION

- CELESTIA TTI

- THINKOM SOLUTIONS, INC.

- MICROWAVE TECHNOLOGY, INC.

- ANYWAVES

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 SATELLITE NTN LAUNCHES, BY REGION, 2021-2024

- TABLE 3 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY ORBIT, 2024 (USD MILLION)

- TABLE 6 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 9 TARIFF DATA FOR HS CODE: 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE SECTOR (%)

- TABLE 16 KEY BUYING CRITERIA, BY HARDWARE

- TABLE 17 BILL OF MATERIALS (BOM) ANALYSIS FOR HARDWARE

- TABLE 18 BILL OF MATERIALS (BOM) ANALYSIS: LEO VS. GEO

- TABLE 19 RECIPROCAL TARIFF RATES ADJUSTED BY US

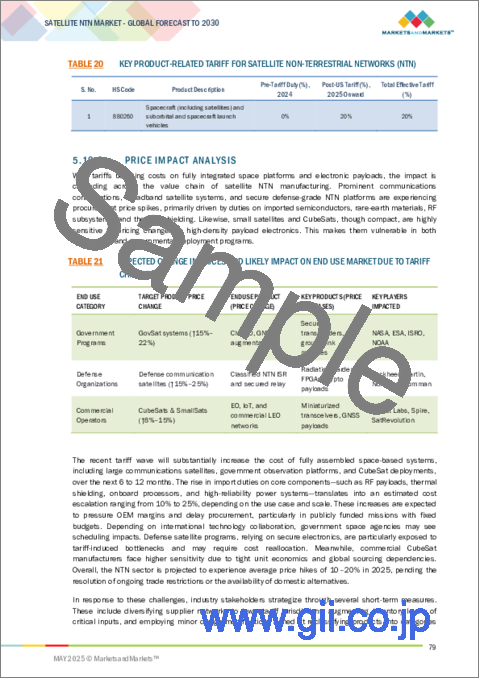

- TABLE 20 KEY PRODUCT-RELATED TARIFF FOR SATELLITE NON-TERRESTRIAL NETWORKS (NTN)

- TABLE 21 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END USE MARKET DUE TO TARIFF CHANGE

- TABLE 22 IMPACT OF AI ON SPACE APPLICATIONS, BY KEY PLAYER

- TABLE 23 PATENT ANALYSIS, 2021-2025

- TABLE 24 SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 25 SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 26 SATELLITE NTN MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 27 SATELLITE NTN MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 28 SATELLITE NTN MARKET, BY END USE SECTOR, 2021-2024 (USD MILLION)

- TABLE 29 SATELLITE NTN MARKET, BY END USE SECTOR, 2025-2030 (USD MILLION)

- TABLE 30 SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 31 SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 SATELLITE NTN MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 33 SATELLITE NTN MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 34 SATELLITE NTN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 SATELLITE NTN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 SATELLITE NTN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 SATELLITE NTN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: SATELLITE NTN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: SATELLITE NTN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 44 US: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 45 US: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 46 US: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 47 US: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 48 CANADA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 49 CANADA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 50 CANADA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 51 CANADA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: SATELLITE NTN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SATELLITE NTN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 55 ASIA PACIFIC: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 57 ASIA PACIFIC: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 58 CHINA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 59 CHINA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 60 CHINA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 61 CHINA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 62 JAPAN: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 63 JAPAN: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 64 JAPAN: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 65 JAPAN: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 66 AUSTRALIA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 67 AUSTRALIA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 68 AUSTRALIA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 69 AUSTRALIA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 70 SOUTH KOREA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 71 SOUTH KOREA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 72 SOUTH KOREA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 73 SOUTH KOREA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: SATELLITE NTN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: SATELLITE NTN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 77 EUROPE: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 78 EUROPE: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 80 LUXEMBOURG: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 81 LUXEMBOURG: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 82 LUXEMBOURG: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 83 LUXEMBOURG: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 84 FRANCE: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 85 FRANCE: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 86 FRANCE: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 87 FRANCE: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 88 GERMANY: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 89 GERMANY: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 90 GERMANY: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 91 GERMANY: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 92 ITALY: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 93 ITALY: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 94 ITALY: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 95 ITALY: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 96 SPAIN: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 97 SPAIN: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 98 SPAIN: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 99 SPAIN: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 SWITZERLAND: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 101 SWITZERLAND: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 102 SWITZERLAND: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 103 SWITZERLAND: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 104 REST OF THE WORLD: SATELLITE NTN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 REST OF THE WORLD: SATELLITE NTN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 REST OF THE WORLD: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 107 REST OF THE WORLD: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 108 REST OF THE WORLD: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 109 REST OF THE WORLD: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: SATELLITE NTN MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 115 LATIN AMERICA: SATELLITE NTN MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 116 LATIN AMERICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 117 LATIN AMERICA: SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 118 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 119 SATELLITE NTN MARKET: DEGREE OF COMPETITION

- TABLE 120 SATELLITE NTN MARKET: REGION FOOTPRINT

- TABLE 121 SATELLITE NTN MARKET: END USE SECTOR FOOTPRINT

- TABLE 122 SATELLITE NTN MARKET: ORBIT FOOTPRINT

- TABLE 123 SATELLITE NTN MARKET: HARDWARE FOOTPRINT

- TABLE 124 SATELLITE NTN MARKET: LIST OF STARTUPS/SMES

- TABLE 125 SATELLITE NTN MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 126 SATELLITE NTN MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 127 SATELLITE NTN MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 128 AIRBUS: COMPANY OVERVIEW

- TABLE 129 AIRBUS: PRODUCTS OFFERED

- TABLE 130 AIRBUS: DEALS

- TABLE 131 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 132 THALES ALENIA SPACE: PRODUCTS OFFERED

- TABLE 133 THALES ALENIA SPACE: DEALS

- TABLE 134 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 135 NEC CORPORATION: PRODUCTS OFFERED

- TABLE 136 NEC CORPORATION: OTHER DEVELOPMENTS

- TABLE 137 KONGSBERG: COMPANY OVERVIEW

- TABLE 138 KONGSBERG: PRODUCTS OFFERED

- TABLE 139 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 140 ANALOG DEVICES, INC.: PRODUCTS OFFERED

- TABLE 141 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 142 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 143 SAFRAN: COMPANY OVERVIEW

- TABLE 144 SAFRAN: PRODUCTS OFFERED

- TABLE 145 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 146 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 147 L3HARRIS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 148 L3HARRIS TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 149 TELEDYNE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 150 TELEDYNE TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 151 SMITHS INTERCONNECT: COMPANY OVERVIEW

- TABLE 152 SMITHS INTERCONNECT: PRODUCTS OFFERED

- TABLE 153 QORVO, INC.: COMPANY OVERVIEW

- TABLE 154 QORVO, INC.: PRODUCTS OFFERED

- TABLE 155 MERCURY SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 156 MERCURY SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 157 MERCURY SYSTEMS, INC.: OTHER DEVELOPMENTS

- TABLE 158 MINI-CIRCUITS: COMPANY OVERVIEW

- TABLE 159 MINI-CIRCUITS: PRODUCTS OFFERED

- TABLE 160 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 161 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 162 FILTRONIC PLC: COMPANY OVERVIEW

- TABLE 163 FILTRONIC PLC: PRODUCTS OFFERED

- TABLE 164 SWISSTO12: COMPANY OVERVIEW

- TABLE 165 SWISSTO12: PRODUCTS OFFERED

- TABLE 166 SWISSTO12: OTHER DEVELOPMENTS

- TABLE 167 ALEN SPACE: COMPANY OVERVIEW

- TABLE 168 RADIALL: COMPANY OVERVIEW

- TABLE 169 ETL SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 170 AETHERCOMM: COMPANY OVERVIEW

- TABLE 171 SPECTRUM CONTROL: COMPANY OVERVIEW

- TABLE 172 ADVANTECH WIRELESS: COMPANY OVERVIEW

- TABLE 173 TEMWELL CORPORATION: COMPANY OVERVIEW

- TABLE 174 CELESTIA TTI: COMPANY OVERVIEW

- TABLE 175 THINKOM SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 176 MICROWAVE TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 177 ANYWAVES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN MODEL

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SATELLITE NTN MARKET, BY HARDWARE, 2025

- FIGURE 8 SATELLITE NTN MARKET, BY TECHNOLOGY, 2025-2030

- FIGURE 9 SATELLITE NTN MARKET, BY REGION, 2025

- FIGURE 10 DEMAND FOR ROBUST CONNECTIVITY IN REMOTE REGIONS TO DRIVE MARKET

- FIGURE 11 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 LEO SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 JAPAN TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 SATELLITE NTN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 16 ECOSYSTEM MAP

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD MILLION)

- FIGURE 19 INDICATIVE PRICING ANALYSIS, BY ORBIT, 2024 (USD MILLION)

- FIGURE 20 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE SECTOR

- FIGURE 23 KEY BUYING CRITERIA, BY HARDWARE

- FIGURE 24 NUMBER AND VALUE OF DEALS IN EUROPEAN SPACE STARTUPS, 2020-2024 (USD BILLION)

- FIGURE 25 GLOBAL SPACE PRIVATE INVESTMENT, BY TYPE, 2020-2024 (USD MILLION)

- FIGURE 26 BILL OF MATERIALS (BOM) ANALYSIS FOR LEO, BY HARDWARE

- FIGURE 27 BILL OF MATERIALS (BOM) ANALYSIS FOR GEO, BY HARDWARE

- FIGURE 28 TECHNOLOGY ROADMAP

- FIGURE 29 EVOLUTION OF SATELLITE TECHNOLOGIES

- FIGURE 30 EMERGING TECHNOLOGY TRENDS

- FIGURE 31 BREAKDOWN OF TOTAL COST OF OWNERSHIP (TCO)

- FIGURE 32 TECHNOLOGY TRENDS

- FIGURE 33 ADOPTION OF AI IN SPACE INDUSTRY

- FIGURE 34 ADOPTION OF AI IN SPACE INDUSTRY, BY KEY COUNTRY

- FIGURE 35 IMPACT OF AI ON SATELLITE PLATFORMS

- FIGURE 36 IMPACT OF AI ON SATELLITE NTN MARKET

- FIGURE 37 PATENT ANALYSIS

- FIGURE 38 LEO SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 KU- & KA-BAND SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 40 DEFENSE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 41 NR NTN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 ANTENNA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 44 SATELLITE NTN MARKET: REGIONAL SNAPSHOT

- FIGURE 45 NORTH AMERICA: SATELLITE NTN MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: SATELLITE NTN MARKET SNAPSHOT

- FIGURE 47 EUROPE: SATELLITE NTN MARKET SNAPSHOT

- FIGURE 48 REST OF THE WORLD: SATELLITE NTN MARKET SNAPSHOT

- FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 50 MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 51 SATELLITE NTN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 SATELLITE NTN MARKET: COMPANY FOOTPRINT

- FIGURE 53 SATELLITE NTN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 55 EV/EBITDA OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 56 SATELLITE NTN MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 AIRBUS: COMPANY SNAPSHOT

- FIGURE 58 THALES ALENIA SPACE: COMPANY SNAPSHOT

- FIGURE 59 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 61 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 62 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 SAFRAN: COMPANY SNAPSHOT

- FIGURE 64 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 65 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 66 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 67 SMITHS INTERCONNECT: COMPANY SNAPSHOT

- FIGURE 68 QORVO, INC.: COMPANY SNAPSHOT

- FIGURE 69 MERCURY SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 70 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 71 FILTRONIC PLC: COMPANY SNAPSHOT

The satellite NTN market is projected to grow from USD 0.56 billion in 2025 to USD 2.79 billion by 2030 at a CAGR of 38.0%. Market growth is driven by the standardized 5G NR protocols for end-to-end terrestrial-satellite interoperability to enable mobile, global broadband services. It is also driven by advancements in light, steerable antennas, and onboard processing, making satellite operations more flexible and efficient. The market's growth can also be attributed to the development of NTNs for autonomous vehicles, AI-focused IoT networks, and critical infrastructure monitoring. Additionally, strategic government and military interest in multi-orbit, resilient communication networks also drive growth, helped by continued investment and innovation above traditional telecom requirements.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Orbit, Frequency, End Use Sector, Technology, Hardware, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"By hardware, the antenna segment is projected to account for the largest share in the satellite NTN market during the forecast period."

The antenna segment is projected to lead the satellite NTN market during the forecast period due to the central role of antennas in enabling reliable and efficient signal transfer and separate height and reception in network configurations. As NTNs are integrated with 5G and support dynamic cases, there is a growing demand for advanced, primarily electronic stereo antennas, which can trace many dynamic satellites and maintain the connection. The US is an essential contributor to the development of antennas, inspired by substantial investments in antenna R&D and the presence of important manufacturers, such as L3harris, Kymmeta, and Ball Aerospace. As per SpaceX and Amazon, US-based satellite operators distribute prominent LEO constellations requiring scalable, light, and low power-up solutions for satellites and ground terminals. In addition, the US Department of Defense is invested in a rubbing, multi-orbit antenna system to ensure flexible communication in a flexible and distant environment.

"By orbit, the LEO segment is projected to register the highest growth in the satellite NTN market during the forecast period."

The LEO segment is projected to register the highest growth during the forecast period due to the ability of LEO satellite communication systems to provide high movement connections with little reconciliation, global access-5 g backhauls, real-time IoT, and autonomous transport. Unlike traditional geostationary satellites, LEO satellites work at an altitude of 500-2,000 km, significantly reducing the signal delay, enabling rapid data transfer, and making themselves ideal for time-sensitive use cases. The US is ahead of this development, focusing on large-scale processing through major initiatives, such as SpaceX's Starlink and Amazon's Project Kuiper. This mega-constellation aims to distribute thousands of satellites to blanket the globe with broadband coverage, especially in external and lowered areas.

"By end use sector, the commercial segment is projected to account for the largest share during the forecast period."

The commercial segment is projected to account for the largest share in the satellite Non-Terrestrial Network (NTN) market during the forecast year due to the runaway demand for high-speed, pervasive connectivity in a host of civilian applications. Maritime, aviation, logistics, agriculture, mining, and media sectors are increasingly leveraging satellite NTN services to offer network extension beyond the reach of ground infrastructure, especially in remote and underserved areas. Mobile broadband, intelligent transportation, and industrial IoT have fueled an attractive commercial rationale for the deployment of satellite NTNs to offer fault-tolerant and unaltered communication. Notably, NTN integration with 5G creates enormous consumer and enterprise market opportunities where high-bandwidth, real-time connectivity is required. Ambitious commercial initiatives, such as SpaceX's Starlink and Amazon's Project Kuiper, fuel the trend by offering scalable, low-latency internet services directly to consumers, enterprises, and government users. These initiatives are backed by significant private investments and pre-launch service contracts from various industries looking for reliable satellite broadband solutions. The convergence of wide application relevance, cost-effective LEO constellations, and growing commercial partnerships is making the commercial segment the primary driver of the growth of the satellite NTN market.

"Europe is projected to be the fastest-growing regional market in the satellite NTN market during the forecast period."

Europe is projected to be the fastest-growing market due to strong institutional support, which increases the demand for flexible connections and ambitious regional efforts. The EU and ESA (European Space Agency) invest heavily in the next generation of satellite infrastructure (satellite flexibility, interaction and security infrastructure and security infrastructure) to enable authorities and commercial communications in Europe and Africa. European countries focus on digital inclusion, promoting satellite NTN for connecting villages and remote villages. Europe also invests in local satellite production, launch services, and NTN technology R&D. Market leaders like Airbus, Thales Alenia Space, and SES are expanding NTN portfolios, and greater collaboration between satellite operators and telecom operators is making hybrid terrestrial-satellite 5G networks a reality. The regulatory environment in Europe is also changing to enable spectrum allocation and NTN deployment at speed. All these drivers combined build a strong and competitive ecosystem, making Europe the fastest-growing market for satellite NTN.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C-Level Designations-25%; Directors-30%; and Others-45%

- By Region: North America-45%; Europe-25%; Asia Pacific-20%; Rest of the World-10%

Airbus (Netherlands), Thales Alenia Space (France), Kongsberg (Norway), Analog Devices, Inc. (US), and NEC Corporation (Japan) are some of the leading players operating in the satellite NTN market.

Research Coverage

The study covers the satellite NTN market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on orbit, frequency, end use sector, hardware, technology, application, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies they adopted.

Key Benefits of Buying this Report

This report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall satellite NTN market and its subsegments, as it covers the entire ecosystem of the satellite NTN market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report offers insights on the following points:

- Analysis of key drivers and factors, such as Acceleration of LEO deployments for low-latency NTN and 3GPP standardization of driving investments in direct-to-device and IoT satellite connectivity

- Product Development: In-depth product innovation/development analysis by companies across various regions

- Market Development: Comprehensive information about lucrative markets-the report analyses the satellite NTN market across various regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the satellite NTN market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Airbus (Netherlands), Thales Alenia Space (France), Kongsberg (Norway), Analog Devices, Inc. (US) and NEC Corporation (Japan), among others, in the satellite NTN market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (Demand side)

- 2.3.1.2 Market size illustration - Spain's LEO orbit satellite NTN market size

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE NTN MARKET

- 4.2 SATELLITE NTN MARKET, BY APPLICATION

- 4.3 SATELLITE NTN MARKET, BY ORBIT

- 4.4 SATELLITE NTN MARKET, BY COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Acceleration of LEO deployments for low-latency NTN

- 5.2.1.2 3GPP standardization to drive investments in direct-to-device and IoT satellite connectivity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory barriers in cross-border spectrum and licensing to hinder deployment of NTNs

- 5.2.2.2 Latency and quality-of-service tradeoffs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of NTN-enabled 5G backhaul in rural markets

- 5.2.3.2 Development of multi-orbit hybrid network architectures for enhanced global connectivity

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex integration of NTN and terrestrial networks

- 5.2.4.2 Disruptions in satellite and launch supply chain

- 5.2.4.3 Thermal, power, and size limitations in satellite hardware

- 5.2.4.4 Risks of orbital congestion and spectrum interference

- 5.2.1 DRIVERS

- 5.3 SATELLITE NTN LAUNCHES: VOLUME DATA

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PAYLOAD MANUFACTURERS

- 5.5.2 COMPONENT PROVIDERS

- 5.5.3 END USERS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY ORBIT

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 IRIDIUM COLLABORATED WITH QUALCOMM TO INTEGRATE ITS SATELLITE NTN CAPABILITIES INTO SNAPDRAGON SATELLITE

- 5.8.2 BT PARTNERED WITH ONEWEB TO PROVIDE HIGH-SPEED, LOW-LATENCY SATELLITE NTN BACKHAUL VIA LEO SATELLITES TO ESTABLISH REMOTE CONNECTIVITY

- 5.8.3 INTELSAT DEPLOYED HYBRID NTN SOLUTION USING GEO AND LEO SATELLITE INTEGRATION, OFFERING MANAGED SERVICES FOR SECURE ENTERPRISE NETWORKING AND SCADA SYSTEMS

- 5.9 HS CODES

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 TARIFF & REGULATORY LANDSCAPE

- 5.11.1 TARIFF DATA (HS CODE: 880260)

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Regenerative payloads

- 5.13.1.2 Software-defined payloads (SDPs)

- 5.13.1.3 Active and passive RF components

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 High-frequency band technology (Ku/Ka)

- 5.13.2.2 Quantum cryptography

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Inter-satellite links (ISL)

- 5.13.1 KEY TECHNOLOGIES

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 MACROECONOMIC OUTLOOK

- 5.15.1 INTRODUCTION

- 5.15.2 NORTH AMERICA

- 5.15.3 EUROPE

- 5.15.4 ASIA PACIFIC

- 5.15.5 MIDDLE EAST

- 5.15.6 LATIN AMERICA & AFRICA

- 5.16 BILL OF MATERIALS (BOM) ANALYSIS

- 5.17 TECHNOLOGY ROADMAP

- 5.18 TOTAL COST OF OWNERSHIP (TCO)

- 5.19 IMPACT OF 2025 US TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END USE INDUSTRIES

- 5.19.5.1 Commercial

- 5.19.5.2 Defense

- 5.19.5.3 Government

- 5.20 INDUSTRY TRENDS

- 5.20.1 INTRODUCTION

- 5.20.2 TECHNOLOGY TRENDS

- 5.20.2.1 Miniaturization of satellite components

- 5.20.2.2 Hybrid satellite-terrestrial network integration

- 5.20.2.3 Advanced thermal management solutions

- 5.20.2.4 Advanced propulsion systems for satellite mobility

- 5.21 IMPACT OF MEGATRENDS

- 5.21.1 ARTIFICIAL INTELLIGENCE (AI) FOR NETWORK OPTIMIZATION AND AUTOMATION

- 5.21.2 CONNECTIVITY AND INTEGRATION WITH TERRESTRIAL NETWORKS

- 5.21.3 BIG DATA AND ANALYTICS FOR ENHANCED DECISION-MAKING

- 5.21.4 BLOCKCHAIN FOR SECURE SATELLITE COMMUNICATIONS

- 5.22 IMPACT OF GENERATIVE AI

- 5.22.1 INTRODUCTION

- 5.22.2 ADOPTION OF AI IN SPACE INDUSTRY, BY KEY COUNTRY

- 5.22.3 IMPACT OF AI ON SPACE: USE CASES

- 5.22.4 IMPACT OF AI ON SATELLITE NTN MARKET

- 5.23 PATENT ANALYSIS

6 SATELLITE NTN MARKET, BY ORBIT

- 6.1 INTRODUCTION

- 6.2 LEO

- 6.2.1 ABILITY TO DELIVER FIBER-LIKE BROADBAND SPEED WITH MINIMAL LATENCY TO DRIVE MARKET

- 6.3 GEO

- 6.3.1 DEMAND FOR UNINTERRUPTED COVERAGE OVER LARGE GEOGRAPHIC AREAS TO DRIVE MARKET

7 SATELLITE NTN MARKET, BY FREQUENCY

- 7.1 INTRODUCTION

- 7.2 L-BAND

- 7.2.1 NEED FOR CONSISTENT, LOW-DATA-RATE COMMUNICATION WITH MINIMAL INFRASTRUCTURE TO BOOST MARKET

- 7.3 S-BAND

- 7.3.1 FOCUS ON ACHIEVING RELIABLE CONNECTIVITY ACROSS DYNAMIC ENVIRONMENTS TO BOOST MARKET

- 7.4 C-BAND

- 7.4.1 C-BAND OFFERS BANDWIDTH GREATER THAN LOW-FREQUENCY BANDS

- 7.5 KU- & KA-BAND

- 7.5.1 NEED FOR DYNAMIC BEAMFORMING AND HIGH-DENSITY USER TARGETING TO DRIVE DEMAND

- 7.6 HF/VHF/UHF-BANDS

- 7.6.1 FOCUS ON ESTABLISHING LOW-POWER TERMINALS AND REDUCING INFRASTRUCTURE COSTS TO BOOST GROWTH

8 SATELLITE NTN MARKET, BY END USE SECTOR

- 8.1 INTRODUCTION

- 8.2 COMMERCIAL

- 8.2.1 RISING DEMAND FOR UNINTERRUPTED CONNECTIVITY TO BOOST GROWTH

- 8.3 DEFENSE

- 8.3.1 FOCUS ON REAL-TIME DATA TRANSFER AND RESILIENT COMMAND AND CONTROL TO DRIVE DEMAND

- 8.4 GOVERNMENT

- 8.4.1 NEED FOR STRENGTHENING RAPID DEPLOYMENT CAPABILITIES OF SATELLITE SYSTEMS TO BOOST DEMAND

9 SATELLITE NTN MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 NR NTN

- 9.2.1 INTEGRATION OF SATELLITE ACCESS WITH GLOBAL 5G STANDARDS TO BOOST MARKET

- 9.2.2 USE CASE: AST SPACEMOBILE DEVELOPED SPACE-BASED CELLULAR BROADBAND NETWORK TO DELIVER 4G AND 5G CONNECTIVITY

- 9.2.3 DIRECT-TO-CELL

- 9.2.4 HYBRID SATELLITE CELLULAR CONNECTIVITY

- 9.3 IOT NTN

- 9.3.1 FOCUS ON STRENGTHENING ABILITY OF SATELLITES TO DELIVER CONSISTENT, LARGE-SCALE COVERAGE TO BOOST GROWTH

- 9.3.2 USE CASE: MYRIOTA DEVELOPED LEO-BASED CONNECTIVITY SERVICE THAT DELIVERS SECURE, LOW-POWER DATA TRANSMISSION

10 SATELLITE NTN MARKET, BY HARDWARE

- 10.1 INTRODUCTION

- 10.2 USE CASE 1: ADOPTION OF HIGH-PERFORMANCE RF FRONT-END COMPONENTS FOR MULTI-BAND SATELLITE COMMUNICATION

- 10.3 USE CASE 2: ADOPTION OF ONBOARD PROCESSING UNITS FOR LOW-LATENCY SATELLITE NTN SERVICES

- 10.4 RF FRONT END

- 10.4.1 DEMAND FOR COMPACT, ENERGY-EFFICIENT COMPONENTS THAT CAN HANDLE MULTIPLE FREQUENCY BANDS TO BOOST GROWTH

- 10.5 ANTENNA

- 10.5.1 NEED FOR REDUCING POWER CONSUMPTION WHILE MAXIMIZING EFFICIENCY TO DRIVE GROWTH

- 10.6 ONBOARD PROCESSOR UNIT

- 10.6.1 INCREASING DEMAND FOR INTELLIGENT, SOFTWARE-DEFINED PAYLOADS TO DRIVE DEMAND

- 10.7 OTHERS

11 SATELLITE NTN MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 USE CASE 1: ENHANCED MOBILE BROADBAND (EMBB) FOR REMOTE BROADBAND ACCESS

- 11.3 USE CASE 2: ULTRA-RELIABLE LOW-LATENCY COMMUNICATIONS (URLLC) FOR MISSION-CRITICAL NETWORKS

- 11.4 ENHANCED MOBILE BROADBAND (EMBB)

- 11.4.1 INCREASING NEED FOR RELIABLE, SCALABLE BROADBAND ACCESS ACROSS WIDE GEOGRAPHIES TO BOOST DEMAND

- 11.5 ULTRA-RELIABLE LOW-LATENCY COMMUNICATIONS (URLLC)

- 11.5.1 NEED TO IMPROVE COMMUNICATION AND OPERATIONAL EFFICIENCY TO BOOST MARKET

- 11.6 MASSIVE MACHINE-TYPE COMMUNICATIONS (MMTC)

- 11.6.1 INCREASING DEPLOYMENT OF IOT ECOSYSTEMS REQUIRING UBIQUITOUS COVERAGE BEYOND REACH OF TERRESTRIAL NETWORKS TO DRIVE MARKET

12 SATELLITE NTN MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 US

- 12.2.2.1 Demand for well-established defense and intelligence sector to drive market

- 12.2.3 CANADA

- 12.2.3.1 Strategic focus on connecting vast rural and remote regions to drive market

- 12.3 ASIA PACIFIC

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 CHINA

- 12.3.2.1 China's 'Digital Silk Road' initiative to drive market

- 12.3.3 JAPAN

- 12.3.3.1 Expertise in robotics, electronics, and semiconductor manufacturing to drive market

- 12.3.4 AUSTRALIA

- 12.3.4.1 Strong government focus on extending reliable broadband to drive market

- 12.3.5 SOUTH KOREA

- 12.3.5.1 Focus on blending satellite NTNs with advanced 5G networks to drive market

- 12.4 EUROPE

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 LUXEMBOURG

- 12.4.2.1 Presence of leading space finance companies and regulatory centers to drive market

- 12.4.3 FRANCE

- 12.4.3.1 Development of cutting-edge satellite constellations and NTN infrastructure to drive market

- 12.4.4 GERMANY

- 12.4.4.1 Focus on prioritizing digital infrastructure and space technology innovation to drive market

- 12.4.5 ITALY

- 12.4.5.1 Strong capabilities in satellite payload manufacturing to drive market

- 12.4.6 SPAIN

- 12.4.6.1 Strong capabilities in satellite communications to drive market

- 12.4.7 SWITZERLAND

- 12.4.7.1 Demand for secure satellite communication services to drive market

- 12.5 REST OF THE WORLD

- 12.5.1 MIDDLE EAST & AFRICA

- 12.5.1.1 Increasing demand for high-capacity, low-latency satellite services to drive growth

- 12.5.2 LATIN AMERICA

- 12.5.2.1 Commitment to digital inclusion and focus on extending internet access to drive market

- 12.5.1 MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 End use sector footprint

- 13.5.5.4 Orbit footprint

- 13.5.5.5 Hardware footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 13.6.5.1 Detailed list of startups/SMEs

- 13.6.5.2 Competitive benchmarking of startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7.1 COMPANY VALUATION

- 13.7.2 FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 AIRBUS

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 THALES ALENIA SPACE

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 NEC CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 KONGSBERG

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 ANALOG DEVICES, INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 LOCKHEED MARTIN CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.7 SAFRAN

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.8 HONEYWELL INTERNATIONAL INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 L3HARRIS TECHNOLOGIES

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.10 TELEDYNE TECHNOLOGIES

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 SMITHS INTERCONNECT

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.12 QORVO, INC

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 MERCURY SYSTEMS, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Other developments

- 14.1.14 MINI-CIRCUITS

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 BAE SYSTEMS

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.16 FILTRONIC PLC

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.17 SWISSTO12

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Other developments

- 14.1.1 AIRBUS

- 14.2 OTHER PLAYERS

- 14.2.1 ALEN SPACE

- 14.2.2 RADIALL

- 14.2.3 ETL SYSTEMS LTD

- 14.2.4 AETHERCOMM

- 14.2.5 SPECTRUM CONTROL

- 14.2.6 ADVANTECH WIRELESS

- 14.2.7 TEMWELL CORPORATION

- 14.2.8 CELESTIA TTI

- 14.2.9 THINKOM SOLUTIONS, INC.

- 14.2.10 MICROWAVE TECHNOLOGY, INC.

- 14.2.11 ANYWAVES

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS