|

|

市場調査レポート

商品コード

1881237

電動二輪車の世界市場 (~2032年):車両タイプ (電動スクーター/電動モペット・電動バイク)・電圧・モータータイプ (ハブ・ミッドドライブ)・バッテリー (リチウムイオン・鉛蓄電池)・モーター出力・技術 (バッテリー・プラグイン)・車両クラス・用途・地域別Electric Two Wheeler Market by Vehicle (E-Scooter/Moped, E-Motorcycle), Voltage Type, Motor Type (Hub, Mid-drive), Battery (Li-ion, lead acid), Motor Power, Technology (Battery, Plug-in), Vehicle Class, Usage, Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 電動二輪車の世界市場 (~2032年):車両タイプ (電動スクーター/電動モペット・電動バイク)・電圧・モータータイプ (ハブ・ミッドドライブ)・バッテリー (リチウムイオン・鉛蓄電池)・モーター出力・技術 (バッテリー・プラグイン)・車両クラス・用途・地域別 |

|

出版日: 2025年11月19日

発行: MarketsandMarkets

ページ情報: 英文 379 Pages

納期: 即納可能

|

概要

電動二輪車の市場規模は、2025年の47億8,000万米ドルから、CAGR 10.6%で推移し、2032年には97億1,000万米ドルの規模に成長すると予測されています。

インドおよび東南アジアでは、大衆向けスクーターのkWhあたりのコスト効率を向上させるため、現地生産のバッテリーパック組立やCTP (cell-to-pack) 設計が採用されています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 数量(ユニット)および金額(米ドル) |

| セグメント | 車両タイプ、モーター出力、モータータイプ、バッテリー、用途、技術、電圧、走行距離、車両クラス、地域 |

| 対象地域 | アジア太平洋、欧州、北米 |

シェアリングモビリティや配送事業者はOEMメーカーにリアルタイムの使用状況データを提供しており、耐久性、耐熱性、メンテナンスの容易さに重点を置いた次世代車両設計に影響を与えています。電動二輪車は現在、短時間の急加速ではなく持続的な出力供給を目的として設計されており、継続的な性能最適化への移行を反映しています。その結果、競争上の差別化は機械的なハードウェアから、ライドモード、トラクションコントロールアルゴリズム、エネルギー管理ソフトウェアなどのインテリジェントシステムへと移行しつつあります。

”予測期間中、ハブモーターが市場を独占する見通し”

ハブモーターは、そのシンプルな構造と低メンテナンス性により、電動二輪車市場を独占すると予想されています。ホイールハブに直接組み込まれるため、チェーン、ベルト、ギアボックスが不要となり、機械的複雑性、重量、サービスコストを削減します。コンパクトな設計により、より軽量で人間工学に基づいた車両を実現し、都市部の通勤者や配送車両にとって重要な利点となります。ハブモーターはまた、効率的な回生ブレーキとエネルギー利用率の向上を提供し、航続距離と総合的な走行効率を高めます。バッテリー価格の低下とエネルギー密度の向上に伴い、ハブモーター搭載車両は生産コスト効率が向上し、大衆市場向けスケールアップが容易になっています。シェアリングモビリティやフリート運営の重要性が高まる中、信頼性と低維持費がピーク性能の必要性を上回るため、ハブモーターの採用がさらに促進されています。都市の電動化という世界的な潮流に沿い、ハブモーター構造はOEMメーカーに対し、コスト・簡素性・拡張性の最適なバランスを提供しています。2025年8月、Ola Electric(インド)はフェライト(希土類フリー)磁石を採用した自社開発ハブモーターを発表し、これにより輸入希土類材料への依存度を低減するとともに、現地製造能力の強化を図りました。

”予測期間中、商用利用セグメントは最も高い成長率を示す見通し”

配送車両、ライドシェアサービス、ラストマイル物流を含む電動スクーター・電動バイクの商用利用は、ライフサイクルコストの削減、運用効率の向上、迅速な車両入れ替えの確保に事業者が注力する中、最も高い成長率が見込まれています。電動二輪車は内燃機関モデルと比較して燃料費とメンテナンス費を大幅に削減できるため、高稼働率のフリートに最適です。Eコマースやフードデリバリーの急成長に伴い、多くの企業が持続可能性目標の達成や都市部の排出規制強化への対応を目的に、フリート全体の電動化を進めています。これらの商用運用では、予測可能なルートと使用パターンが確立されているため、電動車両の大規模導入と資金調達が容易になります。これに対応し、OEM各社は頑丈で貨物輸送能力を備えた電動スクーターやオートバイを開発中です。フリート運用向けに設計されたバッテリー交換システムや専用充電ネットワークがこれを支えています。

”アジア太平洋地域は主にインドによって牽引される”

インドの巨大な二輪車市場は、強い買い替え需要と急速な都市化に支えられ、アジア太平洋地域のスクーター・オートバイ分野の電動化にとって極めて好ましい環境を提供しています。FAME II計画、州レベルの補助金、2030年までにEV普及率30%達成という国家目標といった政府施策により、初期費用が大幅に低減され、普及が加速しています。リチウムイオン電池価格の着実な低下は、内燃機関モデルと比較した電動二輪車のコスト競争力をさらに高めています。Ola Electric、Ather Energy、Hero MotoCorpを含む主要国内OEMメーカーや新興企業は、現地生産・流通・サービスネットワークを強化しつつ、電動車ラインナップの拡充を積極的に進めています。インドの密集した都市交通、短距離通勤、高燃料価格も、総所有コストの観点から電動二輪車を特に魅力的にしています。この電動化への移行は、同国の環境目標やエネルギー安全保障目標とも合致し、市場動向、政策の方向性、消費者需要が一致する形で推進されています。こうした勢いを反映し、インドにおける電動二輪車の販売台数は2024年度に約115万台に達しました。インフラ整備も着実に進んでおり、Ather Energyなどは2026年3月までに全国700店舗へ小売拠点を倍増させる計画を進めています。

当レポートでは、世界の電動二輪車の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 関連市場・異業種との分野横断的機会

- ティア1/2/3企業の戦略的動き

- 特許分析

- 生成AIが電動二輪車市場に与える影響

- 電動二輪車向け音響車両警報システム(AVAS)

- 電動二輪車市場における新たなビジネスモデル

- 主要な新興技術

- 補完的技術

- 技術/製品ロードマップ

- 部品表

- 総所有コスト

- OEM分析

- 電動二輪車エコシステムにおける将来の用途

- マクロ経済指標

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

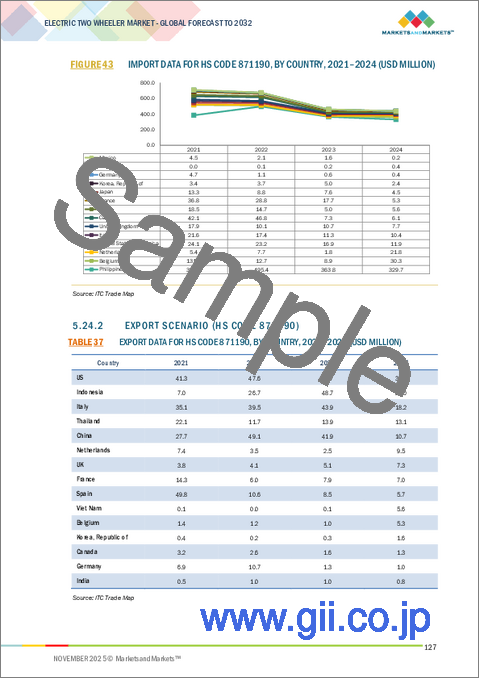

- 貿易分析

- 2025-2026年の主な会議とイベント

- 意思決定プロセス

- ステークホルダーと購入評価基準

- 採用障壁と内部課題

- 規制状況とコンプライアンス

- 持続可能性への取り組み

第6章 電動二輪車市場:車両タイプ別

- 電動スクーター/モペッド

- 電動バイク

- 主要な洞察

第7章 電動二輪車市場:車両クラス別

- エコノミー

- ラグジュアリー

- 主要な洞察

第8章 電動二輪車市場:電圧タイプ別

- 36V

- 48V

- 60V

- 72V

- 72V超

- 主要な洞察

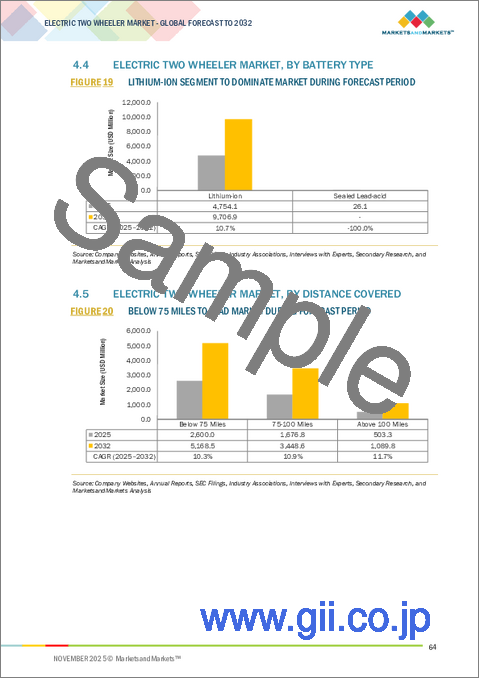

第9章 電動二輪車市場:バッテリー別

- 密閉型鉛蓄電池

- リチウムイオン

- ニッケル水素(NIMH)

- ナトリウムイオン

- 主要な洞察

第10章 電動二輪車市場:走行距離別

- 75マイル未満

- 75~100マイル

- 100マイル超

- 主要な洞察

第11章 電動二輪車市場:用途別

- 個人

- 商用

- 主要な洞察

第12章 電動二輪車市場:技術別

- プラグイン

- バッテリー

- 主要な洞察

第13章 電動二輪車市場:モータータイプ別

- ミッドドライブモーター

- ハブモーター

- その他

- 主要な洞察

第14章 電動二輪車市場:モーター出力別

- 1.5kW未満

- 1.5~3kW

- 3kW以上

- 主要な洞察

第15章 電動二輪車市場:地域別

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- 台湾

- タイ

- インドネシア

- マレーシア

- フィリピン

- ベトナム

- 欧州

- マクロ経済見通し

- フランス

- ドイツ

- スペイン

- オーストリア

- 英国

- イタリア

- ベルギー

- オランダ

- ポーランド

- デンマーク

- 北米

- マクロ経済見通し

- 米国

- カナダ

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 電動二輪車プロバイダーの市場シェア分析

- 収益分析

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- OLA ELECTRIC

- BAJAJ AUTO LTD.

- TVS MOTOR COMPANY

- ATHER ENERGY

- YADEA TECHNOLOGY GROUP CO., LTD.

- HERO ELECTRIC

- GOGORO

- VMOTO LIMITED

- NIU INTERNATIONAL

- JIANGSU XINRI E-VEHICLE CO., LTD.

- IDEANOMICS, INC.

- ASKOLL EVA S.P.A.

- その他の企業

- ULTRAVIOLETTE AUTOMOTIVE

- REVOLT INTELLICORP PRIVATE LIMITED(REVOLT MOTORS)

- Z ELECTRIC VEHICLE

- CAKE

- LIGHTNING MOTORCYCLES

- JOHAMMER E-MOBILITY GMBH

- PIAGGIO GROUP

- KTM AG

- HARLEY DAVIDSON

- BMW GROUP

- AIMA TECHNOLOGY GROUP CO., LTD.

- HONDA MOTOR CO., LTD.

- GREAVES ELECTRIC MOBILITY PRIVATE LIMITED(AMPERE VEHICLES)

- DONGGUAN TAILING ELECTRIC VEHICLE CO., LTD.

- CEZETA

- TERRA MOTORS CORPORATION

- NEXZU MOBILITY LTD.(AVAN MOTORS INDIA)

- EMFLUX MOTORS

- MAHINDRA & MAHINDRA LTD.

- DAMON MOTORS INC.

- VIAR MOTOR INDONESIA

- SELIS

- GESITS

- UNITED E-MOTOR

- SMOOT ELEKTRIK

- PT VOLTA INDONESIA SEMESTA(VOLTA)

- ALVA

- NUSA MOTORS

- BF GOODRICH