|

|

市場調査レポート

商品コード

1588685

米国のアニメマーチャンダイジング市場規模、シェア、動向分析レポート:製品別、流通チャネル別、セグメント別予測、2025年~2030年U.S. Anime Merchandising Market Size, Share & Trends Analysis Report By Product (Figurines, Clothing, Books, Board Games And Toys, Posters), By Distribution Channel, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 米国のアニメマーチャンダイジング市場規模、シェア、動向分析レポート:製品別、流通チャネル別、セグメント別予測、2025年~2030年 |

|

出版日: 2024年10月23日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

米国のアニメマーチャンダイジング市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、米国のアニメマーチャンダイジング市場規模は2030年までに14億7,350万米ドルに達し、2025年から2030年までのCAGRは18.2%で成長すると予測されています。

この大幅な成長は、国内でアニメキャラクターをフィーチャーしたフィギュア、アパレル、アクセサリー、書籍、ポスター、玩具などに対する消費者の関心が高まっていることに起因しています。呪術廻戦、鬼滅の刃、ワンピース、ナルト、ブルーロックなどのアニメタイトルがメインストリームのエンターテイメントとして採用されつつあることが、米国におけるアニメ・マーチャンダイジング市場の成長を加速させています。

世界中で高まるアニメ人気は、アニメのマーチャンダイジング市場に有利な機会を生み出しています。グッズ販売はアニメ市場の大きな部分を形成しており、今後数年間で顕著な成長が見込まれます。アニメファンは、自分の好きなシリーズに関連したグッズを購入することへの関心が高まっています。ファンのコミュニティを維持し、アニメ業界をサポートするために、商品化は非常に重要であると考えているファンもいます。人気のグッズには、フィギュア、シャツ、帽子、ステッカーなどがあります。

オンライン・ファン・コミュニティとアニメに対する消費者の関心の高まりが、米国のアニメ・マーチャンダイジング産業の成長を大きく後押ししています。Netflix、Crunchyroll、Funimationなどのストリーミング・プラットフォームは、視聴者のアニメへの関心に強い影響を与えており、それによって同国のアニメグッズの需要に拍車をかけています。

米国のアニメ・マーチャンダイジング市場で事業を展開するいくつかの企業は、より多くの顧客層を惹きつけ、業界における足場を固めるため、新製品や新商品の投入に注力しています。例えば、バンダイナムコ・トイ&コレクティブルズ・アメリカは2022年、カスタマイズを通じてアニメファンに充実した体験を提供するガンダムインフィニティの最新ラインナップを発表しました。この新商品はカスタマイズ可能なフィギュアのエキサイティングなラインアップで、交換可能なパーツやアクセサリーがいくつかあります。

米国のアニメマーチャンダイジング市場レポートハイライト:

- フィギュリン分野は、2024年に36.20%の最大売上シェアで市場をリードしました。これは、このジャンルの映画やシリーズに対するファンデーションの増加により、アニメのミニチュアやコレクターズアイテムの需要が増加しているためです。

- 衣料品セグメントは、2025年から2030年にかけて最も速いCAGRで推移すると予想されています。

- 流通チャネル別では、オンライン・セグメントが2024年に56.9%の最大売上シェアで市場をリードしました。価格割引、無料宅配、自宅からの買い物のしやすさなどが、オンライン・セグメントの成長を後押しする要因となっています。

- 主な市場プレイヤーは、アトミック・フレア、株式会社コトブキヤ、バンダイナムコ、グッドスマイルカンパニーUSA、Crunchyroll(ソニー・ミュージックエンタテインメント)、Sentai Filmworks, LLC(AMC Networks)、Viz Media LLC、株式会社講談社、Kinokuniya Book Stores of America Co.

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 米国のアニメマーチャンダイジング市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

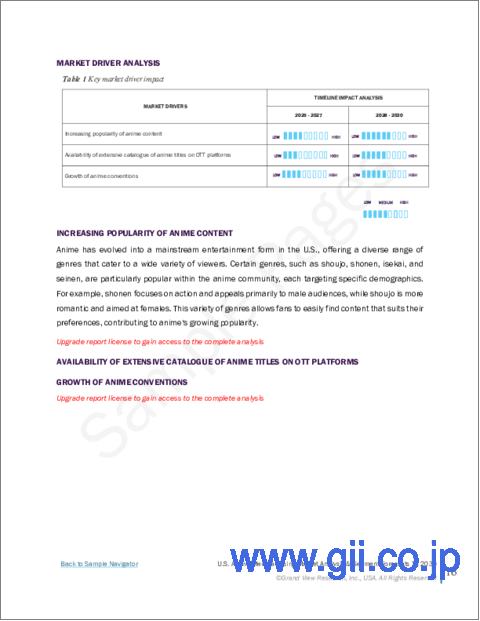

- 市場 促進要因分析

- 市場抑制要因分析

- テクノロジーチャレンジ

- 米国のアニメマーチャンダイジング市場分析ツール

- テクノロジー分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 米国のアニメマーチャンダイジング市場:製品の推定・動向分析

- セグメントダッシュボード

- 米国のアニメマーチャンダイジング市場:製品変動分析、2024年および2030年

- フィギュア

- 衣類

- 書籍

- ボードゲームとおもちゃ

- ポスター

- その他

第5章 米国のアニメマーチャンダイジング市場:流通チャネルの推定・動向分析

- セグメントダッシュボード

- 米国のアニメマーチャンダイジング市場:流通チャネル変動分析、2024年および2030年

- オンライン

- オフライン

第6章 競合情勢

- 企業分類

- 企業の市場ポジショニング

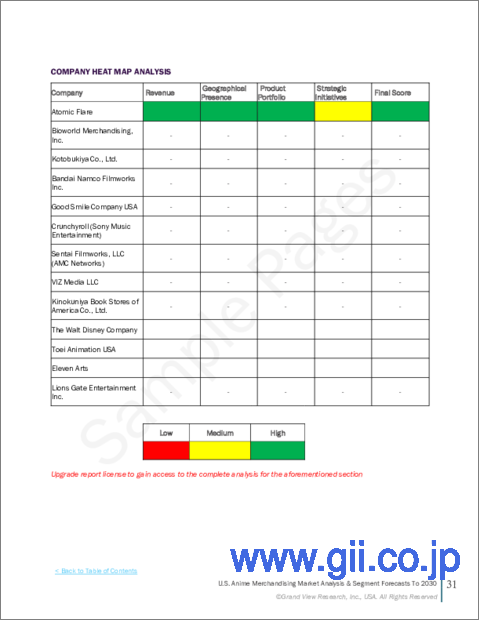

- 企業ヒートマップ分析

- 企業プロファイル

- Atomic Flare

- Bioworld Merchandising, Inc.

- Kotobukiya Co., Ltd.

- Bandai Namco

- Good Smile Company USA

- Crunchyroll(Sony Music Entertainment)

- Sentai Filmworks, LLC(AMC Networks)

- Viz Media LLC

- Kinokuniya Book Stores of America Co., Ltd.

- The Walt Disney Company

- Toei Animation USA

- Eleven Arts

- Lions Gate Entertainment Inc

List of Tables

- Table 1 U.S. anime merchandising market size estimates & forecasts, 2018 - 2030 (USD Million)

- Table 2 U.S. anime merchandising market, by product, 2018 - 2030 (USD Million)

- Table 3 U.S. anime merchandising market, by distribution channel, 2018 - 2030 (USD Million)

- Table 4 Figurine U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 5 Clothing U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 6 Books U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 7 Board Games & Toys U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 8 Posters U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 9 Other U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 10 Online U.S. anime merchandising market, 2018 - 2030 (USD Million)

- Table 11 Offline U.S. anime merchandising market, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 US anime merchandising market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Data validating & publishing

- Fig. 6 US anime merchandising market snapshot

- Fig. 7 US anime merchandising market segment snapshot

- Fig. 8 US anime merchandising market competitive landscape snapshot

- Fig. 9 Market research process

- Fig. 10 Market driver relevance analysis (current & future impact)

- Fig. 11 Market restraint relevance analysis (current & future impact)

- Fig. 12 U.S. anime merchandising market, by product, key takeaways

- Fig. 13 U.S. anime merchandising market, by product, market share, 2024 & 2030

- Fig. 14 Fig.urine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 15 Clothing market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 16 Books market estimates & forecasts, 2018 - 2030 (USD Million

- Fig. 17 Board games & toys market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Posters market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Other market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 20 US anime merchandising market, by distribution channel, market share, 2024 & 2030

- Fig. 21 Online market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Offline market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Strategic Framework

U.S. Anime Merchandising Market Growth & Trends:

The U.S. anime merchandising market size is expected to reach USD 1,473.5 million by 2030, registering to grow at a CAGR of 18.2% from 2025 to 2030 according to a new report by Grand View Research, Inc. The considerable growth can be credited to the increasing consumer interest in figurines, apparel, accessories, books, posters, toys, etc., featuring anime characters in the country. Rising adoption of anime titles such as Jujutsu Kaisen, Demon Slayer, One Piece, Naruto, and Blue Lock, among others, as mainstream entertainment is accelerating the growth of the anime merchandising market in the U.S.

The growing anime popularity across the globe has created lucrative opportunities for the anime merchandising market. Selling merchandise forms a big part of the anime market and is expected to observe notable growth in the years to come. Anime fans are showing an increased interest in buying merchandise related to their favorite series. Several fans believe merchandising is crucial to keep the fan community together and support the anime industry. Some of the popular merchandise items include figurines, shirts, hats, and stickers.

The online fan communities and growing consumer interest in anime are significantly driving the growth of the U.S. anime merchandising industry. Streaming platforms, such as Netflix, Crunchyroll, and Funimation have strongly influenced viewers' interest in anime, thereby impelling the demand for anime items in the country.

Several companies operating in the U.S. anime merchandising market focus on launching new products and offerings to attract a larger customer base and strengthen their foothold in the industry. For instance, in 2022, Bandai Namco Toys & Collectibles America introduced its latest line of Gundam Infinity figures to deliver an enhanced experience to anime fans through customization. The new product range is an exciting line of customizable figures, with several interchangeable parts and accessories.

U.S. Anime Merchandising Market Report Highlights:

- The figurine segment led the market with the largest revenue share of 36.20% in 2024, owing to increasing demand for anime miniatures and collectibles driven by growing fandom for movies and series in this genre.

- The clothing segment is expected to witness at the fastest CAGR from 2025 to 2030, primarily driven by the growing fandom for anime and its increasing integration into fashion trends.

- Based on distribution channel, the online segment led the market with the largest revenue share of 56.9% in 2024, driven by the increasing accessibility and convenience of online shopping. The pricing discounts, free home delivery, and ease of shopping from home are factors boosting the growth of the online segment

- The key market players include Atomic Flare, Kotobukiya Co., Ltd., Bandai Namco, Good Smile Company USA, Crunchyroll (Sony Music Entertainment), Sentai Filmworks, LLC (AMC Networks), Viz Media LLC, Kodansha LTD., Kinokuniya Book Stores of America Co., Ltd., The Walt Disney Company, Toei Animation USA, Eleven Arts, and Lions Gate Entertainment Inc.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.2.1. Information analysis

- 1.2.2. Market formulation & data visualization

- 1.2.3. Data validation & publishing

- 1.3. Research Scope and Assumptions

- 1.3.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. U.S. Anime Merchandising Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Technology Challenge

- 3.3. U.S. Anime Merchandising Market Analysis Tools

- 3.3.1. Technology Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. Technology Analysis - Porter's

Chapter 4. U.S. Anime Merchandising Market: Product Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. U.S. Anime Merchandising Market: Product Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. Figurine

- 4.3.1. Figurine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Clothing

- 4.4.1. Clothing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Books

- 4.5.1. Books Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Board Games & Toys

- 4.6.1. Bankruptcy Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Posters

- 4.7.1. Posters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Others

- 4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. U.S. Anime Merchandising Market: Distribution Channel Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. U.S. Anime Merchandising Market: Distribution Channel Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Online

- 5.3.1. Online Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Offline

- 5.4.1. Offline Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Competitive Landscape

- 6.1. Company Categorization

- 6.2. Company Market Positioning

- 6.3. Company Heat Map Analysis

- 6.4. Company Profiles/Listing

- 6.4.1. Atomic Flare

- 6.4.1.1. Participant's Overview

- 6.4.1.2. Financial Performance

- 6.4.1.3. Product Benchmarking

- 6.4.1.4. Strategic Initiatives

- 6.4.2. Bioworld Merchandising, Inc.

- 6.4.2.1. Participant's Overview

- 6.4.2.2. Financial Performance

- 6.4.2.3. Product Benchmarking

- 6.4.2.4. Strategic Initiatives

- 6.4.3. Kotobukiya Co., Ltd.

- 6.4.3.1. Participant's Overview

- 6.4.3.2. Financial Performance

- 6.4.3.3. Product Benchmarking

- 6.4.3.4. Strategic Initiatives

- 6.4.4. Bandai Namco

- 6.4.4.1. Participant's Overview

- 6.4.4.2. Financial Performance

- 6.4.4.3. Product Benchmarking

- 6.4.4.4. Strategic Initiatives

- 6.4.5. Good Smile Company USA

- 6.4.5.1. Participant's Overview

- 6.4.5.2. Financial Performance

- 6.4.5.3. Product Benchmarking

- 6.4.5.4. Strategic Initiatives

- 6.4.6. Crunchyroll (Sony Music Entertainment)

- 6.4.6.1. Participant's Overview

- 6.4.6.2. Financial Performance

- 6.4.6.3. Product Benchmarking

- 6.4.6.4. Strategic Initiatives

- 6.4.7. Sentai Filmworks, LLC (AMC Networks)

- 6.4.7.1. Participant's Overview

- 6.4.7.2. Financial Performance

- 6.4.7.3. Product Benchmarking

- 6.4.7.4. Strategic Initiatives

- 6.4.8. Viz Media LLC

- 6.4.8.1. Participant's Overview

- 6.4.8.2. Financial Performance

- 6.4.8.3. Product Benchmarking

- 6.4.8.4. Strategic Initiatives

- 6.4.9. Kinokuniya Book Stores of America Co., Ltd.

- 6.4.9.1. Participant's Overview

- 6.4.9.2. Financial Performance

- 6.4.9.3. Product Benchmarking

- 6.4.9.4. Strategic Initiatives

- 6.4.10. The Walt Disney Company

- 6.4.10.1. Participant's Overview

- 6.4.10.2. Financial Performance

- 6.4.10.3. Product Benchmarking

- 6.4.10.4. Strategic Initiatives

- 6.4.11. Toei Animation USA

- 6.4.11.1. Participant's Overview

- 6.4.11.2. Financial Performance

- 6.4.11.3. Product Benchmarking

- 6.4.11.4. Strategic Initiatives

- 6.4.12. Eleven Arts

- 6.4.12.1. Participant's Overview

- 6.4.12.2. Financial Performance

- 6.4.12.3. Product Benchmarking

- 6.4.12.4. Strategic Initiatives

- 6.4.13. Lions Gate Entertainment Inc

- 6.4.13.1. Participant's Overview

- 6.4.13.2. Financial Performance

- 6.4.13.3. Product Benchmarking

- 6.4.13.4. Strategic Initiatives

- 6.4.1. Atomic Flare