|

|

市場調査レポート

商品コード

1117292

成形回路部品 (MID) の世界市場:製品種類別 (アンテナ・接続、センサー)・プロセス別 (レーザー直接構造化、2ショット成形法)・業種別 (家電、通信、医療)・地域別の将来予測 (2027年まで)Molded Interconnect Device (MID) Market by Product Type (Antennae & Connectivity, Sensor),by Process (Laser Direct Structuring, Two-shot Molding), by Industry (Consumer Electronics, Telecommunication, Medical) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 成形回路部品 (MID) の世界市場:製品種類別 (アンテナ・接続、センサー)・プロセス別 (レーザー直接構造化、2ショット成形法)・業種別 (家電、通信、医療)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月15日

発行: MarketsandMarkets

ページ情報: 英文 173 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

成形回路部品 (MID) 市場は、2022年の14億米ドルから2027年には27億米ドルに成長すると予測され、予測期間中のCAGRは13.6%と予想されています。

モールドインターコネクトデバイス (MID) 市場の成長の主な原動力は、自動車産業における進歩の拡大です。

"コネクタ・スイッチの市場規模が、予測期間中に非常に大きい"

コネクタとスイッチは、主に自動車産業と医療産業で使用されています。自動車業界別では、コネクターはナビゲーション機器、インフォテインメント・システム、カメラなどに使用されています。コネクタには、組立作業性の向上、電気的・機械的信頼性、小型化などを目的にMID技術が採用されています。スイッチの限られたスペースをMID技術で解決します。

"通信分野:予測期間中に2番目に高いCAGR"

通信分野では、MIDは携帯電話や固定電話、リモコン、衛星、基地局、ネットワーク機器などの世界な通信インフラに使用されています。

"北米では米国が、予測期間中最も高いCAGRで成長する"

北米でMIDを扱う企業にとって、米国は主要な収益源です。米国では、家電・医療・通信・産業用途がMIDの需要を牽引しています。また、小型化されたパッケージへの需要が高まり始めていることが確認されています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 動向と分布

- 技術分析

- 3D成形回路部品

- レーザープラズマパターニング

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 関税分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 規制状況

第6章 成形回路部品 (MID) 市場:製品種類別

- イントロダクション

- アンテナ・接続モジュール

- センサー

- コネクタとスイッチ

- 照明システム

- その他

第7章 成形回路部品 (MID) 市場:種類別

- イントロダクション

- レーザー直接構造化 (LDS)

- 2ショット成形法

- フィルム技術

第8章 成形回路部品 (MID) 市場:業種別

- イントロダクション

- 通信

- 家電

- 自動車

- 医療

- 工業

- 軍事・航空宇宙

第9章 成形回路部品 (MID) 市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- 他のアジア太平洋諸国

- 他の中東・アフリカ諸国

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 上位5社の3年間の収益分析

- 主要企業の戦略/有力企業

- 市場シェア分析 (2021年)

- 企業評価クアドラント (2021年)

- 中小企業 (SME) の評価クアドラント (2021年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- MOLEX

- LPKF LASER & ELECTRONICS

- TE CONNECTIVITY

- TAOGLAS

- AMPHENOL CORPORATION

- HARTING

- ARLINGTON PLATING COMPANY

- MID SOLUTIONS GMBH

- 2E MECHATRONIC

- KYOCERA AVX

- JOHNAN

- その他の重要な企業

- TEPROSA

- SUNWAY COMMUNICATION

- AXON CABLE

- S2P

- SUZHOU CICOR TECHNOLOGY CO. LTD

- TACTOTEK

- DURATECH INDUSTRIES

- TEKRA

- YOMURA TECHNOLOGIES

- MACDERMID ALPHA ELECTRONICS

- GALTRONICS

- YAZAKI CORPORATION

- CHOGORI TECHNOLOGY

- SUZHOU ZEETEK ELECTRONICS

- TOYO CONNECTORS

- SINOPLAST

第12章 付録

The molded interconnect device (MID) market is expected to grow from USD1.4 billion in 2022 to USD 2.7billion by 2027; it is expected to grow at a CAGR of 13.6% during the forecast period. The major driving factors for the growth of the molded interconnect device (MID)market include the growing advancement in automotive vertical.

Connectors and switches to have significant market size of molded interconnect device (MID)market during the forecast period

Connectors and switches are mainly used in automotive and medical industries. In the automotive Vertical, connectors find application in navigation devices, infotainment systems, cameras, and so on. MID technology is used in connectors to improve assembly operability, provide electrical and mechanical reliability, and offer compactness. Limited space issue in switchescan be solved using MID technology

Telecommunication to have second highestCAGR during the forecast period.

In the telecommunications sector, MIDs are used in mobile phones and landline phones, remote controls, and the global telecommunications infrastructure such as satellites, base equipment, and network equipment. Generally, telecommunications based on the network are used in three different broad business areas, namely, central office, outside plants, and mobility. Central office refers to large facilities where very high-volume communications are switched and processed; outside plants refer to switching stations where distributive switching occurs for commercial and home landlines; and the third area is mobility, where tower-based power and grounding supports mobile communication transmission.

USto grow with highest CAGR in North America during the forecast period.

The US is the major revenue generator for players dealing in MIDs in North America. In 2021, the US accounted for highest CAGR of the MID market in North America, owing to the presence of leading manufacturers such as Molex, Arlington Plating Company, Amphenol Corporation, and Kyocera AVX Corporation. These manufacturers provide a comprehensive range of MID products to enhance the electrical connectivity and performance of the equipment or devices across various applications. Consumer electronics, medical, telecommunication, and industrial applications are driving the demand for MIDs in the US. The consumer electronics market in the US has been continuously growing. Moreover, it has been observed that the demand for miniaturized packages has started gaining momentum in consumer electronics, automotive components, medical equipment, and other devices.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key officials in the molded interconnect device (MID)market. Following is the breakup of the profiles of primary participants for the report.

- By Company Type:Tier 1 - 35 %, Tier 2 - 45%, and Tier 3 - 20%

- By Designation:C-Level Executives - 35%, Directors- 25%, and Others - 40%

- By Region:North America- 45%, Asia Pacific - 30%, Europe- 20% and RoW - 5%

The molded interconnect device (MID)market comprises major players are Molex (US), TE Connectivity (Switzerland), Amphenol Corporation (US), LPKF Laser & Electronics (Germany), and Taoglas (Dublin), Harting (Germany), Arlington Plating Company (US), MID Solutions (Germany), 2E Mechatronic (Germany), KYOCERA AVX (US) and Johnan (Japan),Teprosa(Germany), Sunway Communication(China), Axon Cable(France), S2P (France), Suzhou Cicor Technology (China), TactoTek (Finland), DuraTech (US), Tekra (US), Yomura Technologies (Taiwan), MacDermid Alpha Electronics (US), Galtronics (US), Yazaki Corporation (Japan), Chogori Technology (Japan), Suzhou Zeeteq Electronics (Japan), Toyo Connectors (Japan) and SINOPLAST (China).

Research Coverage

The report defines, describes, and forecasts the molded interconnect device (MID)market based onproduct type, process, verticaland geography. It provides detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the molded interconnect device (MID)market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and developments carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help leaders/new entrants in the molded interconnect device (MID)market in the following ways:

1. The report segments the molded interconnect device (MID)market comprehensively and provides the closest market size estimation for all subsegments across regions.

2. The report will help stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities about molded interconnect device (MID)market.

3. The report will help stakeholders understand their competitors better and gain insights to improve their position in the molded interconnect device (MID)market. The competitive landscape section describes the competitor ecosystem.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 MOLDED INTERCONNECT DEVICE (MID) MARKET: SEGMENTATION

- FIGURE 2 GEOGRAPHIC SCOPE

- FIGURE 3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 PROCESS FLOW: MOLDED INTERCONNECT DEVICE (MID) MARKET SIZE ESTIMATION

- FIGURE 5 MOLDED INTERCONNECT DEVICE (MID) MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Secondary sources

- 2.1.2.2 List of key secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary sources

- 2.1.3.2 Key industry insights

- 2.1.3.3 Primary interviews with experts

- 2.1.3.4 List of key primary respondents

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size by bottom-up analysis

- FIGURE 6 MOLDED INTERCONNECT DEVICE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for deriving market size by top-down analysis

- FIGURE 7 MOLDED INTERCONNECT DEVICE (MID) MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 LASER DIRECT STRUCTURING SEGMENT TO LEAD MOLDED INTERCONNECT DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 10 ANTENNAE AND CONNECTIVITY MODULES TO HOLD LARGEST SHARE OF MOLDED INTERCONNECT DEVICE MARKET BY 2027

- FIGURE 11 AUTOMOTIVE TO RECORD HIGHEST CAGR IN MOLDED INTERCONNECT DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING MARKET FOR MOLDED INTERCONNECT DEVICES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 INCREASING USE OF MOLDED INTERCONNECT DEVICES IN AUTOMOTIVE INDUSTRY TO OFFER OPPORTUNITIES FOR MARKET GROWTH FROM 2022 TO 2027

- 4.2 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY TYPE

- FIGURE 14 SENSORS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL

- FIGURE 15 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST SHARE OF MID MARKET DURING FORECAST PERIOD

- 4.4 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PROCESS AND REGION

- FIGURE 16 LDS TO HAVE LARGEST MARKET SIZE FOR LDS PROCESS DURING FORECAST PERIOD

- 4.5 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY GEOGRAPHY (2027)

- FIGURE 17 MID MARKET TO RECORD HIGHEST CAGR IN CHINA IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 RISING DEMAND FOR MINIATURIZATION IN CONSUMER ELECTRONICS VERTICAL DRIVING MID MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of LDS in production of 5G antennas

- 5.2.1.2 Increasing use of MIDs in medical devices

- 5.2.1.3 Rising demand for miniaturization in consumer electronics industry

- 5.2.1.4 Intensifying need to reduce e-waste

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technological monopoly of LDS equipment manufacturers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of MIDs in automotive industry

- 5.2.3.2 Expanding IoT ecosystem

- 5.2.3.3 Opportunities for chip-level optical interconnects

- 5.2.4 CHALLENGES

- 5.2.4.1 Incompatibility with electronic packages

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 MID MARKET: VALUE CHAIN

- 5.3.1 RESEARCH AND DEVELOPMENT

- 5.3.2 MANUFACTURING

- 5.3.3 ASSEMBLY

- 5.3.4 MARKETING AND SALES

- 5.3.5 END-USERS

- 5.4 MID ECOSYSTEM ANALYSIS

- FIGURE 20 MID ECOSYSTEM

- TABLE 2 MID MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE TRENDS FOR PRODUCTS

- 5.6 TRENDS AND DISTRIBUTION

- FIGURE 21 REVENUE SHIFT FOR MID MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 3D MOLDED INTERCONNECT DEVICES

- 5.7.2 LASER PLASMA PATTERNING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 MID MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 MID SOLUTIONS

- TABLE 7 SIEMENS COLLABORATED WITH LPKF LASER & ELECTRONICS FOR DEVELOPING MID-BASED HEARING AID

- 5.10.2 3D MID TECHNOLOGY

- TABLE 8 3D MID COMPONENTS INSPECTION USING VISCOM S6056 MID

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE DATA FOR HS CODE 947330

- FIGURE 24 IMPORT DATA FOR HS CODE 947330, BY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR HS CODE 947330, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.12 TARIFF ANALYSIS

- TABLE 9 TARIFFS DATA FOR HS 947330

- 5.13 PATENT ANALYSIS

- FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 10 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- TABLE 11 LIST OF PATENTS

- 5.14 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 12 MID MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

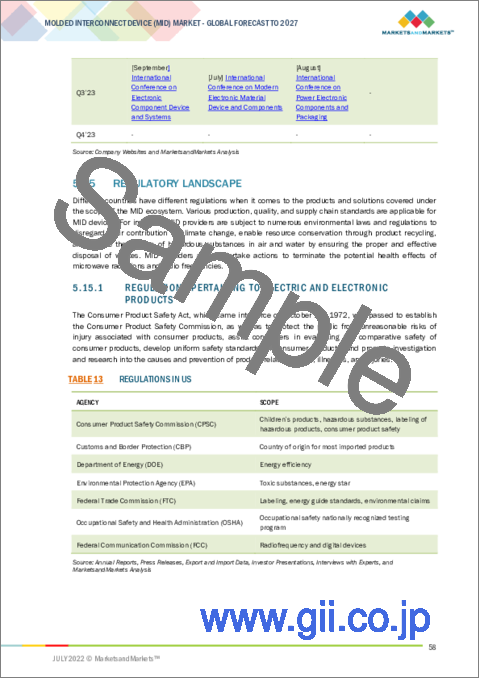

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATIONS PERTAINING TO ELECTRIC AND ELECTRONIC PRODUCTS

- TABLE 13 REGULATIONS IN US

- 5.15.2 STANDARDS RELATED TO ELECTRICAL EQUIPMENT

- TABLE 14 STANDARDS AND DESCRIPTION

- 5.15.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

6 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- FIGURE 28 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PRODUCT TYPE

- FIGURE 29 ANTENNAE AND CONNECTIVITY MODULES TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 15 MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 16 MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 6.2 ANTENNAE AND CONNECTIVITY MODULES

- 6.2.1 EXTENSIVELY USED IN CONSUMER ELECTRONICS

- TABLE 17 ANTENNAE AND CONNECTIVITY MODULES: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 18 ANTENNAE AND CONNECTIVITY MODULES: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 19 ANTENNAE AND CONNECTIVITY MODULES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 20 ANTENNAE AND CONNECTIVITY MODULES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SENSORS

- 6.3.1 USED IN INDUSTRIAL APPLICATIONS

- TABLE 21 SENSORS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 22 SENSORS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 23 SENSORS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 SENSORS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 CONNECTORS AND SWITCHES

- 6.4.1 USED IN NAVIGATION DEVICES

- TABLE 25 CONNECTORS AND SWITCHES: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 26 CONNECTORS AND SWITCHES: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 27 CONNECTORS AND SWITCHES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 CONNECTORS AND SWITCHES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 LIGHTING SYSTEMS

- 6.5.1 MOLDED INTERCONNECT DEVICES MAKE LIGHTING SYSTEMS COST-EFFICIENT AND EFFECTIVE

- TABLE 29 LIGHTING SYSTEMS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 30 LIGHTING SYSTEMS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 31 LIGHTING SYSTEMS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 LIGHTING SYSTEMS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 OTHERS

- TABLE 33 OTHERS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 34 OTHERS: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 35 OTHERS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 OTHERS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

7 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PROCESS

- 7.1 INTRODUCTION

- FIGURE 30 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PROCESS

- FIGURE 31 LASER DIRECT STRUCTURING (LDS) TO REGISTER HIGHEST CAGR IN MID MARKET DURING FORECAST PERIOD

- TABLE 37 MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 38 MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- 7.2 LASER DIRECT STRUCTURING (LDS)

- 7.2.1 CAN INTEGRATE MORE ELECTRONIC CIRCUITS INTO SMALLER SPACES

- TABLE 39 LASER DIRECT STRUCTURING: MOLDED INTERCONNECT DEVICE MARKET, BY REGION 2018-2021 (USD MILLION)

- TABLE 40 LASER DIRECT STRUCTURING: MOLDED INTERCONNECT DEVICE MARKET, BY REGION 2022-2027 (USD MILLION)

- 7.3 TWO-SHOT MOLDING

- 7.3.1 USED FOR HIGH-VOLUME PRODUCTION OF MOLDED INTERCONNECT DEVICES

- TABLE 41 TWO-SHOT MOLDING: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 TWO-SHOT MOLDING: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 FILM TECHNIQUES

- 7.4.1 USED FOR PRODUCTION OF FLAT SURFACES

- TABLE 43 FILM TECHNIQUES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 FILM TECHNIQUES: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

8 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 32 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL

- FIGURE 33 AUTOMOTIVE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 45 MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 46 MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 8.2 TELECOMMUNICATIONS

- 8.2.1 USES MOLDED INTERCONNECT DEVICES FOR WIRELESS COMMUNICATIONS

- TABLE 47 TELECOMMUNICATIONS: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 48 TELECOMMUNICATIONS: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027(USD MILLION)

- TABLE 49 TELECOMMUNICATIONS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 TELECOMMUNICATIONS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027(USD MILLION)

- 8.3 CONSUMER ELECTRONICS

- 8.3.1 USES MOLDED INTERCONNECT DEVICES IN ANTENNAS

- TABLE 51 CONSUMER ELECTRONICS: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 AUTOMOTIVE

- 8.4.1 DEPLOYS MOLDED INTERCONNECT DEVICES IN SMART VEHICLES

- TABLE 55 AUTOMOTIVE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 56 AUTOMOTIVE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 57 AUTOMOTIVE: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 AUTOMOTIVE: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 MEDICAL

- 8.5.1 NEED FOR MINIATURIZED MEDICAL DEVICES

- TABLE 59 MEDICAL: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 60 MEDICAL: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 61 MEDICAL: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 MEDICAL: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 INDUSTRIAL

- 8.6.1 MOLDED INTERCONNECT DEVICES ARE USED IN INDUSTRIAL SENSORS

- TABLE 63 INDUSTRIAL: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 64 INDUSTRIAL: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 65 INDUSTRIAL: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 INDUSTRIAL: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.7 MILITARY & AEROSPACE

- 8.7.1 GROWING DEMAND FOR RADAR AND ELECTRONIC WARFARE EQUIPMENT

- TABLE 67 MILITARY & AEROSPACE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 68 MILITARY & AEROSPACE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 69 MILITARY & AEROSPACE: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 MILITARY & AEROSPACE: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

9 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 MOLDED INTERCONNECT DEVICE MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 71 MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET SNAPSHOT

- TABLE 73 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 74 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Increase in adoption of miniaturized packages

- 9.2.2 CANADA

- 9.2.2.1 Government initiatives and investments to support semiconductors manufacturing

- 9.3 EUROPE

- FIGURE 36 EUROPE: MOLDED INTERCONNECT DEVICE MARKET SNAPSHOT

- TABLE 81 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 82 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 84 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- TABLE 85 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 86 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 87 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 88 EUROPE: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Increasing demand for ADAS

- 9.3.2 FRANCE

- 9.3.2.1 Presence of developed communication network

- 9.3.3 UK

- 9.3.3.1 Heightened demand from medical vertical

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increase in medical equipment manufacturing

- 9.4.2 JAPAN

- 9.4.2.1 Increase in demand for consumer electronics and automobiles

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Expansion of manufacturing sector

- 9.4.4 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- FIGURE 38 REST OF THE WORLD: MOLDED INTERCONNECT DEVICE MARKET SNAPSHOT

- TABLE 97 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 99 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 100 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- TABLE 101 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 102 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 103 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 104 ROW: MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 High adoption of wireless communication

- 9.5.2 MIDDLE EAST AND AFRICA

- 9.5.2.1 Favorable government initiatives and high military investments

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 THREE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 39 REVENUE ANALYSIS, 2019-2021 (USD BILLION)

- 10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 105 KEY STRATEGIES OF TOP PLAYERS IN MID MARKET

- 10.4 MARKET SHARE ANALYSIS (2021)

- TABLE 106 MID MARKET: MARKET SHARE ANALYSIS

- FIGURE 40 MARKET SHARE ANALYSIS: MID MARKET, 2021

- 10.5 COMPANY EVALUATION QUADRANT, 2021

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 41 MID MARKET: COMPANY EVALUATION QUADRANT, 2021

- 10.5.5 COMPANY FOOTPRINT

- TABLE 107 COMPANY FOOTPRINT: MOLDED INTERCONNECT DEVICE (MID) MARKET

- TABLE 108 COMPANY VERTICAL FOOTPRINT: MOLDED INTERCONNECT DEVICE (MID) MARKET

- TABLE 109 COMPANY PROCESS FOOTPRINT: MOLDED INTERCONNECT DEVICE (MID) MARKET

- TABLE 110 COMPANY REGIONAL FOOTPRINT: MOLDED INTERCONNECT DEVICE (MID) MARKET

- 10.6 SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2021

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 42 MOLDED INTERCONNECT DEVICE (MID) MARKET: SME EVALUATION QUADRANT, 2021

- TABLE 111 MID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.7 COMPETITIVE SCENARIO

- TABLE 112 MOLDED INTERCONNECT DEVICE (MID) MARKET: PRODUCT LAUNCHES, JANUARY 2020-JANUARY 2022

- TABLE 113 MOLDED INTERCONNECT DEVICE (MID) MARKET: DEALS, JANUARY 2020-JANUARY 2022

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1.1 MOLEX

- TABLE 114 MOLEX: BUSINESS OVERVIEW

- TABLE 115 MOLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 MOLEX: DEALS

- 11.1.2 LPKF LASER & ELECTRONICS

- TABLE 117 LPKF LASER & ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 43 LPKF LASER & ELECTRONICS: COMPANY SNAPSHOT

- TABLE 118 LPKF LASER & ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 LPKF LASER & ELECTRONICS: PRODUCT LAUNCHES

- 11.1.3 TE CONNECTIVITY

- TABLE 120 TE CONNECTIVITY: BUSINESS OVERVIEW

- FIGURE 44 TE CONNECTIVITY: COMPANY SNAPSHOT

- TABLE 121 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 TE CONNECTIVITY: PRODUCT LAUNCHES

- TABLE 123 TE CONNECTIVITY: DEALS

- 11.1.4 TAOGLAS

- TABLE 124 TAOGLAS: BUSINESS OVERVIEW

- TABLE 125 TAOGLAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 TAOGLAS: PRODUCT LAUNCHES

- TABLE 127 TAOGLAS: DEALS

- 11.1.5 AMPHENOL CORPORATION

- TABLE 128 AMPHENOL CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 129 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 AMPHENOL CORPORATION: PRODUCT LAUNCHES

- TABLE 131 AMPHENOL CORPORATION: DEALS

- TABLE 132 AMPHENOL CORPORATION: OTHERS

- 11.1.6 HARTING

- TABLE 133 HARTING: BUSINESS OVERVIEW

- TABLE 134 HARTING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 HARTING: PRODUCT LAUNCHES

- TABLE 136 HARTING: OTHERS

- 11.1.7 ARLINGTON PLATING COMPANY

- TABLE 137 ARLINGTON PLATING COMPANY: BUSINESS OVERVIEW

- TABLE 138 ARLINGTON PLATING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ARLINGTON PLATING COMPANY: DEALS

- TABLE 140 ARLINGTON PLATING COMPANY: OTHERS

- 11.1.8 MID SOLUTIONS GMBH

- TABLE 141 MID SOLUTIONS GMBH: BUSINESS OVERVIEW

- TABLE 142 MID SOLUTIONS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 MID SOLUTIONS GMBH: OTHERS

- 11.1.9 2E MECHATRONIC

- TABLE 144 2E MECHATRONIC: BUSINESS OVERVIEW

- TABLE 145 2E MECHATRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 2E MECHATRONIC: OTHERS

- 11.1.10 KYOCERA AVX

- TABLE 147 KYOCERA AVX: BUSINESS OVERVIEW

- TABLE 148 KYOCERA AVX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 KYOCERA AVX: PRODUCT LAUNCHES

- TABLE 150 KYOCERA AVX: DEALS

- TABLE 151 KYOCERA AVX: OTHERS

- 11.1.11 JOHNAN

- TABLE 152 JOHNAN: BUSINESS OVERVIEW

- TABLE 153 JOHNAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 JOHNAN: DEALS

- TABLE 155 JOHNAN: OTHERS

- 11.2 OTHER IMPORTANT PLAYERS

- 11.2.1 TEPROSA

- 11.2.2 SUNWAY COMMUNICATION

- 11.2.3 AXON CABLE

- 11.2.4 S2P

- 11.2.5 SUZHOU CICOR TECHNOLOGY CO. LTD

- 11.2.6 TACTOTEK

- 11.2.7 DURATECH INDUSTRIES

- 11.2.8 TEKRA

- 11.2.9 YOMURA TECHNOLOGIES

- 11.2.10 MACDERMID ALPHA ELECTRONICS

- 11.2.11 GALTRONICS

- 11.2.12 YAZAKI CORPORATION

- 11.2.13 CHOGORI TECHNOLOGY

- 11.2.14 SUZHOU ZEETEK ELECTRONICS

- 11.2.15 TOYO CONNECTORS

- 11.2.16 SINOPLAST

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS