|

市場調査レポート

商品コード

1406094

UV硬化樹脂:市場シェア分析、産業動向・統計、成長予測、2024年~2029年UV Curable Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| UV硬化樹脂:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

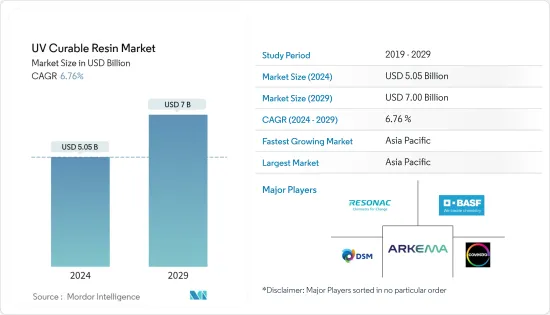

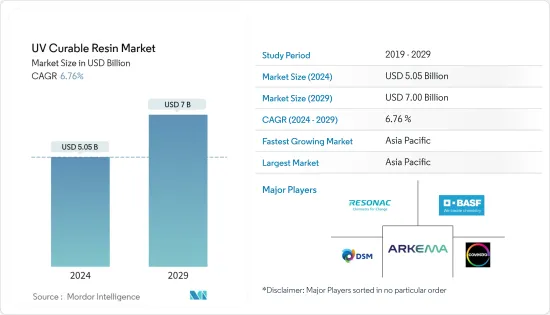

UV硬化樹脂市場規模は2024年に50億5,000万米ドルと推定され、2029年には70億米ドルに達し、予測期間(2024-2029年)のCAGRは6.76%で成長すると予測されています。

COVID-19パンデミックは市場にマイナスの影響を与えました。封鎖や制限により製造施設や工場が閉鎖されたためです。サプライチェーンと輸送の混乱はさらに市場に障害をもたらしました。しかし、2021年には業界は回復し、市場の需要は回復しました。

主なハイライト

- 市場を牽引する主な要因は、環境に優しい工業用コーティング剤の使用増加と、包装用途におけるUV硬化樹脂の需要増です。

- 初期資本コストの高さが市場成長を抑制しています。

- 3Dプリンティング、デジタルプリンティング、プリント回路における用途の増加は、市場成長に様々な有利な機会を提供します。

- アジア太平洋地域は最大の市場を占めており、中国、インド、日本などの国々からの消費により、予測期間中に最も急成長する市場になると予想されます。

UV硬化樹脂市場の動向

包装業界からの需要の増加

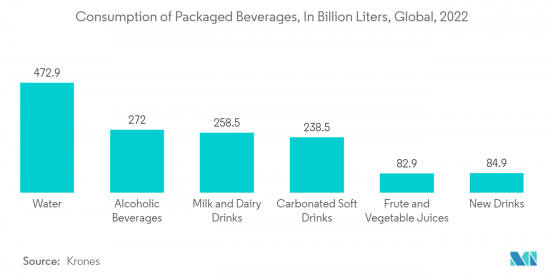

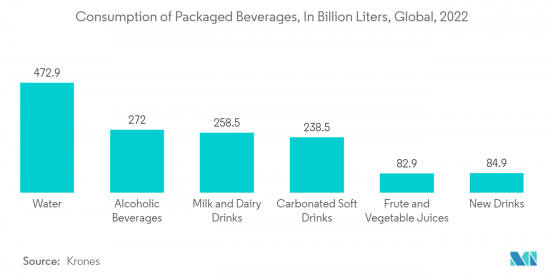

- UV硬化樹脂は、食品や医薬品の包装業界で広く使用されています。コーティング作業性に優れ、均一なコーティング膜を容易に得ることができます。

- アクリル化ウレタンは耐久性と柔軟性に優れているため、軟包装のコーティングに使用され、大きな成長が見込まれています。

- 世界包装機構(WPO)によると、世界の包装産業の売上高は5,000億米ドルを超えており、食品包装はその柱となっています。

- 中国は世界最大の包装消費国であり、これは一人当たり所得の増加とeコマース大手の台頭によるものです。インドプラスチック工業協会によると、インドの包装産業は世界第5位で、年間約22~25%の成長率を示しています。

- 高度に熟練した労働力と安価な人件費により、包装・加工食品のコストは欧州よりも40%低く抑えることができます。人口の増加と包装需要の増加が市場を牽引すると予想されます。

- さらに、FoodDrink Europe Report 2022によると、EUの飲食品産業は460万人を雇用し、売上高1兆1,000億ユーロ(~1兆2,000億米ドル)、付加価値額2,300億ユーロ(~2,440億米ドル)など、EU最大の加工産業のひとつとなっています。同時に、EUは世界最大の飲食品輸出国であり、EU域外への輸出は1,560億ユーロ(~1,650億米ドル)、貿易黒字は730億ユーロ(~770億米ドル)です。

- したがって、上記の要因が、予測期間中のUV硬化樹脂市場を牽引しています。

市場を独占するアジア太平洋地域

- アジア太平洋地域の急速な工業化が市場成長の原動力になると予想されます。同地域では、塗料・コーティング、建設、電気・電子、自動車などの産業が成長し、UV硬化樹脂の成長が見込まれます。

- 中国の包装産業は、経済の拡大と購買力の高い中間層の台頭により、近年一貫して急成長を遂げています。食品包装は包装業界の主要企業であり、中国における市場シェアの約60%を占めています。Interpakによると、中国の食品包装カテゴリーでは、包装総量は2023年に4,470億個に達する見込みです。これは、包装業界からのUV硬化型接着剤に対する需要の増加を示しています。

- また、自動車産業は自動車部品の仕上げにUV硬化樹脂を使用しており、これが市場の成長を押し上げると予測されています。アジア・オセアニアの2022年の自動車生産台数は約5,002万台で、2021年より7%多いです。

- さらに、中国のエレクトロニクス市場は世界最大であり、先進工業国の合計市場よりも大きいです。2022年、中国の電子産業は14%拡大し、2023年には8%の成長が見込まれています。

- インドのエレクトロニクス分野は、Make in India、National Policy of Electronics、Net Zero Imports in Electronics、Zero Defect Zero Effectなどの政府計画により急成長しています。これらは、国内製造業の成長、輸入依存度の低下、輸出と製造業の活性化にコミットするものです。

- 以上のような要因や政府規制の後押しが、この地域におけるUV硬化樹脂の需要拡大に寄与しています。

UV硬化樹脂産業の概要

世界のUV硬化樹脂市場は断片化されており、大手と中小の競合企業が存在します。主要企業には、Arkema Group、BASF SE、Covestro AG、Resonac Holdings Corporation、DSMなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 環境に優しい工業用コーティング剤の使用の増加

- 包装用途におけるUV硬化型インキの需要増加

- その他の促進要因

- 抑制要因

- 初期資本コストの高さ

- その他の阻害要因

- バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(市場規模:金額ベース)

- 樹脂タイプ

- アクリル化エポキシ

- アクリル化ポリスター

- アクリル化ウレタン

- アクリル化シリコーン

- その他

- 組成

- モノマー

- 光重合開始剤

- オリゴマー

- コイニシエーター

- 用途

- コーティング

- 印刷

- 接着剤・シーラント

- その他

- エンドユーザー産業

- エレクトロニクス

- 工業用コーティング

- 医療

- 自動車

- 包装

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- Allnex

- Arkema Group

- BASF SE

- Covestro AG

- DIC CORPORATION

- DSM

- Dymax Corporation

- Eternal Materials Co.,Ltd.

- Resonac Holdings Corporation

- IGM Resins

- Jiangsu Litian Technology Co., Ltd

- Nippon-Gohsei

- SOLTECH LTD.

- TOAGOSEI CO., LTD.

- Wanhua Chemical Group Co.,Ltd.

第7章 市場機会と今後の動向

- 3Dプリンティング、デジタル印刷、プリント回路への応用拡大

- その他の機会

The UV Curable Resin Market size is estimated at USD 5.05 billion in 2024, and is expected to reach USD 7 billion by 2029, growing at a CAGR of 6.76% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Major factors driving the market studied are increased usage of environment-friendly industrial coatings and rising demand for UV-curable resins in packaging applications.

- High initial capital costs are restraining market growth.

- Increasing applications in 3D printing, digital printing, and printed circuits offer various lucrative opportunities for market growth.

- Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the consumption from countries such as China, India, and Japan.

UV Curable Resin Market Trends

Increasing Demand from Packaging Industry

- UV-curable resins are widely used in the food and pharmaceutical packaging industry. They include excellent coating workability, and uniform coating films can be easily obtained.

- Acrylated urethanes are anticipated to grow significantly as they are used in coatings for flexible packaging because of their superior durability and flexibility.

- According to the World Packaging Organization (WPO), the global packaging industry's turnover exceeds USD 500 billion, and food packaging is a pillar area.

- China is the world's largest packaging consumer globally, owing to growing per capita income and rising e-commerce giants. India's packaging industry is the fifth-largest globally, growing at about 22-25% per year, according to the Plastics Industry Association of India.

- Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Furthermore, according to FoodDrink Europe Report 2022, the EU food and beverage industry employs 4.6 million people, including a turnover of EUR 1.1 trillion (~USD 1.2 trillion) and a value-added of EUR 230 billion (~USD 244 billion), making it one of the largest processing industries in the EU. At the same time, the EU is the world's largest exporter of food and beverages, with exports outside the EU of EUR 156 billion (~USD 165 billion) and a trade surplus of EUR 73 billion (~USD 77 billion).

- Hence, the factors above are, in turn, driving the market for UV curable resin during the forecast period.

Asia-Pacific Region to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is expected to drive market growth. The growth of industries such as paints & coating, construction, electrical & electronics, and automotive in the region will result in the growth of UV-curable resins.

- The Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023. It indicates an increased demand for UV-curable adhesives from the packaging industry.

- Also, the automotive industry consumes UV-curable resins in automotive parts for finishes which are anticipated to boost the market's growth. Asia-Oceania manufactured around 50.02 million vehicles in 2022, 7% more than in 2021.

- Furthermore, China's electronics market is the largest in the world, even larger than the combined markets of all industrialized countries. In 2022, the Chinese electronic industry expanded by 14% and is expected to grow by 8% in 2023.

- The electronics sector in India is seeing rapid growth due to government schemes such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect. These offer a commitment to growth in domestic manufacturing, lowering import dependence, and energizing exports and manufacturing.

- The factors above and supportive government regulations are contributing to the increased demand for UV-curable resins in the region.

UV Curable Resin Industry Overview

The global UV curable resin market is fragmented, with major and minor competitors. Some major companies include Arkema Group, BASF SE, Covestro AG, Resonac Holdings Corporation, and DSM, among the key players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Use of Environment-Friendly Industrial Coatings

- 4.1.2 Rising Demand for UV Curable Inks in Packaging Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Initial Capital Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylated Epoxies

- 5.1.2 Acrylated Polysters

- 5.1.3 Acrylated Urethanes

- 5.1.4 Acrylated Silicones

- 5.1.5 Others

- 5.2 Composition

- 5.2.1 Monomers

- 5.2.2 Photoinitiators

- 5.2.3 Oligomers

- 5.2.4 Coinitiators

- 5.3 Application

- 5.3.1 Coating

- 5.3.2 Printing

- 5.3.3 Adhesives and Sealants

- 5.3.4 Others

- 5.4 End-user Industry

- 5.4.1 Electronics

- 5.4.2 Industrial Coatings

- 5.4.3 Medical

- 5.4.4 Automotive

- 5.4.5 Packaging

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East & Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Allnex

- 6.4.2 Arkema Group

- 6.4.3 BASF SE

- 6.4.4 Covestro AG

- 6.4.5 DIC CORPORATION

- 6.4.6 DSM

- 6.4.7 Dymax Corporation

- 6.4.8 Eternal Materials Co.,Ltd.

- 6.4.9 Resonac Holdings Corporation

- 6.4.10 IGM Resins

- 6.4.11 Jiangsu Litian Technology Co., Ltd

- 6.4.12 Nippon-Gohsei

- 6.4.13 SOLTECH LTD.

- 6.4.14 TOAGOSEI CO., LTD.

- 6.4.15 Wanhua Chemical Group Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in 3D printing, Digital Printing and Printed Circuits

- 7.2 Other Opportunities