|

|

市場調査レポート

商品コード

1790170

アパレルの市場規模、シェア、動向分析レポート:カテゴリー別、最終用途別、流通チャネル別、地域別、セグメント別、2025~2030年Apparel Market Size & Forecast Value Report By Category (Mass, Premium, Luxury), By End Use, By Distribution Channel (Online, Offline (Hypermarkets & Supermarkets, Clothing Stores, Others)), And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| アパレルの市場規模、シェア、動向分析レポート:カテゴリー別、最終用途別、流通チャネル別、地域別、セグメント別、2025~2030年 |

|

出版日: 2025年07月01日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界のアパレル市場のサマリー

世界のアパレルの市場規模は、2024年に1兆7,700億米ドルと評価され、2025~2030年にかけてCAGR 4.2%で成長し、2030年には2兆2,600億米ドルに達すると予測されています。世界中の顧客による衣料品への支出が増加していることが、市場成長を促進する主な要因です。

米国労働統計局によると、2023年の女性用衣料品の1世帯当たりの年間平均支出額は約655米ドル、男性用衣料品は約406米ドルでした。オンライン流通による商品の入手可能性、eコマースウェブサイトの市場浸透率の増加、主要市場プレーヤーによる多数のコレクション発売が、予測期間中のさらなる成長を促進すると予想されます。

また、新興国の消費者の可処分所得の増加は、世界のアパレル市場を大きく牽引しています。中国、インド、ブラジルなどの新興国では、急速な都市化、工業化、経済成長が進んでおり、購買力の高い中間層が形成されています。このような人口動態の変化は、消費者がワードローブをアップグレードし、ファッション動向を追いかけ、ライフスタイルを改善しようとするため、衣料品やアクセサリーの需要急増に拍車をかけています。

アパレルを含む持続可能で環境に優しい製品に対する消費者の需要の高まりにより、この市場は成長傾向に転じる可能性があります。消費者は、消費パターンや製造に使用される素材が環境に与える影響を意識するようになりました。その結果、オーガニックコットンやリサイクル素材、その他の革新的な代替素材など、環境に優しい素材を活用し、持続可能かつ倫理的に生産された衣料品を積極的に求めるようになっています。消費者はこの需要に応えるため、透明性の高いサプライチェーンを採用し、廃棄物を最小限に抑え、公正な労働慣行を実施するようブランドに求めています。持続可能なプロセスを取り入れることは、個人や企業が環境フットプリントを減らし、より持続可能な未来に貢献するために不可欠です。持続可能な実践は、長期的な幸福と回復力を促進しながら、生態系、社会、経済への悪影響を軽減します。

過去10年間、アパレル業界はD2C(Direct-to-Consumer)ブランドの台頭という大きな動向を目の当たりにしてきました。これらのブランドは、卸売業者、小売業者、流通業者といった従来の仲介業者を排除し、消費者に直接製品を販売しています。デジタル化とeコマースの普及が進む中、D2Cブランドは、アパレル業界を繁栄させ、再構築する好条件を見出しています。競争力のある価格設定、充実した顧客体験、個人の嗜好に合わせた競合商品やサービスを提供するD2Cブランドは、大きな注目を集め、消費者のロイヤリティを獲得しています。

ソーシャルメディアはファッションの嗜好に大きな影響を与え、消費者の選択やショッピングの嗜好を形成しています。インスタグラムやフェイスブックなどのプラットフォームを通じて、世界中の消費者はインフルエンサーやブロガー、セレブリティが投稿する幅広いファッションコンテンツに簡単にアクセスできるようになりました。このアクセスしやすさの向上が、消費者の間で様々なスタイルを探求し、新しいルックを試すことへの関心を高めています。インフルエンサーはソーシャルメディアを使って様々なファッション動向を紹介し、それらのスタイルを日常や特別な日の装いに取り入れるためのインスピレーションやガイダンスを提供しています。さらに、多くのセレブリティが、結婚式やその他のイベントで伝統的な民族衣装を着用する傾向を、エンドースメントを通じて広めています。

製造、デザイン、ディスプレイ、流通など様々なプロセスにおける革新が、この市場の成長に影響を与えると予測されます。近年、技術の進歩により、主要プレーヤーはブランドの可視性の向上、顧客エンゲージメントの強化、顧客との交流の増加を確実にする手法を採用できるようになりました。例えば、2023年6月、Googleは様々な女性向けアパレルブランド向けに、新しいAIショッピング機能を搭載したバーチャル試着を開始しました。このような進歩は、予測期間中、世界のアパレル産業の顧客エンゲージメントの成長を促進すると予想されます。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 世界のアパレル市場の変数、動向、範囲

- 市場系統の展望

- 親市場の展望

- 関連市場展望

- 業界バリューチェーン分析

- 販売/小売チャネル分析

- 利益率分析

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 業界の機会

- 業界分析ツール

- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者製品の採用動向

- 観察と推奨事項

第5章 世界のアパレル市場:カテゴリー別、推定・動向分析

- 主なポイント:カテゴリー別

- 変動分析・市場シェア:カテゴリー別、2025年および2030年

- カテゴリー別、2018~2030年

- マス

- プレミアム

- ラグジュアリー

第6章 世界のアパレル市場:最終用途別、推定・動向分析

- 主なポイント:最終用途別

- 変動分析・市場シェア:最終用途別、2024年および2030年

- 用途別、2018~2030年

- 男性

- 女性

- 子供

第7章 世界のアパレル市場:流通チャネル別、推定・動向分析

- 主なポイント:流通チャネル別

- 変動分析・市場シェア:流通チャネル別、2024年および2030年

- 流通チャネル別、2018~2030年

- オンライン

- オフライン

第8章 世界のアパレル市場:地域別、推定・動向分析

- 地域別展望

- 主なポイント:地域別

- 地域別、2018~2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 韓国

- ラテンアメリカ

- ブラジル

- 中東・アフリカ

- 南アフリカ

第9章 世界のアパレル市場-競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業市場シェア、2024年

- 企業ヒートマップ/ポジショニング分析

- 戦略マッピング

- 企業プロファイル

- VF Corporation

- Burberry Group plc

- Puma SE

- Adidas AG

- NIKE Inc.

- H &M Hennes &Mauritz AB

- LVMH

- KERING

- PVH Corp.

- INDITEX

List of Tables

- Table 1. Global apparel market estimates & forecast, by region, 2018 - 2030 (USD Billion)

- Table 2. Global apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 3. Global apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 4. Global apparel market estimates & forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 5. North America global apparel market estimates and forecasts, by country, 2018 - 2030 (USD Billion)

- Table 6. North America apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 7. North America apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 8. North America apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 9. U.S. macro-economic outlay

- Table 10. U.S. apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 11. U.S. apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 12. U.S. apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 13. Canada macro-economic outlay

- Table 14. Canada apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 15. Canada apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 16. Canada apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 17. Mexico macro-economic outlay

- Table 18. Mexico apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 19. Mexico apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 20. Mexico apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 21. Europe apparel market estimates and forecasts, by country, 2018 - 2030 (USD Billion)

- Table 22. Europe apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 23. Europe apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 24. Europe apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 25. UK macro-economic outlay

- Table 26. UK apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 27. UK apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 28. UK apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 29. Germany macro-economic outlay

- Table 30. Germany apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 31. Germany apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 32. Germany apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 33. France macro-economic outlay

- Table 34. France apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 35. France apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 36. France apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 37. Italy macro-economic outlay

- Table 38. Italy apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 39. Italy apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 40. Italy apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 41. Asia Pacific apparel market estimates and forecasts, by country, 2018 - 2030 (USD Billion)

- Table 42. Asia Pacific apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 43. Asia Pacific apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 44. Asia Pacific apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 45. China macro-economic outlay

- Table 46. China apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 47. China apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 48. China apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 49. India macro-economic outlay

- Table 50. India apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 51. India apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 52. India apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 53. Japan macro-economic outlay

- Table 54. Japan apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 55. Japan apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 56. Japan apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 57. Australia & New Zealand macro-economic outlay

- Table 58. Australia & New Zealand apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 59. Australia & New Zealand apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 60. Australia & New Zealand apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 61. South Korea macro-economic outlay

- Table 62. South Korea apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 63. South Korea apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 64. South Korea apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 65. Central & South America apparel market estimates and forecasts, by country, 2018 - 2030 (USD Billion)

- Table 66. Central & South America apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 67. Central & South America apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 68. Central & South America apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 69. Brazil macro-economic outlay

- Table 70. Brazil apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 71. Brazil apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 72. Brazil apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 73. Middle East & Africa apparel market estimates and forecasts, by country, 2018 - 2030 (USD Billion)

- Table 74. Middle East & Africa apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 75. Middle East & Africa apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 76. Middle East & Africa apparel market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Billion)

- Table 77. South Africa macro-economic outlay

- Table 78. South Africa apparel market estimates and forecast, by category, 2018 - 2030 (USD Billion)

- Table 79. South Africa apparel market estimates and forecast, by end use, 2018 - 2030 (USD Billion)

- Table 80. South Africa apparel market estimates and forecast, by distribution channel, 2018 - 2030 (USD Billion)

- Table 81. Recent developments & impact analysis, by key market participants

- Table 82. Company market share, 2024

- Table 83. Company heat map analysis

- Table 84. Companies undergoing key strategies

List of Figures

- Fig. 1 Global apparel market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Category segment snapshot

- Fig. 8 End use segment snapshot

- Fig. 9 Distribution channel segment snapshot

- Fig. 10 Competitive landscape snapshot

- Fig. 11 Apparel market value, 2024 (USD Billion)

- Fig. 12 Apparel market - Industry value chain analysis

- Fig. 13 Apparel market dynamics

- Fig. 14 Apparel market: Porter's analysis

- Fig. 15 Apparel market, by category: Key takeaways

- Fig. 16 Apparel market, by category: Market share, 2024 & 2030

- Fig. 17 Mass category apparel market estimates & forecasts, 2018 - 2030 (USD Billion)

- Fig. 18 Premium category market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 19 Luxury category market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 20 Apparel market, by end use: Key takeaways

- Fig. 21 Apparel market, by end use: Market share, 2024 & 2030

- Fig. 22 Men's apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 23 Men's casual wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 24 Men's formal wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 25 Men's sportswear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 26 Men's night wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 27 Men's inner wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 28 Men's ethnic wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 29 Other apparels market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 30 Women's apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 31 Women's casual wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 32 Women's formal wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 33 Women's sportswear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 34 Women's night wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 35 Women's inner wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 36 Women's ethnic wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 37 Other apparels market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 38 Children's apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 39 Children's casual wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 40 Children's formal wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 41 Children's sportswear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 42 Children's night wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 43 Children's inner wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 44 Children's ethnic wear market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 45 Other apparels market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 46 Apparel market, by distribution channel: Key takeaways

- Fig. 47 Apparel market, by distribution channel: Market share, 2024 & 2030

- Fig. 48 Apparel market estimates & forecasts, through online channels, 2018 - 2030 (USD Billion)

- Fig. 49 Apparel market estimates & forecasts, through offline channels, 2018 - 2030 (USD Billion)

- Fig. 50 Apparel market estimates & forecasts, through hypermarkets & supermarkets, 2018 - 2030 (USD Billion)

- Fig. 51 Apparel market estimates & forecasts, through clothing stores, 2018 - 2030 (USD Billion)

- Fig. 52 Apparel market estimates & forecasts, through others, 2018 - 2030 (USD Billion)

- Fig. 53 Apparel market revenue, by region, 2024 & 2030, (USD Billion)

- Fig. 54 Regional marketplace: Key takeaways

- Fig. 55 North America apparel market estimates & forecast, 2018 - 2030 (USD Billion)

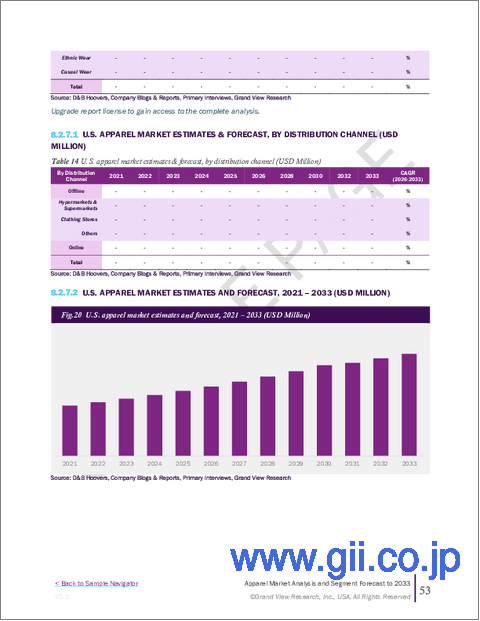

- Fig. 56 U.S. apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 57 Canada apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 58 Mexico apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 59 Europe apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 60 UK apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 61 Germany apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 62 France apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 63 Italy apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 64 Spain apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 65 Asia Pacific apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 66 China apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 67 India apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 68 Japan apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 69 Australia & New Zealand apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 70 South Korea apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 71 Latin America apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 72 Brazil apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 73 Middle East & Africa apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 74 South Africa apparel market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 75 Key company categorization

- Fig. 76 Strategic framework

Apparel Market Summary

The global apparel market size was valued at USD 1.77 trillion in 2024 and is projected to reach USD 2.26 trillion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing expenditure on apparel by customers worldwide is a key factor driving the market growth.

According to the U.S. Bureau of Labor Statistics, in 2023, the average annual per household expenditure for women's apparel was approximately USD 655, and USD 406 for men's apparel. Availability of products through online distribution, increasing market penetration of e-commerce websites, and a large number of collections launched by the key market players are anticipated to drive further growth over the forecast period.

In addition, the increasing disposable income among consumers in emerging economies is significantly driving the global apparel market. Emerging economies such as China, India, Brazil, and others are experiencing rapid urbanization, industrialization, and economic growth, enabling the middle class with higher purchasing power. This demographic shift is fueling a surge in demand for clothing and accessories as consumers seek to upgrade their wardrobes, follow fashion trends, and improve their lifestyles.

Growing consumer demand for sustainable and environmentally friendly products, including apparel, is likely to develop growth trends for this market. Consumers have become conscious of the environmental impact of consumption patterns and materials used in manufacturing. As a result, they are actively seeking out clothing that is sustainably and ethically produced, utilizing eco-friendly materials such as organic cotton, recycled fabrics, and other innovative alternatives. Consumers are urging brands to adopt transparent supply chains, minimize waste, and enforce fair labor practices to meet this demand. Embracing process sustainability is essential for individuals and businesses to lessen their environmental footprint and contribute to a more sustainable future. Sustainable practices mitigate negative ecological, social, and economic impacts while promoting long-term well-being and resilience.

Over the past decade, the apparel industry has witnessed a significant trend related to the emergence of Direct-to-Consumer (D2C) brands. These brands sell their products directly to consumers, eliminating traditional intermediaries, including wholesalers, retailers, or distributors. With the increasing digitalization and prevalence of e-commerce, D2C brands have found favorable conditions to thrive and reshape the apparel industry. Offering competitive pricing, enhanced customer experiences, and customized products and services tailored to individual preferences, D2C brands have garnered significant attention and consumer loyalty.

Social media has greatly influenced fashion preferences, shaping consumer choices and shopping preferences. Through platforms such as Instagram and Facebook, consumers across the globe have easy access to a wide range of fashion content posted by influencers, bloggers, and celebrities. This enhanced accessibility has sparked a growing interest in exploring various styles and experimenting with new looks among consumers. Influencers use social media to showcase multiple fashion trends, offering inspiration and guidance on incorporating these styles into everyday or special occasion attire. In addition, through endorsements, numerous celebrities are popularizing the trend of wearing traditional ethnic attire for weddings and other events.

Innovations in various processes, including manufacturing, designing, display, and distribution, are projected to influence the growth of this market. In recent years, technology advancements have enabled key players to adopt practices that ensure improved brand visibility, enhanced customer engagement, and increased customer interactions. For instance, in June 2023, Google launched virtual try-ons powered by a new AI shopping feature for various women's apparel brands. Such advancements are expected to facilitate growth in customer engagement for the global apparel industry over the forecast period.

Global Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the apparel market report based on category, end use, distribution channel, and region.

- Category Outlook (Revenue, USD Billion, 2018 - 2030)

- Mass

- Premium

- Luxury

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Men

- Casual Wear

- Formal Wear

- Sportswear

- Night Wear

- Inner Wear

- Ethnic Wear

- Others

- Women

- Casual Wear

- Formal Wear

- Sportswear

- Night Wear

- Inner Wear

- Ethnic Wear

- Others

- Children

- Casual Wear

- Formal Wear

- Sportswear

- Night Wear

- Inner Wear

- Ethnic Wear

- Others

- Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Online

- Offline

- Hypermarkets & Supermarkets

- Clothing Stores

- Others

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Global Apparel Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Sales/Retail Channel Analysis

- 3.2.2. Profit Margin Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Industry Challenges

- 3.3.4. Industry Opportunities

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends & Preferences

- 4.3. Factors Influencing Buying Decisions

- 4.4. Consumer Product Adoption Trends

- 4.5. Observations & Recommendations

Chapter 5. Global Apparel Market: Category Estimates & Trend Analysis

- 5.1. Global Apparel Market Category: Key Takeaways

- 5.2. Category Movement Analysis & Market Share, 2025 & 2030

- 5.3. Global Apparel Market Estimates & Forecast, By Category, 2018 to 2030 (USD Billion)

- 5.3.1. Mass

- 5.3.1.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 5.3.2. Premium

- 5.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 5.3.3. Luxury

- 5.3.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 5.3.1. Mass

Chapter 6. Global Apparel Market: End Use Estimates & Trend Analysis

- 6.1. Global Apparel Market Distribution Channel: Key Takeaways

- 6.2. End Use Movement Analysis & Market Share, 2024 & 2030

- 6.3. Global Apparel Market Estimates & Forecast, By End Use, 2018 to 2030 (USD Billion)

- 6.3.1. Men

- 6.3.1.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.2. Casual Wear

- 6.3.1.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.3. Formal Wear

- 6.3.1.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.4. Sportswear

- 6.3.1.4.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.5. Night Wear

- 6.3.1.5.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.6. Inner Wear

- 6.3.1.6.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.7. Ethnic Wear

- 6.3.1.7.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1.8. Others

- 6.3.1.8.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2. Women

- 6.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.2. Casual Wear

- 6.3.2.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.3. Formal Wear

- 6.3.2.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.4. Sportswear

- 6.3.2.4.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.5. Night Wear

- 6.3.2.5.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.6. Inner Wear

- 6.3.2.6.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.7. Ethnic Wear

- 6.3.2.7.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.2.8. Others

- 6.3.2.8.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3. Children

- 6.3.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.2. Casual Wear

- 6.3.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.3. Formal Wear

- 6.3.3.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.4. Sportswear

- 6.3.3.4.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.5. Night Wear

- 6.3.3.5.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.6. Inner Wear

- 6.3.3.6.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.7. Ethnic Wear

- 6.3.3.7.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.3.8. Others

- 6.3.3.8.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 6.3.1. Men

Chapter 7. Global Apparel Market: Distribution Channel Estimates & Trend Analysis

- 7.1. Global Apparel Market Distribution Channel: Key Takeaways

- 7.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2030

- 7.3. Global Apparel Market Estimates & Forecast, By Distribution Channel, 2018 to 2030 (USD Billion)

- 7.3.1. Online

- 7.3.1.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 7.3.2. Offline

- 7.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 7.3.2.2. Hypermarkets & Supermarkets

- 7.3.2.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 7.3.2.3. Clothing Stores

- 7.3.2.3.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 7.3.2.4. Others

- 7.3.2.4.1. Market Estimates & Forecasts, 2018 to 2030 (USD Billion)

- 7.3.1. Online

Chapter 8. Global Apparel Market: Regional Estimates & Trend Analysis

- 8.1. Global Apparel Market: Regional Outlook

- 8.2. Regional Marketplaces: Key Takeaways

- 8.3. Global Apparel Market Estimates & Forecast, By Region, 2018 to 2030 (USD Billion)

- 8.4. North America

- 8.4.1. North America Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.4.2. U.S.

- 8.4.2.1. Key Country Dynamics

- 8.4.2.2. U.S. Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.4.3. Canada

- 8.4.3.1. Key Country Dynamics

- 8.4.3.2. Canada Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.4.4. Mexico

- 8.4.4.1. Key Country Dynamics

- 8.4.4.2. Mexico Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5. Europe

- 8.5.1. Europe Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5.2. Germany

- 8.5.2.1. Key Country Dynamics

- 8.5.2.2. Germany Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5.3. UK

- 8.5.3.1. Key Country Dynamics

- 8.5.3.2. UK Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5.4. France

- 8.5.4.1. Key Country Dynamics

- 8.5.4.2. France Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5.5. Italy

- 8.5.5.1. Key Country Dynamics

- 8.5.5.2. Italy Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.5.6. Spain

- 8.5.6.1. Key Country Dynamics

- 8.5.6.2. Spain Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6. Asia Pacific

- 8.6.1. Asia Pacific Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6.2. China

- 8.6.2.1. Key Country Dynamics

- 8.6.2.2. China Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6.3. India

- 8.6.3.1. Key Country Dynamics

- 8.6.3.2. India Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6.4. Japan

- 8.6.4.1. Key Country Dynamics

- 8.6.4.2. Japan Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6.5. Australia & New Zealand

- 8.6.5.1. Key Country Dynamics

- 8.6.5.2. Australia & New Zealand Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.6.6. South Korea

- 8.6.6.1. Key Country Dynamics

- 8.6.6.2. South Korea Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.7. Latin America

- 8.7.1. Latin America Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.7.2. Brazil

- 8.7.2.1. Key Country Dynamics

- 8.7.2.2. Brazil Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.8. Middle East & Africa

- 8.8.1. Middle East & Africa Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 8.8.2. South Africa

- 8.8.2.1. Key Country Dynamics

- 8.8.2.2. South Africa Apparel Market Estimates & Forecast, 2018 - 2030 (USD Billion)

Chapter 9. Global Apparel Market - Competitive Landscape

- 9.1. Recent Developments & Impact Analysis by Key Market Participants

- 9.2. Company Categorization

- 9.3. Company Market Share, 2024

- 9.4. Company Heat Map/ Positioning Analysis

- 9.5. Strategy Mapping

- 9.6. Company Profiles

- 9.6.1. VF Corporation

- 9.6.1.1. Company Overview

- 9.6.1.2. Financial Performance

- 9.6.1.3. Product Benchmarking

- 9.6.1.4. Strategic Initiatives

- 9.6.2. Burberry Group plc

- 9.6.2.1. Company Overview

- 9.6.2.2. Financial Performance

- 9.6.2.3. Product Benchmarking

- 9.6.2.4. Strategic Initiatives

- 9.6.3. Puma SE

- 9.6.3.1. Company Overview

- 9.6.3.2. Financial Performance

- 9.6.3.3. Product Benchmarking

- 9.6.3.4. Strategic Initiatives

- 9.6.4. Adidas AG

- 9.6.4.1. Company Overview

- 9.6.4.2. Financial Performance

- 9.6.4.3. Product Benchmarking

- 9.6.4.4. Strategic Initiatives

- 9.6.5. NIKE Inc.

- 9.6.5.1. Company Overview

- 9.6.5.2. Financial Performance

- 9.6.5.3. Product Benchmarking

- 9.6.5.4. Strategic Initiatives

- 9.6.6. H & M Hennes & Mauritz AB

- 9.6.6.1. Company Overview

- 9.6.6.2. Financial Performance

- 9.6.6.3. Product Benchmarking

- 9.6.6.4. Strategic Initiatives

- 9.6.7. LVMH

- 9.6.7.1. Company Overview

- 9.6.7.2. Financial Performance

- 9.6.7.3. Product Benchmarking

- 9.6.7.4. Strategic Initiatives

- 9.6.8. KERING

- 9.6.8.1. Company Overview

- 9.6.8.2. Financial Performance

- 9.6.8.3. Product Benchmarking

- 9.6.8.4. Strategic Initiatives

- 9.6.9. PVH Corp.

- 9.6.9.1. Company Overview

- 9.6.9.2. Financial Performance

- 9.6.9.3. Product Benchmarking

- 9.6.9.4. Strategic Initiatives

- 9.6.10. INDITEX

- 9.6.10.1. Company Overview

- 9.6.10.2. Financial Performance

- 9.6.10.3. Product Benchmarking

- 9.6.10.4. Strategic Initiatives

- 9.6.1. VF Corporation