|

|

市場調査レポート

商品コード

1340151

コアHRソフトウェアの世界市場 (~2028年):コンポーネント (ソフトウェア (学習管理・給与&報酬管理・給付&請求管理)・サービス)・展開タイプ・産業 (政府・BFSI・製造)・地域別Core HR Software Market by Component (Software (Learning Management, Payroll & Compensation Management, Benefits & Claims Management) and Services) Deployment Type, Vertical (Government, BFSI, Manufacturing) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コアHRソフトウェアの世界市場 (~2028年):コンポーネント (ソフトウェア (学習管理・給与&報酬管理・給付&請求管理)・サービス)・展開タイプ・産業 (政府・BFSI・製造)・地域別 |

|

出版日: 2023年08月21日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

コアHRソフトウェアの市場規模は、2023年の107億米ドルから、予測期間中は7.0%のCAGRで推移し、2028年には151億米ドルの規模に成長すると予測されています。

HRプロセスの変革に向けたAIと自動化の採用拡大や、リモートワークモデルの採用が予測期間中のコアHRソフトウェアの採用を後押ししています。一方、コアHRソフトウェアの導入に関するプライバシーおよびセキュリティ上の懸念が市場成長にとって重要な課題となっています。

サービス部門の中では、コンサルティングの部門が予測期間中に高いCAGRを記録すると予測されています。コンサルティングサービスは、現代の人事管理の複雑な状況を乗り切るために組織を支援する上で極めて重要な役割を果たしています。これらのサービスは、コアHRソフトウェアソリューションの導入と最適化を通じて、専門家によるガイダンスと戦略的サポートを提供します。この分野のコンサルタントは、人事プロセス、技術動向、産業のベストプラクティスを深く理解しています。まず、包括的なニーズ調査を実施し、組織の既存の人事ワークフロー、ペインポイント、目標を綿密に分析します。この理解をもとに、クライアントと密接に協力し、組織の要件に合致する最適な人事ソフトウェア・ベンダーを特定・選定します。

産業別では、BFSIの部門が2023年に第2位の市場シェアを示す見通しです。BFSI部門は、複雑な労働力要件、厳格なコンプライアンス規制、効率的な人材管理の必要性で知られています。人事情報システム (HRIS) としても知られるコアHRソフトウェアは、こうした特定のニーズに対応し、組織がより高い効率性と生産性を達成できるよう支援します。コアHRソフトウェアは、シームレスな採用・入社プロセスを促進し、BFSI企業が優秀な人材を獲得し、包括的なバックグラウンドチェックを実施し、採用を迅速化することを可能にします。

地域別では、中東・アフリカ地域が予測期間中に2番目に高いCAGRを記録すると予測されています。中東・アフリカ地域では、デジタル化への取り組みが活発化しています。インターネット普及率の上昇、技術導入の増加、複雑な規制環境、コア人事業務の合理化が、この地域の主な成長促進要因となっています。

当レポートでは、世界のコアHRソフトウェアの市場を調査し、市場概要、市場への影響因子および市場機会の分析、ケーススタディ分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

第6章 コアHRソフトウェア市場:コンポーネント別

- ソフトウェア

- サービス

第7章 コアHRソフトウェア市場:ソフトウェア別

- 給付・請求管理

- 給与・報酬管理

- 人事管理

- 学習管理

- 年金管理

- コンプライアンス管理

- その他

第8章 コアHRソフトウェア市場:サービス別

- 実装・統合

- サポート・メンテナンス

- コンサルティング

第9章 コアHRソフトウェア市場:展開タイプ別

- クラウド

- オンプレミス

第10章 コアHRソフトウェア市場:産業別

- 政府

- 製造

- エネルギー・ユーティリティ

- 消費財・小売

- ヘルスケア

- 輸送・物流

- IT・通信

- BFSI

- その他

第11章 コアHRソフトウェア市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 収益分析

- 市場シェア分析

- 企業評価指標

- 主要な市場展開

第13章 企業プロファイル

- 主要企業

- WORKDAY

- ADP

- SAP

- UKG

- ORACLE

- CERIDIAN

- IBM

- PAYCOM

- PAYLOCITY

- CORNERSTONE ONDEMAND

- その他の企業

- VISMA

- ACCESS GROUP

- PAYCHEX

- EMPLOYWISE

- HRONE

- GREYTHR

- PEOPLESTRONG

- PERSONIO

- SPROUT SOLUTIONS

- DARWINBOX

- SERVICENOW

- HIBOB

- APS PAYROLL

- BAMBOOHR

- PAYCOR

- ZOHO

- NAMELY

- GUSTO

- RIPPLING

第14章 隣接市場

第15章 付録

The core HR software market size is expected to grow from USD 10.7 billion in 2023 to USD 15.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. The growing adoption of AI and automation for transforming HR processes and the adoption of remote working models boost the adoption of core HR software during the forecast period. Privacy and security concerns over the implementation of core HR software represent a significant challenge for the growth of the core HR software market.

"As services, the consulting segment is projected to witness a higher CAGR during the forecast period. "

Consulting services in the core HR software market play a pivotal role in assisting organizations to navigate the complex landscape of modern human resource management. These services provide expert guidance and strategic support throughout adopting and optimizing core HR software solutions. Consultants in this field deeply understand HR processes, technology trends, and industry best practices. They begin by conducting comprehensive needs assessments, meticulously analyzing an organization's existing HR workflows, pain points, and objectives. With this understanding, they collaborate closely with the client to identify and select the most suitable HR software vendors that align with the organization's requirements.

"As per vertical, the BFSI vertical to hold second largest market share in 2023."

Core HR software is crucial in the Banking, Financial Services, and Insurance (BFSI) industry by streamlining and optimizing human resources management processes. The BFSI sector is known for its complex workforce requirements, rigorous compliance regulations, and the need for efficient talent management. Core HR software, also known as Human Resource Information System (HRIS), caters to these specific needs and helps organizations achieve greater efficiency and productivity. Core HR software facilitates seamless recruitment and onboarding processes, enabling BFSI companies to attract top talent, conduct comprehensive background checks, and expedite hiring. The system ensures all necessary documentation and compliance requirements are met, which is crucial in a highly regulated industry like BFSI.

Moreover, it provides a centralized repository for employee data, including personal information, employment history, certifications, and performance records, making it easier for HR professionals and managers to access critical information when needed and make data-driven decisions. Furthermore, core HR software helps BFSI companies comply with industry regulations and labor laws. It can automatically update policies, track certifications, and manage employee licenses, ensuring the workforce operates within the legal framework.

As per region, the Middle East & Africa region is projected to witness the second highest CAGR during the forecast period.

Middle East & Africa have grown exponentially in the core HR software market. The region comprises countries such as the Kingdom of Saudi Arabia (KSA), the United Arab Emirates (UAE), and the Rest of the Middle East & Africa. Middle East & Africa are increasingly getting oriented toward digitalization initiatives. Increasing internet penetration, rising technological adoption, a complex regulatory environment, and streamlined core HR operations are the major growth drivers for this region. The KSA and UAE are setting up smart city initiatives. Also, GCC countries are investing in core HR software. The Middle East and & Africa are expected to witness promising opportunities to adopt core HR software services and show good prospects for growth after the Asia Pacific region.

The breakup of the profiles of the primary participants is given below:

- By Company: Tier I: 38%, Tier II: 42%, and Tier III: 20%

- By Designation: C-Level Executives: 40%, Director Level: 35%, and Others: 25%

- By Region: North America: 35%, Europe: 40%, Asia Pacific: 15%, and the Rest of the World: 10%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the key vendors offering core HR software across the globe include Workday (US), SAP (Germany), ADP (US), UKG (US), Oracle (US), Ceridian (US), IBM (US), Paycom (US), Paylocity (US), and Cornerstone OnDemand (US), Visma (US), Access Group (US), Paychex(US), EmployWise (India), HrOne (India), greytHR(India), PeopleStrong (India), Personio (Germany), Sprout Solutions (Philippines), Darwinbox (India), ServiceNow (US), HiBob (US), APS Payroll (US), BambooHR(US), Paycor (US), Zoho (India), Namely (US), Gusto (US), and Rippling (US).

Research coverage:

The market study covers the core HR software market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as components, software, services, deployment type, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the core HR software market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (need for improved compliance and risk management to adhere to employment laws and regulations, analytics and reporting capabilities enable data driven-decisions, demand for centralization and automation of routine HR processes to reduce manual errors), restraints (high cost of implementation of core HR software among SMEs) opportunities (growing adoption of AI and automation for transforming HR processes, adoption of remote working models to boost adoption of core HR software, rapid adoption of cloud-based HR software to improve efficiency and scalability), and challenges (interactive training for infrequent users of core HR software, privacy and security concerns over implementation of core HR software) influencing the growth of the core HR software market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the core HR software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the core HR software market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the core HR software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Workday (US), SAP (Germany), ADP (US), UKG (US), Oracle (US), Ceridian (US), IBM (US), Paycom (US), Paylocity (US), and Cornerstone OnDemand (US) among others in the core HR software market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CORE HR SOFTWARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 CORE HR SOFTWARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF CORE HR SOFTWARE FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CORE HR SOFTWARE VENDORS

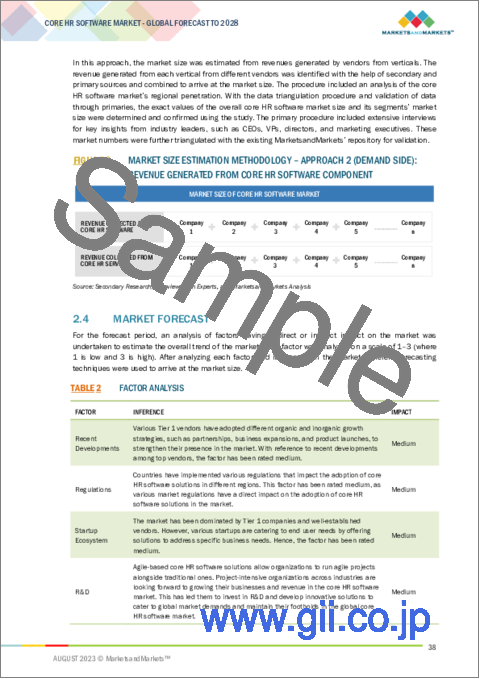

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - (DEMAND SIDE)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM CORE HR SOFTWARE COMPONENT

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 FASTEST-GROWING SEGMENTS IN CORE HR SOFTWARE MARKET, 2023-2028

- FIGURE 11 SOFTWARE SEGMENT TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 12 LEARNING MANAGEMENT SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 IMPLEMENTATION & INTEGRATION SERVICES SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 14 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- FIGURE 15 GOVERNMENT VERTICAL SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 16 CORE HR SOFTWARE MARKET REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF CORE HR SOFTWARE MARKET

- FIGURE 17 ONGOING DIGITAL TRANSFORMATION AND RISE IN ADOPTION OF REMOTE WORKING MODELS TO DRIVE GROWTH OF CORE HR SOFTWARE MARKET

- 4.2 CORE HR SOFTWARE MARKET, BY COMPONENT, 2023 VS. 2028

- FIGURE 18 SOFTWARE SEGMENT EXPECTED TO BE LARGER DURING FORECAST PERIOD

- 4.3 CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023 VS. 2028

- FIGURE 19 LEARNING MANAGEMENT SOFTWARE SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- 4.4 CORE HR SOFTWARE MARKET, BY SERVICES, 2023 VS. 2028

- FIGURE 20 IMPLEMENTATION & INTEGRATION SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- 4.5 CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023 VS. 2028

- FIGURE 21 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- 4.6 CORE HR SOFTWARE MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 22 GOVERNMENT VERTICAL TO BE LARGEST DURING FORECAST PERIOD

- 4.7 CORE HR SOFTWARE MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN CORE HR SOFTWARE DURING NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 MARKET DYNAMICS: CORE HR SOFTWARE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Need for improved compliance and risk management to adhere to employment laws and regulations

- 5.2.1.2 Analytics and reporting capabilities enable data-driven decisions

- FIGURE 25 PROGRESS IN REPORTING AND ANALYTICS CAPABILITIES IN HR

- 5.2.1.3 Demand for centralization and automation of routine HR processes to reduce manual errors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of implementation of core HR software for SMEs

- FIGURE 26 FACTORS RESTRAINING TECH ADOPTION IN HR

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of AI and automation for transforming HR processes

- 5.2.3.2 Adoption of remote working models to boost adoption of core HR software

- FIGURE 27 UTILIZATION OF HR TECHNOLOGY TO BETTER MANAGE REMOTE WORK

- 5.2.3.3 Rapid adoption of cloud-based HR software to improve efficiency and scalability

- FIGURE 28 HR TECHNOLOGY MODEL, 2020 VS. 2023

- 5.2.4 CHALLENGES

- 5.2.4.1 Interactive training for infrequent users of core HR software

- 5.2.4.2 Privacy and security concerns over implementation of core HR software

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: REAL-TIME DATA VISIBILITY ENABLED PVR CINEMAS TO OPTIMIZE STAFFING

- 5.3.2 CASE STUDY 2: INDICA LABS CONSOLIDATED AND SECURED EMPLOYEE DATA AND STREAMLINED TIME-CONSUMING HR PROCESSES WITH BAMBOOHR

- 5.3.3 CASE STUDY 3: MOD PIZZA PROVIDED EXCEPTIONAL EMPLOYEE EXPERIENCES WITH SAP SUCCESS FACTOR SOLUTIONS

- 5.3.4 CASE STUDY 4: GANETT LEVERAGED CERIDIAN TO BOOST SCALABILITY, RESILIENCE, AND IMPROVE EMPLOYEE EXPERIENCE

- 5.3.4.1 Case Study 5: Paylocity enabled Crafton Tull to rebuild HR on firmer foundations

6 CORE HR SOFTWARE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: CORE HR SOFTWARE MARKET DRIVERS

- FIGURE 29 CORE HR SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 4 CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 5 CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 SOFTWARE

- 6.2.1 DEMAND FOR CENTRALIZING ADMINISTRATIVE TASKS

- TABLE 6 SOFTWARE: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 7 SOFTWARE: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 OPTIMIZATION OF EFFECTIVENESS OF CORE HR SOFTWARE

- TABLE 8 SERVICES: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 9 SERVICES: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 CORE HR SOFTWARE MARKET, BY SOFTWARE

- 7.1 INTRODUCTION

- 7.1.1 SOFTWARE: CORE HR SOFTWARE MARKET DRIVERS

- FIGURE 30 LEARNING MANAGEMENT SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- TABLE 10 CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 11 CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- 7.2 BENEFITS & CLAIMS MANAGEMENT

- 7.2.1 SEAMLESS DESIGN, CUSTOMIZATION, AND COMMUNICATION OF BENEFITS

- TABLE 12 BENEFITS & CLAIMS MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 13 BENEFITS & CLAIMS MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PAYROLL & COMPENSATION MANAGEMENT

- 7.3.1 STRATEGIC PLANNING, ADMINISTRATION, AND PROCESSING OF COMPENSATION TO DRIVE MARKET

- TABLE 14 PAYROLL & COMPENSATION MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 15 PAYROLL & COMPENSATION MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 PERSONNEL MANAGEMENT

- 7.4.1 ENHANCEMENT OF WORKFORCE PRODUCTIVITY, ENGAGEMENT, AND STRATEGIC DECISION-MAKING TO DRIVE MARKET

- TABLE 16 PERSONNEL MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 PERSONNEL MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 LEARNING MANAGEMENT

- 7.5.1 CREATION, DELIVERY, AND MANAGEMENT OF EMPLOYEE TRAINING AND DEVELOPMENT PROGRAMS TO DRIVE MARKET

- TABLE 18 LEARNING MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 LEARNING MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 PENSION MANAGEMENT

- 7.6.1 ENABLES ACCOMMODATION OF DIFFERENT RETIREMENT STRUCTURES FOR DIVERSE WORKFORCES, GLOBAL OPERATIONS, CURRENCIES, AND REGULATIONS

- TABLE 20 PENSION MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 PENSION MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

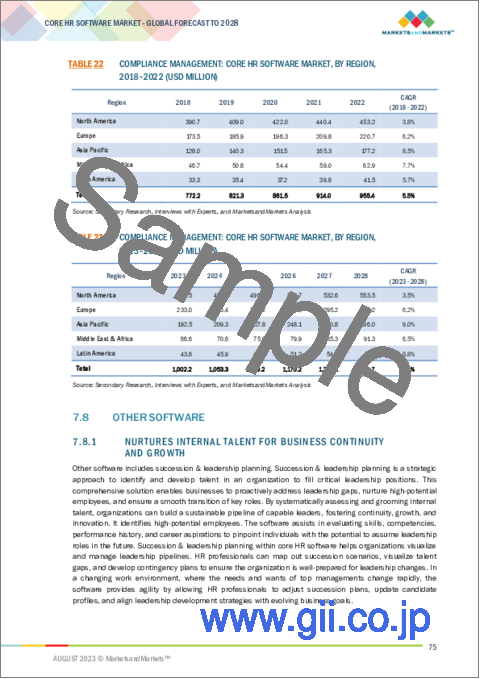

- 7.7 COMPLIANCE MANAGEMENT

- 7.7.1 COMPLIES WITH LAWS, MITIGATES RISK, AND ENSURES ETHICAL HR PRACTICES

- TABLE 22 COMPLIANCE MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 COMPLIANCE MANAGEMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 OTHER SOFTWARE

- 7.8.1 NURTURES INTERNAL TALENT FOR BUSINESS CONTINUITY AND GROWTH

- TABLE 24 OTHER SOFTWARE: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 OTHER SOFTWARE: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 CORE HR SOFTWARE MARKET, BY SERVICES

- 8.1 INTRODUCTION

- 8.1.1 SERVICES: CORE HR SOFTWARE MARKET DRIVERS

- FIGURE 31 IMPLEMENTATION & INTEGRATION SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- TABLE 26 CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 27 CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- 8.2 IMPLEMENTATION & INTEGRATION

- 8.2.1 BETTER VISIBILITY AND CONNECTIVITY TO DRIVE MARKET

- TABLE 28 IMPLEMENTATION & INTEGRATION: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 IMPLEMENTATION & INTEGRATION: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SUPPORT & MAINTENANCE

- 8.3.1 OFFER SUPPORT, SOFTWARE MAINTENANCE, CUSTOMER PORTAL, POST-DEPLOYMENT ASSISTANCE, AND CLIENT TESTIMONIAL SERVICES

- TABLE 30 SUPPORT & MAINTENANCE: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 SUPPORT & MAINTENANCE: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 CONSULTING

- 8.4.1 ASSISTANCE IN NAVIGATING COMPLEX MODERN HUMAN RESOURCE MANAGEMENT LANDSCAPE

- TABLE 32 CONSULTING: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 CONSULTING: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE

- 9.1 INTRODUCTION

- FIGURE 32 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- 9.1.1 DEPLOYMENT TYPE: CORE HR SOFTWARE MARKET DRIVERS

- TABLE 34 CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 35 CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 9.2 CLOUD

- 9.2.1 INCREASING ADOPTION OF CLOUD-BASED SERVICES TO DRIVE GROWTH

- TABLE 36 CLOUD: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 CLOUD: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 ON-PREMISES

- 9.3.1 UTILIZED IN HEALTHCARE AND BFSI TO MINIMIZE DATA BREACHES

- TABLE 38 ON-PREMISES: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 ON-PREMISES: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

10 CORE HR SOFTWARE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 33 GOVERNMENT SEGMENT ESTIMATED TO BE LARGEST IN 2023

- 10.1.1 VERTICAL: CORE HR SOFTWARE MARKET DRIVERS

- TABLE 40 CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 41 CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 GOVERNMENT

- 10.2.1 TRANSPARENCY, PRODUCTIVITY, AND EMPLOYEE SATISFACTION CONTRIBUTE TO EFFECTIVE AND EFFICIENT DELIVERY OF PUBLIC SERVICES

- TABLE 42 GOVERNMENT: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 GOVERNMENT: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 MANUFACTURING

- 10.3.1 OPTIMIZES WORKFORCE PLANNING, TRAINING AND SKILL DEVELOPMENT, COMPLIANCE MANAGEMENT, AND PERFORMANCE EVALUATION

- TABLE 44 MANUFACTURING: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 MANUFACTURING: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 ENERGY & UTILITIES

- 10.4.1 MANAGES AND TRACKS EMPLOYEE CERTIFICATIONS, LICENSES, AND SAFETY TRAINING

- TABLE 46 ENERGY & UTILITIES: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 ENERGY & UTILITIES: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 CONSUMER GOODS & RETAIL

- 10.5.1 ENABLES EFFECTIVE WORKFORCE MANAGEMENT

- TABLE 48 CONSUMER GOODS & RETAIL: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 CONSUMER GOODS & RETAIL: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 HEALTHCARE

- 10.6.1 STREAMLINES HR OPERATIONS, ENHANCES PATIENT CARE, AND MAINTAINS COMPLIANCE WITH INDUSTRY REGULATIONS

- TABLE 50 HEALTHCARE: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 HEALTHCARE: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 TRANSPORTATION & LOGISTICS

- 10.7.1 FACILITATES SCHEDULING, TRACKS EMPLOYEE HOURS, AND MANAGES SHIFT ASSIGNMENTS

- TABLE 52 TRANSPORTATION & LOGISTICS: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 TRANSPORTATION & LOGISTICS: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 IT & TELECOM

- 10.8.1 OPTIMIZES WORKFORCE DEPLOYMENT, AVOIDS OVERSTAFFING OR UNDERSTAFFING, AND ENSURES EFFICIENT EXECUTION OF PROJECTS

- TABLE 54 IT & TELECOM: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 IT & TELECOM: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 BFSI

- 10.9.1 ATTRACTS TOP TALENT, CONDUCTS COMPREHENSIVE BACKGROUND CHECKS, AND EXPEDITES HIRING PROCESS

- TABLE 56 BFSI: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 BFSI: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 OTHER VERTICALS

- TABLE 58 OTHER VERTICALS: CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 OTHER VERTICALS: CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

11 CORE HR SOFTWARE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 34 NORTH AMERICA TO BE LARGEST MARKET BY 2028

- TABLE 60 CORE HR SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 CORE HR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.1.1 NORTH AMERICA

- 11.1.2 NORTH AMERICA: CORE HR SOFTWARE MARKET DRIVERS

- 11.1.3 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 35 NORTH AMERICA: CORE HR SOFTWARE MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.1.4 US

- 11.1.4.1 Myriad labor laws and regulations at federal, state, and local levels to drive market

- TABLE 74 US: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 75 US: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 76 US: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 77 US: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.1.5 CANADA

- 11.1.5.1 Compliance with varied and complex regulations to drive market

- TABLE 78 CANADA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 79 CANADA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 80 CANADA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 81 CANADA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.2 EUROPE

- 11.2.1 EUROPE: CORE HR SOFTWARE MARKET DRIVERS

- 11.2.2 IMPACT OF RECESSION ON EUROPE

- TABLE 82 EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 83 EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 84 EUROPE: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 85 EUROPE: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 87 EUROPE: CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 89 EUROPE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 90 EUROPE: CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 91 EUROPE: CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: CORE HR SOFTWARE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 93 EUROPE: CORE HR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 UK

- 11.2.3.1 Growing adoption of cloud and other technologies to drive market

- TABLE 94 UK: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 95 UK: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 96 UK: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 97 UK: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.2.4 GERMANY

- 11.2.4.1 Cloud-based solutions to drive market

- TABLE 98 GERMANY: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 99 GERMANY: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 100 GERMANY: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 101 GERMANY: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.2.5 FRANCE

- 11.2.5.1 Optimization of HR applications to drive market

- TABLE 102 FRANCE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 103 FRANCE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 104 FRANCE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 105 FRANCE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.2.6 REST OF EUROPE

- TABLE 106 REST OF EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.3 ASIA PACIFIC

- 11.3.1 ASIA PACIFIC: CORE HR SOFTWARE MARKET DRIVERS

- 11.3.2 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: CORE HR SOFTWARE MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 CHINA

- 11.3.3.1 Innovative technologies to drive market

- TABLE 122 CHINA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 123 CHINA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 124 CHINA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 125 CHINA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.3.4 JAPAN

- 11.3.4.1 Increased R&D investments and skilled professionals drive market

- TABLE 126 JAPAN: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 127 JAPAN: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 128 JAPAN: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 129 JAPAN: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.3.5 REST OF ASIA PACIFIC

- TABLE 130 REST OF ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.4 MIDDLE EAST & AFRICA

- 11.4.1 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET DRIVERS

- 11.4.2 IMPACT OF RECESSION ON MIDDLE EAST & AFRICA

- TABLE 134 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 KINGDOM OF SAUDI ARABIA

- 11.4.3.1 Workforce optimization to drive market

- TABLE 146 KSA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 147 KSA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 148 KSA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 149 KSA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.4.4 UAE

- 11.4.4.1 Adoption of advancements in latest technologies to drive market

- TABLE 150 UAE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 151 UAE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 152 UAE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 153 UAE: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.4.5 REST OF MIDDLE EAST & AFRICA

- TABLE 154 REST OF MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: CORE HR SOFTWARE MARKET DRIVERS

- 11.5.2 IMPACT OF RECESSION ON LATIN AMERICA

- TABLE 158 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 BRAZIL

- 11.5.3.1 Digital transformation across industries to drive market

- TABLE 170 BRAZIL: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 171 BRAZIL: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 172 BRAZIL: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 173 BRAZIL: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.5.4 MEXICO

- 11.5.4.1 Scalability and flexibility for businesses to drive market

- TABLE 174 MEXICO: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 175 MEXICO: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 176 MEXICO: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 177 MEXICO: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 11.5.5 REST OF LATIN AMERICA

- TABLE 178 REST OF LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 181 REST OF LATIN AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS

- FIGURE 37 HISTORICAL FOUR-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2022 (USD BILLION)

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 38 CORE HR SOFTWARE MARKET SHARE ANALYSIS, 2022

- TABLE 182 MARKET SHARE OF KEY PLAYERS IN 2022

- 12.4 COMPANY EVALUATION METRIX

- FIGURE 39 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 40 CORE HR SOFTWARE MARKET, KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 RANKING OF KEY PLAYERS IN CORE HR SOFTWARE MARKET, 2022

- 12.5 KEY MARKET DEVELOPMENTS

- 12.5.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 183 PRODUCT LAUNCHES & ENHANCEMENTS, 2020-2023

- 12.5.2 DEALS

- TABLE 184 DEALS, 2021-2023

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 WORKDAY

- TABLE 185 WORKDAY: COMPANY OVERVIEW

- FIGURE 42 WORKDAY: COMPANY SNAPSHOT

- TABLE 186 WORKDAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 WORKDAY: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 188 WORKDAY: DEALS

- 13.2.2 ADP

- TABLE 189 ADP: COMPANY OVERVIEW

- FIGURE 43 ADP: COMPANY SNAPSHOT

- TABLE 190 ADP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 ADP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 192 ADP: DEALS

- 13.2.3 SAP

- TABLE 193 SAP: COMPANY OVERVIEW

- FIGURE 44 SAP: COMPANY SNAPSHOT

- TABLE 194 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 196 SAP: DEALS

- 13.2.4 UKG

- TABLE 197 UKG: COMPANY OVERVIEW

- TABLE 198 UKG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 UKG: DEALS

- 13.2.5 ORACLE

- TABLE 200 ORACLE: COMPANY OVERVIEW

- FIGURE 45 ORACLE: COMPANY SNAPSHOT

- TABLE 201 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 203 ORACLE: DEALS

- 13.2.6 CERIDIAN

- TABLE 204 CERIDIAN: COMPANY OVERVIEW

- FIGURE 46 CERIDIAN: COMPANY SNAPSHOT

- TABLE 205 CERIDIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CERIDIAN: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 207 CERIDIAN: DEALS

- 13.2.7 IBM

- TABLE 208 IBM: COMPANY OVERVIEW

- FIGURE 47 IBM: COMPANY SNAPSHOT

- TABLE 209 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.8 PAYCOM

- TABLE 210 PAYCOM: COMPANY OVERVIEW

- FIGURE 48 PAYCOM: COMPANY SNAPSHOT

- TABLE 211 PAYCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 PAYCOM: PRODUCT LAUNCHES & ENHANCEMENTS

- 13.2.9 PAYLOCITY

- TABLE 213 PAYLOCITY: COMPANY OVERVIEW

- FIGURE 49 PAYLOCITY: COMPANY SNAPSHOT

- TABLE 214 PAYLOCITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 PAYLOCITY: DEALS

- 13.2.10 CORNERSTONE ONDEMAND

- TABLE 216 CORNERSTONE ONDEMAND: COMPANY OVERVIEW

- TABLE 217 CORNERSTONE ONDEMAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 CORNERSTONE ONDEMAND: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 219 CORNERSTONE ONDEMAND: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies

- 13.3 OTHER PLAYERS

- 13.3.1 VISMA

- 13.3.2 ACCESS GROUP

- 13.3.3 PAYCHEX

- 13.3.4 EMPLOYWISE

- 13.3.5 HRONE

- 13.3.6 GREYTHR

- 13.3.7 PEOPLESTRONG

- 13.3.8 PERSONIO

- 13.3.9 SPROUT SOLUTIONS

- 13.3.10 DARWINBOX

- 13.3.11 SERVICENOW

- 13.3.12 HIBOB

- 13.3.13 APS PAYROLL

- 13.3.14 BAMBOOHR

- 13.3.15 PAYCOR

- 13.3.16 ZOHO

- 13.3.17 NAMELY

- 13.3.18 GUSTO

- 13.3.19 RIPPLING

14 ADJACENT MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.2 ENTERPRISE ASSET MANAGEMENT MARKET

- TABLE 220 ENTERPRISE ASSET MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 221 ENTERPRISE ASSET MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 222 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 223 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 224 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2018-2021 (USD MILLION)

- TABLE 225 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2022-2027 (USD MILLION)

- TABLE 226 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 227 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 228 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 229 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 230 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 231 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.3 HUMAN CAPITAL MANAGEMENT MARKET

- TABLE 232 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2017-2020 (USD MILLION)

- TABLE 233 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 234 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2017-2020 (USD MILLION)

- TABLE 235 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2021-2026 (USD MILLION)

- TABLE 236 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2017-2020 (USD MILLION)

- TABLE 237 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- TABLE 238 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2017-2020 (USD MILLION)

- TABLE 239 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2026 (USD MILLION)

- TABLE 240 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2020 (USD MILLION)

- TABLE 241 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 242 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2017-2020 (USD MILLION)

- TABLE 243 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 244 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 245 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- 14.4 WORKFORCE MANAGEMENT MARKET

- TABLE 246 WORKFORCE MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- TABLE 247 WORKFORCE MANAGEMENT MARKET, BY SOLUTION, 2018-2025 (USD MILLION)

- TABLE 248 WORKFORCE MANAGEMENT MARKET, BY SERVICE, 2018-2025 (USD MILLION)

- TABLE 249 WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2018-2025 (USD MILLION)

- TABLE 250 WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2025 (USD MILLION)

- TABLE 251 WORKFORCE MANAGEMENT MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- TABLE 252 WORKFORCE MANAGEMENT MARKET, BY REGION, 2018-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS