|

|

市場調査レポート

商品コード

1350664

B2Bデジタル決済の世界市場:オファリング別(ソリューション、サービス)、決済方法別(クレジットカード/デビットカード/バーチャルカード、デジタルウォレット)、取引タイプ別(国内、海外)、業界別、地域別-2028年までの予測B2B Digital Payment Market by Offering (Solutions, Services), Payment Method (Credit Cards/Debit Cards/Virtual Cards, Digital Wallet), Transaction Type (Domestic, Cross-Border), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| B2Bデジタル決済の世界市場:オファリング別(ソリューション、サービス)、決済方法別(クレジットカード/デビットカード/バーチャルカード、デジタルウォレット)、取引タイプ別(国内、海外)、業界別、地域別-2028年までの予測 |

|

出版日: 2023年09月19日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

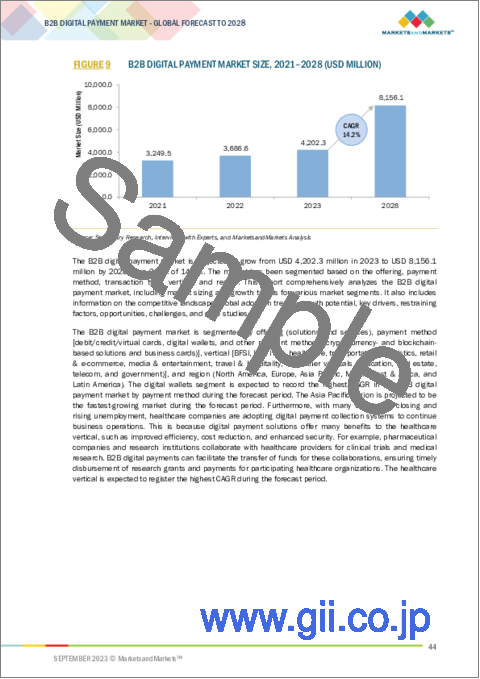

B2Bデジタル決済の市場規模は2023年の42億米ドルから2028年には82億米ドルに成長し、予測期間中のCAGRは14.3%になると予測されています。

COVID-19のパンデミックは、リモートワークや社会との距離の取り方が常態化するにつれて、デジタル決済手法の採用を加速させました。多くの企業は、困難な時期にも継続性を確保するために、決済を含むデジタル業務に重点を移しました。

ヘルスケア業界では、患者へのサービス向上のため、新技術の導入・採用が進んでいます。この業界の組織は、業務を合理化し、顧客体験を向上させるために、効率的なデジタル決済技術を必要としています。デジタル決済ソリューションは、請求プロセスを簡素化し、複数の支払い方法を提供できるため、ヘルスケアプロバイダーによる採用が増加しています。医療保険の増加により、この業界の組織は既存の決済プロセスをデジタル化する必要に迫られています。ヘルスケア支出の増加と新技術の急速な導入は、ヘルスケア業界におけるB2Bデジタル決済ソリューションの需要を高める主な要因となっています。

B2B(企業間)決済ソリューション市場における決済インフラとは、企業間の安全かつ効率的でシームレスな資金移動を可能にする基盤となるフレームワークと技術を指します。B2B決済ソリューションは、企業の決済プロセスを簡素化・自動化し、金融取引を合理化して手作業の介入を減らすことを目的としています。決済インフラは、こうした取引を促進する上で極めて重要な役割を果たします。B2Bデジタル決済市場の決済インフラセグメントは、決済ゲートウェイ、決済プロセッサー、モバイル決済アプリケーション、POS(販売時点情報管理)、暗号通貨プラットフォームなどのその他のソリューションに分類されます。ペイメントゲートウェイとペイメントプロセッサーは、加盟店の間で最も広く求められているソリューションです。

アジア太平洋のB2Bデジタル決済市場は、近年大きな変貌を遂げています。アジア太平洋地域の消費者は、デジタル決済取引のあらゆる側面において、シームレスで均等なセキュリティを好んでいます。同地域の小売市場の成長により、世界の決済処理ソリューションプロバイダーは、先進的なソリューションを提供するため、同地域に一層注力するようになっています。この地域には、中国、インド、インドネシア、マレーシアなどの経済成長国があり、そこでは日常的に多数の取引がモバイル経由で行われています。このため、各国政府も消費者の支払い方法の簡便化に注力せざるを得なくなっています。B2Bデジタル決済ソリューションは、進行中のデジタル変革の一環として、電子請求書発行や資金移動を含め、企業に受け入れられています。eコマースの成長は大きな推進力となっており、オンラインマーケットプレースや国境を越えた取引が、合理化されたB2B取引の需要を促進しています。

当レポートでは、世界のB2Bデジタル決済市場について調査し、オファリング別、決済方法別、取引タイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 業界の動向

- B2Bデジタル決済市場のベストプラクティス

- 規制状況

- サプライチェーン分析

- B2Bデジタル決済技術の簡単な歴史

- 生態系マッピング

- 特許分析

- ケーススタディ分析

- 価格分析

- B2Bデジタル決済が隣接テクノロジーに与える影響

- 技術分析

- ポーターのファイブフォース分析

- お客様のビジネスに影響を与える混乱/動向

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

- B2Bデジタル決済技術の未来

第6章 B2Bデジタル決済市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 B2Bデジタル決済市場、取引タイプ別

- イントロダクション

- 国内

- 海外

第8章 B2Bデジタル決済市場、決済方法別

- イントロダクション

- クレジット/デビット/バーチャルカード

- デジタルウォレット

- その他

第9章 B2Bデジタル決済市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 輸送と物流

- ITとITES

- ヘルスケア

- 小売とeコマース

- 旅行とホスピタリティ

- メディアとエンターテイメント

- その他

第10章 B2Bデジタル決済市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略、2019~2023年

- 主要企業の市場シェア分析

- 収益分析、2020~2022年

- B2Bデジタル決済市場の主要企業ランキング、2023年

- 企業評価マトリックス、2023年

- スタートアップ/中小企業評価マトリックス、2023年

- 企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオと動向

- B2Bデジタル決済製品のベンチマーク

- 主要なB2Bデジタル決済ソリューションおよびサービスベンダーの評価と財務指標

第12章 企業プロファイル

- 主要参入企業

- PAYPAL

- FIS

- FISERV, INC.

- VISA

- MASTERCARD

- GLOBAL PAYMENTS INC.

- ACI WORLDWIDE

- BLOCK, INC.

- PAYONEER INC.

- STRIPE, INC.

- HELCIM INC.

- PAY SET LIMITED

- PAYTM

- RAZORPAY

- RAPYD FINANCIAL NETWORK LTD.

- その他の企業

- STAX LLC

- EBANX

- RAMP BUSINESS CORPORATION

- HIGHRADIUS

- MATCHMOVE PAY PTE LTD

- BHARATPE

- JUSPAY

- RIPPLE

- TERRA

- LOLLI

- PAYSTAND, INC.

第13章 隣接市場

第14章 付録

MarketsandMarkets forecasts that the B2B digital payment market size is projected to grow from USD 4.2 billion in 2023 to USD 8.2 billion by 2028, at a CAGR of 14.3% during the forecast period. The COVID-19 pandemic accelerated the adoption of digital payment methods as remote work and social distancing became the norm. Many businesses shifted their focus to digital operations, including payments, to ensure continuity during challenging times.

"By Vertical, Healthcare segment is expected to grow with the highest CAGR during the forecast period."

The healthcare industry is implementing and adopting new technologies to provide improved services to patients. Organizations in this industry require efficient digital payment technologies to streamline their operations and enhance customer experience. Digital payment solutions are being increasingly adopted by healthcare providers, as they help simplify the billing process and provide multiple modes of payment. The rise in healthcare insurance compels organizations in this vertical to digitize their existing payment process. Increase in healthcare spending and rapid deployment of new technologies are key factors contributing to the demand for B2B digital payment solutions in the healthcare industry.

"By Offering, the payment infrastructure segment is expected to hold the largest market size during the forecast period."

Payment infrastructure in the B2B (business-to-business) payment solutions market refers to the underlying framework and technology that enables the secure, efficient, and seamless transfer of funds between businesses. B2B payment solutions aim to simplify and automate the payment process for businesses, streamlining financial transactions and reducing manual intervention. The payment infrastructure plays a crucial role in facilitating these transactions. The payment infrastructure segment of the B2B digital payment market has been classified into payment gateway, payment processors, mobile payment applications, and other solutions such as point-of-sale (POS), and cryptocurrencies platform. Payment gateway and payment processors are the most widely demanded solutions among merchants.

"Asia Pacific is expected to grow with the highest CAGR during the forecast period."

The B2B digital payment market in the Asia Pacific region has undergone significant transformation in recent years. Asia Pacific consumers prefer equal measures of seamless security in all aspects of their digital payment transactions. The growing retail market in the region has enabled global payment processing solution providers to focus more on this region for providing advanced solutions. The region has some growing economies, such as China, India, Indonesia, and Malaysia, where a large number of transactions are done via mobile on a daily basis. This has also forced the respective governments to focus on ease of payment methods for consumers. B2B digital payment solutions have been embraced by businesses, including electronic invoicing and funds transfer, as part of the ongoing digital transformation. E-commerce growth has been a major driver, with online marketplaces and cross-border trade fueling demand for streamlined B2B transactions.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company: Tier 1-20%, Tier 2-25%, and Tier 3-55%

- By Designation: C-Level Executives-40%, Director Level-33%, and Others-27%

- By Region: North America-32%, Europe-38%, APAC-18%, RoW-12%

The major players in the B2B digital payment market PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Block (US), MasterCard (US), Visa (US), Payoneer (US), Stripe (US), Helcim (Canada), Payset (UK), Paytm (India), Razorpay (India), Rapyd (UK), Stax (US), EBANX (Brazil), Ramp (US), HighRadius (US), MatchMove (US), BharatPe (India), Juspay (India), Ripple (US), Terra (South Korea), Lolli (US), Paystand (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the B2B digital payment market.

Research Coverage

The report segments the global B2B digital payment market by offering into two categories: solutions and services. By transaction type, the B2B digital payment market is divided into two categories: domestic and cross border. By payment method, the B2B digital payment market is divided into three major categories: credit card/debit card/virtual card, digital wallets, and other payment methods. By vertical, the B2B digital payment market has been classified into BFSI, IT and ITES, retail and e-commerce, healthcare, transportation and logistics, travel and hospitality, media and entertainment, and other verticals (education, media, and entertainment). By region, the market has been segmented into North America, Europe, APAC, MEA, and Latin America.

Key benefits of the report

The report would help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall B2B digital payment market and the subsegments. This report would help stakeholders understand the competitive landscape and gain insights to better position their businesses and plan suitable go-to-market strategies. The report would help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing digital transformation across industries, High proliferation of smartphones enabling mCommerce growth, Rise of eCommerce and adoption of embedded payment system, Rise in the adoption of contactless payments, Increase in the adoption of real-time payments), restraints (Lack of global standards for cross-border payments, complexity of processes), opportunities (Rapid decline in unbanked population across the globe, Gradual adoption of Open-Banking APIs, Progressive changes in regulatory frameworks, Rise in cross-border payments, Collaboration between banks and fintech institutions to leverage customer experience), and challenges (Fragmented regional regulatory landscape, Fraud, and security concerns) influencing the growth of the B2B digital payment market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the B2B digital payment market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the B2B digital payment market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the B2B digital payment market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Block (US), MasterCard (US), Visa (US), Payoneer (US), Stripe (US), Helcim (Canada), Payset (UK), Paytm (India), Razorpay (India), Rapyd (UK), Stax (US), EBANX (Brazil), Ramp (US), HighRadius (US), MatchMove (US), BharatPe (India), Juspay (India), Ripple (US), Terra (South Korea), Lolli (US), Paystand (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 B2B DIGITAL PAYMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Primary sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 KEY STEPS FOLLOWED TO ESTIMATE MARKET SIZE

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE GENERATED THROUGH SALES OF DIGITAL PAYMENT PLATFORMS AND SERVICES

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF B2B DIGITAL PAYMENT VENDORS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.2.3 B2B DIGITAL PAYMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 9 B2B DIGITAL PAYMENT MARKET SIZE, 2021-2028 (USD MILLION)

- FIGURE 10 REGION-WISE MARKET SUMMARY (SIZE, SHARE, AND CAGR)

- FIGURE 11 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR B2B DIGITAL PAYMENT SOLUTIONS AND SERVICES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN B2B DIGITAL PAYMENT MARKET

- FIGURE 12 RISE IN CROSS-BORDER PAYMENTS TO CREATE OPPORTUNITIES FOR PLAYERS IN B2B DIGITAL PAYMENT MARKET

- 4.2 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE

- FIGURE 13 CROSS-BORDER SEGMENT TO WITNESS HIGHER CAGR FROM 2023 TO 2028

- 4.3 B2B DIGITAL PAYMENT MARKET, BY OFFERING

- FIGURE 14 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- 4.4 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD

- FIGURE 15 CREDIT/DEBIT/VIRTUAL CARDS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.5 B2B DIGITAL PAYMENT MARKET IN NORTH AMERICA, BY PAYMENT METHOD AND VERTICAL

- FIGURE 16 CREDIT/DEBIT/VIRTUAL CARDS AND IT & ITES SEGMENTS TO ACCOUNT FOR MAJORITY OF NORTH AMERICAN MARKET SHARE, BY PAYMENT METHOD AND VERTICAL, RESPECTIVELY, IN 2023

- 4.6 B2B DIGITAL PAYMENT MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

- FIGURE 17 IT & ITES AND CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC MARKET, BY VERTICAL AND COUNTRY, RESPECTIVELY, IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: B2B DIGITAL PAYMENT MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Aggressive promotion and adoption of digital ecosystem by governments worldwide

- 5.2.1.2 High proliferation of smartphones enabling m-commerce growth

- 5.2.1.3 Exponential expansion of e-commerce and high adoption of embedded payment systems

- 5.2.1.4 Increased consumer preference for contactless payments

- 5.2.1.5 Extensive use of real-time payment systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of global standards for cross-border payments

- 5.2.2.2 Complexities associated with B2B payment transactions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid decline in unbanked population globally

- 5.2.3.2 Gradual adoption of open-banking APIs

- 5.2.3.3 Progressive changes in regulatory frameworks pertaining to B2B digital payments

- 5.2.3.4 Rise in cross-border payments

- 5.2.3.5 Collaboration between banks and FinTech institutions to enhance customer experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented regional regulatory landscape

- 5.2.4.2 Risk of fraud and security concerns

- 5.3 INDUSTRY TRENDS

- 5.3.1 BEST PRACTICES IN B2B DIGITAL PAYMENT MARKET

- 5.3.2 REGULATORY LANDSCAPE

- 5.3.3 SUPPLY CHAIN ANALYSIS

- FIGURE 19 B2B DIGITAL PAYMENT SUPPLY CHAIN ANALYSIS

- 5.3.4 BRIEF HISTORY OF B2B DIGITAL PAYMENT TECHNOLOGY

- FIGURE 20 EVOLUTION OF B2B DIGITAL PAYMENT

- 5.3.4.1 2000-2010

- 5.3.4.2 2010-2020

- 5.3.4.3 2020-Present

- 5.3.5 ECOSYSTEM MAPPING

- FIGURE 21 B2B DIGITAL PAYMENT ECOSYSTEM ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN B2B DIGITAL PAYMENT ECOSYSTEM

- 5.3.6 PATENT ANALYSIS

- 5.3.6.1 Methodology

- 5.3.6.2 Document type

- TABLE 4 PATENTS FILED, 2020-2023

- 5.3.6.3 Innovations and patent applications

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2020-2023

- 5.3.6.4 Top applicants

- FIGURE 23 TOP 10 PATENT APPLICANTS, 2020-2023

- 5.3.7 CASE STUDY ANALYSIS

- 5.3.7.1 Case study 1: Implementation of PayPal products by Tradera to streamline operations and scale business

- 5.3.7.2 Case study 2: Adoption of FIS Exemption Engine solution by Zalando to ensure fast and frictionless checkout process

- 5.3.7.3 Case study 3: Deployment of Braintree payment gateway by Animoto to increase renewal rates and build customer base

- 5.3.7.4 Case study 4: Execution of Stripe platform by Mindbody to provide hybrid fitness experience to customers

- 5.3.7.5 Case study 5: Integration of Square platform with Brushfire's dashboard to offer omnichannel tool to manage ticketing and event payments

- 5.3.8 PRICING ANALYSIS

- 5.3.8.1 Average selling price of B2B digital payment solutions provided by key players

- TABLE 5 PRICING ANALYSIS

- 5.3.8.2 Average selling price trend

- 5.3.9 IMPACT OF B2B DIGITAL PAYMENTS ON ADJACENT TECHNOLOGIES

- 5.3.10 TECHNOLOGY ANALYSIS

- 5.3.10.1 Adjacent technologies

- 5.3.10.1.1 Blockchain and distributed ledger technology (DLT)

- 5.3.10.1.2 Artificial intelligence (AI), machine learning (ML), and data analytics

- 5.3.10.1.3 Robotic process automation (RPA)

- 5.3.10.1.4 API integration

- 5.3.10.1.5 Electronic invoicing (E-invoicing)

- 5.3.10.1.6 Digital identity verification and biometric authentication

- 5.3.10.1.7 Cybersecurity solutions

- 5.3.10.1.8 Contactless payments and smart contracts

- 5.3.10.2 Related technologies

- 5.3.10.2.1 Electronic funds transfer (EFT)

- 5.3.10.2.2 Wire transfer and virtual credit cards

- 5.3.10.2.3 Digital wallets, payment gateways, and P2P payment systems

- 5.3.10.2.4 Tokenization and cross-border payment solutions

- 5.3.10.1 Adjacent technologies

- TABLE 6 TECHNOLOGY ENABLERS IN B2B DIGITAL PAYMENTS

- 5.3.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 B2B DIGITAL PAYMENT MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.11.1 Threat of new entrants

- 5.3.11.2 Threat of substitutes

- 5.3.11.3 Bargaining power of buyers

- 5.3.11.4 Bargaining power of suppliers

- 5.3.11.5 Intensity of competitive rivalry

- 5.3.12 DISRUPTIONS/TRENDS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 24 REVENUE SHIFT FOR B2B DIGITAL PAYMENT MARKET

- 5.3.12.1 Buy Now Pay Later (BNPL)

- 5.3.12.2 Real-time cross-border payments

- 5.3.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 8 B2B DIGITAL PAYMENT MARKET: LIST OF CONFERENCES AND EVENTS

- 5.3.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.14.1 Key stakeholders in buying process

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- 5.3.14.2 Buying criteria

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.3.15 FUTURE OF B2B DIGITAL PAYMENT TECHNOLOGY

6 B2B DIGITAL PAYMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 27 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- 6.1.1 OFFERINGS: B2B DIGITAL PAYMENT MARKET DRIVERS

- TABLE 11 OFFERING: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 12 OFFERING: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- TABLE 13 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 14 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 15 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 16 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 PAYMENT INFRASTRUCTURE

- 6.2.1.1 Growing demand for payment gateways and processors by merchants to drive segmental growth

- TABLE 17 PAYMENT INFRASTRUCTURE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 PAYMENT INFRASTRUCTURE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.2 Payment gateways

- 6.2.1.3 Payment processors

- 6.2.1.4 Mobile payment applications

- 6.2.1.5 Other solutions

- 6.2.2 BILLING & ACCOUNTING MANAGEMENT

- 6.2.2.1 Increasing use of billing & accounting management solutions to track invoice and payment status to drive market

- TABLE 19 BILLING & ACCOUNTING MANAGEMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 BILLING & ACCOUNTING MANAGEMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.2 Recurring billing & subscription management

- 6.2.2.3 Account payables & account receivables

- 6.2.2.4 Others

- 6.2.3 SECURITY, COMPLIANCE, & FRAUD PREVENTION

- 6.2.3.1 Rising focus on securing end-to-end payment transactions to drive segmental growth

- TABLE 21 SECURITY, COMPLIANCE, & FRAUD PREVENTION: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 SECURITY, COMPLIANCE, & FRAUD PREVENTION: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 SURGING ADOPTION OF DIGITAL PAYMENT SOLUTIONS TO DRIVE DEMAND FOR SERVICES

- TABLE 23 SERVICES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 SERVICES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.3 MANAGED SERVICES

7 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE

- 7.1 INTRODUCTION

- FIGURE 28 CROSS-BORDER TRANSACTIONS TO EXHIBIT HIGHER CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- 7.1.1 TRANSACTION TYPES: B2B DIGITAL PAYMENT MARKET DRIVERS

- TABLE 25 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 26 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- 7.2 DOMESTIC

- 7.2.1 SIMPLICITY, HIGH SPEED, AND LOW COST OF DOMESTIC TRANSACTIONS TO DRIVE SEGMENTAL GROWTH

- TABLE 27 DOMESTIC: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 DOMESTIC: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 CROSS-BORDER

- 7.3.1 COMPLEX REGULATORY FRAMEWORK AND RISKS ASSOCIATED WITH CURRENCY EXCHANGE RATES TO PRESENT DISTINCT CHALLENGES

- TABLE 29 CROSS-BORDER: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 CROSS-BORDER: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

8 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD

- 8.1 INTRODUCTION

- FIGURE 29 DIGITAL WALLETS TO RECORD HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, DURING FORECAST PERIOD

- 8.1.1 PAYMENT METHODS: B2B DIGITAL PAYMENT MARKET DRIVERS

- TABLE 31 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 32 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- 8.2 CREDIT/DEBIT/VIRTUAL CARDS

- 8.2.1 INCREASING NUMBER OF CARD USERS TO BOOST MARKET GROWTH

- TABLE 33 CREDIT/DEBIT/VIRTUAL CARDS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 CREDIT/DEBIT/VIRTUAL CARDS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 DIGITAL WALLETS

- 8.3.1 ROBUST SECURITY MEASURES, SUCH AS ENCRYPTION AND MULTI-FACTOR AUTHENTICATION, OFFERED BY DIGITAL WALLETS TO DRIVE SEGMENTAL GROWTH

- TABLE 35 DIGITAL WALLETS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 DIGITAL WALLETS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 OTHER PAYMENT METHODS

- TABLE 37 OTHER PAYMENT METHODS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OTHER PAYMENT METHODS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 B2B DIGITAL PAYMENT MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 30 HEALTHCARE VERTICAL TO RECORD HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- 9.1.1 VERTICALS: B2B DIGITAL PAYMENT MARKET DRIVERS

- TABLE 39 B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 40 B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)

- 9.2.1 GROWING FOCUS OF BFSI COMPANIES ON REDUCING CUSTOMER ATTRITION BY OFFERING DIGITAL FINANCIAL SERVICES TO DRIVE MARKET

- TABLE 41 BFSI: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 BFSI: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.2 CASE STUDY

- 9.2.2.1 Fundraise Up and Stripe partnered to provide seamless payment experience to donors

- 9.2.2.2 FIS helped River City Bank to strengthen business continuity, regulatory compliance, and resilience

- 9.3 TRANSPORTATION & LOGISTICS

- 9.3.1 RISING ADOPTION OF DIGITAL PAYMENT SOLUTIONS TO BUILD TRUST AND ACCOUNTABILITY AMONG PARTNERS TO FUEL MARKET GROWTH

- TABLE 43 TRANSPORTATION & LOGISTICS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 TRANSPORTATION & LOGISTICS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 CASE STUDY

- 9.3.2.1 Maersk adopted intuitive platform from Stripe to accept payments through credit cards

- 9.3.2.2 Brightwell provided Mastercard cross-border services to tourists on ships to remit money internationally

- 9.4 IT & ITES

- 9.4.1 INTEGRATION OF BLOCKCHAIN AND AI TECHNOLOGIES INTO B2B PAYMENT PLATFORMS TO SUPPORT SEAMLESS AND SECURE PAYMENT TRANSACTIONS

- TABLE 45 IT & ITES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 IT & ITES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.2 CASE STUDY

- 9.4.2.1 Atlassian selected Stripe to create single payment and billing platform for global transactions

- 9.4.2.2 Linear partnered with Stripe to grow its business globally

- 9.5 HEALTHCARE

- 9.5.1 PRESSING NEED TO SIMPLIFY BILLING AND INSURANCE CLAIM PROCESSES TO BOOST ADOPTION OF DIGITAL PAYMENT METHODS

- TABLE 47 HEALTHCARE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 HEALTHCARE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.2 CASE STUDY

- 9.5.2.1 Doctolib utilized Stripe Connect to scale telemedicine services during pandemic

- 9.5.2.2 ACI helped leading healthcare service provider to launch new electronic payment system

- 9.6 RETAIL & E-COMMERCE

- 9.6.1 INCREASING EFFORTS OF RETAILERS TOWARD ELIMINATING PAPER CHECKS TO BOOST ADOPTION OF DIGITAL PAYMENTS

- TABLE 49 RETAIL & E-COMMERCE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 RETAIL & E-COMMERCE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.2 CASE STUDY

- 9.6.2.1 Tradera implemented PayPal products to streamline operations and scale business

- 9.6.2.2 Amazon partnered with Stripe to simply cross-border payments

- 9.6.2.3 Decathlon partnered with Stripe to support payments for new coaches and sports classes

- 9.7 TRAVEL & HOSPITALITY

- 9.7.1 GROWING EMPHASIS ON PROTECTING SENSITIVE CUSTOMER AND FINANCIAL DATA TO FUEL SEGMENTAL GROWTH

- TABLE 51 TRAVEL & HOSPITALITY: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 TRAVEL & HOSPITALITY: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7.2 CASE STUDY

- 9.7.2.1 Mount Errigal Hotel switched to Worldpay to make seamless payment improvements

- 9.7.2.2 Aegean Airlines partnered with ACI Worldwide to resolve issue of e-commerce payment fraud

- 9.8 MEDIA & ENTERTAINMENT

- 9.8.1 INCREASING POPULARITY OF STREAMING SERVICES AND OTT PLATFORMS TO BOOST DEMAND FOR DIGITAL PAYMENT SOLUTIONS

- TABLE 53 MEDIA & ENTERTAINMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 MEDIA & ENTERTAINMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8.2 CASE STUDY

- 9.8.2.1 Mindbody partnered with Stripe to build customer trust and simplify onboarding experience for customers

- 9.8.2.2 Agua Bendita expanded internationally with B2B digital payment solutions from Stripe and VTEX

- 9.9 OTHER VERTICALS

- TABLE 55 OTHER VERTICALS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 OTHER VERTICALS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

10 B2B DIGITAL PAYMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 31 B2B DIGITAL PAYMENT MARKET: REGIONAL SNAPSHOT, 2023

- FIGURE 32 B2B DIGITAL PAYMENT MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- TABLE 57 B2B DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 B2B DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET SNAPSHOT

- TABLE 59 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Presence of eminent companies offering digital payment solutions to drive market

- TABLE 71 US: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 72 US: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 73 US: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 74 US: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 75 US: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 76 US: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 77 US: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 78 US: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 79 US: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 80 US: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Technological advancements in digital payment solutions to support market growth

- TABLE 81 CANADA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 82 CANADA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 CANADA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 84 CANADA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 85 CANADA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 86 CANADA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 87 CANADA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 88 CANADA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 89 CANADA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 90 CANADA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: B2B DIGITAL PAYMENT MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 91 EUROPE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 92 EUROPE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 93 EUROPE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 94 EUROPE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 95 EUROPE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 96 EUROPE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 97 EUROPE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 98 EUROPE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 100 EUROPE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 102 EUROPE: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rising demand for contactless payment solutions and card acceptance devices to drive market

- TABLE 103 UK: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 104 UK: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 105 UK: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 106 UK: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 107 UK: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 108 UK: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 109 UK: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 110 UK: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 111 UK: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 112 UK: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 High adoption of mobile-friendly payment solutions to contribute to market growth

- TABLE 113 GERMANY: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 114 GERMANY: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 115 GERMANY: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 116 GERMANY: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 117 GERMANY: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 118 GERMANY: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 119 GERMANY: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 120 GERMANY: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 121 GERMANY: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 122 GERMANY: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Significant investments by government to improve digital infrastructure to boost demand for digital payment solutions

- 10.3.6 SPAIN

- 10.3.6.1 Increasing use of digital and mobile wallets to reshape landscape of digital payments

- 10.3.7 ITALY

- 10.3.7.1 Thriving e-commerce sector to create opportunities for payment gateway providers

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 34 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET SNAPSHOT

- TABLE 123 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Increasing installation of PoS terminals to support market growth

- TABLE 135 CHINA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 136 CHINA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 137 CHINA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 138 CHINA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 139 CHINA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 140 CHINA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 141 CHINA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 142 CHINA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 143 CHINA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 144 CHINA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Revolution in digital payments and banking services through BHIM and YONO apps to accelerate market

- TABLE 145 INDIA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 146 INDIA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 147 INDIA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 148 INDIA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 149 INDIA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 150 INDIA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 151 INDIA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 152 INDIA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 153 INDIA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 154 INDIA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Rising number of card-based payment transactions to drive market

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Increasing popularity of contactless payment technologies to fuel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 155 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 UAE

- 10.5.3.1 Innovations in financial technology to drive market

- TABLE 167 UAE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 168 UAE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 169 UAE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 170 UAE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 171 UAE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 172 UAE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 173 UAE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 174 UAE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 175 UAE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 176 UAE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.4 KINGDOM OF SAUDI ARABIA

- 10.5.4.1 Saudi Vision 2030 program by government to create opportunities for digital banking service providers

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Government's focus on modernizing payment methods to support market growth

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 177 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Increasing penetration of mobiles and other payment devices in Brazil to drive market

- TABLE 189 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 190 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 191 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 192 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 193 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 194 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 195 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 196 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 197 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 198 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Growing digital innovations and technological advancements to drive market

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2023

- TABLE 199 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2019-2023

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 200 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 11.4 REVENUE ANALYSIS, 2020-2022

- FIGURE 35 THREE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 11.5 RANKING OF KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2023

- FIGURE 36 MARKET RANKING OF KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2023

- 11.6 COMPANY EVALUATION MATRIX, 2023

- FIGURE 37 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 38 B2B DIGITAL PAYMENT MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.7 STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 39 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 40 B2B DIGITAL PAYMENT MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 11.8 COMPANY FOOTPRINT

- TABLE 201 B2B DIGITAL PAYMENT MARKET: OVERALL COMPANY FOOTPRINT

- 11.9 COMPETITIVE BENCHMARKING

- TABLE 202 B2B DIGITAL PAYMENT MARKET: LIST OF STARTUPS/SMES

- TABLE 203 B2B DIGITAL PAYMENT MARKET: COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 204 B2B DIGITAL PAYMENT MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS

- 11.10 COMPETITIVE SCENARIOS AND TRENDS

- 11.10.1 PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 205 B2B DIGITAL PAYMENT MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, 2020-2023

- 11.10.2 DEALS

- TABLE 206 B2B DIGITAL PAYMENT MARKET: DEALS, 2020-2023

- 11.11 B2B DIGITAL PAYMENT PRODUCT BENCHMARKING

- 11.11.1 PROMINENT B2B DIGITAL PAYMENT SOLUTIONS

- TABLE 207 COMPARISON OF BRANDS IN B2B DIGITAL PAYMENT ECOSYSTEM

- 11.11.1.1 Razorpay

- 11.11.1.2 Stripe

- 11.11.1.3 Mastercard

- 11.11.1.4 Visa

- 11.11.1.5 PayPal

- 11.12 VALUATION AND FINANCIAL METRICS FOR KEY B2B DIGITAL PAYMENT SOLUTION AND SERVICE VENDORS

- FIGURE 41 VALUATION AND FINANCIAL METRICS FOR MAJOR VENDORS OF B2B DIGITAL PAYMENT SOLUTIONS AND SERVICES

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.1.1 PAYPAL

- TABLE 208 PAYPAL: COMPANY OVERVIEW

- FIGURE 42 PAYPAL: COMPANY SNAPSHOT

- TABLE 209 PAYPAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 PAYPAL: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 211 PAYPAL: DEALS

- 12.1.2 FIS

- TABLE 212 FIS: COMPANY OVERVIEW

- FIGURE 43 FIS: COMPANY SNAPSHOT

- TABLE 213 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FIS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 215 FIS: DEALS

- 12.1.3 FISERV, INC.

- TABLE 216 FISERV, INC.: COMPANY OVERVIEW

- FIGURE 44 FISERV, INC.: COMPANY SNAPSHOT

- TABLE 217 FISERV, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 FISERV, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 219 FISERV, INC.: DEALS

- 12.1.4 VISA

- TABLE 220 VISA: COMPANY OVERVIEW

- FIGURE 45 VISA: COMPANY SNAPSHOT

- TABLE 221 VISA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 VISA: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 223 VISA: DEALS

- 12.1.5 MASTERCARD

- TABLE 224 MASTERCARD: COMPANY OVERVIEW

- FIGURE 46 MASTERCARD: COMPANY SNAPSHOT

- TABLE 225 MASTERCARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MASTERCARD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 227 MASTERCARD: DEALS

- 12.1.6 GLOBAL PAYMENTS INC.

- TABLE 228 GLOBAL PAYMENTS INC.: COMPANY OVERVIEW

- FIGURE 47 GLOBAL PAYMENTS INC.: COMPANY SNAPSHOT

- TABLE 229 GLOBAL PAYMENTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 GLOBAL PAYMENTS INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 231 GLOBAL PAYMENTS INC.: DEALS

- 12.1.7 ACI WORLDWIDE

- TABLE 232 ACI WORLDWIDE: COMPANY OVERVIEW

- FIGURE 48 ACI WORLDWIDE: COMPANY SNAPSHOT

- TABLE 233 ACI WORLDWIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ACI WORLDWIDE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 235 ACI WORLDWIDE: DEALS

- 12.1.8 BLOCK, INC.

- TABLE 236 BLOCK, INC.: COMPANY OVERVIEW

- FIGURE 49 BLOCK, INC.: COMPANY SNAPSHOT

- TABLE 237 BLOCK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BLOCK, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 239 BLOCK, INC.: DEALS

- 12.1.9 PAYONEER INC.

- TABLE 240 PAYONEER INC.: COMPANY OVERVIEW

- FIGURE 50 PAYONEER INC.: COMPANY SNAPSHOT

- TABLE 241 PAYONEER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 PAYONEER INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 243 PAYONEER INC.: DEALS

- 12.1.10 STRIPE, INC.

- TABLE 244 STRIPE, INC.: COMPANY OVERVIEW

- TABLE 245 STRIPE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 STRIPE, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 247 STRIPE, INC.: DEALS

- 12.1.11 HELCIM INC.

- 12.1.12 PAY SET LIMITED

- 12.1.13 PAYTM

- 12.1.14 RAZORPAY

- 12.1.15 RAPYD FINANCIAL NETWORK LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 STAX LLC

- 12.2.2 EBANX

- 12.2.3 RAMP BUSINESS CORPORATION

- 12.2.4 HIGHRADIUS

- 12.2.5 MATCHMOVE PAY PTE LTD

- 12.2.6 BHARATPE

- 12.2.7 JUSPAY

- 12.2.8 RIPPLE

- 12.2.9 TERRA

- 12.2.10 LOLLI

- 12.2.11 PAYSTAND, INC.

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKET

- 13.1 INTRODUCTION

- TABLE 248 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 DIGITAL PAYMENT MARKET

- TABLE 249 BFSI: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 250 BFSI: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 251 RETAIL & E-COMMERCE: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 252 RETAIL & E-COMMERCE: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 253 HEALTHCARE: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 254 HEALTHCARE: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 255 TRAVEL & HOSPITALITY: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 256 TRAVEL & HOSPITALITY: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 257 TRANSPORTATION & LOGISTICS: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 258 TRANSPORTATION & LOGISTICS: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 259 MEDIA & ENTERTAINMENT: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 260 MEDIA & ENTERTAINMENT: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 261 OTHER VERTICALS: DIGITAL PAYMENT MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 262 OTHER VERTICALS: DIGITAL PAYMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- 13.4 PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 263 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 264 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 265 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 266 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 267 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 268 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS