|

|

市場調査レポート

商品コード

1516505

5G NTNの世界市場:オファリング別、プラットフォーム別、用途別、最終用途産業別、場所別、地域別 - 2029年までの予測5G NTN Market by Offering (Hardware, Software, and Services), End-Use Industry (Maritime, Aerospace & Defense, Government, Mining), Application (EMBB, URLLC, MMTC), Location (Urban, Rural, Remote, Isolated), Platform and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 5G NTNの世界市場:オファリング別、プラットフォーム別、用途別、最終用途産業別、場所別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月11日

発行: MarketsandMarkets

ページ情報: 英文 233 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

5G NTNの市場規模は、2024年に72億米ドル、2029年には317億米ドルと推定され、年間平均成長率(CAGR)は34.7%になるとみられています。

5G NTN産業は、家電製品の急増によって牽引されています。5G対応のスマートフォンやタブレット、その他のガジェットを導入する人が増えるにつれて、広帯域接続のニーズが高まっています。このニーズを満たすため、5G NTNは地方でも高速インターネット接続を提供します。5G NTN市場は、消費者向けアプリケーションとサービスの全く新しい世界を切り開く、この強化されたカバレッジによって大きく発展すると期待されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、プラットフォーム別、用途別、最終用途産業別、場所別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

5G NTN GEO衛星市場は、その明確な利点を活用しています。GEO衛星は赤道直下の高い位置から広範囲をカバーし、信頼性が高いため、遠隔資産監視や海上通信に最適です。新しい衛星コンステレーションを立ち上げる場合、既存のインフラを利用すると初期投資コストが高くなります。しかし、GEO衛星は顧客からの距離が遠いため、遅延が大きく、リアルタイムアプリケーションには不向きです。GEO衛星は、低遅延よりも広いカバレッジが重要なアプリケーション(機内インターネットサービスや遠距離センサーデータのバックホーリングなど)において、特に優れた性能を発揮します。競合する衛星技術の重要性が増しているにもかかわらず、GEO衛星の明確な能力は、市場が変化するにつれて、特定の要求を満たし続けています。

サービス向け5G NTN市場は、ユビキタス接続に対する需要の高まりによって爆発的な成長を遂げています。この需要は、遠隔操作やデータ交換のためにシームレスな世界カバレッジを求める企業、サービスが行き届いていない地域におけるデジタルデバイドの解消に努める政府、あらゆる場所での中断のない高速インターネットアクセスに飢えている消費者から生じています。5G NTNサービス市場は、このようなニーズに対応するさまざまなソリューションを提供しています。これには、5G NTNインフラへのアクセスを提供するネットワーク接続サービスが含まれ、ユーザーは遠隔地でも接続を確保できます。さらに、5G NTNネットワークの計画、設置、管理に不可欠な配備サービスもあり、5G NTNネットワークの潜在能力を最大限に引き出すことができます。このようなサービスの組み合わせにより、5G NTN市場の急速な拡大が促進され、真に世界で中断のない接続性の未来が育まれています。

急速に発展するアジア太平洋の5G NTN市場では、革新的な市場開発と戦略的な投資によって大きな飛躍が遂げられつつあります。中国、韓国、インドはアジア太平洋の主要な収益貢献国です。これらの国々ではスマートデバイスの利用者が大幅に増加しています。

当レポートでは、世界の5G NTN市場について調査し、オファリング別、プラットフォーム別、用途別、最終用途産業別、場所別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 5G NTN技術の簡単な歴史

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- バリューチェーン分析

- 5G NTN市場:エコシステム分析

- 技術分析

- 特許分析

- HSコード

- ケーススタディ分析

- 主な会議とイベント

- 5G NTN市場:ビジネスモデル

- 5G NTN市場におけるベストプラクティス

- 5G NTNツール、フレームワーク、テクニック

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

第6章 5G NTN市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 5G NTN市場、プラットフォーム別

- イントロダクション

- UASプラットフォーム

- LEO衛星

- MEOサテライト

- ジオサテライト

第8章 5G NTN市場、用途別

- イントロダクション

- エンブレム

- MMTC

- URLLC

第9章 5G NTN市場、最終用途産業別

- イントロダクション

- 海事

- 航空宇宙および防衛

- 政府

- 鉱業

- その他

第10章 5G NTN市場、場所別

- イントロダクション

- 都会部

- 田園部

- 遠隔部

- 孤立地域

第11章 5G NTN市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

- ブランド/製品比較

- 企業価値評価と財務指標

第13章 企業プロファイル

- 主要参入企業

- THALES

- ECHOSTAR CORPORATION

- QUALCOMM TECHNOLOGIES

- MEDIATEK

- SPACEX

- KEYSIGHT TECHNOLOGIES

- GATEHOUSE

- SOFTBANK GROUP

- ROHDE & SCHWARZ

- SES

- ZTE

- VIAVI SOLUTIONS INC.

- TELEFONICA

- VIASAT

- GLOBALSTAR

- SPIRENT COMMUNICATIONS

- ERICSSON

- NOKIA

- RADISYS

- TELESAT

- スタートアップ/中小企業

- AST SPACEMOBILE

- ONEWEB

- OMNISPACE

- SKYLO

- SPACEIOT

- SATELIOT

- NELCO

- KUIPER SYSTEMS

第14章 隣接/関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 MARKET FORECAST

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWARE (USD)

- TABLE 4 INDICATIVE PRICING ANALYSIS OF 5G NTN, BY SERVICE (USD)

- TABLE 5 5G NTN MARKET: ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 851761, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE: 851761, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 8 5G NTN MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 IMPACT OF PORTER'S FIVE FORCES ON 5G NTN MARKET

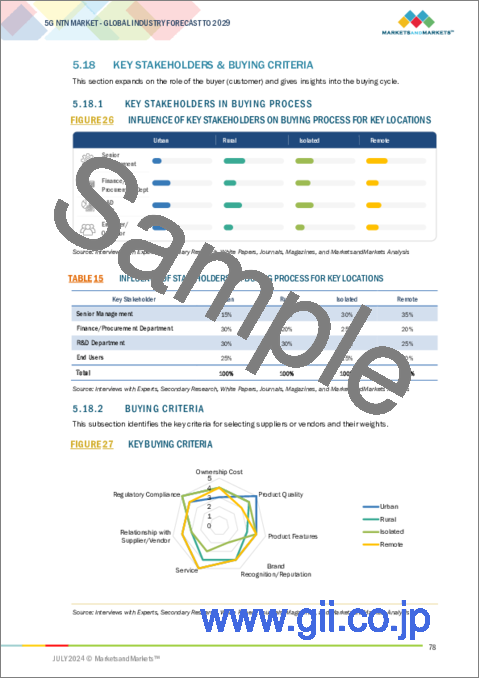

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY LOCATIONS

- TABLE 16 KEY BUYING CRITERIA

- TABLE 17 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 18 HARDWARE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 19 SOFTWARE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 20 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 21 SERVICES: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 22 DEPLOYMENT SERVICES: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 23 CONNECTIVITY SERVICES: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 24 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 25 UAS PLATFORM: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 26 LEO SATELLITE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 27 MEO SATELLITE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 28 GEO SATELLITE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 29 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 30 EMBB: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 31 MMTC: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 32 URLLC: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 33 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 34 MARITIME: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 35 AEROSPACE & DEFENSE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 36 GOVERNMENT: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 37 MINING: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 38 OTHER END-USE INDUSTRIES: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 39 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 40 URBAN: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 41 RURAL: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 42 REMOTE: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 43 ISOLATED: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 44 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: 5G NTN MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 52 EUROPE: 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 53 EUROPE: 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 54 EUROPE: 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 55 EUROPE: 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 56 EUROPE: 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 57 EUROPE: 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 58 EUROPE: 5G NTN MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 59 ASIA PACIFIC: 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 60 ASIA PACIFIC: 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 61 ASIA PACIFIC: 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 63 ASIA PACIFIC: 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 64 ASIA PACIFIC: 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 65 ASIA PACIFIC: 5G NTN MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 66 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 69 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 70 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 72 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 73 LATIN AMERICA: 5G NTN MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 74 LATIN AMERICA: 5G NTN MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 75 LATIN AMERICA: 5G NTN MARKET, BY PLATFORM, 2023-2029 (USD MILLION)

- TABLE 76 LATIN AMERICA: 5G NTN MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- TABLE 77 LATIN AMERICA: 5G NTN MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 78 LATIN AMERICA: 5G NTN MARKET, BY LOCATION, 2023-2029 (USD MILLION)

- TABLE 79 LATIN AMERICA: 5G NTN MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 80 5G NTN MARKET: DEGREE OF COMPETITION

- TABLE 81 OFFERING FOOTPRINT, 2023

- TABLE 82 LOCATION FOOTPRINT, 2023

- TABLE 83 REGIONAL FOOTPRINT, 2023

- TABLE 84 DETAILED LIST OF STARTUPS/SMES, 2023

- TABLE 85 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 86 5G NTN MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2023

- TABLE 87 5G NTN MARKET: DEALS, JANUARY 2021-MARCH 2024

- TABLE 88 THALES: BUSINESS OVERVIEW

- TABLE 89 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 90 THALES: DEALS

- TABLE 91 ECHOSTAR CORPORATION: BUSINESS OVERVIEW

- TABLE 92 ECHOSTAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 ECHOSTAR CORPORATION: PRODUCT LAUNCHES

- TABLE 94 ECHOSTAR CORPORATION: DEALS

- TABLE 95 ECHOSTAR CORPORATION: CONTRACTS

- TABLE 96 QUALCOMM: BUSINESS OVERVIEW

- TABLE 97 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 QUALCOMM: PRODUCT LAUNCHES

- TABLE 99 QUALCOMM: DEALS

- TABLE 100 MEDIATEK: BUSINESS OVERVIEW

- TABLE 101 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 MEDIATEK: PRODUCT LAUNCHES

- TABLE 103 MEDIATEK: DEALS

- TABLE 104 SPACEX: BUSINESS OVERVIEW

- TABLE 105 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 SPACEX: PRODUCT LAUNCHES

- TABLE 107 SPACEX: DEALS

- TABLE 108 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 109 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 111 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 112 GATEHOUSE: BUSINESS OVERVIEW

- TABLE 113 GATEHOUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 GATEHOUSE: DEALS

- TABLE 115 SOFTBANK GROUP: BUSINESS OVERVIEW

- TABLE 116 SOFTBANK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 SOFTBANK GROUP: PRODUCT LAUNCHES

- TABLE 118 SOFTBANK GROUP: DEALS

- TABLE 119 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 120 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 ROHDE & SCHWARZ: DEALS

- TABLE 122 SES: BUSINESS OVERVIEW

- TABLE 123 SES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 SES: DEALS

- TABLE 125 ZTE: BUSINESS OVERVIEW

- TABLE 126 ZTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ZTE: PRODUCT LAUNCHES

- TABLE 128 ZTE: DEALS

- TABLE 129 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2016-2018 (USD MILLION)

- TABLE 130 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- TABLE 131 SOLUTIONS: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2016-2018 (USD MILLION)

- TABLE 132 SOLUTIONS: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 133 SERVICES: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2016-2018 (USD MILLION)

- TABLE 134 SERVICES: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 135 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION, 2016-2018 (USD MILLION)

- TABLE 136 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION, 2019-2025 (USD MILLION)

- TABLE 137 VSAT: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2016-2018 (USD MILLION)

- TABLE 138 VSAT: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 139 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE, 2016-2018 (USD MILLION)

- TABLE 140 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE, 2019-2025 (USD MILLION)

- TABLE 141 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER, 2016-2018 (USD MILLION)

- TABLE 142 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER, 2019-2025 (USD MILLION)

- TABLE 143 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 144 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 145 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 146 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 147 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 148 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 149 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 150 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 151 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 152 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 153 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 154 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 5G NTN MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM HARDWARE, SOFTWARE, AND SERVICES OF 5G NTN MARKET

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (TOP-DOWN)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 LIMITATIONS

- FIGURE 7 5G NTN MARKET, 2024-2029 (USD MILLION)

- FIGURE 8 5G NTN MARKET, BY REGION, 2024

- FIGURE 9 INCREASING DEMAND FOR INTERNET IN REMOTE AND ISOLATED AREAS TO DRIVE MARKET GROWTH

- FIGURE 10 SERVICES SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 11 RURAL SEGMENT ESTIMATED TO LEAD MARKET IN 2024

- FIGURE 12 EMBB SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2029

- FIGURE 13 MARITIME TO ACCOUNT FOR LARGEST MARKET BY 2029

- FIGURE 14 GEO SATELLITE TO ACCOUNT FOR LARGEST MARKET BY 2024

- FIGURE 15 HARDWARE AND GEO SATELLITE SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARES IN 2024

- FIGURE 16 5G NTN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 BRIEF HISTORY OF 5G NTN TECHNOLOGY

- FIGURE 18 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 19 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY HARDWARE

- FIGURE 20 5G NTN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 5G NTN MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 LIST OF MAJOR PATENTS IN 5G NTN MARKET

- FIGURE 23 EXPORT SCENARIO FOR HS CODE: 851761, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 24 IMPORT SCENARIO FOR HS CODE: 851761, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 25 5G NTN MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR KEY LOCATIONS

- FIGURE 27 KEY BUYING CRITERIA

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 LEO SATELLITE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 MMTC SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 AEROSPACE & DEFENSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ISOLATED SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 5G NTN MARKET: REGIONAL SNAPSHOT

- FIGURE 35 5G NTN MARKET, BY REGION, 2024 VS. 2029 (USD MILLION)

- FIGURE 36 NORTH AMERICA: 5G NTN MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: 5G NTN MARKET SNAPSHOT

- FIGURE 38 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 39 SHARE OF LEADING COMPANIES IN 5G NTN MARKET, 2023

- FIGURE 40 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 41 5G NTN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 42 COMPANY FOOTPRINT, 2024

- FIGURE 43 5G NTN MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 COMPANY VALUATION (USD MILLION)

- FIGURE 46 FINANCIAL METRICS OF KEY 5G NTN VENDORS, 2024

- FIGURE 47 THALES: COMPANY SNAPSHOT

- FIGURE 48 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 50 MEDIATEK: COMPANY SNAPSHOT

- FIGURE 51 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 52 SOFTBANK GROUP: COMPANY SNAPSHOT

- FIGURE 53 SES: COMPANY SNAPSHOT

- FIGURE 54 ZTE: COMPANY SNAPSHOT

The 5G NTN market is estimated at USD 7.2 billion in 2024 to USD 31.7 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 34.7%. The 5G NTN industry is being driven by the surge in consumer electronics. The need for pervasive connection is growing as more people embrace 5G-enabled smartphones, tablets, and other gadgets. To fill the need, 5G NTN provides high-speed internet connection even in rural locations. The 5G NTN market is expected to develop significantly due to this enhanced coverage, which opens up a whole new universe of consumer applications and services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By offering, by platform, By application, by end-use industry, by location |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"The GEO satellite segment is expected to hold the largest market size during the forecast period." The 5G NTN GEO satellite market capitalizes on its distinct advantages. GEO satellites provide wide-ranging and reliable coverage from their high equatorial position, making them perfect for remote asset monitoring and marine communications. When launching new satellite constellations, the initial investment costs are higher when using existing infrastructure. However, since they are farther away from customers, GEO satellites have higher latency, which makes them less suitable for real-time applications. They perform particularly well in applications where wide coverage is more important than low latency, including in-flight internet services and distant sensor data backhauling. Notwithstanding the growing importance of competing satellite technologies, the distinct capabilities of GEO satellites continue to meet particular demands as the market changes.

"The services segment to register the fastest growth rate during the forecast period."

The 5G NTN market for services is experiencing explosive growth driven by the increasing demand for ubiquitous connectivity. This demand stems from businesses seeking seamless global coverage for remote operations and data exchange, governments striving to bridge the digital divide in underserved regions, and consumers hungry for uninterrupted high-speed internet access everywhere. The 5G NTN service market offers a range of solutions to address these needs. These include network connectivity services that provide access to 5G NTN infrastructure, ensuring users stay connected even in remote locations. Additionally, deployment services are crucial for planning, installing, and managing 5G NTN networks, ensuring they reach their full potential. This combination of services is fueling rapid expansion in the 5G NTN market, fostering a future of truly global and uninterrupted connectivity.

"Asia Pacific's highest growth rate during the forecast period."

In the rapidly evolving 5G NTN market across Asia-Pacific, significant strides are being made by innovative developments and strategic investments. China, South Korea, and India are the major revenue-contributing countries in the Asia Pacific. These countries have shown a significant rise in smart device users. According to the Ericsson Mobility Report published in June 2022, with the rising adoption of 5G smartphones in Asian countries, 5G subscriptions are expected to reach around 50 million by the end of 2023. The large population in Asia Pacific has created an extensive pool of mobile subscribers for telecom companies. The region is the largest contributor to the total number of mobile subscribers across the globe and will add more subscribers to its network in the coming years. Improving public safety in disasters and other emergencies can also be a major driver in adopting 5G NTN solutions in this region. The Asia Pacific region is witnessing a surge in smart infrastructures, such as smart city projects, creating a greater demand for public safety and security technologies such as surveillance systems, scanning and screening systems, and critical communication networks. Various industries such as aerospace, maritime, defense, and others are adopting integrated 5G network and satellite-based solutions to enhance network coverage in diverse locations. In the marine industry, maritime satellite technology has been adopted to leverage advanced communication networks to establish communication with employees working at remote offshore locations.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the 5G NTN market.

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 35%, Asia Pacific - 25%, RoW- 10%,

The major players in the 5G NTN market include Qualcomm Technologies Inc (US), SoftBank Group Corporation (Japan), Thales Group (France), Rohde & Schwarz GmbH & Co KG (Germany), Keysight Technologies, Inc (US), MediaTek Inc. (Taiwan), SES S.A. (Luxembourg), EchoStar Corporation (US), SpaceX (US), AST SpaceMobile (US), ZTE Corporation (China), GateHouse SatCom (Denmark), OneWeb (UK), Omnispace LLC (US), Nelco (India), Skylo Technologies (US), Globalstar Inc (US), Spirent Communications (UK), Ericsson (Sweden), Nokia Corporation (Finland), Telefonica S.A. (Spain), Viasat Inc, (US), Telesat (Canada), Kuiper Systems (US), Sateliot (Spain), VIAVI Solutions (US), Radisys (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their 5G NTN market footprint.

Research Coverage

The market study covers the 5G NTN market size across different segments. It aims at estimating the market size and the growth potential across different segments, including By offering (hardware, software, services), by platform (UAS, LEO Satellite, MEO satellite, GEO satellite), By application (eMBB, mMTC, URLLC), by end-use Industry (maritime, aerospace & defense, government, mining, other end-use industries) by vertical ( urban, rural, remote, isolated) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global 5G NTN market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (Adoption of software-centric approach, Need to address extreme coverage extension, 3GPP evolution toward NTN interworking and integration, Growing demand for IoT), restraints (Need for radio components to be grounded, Regulatory constraints), opportunities (Impact of NR-NTN integration on 5G connectivity, Need for NTN in the evolution toward 5G and 6G, 5G NB-IoT NTN to contribute to global high speed), and challenges (Signal interception, Propagation delay and low latency due to great distance between satellites and terrestrial user equipment) influencing the growth of the 5G NTN market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 5G NTN market.

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the 5G NTN market across various regions.

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the 5G NTN market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading include Qualcomm Technologies Inc (US), SoftBank Group Corporation (Japan), Thales Group (France), Rohde & Schwarz GmbH & Co KG (Germany), Keysight Technologies, Inc (US), MediaTek Inc. (Taiwan), SES S.A. (Luxembourg), EchoStar Corporation (US), SpaceX (US), AST SpaceMobile (US), ZTE Corporation (China), GateHouse SatCom (Denmark), OneWeb (UK), Omnispace LLC (US), Nelco (India), Skylo Technologies (US), Globalstar Inc (US), Spirent Communications (UK), Ericsson (Sweden), Nokia Corporation (Finland), Telefonica S.A. (Spain), Viasat Inc, (US), Telesat (Canada), Kuiper Systems (US), Sateliot (Spain), VIAVI Solutions (US), Radisys (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 5G NTN MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (TOP-DOWN)

- 2.2.4 5G NTN MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.2.5 MARKET FORECAST

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION ON 5G NTN MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN 5G NTN MARKET

- 4.2 5G NTN MARKET, BY OFFERING

- 4.3 5G NTN MARKET, BY LOCATION

- 4.4 5G NTN MARKET, BY APPLICATION

- 4.5 5G NTN MARKET, BY END-USE INDUSTRY

- 4.6 5G NTN MARKET, BY PLATFORM

- 4.7 NORTH AMERICA: 5G NTN MARKET, BY OFFERING AND KEY PLATFORM

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of software-centric approach

- 5.2.1.2 Need to address extreme coverage extension

- 5.2.1.3 3GPP evolution toward NTN interworking and integration

- 5.2.1.4 Growing demand for IoT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Need for radio components to be grounded

- 5.2.2.2 Regulatory constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Impact of NR-NTN integration on 5G connectivity

- 5.2.3.2 Need for NTN in evolution toward 5G and 6G

- 5.2.3.3 5G NB-IoT NTN to contribute to global high speed

- 5.2.4 CHALLENGES

- 5.2.4.1 Signal interception

- 5.2.4.2 Propagation delay and low latency due to great distance between satellites and terrestrial user equipment

- 5.2.4.3 Doppler frequency shift owing to mobility issues

- 5.2.1 DRIVERS

- 5.3 BRIEF HISTORY OF 5G NTN TECHNOLOGY

- 5.3.1 2000-2015

- 5.3.2 2016-2018

- 5.3.3 2019-2021

- 5.3.4 2022-2023

- 5.3.5 2024-PRESENT

- 5.4 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWARE

- 5.5.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SERVICE

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 5G NTN MARKET: ECOSYSTEM ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Satellite communications

- 5.8.1.2 IoT

- 5.8.1.3 High-Altitude Platforms (HAPs)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Wi-Fi

- 5.8.2.2 Cloud computing

- 5.8.2.3 Fiber optic

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Artificial Intelligence and Machine Learning

- 5.8.3.2 Edge computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 LIST OF MAJOR PATENTS GRANTED, 2022-2023

- 5.10 HS CODES

- 5.10.1 EXPORT SCENARIO FOR HS CODE: 851761

- 5.10.2 IMPORT SCENARIO FOR HS CODE: 851761

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CASE STUDY 1: KEYSIGHT TECHNOLOGIES AND QUALCOMM TECHNOLOGIES ESTABLISHED END-TO-END 5G NTN CONNECTION

- 5.11.2 CASE STUDY 2: ERICSSON, QUALCOMM, AND THALES COLLABORATED TO PROVIDE GLOBAL COVERAGE THROUGH 5G SMARTPHONES

- 5.11.3 CASE STUDY 3: SMART AND OMNISPACE TEAMED UP TO EXPLORE SPACE-BASED 5G TECHNOLOGIES

- 5.11.4 CASE STUDY 4: T-MOBILE AND SPACEX COLLABORATED TO PROVIDE TEXT COVERAGE AND OFFER NO-DEAD ZONES

- 5.11.5 CASE STUDY 5: ZTE CORPORATION AND CHINA MOBILE SHOWCASED FIRST 5G NTN FIELD TRIAL

- 5.12 KEY CONFERENCES & EVENTS

- 5.13 5G NTN MARKET: BUSINESS MODELS

- 5.13.1 SATELLITE INTERNET SERVICE PROVIDERS (ISPS)

- 5.13.2 AERIAL NETWORK PROVIDERS

- 5.13.3 ENTERPRISE SOLUTIONS

- 5.13.4 SUBSCRIPTION-BASED SERVICES

- 5.13.5 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

- 5.14 BEST PRACTICES IN 5G NTN MARKET

- 5.14.1 STRATEGIC DEPLOYMENT PLANNING

- 5.14.2 TECHNOLOGY INTEGRATION

- 5.14.3 ADVANCED ANTENNA AND MODEM TECHNOLOGIES

- 5.14.4 EFFICIENT SPECTRUM MANAGEMENT

- 5.14.5 ROBUST BACKHAUL SOLUTIONS

- 5.14.6 POWER MANAGEMENT AND SUSTAINABILITY

- 5.14.7 SECURITY AND PRIVACY

- 5.14.8 COLLABORATIONS AND PARTNERSHIPS

- 5.14.9 ROBUST API DOCUMENTATION

- 5.14.10 USER EXPERIENCE AND FEEDBACK

- 5.15 5G NTN TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 REGULATIONS, BY REGION

- 5.16.2.1 North America

- 5.16.2.1.1 US

- 5.16.2.1.2 Canada

- 5.16.2.2 Europe

- 5.16.2.3 Asia Pacific

- 5.16.2.3.1 China

- 5.16.2.3.2 Australia

- 5.16.2.3.3 Japan

- 5.16.2.4 Middle East & Africa

- 5.16.2.4.1 UAE

- 5.16.2.4.2 KSA

- 5.16.2.5 Latin America

- 5.16.2.5.1 Mexico

- 5.16.2.1 North America

- 5.17 PORTER'S FIVE FORCES ANALYSIS

- 5.17.1 THREAT OF NEW ENTRANTS

- 5.17.2 THREAT OF SUBSTITUTES

- 5.17.3 BARGAINING POWER OF BUYERS

- 5.17.4 BARGAINING POWER OF SUPPLIERS

- 5.17.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.18 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 INVESTMENT & FUNDING SCENARIO

6 5G NTN MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: 5G NTN MARKET DRIVERS

- 6.2 HARDWARE

- 6.2.1 SHIFT TOWARD 5G NTN HARDWARE INSTALLATION TO ENHANCE NETWORK COVERAGE

- 6.3 SOFTWARE

- 6.3.1 SOFTWARE SOLUTIONS TO ENSURE SEAMLESS CONNECTIVITY IN REMOTE LOCATIONS

- 6.4 SERVICES

- 6.4.1 DEMAND FOR UNINTERRUPTED CONNECTIVITY IN UNDERSERVED AREAS TO DRIVE MARKET FOR 5G NTN SERVICES

- 6.4.2 DEPLOYMENT SERVICES

- 6.4.3 CONNECTIVITY SERVICES

7 5G NTN MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.1.1 PLATFORMS: 5G NTN MARKET DRIVERS

- 7.2 UAS PLATFORM

- 7.2.1 FOCUS ON SUPPORTING AIRBORNE COMMUNICATION TO SPUR GROWTH

- 7.3 LEO SATELLITE

- 7.3.1 LEO SATELLITES PROVIDE CONNECTIVITY COVERAGE AT ALTITUDES RANGING FROM 300 TO 1500 KM

- 7.4 MEO SATELLITE

- 7.4.1 MEO SATELLITES HAVE LOWER ORBITS THAN GEO SATELLITES, REDUCING RF POWER REQUIREMENTS AND COMMUNICATION DELAYS

- 7.5 GEO SATELLITE

- 7.5.1 GEO PLATFORMS SUPPORT AND ENHANCE NETWORK COVERAGE IN REMOTE, ISOLATED, AND UNDERSERVED AREAS

8 5G NTN MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATIONS: 5G NTN MARKET DRIVERS

- 8.2 EMBB

- 8.2.1 NEED TO OFFER HIGH-SPEED BROADBAND CONNECTIVITY IN DENSELY POPULATED AREAS TO PROPEL GROWTH

- 8.3 MMTC

- 8.3.1 NEED FOR SCALABLE AND EFFICIENT CONNECTIVITY OF MANY DEVICES TO BOOST MARKET EXPANSION

- 8.4 URLLC

- 8.4.1 URLLC PROVIDES DATA TRANSMISSION WITH HIGH RELIABILITY IN 5G NTN SYSTEMS

9 5G NTN MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.1.1 END-USE INDUSTRIES: 5G NTN MARKET DRIVERS

- 9.2 MARITIME

- 9.2.1 ENHANCED 5G NETWORK COVERAGE TO SUPPORT TRACKING AND MONITORING IN MARITIME INDUSTRY

- 9.2.2 USE CASES

- 9.2.2.1 Vessel Connectivity

- 9.2.2.2 Port Operations Optimization

- 9.3 AEROSPACE & DEFENSE

- 9.3.1 INCREASING ADOPTION OF INNOVATIVE TECHNOLOGY AND DIGITALIZED SOLUTIONS TO DRIVE MARKET

- 9.3.2 USE CASES

- 9.3.2.1 Military Tactical Communication

- 9.3.2.2 Airborne Command and Control

- 9.3.2.3 Defense Surveillance and Reconnaissance

- 9.4 GOVERNMENT

- 9.4.1 RISING NEED FOR IMPROVED SAFETY AND SECURITY OF GOVERNMENT NETWORKS TO BOOST MARKET

- 9.4.2 USE CASES

- 9.4.2.1 Disaster Response Coordination

- 9.4.2.2 Remote Governance and Public Services

- 9.5 MINING

- 9.5.1 ADOPTION OF 5G CONNECTIVITY IN MINING SECTOR TO FACILITATE WORKER SAFETY

- 9.5.2 USE CASES

- 9.5.2.1 Remote Equipment Monitoring

- 9.5.2.2 Environmental Monitoring

- 9.6 OTHER END-USE INDUSTRIES

- 9.6.1 USE CASES

- 9.6.1.1 Smart Warehousing

- 9.6.1.2 Wildfire Detection and Prevention

- 9.6.1.3 Autonomous Driving

- 9.6.1.4 Real-Time Patient Monitoring

- 9.6.1 USE CASES

10 5G NTN MARKET, BY LOCATION

- 10.1 INTRODUCTION

- 10.1.1 LOCATIONS: 5G NTN MARKET DRIVERS

- 10.2 URBAN

- 10.2.1 HIGH-SPEED INTERNET CONNECTIVITY TO STRENGTHEN SMART INFRASTRUCTURE IN URBAN AREAS

- 10.3 RURAL

- 10.3.1 FOCUS ON ELIMINATING DIGITAL DIVIDE IN RURAL AREAS TO ENCOURAGE ADOPTION OF 5G NTN SYSTEMS

- 10.4 REMOTE

- 10.4.1 5G NTN SYSTEMS SUPPORT MOVEMENT OF WORKERS FROM URBAN TO REMOTE AREAS

- 10.5 ISOLATED

- 10.5.1 5G NTN SERVICES PROVIDE 5G COVERAGE IN ISOLATED AREAS

11 5G NTN MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: 5G NTN MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- 11.2.3 US

- 11.2.3.1 Remarkable growth of smart connected devices to boost market growth

- 11.2.4 CANADA

- 11.2.4.1 Improvement in network connectivity in rural areas to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: 5G NTN MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- 11.3.3 UK

- 11.3.3.1 Deployment of 5G services to help reduce carbon emission

- 11.3.4 GERMANY

- 11.3.4.1 Initiatives by government to expand 5G coverage to spur growth

- 11.3.5 FRANCE

- 11.3.5.1 Advanced economy and flourishing IT market to drive use of 5G NTN systems

- 11.3.6 ITALY

- 11.3.6.1 Government initiatives and funding to drive use of 5G NTN systems

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: 5G NTN MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- 11.4.3 CHINA

- 11.4.3.1 Successful field trial of 5G NTN to demonstrate communication services

- 11.4.4 INDIA

- 11.4.4.1 Increasing focus on smart infrastructure development to lead to adoption of 5G NTN services

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Demand for 5G and 6G wireless technology to drive market

- 11.4.6 JAPAN

- 11.4.6.1 Strategic collaborations and 5G NTN advancements to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: 5G NTN MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 UAE

- 11.5.3.1.1 Government initiatives and major companies to drive growth

- 11.5.3.2 Saudi Arabia

- 11.5.3.2.1 Initiatives by major players to drive growth

- 11.5.3.3 Rest of GCC Countries

- 11.5.3.1 UAE

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Focus of rural connectivity to drive growth of market

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: 5G NTN MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- 11.6.3 BRAZIL

- 11.6.3.1 Increased investment in digital infrastructure to drive demand for 5G NTN solutions

- 11.6.4 MEXICO

- 11.6.4.1 Focus of select companies on enhancing network connectivity to propel market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY 5G NTN PLAYERS

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company Footprint

- 12.5.5.2 Offering Footprint

- 12.5.5.3 Location Footprint

- 12.5.5.4 Regional Footprint

- 12.6 STARTUP/SME EVALUATION MATRIX, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPANY VALUATION AND FINANCIAL METRICS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 THALES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ECHOSTAR CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices made

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 QUALCOMM TECHNOLOGIES

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices made

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MEDIATEK

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices made

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SPACEX

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices made

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KEYSIGHT TECHNOLOGIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 GATEHOUSE

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 SOFTBANK GROUP

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 ROHDE & SCHWARZ

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 SES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 ZTE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.12 VIAVI SOLUTIONS INC.

- 13.1.13 TELEFONICA

- 13.1.14 VIASAT

- 13.1.15 GLOBALSTAR

- 13.1.16 SPIRENT COMMUNICATIONS

- 13.1.17 ERICSSON

- 13.1.18 NOKIA

- 13.1.19 RADISYS

- 13.1.20 TELESAT

- 13.1.1 THALES

- 13.2 STARTUPS/SMES

- 13.2.1 AST SPACEMOBILE

- 13.2.2 ONEWEB

- 13.2.3 OMNISPACE

- 13.2.4 SKYLO

- 13.2.5 SPACEIOT

- 13.2.6 SATELIOT

- 13.2.7 NELCO

- 13.2.8 KUIPER SYSTEMS

14 ADJACENT/RELATED MARKETS

- 14.1 MARITIME SATELLITE COMMUNICATION

- 14.1.1 MARKET OVERVIEW

- 14.1.2 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT

- 14.1.3 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION

- 14.1.4 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE

- 14.1.5 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER

- 14.2 NANOSATELLITE AND MICROSATELLITE MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT

- 14.2.3 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE

- 14.2.4 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE

- 14.2.5 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION

- 14.2.6 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL

- 14.2.7 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS