|

|

市場調査レポート

商品コード

1719523

ペット用サプリメントの世界市場:タイプ別、サプリメント形状別、サプリメントタイプ別、機能別、流通チャネル別、地域別 - 予測(~2030年)Pet Dietary Supplements Market by Type (Dogs, Cats, and Other Pet Types), Supplement Form (Tablets & Capsules, Powders, Soft Chews, and Other Supplement Forms), Supplement Type, Function, Distribution Channel, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ペット用サプリメントの世界市場:タイプ別、サプリメント形状別、サプリメントタイプ別、機能別、流通チャネル別、地域別 - 予測(~2030年) |

|

出版日: 2025年04月28日

発行: MarketsandMarkets

ページ情報: 英文 323 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

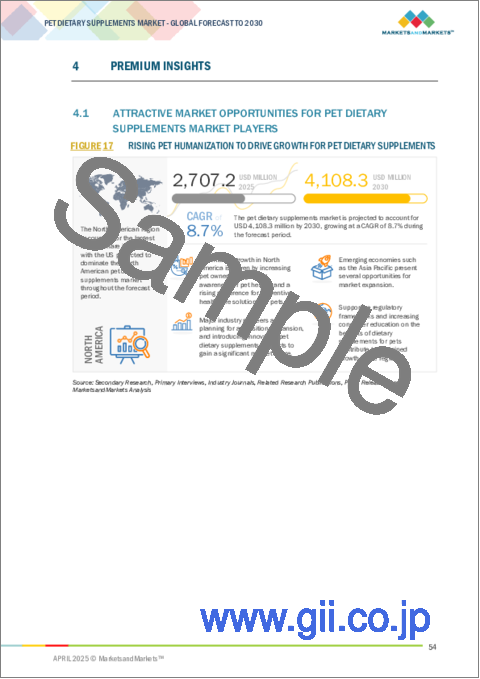

世界のペット用サプリメントの市場規模は、2025年に推定27億1,000万米ドルであり、2030年までに41億1,000万米ドルに達すると予測され、2025年~2030年にCAGRで8.7%の成長が見込まれます。

ペットの飼い主は、免疫力強化、関節の問題の予防、消化器系の健康の向上、アレルギーや不安といった特定の症状の管理など、ペットのための予防策としてサプリメントを利用するようになっています。ビタミン、プロバイオティクス、オメガ3脂肪酸などのサプリメントは、既存の健康問題のソリューションと見なされるだけでなく、長期的な健康に向けたツールとも見なされるようになっています。グルコサミンやコンドロイチンなどの成分を含む関節の健康向けのサプリメントは、ペットの自然な老化プロセスに対する予防策として、特に大型犬でますます求められています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 100万米ドル/1,000米ドル |

| セグメント | ペットタイプ、サプリメント形状、サプリメントタイプ、機能、流通チャネル、性質、地域 |

| 対象地域 | アジア、北米、欧州 |

さらに、ペット用サプリメントの伸びは、特定の健康上の懸念に対応するオーダーメイドの特殊製品の利用可能性の増加にも影響されています。各社は現在、特定のライフステージ(子犬、成犬、シニアペット)、食事制限(グレインフリー、グルテンフリー)、特定の健康ニーズ(消化器系の問題、皮膚と被毛の健康、認知機能)に対応した製剤を開発しています。ペットの健康を個別化するこの動向は、カスタマイズと専門化が購買決定における要因である消費者行動の幅広い変化を反映しています。

ペット用サプリメント市場の混乱

ペット用サプリメント市場は、消費者の嗜好の変化、革新的な製品開発、そして小売業界のダイナミクスの変化によって、破壊的な局面を迎えています。ペットの飼い主がクリーンラベルの選択肢を求めるにつれ、天然成分やオーガニック成分の人気が高まっています。さらに、技術を活用して個々のペットのニーズに合わせたサプリメントを提供する、個別化されたペット栄養への志向が高まっています。スタートアップやニッチブランドは、ユニークな処方と消費者への直接販売戦略でこのセグメントに参入し、従来の企業に挑戦しています。このような変化により競合情勢は再構築され、各社は関連性を維持するために迅速な適応を迫られています。

「サプリメント形状別では、錠剤・カプセルセグメントがペット用サプリメント市場で大きなシェアを占めています。」

錠剤・カプセルは、粉末や液体などの他の形状のサプリメントと比較して、一般的に保管が容易です。保存期間も長く、腐敗や汚染の心配も少ないです。また、コンパクトで丈夫なパッケージは旅行にも最適で、飼い主は旅行先でも動物病院でもサプリメントを簡単に持ち運ぶことができます。こうした利便性と携帯性の向上は、特に活動的で移動の多いライフスタイルを送る飼い主にとって、大きなセールスポイントとなります。

錠剤・カプセルの地位が高いもう1つの要因は、有効成分を送達する有効性です。多くのサプリメント、特に関節の健康、消化機能、皮膚疾患などをターゲットにしたサプリメントでは、正確な量のグルコサミン、コンドロイチン、オメガ3脂肪酸、プロバイオティクスなどの主要な栄養素を摂取する必要があります。錠剤・カプセルは、これらの成分を効果的にカプセル化し、吸収を最大化する放出制御を提供することができます。これは、高齢のペットや、持続的な栄養摂取が必要な特定の健康問題を抱えるペットにとって特に有益です。

当レポートでは、世界のペット用サプリメント市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- ペット用サプリメント市場における魅力的な市場機会

- 北米のペット用サプリメント市場::ペットタイプ別、国別

- ペット用サプリメント市場:ペットタイプ別、地域別

- ペット用サプリメント市場:サプリメントタイプ別

- ペット用サプリメント市場:サプリメント形状別

- ペット用サプリメント市場:機能別

- ペット用サプリメント市場:流通チャネル別

- ペット用サプリメント市場:主要地域市場のシェア

第5章 市場の概要

- イントロダクション

- マクロ経済の見通し

- ペットの個体数と飼育数の増加

- ペットケア経済の成長とプレミアム化の動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ペット用サプリメントに対する生成AIの影響

- イントロダクション

- ペット用サプリメントにおける生成AIの使用

- ケーススタディ分析

- ペット用サプリメント市場に対する影響

- 生成AIに取り組む隣接エコシステム

第6章 産業動向

- イントロダクション

- ペット用サプリメント市場に対する関税の影響

- イントロダクション

- 主な関税率

- ペット用サプリメントの混乱

- 価格の影響の分析

- 各地域への主な影響

- 最終用途産業レベルに対する影響

- バリューチェーン分析

- 研究開発

- 原材料調達

- 製造/生産

- 品質管理・安全性

- ロジスティクス・流通

- マーケティング・セールス

- 最終使用

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業のペットタイプとサプリメントタイプの平均販売価格の動向:ペット用サプリメント製品別

- 平均販売価格の動向:地域別

- エコシステム分析

- デマンドサイド

- サプライサイド

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 購買プロセスにおける主なステークホルダー

- 購買プロセスにおける主なステークホルダー

- 購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 ペット用サプリメント市場:ペットタイプ別

- イントロダクション

- 犬

- 猫

- その他のペットタイプ

第8章 ペット用サプリメント市場:サプリメントタイプ別

- イントロダクション

- ビタミン・マルチビタミン

- プロバイオティクス・プレバイオティクス

- タンパク質・ペプチド

- オメガ3脂肪酸

- その他のサプリメントタイプ

第9章 ペット用サプリメント市場:サプリメント形状別

- イントロダクション

- ソフトチューズ

- 錠剤・カプセル

- 粉末

- その他のサプリメント形状

第10章 ペット用サプリメント市場:機能別

- イントロダクション

- 骨と関節の健康

- 皮膚と被毛の健康

- 消化器系の健康

- 免疫系のサポート

- 心臓の健康

- ストレスと不安の緩和

- 体重管理

- その他の機能

第11章 ペット用サプリメント市場:流通チャネル別

- イントロダクション

- eコマース

- ペット専門店

- スーパーマーケット・ハイパーマーケット

- 動物クリニック

- その他の流通チャネル

第12章 ペット用サプリメント市場:性質別

- イントロダクション

- オーガニック

- 従来式

第13章 ペット用サプリメント市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- オーストラリア・ニュージーランド

- 日本

- タイ

- インド

- インドネシア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- 中東

- アフリカ

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- PURINA

- ZESTY PAWS

- BUCKEYE NUTRITION

- NATURVET

- FERA PETS

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第15章 企業プロファイル

- 主要企業

- NESTLE (NESTLE PURINA PETCARE COMPANY)

- ELANCO

- H&H GROUP

- SWEDENCARE AB

- MARS, INCORPORATED

- GENERAL MILLS INC.

- VIRBAC

- ZOETIS SERVICES LLC

- VETOQUINOL

- WELLNESS PET, LLC

- AFFINITY PETCARE S.A

- NOW FOODS

- FOODSCIENCE

- THORNE VET

- NUTRI-PET RESEARCH, INC.

- その他の企業

- NUTRAMAX LABORATORIES

- VAFO GROUP

- NORDIC NATURALS

- ARK NATURALS

- ANIAMOR

- GROWEL AGROVET

- PET HONESTY

- MCEPHARMA A. S.

- NUTRI-VET

- ADVACARE PHARMA

第16章 隣接市場と関連市場

- イントロダクション

- 調査の限界

- ペットフード原料市場

- 市場の定義

- 市場の概要

- ペットフード原料市場:形状別

- ウェットペットフード市場

- 市場の定義

- 市場の概要

- ウェットペットフード市場:原料別

第17章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2024

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 RESEARCH ASSUMPTIONS

- TABLE 5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- TABLE 6 PET DIETARY SUPPLEMENTS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 7 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 8 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFFS

- TABLE 9 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: PET FOOD & PET SUPPLEMENTS

- TABLE 10 TOP 10 EXPORTERS OF HS CODE 230910, 2020-2024 (USD THOUSAND)

- TABLE 11 TOP 10 EXPORTERS OF HS CODE 230910, 2020-2024 (TON)

- TABLE 12 TOP 10 IMPORTERS OF HS CODE 230910, 2020-2024 (USD THOUSAND)

- TABLE 13 TOP 10 IMPORTERS OF HS CODE 230910, 2020-2024 (TON)

- TABLE 14 AVERAGE SELLING PRICE TREND OF PET DIETARY SUPPLEMENTS AMONG KEY PLAYERS, BY PET AND SUPPLEMENT TYPE, 2024 (USD/TON)

- TABLE 15 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/TON)

- TABLE 16 PET DIETARY SUPPLEMENTS MARKET: ECOSYSTEM

- TABLE 17 LIST OF MAJOR PATENTS PERTAINING TO PET DIETARY SUPPLEMENTS MARKET, 2023-2025

- TABLE 18 PET DIETARY SUPPLEMENTS MARKET: KEY DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 CONTACT INFORMATION FOR BUSINESS OPERATORS FOR INQUIRIES REGARDING PET FOOD/SUPPLEMENTS SAFETY ACT

- TABLE 25 STANDARDS FOR PET DIETARY SUPPLEMENT MANUFACTURERS

- TABLE 26 IMPACT OF PORTER'S FIVE FORCES ON PET DIETARY SUPPLEMENTS MARKET

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SUPPLEMENT TYPE

- TABLE 28 KEY BUYING CRITERIA FOR SUPPLEMENT TYPES OF PET DIETARY SUPPLEMENTS

- TABLE 29 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 30 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 31 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 32 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 33 PET DIETARY SUPPLEMENTS MARKET FOR DOGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 PET DIETARY SUPPLEMENTS MARKET FOR DOGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 PET DIETARY SUPPLEMENTS MARKET FOR DOGS, BY REGION, 2021-2024 (TON)

- TABLE 36 PET DIETARY SUPPLEMENTS MARKET FOR DOGS, BY REGION, 2025-2030 (TON)

- TABLE 37 PET DIETARY SUPPLEMENTS MARKET FOR CATS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 PET DIETARY SUPPLEMENTS MARKET FOR CATS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 PET DIETARY SUPPLEMENTS MARKET FOR CATS, BY REGION, 2021-2024 (TON)

- TABLE 40 PET DIETARY SUPPLEMENTS MARKET FOR CATS, BY REGION, 2025-2030 (TON)

- TABLE 41 PET DIETARY SUPPLEMENTS MARKET FOR OTHER PET TYPES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 PET DIETARY SUPPLEMENTS MARKET FOR OTHER PET TYPES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 PET DIETARY SUPPLEMENTS MARKET FOR OTHER PET TYPES, BY REGION, 2021-2024 (TON)

- TABLE 44 PET DIETARY SUPPLEMENTS MARKET FOR OTHER PET TYPES, BY REGION, 2025-2030 (TON)

- TABLE 45 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 46 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 47 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 48 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 49 PET DIETARY SUPPLEMENT SOFT CHEWS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 PET DIETARY SUPPLEMENT SOFT CHEWS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 PET DIETARY SUPPLEMENT TABLETS & CAPSULES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 PET DIETARY SUPPLEMENT TABLETS & CAPSULES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PET DIETARY SUPPLEMENT POWDERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 PET DIETARY SUPPLEMENT POWDERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OTHER PET DIETARY SUPPLEMENT FORMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 OTHER PET DIETARY SUPPLEMENT FORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 58 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 59 PET DIETARY SUPPLEMENTS MARKET FOR BONE & JOINT HEALTH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 PET DIETARY SUPPLEMENTS MARKET FOR BONE & JOINT HEALTH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 PET DIETARY SUPPLEMENTS MARKET FOR SKIN & COAT HEALTH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 PET DIETARY SUPPLEMENTS MARKET FOR SKIN & COAT HEALTH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 PET DIETARY SUPPLEMENTS MARKET FOR DIGESTIVE HEALTH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 PET DIETARY SUPPLEMENTS MARKET FOR DIGESTIVE HEALTH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 PET DIETARY SUPPLEMENTS MARKET FOR IMMUNE SYSTEM SUPPORT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 PET DIETARY SUPPLEMENTS MARKET FOR IMMUNE SYSTEM SUPPORT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 PET DIETARY SUPPLEMENTS MARKET FOR HEART HEALTH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 PET DIETARY SUPPLEMENTS MARKET FOR HEART HEALTH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 PET DIETARY SUPPLEMENTS MARKET FOR STRESS & ANXIETY RELIEF, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 PET DIETARY SUPPLEMENTS MARKET FOR STRESS & ANXIETY RELIEF, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 PET DIETARY SUPPLEMENTS MARKET FOR WEIGHT MANAGEMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 PET DIETARY SUPPLEMENTS MARKET FOR WEIGHT MANAGEMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 PET DIETARY SUPPLEMENTS MARKET FOR OTHER FUNCTIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 PET DIETARY SUPPLEMENTS MARKET FOR OTHER FUNCTIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 76 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 77 PET DIETARY SUPPLEMENTS MARKET FOR E-COMMERCE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 PET DIETARY SUPPLEMENTS MARKET FOR E-COMMERCE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 PET DIETARY SUPPLEMENTS MARKET THROUGH PET SPECIALTY STORES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 PET DIETARY SUPPLEMENTS MARKET THROUGH PET SPECIALTY STORES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PET DIETARY SUPPLEMENTS MARKET THROUGH SUPERMARKETS & HYPERMARKETS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 PET DIETARY SUPPLEMENTS MARKET THROUGH SUPERMARKETS & HYPERMARKETS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 PET DIETARY SUPPLEMENTS MARKET THROUGH VETERINARY CLINICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 PET DIETARY SUPPLEMENTS MARKET THROUGH VETERINARY CLINICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 PET DIETARY SUPPLEMENTS MARKET THROUGH OTHER DISTRIBUTION CHANNELS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 PET DIETARY SUPPLEMENTS MARKET THROUGH OTHER DISTRIBUTION CHANNELS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (TON)

- TABLE 90 PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 91 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 96 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 97 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 103 US: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 104 US: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 105 US: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 106 US: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 108 CANADA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 109 CANADA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 110 CANADA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 111 MEXICO: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 112 MEXICO: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 120 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 121 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 128 GERMANY: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 131 UK: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 132 UK: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 133 UK: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 134 UK: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 137 FRANCE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 138 FRANCE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 139 ITALY: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 140 ITALY: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ITALY: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 142 ITALY: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 143 SPAIN: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 144 SPAIN: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 145 SPAIN: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 146 SPAIN: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 148 REST OF EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 156 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 157 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 163 CHINA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 164 CHINA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 165 CHINA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 166 CHINA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 167 AUSTRALIA & NEW ZEALAND: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 168 AUSTRALIA & NEW ZEALAND: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 169 AUSTRALIA & NEW ZEALAND: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 170 AUSTRALIA & NEW ZEALAND: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 171 JAPAN: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 172 JAPAN: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 173 JAPAN: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 174 JAPAN: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 175 THAILAND: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 176 THAILAND: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 177 THAILAND: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 178 THAILAND: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 179 INDIA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 180 INDIA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE,

025-2030 (USD MILLION)

- TABLE 181 INDIA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 182 INDIA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 183 INDONESIA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 184 INDONESIA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 185 INDONESIA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 186 INDONESIA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 196 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 197 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 201 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 203 BRAZIL: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 204 BRAZIL: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 205 BRAZIL: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 206 BRAZIL: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 207 ARGENTINA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 208 ARGENTINA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ARGENTINA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 210 ARGENTINA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 211 REST OF SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 215 ROW: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 216 ROW: PET DIETARY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 217 ROW: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 218 ROW: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 219 ROW: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (TON)

- TABLE 220 ROW: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (TON)

- TABLE 221 ROW: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 222 ROW: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 223 ROW: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 224 ROW: PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 225 ROW: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 226 ROW: PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 228 MIDDLE EAST: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 230 MIDDLE EAST: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 231 AFRICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 232 AFRICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 233 AFRICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2021-2024 (USD MILLION)

- TABLE 234 AFRICA: PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025-2030 (USD MILLION)

- TABLE 235 OVERVIEW OF STRATEGIES ADOPTED BY KEY PET DIETARY SUPPLEMENT VENDORS

- TABLE 236 PET DIETARY SUPPLEMENTS MARKET: DEGREE OF COMPETITION

- TABLE 237 PET DIETARY SUPPLEMENTS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 238 PET DIETARY SUPPLEMENTS MARKET: SUPPLEMENT TYPE FOOTPRINT, 2024

- TABLE 239 PET DIETARY SUPPLEMENTS MARKET: PET TYPE FOOTPRINT, 2024

- TABLE 240 PET DIETARY SUPPLEMENTS MARKET: FUNCTION FOOTPRINT, 2024

- TABLE 241 PET DIETARY SUPPLEMENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 242 PET DIETARY SUPPLEMENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 243 PET DIETARY SUPPLEMENTS MARKET: PRODUCT LAUNCHES, APRIL 2023-FERUARY 2025

- TABLE 244 PET DIETARY SUPPLEMENTS MARKET: DEALS, NOVEMBER 2023-JANUARY 2025

- TABLE 245 PET DIETARY SUPPLEMENTS MARKET: EXPANSIONS, JUNE 2024

- TABLE 246 PET DIETARY SUPPLEMENTS MARKET: OTHER DEVELOPMENTS, MAY 2023-FEBRUARY 2025

- TABLE 247 NESTLE (NESTLE PURINA PETCARE COMPANY): BUSINESS OVERVIEW

- TABLE 248 NESTLE (NESTLE PURINA PETCARE COMPANY): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 249 NESTLE (NESTLE PURINA PETCARE COMPANY): PRODUCT LAUNCHES

- TABLE 250 NESTLE (NESTLE PURINA PETCARE COMPANY): OTHER DEVELOPMENTS

- TABLE 251 ELANCO: BUSINESS OVERVIEW

- TABLE 252 ELANCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ELANCO: PRODUCT LAUNCHES

- TABLE 254 H&H GROUP: BUSINESS OVERVIEW

- TABLE 255 H&H GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 SWEDENCARE AB: BUSINESS OVERVIEW

- TABLE 257 SWEDENCARE AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SWEDENCARE AB: DEALS

- TABLE 259 SWEDENCARE AB: EXPANSIONS

- TABLE 260 SWEDENCARE AB: OTHER DEVELOPMENTS

- TABLE 261 MARS, INCORPORATED: BUSINESS OVERVIEW

- TABLE 262 MARS, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 GENERAL MILLS INC.: BUSINESS OVERVIEW

- TABLE 264 GENERAL MILLS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GENERAL MILLS INC.: DEALS

- TABLE 266 VIRBAC: BUSINESS OVERVIEW

- TABLE 267 VIRBAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 VIRBAC: DEALS

- TABLE 269 ZOETIS SERVICES LLC: BUSINESS OVERVIEW

- TABLE 270 ZOETIS SERVICES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 VETOQUINOL: BUSINESS OVERVIEW

- TABLE 272 VETOQUINOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 WELLNESS PET, LLC: BUSINESS OVERVIEW

- TABLE 274 WELLNESS PET, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 WELLNESS PET, LLC: PRODUCT LAUNCHES

- TABLE 276 WELLNESS PET, LLC: DEALS

- TABLE 277 AFFINITY PETCARE S.A: BUSINESS OVERVIEW

- TABLE 278 AFFINITY PETCARE S.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 NOW FOODS: BUSINESS OVERVIEW

- TABLE 280 NOW FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 FOODSCIENCE: BUSINESS OVERVIEW

- TABLE 282 FOODSCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 THORNE VET: BUSINESS OVERVIEW

- TABLE 284 THORNE VET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 NUTRI-PET RESEARCH, INC.: BUSINESS OVERVIEW

- TABLE 286 NUTRI-PET RESEARCH, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 NUTRAMAX LABORATORIES: BUSINESS OVERVIEW

- TABLE 288 NUTRAMAX LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 VAFO GROUP: BUSINESS OVERVIEW

- TABLE 290 VAFO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 VAFO GROUP: DEALS

- TABLE 292 NORDIC NATURALS: BUSINESS OVERVIEW

- TABLE 293 NORDIC NATURALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 ARK NATURALS: BUSINESS OVERVIEW

- TABLE 295 ARK NATURALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ANIAMOR: BUSINESS OVERVIEW

- TABLE 297 ANIAMOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 ADJACENT MARKETS TO PET DIETARY SUPPLEMENTS MARKET

- TABLE 299 PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 300 PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 301 WET PET FOOD MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 302 WET PET FOOD MARKET, BY SOURCE, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 PET DIETARY SUPPLEMENTS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 PET DIETARY SUPPLEMENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 9 PET DIETARY SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 PET DIETARY SUPPLEMENTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

- FIGURE 17 RISING PET HUMANIZATION TO DRIVE GROWTH FOR PET DIETARY SUPPLEMENTS

- FIGURE 18 DOGS SEGMENT AND US TO ACCOUNT FOR LARGEST RESPECTIVE SEGMENTAL SHARES IN NORTH AMERICAN PET DIETARY SUPPLEMENTS MARKET IN 2025

- FIGURE 19 DOGS TO DOMINATE MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 20 VITAMINS & MULTIVITAMINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 SOFT CHEWS TO DOMINATE MARKET AMONG FORMS DURING FORECAST PERIOD

- FIGURE 22 BONE & JOINT HEALTH TO LEAD MARKET AMONG FUNCTIONS DURING FORECAST PERIOD

- FIGURE 23 E-COMMERCE TO LEAD MARKET AMONG DISTRIBUTION CHANNELS DURING FORECAST PERIOD

- FIGURE 24 US TO ACCOUNT FOR LARGEST SHARE (BY VALUE) IN 2025

- FIGURE 25 US: PET OWNERSHIP DEMOGRAPHICS AND EXPENDITURE, 2024 (USD)

- FIGURE 26 US: PET INDUSTRY EXPENDITURES, 2018-2025 (USD BILLION)

- FIGURE 27 MARKET DYNAMICS: PET DIETARY SUPPLEMENTS MARKET

- FIGURE 28 PET OWNERSHIP DEMOGRAPHICS, BY GENERATION, 2024

- FIGURE 29 ADOPTION OF GEN AI IN PET DIETARY SUPPLEMENTS

- FIGURE 30 VALUE CHAIN ANALYSIS: PET DIETARY SUPPLEMENTS MARKET

- FIGURE 31 CAT OR DOG FOOD, PUT UP FOR RETAIL SALE - HS CODE 230910: TOP 5 EXPORTERS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 32 CAT OR DOG FOOD, PUT UP FOR RETAIL SALE - HS CODE 230910: TOP 5 EXPORTERS, BY COUNTRY, 2020-2024 (TON)

- FIGURE 33 CAT OR DOG FOOD, PUT UP FOR RETAIL SALE - HS CODE 230910: TOP 5 IMPORTERS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 CAT OR DOG FOOD, PUT UP FOR RETAIL SALE - HS CODE 230910: TOP 5 IMPORTERS, BY COUNTRY, 2020-2024 (TON)

- FIGURE 35 AVERAGE SELLING PRICE TREND OF PET DIETARY SUPPLEMENTS AMONG KEY PLAYERS, BY PET AND SUPPLEMENT TYPE, 2024 (USD)

- FIGURE 36 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/TON)

- FIGURE 37 KEY PLAYERS IN PET DIETARY SUPPLEMENTS ECOSYSTEM

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 39 NUMBER OF PATENTS GRANTED FOR PET DIETARY SUPPLEMENTS MARKET, 2014-2024

- FIGURE 40 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PET DIETARY SUPPLEMENTS MARKET, 2014-2024

- FIGURE 41 PORTER'S FIVE FORCES ANALYSIS: PET DIETARY SUPPLEMENTS MARKET

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 43 KEY BUYING CRITERIA FOR SUPPLEMENT TYPES

- FIGURE 44 INVESTMENT AND FUNDING SCENARIO, BY KEY COMPANY (USD MILLION)

- FIGURE 45 US: TOTAL NUMBER OF DOGS AND CATS OWNING HOUSEHOLDS (MILLION)

- FIGURE 46 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 47 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 48 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 49 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 50 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 51 PET DIETARY SUPPLEMENTS MARKET SHARE THROUGH E-COMMERCE, BY DISTRIBUTION CHANNEL, 2024

- FIGURE 52 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL PET DIETARY SUPPLEMENTS MARKET FROM 2025 TO 2030

- FIGURE 53 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET SNAPSHOT

- FIGURE 54 US: PET OWNERSHIP TREND, 2018-2025 (MILLION)

- FIGURE 55 US: PET OWNERSHIP SHARE, BY GENERATION, 2024

- FIGURE 56 ASIA PACIFIC: PET DIETARY SUPPLEMENTS MARKET SNAPSHOT

- FIGURE 57 REVENUE ANALYSIS FOR KEY COMPANIES OVER THREE YEARS, 2022-2024 (USD BILLION)

- FIGURE 58 SHARE OF LEADING COMPANIES IN PET DIETARY SUPPLEMENTS MARKET, 2024

- FIGURE 59 COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 60 EV/EBITDA OF MAJOR PLAYERS, 2024

- FIGURE 61 BRAND/PRODUCT COMPARISON ANALYSIS, BY PRODUCT BRAND

- FIGURE 62 PET DIETARY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 PET DIETARY SUPPLEMENTS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 64 PET DIETARY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 NESTLE (NESTLE PURINA PETCARE COMPANY): COMPANY SNAPSHOT

- FIGURE 66 ELANCO: COMPANY SNAPSHOT

- FIGURE 67 H&H GROUP: COMPANY SNAPSHOT

- FIGURE 68 SWEDENCARE AB: COMPANY SNAPSHOT

- FIGURE 69 GENERAL MILLS INC.: COMPANY SNAPSHOT

- FIGURE 70 VIRBAC: COMPANY SNAPSHOT

- FIGURE 71 ZOETIS SERVICES LLC: COMPANY SNAPSHOT

- FIGURE 72 VETOQUINOL: COMPANY SNAPSHOT

The pet dietary supplements market is estimated at USD 2.71 billion in 2025 and is projected to reach USD 4.11 billion by 2030, at a CAGR of 8.7% from 2025 to 2030. Pet owners are increasingly turning to dietary supplements as a proactive measure for their pets to enhance immunity, prevent joint issues, improve digestive health, and manage specific conditions such as allergies or anxiety. Supplements such as vitamins, probiotics, and omega-3 fatty acids are seen not only as solutions to existing health problems but also as tools for long-term well-being. Joint health supplements with ingredients such as glucosamine and chondroitin are increasingly sought after as preventative measures against the natural aging process in pets, particularly in dogs of larger breeds.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/USD Thousand) |

| Segments | By Category, By Power Output, by End-use Application, Kei Cars By Propulsion, Quadricycles by Propulsion, Quadricycles by Classification, and Region |

| Regions covered | Asia, North America, and Europe |

Furthermore, the rise in pet supplements is also influenced by an increase in the availability of tailored, specialized products that address specific health concerns. Companies are now developing formulations that cater to particular life stages (puppies, adult pets, senior pets), dietary restrictions (grain-free, gluten-free), or specific health needs (digestive issues, skin and coat health, cognitive function). This trend toward personalized pet health reflects broader changes in consumer behavior, where customization and specialization are key factors in purchasing decisions.

Disruption in the pet dietary supplements market

The pet dietary supplements market's phase of disruption is marked by evolving consumer preferences, innovative product development, and a shift in retail dynamics. Natural and organic ingredients are becoming increasingly popular as pet owners seek clean-label options. Additionally, there's a growing inclination toward personalized pet nutrition, leveraging technology to deliver supplements tailored to individual pet needs. Startups and niche brands are entering the segment with unique formulations and direct-to-consumer strategies, challenging traditional players. These changes are reshaping the competitive landscape and compelling companies to adapt quickly to stay relevant.

"The tablets and capsules segment holds a significant market share among the supplement form in the pet dietary supplements market."

Tablets and capsules are generally easier to store compared to other forms of supplements, such as powders or liquids. They have a longer shelf life, reducing concerns about spoilage and contamination. Their compact and durable packaging also makes them ideal for travel, allowing pet owners to easily carry the supplements with them, whether on a trip or to the veterinarian's office. These added convenience and portability are significant selling points, especially for pet owners who lead active or mobile lifestyles.

Another factor contributing to the strong position of tablets and capsules is their effectiveness in delivering active ingredients. Many supplements, particularly those targeting joint health, digestive function, or skin conditions, require precise amounts of key nutrients such as glucosamine, chondroitin, omega-3 fatty acids, or probiotics. Tablets and capsules allow these ingredients to be effectively encapsulated, providing a controlled release that maximizes absorption. This is especially beneficial for older pets or those with specific health issues that may require sustained nutrient intake.

"The e-commerce segment accounts for the highest CAGR among the distribution channels in the pet dietary supplements market during the forecast period."

As e-commerce continues to shape consumer purchasing behavior across industries, the pet dietary supplements sector is no exception, with online platforms offering convenience, wider selection, and enhanced shopping experience. The rise of digital channels has transformed the way pet owners discover, compare, and purchase supplements for their pets, making it easier than ever to access a diverse range of products tailored to specific pet health needs.

One of the significant factors fueling the growth of e-commerce distribution in the pet dietary supplements market is the convenience it offers. Pet owners can browse an extensive selection of products from the comfort of their homes, avoiding the time-consuming task of visiting physical stores. This is particularly beneficial for those with busy schedules or living where pet care products are not readily available. The ability to shop anytime, whether during the day, evening, or weekend, adds significant value, catering to the modern consumer's desire for flexibility and convenience.

"The North American region is set to be dominant in the pet dietary supplements market."

The region's pet industry has seen continuous growth, with a growing number of households viewing pets not just as animals, but as integral members of the family. This shift, often referred to as the "humanization of pets," has led to a strong demand for premium pet care products, including dietary supplements aimed at enhancing pets' health and well-being.

The US and Canada, in particular, are home to some of the highest rates of pet ownership globally. According to recent surveys, a significant percentage of households in both countries own pets, with many choosing to invest in products that promote their pets' long-term health. This widespread ownership, coupled with increasing pet care awareness, has translated into heightened demand for specialized supplements. Pet owners are now more focused on preventing health issues before they arise, leading to a growing market for supplements that improve joint health, skin condition, immunity, and overall vitality.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the pet dietary supplements market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Nestle (Nestle Purina Petcare Company) (Switzerland), Elanco (US), H&H Group (Hong Kong), SwedenCare (Sweden), Mars, Incorporated (US), Nutramax Laboratories (US), Virbac (France), General Mills Inc. (US), Zoetis Services LLC (US), Wellness Pet, LLC (US), NOW Foods (US), Vetoquinol (France), Affinity Petcare S.A (Spain), FoodScience (US), and Thorne Vet (US).

Other players include Nutri-Pet Research, Inc. (US), VAFO Group (Czech Republic), Nordic Natural (US), Ark Naturals (US), Aniamor (India), Growelagrovet (India), Pet Honesty (US), mcePharma a. s. (Czech Republic), Nutri+Vet (US), and AdvaCare Pharma (US).

Research Coverage

This research report categorizes the pet dietary supplements market by pet type (dogs, cats, and other pet types), supplement type (vitamins, multivitamins, probiotics & prebiotics, protein & peptides, omega-3 fatty acids, and other supplement types), supplement form (tablets and capsules, powder, soft chews, and other supplement form), function (bone and joint health, digestive health, skin and coat health, immune system support, heart health, stress & anxiety relief, weight management, and other functions), distribution channel (offline and online), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of pet dietary supplements. A thorough analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new product launches, mergers and acquisitions, and recent developments associated with the pet dietary supplements market. This report covers a competitive analysis of upcoming startups in the pet dietary supplements market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall pet dietary supplements and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising pet ownership and humanization of pets), restraints (high cost of premium products), opportunities (rise of e-commerce and direct-to-consumer channels), and challenges (regulatory and labeling complexities) influencing the growth of the pet dietary supplements market

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the pet dietary supplements market

- Market Development: Comprehensive information about lucrative markets - the report analyzes pet dietary supplements across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the pet dietary supplements market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as Nestle (Nestle Purina Petcare Company) (Switzerland), Elanco (US), H&H Group (Hong Kong), SwedenCare (Sweden), Mars, Incorporated (US), and other players in the pet dietary supplements market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET COVERED

- 1.3.2 STUDY YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- 1.4.2 VOLUME UNIT

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PET DIETARY SUPPLEMENTS MARKET PLAYERS

- 4.2 NORTH AMERICA: PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE & COUNTRY

- 4.3 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE & REGION

- 4.4 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE

- 4.5 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM

- 4.6 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION

- 4.7 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 4.8 PET DIETARY SUPPLEMENTS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASE IN PET POPULATION AND PET OWNERSHIP

- 5.2.2 GROWTH OF PET CARE ECONOMY AND PREMIUMIZATION TRENDS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rise in pet ownership and humanization

- 5.3.1.2 Increase in awareness of pet health

- 5.3.1.3 Product innovation in supplement forms

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of premium products

- 5.3.2.2 Lack of veterinarian endorsement

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Expansion of pet dietary supplement use through strategic consumer education

- 5.3.3.2 Expansion of e-commerce platforms

- 5.3.4 CHALLENGES

- 5.3.4.1 Regulatory and labeling complexities

- 5.3.4.2 Intense competition and brand proliferation

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON PET DIETARY SUPPLEMENTS

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN PET DIETARY SUPPLEMENTS

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 AI-POWERED PLATFORM FOR OPTIMIZED PET HEALTH MANAGEMENT

- 5.4.4 IMPACT ON PET DIETARY SUPPLEMENTS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TARIFF IMPACT ON PET DIETARY SUPPLEMENTS MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN PET DIETARY SUPPLEMENT PRODUCTS

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 KEY IMPACTS ON VARIOUS REGIONS

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 China

- 6.2.6 END-USE INDUSTRY-LEVEL IMPACT

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 MANUFACTURING/PRODUCTION

- 6.3.4 QUALITY CONTROL & SAFETY

- 6.3.5 LOGISTICS & DISTRIBUTION

- 6.3.6 MARKETING AND SALES

- 6.3.7 END USE

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO

- 6.4.2 IMPORT SCENARIO

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Precision nutrition platforms

- 6.5.1.2 Microencapsulation

- 6.5.1.3 Biotechnology & functional ingredient development

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 AUGMENTED REALITY (AR) FOR MARKETING

- 6.5.2.2 Smart & sustainable packaging

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Veterinary telemedicine & diagnostics

- 6.5.3.2 Sustainable & alternative ingredient sourcing

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF PET AND SUPPLEMENT TYPE AMONG KEY PLAYERS, BY PET DIETARY SUPPLEMENT PRODUCT

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 6.9 PATENT ANALYSIS

- 6.9.1 LIST OF MAJOR PATENTS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.1.1 US

- 6.11.2.1.2 Association of American Feed Control Officials (AAFCO)

- 6.11.2.2 European Union

- 6.11.2.3 Asia Pacific

- 6.11.2.3.1 China

- 6.11.2.3.2 Japan

- 6.11.2.3.3 India

- 6.11.2.4 South Africa

- 6.11.2.1 North America

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.3 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 K9VITALITY LAUNCHED SUCCESSFUL D2C PET SUPPLEMENT BRAND WITH SPEED, QUALITY, AND CUSTOMER LOYALTY

- 6.14.2 NATURVET REINVENTED ITS BRAND TO CONNECT WITH NEW GENERATION OF PET OWNERS AND RECLAIM MARKET LEADERSHIP

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 PET DIETARY SUPPLEMENTS MARKET, BY PET TYPE

- 7.1 INTRODUCTION

- 7.2 DOGS

- 7.2.1 CANINE OWNERSHIP AND CUSTOMIZED HEALTH SOLUTIONS TO PROPEL DOMINANCE OF DOGS IN DIETARY SUPPLEMENT MARKET

- 7.3 CATS

- 7.3.1 RISE IN HEALTH AWARENESS AND LIFESTYLE SHIFTS TO POSITION CATS AS FASTEST-GROWING SEGMENT

- 7.4 OTHER PET TYPES

8 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT TYPE

- 8.1 INTRODUCTION

- 8.2 VITAMINS & MULTIVITAMINS

- 8.2.1 INCREASE IN DEMAND FOR COMPREHENSIVE HEALTH SUPPORT AND CONVENIENCE TO DRIVE ADOPTION

- 8.3 PROBIOTICS & PREBIOTICS

- 8.3.1 RISE IN AWARENESS OF IMPORTANCE OF DIGESTIVE HEALTH AND GUT MICROBIOTA BALANCE TO FUEL SEGMENT

- 8.4 PROTEIN & PEPTIDES

- 8.4.1 GROWTH IN FOCUS ON FITNESS, RECOVERY, AND OVERALL VITALITY TO DRIVE DEMAND FOR PROTEIN AND PEPTIDE SUPPLEMENTS

- 8.5 OMEGA-3 FATTY ACIDS

- 8.5.1 BENEFITS OF OMEGA-3 FATTY ACIDS IN SUPPORTING JOINT HEALTH, COGNITIVE FUNCTION, AND OVERALL WELL-BEING TO FUEL SEGMENT

- 8.6 OTHER SUPPLEMENT TYPES

9 PET DIETARY SUPPLEMENTS MARKET, BY SUPPLEMENT FORM

- 9.1 INTRODUCTION

- 9.2 SOFT CHEWS

- 9.2.1 PALATABLE AND EASY-TO-ADMINISTER SUPPLEMENT FORMAT TO DRIVE MARKET DOMINANCE

- 9.3 TABLETS & CAPSULES

- 9.3.1 PRECISION DOSAGE PREFERENCE TO FUEL STEADY GROWTH

- 9.4 POWDERS

- 9.4.1 POWDERS OFFER ADAPTABLE NUTRITION FOR HOUSEHOLDS WITH MULTIPLE PETS

- 9.5 OTHER SUPPLEMENT FORMS

10 PET DIETARY SUPPLEMENTS MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 BONE & JOINT HEALTH

- 10.2.1 AGING PET POPULATION, BREED-SPECIFIC VULNERABILITIES, AND INCREASED FOCUS ON PREVENTATIVE CARE TO FUEL SEGMENT

- 10.3 SKIN & COAT HEALTH

- 10.3.1 RIES IN FOCUS ON PET AESTHETICS AND DERMATOLOGICAL WELL-BEING TO DRIVE DEMAND

- 10.4 DIGESTIVE HEALTH

- 10.4.1 INCREASE IN GASTROINTESTINAL ISSUES, EVOLVING PET DIETS, AND GROWING AWARENESS OF GUT HEALTH'S LINK TO OVERALL WELLNESS TO PROPEL SEGMENT

- 10.5 IMMUNE SYSTEM SUPPORT

- 10.5.1 RISE IN HEALTH AWARENESS TO FUEL IMMUNE SUPPLEMENT DEMAND

- 10.6 HEART HEALTH

- 10.6.1 GROWTH IN FOCUS ON BREED-SPECIFIC CARDIAC CARE TO BOOST DEMAND FOR HEART SUPPLEMENTS IN AGING AND AT-RISK PETS

- 10.7 STRESS & ANXIETY RELIEF

- 10.7.1 RISE IN PET ANXIETY IN MODERN LIFESTYLES TO PROPEL GROWTH IN NATURAL CALMING SUPPLEMENT ADOPTION

- 10.8 WEIGHT MANAGEMENT

- 10.8.1 RISE IN PET OBESITY RATES TO FUEL DEMAND FOR FUNCTIONAL SUPPLEMENTS SUPPORTING SAFE AND SUSTAINED WEIGHT CONTROL

- 10.9 OTHER FUNCTIONS

11 PET DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- 11.2 E-COMMERCE

- 11.2.1 E-COMMERCE TO DRIVE GROWTH WITH EXTENSIVE PRODUCT RANGE AND REVIEW BY PET OWNERS

- 11.2.2 THIRD-PARTY CHANNELS

- 11.2.3 DIRECT-TO-CONSUMER (DTC)

- 11.3 PET SPECIALTY STORES

- 11.3.1 NEED TO CATER TO PREMIUM PET HEALTH WITH EXPERT ADVICE AND CURATED PRODUCTS

- 11.4 SUPERMARKETS & HYPERMARKETS

- 11.4.1 GROWTH IN PRESENCE IN E-COMMERCE TO FURTHER STRENGTHEN THEIR ROLE IN MARKET

- 11.5 VETERINARY CLINICS

- 11.5.1 VETERINARY CLINICS' EXPERT-RECOMMENDED SUPPLEMENTS TO WHICH DRIVE SEGMENT

- 11.6 OTHER DISTRIBUTION CHANNELS

12 PET DIETARY SUPPLEMENTS MARKET, BY NATURE

- 12.1 INTRODUCTION

- 12.2 ORGANIC

- 12.3 CONVENTIONAL

13 PET DIETARY SUPPLEMENTS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Growth in pet ownership and changing demographics to drive supplement demand

- 13.2.2 CANADA

- 13.2.2.1 Rise in pet adoption and holistic health trends to strengthen market

- 13.2.3 MEXICO

- 13.2.3.1 Increase in veterinarian engagement and participation of global brands to accelerate growth

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Robust pet ownership, premiumization, and sustainability trends to drive growth of pet dietary supplements in Germany

- 13.3.2 UK

- 13.3.2.1 Rise in pet humanization and demand for preventive pet healthcare to fuel growth

- 13.3.3 FRANCE

- 13.3.3.1 Cultural affinity for natural products and growth in holistic pet care to drive market

- 13.3.4 ITALY

- 13.3.4.1 Increase in senior pet population to propel supplement needs

- 13.3.5 SPAIN

- 13.3.5.1 Health consciousness and expansion of e-commerce channels to drive market in Spain

- 13.3.6 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Strong preference for premium pet products to propel demand for dietary supplements for pets

- 13.4.2 AUSTRALIA & NEW ZEALAND

- 13.4.2.1 Focus on high-quality pet care to fuel adoption of dietary supplements

- 13.4.3 JAPAN

- 13.4.3.1 Emphasis on high-tech, premium products to propel pet dietary supplements market growth

- 13.4.4 THAILAND

- 13.4.4.1 Significant increase in pet ownership, with growing middle class, to contribute to burgeoning demand for dietary supplements

- 13.4.5 INDIA

- 13.4.5.1 Awareness and education around pet wellness, particularly among younger generation, to drive market growth

- 13.4.6 INDONESIA

- 13.4.6.1 E-commerce and accessibility of pet supplements to propel market growth

- 13.4.7 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Regulatory framework and industry evolution to drive market growth

- 13.5.2 ARGENTINA

- 13.5.2.1 Positive momentum in domestic production and export opportunities to fuel market

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 REST OF THE WORLD

- 13.6.1 MIDDLE EAST

- 13.6.1.1 Rise in pet humanization and convenience-driven retail innovations to boost market growth

- 13.6.2 AFRICA

- 13.6.2.1 Demand for natural health solutions to drive market expansion

- 13.6.1 MIDDLE EAST

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2022-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5.1 COMPANY VALUATION

- 14.5.2 FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.6.1 PURINA

- 14.6.2 ZESTY PAWS

- 14.6.3 BUCKEYE NUTRITION

- 14.6.4 NATURVET

- 14.6.5 FERA PETS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Supplement type footprint

- 14.7.5.4 Pet type footprint

- 14.7.5.5 Function footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NESTLE (NESTLE PURINA PETCARE COMPANY)

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 ELANCO

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 H&H GROUP

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 SWEDENCARE AB

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.3.2 Expansions

- 15.1.4.3.3 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 MARS, INCORPORATED

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 GENERAL MILLS INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths/right to win

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses and competitive threats

- 15.1.7 VIRBAC

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.4 MnM view

- 15.1.8 ZOETIS SERVICES LLC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.4 MnM view

- 15.1.8.4.1 Key strengths/right to win

- 15.1.8.4.2 Strategic choices

- 15.1.8.4.3 Weaknesses and competitive threats

- 15.1.9 VETOQUINOL

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.4 MnM view

- 15.1.10 WELLNESS PET, LLC

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.10.3.2 Deals

- 15.1.10.4 MnM view

- 15.1.11 AFFINITY PETCARE S.A

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.4 MnM view

- 15.1.12 NOW FOODS

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.4 MnM view

- 15.1.13 FOODSCIENCE

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.4 MnM view

- 15.1.14 THORNE VET

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.4 MnM view

- 15.1.15 NUTRI-PET RESEARCH, INC.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.4 MnM view

- 15.1.1 NESTLE (NESTLE PURINA PETCARE COMPANY)

- 15.2 OTHER PLAYERS

- 15.2.1 NUTRAMAX LABORATORIES

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.4 MnM view

- 15.2.2 VAFO GROUP

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Deals

- 15.2.2.4 MnM view

- 15.2.3 NORDIC NATURALS

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.4 MnM view

- 15.2.4 ARK NATURALS

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.4 MnM view

- 15.2.5 ANIAMOR

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.4 MnM view

- 15.2.6 GROWEL AGROVET

- 15.2.7 PET HONESTY

- 15.2.8 MCEPHARMA A. S.

- 15.2.9 NUTRI-VET

- 15.2.10 ADVACARE PHARMA

- 15.2.1 NUTRAMAX LABORATORIES

16 ADJACENT & RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 RESEARCH LIMITATIONS

- 16.3 PET FOOD INGREDIENTS MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.3.3 PET FOOD INGREDIENTS MARKET, BY FORM

- 16.4 WET PET FOOD MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- 16.4.3 WET PET FOOD MARKET, BY SOURCE

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS