|

|

市場調査レポート

商品コード

1415815

甘味料市場:タイプ別(高強度甘味料、低強度甘味料)、製品別(ショ糖、高フルクトースコーンシロップ、天然甘味料、ポリオール、人工甘味料、新規甘味料)、形態別、用途別、販売チャネル別、地域別-2028年までの予測Sweeteners Market by Type (High-intensity & Low-intensity sweeteners), Product (Sucrose, High-fructose corn syrup, Natural sweeteners, Polyols, Artificial & Novel sweeteners), Form, Application, Sales Channel and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 甘味料市場:タイプ別(高強度甘味料、低強度甘味料)、製品別(ショ糖、高フルクトースコーンシロップ、天然甘味料、ポリオール、人工甘味料、新規甘味料)、形態別、用途別、販売チャネル別、地域別-2028年までの予測 |

|

出版日: 2024年01月16日

発行: MarketsandMarkets

ページ情報: 英文 415 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | タイプ別、製品別、形態別、販売チャネル別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

甘味料の市場規模は2023年の1,158億米ドルから2028年には1,447億米ドルに成長し、予測期間の2023年~2028年のCAGRは4.6%と予測されています。

甘味料市場は、食品・飲料業界における食卓糖と砂糖代替品の用途拡大により、力強い成長を遂げています。健康志向の消費者動向と砂糖の過剰摂取が健康に与える影響に対する懸念の高まりにより、砂糖代替品への需要が急増しています。その結果、ステビア、エリスリトール、モンクフルーツなどの様々な砂糖代替品が人気を集めており、カロリーが少ないかゼロで甘味を提供しています。食品・飲料メーカーは、低カロリー製品や砂糖不使用製品に対する需要の高まりに対応するため、これらの代替食品を取り入れています。同時に、伝統的なテーブルシュガーは、特に製パンや菓子類の分野で広く使われ続けています。砂糖の多用途性は、風味と食感を高める役割とともに、その継続的な関連性を保証しています。伝統的な砂糖と砂糖代替品の両方の利用が増加するというこの二重の動向は、甘味料市場全体の成長を促進し、消費者に多様な選択肢を提供すると同時に、進化する食品と飲料の状況における健康と味覚の嗜好に対応しています。

ショ糖は、いくつかの説得力のある理由により、甘味料市場で最大のシェアを維持する構えです。一般にテーブルシュガーとして知られる天然の二糖類であるショ糖は、消費者に広く受け入れられ、様々な食品・食品・飲料用途の定番となっています。その汎用性は、味覚プロファイルの向上から、無数の製品における食感や色の提供にまで及んでいます。ショ糖固有の甘味と親しみやすさが消費者に好まれ、その用途は製パン、菓子類、飲料など幅広い産業に及んでいます。

さらに、食品の全体的な感覚を保持し、向上させるショ糖の機能性が、その永続的な市場支配に寄与しています。代替甘味料が人気を集めている一方で、ショ糖は数多くの製剤の主要成分であり続けています。ショ糖の永続的な需要は、料理用途におけるその代えがたい役割と相まって、ダイナミックに進化する甘味料市場で最大のシェアを獲得し維持するトップランナーとして位置づけられています。

米国は甘味料市場において最大のシェアを占めると予測されており、これは米国の成人や若年層が常に1日の推奨添加糖摂取量を超えている状況における代替品への差し迫ったニーズを反映しています。大人は推奨量の2~3倍、子供は1日平均ティースプーン16杯(米国心臓協会による)を摂取しており、低カロリーで砂糖不使用の選択肢に対する需要が高まっています。砂糖の大量摂取に伴う健康リスク、特に添加砂糖の47%が含まれる飲料における健康リスクに対する意識の高まりが、甘味料市場の成長を後押ししています。消費者がより健康的な選択肢を求め、食品・飲料業界が進化する嗜好に適応するにつれて、砂糖代替品を含む甘味料の需要は増加傾向にあります。米国市場の広大な規模と健康志向の動向への対応が、甘味料市場の大きなシェアを牽引しています。

当レポートでは、世界の甘味料市場について調査し、タイプ別、製品別、形態別、販売チャネル別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- フレーバーモジュレーション

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- 生態系/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

第7章 甘味料市場、用途別

- イントロダクション

- 食品

- 飲料

- パーソナルケア

- 医薬品

- その他

第8章 甘味料市場、製品別

- イントロダクション

- ショ糖

- 高フルクトースコーンシロップ

- 天然甘味料

- 人工甘味料

- 新規甘味料

- ポリオール

第9章 甘味料市場、タイプ別

- イントロダクション

- 高強度甘味料

- 低強度甘味料

第10章 甘味料市場、形態別

- イントロダクション

- 粉末

- 液体

- 結晶

第11章 甘味料市場、販売チャネル別

- イントロダクション

- 直接(B2B)

- 間接(B2C)

第12章 甘味料市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要参入企業の戦略/強み

- 収益分析

- 主要企業の年間収益VS.成長

- 主要企業のEBITDA

- 主要な市場参入企業の世界スナップショット

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- CARGILL, INCORPORATED

- ADM

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- INGREDION INCORPORATED

- TATE & LYLE

- ASSOCIATED BRITISH FOODS PLC

- GIVAUDAN

- FIRMENICH SA

- SYMRISE

- SUDZUCKER AG

- AJINOMOTO CO., INC.

- ZYDUS WELLNESS

- TEREOS

- ROQUETTE FRERES

- MACANDREWS & FORBES HOLDINGS INCORPORATED

- FOODCHEM INTERNATIONAL CORPORATION

- JK SUCRALOSE INC.

- ZUCHEM

- MANE SA

- DOHLER GMBH

- その他の企業

- ECOGREEN OLEOCHEMICALS

- SUMINTER INDIA ORGANICS

- TAG INGREDIENTS INDIA PVT. LTD.

- THE REAL STEVIA COMPANY AB

- SWEETLY STEVIAUSA

- STEVIA HUB INDIA

- PYURE BRANDS

- XILINAT

- FOODITIVE GROUP

- SAGANA

第15章 隣接市場および関連市場

第16章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD) |

| Segments | By Type, Product, Form, Sales Channel, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

The sweeteners market is projected to grow to USD 144.7 billion in 2028 from USD 115.8 billion in 2023 at a CAGR of 4.6% during the forecast period 2023-2028. The sweeteners market is experiencing robust growth due to the expanded application of both table sugar and sugar substitutes in the food and beverage industry. Health-conscious consumer trends and increasing concerns about the impact of excessive sugar consumption on health have led to a surge in demand for sugar alternatives. As a result, various sugar substitutes such as stevia, erythritol, and monk fruit are gaining popularity, providing sweetness with fewer or no calories. Food and beverage manufacturers are incorporating these substitutes to meet the rising demand for reduced-calorie and sugar-free products. Simultaneously, traditional table sugar continues to find extensive use, especially in the baking and confectionery sectors. The versatility of sugar, along with its role in enhancing flavor and texture, ensures its continued relevance. This dual trend-increased utilization of both traditional sugar and sugar substitutes-drives the overall growth of the sweeteners market, offering consumers a diverse range of options while addressing health and taste preferences in the evolving food and beverage landscape.

"Sucrose is expected to be one of the largest sub-segments in the market."

Sucrose is poised to maintain the largest share in the sweeteners market for several compelling reasons. As a natural disaccharide commonly known as table sugar, sucrose possesses widespread consumer acceptance and is a staple in various food and beverage applications. Its versatility extends from enhancing taste profiles to providing texture and color in a myriad of products. The inherent sweetness and familiarity associated with sucrose make it a preferred choice among consumers, and its application extends across a broad spectrum of industries, including baking, confectionery, and beverages.

Moreover, sucrose's functionality in preserving and enhancing the overall sensory experience of food products contributes to its enduring market dominance. While alternative sweeteners are gaining popularity, sucrose continues to be a key ingredient in numerous formulations. The enduring demand for sucrose, coupled with its irreplaceable role in culinary applications, positions it as a frontrunner in capturing and maintaining the largest share in the dynamic and evolving sweeteners market.

"US is projected to have the largest share during the forecast period."

US is anticipated to command the largest share in the sweeteners market, reflecting the pressing need for alternatives in a landscape where American adults and young individuals consistently exceed recommended daily added sugar intake. With adults consuming 2-3 times the recommended amount and children averaging 16 teaspoons daily (according to The American Heart Association), there is a heightened demand for low-calorie and sugar-free options. This surge in awareness regarding the health risks associated with high sugar consumption, particularly in beverages where 47% of added sugars are found, propels the growth of the sweeteners market. As consumers seek healthier choices and the food and beverage industry adapts to evolving preferences, the demand for sweeteners, including sugar substitutes, is on the rise. U.S. market's expansive size and responsiveness to health-conscious trends is driving the substantial share of the sweeteners market.

The break-up of the profile of primary participants in the sweeteners market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: CXOs - 25%, Managers - 50%, Executives-25%

- By Region: North America - 25%, Europe - 25%, Asia Pacific - 40%, and Rest of the World - 10%

Prominent companies include Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), Ingredion Incorporated (US), Tate & Lyle (UK), Associated British Foods (UK), Sudzucker AG (Germany), and Ajinomoto Co., Inc. (Japan).

Research Coverage:

This research report classifies the dairy processing equipment market based on various factors, including by type (High-intensity sweeteners, Low-intensity sweeteners), product (Sucrose, High-fructose corn syrup, Natural sweeteners, Artificial sweeteners, Novel sweeteners, and Polyols), form (Liquid, Powder, and Crystals), sales channel (Direct, Indirect), application (Food, Beverages, Personal Care, Pharmaceuticals, and Other applications) and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). The report provides comprehensive insights into market dynamics, encompassing drivers, limitations, challenges, and opportunities that influence the growth of the sweeteners market. Additionally, it offers a thorough analysis of key industry players, their business profiles, solutions, services, strategies, contracts, partnerships, agreements, new product launches, mergers, acquisitions, and recent developments in the sweeteners market. The report also includes a competitive analysis of emerging startups within the sweeteners market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall sweeteners market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing incidence of obesity and diabetes), restraints (Ambiguity in the minds of consumers associated with natural sweeteners consumption), opportunities (Government regulations on sugar content), and challenges (Product labeling and claim issues) influencing the growth of the sweeteners market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the sweeteners market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the sweeteners market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the sweeteners market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), Ingredion Incorporated (US), Tate & Lyle (UK), Associated British Foods (UK), Sudzucker AG (Germany), and Ajinomoto Co., Inc. (Japan) in the sweeteners market strategies. The report also helps stakeholders understand the sweeteners market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY/VALUE CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.6 VOLUME UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SWEETENERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH (DEMAND SIDE)

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.3 SUPPLY SIDE ANALYSIS

- FIGURE 5 SWEETENERS MARKET SIZE CALCULATION: SUPPLY SIDE

- 2.3 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACRO-INDICATORS OF RECESSION

- FIGURE 7 SWEETENERS MARKET: MAJOR INDICATORS OF RECESSION

- FIGURE 8 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 9 GLOBAL GROSS DOMESTIC PRODUCT, 2011-2021 (USD TRILLION)

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON SWEETENERS MARKET

- FIGURE 11 GLOBAL SWEETENERS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 SWEETENERS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 12 SWEETENERS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 SWEETENERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 SWEETENERS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 SWEETENERS MARKET, BY SALES CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 SWEETENERS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 SWEETENERS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SWEETENERS MARKET

- FIGURE 18 INCREASED DEMAND DRIVEN BY CONSUMER PREFERENCE FOR HEALTHIER OPTIONS AND ONGOING INNOVATIONS IN FORMULATIONS TO DRIVE MARKET

- 4.2 SWEETENERS MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 19 US AND INDIA TO BE LUCRATIVE MARKETS IN 2023

- 4.3 ASIA PACIFIC: SWEETENERS MARKET, BY KEY COUNTRY AND PRODUCT

- FIGURE 20 SUCROSE SEGMENT AND INDIA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- 4.4 SWEETENERS MARKET, BY PRODUCT

- FIGURE 21 SUCROSE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 SWEETENERS MARKET, BY TYPE

- FIGURE 22 HIGH-INTENSITY SWEETENERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 SWEETENERS MARKET, BY FORM

- FIGURE 23 POWDER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 SWEETENERS MARKET, BY SALES CHANNEL

- FIGURE 24 DIRECT (B2B) SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.8 SWEETENERS MARKET, BY APPLICATION

- FIGURE 25 BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 FLUCTUATIONS IN PRICES AND SUPPLY OF CONVENTIONAL SUGAR TO DRIVE DEMAND FOR SWEETENERS

- FIGURE 26 FRP OF SUGARCANE PAYABLE BY SUGAR FACTORIES IN INDIA, 2010-2023 (INR/QUINTAL)

- 5.2.2 RISING APPETITE FOR SWEETENERS WITH GLOBAL INCREASE IN POPULATION AND GDP

- FIGURE 27 GLOBAL POPULATION GROWTH, 1950-2050 (BILLION)

- FIGURE 28 GDP GROWTH, 2016-2022 (TRILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 29 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing awareness regarding health issues related to high sugar consumption

- 5.3.1.2 Rise in consumer inclination toward natural products

- 5.3.1.3 Partnerships established between sweetener manufacturers and food & beverage entities

- 5.3.1.4 Advances in technology leading to development of new and improved sweeteners

- 5.3.1.5 Reduced ingredient costs through HFCS usage

- 5.3.2 RESTRAINTS

- 5.3.2.1 Consumer confusion around usage of natural sweeteners and their potential health risks

- 5.3.2.2 Health issues linked to excessive consumption of high-fructose corn syrup

- 5.3.2.3 Stringent international quality standards and regulations for sweeteners and sweetener-based products

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Advancements in natural sweeteners gaining significant traction, especially in food & beverage industry

- 5.3.3.2 Research and development around diabetic-friendly sweeteners

- 5.3.4 CHALLENGES

- 5.3.4.1 Product labeling and claims issues

- TABLE 3 CANADIAN FOOD LABELING REGULATIONS

- 5.3.4.2 Balancing production costs and pricing of sweeteners to meet consumer expectations

- 5.4 FLAVOR MODULATION

- 5.4.1 INTRODUCTION

- 5.4.2 KEY TRENDS

- 5.4.2.1 Natural and clean-label flavors

- 5.4.2.2 Comfort food flavors

- 5.4.2.3 Global taste expansions

- 5.4.3 IMPACT OF FLAVOR MODULATIONS ON SWEETENERS MARKET

- 5.4.3.1 Increased demand for natural sweeteners

- FIGURE 30 VALUE OF HONEY PRODUCTION, 2019-2022 (THOUSAND DOLLARS)

- 5.4.3.2 Innovation in non-caloric sweeteners

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 31 SWEETENERS MARKET: SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 32 SWEETENERS MARKET: VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PROCESSING & PRODUCTION

- 6.3.4 DISTRIBUTION & LOGISTICS

- 6.3.5 INCORPORATION OF SWEETENERS INTO PRODUCTS

- 6.3.6 MARKETING & SALES

- 6.4 TRADE ANALYSIS

- TABLE 4 IMPORT VALUE OF SUCROSE FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 5 EXPORT VALUE OF SUCROSE FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 6 IMPORT VALUE OF FOOD PREPARATIONS CLOSEST TO HIGH-INTENSITY SWEETENERS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 7 EXPORT VALUE OF FOOD PREPARATIONS CLOSEST TO HIGH-INTENSITY SWEETENERS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 LIQUID-LIQUID EXTRACTION

- 6.5.2 HPLC-DAD

- 6.6 PRICING ANALYSIS

- 6.6.1 INDICATIVE AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2022

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 9 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2023 (USD/TON)

- 6.6.3 AVERAGE SELLING PRICE TREND, BY PRODUCT

- TABLE 10 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2019-2023 (USD/TON)

- 6.7 ECOSYSTEM/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- FIGURE 33 SWEETENERS MARKET: MARKET MAP

- TABLE 11 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 PATENT ANALYSIS

- TABLE 12 LIST OF MAJOR PATENTS PERTAINING TO SWEETENERS MARKET, 2013-2023

- FIGURE 35 NUMBER OF PATENTS GRANTED, 2013-2023

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023-2024

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.1.1 US

- 6.11.2.1.2 Canada

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.11.2.3.1 China

- 6.11.2.3.2 India

- 6.11.2.3.3 Japan

- 6.11.2.3.4 Australia & New Zealand

- 6.11.2.4 Latin America

- 6.11.2.4.1 Brazil

- 6.11.2.4.2 Argentina

- 6.11.2.4.3 Mexico

- 6.11.2.5 Middle East & Africa

- 6.11.2.1 North America

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 IMPACT OF PORTER'S FIVE FORCES ON SWEETENERS MARKET

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- 6.13.2 BUYING CRITERIA

- TABLE 17 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 38 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 INCREASE IN INITIATIVES FOR SUGAR REDUCTION

7 SWEETENERS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 39 SWEETENERS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 18 SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 19 SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 FOOD

- TABLE 20 FOOD: SWEETENERS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 21 FOOD: SWEETENERS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 22 FOOD: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 FOOD: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 CONFECTIONERY PRODUCTS

- 7.2.1.1 Soaring demand for sweeteners as caramelizing agents in confectionery industry to drive market

- 7.2.2 BAKERY PRODUCTS

- 7.2.2.1 Increased demand for sugar-free baked items to drive market

- 7.2.3 DAIRY PRODUCTS

- 7.2.3.1 Demand for low-sugar, vegan dairy products to drive market

- 7.2.4 SWEET SPREADS

- 7.2.4.1 Surging demand for healthy sweet spreads to drive market growth

- 7.2.5 PLANT-BASED FOODS

- 7.2.5.1 Surge in demand for flavorful, plant-based foods to enhance application of sweeteners

- 7.2.6 OTHER FOOD PRODUCTS

- 7.3 BEVERAGES

- TABLE 24 BEVERAGES: SWEETENERS MARKET, BY SUBAPPLICATION, 2019-2022 (USD MILLION)

- TABLE 25 BEVERAGES: SWEETENERS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 26 BEVERAGES: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 BEVERAGES: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1 CARBONATED DRINKS

- 7.3.1.1 Need for innovative sweetener formulations in carbonated drinks to boost their popularity

- 7.3.2 FRUIT DRINKS & JUICES

- 7.3.2.1 Demand for strategic and innovative sweeteners in fruit drinks and juices to catalyze market expansion

- 7.3.3 POWDERED DRINKS

- 7.3.3.1 Demand for use of diverse sweeteners in powdered drinks to contribute to market growth

- 7.3.4 ALCOHOLIC BEVERAGES

- 7.3.4.1 Changing consumer preferences and quest for innovative flavor profiles to boost market

- 7.3.5 FLAVORED ALCOHOLIC BEVERAGES

- 7.3.5.1 Demand for refreshing fusion of real fruit juices and alcohol derived from cane sugar to propel growth

- 7.3.6 PLANT-BASED BEVERAGES

- 7.3.6.1 Surge in consumption of natural, plant-based beverages to drive use of sweeteners

- 7.3.7 OTHER BEVERAGES

- 7.4 PERSONAL CARE

- 7.4.1 NATURAL SWEETENERS IMPROVE HEALTH-ENHANCING FEATURES OF PERSONAL PRODUCTS

- TABLE 28 PERSONAL CARE: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 PERSONAL CARE: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 PHARMACEUTICALS

- 7.5.1 INVESTMENTS IN INNOVATIVE FORMULATIONS TO DRIVE GLOBAL ADOPTION OF SWEETENERS IN PHARMACEUTICALS

- TABLE 30 PHARMACEUTICALS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 PHARMACEUTICALS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 32 OTHER APPLICATIONS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 OTHER APPLICATIONS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SWEETENERS MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- FIGURE 40 SUCROSE SEGMENT TO DOMINATE MARKET BY 2028

- TABLE 34 SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 35 SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 36 SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 37 SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- 8.2 SUCROSE

- 8.2.1 INCREASING DEMAND FOR PROCESSED AND CONVENIENCE FOOD PRODUCTS TO DRIVE MARKET

- TABLE 38 SUCROSE: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 SUCROSE: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 SUCROSE: SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 41 SUCROSE: SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.3 HIGH-FRUCTOSE CORN SYRUP

- 8.3.1 BLENDING PROPERTIES, COST-EFFECTIVENESS, AND INCREASED SHELF-LIFE OF HFCS TO PROPEL ITS GROWTH

- TABLE 42 HIGH-FRUCTOSE CORN SYRUP: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 HIGH-FRUCTOSE CORN SYRUP: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 HIGH-FRUCTOSE CORN SYRUP: SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

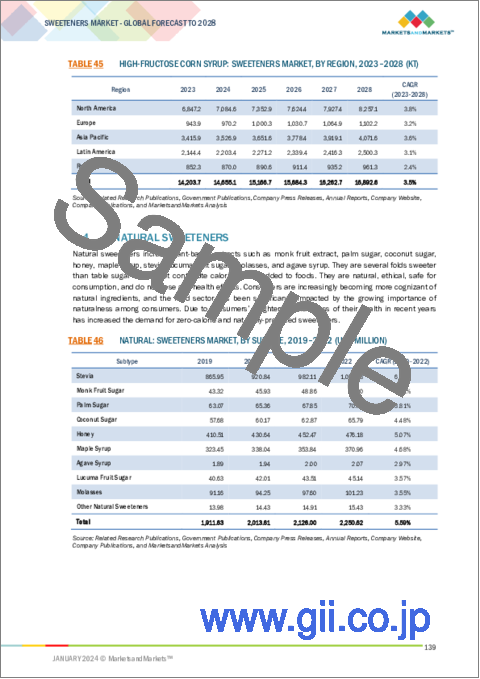

- TABLE 45 HIGH-FRUCTOSE CORN SYRUP: SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.4 NATURAL SWEETENERS

- TABLE 46 NATURAL: SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 47 NATURAL: SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 48 NATURAL: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 NATURAL: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 NATURAL: SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 51 NATURAL: SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.4.1 STEVIA

- 8.4.1.1 Growing health-conscious consumer preferences to spur demand for stevia

- 8.4.2 MONK FRUIT SUGAR

- 8.4.2.1 Rising demand for natural, non-nutritive sweeteners to drive market

- 8.4.3 PALM SUGAR

- 8.4.3.1 Wide range of culinary applications of palm sugar to drive market

- 8.4.4 COCONUT SUGAR

- 8.4.4.1 Diverse nutritional properties of coconut sugar to drive its consumption

- 8.4.5 HONEY

- 8.4.5.1 Surging demand for artisanal honey varieties to drive market

- 8.4.6 MAPLE SYRUP

- 8.4.6.1 Organic and sustainable nature of maple syrup to drive growth

- 8.4.7 AGAVE SYRUP

- 8.4.7.1 Rising demand for low-glycemic sweeteners to drive market

- 8.4.8 LUCUMA FRUIT SUGAR

- 8.4.8.1 Distinctive flavor and nutritional benefits of lucuma fruit sugar to encourage market growth

- 8.4.9 MOLASSES

- 8.4.9.1 Unique taste profile of molasses to spur their consumption

- 8.4.10 OTHER NATURAL SWEETENERS

- 8.5 ARTIFICIAL SWEETENERS

- TABLE 52 ARTIFICIAL: SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 53 ARTIFICIAL: SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 54 ARTIFICIAL: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 ARTIFICIAL: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 ARTIFICIAL: SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 57 ARTIFICIAL: SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.5.1 ASPARTAME

- 8.5.1.1 Diverse application of aspartame in food and beverages to drive market growth

- 8.5.2 SUCRALOSE

- 8.5.2.1 Stability, taste, and safety of sucralose to boost its demand and consumption

- 8.5.3 SACCHARIN

- 8.5.3.1 Increasing use of saccharin in health and wellness products to propel demand

- 8.5.4 CYCLAMATE

- 8.5.4.1 Heat stability and prolonged shelf life of cyclamate to propel market expansion

- 8.5.5 ACE-K

- 8.5.5.1 Acesulfame K's resilience and safety to boost market expansion amidst health-conscious trends

- 8.5.6 OTHER ARTIFICIAL SWEETENERS

- 8.6 NOVEL SWEETENERS

- TABLE 58 NOVEL SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 59 NOVEL SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 60 NOVEL SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 NOVEL SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 62 NOVEL SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 63 NOVEL SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.6.1 ALLULOSE

- 8.6.1.1 Global acceptance of allulose to drive market demand

- 8.6.2 D-TAGATOSE

- 8.6.2.1 Versatility of d-tagatose in meeting evolving dietary preferences of consumers to boost growth

- 8.7 POLYOLS

- TABLE 64 POLYOLS: SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 65 POLYOLS: SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 66 POLYOLS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 POLYOLS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 POLYOLS: SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 69 POLYOLS: SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 8.7.1 SORBITOL

- 8.7.1.1 Multifunctionality of sorbitol to encourage its adoption in food and beverages

- 8.7.2 MALTITOL

- 8.7.2.1 Versatility of maltitol to drive market demand

- 8.7.3 XYLITOL

- 8.7.3.1 Diverse medical applications to xylitol to drive its demand

- 8.7.4 MANNITOL

- 8.7.4.1 Wide uses of mannitol in pharmaceutical and food industries to spur market

- 8.7.5 ERYTHRITOL

- 8.7.5.1 Extensive adoption of erythritol as food ingredient across globe to boost market

- 8.7.6 OTHER POLYOLS

9 SWEETENERS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 41 HIGH-INTENSITY SWEETENERS SEGMENT TO DOMINATE SWEETENERS MARKET BY 2028

- TABLE 70 SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 71 SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2 HIGH-INTENSITY SWEETENERS

- 9.2.1 INCREASED APPLICATION OF HIGH-INTENSITY SWEETENERS AS FOOD ADDITIVES IN DESSERTS, SWEETS, DRINKS, AND CHEWING GUMS TO PROPEL MARKET

- TABLE 72 HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 74 HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 75 HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- 9.2.2 NATURAL

- TABLE 76 NATURAL HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 NATURAL HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.3 ARTIFICIAL

- TABLE 78 ARTIFICIAL HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 ARTIFICIAL HIGH-INTENSITY SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LOW-INTENSITY SWEETENERS

- 9.3.1 SOARING NUMBER OF METABOLIC DISEASES TO PROMPT INCREASED APPLICATION OF LOW-INTENSITY SWEETENERS IN FOOD AND BEVERAGES

- TABLE 80 LOW-INTENSITY SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 LOW-INTENSITY SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 SWEETENERS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 42 POWDER SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- TABLE 82 SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 83 SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.2 POWDER

- 10.2.1 INCREASING CONSUMER DEMAND FOR CONVENIENT, LOW-CALORIE, AND PORTION-CONTROLLED SWEETENERS TO DRIVE GROWTH

- TABLE 84 POWDER: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 POWDER: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 LIQUID

- 10.3.1 EXTENDED SHELF-LIFE AND EASY APPLICATION OF LIQUID SWEETENERS TO BOOST THEIR GROWTH

- TABLE 86 LIQUID: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 LIQUID: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 CRYSTALS

- 10.4.1 ADVANCEMENTS IN FOOD TECHNOLOGY, RESULTING IN IMPROVED TASTE PROFILE AND SOLUBILITY OF CRYSTAL SWEETENERS, TO SPUR THEIR GROWTH

- TABLE 88 CRYSTALS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 CRYSTALS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 SWEETENERS MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- FIGURE 43 SWEETENERS MARKET, BY SALES CHANNEL, 2023 VS. 2028 (USD MILLION)

- TABLE 90 SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 91 SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- 11.2 DIRECT (B2B)

- 11.2.1 NEED FOR PERSONALIZED AND STREAMLINED PROCESS OF OFFERING SWEETENERS TO BOOST THEIR SALES THROUGH DIRECT SALES CHANNELS

- TABLE 92 DIRECT (B2B): SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 DIRECT (B2B): SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 INDIRECT (B2C)

- TABLE 94 SWEETENERS MARKET, BY INDIRECT (B2C) SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 95 SWEETENERS MARKET, BY INDIRECT (B2C) SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 96 INDIRECT (B2C): SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 97 INDIRECT (B2C): SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.1 HYPERMARKETS/SUPERMARKETS

- 11.3.1.1 Widespread product accessibility and consumer engagement to facilitate sales of sweeteners through hypermarkets

- TABLE 98 HYPERMARKETS/SUPERMARKETS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 HYPERMARKETS/SUPERMARKETS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.2 CONVENIENCE STORES

- 11.3.2.1 Promotional strategies adopted by convenience stores to persuade people to purchases and, in turn, catalyze market expansion

- TABLE 100 CONVENIENCE STORES: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 101 CONVENIENCE STORES: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.3 SPECIALTY RETAIL STORES

- 11.3.3.1 Specialty retail stores within global sweeteners market cater to niche consumer segments by offering curated selection of sweetener products

- TABLE 102 SPECIALTY RETAIL STORES: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 SPECIALTY RETAIL STORES: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.4 ONLINE RETAILERS

- 11.3.4.1 Convenience of door-step delivery provided by online retailers to propel sweeteners market

- TABLE 104 ONLINE RETAILERS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 ONLINE RETAILERS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.5 OTHER CHANNELS

- TABLE 106 OTHER CHANNELS: SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 OTHER CHANNELS: SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 SWEETENERS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 44 US AND CANADA TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- TABLE 108 SWEETENERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 SWEETENERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 110 SWEETENERS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 111 SWEETENERS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: SWEETENERS MARKET SNAPSHOT

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 46 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 112 NORTH AMERICA: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 115 NORTH AMERICA: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 116 NORTH AMERICA: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 119 NORTH AMERICA: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- TABLE 120 NORTH AMERICA: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: POLYOLS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: POLYOLS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2019-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2023-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: SWEETENERS MARKET, BY FOOD APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: SWEETENERS MARKET, BY FOOD APPLICATION, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Rise in consumer awareness regarding detriments of high sugar intake

- TABLE 144 US: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 US: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Government approval for several sugar alternatives

- TABLE 146 CANADA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 CANADA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- FIGURE 47 EUROPE: SWEETENERS MARKET SNAPSHOT

- 12.3.1 EUROPE: RECESSION IMPACT

- FIGURE 48 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 148 EUROPE: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 149 EUROPE: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 150 EUROPE: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 151 EUROPE: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 152 EUROPE: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 153 EUROPE: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 154 EUROPE: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 155 EUROPE: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- TABLE 156 EUROPE: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 157 EUROPE: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 159 EUROPE: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 160 EUROPE: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 161 EUROPE: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: POLYOLS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 163 EUROPE: POLYOLS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 165 EUROPE: SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 EUROPE: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 167 EUROPE: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 169 EUROPE: SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 171 EUROPE: SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 172 EUROPE: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2019-2022 (USD MILLION)

- TABLE 173 EUROPE: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2023-2028 (USD MILLION)

- TABLE 174 EUROPE: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 175 EUROPE: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 176 EUROPE: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 177 EUROPE: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 178 EUROPE: SWEETENERS MARKET, BY FOOD APPLICATION, 2019-2022 (USD MILLION)

- TABLE 179 EUROPE: SWEETENERS MARKET, BY FOOD APPLICATION, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Increase in consumer inclination toward maintaining balanced lifestyles

- TABLE 180 GERMANY: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 181 GERMANY: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Greater preference for products with additional functional benefits

- TABLE 182 UK: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 183 UK: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 Increase in investor-friendly policies and free-trade agreements

- TABLE 184 FRANCE: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 185 FRANCE: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Rise in demand for health-enriching beverages with growth of chronic illnesses

- TABLE 186 ITALY: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 187 ITALY: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Increase in popularity of healthy food and beverages

- TABLE 188 SPAIN: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 189 SPAIN: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.7 RUSSIA

- 12.3.7.1 Surge in production of sugar and confections

- TABLE 190 RUSSIA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 191 RUSSIA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.8 POLAND

- 12.3.8.1 Robust sugar industry

- TABLE 192 POLAND: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 193 POLAND: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.9 REST OF EUROPE

- TABLE 194 REST OF EUROPE: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 195 REST OF EUROPE: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 49 ASIA PACIFIC: SWEETENERS MARKET SNAPSHOT

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 50 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 196 ASIA PACIFIC: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 199 ASIA PACIFIC: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 200 ASIA PACIFIC: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 201 ASIA PACIFIC: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 203 ASIA PACIFIC: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- TABLE 204 ASIA PACIFIC: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 205 ASIA PACIFIC: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 207 ASIA PACIFIC: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 209 ASIA PACIFIC: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: POLYOLS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: POLYOLS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2019-2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2023-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 224 ASIA PACIFIC: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 226 ASIA PACIFIC: SWEETENERS MARKET, BY FOOD APPLICATION, 2019-2022 (USD MILLION)

- TABLE 227 ASIA PACIFIC: SWEETENERS MARKET, BY FOOD APPLICATION, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Increase in awareness regarding risks pertaining to excessive consumption of sugar

- TABLE 228 CHINA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 229 CHINA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Rise in cases of diabetes and encouragement toward intake of natural sweeteners

- TABLE 230 INDIA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 231 INDIA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Growth in government initiatives to promote healthy living

- TABLE 232 JAPAN: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 233 JAPAN: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 High adoption of low-calorie and sugar-free products

- TABLE 234 AUSTRALIA & NEW ZEALAND: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 235 AUSTRALIA & NEW ZEALAND: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Zero-calorie programs launched by food processing industries

- TABLE 236 SOUTH KOREA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 237 SOUTH KOREA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.7 INDONESIA

- 12.4.7.1 Introduction of self-sufficiency plans, including expansion of cane cultivation

- TABLE 238 INDONESIA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 239 INDONESIA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.8 THAILAND

- 12.4.8.1 Dependence of economy on sugar production and export

- TABLE 240 THAILAND: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 241 THAILAND: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.9 MALAYSIA

- 12.4.9.1 Robust raw sugar trade dynamics with growth in exports

- TABLE 242 MALAYSIA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 243 MALAYSIA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.10 REST OF ASIA PACIFIC

- TABLE 244 REST OF ASIA PACIFIC: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: RECESSION IMPACT

- FIGURE 51 LATIN AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 246 LATIN AMERICA: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 247 LATIN AMERICA: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: SWEETENERS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 249 LATIN AMERICA: SWEETENERS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 250 LATIN AMERICA: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 251 LATIN AMERICA: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 253 LATIN AMERICA: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- TABLE 254 LATIN AMERICA: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 255 LATIN AMERICA: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 257 LATIN AMERICA: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 259 LATIN AMERICA: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 260 LATIN AMERICA: POLYOLS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 261 LATIN AMERICA: POLYOLS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 263 LATIN AMERICA: SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 265 LATIN AMERICA: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 267 LATIN AMERICA: SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 269 LATIN AMERICA: SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2019-2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2023-2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: SWEETENERS MARKET, BY FOOD APPLICATION, 2019-2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: SWEETENERS MARKET, BY FOOD APPLICATION, 2023-2028 (USD MILLION)

- 12.5.2 MEXICO

- 12.5.2.1 Surge in national campaigns to create health awareness

- TABLE 278 MEXICO: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 279 MEXICO: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.3 BRAZIL

- 12.5.3.1 Brazil's dominance in sugar industry and climate-resilient strategies

- TABLE 280 BRAZIL: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 281 BRAZIL: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.4 ARGENTINA

- 12.5.4.1 Argentina's expanding raw sugar exports to signal growth surge

- TABLE 282 ARGENTINA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 283 ARGENTINA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.5 REST OF LATIN AMERICA

- TABLE 284 REST OF LATIN AMERICA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 ROW: RECESSION IMPACT

- FIGURE 52 ROW: RECESSION IMPACT ANALYSIS

- TABLE 286 ROW: SWEETENERS MARKET, BY COUNTRY/REGION, 2019-2022 (USD MILLION)

- TABLE 287 ROW: SWEETENERS MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 288 ROW: SWEETENERS MARKET, BY COUNTRY/REGION, 2019-2022 (KT)

- TABLE 289 ROW: SWEETENERS MARKET, BY COUNTRY/REGION, 2023-2028 (KT)

- TABLE 290 ROW: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 291 ROW: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 292 ROW: SWEETENERS MARKET, BY PRODUCT, 2019-2022 (KT)

- TABLE 293 ROW: SWEETENERS MARKET, BY PRODUCT, 2023-2028 (KT)

- TABLE 294 ROW: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 295 ROW: NATURAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 296 ROW: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 297 ROW: ARTIFICIAL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 298 ROW: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 299 ROW: NOVEL SWEETENERS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 300 ROW: POLYOLS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 301 ROW: POLYOLS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 302 ROW: SWEETENERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 303 ROW: SWEETENERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 304 ROW: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2019-2022 (USD MILLION)

- TABLE 305 ROW: HIGH-INTENSITY SWEETENERS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 306 ROW: SWEETENERS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 307 ROW: SWEETENERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 308 ROW: SWEETENERS MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 309 ROW: SWEETENERS MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 310 ROW: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2019-2022 (USD MILLION)

- TABLE 311 ROW: SWEETENERS MARKET, BY INDIRECT (B2C) CHANNEL, 2023-2028 (USD MILLION)

- TABLE 312 ROW: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 313 ROW: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 314 ROW: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 315 ROW: SWEETENERS MARKET, BY BEVERAGE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 316 ROW: SWEETENERS MARKET, BY FOOD APPLICATION, 2019-2022 (USD MILLION)

- TABLE 317 ROW: SWEETENERS MARKET, BY FOOD APPLICATION, 2023-2028 (USD MILLION)

- 12.6.2 SOUTH AFRICA

- 12.6.2.1 Consumer spending on premium food and beverage products

- TABLE 318 SOUTH AFRICA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 319 SOUTH AFRICA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.3 SAUDI ARABIA

- 12.6.3.1 Growing awareness regarding sugar-related health concerns such as diabetes

- TABLE 320 SAUDI ARABIA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 321 SAUDI ARABIA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.4 REST OF AFRICA

- TABLE 322 REST OF AFRICA: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 323 REST OF AFRICA: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.5 REST OF MIDDLE EAST

- TABLE 324 REST OF MIDDLE EAST: SWEETENERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 325 REST OF MIDDLE EAST: SWEETENERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- TABLE 326 SUCROSE MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 327 SUGAR SUBSTITUTE MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- 13.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 328 STRATEGIES ADOPTED BY KEY PLAYERS IN SWEETENERS MARKET

- 13.4 REVENUE ANALYSIS

- FIGURE 53 ANNUAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2022 (USD BILLION)

- 13.5 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- FIGURE 54 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 13.6 KEY PLAYERS' EBITDA

- FIGURE 55 EBITDA, 2022 (USD BILLION)

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 56 SWEETENERS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 13.8 COMPANY EVALUATION MATRIX

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- FIGURE 57 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 13.8.5 COMPANY FOOTPRINT

- TABLE 329 COMPANY FOOTPRINT, BY PRODUCT

- TABLE 330 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 331 COMPANY FOOTPRINT, BY REGION

- TABLE 332 OVERALL COMPANY FOOTPRINT

- 13.9 STARTUP/SME EVALUATION MATRIX

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- FIGURE 58 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 13.9.5 COMPETITIVE BENCHMARKING

- TABLE 333 SWEETENERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 334 SWEETENERS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 13.10 COMPETITIVE SCENARIO AND TRENDS

- 13.10.1 PRODUCT LAUNCHES

- TABLE 335 SWEETENERS MARKET: PRODUCT LAUNCHES, 2019-2023

- 13.10.2 DEALS

- TABLE 336 SWEETENERS MARKET: DEALS, 2019-2023

- 13.10.3 OTHERS

- TABLE 337 SWEETENERS MARKET: OTHERS, 2019-2023

14 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 14.1 KEY COMPANIES

- 14.1.1 CARGILL, INCORPORATED

- TABLE 338 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 59 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 339 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 340 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 341 CARGILL, INCORPORATED: DEALS

- TABLE 342 CARGILL, INCORPORATED: OTHERS

- 14.1.2 ADM

- TABLE 343 ADM: BUSINESS OVERVIEW

- FIGURE 60 ADM: COMPANY SNAPSHOT

- TABLE 344 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 345 ADM: DEALS

- TABLE 346 ADM: OTHERS

- 14.1.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 347 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 61 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 348 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 349 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 350 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- 14.1.4 INGREDION INCORPORATED

- TABLE 351 INGREDION INCORPORATED: BUSINESS OVERVIEW

- FIGURE 62 INGREDION INCORPORATED: COMPANY SNAPSHOT

- TABLE 352 INGREDION INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 353 INGREDION INCORPORATED: PRODUCT LAUNCHES

- TABLE 354 INGREDION INCORPORATED: DEALS

- TABLE 355 INGREDION INCORPORATED: OTHERS

- 14.1.5 TATE & LYLE

- TABLE 356 TATE & LYLE: BUSINESS OVERVIEW

- FIGURE 63 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 357 TATE & LYLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 358 TATE & LYLE: PRODUCT LAUNCHES

- TABLE 359 TATE & LYLE: DEALS

- TABLE 360 TATE & LYLE: OTHERS

- 14.1.6 ASSOCIATED BRITISH FOODS PLC

- TABLE 361 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- FIGURE 64 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 362 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.7 GIVAUDAN

- TABLE 363 GIVAUDAN: BUSINESS OVERVIEW

- FIGURE 65 GIVAUDAN: COMPANY SNAPSHOT

- TABLE 364 GIVAUDAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 365 GIVAUDAN: DEALS

- 14.1.8 FIRMENICH SA

- TABLE 366 FIRMENICH SA: BUSINESS OVERVIEW

- FIGURE 66 FIRMENICH SA: COMPANY SNAPSHOT

- TABLE 367 FIRMENICH SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 368 FIRMENICH SA: DEALS

- 14.1.9 SYMRISE

- TABLE 369 SYMRISE: BUSINESS OVERVIEW

- FIGURE 67 SYMRISE: COMPANY SNAPSHOT

- TABLE 370 SYMRISE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 371 SYMRISE: DEALS

- 14.1.10 SUDZUCKER AG

- TABLE 372 SUDZUCKER AG: BUSINESS OVERVIEW

- FIGURE 68 SUDZUCKER AG: COMPANY SNAPSHOT

- TABLE 373 SUDZUCKER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.11 AJINOMOTO CO., INC.

- TABLE 374 AJINOMOTO CO., INC.: BUSINESS OVERVIEW

- FIGURE 69 AJINOMOTO CO., INC.: COMPANY SNAPSHOT

- TABLE 375 AJINOMOTO CO., INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.12 ZYDUS WELLNESS

- TABLE 376 ZYDUS WELLNESS: BUSINESS OVERVIEW

- FIGURE 70 ZYDUS WELLNESS: COMPANY SNAPSHOT

- TABLE 377 ZYDUS WELLNESS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 378 ZYDUS WELLNESS: OTHERS

- 14.1.13 TEREOS

- TABLE 379 TEREOS: BUSINESS OVERVIEW

- FIGURE 71 TEREOS: COMPANY SNAPSHOT

- TABLE 380 TEREOS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 381 TEREOS: DEALS

- 14.1.14 ROQUETTE FRERES

- TABLE 382 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 383 ROQUETTE FRERES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 384 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 385 ROQUETTE FRERES: DEALS

- 14.1.15 MACANDREWS & FORBES HOLDINGS INCORPORATED

- TABLE 386 MACANDREWS & FORBES HOLDINGS INCORPORATED: BUSINESS OVERVIEW

- TABLE 387 MACANDREWS & FORBES HOLDINGS INCORPORATED: PRODUCTS OFFERED

- TABLE 388 MACANDREWS & FORBES HOLDINGS INCORPORATED: DEALS

- 14.1.16 FOODCHEM INTERNATIONAL CORPORATION

- TABLE 389 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 390 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- 14.1.17 JK SUCRALOSE INC.

- TABLE 391 JK SUCRALOSE INC.: BUSINESS OVERVIEW

- TABLE 392 JK SUCRALOSE INC.: PRODUCTS OFFERED

- 14.1.18 ZUCHEM

- TABLE 393 ZUCHEM: BUSINESS OVERVIEW

- TABLE 394 ZUCHEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.19 MANE SA

- TABLE 395 MANE SA: BUSINESS OVERVIEW

- TABLE 396 MANE SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.20 DOHLER GMBH

- TABLE 397 DOHLER GMBH: BUSINESS OVERVIEW

- TABLE 398 DOHLER GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 399 DOHLER GMBH: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 ECOGREEN OLEOCHEMICALS

- TABLE 400 ECOGREEN OLEOCHEMICALS: BUSINESS OVERVIEW

- TABLE 401 ECOGREEN OLEOCHEMICALS: PRODUCTS OFFERED

- 14.2.2 SUMINTER INDIA ORGANICS

- TABLE 402 SUMINTER INDIA ORGANICS: BUSINESS OVERVIEW

- TABLE 403 SUMINTER INDIA ORGANICS: PRODUCTS OFFERED

- 14.2.3 TAG INGREDIENTS INDIA PVT. LTD.

- TABLE 404 TAG INGREDIENTS INDIA PVT. LTD.: BUSINESS OVERVIEW

- TABLE 405 TAG INGREDIENTS INDIA PVT. LTD: PRODUCTS OFFERED

- 14.2.4 THE REAL STEVIA COMPANY AB

- TABLE 406 THE REAL STEVIA COMPANY AB: BUSINESS OVERVIEW

- TABLE 407 THE REAL STEVIA COMPANY AB: PRODUCTS OFFERED

- 14.2.5 SWEETLY STEVIAUSA

- TABLE 408 SWEETLY STEVIAUSA: BUSINESS OVERVIEW

- TABLE 409 SWEETLY STEVIAUSA: PRODUCTS OFFERED

- 14.2.6 STEVIA HUB INDIA

- TABLE 410 STEVIA HUB INDIA: COMPANY OVERVIEW

- 14.2.7 PYURE BRANDS

- TABLE 411 PYURE BRANDS: COMPANY OVERVIEW

- 14.2.8 XILINAT

- TABLE 412 XILINAT: COMPANY OVERVIEW

- 14.2.9 FOODITIVE GROUP

- TABLE 413 FOODITIVE GROUP: COMPANY OVERVIEW

- 14.2.10 SAGANA

- TABLE 414 SAGANA: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 415 MARKETS ADJACENT TO SWEETENERS MARKET

- 15.2 LIMITATIONS

- 15.3 SUGAR SUBSTITUTES MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 416 SUGAR SUBSTITUTES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 417 SUGAR SUBSTITUTES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 15.4 POLYOL SWEETENERS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 418 POLYOL SWEETENERS MARKET, BY TYPE, 2015-2022 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS