|

|

市場調査レポート

商品コード

1654523

アニメマーチャンダイジング市場規模、シェア、動向分析レポート:製品別、流通チャネル別、地域別、セグメント予測、2025年~2030年Anime Merchandising Market Size, Share & Trends Analysis Report By Product (Figurine, Clothing, Books, Board Games & Toys, Posters), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| アニメマーチャンダイジング市場規模、シェア、動向分析レポート:製品別、流通チャネル別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2025年01月21日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

アニメマーチャンダイジング市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界のアニメマーチャンダイジング市場規模は2030年までに186億7,590万米ドルに達し、2025~2030年のCAGRは9.4%で成長すると推定されています。

同市場の著しい成長は、アニメのキャラクターやプロパティをフィーチャーしたフィギュア、アパレル、アクセサリー、書籍、ポスター、玩具などに対する消費者の関心の高まりに起因しています。加えて、柔術廻戦、デーモンスレイヤー、ワンピース、ナルト、ブルーロックなどのアニメタイトルが主流のエンターテイメントとして採用されつつあることが、世界中で市場の成長を加速させています。

世界のアニメ人気の高まりは、市場に有利な機会を生み出しています。グッズ販売はアニメ市場の主要部分を占めており、今後も顕著な成長が見込まれます。アニメファンは、自分の好きなシリーズやキャラクターに関連したグッズを購入することにますます興味を持っています。ファンのコミュニティを維持し、アニメ産業を支えるためには、グッズ販売が重要であると考えるファンも多く、市場の成長をさらに後押しすると予想されます。人気のグッズには、フィギュア、シャツ、帽子、ステッカーなどがあります。

同市場で事業を展開する複数の企業は、より広範な顧客層を惹きつけ、産業における骨格を固めるため、新製品や新商品の投入に注力しています。例えば、2022年6月、Bandai Namco Toys & Collectibles Americaは、カスタマイズを通じてアニメファンに充実した体験を提供するガンダムインフィニティフィギュアの最新ラインナップを世界的に発表しました。この新製品シリーズは、交換可能なパーツやアクセサリーをいくつか備えた、カスタマイズ可能なフィギュアのエキサイティングなラインナップを提供しています。このような取り組みが、予測期間中の市場成長を促進すると期待されています。

アニメマーチャンダイジング市場レポートハイライト

- フィギュアセグメントは2024年に37%以上の最大収益シェアを記録。この成長の原動力は、アニメシリーズの人気上昇とファンの間での捕収剤文化の高まりです。

- eコマースセグメントは2024年に最大の売上シェアを記録しました。この成長は主に、デジタルプラットフォームが提供する利便性とアクセスのしやすさによるものです。

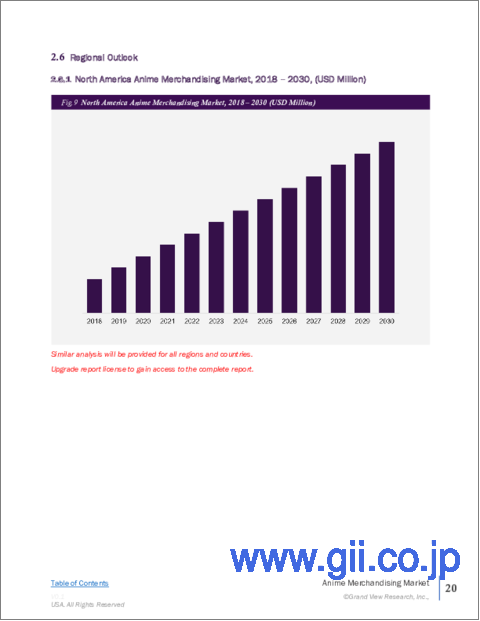

- 北米のアニメマーチャンダイジング市場は、2025~2030年にかけてCAGR 17%以上の成長が見込まれます。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 アニメマーチャンダイジング市場-産業展望

- 市場系統の展望

- 産業バリューチェーン分析

- 市場力学

- 産業分析ツール

第4章 アニメグッズ市場:製品別、推定・動向分析

- セグメントダッシュボード

- アニメマーチャンダイジング市場:製品変動分析、2024年と2030年

- フィギュア

- アパレル

- 書籍

- ボードゲームと玩具

- ポスター

- その他

第5章 アニメグッズ市場:流通チャネル別、推定・動向分析

- セグメントダッシュボード

- アニメマーチャンダイジング市場:流通チャネル変動分析、2024年と2030年

- オンライン

- オフライン

第6章 地域別、推定・動向分析

- 地域別アニメ商品市場、2024年と2030年

- 北米

- 北米のアニメマーチャンダイジング市場推定と予測、2018~2030年、

- 米国

- カナダ

- 欧州

- 欧州のアニメマーチャンダイジング市場推定・予測、2018~2030年

- 英国

- ドイツ

- フランス

- アジア太平洋

- アジア太平洋のアニメマーチャンダイジング市場推定・予測、2018~2030年

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ラテンアメリカのアニメマーチャンダイジング市場推定・予測、2018~2030年

- ブラジル

- メキシコ

- 中東・アフリカ

- 中東・アフリカのアニメマーチャンダイジング市場推定・予測、2018~2030年

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第7章 アニメマーチャンダイジング市場-競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- Studio Ghibli, Inc.

- Bandai Namco Filmworks Inc.

- Crunchyroll(Sony Pictures Entertainment Inc.)

- Good Smile Company, Inc.

- Sentai Holdings, LLC(AMC Networks)

- Ufotable Co., Ltd.

- Atomic Flare

- MegaHouse(Bandai Namco Filmworks Inc.)

- MAX FACTORY, INC.

- Alter Co., Ltd.

- BANDAI SPIRITS CO., LTD.

- Bioworld Merchandising, Inc.

- Stronger Co., Ltd.

- Aniplex Inc.(Sony Pictures Entertainment Inc.)

- Medicom Toy Co., Ltd.

List of Tables

- Table 1 Global anime merchandising market size estimates & forecasts 2018 - 2030 (USD Million)

- Table 2 Global anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 3 Global anime merchandising market, by product, 2018 - 2030 (USD Million)

- Table 4 Global anime merchandising market, by distribution channel, 2018 - 2030 (USD Million)

- Table 5 Figurine anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 6 Clothing anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 7 Books anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 8 Board games & toys anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 9 Posters anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 10 Others (accessories) anime merchandising market, by region 2018 - 2030 (USD Million)

- Table 11 North America anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 12 North America anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 13 U.S. anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 14 U.S. anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 15 Canada anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 16 Canada anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 17 Europe anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 18 Europe anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 19 UK anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 20 UK anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 21 Germany anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 22 Germany anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 23 France anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 24 France anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 25 Asia-Pacific anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 26 Asia-Pacific anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 27 China anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 28 China anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 29 India anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 30 India anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 31 Japan anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 32 Japan anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 33 South Korea anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 34 South Korea anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 35 Australia anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 36 Australia anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 37 Latin America anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 38 Latin America anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 39 Brazil anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 40 Brazil anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 41 Mexico anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 42 South Africa anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 43 South Africa anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 44 Saudi Arabia anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 45 Saudi Arabia anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

- Table 46 UAE anime merchandising market, by product 2018 - 2030 (USD Million)

- Table 47 UAE anime merchandising market, by distribution channel 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Anime merchandising market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Data validating & publishing

- Fig. 6 Anime merchandising market snapshot

- Fig. 7 Anime merchandising market segment snapshot

- Fig. 8 Anime merchandising market competitive landscape snapshot

- Fig. 9 Market research process

- Fig. 10 Market driver relevance analysis (current & future impact)

- Fig. 11 Market restraint relevance analysis (current & future impact)

- Fig. 12 Anime merchandising market, by product, key takeaways, 2018 - 2030 revenue (USD Million)

- Fig. 13 Anime merchandising market, by product: market share, 2024 & 2030

- Fig. 14 Figurine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 15 Clothing market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 16 Books market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 17 Board Games & Toys market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Posters market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Others market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Anime merchandising market, by distribution channel, key takeaways, 2018 - 2030 revenue (USD Million)

- Fig. 21 Anime merchandising market, by distribution channel: market share, 2024 & 2030

- Fig. 22 Online market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Offline market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Regional marketplace: key takeaways

- Fig. 25 North America anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 26 U.S. anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 27 Canada anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 28 Europe anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 29 Germany anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 30 UK anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 31 France anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 32 Asia pacific anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 33 China anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 34 Japan anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 35 India anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 36 South Korea anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 37 Australia anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 38 Latin America anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 39 Brazil anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 40 Mexico anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 41 MEA anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 42 South Africa anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 43 Saudi Arabia anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 44 UAE anime merchandising market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 45 Key company categorization

- Fig. 46 Strategy framework

Anime Merchandising Market Growth & Trends:

The global anime merchandising market size is estimated to reach USD 18,675.9 million by 2030, registering to grow at a CAGR of 9.4% from 2025 to 2030 according to a new report by Grand View Research, Inc. The significant growth of the market is attributed to the increasing consumer interest in figurines, apparel, accessories, books, posters, toys, etc., featuring anime characters and properties. Additionally, the rising adoption of anime titles, such as Jujutsu Kaisen, Demon Slayer, One Piece, Naruto, and Blue Lock, among others, as mainstream entertainment is accelerating the growth of the market across the globe.

The growing anime popularity globally has created lucrative opportunities for the market. Merchandise sales make up a major part of the anime market and is expected to observe notable growth in the future. Anime fans are increasingly interested in buying merchandise related to their favorite series and characters. Several fans believe merchandising is crucial to keep the fan community together and support the anime industry, which is expected to further fuel the market growth. Some popular merchandise items include figurines, shirts, hats, and stickers, among others.

Several companies operating in the market focus on launching new products and offerings to attract a more extensive customer base and strengthen their foothold in the industry. For instance, in June 2022, Bandai Namco Toys & Collectibles America introduced its latest line of Gundam Infinity figures to deliver an enhanced experience to anime fans through customization globally. The new product range offers an exciting line of customizable figures with several interchangeable parts and accessories. Such initiatives are expected to propel the market growth during the forecast period.

Anime Merchandising Market Report Highlights:

- The figurine segment recorded the largest revenue share of over 37% in 2024. This growth is driven by the rising popularity of anime series and the growing collector culture among fans.

- The e-commerce segment recorded the largest revenue share in 2024. This growth is primarily driven by the convenience and accessibility offered by digital platforms.

- North America's anime merchandising market is expected to grow at a CAGR of over 17% from 2025 to 2030.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definitions

- 1.3. Information Procurement

- 1.3.1. Information analysis

- 1.3.2. Market formulation & data visualization

- 1.3.3. Data validation & publishing

- 1.4. 1.4 Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Anime Merchandising Market Snapshot

- 2.2. Anime Merchandising Market - Segment Snapshot (1/2)

- 2.3. Anime Merchandising Market - Segment Snapshot (2/2)

- 2.4. Anime Merchandising Market - Competitive Landscape Snapshot

Chapter 3. Anime Merchandising Market - Industry Outlook

- 3.1. Market Lineage Outlook

- 3.2. Industry Value Chain Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Industry Challenges

- 3.3.4. Industry Opportunities

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's five forces analysis

- 3.4.2. Macroeconomic analysis

Chapter 4. Anime Merchandising Market: Product Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Anime Merchandising Market: Product Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. Figurine

- 4.3.1. Figurine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Clothing

- 4.4.1. Clothing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Books

- 4.5.1. Books Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Board Games & Toys

- 4.6.1. Board Games & Toys Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Posters

- 4.7.1. Posters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Others

- 4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Anime Merchandising Market: Distribution Channel Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Anime Merchandising Market: Distribution Channel Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Online

- 5.3.1. Online Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Offline

- 5.4.1. Offline Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Regional Estimates & Trend Analysis

- 6.1. Anime Merchandising Market by Region, 2024 & 2030

- 6.2. North America

- 6.2.1. North America Anime Merchandising Market Estimates & Forecasts, 2018 - 2030, (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. U.S. Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.2.3. Canada

- 6.2.3.1. Canada Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3. Europe

- 6.3.1. Europe Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.2. UK

- 6.3.2.1. UK Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.3. Germany

- 6.3.3.1. Germany Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.4. France

- 6.3.4.1. France Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.2. China

- 6.4.2.1. China Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.3. Japan

- 6.4.3.1. Japan Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.4. India

- 6.4.4.1. India Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.5. South Korea

- 6.4.5.1. South Korea Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.6. Australia

- 6.4.6.1. Australia Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Brazil Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5.3. Mexico

- 6.5.3.1. Mexico Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6. Middle East and Africa

- 6.6.1. Middle East and Africa Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6.2. UAE

- 6.6.2.1. UAE Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6.3. Saudi Arabia

- 6.6.3.1. Saudi Arabia Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6.4. South Africa

- 6.6.4.1. South Africa Anime Merchandising Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Anime Merchandising Market - Competitive Landscape

- 7.1. Company Categorization

- 7.2. Company Market Positioning

- 7.3. Company Heat Map Analysis

- 7.4. Company Profiles/Listing

- 7.4.1. Studio Ghibli, Inc.

- 7.4.1.1. Participant's Overview

- 7.4.1.2. Financial Performance

- 7.4.1.3. Product Benchmarking

- 7.4.1.4. Recent Developments

- 7.4.2. Bandai Namco Filmworks Inc.

- 7.4.2.1. Participant's Overview

- 7.4.2.2. Financial Performance

- 7.4.2.3. Product Benchmarking

- 7.4.2.4. Recent Developments

- 7.4.3. Crunchyroll (Sony Pictures Entertainment Inc.)

- 7.4.3.1. Participant's Overview

- 7.4.3.2. Financial Performance

- 7.4.3.3. Product Benchmarking

- 7.4.3.4. Recent Developments

- 7.4.4. Good Smile Company, Inc.

- 7.4.4.1. Participant's Overview

- 7.4.4.2. Financial Performance

- 7.4.4.3. Product Benchmarking

- 7.4.4.4. Recent Developments

- 7.4.5. Sentai Holdings, LLC (AMC Networks)

- 7.4.5.1. Participant's Overview

- 7.4.5.2. Financial Performance

- 7.4.5.3. Product Benchmarking

- 7.4.5.4. Recent Developments

- 7.4.6. Ufotable Co., Ltd.

- 7.4.6.1. Participant's Overview

- 7.4.6.2. Financial Performance

- 7.4.6.3. Product Benchmarking

- 7.4.6.4. Recent Developments

- 7.4.7. Atomic Flare

- 7.4.7.1. Participant's Overview

- 7.4.7.2. Financial Performance

- 7.4.7.3. Product Benchmarking

- 7.4.7.4. Recent Developments

- 7.4.8. MegaHouse (Bandai Namco Filmworks Inc.)

- 7.4.8.1. Participant's Overview

- 7.4.8.2. Financial Performance

- 7.4.8.3. Product Benchmarking

- 7.4.8.4. Recent Developments

- 7.4.9. MAX FACTORY, INC.

- 7.4.9.1. Participant's Overview

- 7.4.9.2. Financial Performance

- 7.4.9.3. Product Benchmarking

- 7.4.9.4. Recent Developments

- 7.4.10. Alter Co., Ltd.

- 7.4.10.1. Participant's Overview

- 7.4.10.2. Financial Performance

- 7.4.10.3. Product Benchmarking

- 7.4.10.4. Recent Developments

- 7.4.11. BANDAI SPIRITS CO., LTD.

- 7.4.11.1. Participant's Overview

- 7.4.11.2. Financial Performance

- 7.4.11.3. Product Benchmarking

- 7.4.11.4. Recent Developments

- 7.4.12. Bioworld Merchandising, Inc.

- 7.4.12.1. Participant's Overview

- 7.4.12.2. Financial Performance

- 7.4.12.3. Product Benchmarking

- 7.4.12.4. Recent Developments

- 7.4.13. Stronger Co., Ltd.

- 7.4.13.1. Participant's Overview

- 7.4.13.2. Financial Performance

- 7.4.13.3. Product Benchmarking

- 7.4.13.4. Recent Developments

- 7.4.14. Aniplex Inc. (Sony Pictures Entertainment Inc.)

- 7.4.14.1. Participant's Overview

- 7.4.14.2. Financial Performance

- 7.4.14.3. Product Benchmarking

- 7.4.14.4. Recent Developments

- 7.4.15. Medicom Toy Co., Ltd.

- 7.4.15.1. Participant's Overview

- 7.4.15.2. Financial Performance

- 7.4.15.3. Product Benchmarking

- 7.4.15.4. Recent Development

- 7.4.1. Studio Ghibli, Inc.