|

|

市場調査レポート

商品コード

1107622

植物性タンパク質 (TVP) の世界市場:種類別 (スライス、チャンク、フレーク、顆粒)・原料別 (大豆、小麦、エンドウ)・用途別 (代替肉、シリアル・スナック食品)・形状別 (乾式、湿式)・特性別・地域別の将来予測 (2027年まで)Textured Vegetable Protein Market by Type (Slices, Chunks, Flakes, and Granules), Source (Soy, Wheat, and Pea), Application (Meat Alternatives, Cereals & Snacks), Form (Dry and Wet), Nature and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 植物性タンパク質 (TVP) の世界市場:種類別 (スライス、チャンク、フレーク、顆粒)・原料別 (大豆、小麦、エンドウ)・用途別 (代替肉、シリアル・スナック食品)・形状別 (乾式、湿式)・特性別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月25日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

植物性タンパク質 (TVP:テキスチャードベジタブルプロテイン) の世界市場は、2022年に14億米ドルと推定されます。

2027年には19億米ドルに達すると予測され、予測期間中に6.9%のCAGRを記録しています。TVP市場は、従来の食肉生産による有害な影響や消費者の健康への懸念が高まっていることが原動力となっています。このため、従来の食肉製品を代替するための代替肉や研究開発活動の進展に対する需要が高まっています。世界の食肉市場は、消費者の消費パターンが大きく変化していることを目の当たりにしています。様々な食品カテゴリーにおいて、生存可能な代替肉の急速な成長により、競争と混乱が起きています。菜食主義者の動向は、西欧諸国の消費者の多くを健康的なライフスタイルへと駆り立て、その結果、メーカーは肉の代替品の開発に多額の投資を行い、それによって食品産業におけるTVPの需要に拍車をかけています。

"米国の消費者は非常に肉の消費の影響に支配されており、そのため、TVPの需要が拡大し、代替肉への傾向を強めている"

米国は、世界最大の代替肉の消費国です。また、TVPの需要と供給に関して支配的な国でした。米国の消費者は、従来の肉の消費による環境への影響に強く影響されています。彼らは代替肉を採用する方向にあり、その結果、TVP市場が成長しています。大豆、小麦、エンドウ豆などを原料とするTVPは、機能的な利点を備えた食品代替物への需要が高まっているため、肉代替物に使用される重要な原料として台頭しています。このため、代替肉に嗜好を移す人が増えています。

"様々な食品用途における代替肉の利用増加が、TVPの需要を牽引している"

TVPは、栄養価を下げることなくコストを削減するために、ひき肉の延長として使用されてきました。TVPの添加は、添加されたテクスチャー付きタンパク質含有量に基づき、ひき肉製品の品質に影響を与えます。食肉類似物は、食肉代替物、模擬肉、フェイクミート、または模造肉とも呼ばれ、特定の種類の食肉の特定の美的品質および化学的特性を模倣するものです。家畜に関連する病気、動物性タンパク質の世界の不足の予測、環境への懸念、健全で宗教的(ハラール)な食品への強い要求、および経済的理由から、食品中の植物性タンパク質の消費は年々増加しています。

"湿式TVP:加工中に複数の機能性成分が導入可能で、カスタマイズの範囲を増加させ、それゆえ予測期間中にその成長を促進する"

湿式TVPは、湿式粉砕タンパク質とも呼ばれ、肉延長剤または類似物の生産のためにメーカーが利用する主要な変種の1つです。湿式TVPは、マージネーション、コーティング、および冷却を使用して製造されます。乾式TVPとは異なり、湿式TVPは、押出工程で導入された水を利用します。この加工形態では、十分な量の水とエネルギーが消費されます。タンパク質の抽出では、原料作物を水中に分散させ、限外ろ過や等電点沈殿によって炭水化物などの他の成分を抽出します。さらに、等電点沈殿を行うと、溶解したタンパク質が水相から沈殿し、別のデカンターに集められます。沈殿したタンパク質は、ろ過や遠心分離によって分離されます。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

第6章 産業動向

- イントロダクション

- バリューチェーン

- 研究・製品開発

- 原料調達

- 生産・加工

- 流通

- マーケティング・販売

- サプライチェーン分析

- 技術分析

- コンピューターによるタンパク質の設計

- 押出プロセスにおける技術進歩

- 価格分析

- 植物性タンパク質 (TVP) 市場のマッピングとエコシステム

- 需要サイド

- 供給サイド

- エコシステムマップ

- 顧客のビジネスに影響を与える動向/混乱

- TVP市場:特許分析

- 貿易データ:TVP市場

- ケーススタディ

- 主な会議とイベント (2022年~2023年)

- 関税・規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 植物性タンパク質 (TVP) 市場:種類別

- イントロダクション

- スライス

- フレーク

- チャンク

- 顆粒

第8章 植物性タンパク質 (TVP) 市場:原料別

- イントロダクション

- 大豆

- エンドウ

- 小麦

第9章 植物性タンパク質 (TVP) 市場:形状別

- イントロダクション

- 乾式

- 湿式

第10章 植物性タンパク質 (TVP) 市場:用途別

- イントロダクション

- 代替肉

- ミートエクステンダー

- 肉の類似物

- シリアル・スナック食品

- その他の用途

第11章 植物性タンパク質 (TVP) 市場:特性別

- イントロダクション

- オーガニック

- 従来型

第12章 植物性タンパク質 (TVP) 市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- イントロダクション

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東・アフリカ

第13章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業が採用した戦略

- 主要企業の収益分析:セグメント別

- 企業評価クアドラント (主要企業)

- TVP市場:スタートアップ/中小企業の評価クアドラント (2021年)

- 製品の発売、取引、およびその他の動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- ADM

- CARGILL, INCORPORATED

- ROQUETTE FRERES

- DUPONT

- INGREDION

- THE SCOULAR COMPANY

- PURIS

- DSM

- BENEO

- AXIOM FOODS, INC.

- SHANDONG YUNIX BIOTECHNOLOGY CO., LTD.

- MGP

- KANSAS PROTEIN FOODS

- FOODCHEM INTERNATIONAL CORPORATION

- DACSA GROUP

- その他の企業 (中小企業/スタートアップ)

- SHANDONG WONDERFUL INDUSTRIAL GROUP CO., LTD.

- SUN NUTRAFOODS

- CROWN SOYA PROTEIN GROUP COMPANY

- GUSHEN BIOTECHNOLOGY GROUP CO., LTD.

- SOTEXPRO

- LIVING FOODS

- STENTORIAN INDUSTRIES CO., LTD.

- SOYPROTEINCN

- BLATTMANN SCHWEIZ AG

- SONIC BIOCHEM

第15章 隣接・関連市場

- イントロダクション

- 制限事項

- 大豆タンパク質 (テキスチャードソイプロテイン) 市場

- 代用肉市場

第16章 付録

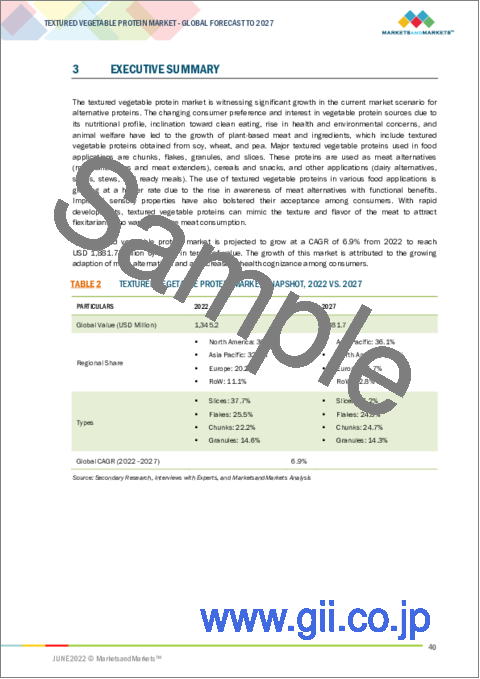

The global textured vegetable protein market is estimated to be valued at USD 1.4 billion in 2022. It is projected to reach USD 1.9 billion by 2027, recording a CAGR of 6.9% during the forecast period. The textured vegetable protein market is driven by the rise in the detrimental effects of conventional meat production and health concerns among consumers. This has increased the demand for meat alternatives and advancements in the research and development activities for substituting traditional meat products. The global meat market has witnessed a huge change in consumer consumption patterns. There has been discrete competition and disruption driven by the rapid growth of viable meat alternatives across various food categories. The vegan trend has propelled a large percentage of consumers in the Western region toward a healthier lifestyle, resulting in manufacturers investing heavily in the development of meat alternatives, thereby fueling the demand for textured vegetable protein in the food industry.

"Consumers of US are highly driven by impact of meat consumption and hence inclined more towards meat alternative resulting in the increase in demand of textured vegetable protein."

The US is a global powerhouse for consumers adopting meat alternatives. It has been the dominant country regarding textured vegetable protein demand and supply. Consumers in the US are highly driven by the environmental impact of conventional meat consumption. They are inclined toward adopting meat alternatives, resulting in a growing textured protein market. Textured proteins from sources, such as soy, wheat, and pea, are emerging as key ingredients used in meat alternatives due to the rising demand for food substitutes with functional benefits. According to the National Centre for Health Statistics (NCHS), about one-third of the US adults aged 20 and older were found obese in 2019. Also, in a study published in the American Journal of Epidemiology, researchers found that the mitigating consumption of meat products can decrease the risk of coronary heart disease (CHD). As per the World Health Organization record, in 2022, the United States reported having the 12th highest obesity rate, at 36.2%. This has resulted in more people shifting their preferences to meat alternatives.

"Increase in use of alternative meat in various food applications has drive the demand of textured vegetable protein".

Textured vegetable proteins (TVPs) have been used to extend ground meat to reduce the cost without reducing the nutritional value. The addition of TVPs influences the quality of ground meat products based on the textured protein content added to them. A meat analogue, also called a meat substitute, mock meat, faux meat, or imitation meat, mimics certain aesthetic qualities and chemical characteristics of specific types of meat. The consumption of plant proteins in food products has been increasing over the years because of livestock-associated diseases, projected global shortage of animal protein, environmental concerns, strong demand for wholesome and religious (halal) food, and economic reasons.

Texturized vegetable proteins can substitute meat products while providing an economical, functional, and high-protein food ingredient or can be consumed directly as a meat analogue. Meat analogues are successful because of their healthy image (cholesterol-free), meat-like texture, and low cost. Texturized vegetable proteins and several mycoprotein-based products are accepted as analogues of food.

"During processing of the wet textured protein multiple functional ingredients can be introduced, increasing its scope of customization hence driving its growth during forecast period."

Wet textured vegetable proteins, also referred to as wet-milled proteins, are among the key variants utilized by manufacturers for the production of meat extenders or analogues. Wet textured vegetable proteins are manufactured using margination, coating, and cooling. Unlike dry vegetable protein, wet textured protein utilizes water introduced during the extrusion process. This form of processing involves the consumption of a sufficient amount of water and energy. During protein extraction, the source crop is dispersed in water so that other components, such as carbohydrates, are extracted through ultrafiltration or iso-electric precipitation. Moreover, when it undergoes isoelectric precipitation, the dissolved proteins are precipitated out of the aqueous phase and are collected in a separate decanter. The precipitated protein is separated through filtration or centrifugation.

Break-up of Primaries:

By Company: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

By Designation: Managers - 25%, D-Level- 30%, and C-Level- 45%

By Region: Europe - 30%, Asia Pacific - 35%, North America - 25%, RoW - 10%

Leading players profiled in this report:

- Cargill Incorporated (US)

- ADM (US)

- DuPont (US)

- Ingredion (US)

- DSM (Netherlands)

- Roquette Freres (France)

- DuPont (US)

- The Scoular Company (US)

- PURIS (US)

- Beneo (Germany)

- Axiom Foods Inc. (US)

- Shandong Yuxin Biotechnology Co., Ltd (China)

- MGP (US)

- Kansas Protein Foods LLC (US)

- Foodchem International Corporation (China)

- DACSA Group (Spain)

Research Coverage:

The report segments the textured vegetable protein market on the basis of type, source, form, application, nature, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global textured vegetable protein, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the textured vegetable protein market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the textured vegetable protein market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 TEXTURED VEGETABLE PROTEIN: MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- FIGURE 2 GEOGRAPHIC SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019-2021

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 TEXTURED VEGETABLE PROTEIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 TEXTURED VEGETABLE PROTEIN MARKET ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 5 TEXTURED VEGETABLE PROTEIN MARKET ESTIMATION (DEMAND SIDE)

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 TEXTURED VEGETABLE PROTEIN MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 TEXTURED VEGETABLE PROTEIN MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 TEXTURED VEGETABLE PROTEIN MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 TEXTURED VEGETABLE PROTEIN MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF TEXTURED VEGETABLE PROTEIN MARKET

- FIGURE 14 GROWING ADOPTION OF MEAT ALTERNATIVES AND INCREASE IN HEALTH COGNIZANCE AMONG CONSUMERS

- 4.2 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION AND COUNTRY

- FIGURE 15 US AND MEAT ALTERNATIVES SEGMENT ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2021

- 4.3 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE AND REGION

- FIGURE 16 SLICES SEGMENT EXPECTED TO DOMINATE MARKET

- 4.4 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE

- FIGURE 17 CONVENTIONAL SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

- 4.5 TEXTURED VEGETABLE PROTEIN MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 18 US ACCOUNTED FOR LARGEST MARKET SHARE GLOBALLY IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 19 CONSUMER PRICE INDEX FOR FOOD AND NON-ALCOHOLIC BEVERAGES, PERCENTAGE CHANGE, 2018-2021

- 5.2 MARKET DYNAMICS

- FIGURE 20 TEXTURED VEGETABLE PROTEIN MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of meat alternatives

- FIGURE 21 IMPACT OF COVID-19 OUTBREAK ON US FOOD RETAIL SALES OF MEAT AND MEAT ALTERNATIVES AND FRESH MEAT IN 2020

- 5.2.1.2 Increase in health awareness

- FIGURE 22 GROWTH OF PLANT-BASED MEAT AND ANIMAL MEAT RETAIL SALES IN US, 2019

- FIGURE 23 GROWTH IN PLANT-BASED PRODUCT CATEGORIES IN US, 2021

- TABLE 3 EUROPE: MEAT SUBSTITUTES SALES VS. CONVENTIONAL MEAT SALES, 2013 VS. 2018 (VOLUME)

- FIGURE 24 EUROPEAN PLANT-BASED PROTEIN MARKET SHARE OF PROMINENT COUNTRIES

- 5.2.1.3 Innovations and developments augmenting vegan trend

- 5.2.1.4 Growth in investments and collaborations in plant-sourced food business

- FIGURE 25 GREENHOUSE GAS EMISSIONS FROM AVERAGE FOOD CONSUMPTION, BY FOOD TYPE, 2018

- 5.2.2 RESTRAINTS

- 5.2.2.1 Allergies associated with vegetable protein sources

- FIGURE 26 US: POPULATION WITH FOOD ALLERGIES, 2019

- 5.2.2.2 Processing complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Economical solutions using plant-based ingredients

- 5.2.3.2 Developments in extraction of textured vegetable protein from new sources

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government regulations and safety concerns due to inclusion of GM ingredients

- 5.2.4.2 Unpleasant flavor of soy

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION AND PROCESSING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING AND SALES

- FIGURE 27 VALUE CHAIN ANALYSIS OF TEXTURED VEGETABLE PROTEIN MARKET

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 28 TEXTURED VEGETABLE PROTEIN MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 COMPUTATIONAL PROTEIN DESIGN

- 6.4.2 TECHNOLOGICAL ADVANCEMENTS WITHIN EXTRUSION PROCESS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE CHARGED BY KEY PLAYERS, BY SOURCE

- FIGURE 29 AVERAGE SELLING PRICE, BY SOURCE, 2022

- TABLE 4 AVERAGE SELLING PRICE FROM KEY PLAYERS, BY SOURCE (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE IN KEY REGIONS, BY SOURCE, 2022 (USD/KG)

- TABLE 5 SOY: AVERAGE SELLING PRICE (ASP), BY REGION, 2018-2021 (USD/KG)

- TABLE 6 WHEAT: AVERAGE SELLING PRICE (ASP), BY REGION, 2018-2021(USD/KG)

- TABLE 7 PEA: AVERAGE SELLING PRICE (ASP), BY REGION, 2018-2021 (USD/KG)

- 6.6 MARKET MAPPING AND ECOSYSTEM OF TEXTURED VEGETABLE PROTEIN

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- FIGURE 31 PLANT-BASED PROTEIN: MARKET MAP

- 6.6.3 ECOSYSTEM MAP

- TABLE 8 TEXTURED VEGETABLE PROTEIN MARKET: ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 6.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR TEXTURED VEGETABLE PROTEIN MANUFACTURERS

- FIGURE 32 REVENUE SHIFT FOR TEXTURED VEGETABLE PROTEIN MARKET

- 6.8 TEXTURED VEGETABLE PROTEIN MARKET: PATENT ANALYSIS

- FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

- FIGURE 34 TOP TEN APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 9 TOP APPLICANTS AND THEIR DOCUMENTS COUNT, 2019-2022

- FIGURE 35 PATENTS GRANTED FOR TEXTURED VEGETABLE PROTEIN MARKET, BY KEY REGIONS, 2012-2022

- TABLE 10 LIST OF PATENTS IN TEXTURED VEGETABLE PROTEIN MARKET, 2020-2022

- 6.8.1 LIST OF MAJOR PATENTS

- 6.9 TRADE DATA: TEXTURED VEGETABLE PROTEIN MARKET

- 6.9.1 TRADE DATA: PLANT-BASED PROTEIN SOURCES

- FIGURE 36 SOY IMPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- FIGURE 37 SOY EXPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- TABLE 11 TOP TEN SOYBEAN IMPORTERS AND EXPORTERS, 2021 (TONS)

- FIGURE 38 WHEAT IMPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- FIGURE 39 WHEAT EXPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- TABLE 12 TOP TEN WHEAT IMPORTERS AND EXPORTERS, 2021 (TONS)

- FIGURE 40 PEA IMPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- FIGURE 41 PEA EXPORTS, BY KEY COUNTRIES, 2017-2021 (TONS)

- TABLE 13 TOP TEN PEA IMPORTERS AND EXPORTERS, 2021 (TONS)

- 6.10 CASE STUDIES

- 6.10.1 INGREDION: TEXTURIZED PEA PROTEIN WITH MEAT BITE

- 6.10.2 ROQUETTE FRERES: ORGANIC RANGE OF TEXTURED VEGETABLE PROTEIN

- 6.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 14 KEY CONFERENCES AND EVENTS, 2022-2023

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATIONS

- 6.12.2.1 North America

- 6.12.2.2 Europe

- 6.12.2.3 Asia Pacific

- 6.12.2.4 Rest of the World

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 TEXTURED VEGETABLE PROTEIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 DEGREE OF COMPETITION

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 42 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TYPE

- TABLE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TYPE

- 6.14.2 BUYING CRITERIA

- TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR, BY TYPE

- FIGURE 43 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 44 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 22 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 23 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 SLICES

- 7.2.1 USE OF TEXTURED VEGETABLE PROTEIN SLICES AS HEALTHY MEAT SUBSTITUTE

- TABLE 24 SLICES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 SLICES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 FLAKES

- 7.3.1 HIGH PROTEIN AND LOW FATS BOOSTING GROWTH OF FLAKES

- TABLE 26 FLAKES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 FLAKES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 CHUNKS

- 7.4.1 CUSTOMIZABLE FLAVOR OPTIONS ADDING TO POPULARITY OF TEXTURED CHUNKS

- TABLE 28 CHUNKS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 CHUNKS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 GRANULES

- 7.5.1 USE OF GRANULES AS MEAT EXTENDERS BY MEAT PRODUCT MANUFACTURERS

- TABLE 30 GRANULES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 GRANULES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

8 TEXTURED VEGETABLE PROTEIN, BY SOURCE

- 8.1 INTRODUCTION

- FIGURE 45 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- TABLE 32 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 33 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 34 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (KT)

- TABLE 35 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (KT)

- 8.2 SOY

- 8.2.1 HIGH SHELF-LIFE AND LOW CALORIES BOOSTING GROWTH OF TEXTURED SOY PROTEIN

- TABLE 36 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 38 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (KT)

- TABLE 39 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (KT)

- 8.3 PEA

- 8.3.1 USE OF TEXTURED PEA PROTEIN IN DIFFERENT PRODUCTS DUE TO ITS HIGH PROTEIN CONTENT

- TABLE 40 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 42 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (KT)

- TABLE 43 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (KT)

- 8.4 WHEAT

- 8.4.1 EXCELLENT BINDING CHARACTERISTICS OF WHEAT INCREASING ITS USAGE IN ALTERNATIVE MEAT PRODUCTS

- TABLE 44 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 46 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (KT)

- TABLE 47 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (KT)

9 TEXTURED VEGETABLE PROTEIN, BY FORM

- 9.1 INTRODUCTION

- FIGURE 46 TEXTURIZED VEGETABLE PROTEIN MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- TABLE 48 TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 49 TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022-2027 (USD MILLION)

- 9.2 DRY

- 9.2.1 WIDESPREAD APPLICABILITY AND LOWER PROCESSING COSTS OF DRY TEXTURED PROTEIN

- TABLE 50 DRY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 DRY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 WET

- 9.3.1 HIGH SCOPE FOR CUSTOMIZATION OF WET TEXTURED PROTEIN

- TABLE 52 WET: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 WET: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

10 TEXTURED VEGETABLE PROTEIN, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 47 TEXTURIZED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 54 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 55 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 MEAT ALTERNATIVES

- 10.2.1 INCREASING USE OF MEAT ALTERNATIVES IN VARIOUS FOOD APPLICATIONS DRIVING MARKET FOR TEXTURED VEGETABLE PROTEIN

- TABLE 56 MEAT ALTERNATIVES: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 MEAT ALTERNATIVES: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 58 TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 59 TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 10.2.2 MEAT EXTENDERS

- 10.2.2.1 Use of meat extenders as economical substitute for traditional meat textured vegetable protein

- 10.2.3 MEAT ANALOGUES

- 10.2.3.1 Awareness about functional health benefits of meat analogues driving their growth

- 10.3 CEREALS AND SNACKS

- 10.3.1 HEALTHY SNACKING HABITS DRIVING PARADIGM SHIFT IN CONSUMER BEHAVIOR FOR TEXTURED PROTEINS

- TABLE 60 CEREALS AND SNACKS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 61 CEREALS AND SNACKS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 OTHER APPLICATIONS

- TABLE 62 OTHER APPLICATIONS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 OTHER APPLICATIONS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

11 TEXTURED VEGETABLE PROTEIN, BY NATURE

- 11.1 INTRODUCTION

- FIGURE 48 TEXTURIZED VEGETABLE PROTEIN MARKET, BY NATURE, 2022 VS. 2027 (USD MILLION)

- TABLE 64 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 65 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2022-2027 (USD MILLION)

- 11.2 ORGANIC

- 11.2.1 AVAILABILITY OF LOW-COST ORGANIC PROTEIN DRIVING MARKET FOR ORGANIC TEXTURED VEGETABLE PROTEIN

- TABLE 66 ORGANIC: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 ORGANIC: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 CONVENTIONAL

- 11.3.1 RISING GROWTH OF CONVENTIONAL FARMING DUE TO LOW POPULARITY OF ORGANIC FARMING

- TABLE 68 CONVENTIONAL: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 CONVENTIONAL: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

12 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 49 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 70 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 72 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 73 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 75 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (KT)

- TABLE 79 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 80 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 81 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2022-2027 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Inclination of US consumers toward meat alternatives driving market for textured vegetable protein

- TABLE 88 US: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 89 US: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 90 US: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 US: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Abundant pulse and crop production bolstering market demand

- TABLE 92 CANADA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 93 CANADA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 94 CANADA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 95 CANADA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Sluggish growth for textured vegetable protein due to dependency on US and Canadian manufacturers

- TABLE 96 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 99 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 INTRODUCTION

- TABLE 100 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 101 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 102 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 103 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 104 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 105 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 106 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (KT)

- TABLE 107 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 108 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 109 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 110 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 111 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 112 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 113 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 114 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 115 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2022-2027 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Government's promotion based on changing consumer preferences

- TABLE 116 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 117 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 118 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 119 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Reduction in meat consumption creating an opportunity for textured vegetable protein

- TABLE 120 UK: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 121 UK: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 122 UK: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 UK: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 Robust agricultural background fueling market

- TABLE 124 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 125 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 126 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 127 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Shifting consumer opinions in well-entrenched meat market to aid meat alternative disruption

- TABLE 128 ITALY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 ITALY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 ITALY: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 131 ITALY: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Growing preference of millennials for healthy food driving textured vegetable protein market

- TABLE 132 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 134 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 135 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 136 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION,2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 138 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 139 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 140 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 INTRODUCTION

- FIGURE 51 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET SNAPSHOT

- TABLE 142 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 144 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 147 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 148 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (KT)

- TABLE 149 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 150 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 156 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Well-established production base augmenting growth prospects of textured vegetable protein market

- TABLE 158 CHINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 159 CHINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 160 CHINA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 CHINA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Western culture fueling vegan trends and resulting in increased demand for textured vegetable protein

- TABLE 162 INDIA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 163 INDIA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 164 INDIA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 165 INDIA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Rise in health concerns propelling textured vegetable protein market

- TABLE 166 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 167 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 168 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 169 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA AND NEW ZEALAND

- 12.4.5.1 Consumer preferences, environmental concerns, and sustainability driving market

- TABLE 170 AUSTRALIA AND NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 171 AUSTRALIA AND NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 172 AUSTRALIA AND NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 173 AUSTRALIA AND NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 174 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 INTRODUCTION

- TABLE 178 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 179 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 180 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 181 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 182 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 183 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 184 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2018-2021 (KT)

- TABLE 185 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 186 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 187 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 188 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 189 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 190 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 191 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 192 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 193 REST OF THE WORLD: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2022-2027 (USD MILLION)

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Rising veganism triggering market growth

- TABLE 194 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 195 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 196 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 197 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

- 12.5.3 MIDDLE EAST AND AFRICA

- 12.5.3.1 High consumption of plant-based dairy products boosting market for textured vegetable protein

- TABLE 198 MIDDLE EAST AND AFRICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 199 MIDDLE EAST AND AFRICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 200 MIDDLE EAST AND AFRICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2018-2021 (USD MILLION)

- TABLE 201 MIDDLE EAST AND AFRICA: TEXTURED VEGETABLE PROTEIN MARKET FOR MEAT ALTERNATIVES, BY SUB-APPLICATION, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 202 TEXTURED VEGETABLE PROTEIN MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 52 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017-2021 (USD MILLION)

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 53 TEXTURED VEGETABLE PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 203 COMPANY FOOTPRINT, BY SOURCE

- TABLE 204 COMPANY FOOTPRINT, BY TYPE

- TABLE 205 COMPANY FOOTPRINT, BY REGION

- TABLE 206 OVERALL COMPANY FOOTPRINT

- 13.6 TEXTURED VEGETABLE PROTEIN MARKET, EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 54 TEXTURED VEGETABLE PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- 13.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 TEXTURED VEGETABLE PROTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 208 TEXTURED VEGETABLE PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 13.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

- 13.7.1 PRODUCT LAUNCHES

- TABLE 209 PRODUCT LAUNCHES, 2020-2021

- 13.7.2 DEALS

- TABLE 210 DEALS, 2018-2022

- 13.7.3 OTHERS

- TABLE 211 OTHERS, 2018-2022

14 COMPANY PROFILES

- 14.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)**

- 14.2 KEY PLAYERS

- 14.2.1 ADM

- TABLE 212 ADM: BUSINESS OVERVIEW

- FIGURE 55 ADM: COMPANY SNAPSHOT

- TABLE 213 ADM: PRODUCTS OFFERED

- TABLE 214 ADM: PRODUCT LAUNCHES, 2020

- TABLE 215 ADM: DEALS, 2022

- TABLE 216 ADM: OTHERS, 2018-2022

- 14.2.2 CARGILL, INCORPORATED

- TABLE 217 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 56 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 218 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 219 CARGILL, INCORPORATED: OTHERS, 2022

- 14.2.3 ROQUETTE FRERES

- TABLE 220 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 221 ROQUETTE FRERES: PRODUCTS OFFERED

- TABLE 222 ROQUETTE FRERES: NEW PRODUCT LAUNCHES, 2022

- TABLE 223 ROQUETTE FRERES: DEALS, 2020

- TABLE 224 ROQUETTE FRERES: OTHERS, 2019-2021

- 14.2.4 DUPONT

- TABLE 225 DUPONT: BUSINESS OVERVIEW

- FIGURE 57 DUPONT: COMPANY SNAPSHOT

- TABLE 226 DUPONT: PRODUCTS OFFERED

- TABLE 227 DUPONT: DEALS, 2019

- 14.2.5 INGREDION

- TABLE 228 INGREDION: BUSINESS OVERVIEW

- FIGURE 58 INGREDION: COMPANY SNAPSHOT

- TABLE 229 INGREDION: PRODUCTS OFFERED

- 14.2.6 THE SCOULAR COMPANY

- TABLE 230 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 231 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 232 THE SCOULAR COMPANY: OTHERS, 2021

- 14.2.7 PURIS

- TABLE 233 PURIS: BUSINESS OVERVIEW

- TABLE 234 PURIS: PRODUCTS OFFERED

- TABLE 235 PURIS: OTHERS, 2019-2020

- 14.2.8 DSM

- TABLE 236 DSM: BUSINESS OVERVIEW

- FIGURE 59 DSM: COMPANY SNAPSHOT

- TABLE 237 DSM: PRODUCTS OFFERED

- TABLE 238 DSM: DEALS, 2021

- 14.2.9 BENEO

- TABLE 239 BENEO: BUSINESS OVERVIEW

- TABLE 240 BENEO: PRODUCTS OFFERED

- TABLE 241 BENEO: DEALS, 2022

- 14.2.10 AXIOM FOODS, INC.

- TABLE 242 AXIOM FOODS, INC.: BUSINESS OVERVIEW

- TABLE 243 AXIOM FOODS, INC.: PRODUCTS OFFERED

- TABLE 244 AXIOM FOODS, INC: PRODUCT LAUNCHES, 2020

- 14.2.11 SHANDONG YUNIX BIOTECHNOLOGY CO., LTD.

- TABLE 245 SHANDONG YUNIX BIOTECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 246 SHANDONG YUNIX BIOTECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 14.2.12 MGP

- TABLE 247 MGP: BUSINESS OVERVIEW

- FIGURE 60 MGP: COMPANY SNAPSHOT

- TABLE 248 MGP: PRODUCTS OFFERED

- 14.2.13 KANSAS PROTEIN FOODS

- TABLE 249 KANSAS PROTEIN FOODS: BUSINESS OVERVIEW

- TABLE 250 KANSAS PROTEIN FOODS: PRODUCTS OFFERED

- 14.2.14 FOODCHEM INTERNATIONAL CORPORATION

- TABLE 251 FOODCHEM INTERNATIONAL CORPORATION BUSINESS OVERVIEW

- TABLE 252 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- 14.2.15 DACSA GROUP

- TABLE 253 DACSA GROUP: BUSINESS OVERVIEW

- TABLE 254 DACSA GROUP: PRODUCTS OFFERED

- 14.3 OTHER PLAYERS (SMES/STARTUPS)

- 14.3.1 SHANDONG WONDERFUL INDUSTRIAL GROUP CO., LTD.

- TABLE 255 SHANDONG WONDERFUL INDUSTRIAL GROUP CO., LTD.: BUSINESS OVERVIEW

- TABLE 256 SHANDONG WONDERFUL INDUSTRIAL GROUP CO., LTD.: PRODUCTS OFFERED

- 14.3.2 SUN NUTRAFOODS

- TABLE 257 SUN NUTRAFOODS: BUSINESS OVERVIEW

- TABLE 258 SUN NUTRAFOODS: PRODUCTS OFFERED

- TABLE 259 SUN NUTRAFOODS: PRODUCT LAUNCHES, 2020

- 14.3.3 CROWN SOYA PROTEIN GROUP COMPANY

- TABLE 260 CROWN SOYA PROTEIN GROUP COMPANY: BUSINESS OVERVIEW

- TABLE 261 CROWN SOYA PROTEIN GROUP COMPANY: PRODUCTS OFFERED

- 14.3.4 GUSHEN BIOTECHNOLOGY GROUP CO., LTD.

- TABLE 262 GUSHEN BIOTECHNOLOGY GROUP CO., LTD.: BUSINESS OVERVIEW

- TABLE 263 GUSHEN BIOTECHNOLOGY GROUP CO., LTD.: PRODUCTS OFFERED

- 14.3.5 SOTEXPRO

- TABLE 264 SOTEXPRO: BUSINESS OVERVIEW

- TABLE 265 SOTEXPRO: PRODUCTS OFFERED

- 14.3.6 LIVING FOODS

- 14.3.7 STENTORIAN INDUSTRIES CO., LTD.

- 14.3.8 SOYPROTEINCN

- 14.3.9 BLATTMANN SCHWEIZ AG

- 14.3.10 SONIC BIOCHEM

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 266 ADJACENT MARKETS TO TEXTURED VEGETABLE PROTEIN

- 15.2 LIMITATIONS

- 15.3 TEXTURED SOY PROTEIN MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 267 TEXTURED SOY PROTEIN MARKET, BY TYPE, 2015-2022 (USD MILLION)

- TABLE 268 TEXTURED SOY PROTEIN MARKET, BY TYPE, 2015-2022 (KT)

- 15.4 MEAT SUBSTITUTES MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 269 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2017-2020 (USD MILLION)

- TABLE 270 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2021-2027 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATION

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS