|

|

市場調査レポート

商品コード

1366408

AR・VRソフトウェアの世界市場 (~2028年):技術タイプ・ソフトウェアタイプ ・産業 ・地域別AR VR Software Market by Technology Type (AR Software and VR Software), Software Type (Software Development Kit, Game Engine), Vertical (Media & Entertainment, Retail & eCommerce, Manufacturing, Healthcare) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| AR・VRソフトウェアの世界市場 (~2028年):技術タイプ・ソフトウェアタイプ ・産業 ・地域別 |

|

出版日: 2023年10月05日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

AR・VRソフトウェアの市場規模は、2023年の325億米ドルから、予測期間中は19.0%のCAGRで推移し、2028年には775億米ドルの規模に成長すると予測されています。

高速データ転送と最小の待ち時間を提供する5Gネットワークの広範な展開は、AR・VRソフトウェアにとって有利な大きな技術的飛躍です。この進歩は、シームレスで没入感のあるAR・VR体験を提供する上で極めて重要です。5Gにより、ユーザーはAR・VRアプリケーションとの高品質でリアルタイムのインタラクションを中断することなく楽しむことができます。この新たなスピードと応答性は、AR・VR技術の可能性を大きく広げ、さまざまな領域でAR・VR技術の発展を可能にします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 技術タイプ・ソフトウェアタイプ・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

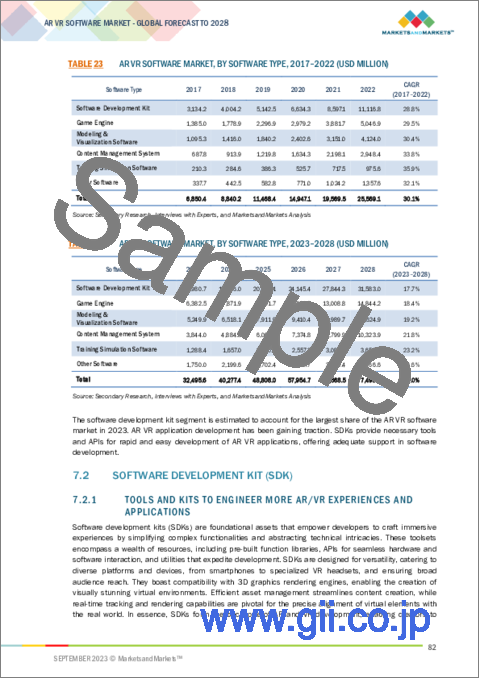

「ソフトウェアタイプ別では、ソフトウェア開発キット (SDK) の部門が予測期間中に最大の規模に」

SDKはAR・VRアプリケーションの開発に不可欠なツールです。SDKは、開発者が現実世界と相互作用する没入型体験を作成するために必要なツールとリソースを提供し、ゲーム、エンターテインメント、教育、企業など、さまざまな目的に使用できます。SDKは、モバイルデバイス、スマートグラス、ヘッドセットなど、さまざまなプラットフォーム向けに高品質のARおよびVRアプリケーションを開発するために使用できます。

「産業別では、旅行・ホスピタリティの部門が予測期間中に最速の成長を記録する見込み」

拡張ナビゲーションは、ARを旅にシームレスに統合することで、観光客が不慣れな都市を探索する方法に革命をもたらします。専用のARナビゲーションアプリにより、旅行者はスマートフォンやARメガネを通して周囲を見ることができ、近くの名所、歴史、道順に関する情報をリアルタイムで受け取ることができます。このようなARを活用した体験は、探索をより魅力的なものにするだけでなく、AR・VRソフトウェア市場にとって魅力的な推進力となります。

「予測期間中はアジア太平洋地域がもっとも高い成長率を示す」

アジア太平洋地域全体で、数多くの都市がスマートシティへの変革のために多額の投資を行っています。こうした都市イノベーションの取り組みの中で、AR・VR技術は極めて重要な役割を果たしています。これらの技術は、没入感のある都市景観の視覚化を可能にすることで、都市計画プロセスの合理化を促進します。さらに、これらの技術は、リアルタイムのデータとナビゲーションソリューションを提供し、効率的な交通管理に貢献しています。さらに、AR・VRは、インタラクティブな情報ハブやメンテナンスツールによって公共サービスを強化します。このような技術と都市開発の融合は、AR・VRソフトウェアソリューションの成長を促進し、この地域における、よりスマートでコネクテッドな都市の未来を形成します。

当レポートでは、世界のAR・VRソフトウェアの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- AR/VRソフトウェアの簡単な歴史

- ケーススタディ分析

- エコシステム分析

- バリューチェーン分析

- 規制状況

- 価格分析

- 技術分析

- 特許分析

- 主要なステークホルダーと購入基準

- 主要な会議とイベント

- ポーターのファイブフォース分析

- 顧客の事業に影響を与える動向・ディスラプション

- AR・VRソフトウェア市場のベストプラクティス

- 現在および新たなビジネスモデル

- AR・VRソフトウェアツール、フレームワーク、テクニック

- AR・VRソフトウェア市場の将来情勢

第6章 AR・VRソフトウェア市場:技術タイプ別

- ARソフトウェア

- マーカーベースAR技術

- マーカーレスAR技術

- VRソフトウェア

第7章 AR・VRソフトウェア市場:ソフトウェアタイプ別

- ソフトウェア開発キット (SDK)

- ゲームエンジン

- モデリングおよび視覚化ソフトウェア

- コンテンツ管理システム

- トレーニングシミュレーションソフトウェア

- その他

第8章 AR・VRソフトウェア市場:産業別

- メディア&エンターテイメント

- 小売・Eコマース

- トレーニング・教育

- 旅行・ホスピタリティ

- 不動産

- 製造

- ヘルスケア

- 航空宇宙・防衛

- 自動車

- その他

第9章 AR・VRソフトウェア市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- 主要企業の採用戦略

- 過去の収益分析

- 主要企業の市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ・動向

- AR・VR製品のベンチマーキング

- 主要AR・VRソフトウェアベンダーの評価と財務指標

第11章 企業プロファイル

- 主要企業

- META

- MICROSOFT

- UNITY TECHNOLOGIES

- QUALCOMM

- ADOBE

- AUTODESK

- PTC

- TEAMVIEWER

- NVIDIA CORPORATION

- ADVANCED MICRO DEVICES

- ZOHO CORPORATION

- VMWARE

- HEXAGON AB

- MAGIC LEAP

- その他の企業

- TAQTILE

- BLIPPAR

- AUGMENT

- SHAPESXR

- ARUVR

- SCOPE AR

- VECTARY

- EON REALITY

- WEVR

- TALESPIN REALITY LABS

- SQUINT

- NIANTIC

- MARXENT LABS

- INGLOBE TECHNOLOGIES

- ULTRALEAP

- AMELIA VIRTUAL CARE

第12章 隣接/関連市場

第13章 付録

The AR VR Software market is estimated at USD 32.5 billion in 2023 to reach USD 77.5 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 19.0%. The widespread deployment of 5G networks represents a significant technological leap for AR VR software by offering rapid data transfer and minimal latency. This advancement is pivotal in delivering seamless and immersive AR VR experiences. With 5G, users can enjoy high-quality, real-time interactions with AR VR applications, free from disruptions. This newfound speed and responsiveness unlock a wealth of possibilities for AR VR technology, enabling it to flourish across various domains. Consequently, 5G's technical capabilities stand as a fundamental catalyst driving the growth and evolution of AR VR software, ensuring its continued innovation and adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | By Technology Type, Software Type, Vertical and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

"By software type, software development kit (SDK) segment to hold the largest market size during the forecast period."

SDKs are essential tools for developing AR and VR applications. They provide developers with the tools and resources they need to create immersive experiences that interact with the real world and can be used for a variety of purposes, such as gaming, entertainment, education, and enterprise. SDKs can be used to develop high quality AR and VR applications for a variety of platforms, including mobile devices, smart glasses, and headsets.

"Based on vertical, the travel & hospitality segment is expected to register the fastest growth rate during the forecast period. "

Augmented navigation revolutionizes the way tourists explore unfamiliar cities by seamlessly integrating augmented reality into their journeys. Through dedicated AR navigation apps, travelers can view their surroundings through their smartphone or AR glasses and receive real-time information about nearby points of interest, historical facts, and directions. This immersive experience transforms ordinary walks into informative and engaging adventures, allowing tourists to discover hidden gems and cultural insights while confidently navigating through the city's streets. These AR-enhanced experiences not only make exploration more engaging but also serve as a compelling driver for the AR and VR software market. They drive development of more such sophisticated apps that cater to tourists' demand for travel information and adventure, fostering growth in the AR and VR software sector.

"Asia Pacific highest growth rate during the forecast period."

Across the Asia-Pacific region, numerous cities are investing substantially to transform into smart cities. Within these urban innovation initiatives, AR and VR technologies play pivotal roles. They facilitate streamlined urban planning processes by enabling immersive cityscape visualization. Moreover, these technologies contribute to efficient transportation management, offering real-time data and navigation solutions. In addition, AR and VR enhance public services with interactive information hubs and maintenance tools. This convergence of technology and urban development fosters the growth of tailored AR and VR software solutions, shaping the future of smarter, more connected cities in the region.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Middle East & Africa - 10%, and Latin America- 5%.

The major players in the AR VR Software market include Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their AR VR Software market footprint.

Research Coverage

The market study covers the AR VR software market size across different segments. It aims at estimating the market size and the growth potential across different segments, including Technology Type (AR software and VR software), Software Type (Software Development Kit, Game Engine, Modeling and visualization Software, Content Management System, Training Simulation Software, and Other Software (Collaboration, Geospatial Mapping, And Industrial Platforms), Vertical (Media & Entertainment, Retail & Ecommerce, Training & Education, Travel & Hospitality, Aerospace & Defense, Real Estate, Manufacturing, Healthcare, Aerospace & Defense, Automotive, and Other Verticals (IT & Telecom, Transportation & Logistics, And Energy & Utilities), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global AR VR Software market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (growing popularity of gaming, diverse use cases of AR VR in multiple industries, restraints (fragmentation in the AR VR landscape), opportunities (enhancing remote work and collaboration), and challenges (optimizing performance is a paramount concern in AR/VR software development, limited amount of content available for AR VR) influencing the growth of the AR VR software market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AR VR software market. Market Development: Comprehensive information about lucrative markets - the report analyses the AR VR software market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AR VR Software market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 AR VR SOFTWARE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Primary sources

- 2.1.2.4 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN AR VR SOFTWARE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): AR VR SOFTWARE MARKET

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY USING BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 IMPLICATION OF RECESSION ON AR VR SOFTWARE MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 AR VR SOFTWARE MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 11 AR VR SOFTWARE MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AR VR SOFTWARE MARKET

- FIGURE 12 GOVERNMENT INITIATIVES AND STRONG REGULATORY FRAMEWORK TO DRIVE MARKET

- 4.2 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE

- FIGURE 13 AR SOFTWARE SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.3 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE

- FIGURE 14 SOFTWARE DEVELOPMENT KIT SEGMENT ESTIMATED TO LEAD MARKET IN 2023

- 4.4 AR VR SOFTWARE MARKET, BY VERTICAL

- FIGURE 15 MEDIA & ENTERTAINMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 NORTH AMERICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE AND TOP THREE VERTICALS

- FIGURE 16 AR SOFTWARE AND MEDIA & ENTERTAINMENT SEGMENTS ESTIMATED TO HOLD LARGEST MARKET SHARES IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 AR VR SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing popularity of gaming

- 5.2.1.2 Diverse use cases of AR/VR across multiple industries

- 5.2.1.3 Advancements in real-time rendering engines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Diversity of AR/VR platforms and complex development landscape

- 5.2.2.2 High initial costs and limited hardware options

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in remote working and collaboration through AR/VR software

- 5.2.3.2 Increasing role of AR/VR software in healthcare transformation

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for optimized performance in AR/VR

- 5.2.4.2 Limited availability of content for AR/VR

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF AR/VR SOFTWARE

- FIGURE 18 BRIEF HISTORY OF AR/VR SOFTWARE

- 5.3.1.1 1950-1970

- 5.3.1.2 1970-2000

- 5.3.1.3 2000-2010

- 5.3.1.4 2011-2023

- 5.3.2 CASE STUDY ANALYSIS

- 5.3.2.1 Case study 1: Magna supercharges its quality control and training processes with AR

- 5.3.2.2 Case study 2: STERIS helps customers reduce critical mistakes with AR

- 5.3.2.3 Case study 3: Revolutionizing technical training in VR

- 5.3.2.4 Case study 4: Streamlining enterprise VR training development

- 5.3.3 ECOSYSTEM ANALYSIS

- FIGURE 19 AR VR SOFTWARE MARKET ECOSYSTEM MAPPING

- TABLE 4 AR VR SOFTWARE MARKET: ECOSYSTEM

- 5.3.3.1 AR software providers

- 5.3.3.2 VR software providers

- 5.3.4 VALUE CHAIN ANALYSIS

- FIGURE 20 AR VR SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- 5.3.5 REGULATORY LANDSCAPE

- 5.3.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.5.2 North America

- 5.3.5.2.1 US

- 5.3.5.2.2 Canada

- 5.3.5.3 Europe

- 5.3.5.3.1 UK

- 5.3.5.3.2 Germany

- 5.3.5.4 Asia Pacific

- 5.3.5.4.1 China

- 5.3.5.4.2 India

- 5.3.5.4.3 Japan

- 5.3.5.5 Middle East & Africa

- 5.3.5.5.1 UAE

- 5.3.5.5.2 South Africa

- 5.3.5.6 Latin America

- 5.3.5.6.1 Brazil

- 5.3.5.2 North America

- 5.3.6 PRICING ANALYSIS

- 5.3.6.1 Average selling price trend of key players, by VR software

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY VR SOFTWARE (USD)

- 5.3.6.2 Indicative pricing analysis of key players, by AR software

- TABLE 10 INDICATIVE PRICING ANALYSIS, BY AR SOFTWARE (USD)

- 5.3.7 TECHNOLOGY ANALYSIS

- 5.3.7.1 Key technologies

- 5.3.7.1.1 3D modeling and rendering

- 5.3.7.1.2 Simulations and physics engine

- 5.3.7.1.3 Augmented reality cloud

- 5.3.7.2 Complementary technologies

- 5.3.7.2.1 Artificial intelligence & machine learning (AI & ML)

- 5.3.7.2.2 5G connectivity

- 5.3.7.2.3 Haptics

- 5.3.7.2.4 Spatial computing

- 5.3.7.3 Adjacent technologies

- 5.3.7.3.1 Blockchain

- 5.3.7.3.2 Wearable technology

- 5.3.7.3.3 IoT

- 5.3.7.1 Key technologies

- 5.3.8 PATENT ANALYSIS

- 5.3.8.1 Methodology

- 5.3.8.2 Types of patents

- TABLE 11 PATENTS FILED, 2021-2023

- 5.3.8.3 Innovations and patent applications

- FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 2021-2023

- 5.3.8.3.1 Top applicants

- FIGURE 22 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021-2023

- TABLE 12 PATENTS GRANTED IN AR VR SOFTWARE MARKET, 2021-2023

- 5.3.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.9.1 Key stakeholders in buying process

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- 5.3.9.2 Buying criteria

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.3.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.3.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 AR VR SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.11.1 Threat of new entrants

- 5.3.11.2 Threat of substitutes

- 5.3.11.3 Bargaining power of buyers

- 5.3.11.4 Bargaining power of suppliers

- 5.3.11.5 Intensity of competitive rivalry

- 5.3.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.13 BEST PRACTICES OF AR VR SOFTWARE MARKET

- 5.3.13.1 User-centered design

- 5.3.13.2 Cross-platform compatibility

- 5.3.13.3 Interactivity and immersion

- 5.3.13.4 Accessibility

- 5.3.13.5 Content creation

- 5.3.14 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.14.1 Subscription services model

- 5.3.14.2 Freemium

- 5.3.14.3 Pay-per-use or pay-per-session

- 5.3.14.4 Enterprise licensing

- 5.3.14.5 Content marketplace

- 5.3.15 AR VR SOFTWARE TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.15.1 AR VR software tools

- 5.3.15.1.1 Content creation tools

- 5.3.15.1.2 Development platforms

- 5.3.15.1.3 Visualization and simulation software

- 5.3.15.2 AR VR software frameworks

- 5.3.15.2.1 OpenXR

- 5.3.15.2.2 WebXR

- 5.3.15.3 AR VR software techniques

- 5.3.15.3.1 3D modeling and texturing

- 5.3.15.3.2 User interface design

- 5.3.15.3.3 Simultaneous localization and mapping

- 5.3.15.3.4 Rendering

- 5.3.15.3.5 Tracking

- 5.3.15.3.6 Computer vision

- 5.3.15.1 AR VR software tools

- 5.3.16 FUTURE LANDSCAPE OF AR VR SOFTWARE MARKET

- 5.3.16.1 AR VR software technology roadmap till 2030

- 5.3.16.1.1 Short-term roadmap (2023-2025)

- 5.3.16.1.2 Mid-term roadmap (2026-2028)

- 5.3.16.1.3 Long-term roadmap (2029-2030)

- 5.3.16.1 AR VR software technology roadmap till 2030

6 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE

- 6.1 INTRODUCTION

- FIGURE 26 AR VR SOFTWARE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 TECHNOLOGY TYPE: AR VR SOFTWARE MARKET DRIVERS

- TABLE 17 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 18 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- 6.2 AR SOFTWARE

- 6.2.1 ENHANCES REAL-WORLD EXPERIENCES BY ADDING LAYERS OF IMMERSION AND INTERACTION USING AR

- TABLE 19 AR SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 AR SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 MARKER-BASED AR TECHNOLOGY

- 6.2.3 MARKERLESS AR TECHNOLOGY

- 6.3 VR SOFTWARE

- 6.3.1 CRAFTS HYPER-REALISTIC WORLDS FOR UNPARALLELED IMMERSIVE EXPLORATION AND INNOVATION

- TABLE 21 VR SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 VR SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE

- 7.1 INTRODUCTION

- FIGURE 27 TRAINING SIMULATION SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 7.1.1 SOFTWARE TYPE: AR VR SOFTWARE MARKET DRIVERS

- TABLE 23 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 24 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- 7.2 SOFTWARE DEVELOPMENT KIT (SDK)

- 7.2.1 TOOLS AND KITS TO ENGINEER MORE AR/VR EXPERIENCES AND APPLICATIONS

- TABLE 25 SOFTWARE DEVELOPMENT KIT: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 SOFTWARE DEVELOPMENT KIT: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 GAME ENGINE

- 7.3.1 BUILDS VIRTUAL WORLDS AND IMMERSIVE GAMING ADVENTURES

- TABLE 27 GAME ENGINE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 GAME ENGINE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 MODELING & VISUALIZATION SOFTWARE

- 7.4.1 HELPS DESIGN INTERACTIVE VISUAL EXPERIENCES WITH EXTREME PRECISION AND DETAIL

- TABLE 29 MODELING & VISUALIZATION SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 MODELING & VISUALIZATION SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 CONTENT MANAGEMENT SYSTEM

- 7.5.1 MANAGES AR AND VR MULTIMEDIA CONTENT ACROSS MULTIPLE PLATFORMS

- TABLE 31 CONTENT MANAGEMENT SYSTEM: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 CONTENT MANAGEMENT SYSTEM: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 TRAINING SIMULATION SOFTWARE

- 7.6.1 SIMULATES REALISTIC TRAINING MODULES TO SAVE TIME AND COST

- TABLE 33 TRAINING SIMULATION SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 TRAINING SIMULATION SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 OTHER SOFTWARE

- TABLE 35 OTHER SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 OTHER SOFTWARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AR VR SOFTWARE MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 28 TRAVEL & HOSPITALITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 8.1.1 VERTICAL: AR VR SOFTWARE MARKET DRIVERS

- TABLE 37 AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 38 AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 MEDIA & ENTERTAINMENT

- 8.2.1 INCREASING POPULARITY OF AR/VR-BASED GAMING TO DRIVE MARKET

- 8.2.2 USE CASES

- 8.2.2.1 Immersive gaming experiences

- 8.2.2.2 Enhanced sports viewing

- TABLE 39 MEDIA & ENTERTAINMENT: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 MEDIA & ENTERTAINMENT: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 RETAIL & ECOMMERCE

- 8.3.1 RESHAPING VIRTUAL SHOPPING EXPERIENCES WITH AR AND VR

- 8.3.2 USE CASE

- 8.3.2.1 Virtual try-on

- 8.3.2.2 Furniture and decor visualization

- TABLE 41 RETAIL & ECOMMERCE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 RETAIL & ECOMMERCE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 TRAINING & EDUCATION

- 8.4.1 ELEVATING EDUCATION THROUGH IMMERSIVE TRAINING EXPERIENCES

- 8.4.2 USE CASES

- 8.4.2.1 Employee training

- 8.4.2.2 Historical reconstruction

- TABLE 43 TRAINING & EDUCATION: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 TRAINING & EDUCATION: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 TRAVEL & HOSPITALITY

- 8.5.1 AR AND VR TECHNOLOGIES HELP TRAVELERS RESEARCH, PLAN, AND EXPERIENCE JOURNEYS

- 8.5.2 USE CASE

- 8.5.2.1 Virtual destination tours

- 8.5.2.2 Language translation and navigation

- TABLE 45 TRAVEL & HOSPITALITY: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 TRAVEL & HOSPITALITY: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 REAL ESTATE

- 8.6.1 AR-BASED INSIGHTS AND PROPERTY TOURS

- 8.6.2 USE CASE

- 8.6.2.1 Interactive 3D floor plans

- 8.6.2.2 Architectural visualization

- TABLE 47 REAL ESTATE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 REAL ESTATE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 MANUFACTURING

- 8.7.1 AR AND VR ASSIST IN MANUFACTURING TO MAINTAIN RISK-FREE ENVIRONMENTS

- 8.7.2 USE CASE

- 8.7.2.1 Design and prototyping

- 8.7.2.2 Quality control

- TABLE 49 MANUFACTURING: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 MANUFACTURING: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 HEALTHCARE

- 8.8.1 AR AND VR TECHNOLOGIES ENHANCE PATIENT CARE, MEDICAL TRAINING, AND THERAPEUTIC INTERVENTIONS

- 8.8.2 USE CASE

- 8.8.2.1 Phobia and PTSD treatment

- 8.8.2.2 Surgical planning

- TABLE 51 HEALTHCARE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 HEALTHCARE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9 AEROSPACE & DEFENSE

- 8.9.1 IMPROVING SITUATIONAL AWARENESS AND PLANNING EFFECTIVE RESPONSE WITH AR AND VR-BASED SIMULATION

- 8.9.2 USE CASE

- 8.9.2.1 Flight simulation and training

- 8.9.2.2 Military training simulation

- TABLE 53 AEROSPACE & DEFENSE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 AEROSPACE & DEFENSE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10 AUTOMOTIVE

- 8.10.1 AR AND VR TECHNOLOGIES ENHANCE PROTOTYPING PROCESSES BY BUILDING MORE INTERACTIVE 3D MODELS

- 8.10.2 USE CASE

- 8.10.2.1 Vehicle customization

- 8.10.2.2 Autonomous vehicle development

- TABLE 55 AUTOMOTIVE: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 AUTOMOTIVE: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.11 OTHER VERTICALS

- 8.11.1 USE CASE

- 8.11.1.1 Remote technical support

- 8.11.1.2 Inventory management

- 8.11.1.3 Infrastructure design

- TABLE 57 OTHER VERTICALS: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 OTHER VERTICALS: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.11.1 USE CASE

9 AR VR SOFTWARE MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 59 AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: AR VR SOFTWARE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 29 NORTH AMERICA: AR VR SOFTWARE MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: AR VR SOFTWARE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: AR VR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Extensive research in AR and VR to drive market

- TABLE 69 US: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 70 US: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 71 US: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 72 US: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 73 US: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 74 US: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Rising implementation of AR/VR software by enterprises to drive market

- TABLE 75 CANADA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 76 CANADA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 CANADA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 78 CANADA AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 79 CANADA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 80 CANADA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: AR VR SOFTWARE MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 81 EUROPE: AR VR SOFTWARE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 82 EUROPE: AR VR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 83 EUROPE: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 84 EUROPE: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 86 EUROPE: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 88 EUROPE: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Funding initiatives, grants, and tax incentives for tech companies to drive market

- TABLE 89 UK: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 90 UK: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 UK: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 92 UK: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 93 UK: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 94 UK: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Focus on integrating AR and VR within industries and film making to drive market

- 9.3.5 FRANCE

- 9.3.5.1 Favorable government policies and rising adoption of immersive technologies in automobile and fashion industries to drive market

- 9.3.6 ITALY

- 9.3.6.1 Increasing demand for AR/VR-based tourism to drive market

- 9.3.7 SPAIN

- 9.3.7.1 Increasing use of AR/VR in building interactive and engaging infrastructure to drive market

- 9.3.8 NORDICS

- 9.3.8.1 Tech-savvy population and robust investment in technology companies to drive market

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: AR VR SOFTWARE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 30 ASIA PACIFIC: AR VR SOFTWARE MARKET SNAPSHOT

- TABLE 95 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Robust tech ecosystem to drive market

- TABLE 103 CHINA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 104 CHINA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 105 CHINA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 106 CHINA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 107 CHINA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 108 CHINA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Investments, partnerships, and government support to drive market

- 9.4.5 JAPAN

- 9.4.5.1 Introduction of AR and VR-friendly policies and regulations to drive market

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Increasing application of AR and VR in defense and farming to drive market

- 9.4.7 SOUTH KOREA

- 9.4.7.1 Thriving gaming ecosystem to drive market

- 9.4.8 SOUTHEAST ASIA

- 9.4.8.1 Increasing adoption of AR and VR in tourism to drive market

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 109 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.5.3 MIDDLE EAST

- 9.5.3.1 Growing adoption of AR VR technologies to enhance healthcare and tourism to drive market

- TABLE 117 MIDDLE EAST: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 119 MIDDLE EAST: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 120 MIDDLE EAST: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 121 MIDDLE EAST: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 122 MIDDLE EAST: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.5.4 AFRICA

- 9.5.4.1 Strong initiatives from governments and companies to drive market

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: AR VR SOFTWARE MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 123 LATIN AMERICA: AR VR SOFTWARE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 124 LATIN AMERICA: AR VR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 126 LATIN AMERICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 128 LATIN AMERICA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 130 LATIN AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Increasing adoption of AR/VR in education and healthcare to drive market

- TABLE 131 BRAZIL: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 132 BRAZIL: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 133 BRAZIL: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 134 BRAZIL: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 135 BRAZIL: AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 136 BRAZIL: AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Government initiatives and adoption of AR/VR across diverse sectors to drive market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 137 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 31 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 138 AR VR SOFTWARE MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 32 AR VR SOFTWARE MARKET: COMPANY EVALUATION MATRIX, 2023

- 10.5.5 COMPANY FOOTPRINT

- TABLE 139 COMPANY FOOTPRINT

- TABLE 140 TECHNOLOGY FOOTPRINT

- TABLE 141 SOFTWARE FOOTPRINT

- TABLE 142 REGIONAL FOOTPRINT

- 10.6 STARTUP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 33 AR VR SOFTWARE MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 143 DETAILED LIST OF STARTUPS/SMES

- TABLE 144 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 145 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- 10.7.1 PRODUCT LAUNCHES

- TABLE 146 AR VR SOFTWARE MARKET: PRODUCT LAUNCHES, JANUARY 2021-SEPTEMBER 2023

- 10.7.2 DEALS

- TABLE 147 AR VR SOFTWARE MARKET: DEALS, JANUARY 2021-SEPTEMBER 2023

- 10.7.3 OTHERS

- TABLE 148 AR VR SOFTWARE MARKET: OTHERS

- 10.8 AR VR PRODUCT BENCHMARKING

- 10.8.1 PROMINENT AR SOFTWARE SOLUTIONS

- TABLE 149 COMPARATIVE ANALYSIS OF PROMINENT AR SOFTWARE

- 10.8.1.1 Unity AR Engine

- 10.8.1.2 Microsoft Mesh

- 10.8.1.3 ARCore

- 10.8.1.4 Frontline AR

- 10.8.1.5 Zoho Corporation Lens

- 10.8.2 PROMINENT VR SOFTWARE SOLUTIONS

- TABLE 150 COMPARATIVE ANALYSIS OF PROMINENT VR SOFTWARE

- 10.8.2.1 Unity VR tools

- 10.8.2.2 Oculus Platform SDK

- 10.8.2.3 NVIDIA Corporation Omniverse

- 10.8.2.4 myVR Software

- 10.8.2.5 Wevr Virtual Studio

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY AR VR SOFTWARE VENDORS

- FIGURE 34 VALUATION AND FINANCIAL METRICS OF KEY AR VR SOFTWARE VENDORS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 META

- TABLE 151 META: COMPANY OVERVIEW

- FIGURE 35 META: COMPANY SNAPSHOT

- TABLE 152 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 META: DEALS

- 11.1.2 MICROSOFT

- TABLE 154 MICROSOFT: COMPANY OVERVIEW

- FIGURE 36 MICROSOFT: COMPANY SNAPSHOT

- TABLE 155 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MICROSOFT: DEALS

- 11.1.3 GOOGLE

- TABLE 157 GOOGLE: COMPANY OVERVIEW

- FIGURE 37 GOOGLE: COMPANY SNAPSHOT

- TABLE 158 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 GOOGLE: PRODUCT LAUNCHES

- TABLE 160 GOOGLE: DEALS

- 11.1.4 UNITY TECHNOLOGIES

- TABLE 161 UNITY TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 38 UNITY TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 162 UNITY TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 UNITY TECHNOLOGIES: DEALS

- 11.1.5 QUALCOMM

- TABLE 164 QUALCOMM: COMPANY OVERVIEW

- FIGURE 39 QUALCOMM: COMPANY SNAPSHOT

- TABLE 165 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 QUALCOMM: DEALS

- TABLE 167 QUALCOMM: OTHERS

- 11.1.6 ADOBE

- TABLE 168 ADOBE: COMPANY OVERVIEW

- FIGURE 40 ADOBE: COMPANY SNAPSHOT

- TABLE 169 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 ADOBE: DEALS

- 11.1.7 AUTODESK

- TABLE 171 AUTODESK: COMPANY OVERVIEW

- FIGURE 41 AUTODESK: COMPANY SNAPSHOT

- TABLE 172 AUTODESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 AUTODESK: DEALS

- 11.1.8 PTC

- TABLE 174 PTC: COMPANY OVERVIEW

- FIGURE 42 PTC: COMPANY SNAPSHOT

- TABLE 175 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 PTC: PRODUCT LAUNCHES

- TABLE 177 PTC: DEALS

- 11.1.9 TEAMVIEWER

- TABLE 178 TEAMVIEWER: COMPANY OVERVIEW

- FIGURE 43 TEAMVIEWER: COMPANY SNAPSHOT

- TABLE 179 TEAMVIEWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 TEAMVIEWER: PRODUCT LAUNCHES

- TABLE 181 TEAMVIEWER: DEALS

- 11.1.10 NVIDIA CORPORATION

- TABLE 182 NVIDIA CORPORATION: COMPANY OVERVIEW

- FIGURE 44 NVIDIA CORPORATION: COMPANY SNAPSHOT

- TABLE 183 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 185 NVIDIA CORPORATION: DEALS

- 11.1.11 ADVANCED MICRO DEVICES

- TABLE 186 ADVANCED MICRO DEVICES: COMPANY OVERVIEW

- FIGURE 45 ADVANCED MICRO DEVICES: COMPANY SNAPSHOT

- TABLE 187 ADVANCED MICRO DEVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ADVANCED MICRO DEVICES: DEALS

- 11.1.12 ZOHO CORPORATION

- 11.1.13 VMWARE

- 11.1.14 HEXAGON AB

- 11.1.15 MAGIC LEAP

- 11.2 OTHER PLAYERS

- 11.2.1 TAQTILE

- TABLE 189 TAQTILE: COMPANY OVERVIEW

- TABLE 190 TAQTILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 TAQTILE: PRODUCT LAUNCHES

- TABLE 192 TAQTILE: DEALS

- 11.2.2 BLIPPAR

- 11.2.3 AUGMENT

- 11.2.4 SHAPESXR

- 11.2.5 ARUVR

- 11.2.6 SCOPE AR

- 11.2.7 VECTARY

- 11.2.8 EON REALITY

- 11.2.9 WEVR

- 11.2.10 TALESPIN REALITY LABS

- 11.2.11 SQUINT

- 11.2.12 NIANTIC

- 11.2.13 MARXENT LABS

- 11.2.14 INGLOBE TECHNOLOGIES

- 11.2.15 ULTRALEAP

- 11.2.16 AMELIA VIRTUAL CARE

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 EXTENDED REALITY MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 EXTENDED REALITY MARKET, BY TECHNOLOGY

- TABLE 193 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 194 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 12.2.4 EXTENDED REALITY MARKET, BY VR TECHNOLOGY

- TABLE 195 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 196 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- 12.2.5 EXTENDED REALITY MARKET, BY OFFERING

- TABLE 197 EXTENDED REALITY MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 198 EXTENDED REALITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 199 HARDWARE: EXTENDED REALITY MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 200 HARDWARE: EXTENDED REALITY MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 201 AR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 202 AR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 203 VR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 204 VR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 205 MR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 206 MR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.6 EXTENDED REALITY MARKET, DEVICE TYPE

- TABLE 207 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 208 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- 12.2.7 EXTENDED REALITY MARKET, BY REGION

- TABLE 209 EXTENDED REALITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 210 EXTENDED REALITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 IMMERSIVE ANALYTICS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 IMMERSIVE ANALYTICS MARKET, BY OFFERING

- TABLE 211 IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 212 IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 213 AR/VR/MR HEADSETS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 214 DISPLAYS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 215 SENSORS & CONTROLLERS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 216 OTHER HARDWARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 217 IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 218 PROFESSIONAL SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 219 MANAGED SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3.4 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY

- TABLE 220 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 221 MEDIA & ENTERTAINMENT: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 222 HEALTHCARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 223 AUTOMOTIVE & TRANSPORTATION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 224 CONSTRUCTION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 225 GOVERNMENT & DEFENSE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 226 OTHER END-USE INDUSTRIES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3.5 IMMERSIVE ANALYTICS MARKET, BY REGION

- TABLE 227 IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS